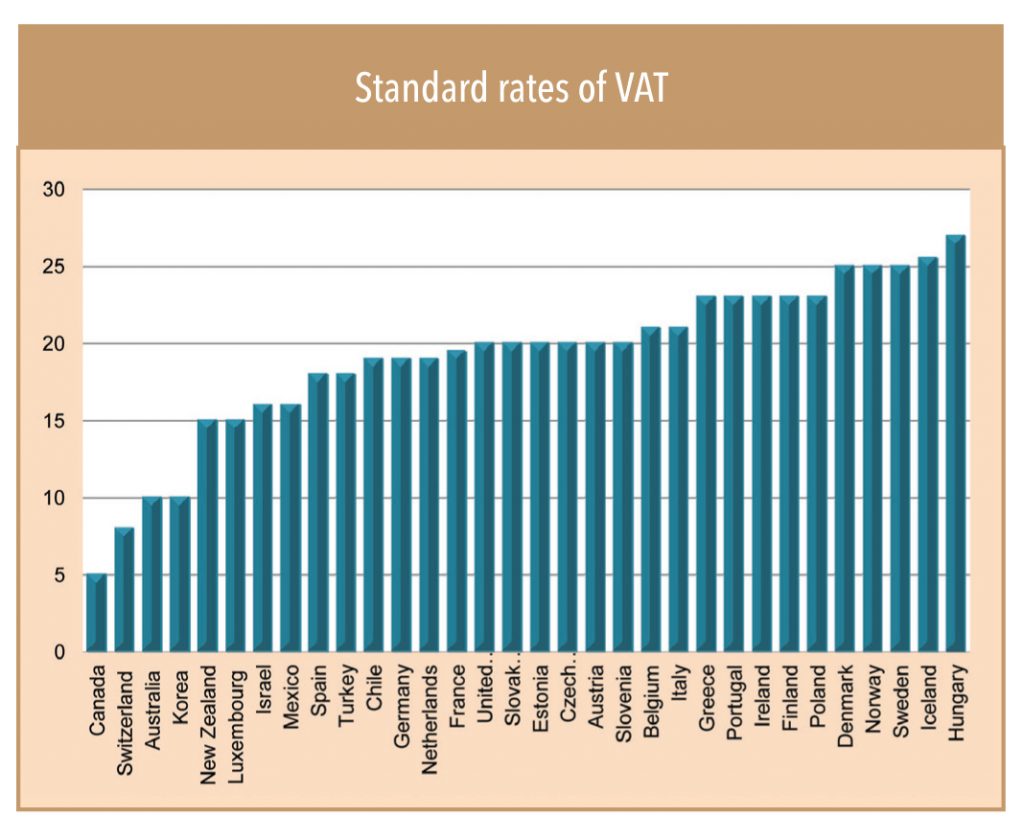

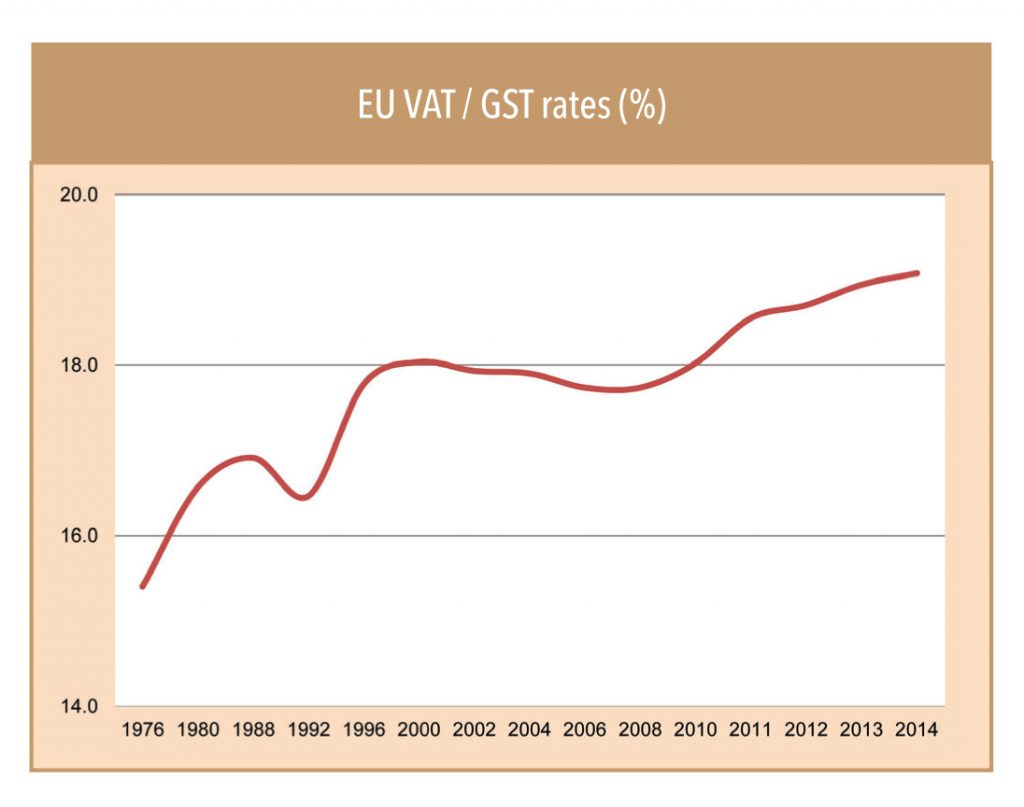

About 150 countries have adopted a GST or national-level value-added tax framework, with GST rates varying from 5% to 27%. Studies have shown that higher indirect taxes and lower direct taxes have limited impact on economic growth and promote businesses. In the wake of the financial crisis, developed countries raised GST/VAT rates to propel economic growth. Average VAT rate in European Union has increased to 21.4% in 2014 compared to 19.4% in 2008.

New entrants to join GST: Bahamas and Malaysia are likely to implement GST/VAT in 2015. China has successfully implemented a VAT pilot that replaces its much narrower ‘business tax’. Other countries such as the Gulf Cooperation Council states are actively considering introduction of VAT/GST system.

