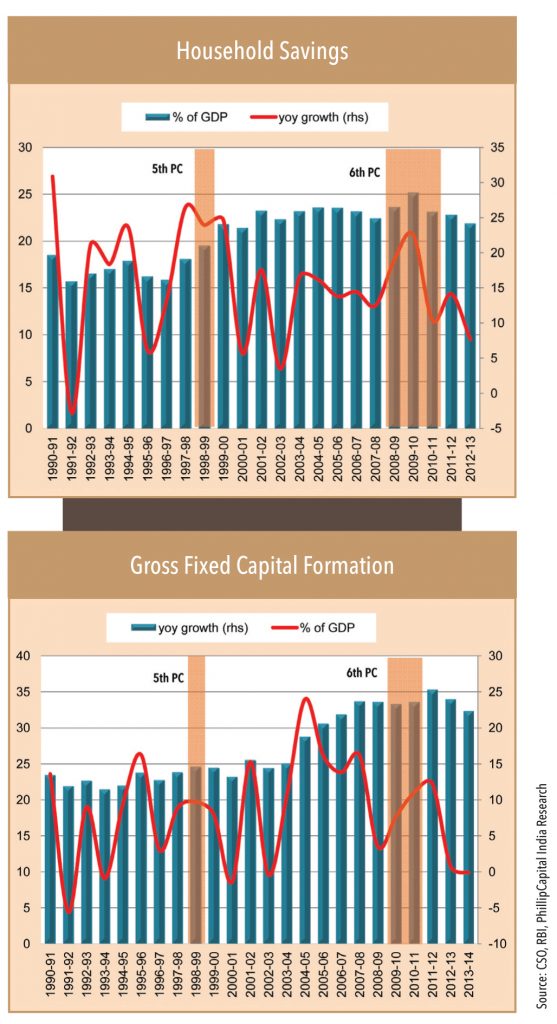

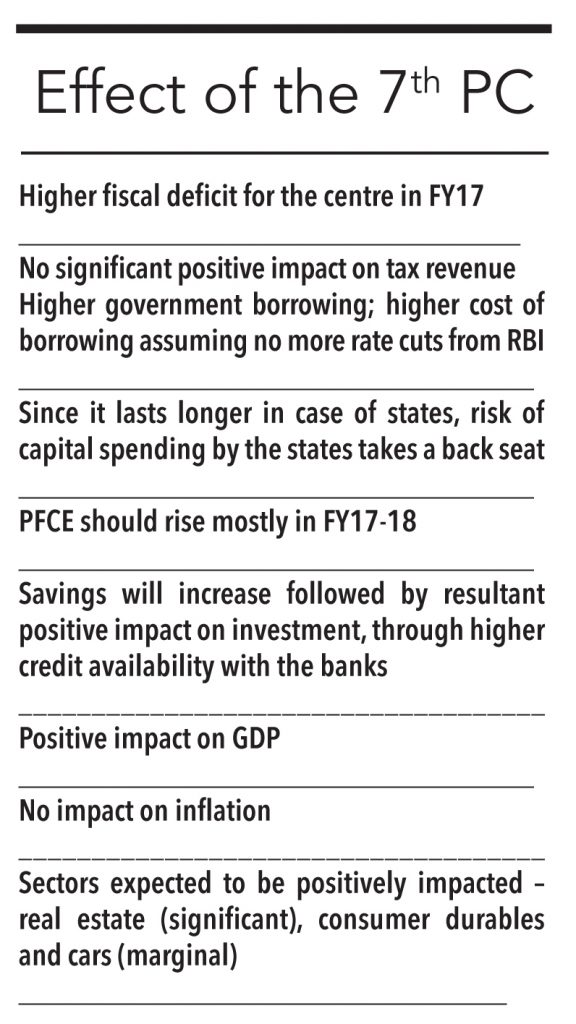

While the common belief is that the increase in income from pay commissions is largely consumed, empirical evidence suggests that higher salaries also lead to higher savings (about a 2% rise in savings rate). The last two pay commissions led to a structural rise in the household savings rate – during the 6th PC (FY09), the rate increased to 24% (from 23% in FY08) and further to 25% in FY10. It has been declining since then – according to the latest available data (which is FY13) it is 22%. During the 5th PC (savings rate/GDP surged to 18.1% from 15.8% in FY97, continued to rise to 22% in FY00; yoy growth of 27%/24%/25% in FY98/99/00).

