Manufacturing sector

Imposition of GST will reduce the tax burden on the manufacturer as taxes will be paid on value addition for both goods and services. Elimination of multiple tax structure will reduce cost, enhance margins, add to profitability, and make manufacturers globally competitive. The resultant tax rate is expected to decline to 14-16% under GST vis-à-vis the current tax rate of 20%. At the same time, shift from one tax regime to another is generally fraught with several challenges in terms of infrastructure, administrative capabilities, and business impact.

Pharmaceutical sector

Indian pharma sector is fraught with multiple taxation (customs duty, excise duty, CST/VAT, service tax, entry tax, octroi, cess). GST will lower transaction and compliance cost for the industry. Tax credit benefits will reduce the cost of the goods — this will enable Indian pharma companies, to become more competitive globally (pharmaceuticals are one of the key contributors to Indian exports). Relocation and reduction of warehouses will reduce the cost for the company and simplify inter-state transactions. Location-based incentives (like tax holiday in Himachal Pradesh and Uttarakhand) may continue in the form of reimbursement to ensure continuity of GST at every stage.

Currently, drugs and medicines fall under the 4-5% excise duty category and this is expected to continue at the same rate under GST, while APIs are taxed at 8%. Companies are unable to set-off taxes due to tax differential between the input and finished goods. GST tax rate is expected to be higher than current API tax rate (if aligned with GST, consumers could be burdened), tax set-off benefit across the supply chain will be a significant benefit for the industry.

Automobile sector

GST benefit will come in the form of simplistic tax structure and inter-state stock movement. For the automobile industry, 80% of the stock is sold outside the manufacturing state through distributors and stock transfers. CST is charged on the goods movement (which increases the price of the good) and CST cannot be set-off against VAT. This will lead to consolidation of OEM plants and warehouses. Negative will be in the form of stock transfers coming under GST (which is currently tax-free or taxed minimally by some states), however companies will be able to set it off against other tax liabilities. GST rate of around 16-18% will be good for the sector as the current tax rate is higher, especially for big cars.

Logistics sector

The introduction of GST will bring huge opportunities for this sector. Manufacturers will relocate warehouses based on economic efficiencies and will not need to have state-wise warehouses to adhere to each state’s tax code. Currently, a company builds warehouses across states (25-40 small warehouses depending on regions and scale of operations) instead of 6-8 large warehouses to cover entire India.

With GST coming in, consolidation of warehouses will take place and there will be a focus on good quality technology to increase the efficiencies. This function could be outsourced to logistic service providers, as they are well placed and prepared to manage the distribution and supply chain.

Housing and construction industry

The Kelkar committee has recommended inclusion of housing and construction in GST, considering its contribution to GDP. Bringing this sector brought under GST (stamp duty will be subsumed with GST) will bring in transparency in this largely unorganised and uncontrolled sector. All the newly constructed residential as well as commercial segments will fall under GST. Experts believe that the overall impact of this measure on property prices would be marginal. Others believe that different land laws across states (even if tax rates are streamlined after GST) will keep the structure complicated. However, government officials have said that the burden on tax payers will go down by as much as 25-30% after the introduction of GST.