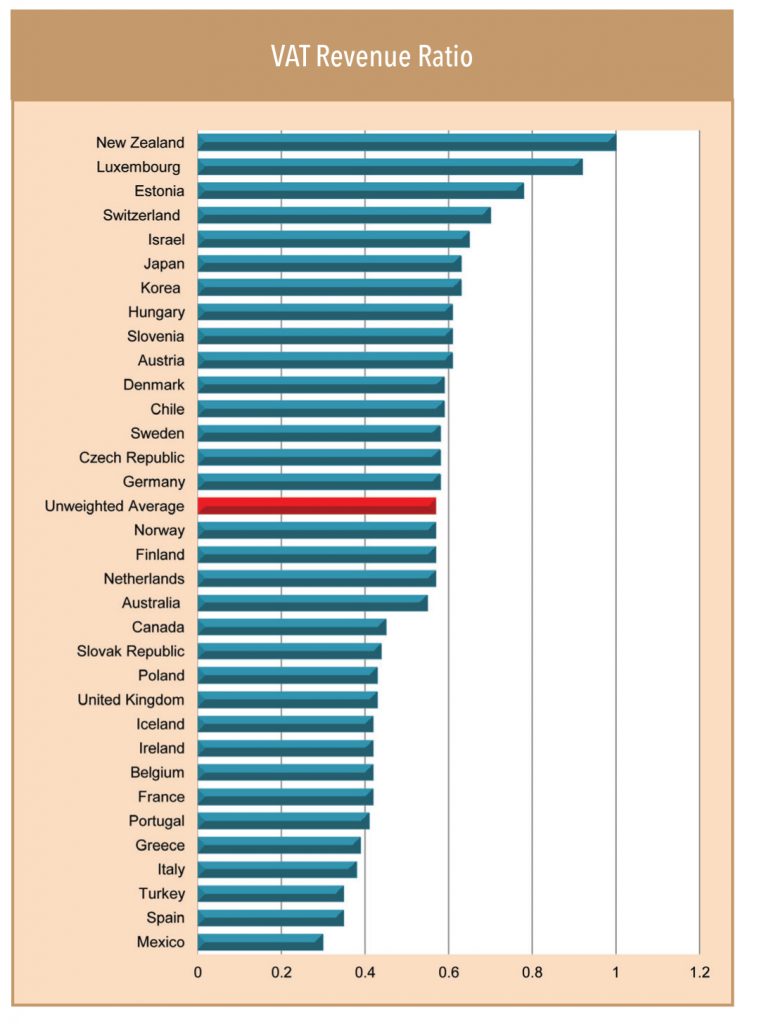

Actual revenue falls short of planned: Global evidence suggests (OECD, 2009) that GST revenue earned has mostly fallen short by 40-50% vs. the revenue stream planned. However,it is unclear if the shortfall is due to tax exemption, tax avoidance, or difficulty in tax collection. At the same time, evidence is sufficient that efficient and effective design of GST plays an important role in implementation and revenue collection. For example, New Zealand uses a broad base with few exemptions, which could explain the good VAT revenue ratio. At the other end of the scale, Mexico employs zero or reduced rates on a wide range of supplies.

Legislative changes continue: EY carried out a global survey (Nov 13) on frequency of VAT/GST changes, covering 96 countries. It showed that in more than 50% of the participating countries, the primary indirect tax legislation changes at least once a year, and in more than 20 countries, major changes take place more frequently than once a year. The reasons for continuous legislative changes are — to add efficiency to tax structure, to address fraud, technological upgradation, and due to the influence of multi-territory indirect tax systems. Legislative changes add to the problem of understanding the change and implementing the change for the businesses.

Study by OECD

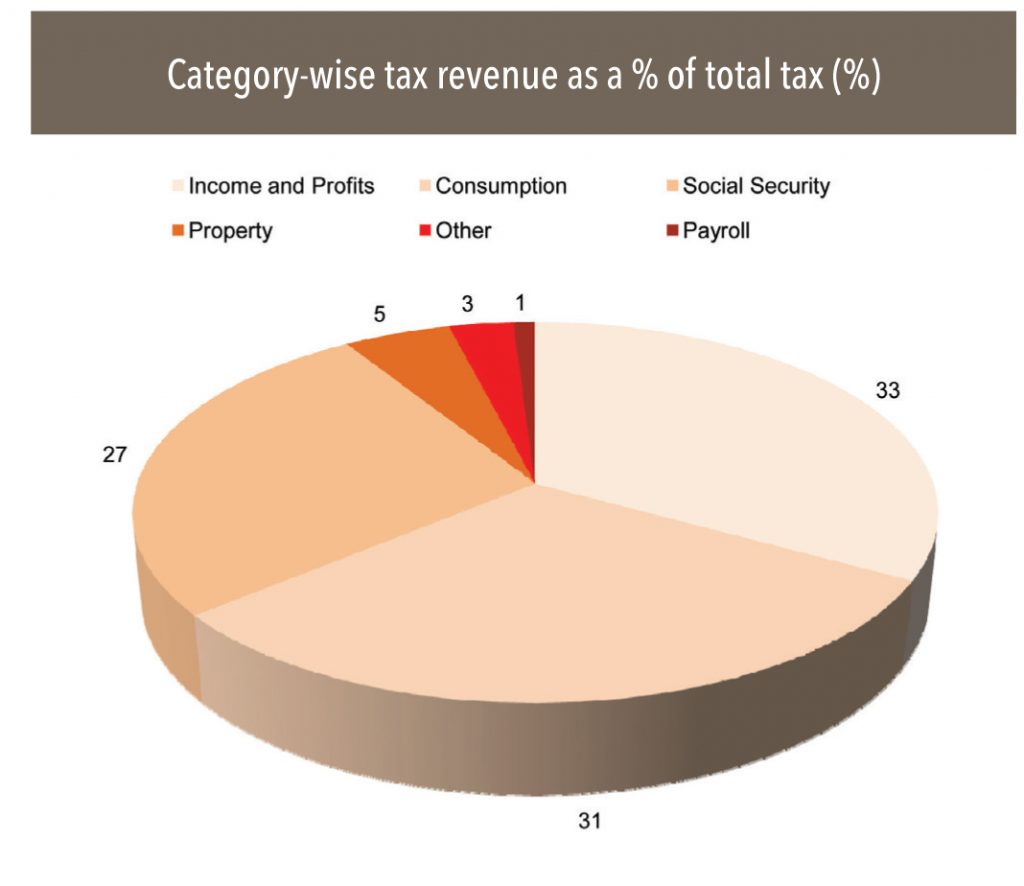

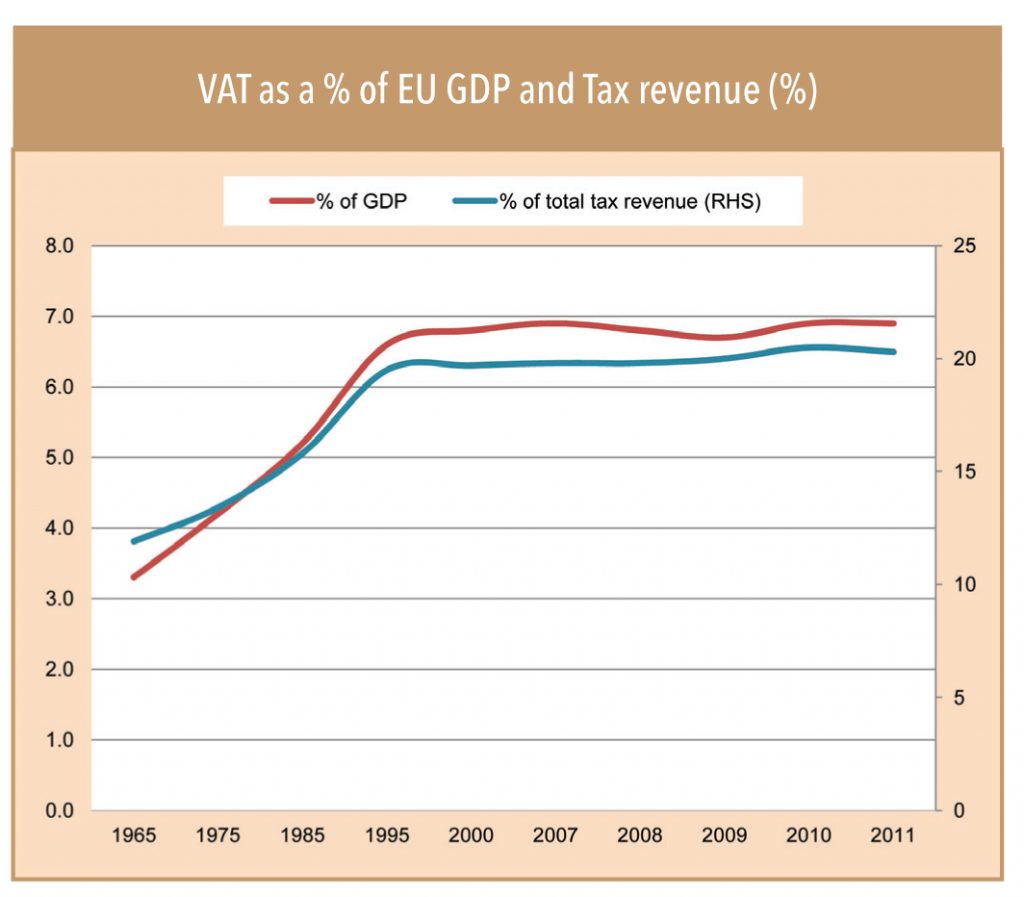

VAT has been adopted in more than 150 countries across the world due to factors like globalisation, systemic neutrality

of tax towards international trade, and its efficiency in raising revenues. It accounts for one-fifth of the tax revenue of the OECD nations. VAT systems are largely made on the same core VAT principles. However, variation is seen across countries in the way it is implemented – wide range of rate, exemptions, and special arrangements that are designed for non-tax policy objectives.

VAT rates: Global VAT rates remained stable between 1996 and 2008. However, they have risen since then in order to ensure fiscal consolidation. At the same time, tax rates on essentials – medical, hospital care, food, and water supplies – have been reduced.