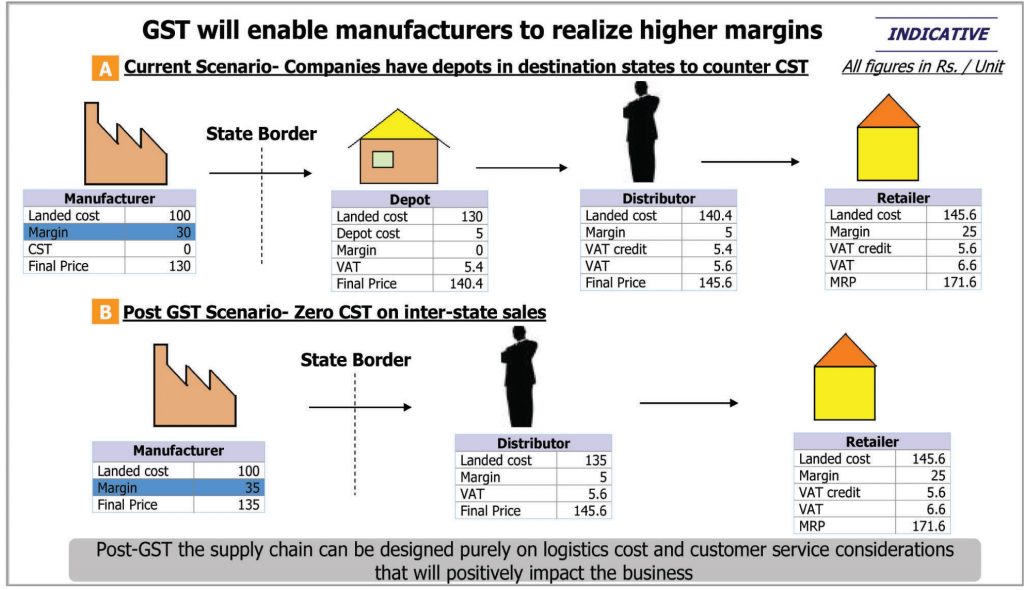

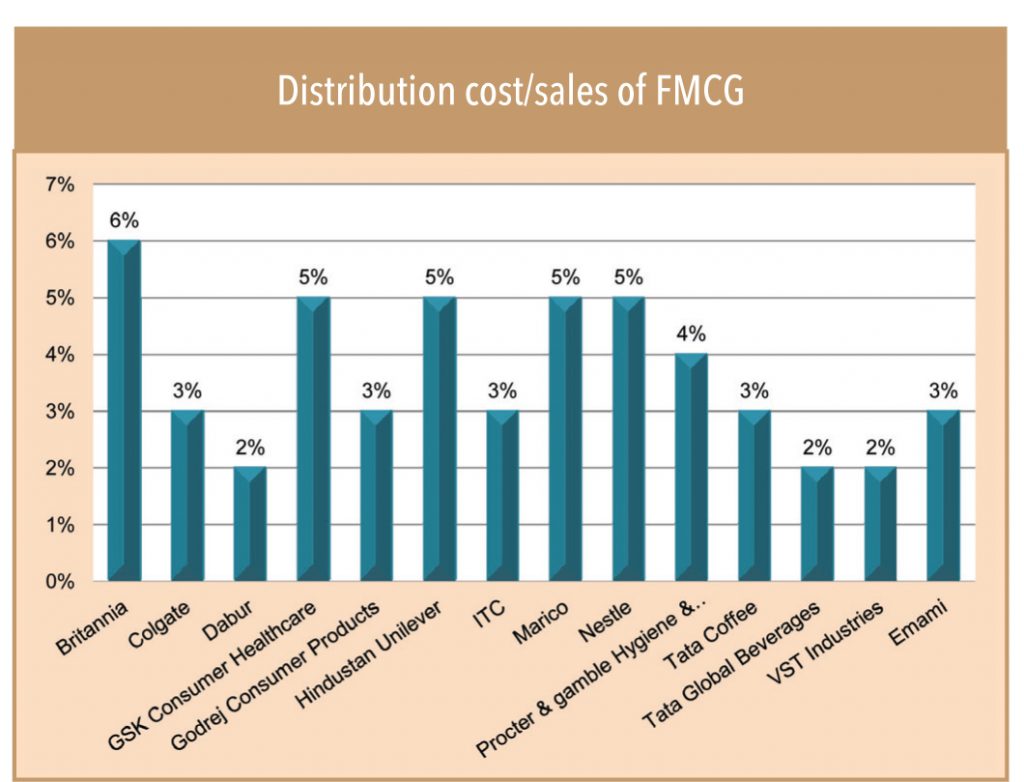

FMCG Sector

For FMCG goods, excise duty rate varies from 4% to 10%, and VAT from 4% to 15%, depending on the product. Tax incidence on Indian FMCG sector is supposedly the highest in the world along with the complex tax structure. Warehouses and depots are based on tax benefit (like for most other sectors) and distribution cost is at 2-7% of turnover. Consolidation of warehouses should positively impact FMCG margins (experts say 4-5% impact). Currently, packaged foods are taxed at 4-5% rate, if brought under GST (as talks are ripe that exemption and low tax commodity list will be pruned under GST), consumer may be burdened while companies will remain neutral due to tax set-off benefit.

Small and medium enterprises

The Empowered Committee has recommended (and states have agreed) a threshold limit of Rs 1mn as annual turnover for goods and services, below which GST will not be levied. The threshold limit should be same across all the sectors and union territories. Current exemption under VAT stands at Rs 0.5mn for most states; it is lower for north-eastern and special-category states. The threshold under Centre GST for goods is recommended at Rs 15mn and a similarly higher threshold is recommended for services. Higher threshold limits under GST vs. VAT will bode well for SMEs.

As per a NCAER study (it is India’s oldest and largest independent, non-profit, economic policy research institute), GST reform would benefit the small-scale and other manufacturing units in unregistered sectors relatively more than the corresponding registered sectors — it will do so by making capital cheaper than before because GST will provide the benefits of full tax offsets.