Exemptions: Although exemptions are a departure from the basic rule of VAT, all OECD countries (except New Zealand and Turkey), exempt socially-oriented sectors like health, education, and charities. In addition, most countries also use exemptions for practical reasons (financial and insurance services due to the difficulty of assessing tax base) and for historical reasons (postal services, letting of immovable property, supply of land and buildings). Exemptions result in movement away from neutrality and may result in a cascading effect, which will depend on the stage of supply chain at which exemption is allowed; just prior to final sale will not result in cascading impact and the consequence will be only loss of revenue from the last stage of value addition. Exemption of financial services creates huge distortion with respect to both consumer and business decisions.

Thresholds: There is no consensus on thresholds across OECD countries. The main reason for excluding small businesses is the disproportionate cost involved versus revenues generated in tax administration. Similarly, VAT compliance cost for small businesses is disproportionate.

Restrictions on right to deduct VAT: According to VAT principles, right to deduct input taxes should be limited to the extent that those inputs are used for the taxable purposes of businesses. The right of deduction is legitimately denied where inputs are used to make onward transactions that fall outside the scope of the tax such as tax exemptions. This is also the case for input tax relating to purchases that are not wholly used for furtherance of taxable business activity, for example, when they are used for the private needs of the business owner or its employees. Most OECD countries have legislation in place that provides for blocking input tax deduction on a number of goods and services because of their nature rather than because of their use by businesses,generally with a view to ensure (input) taxation of their deemed final consumption (e.g., restaurant meals, reception costs, hotel accommodation, use of cars by the employees of businesses, etc.)

Measuring performance – VAT revenue ratio (VRR): VAT revenue ratio is defined as actual tax collected vs. the revenue that would theoretically be raised if VAT was applied at the standard rate to all final consumption. The ideal rate for revenue ratio is 1. Low VRR indicates a reduction in tax base due to a large number of exemptions or reduced rates or a failure to collect all due taxes. New Zealand and Luxembourg have a VRR of 0.98 and 0.93, respectively. Most countries (26 of 33) have a VRR below 0.65 and about half (14 of 33) have a ratio below 0.50 with an OECD average of 0.55. This suggests that about one half of potential VAT revenue is not collected. Weak VRR suggests that most OECD countries apply VAT only on a narrow tax base giving a wide range of exemptions. It also reflects the lower rates that exist in most member countries.

VAT and GST system in federal countries with dual rate structure: GST system is appropriate in countries where centre and state enjoys tax authority as it prevents cascading effect between overlapping taxes and states’ tax competition.In this section, we have looked at countries like Canada and Brazil which also work under dual GST structure.

Canada’s experience has shown that it is possible to successfully implement dual GST in a federal state. In Canada, both federal and provincial governments have the power to levy consumption and sales taxes. New harmonised sales tax includes federal GST and provincial sales tax and applies normally to the same base. HST is normally levied at 13% and includes a 5% federal tax.

Brazil on the other hand reflects the ‘not one size fits all’ approach. Brazil follows a tax model where tax powers are shared at various levels of government with no federal harmonisation of the tax base as this would grant too much control to the federal government. Union, states, and federal districts have the power to legislate on tax, but the scope of the power varies.

Conclusion

GST should be implemented as soon as possible, even with exemptions in the beginning. With time, changes can be brought in the GST structure. GST is going to be a significant indirect tax reform for India, benefiting companies and the government immensely. Companies will benefit from tax simplification and elimination of cascading effect for goods and services. Both central and state governments will benefit from revenue increment due to wider base, minimum leakage, and higher compliance. GST aims at taxing consumption — therefore,the consumer may be burdened initially. However, competitive forces should eventually bring price stability. Companies will not be impacted if GST tax rate is set on the higher side due to credit benefit facility under GST at every stage. Consumer demand may suffer in case of higher tax rate.

At the current juncture, the basic GST framework exists with limited information on specific details for the industry. At the time of implementation, sufficient time should be provided to the industry to upgrade their systems. Government should provide a simple IT platform that small businessmen can understand, for them to comply with GST easily.

Global experience shows that more exemptions defeat the advantages of GST and result in a cascading effect and lower tax revenue. Exemptions should be limited to necessary commodities and services. In India, petroleum and alcohol are being contemplated for exclusion. This will certainly have an adverse impact for companies and central government. GST introduction is keenly awaited by ALL!

Subscribe to enjoy uninterrupted access