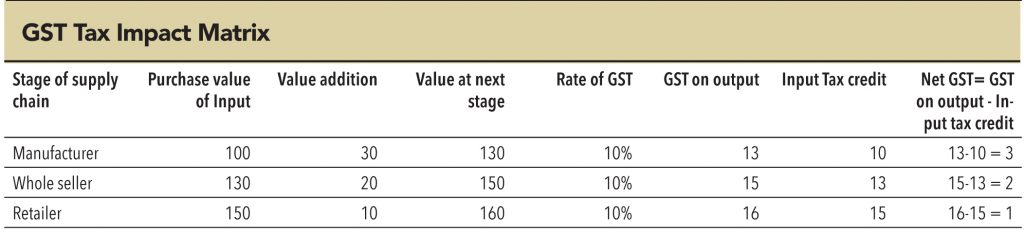

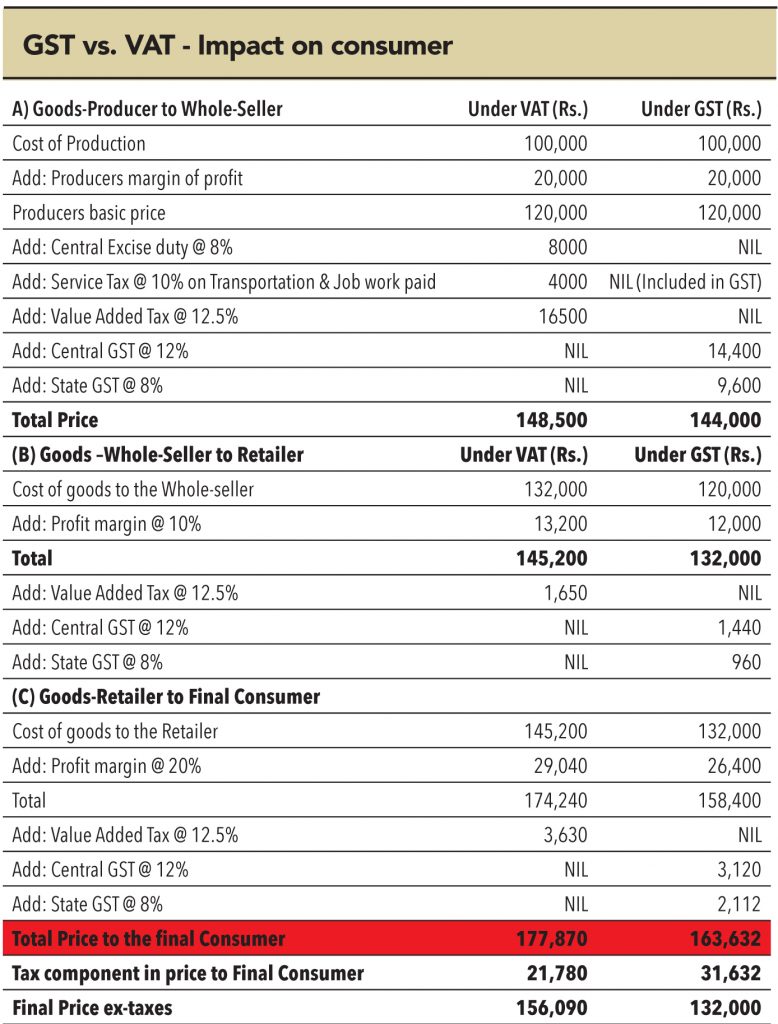

Consumer

GST will be levied at the point of manufacturing, sale, and consumption of goods and services at the central and state level. Taxes will be paid on value addition; thus, manufacturers will be able to set off the taxes paid on purchase of goods and services against the taxes payable on supply of goods and services. Technically, manufacturers will benefit while the entire burden will fall on the end-consumer. However,it is believed that GST will not be an additional burden on the consumer. Manufacturers of goods and services will be able to save by shifting to GST as they will pay taxes on value addition vs. total value of purchase. This benefit is expected to be passed on to the consumer. Tax rate is expected to decline to 14-16% vs. the current tax rate of 20%. This should result in a positive impact on consumption demand and inflation. Depending on the rate agreed on CGST and SGST, a one-time inflationary reaction is possible as and when GST is implemented. After that, it should be neutral for inflation. As per the 13th finance Commission, inflation should fall if GST rate is implemented at 12%.

Subscribe to enjoy uninterrupted access