Higher savings should also boost investments– this manifested after both the 5th and 6th PCs. GFCF rose in FY98-00 at an annual rate of 9% (up from 22.7% of GDP in FY97 to 23.8%/24.5%/24.4% in FY98/99/00). 6th PC impact was felt in FY11-12 when GFCF rose at an annual rate of 12% – from 33.3% of GDP in FY10 to 33.5% in FY11 and 35.3% in FY12.

Impact on inflation

There is a belief that higher spending should be inflationary. However, there are no signs of any correlation between pay commission salaries and higher demand leading to higher inflation (in both WPI and CPI). Rise in inflation that happened around this time was due to higher food inflation because of poor agriculture output.

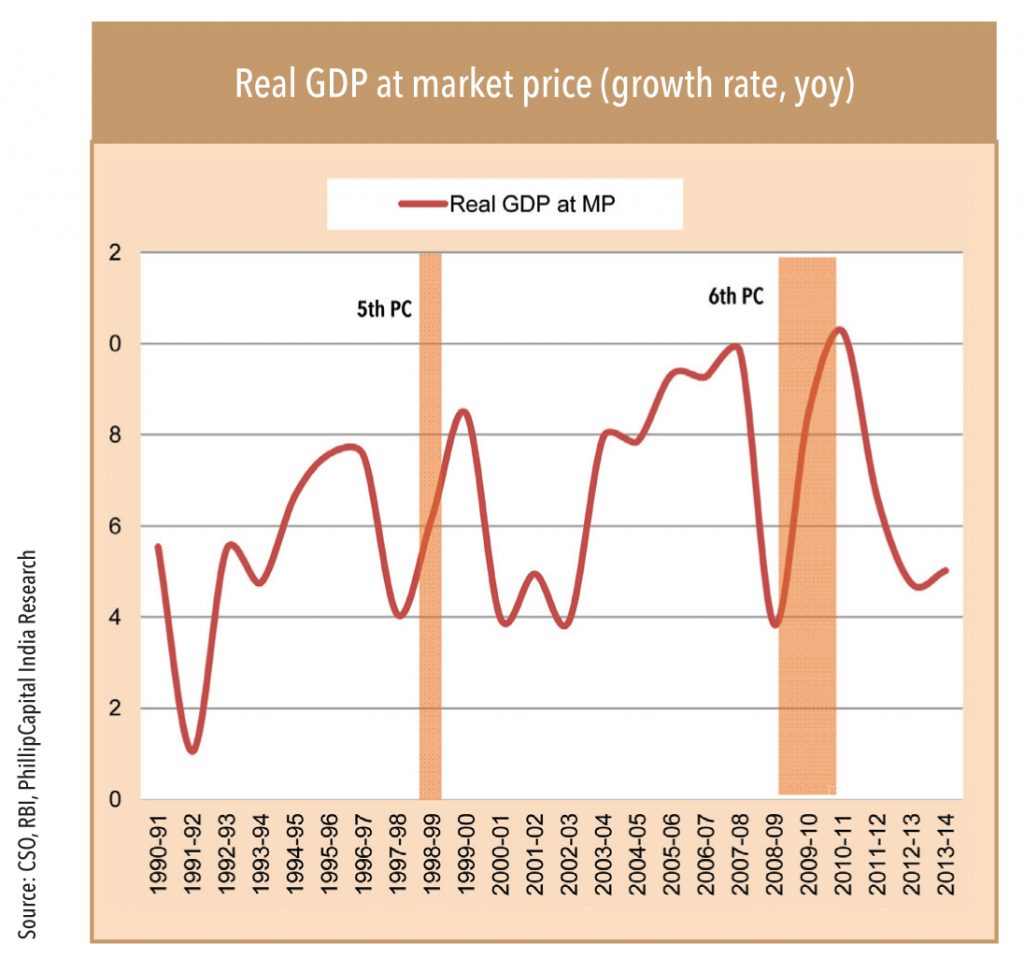

Impact on GDP

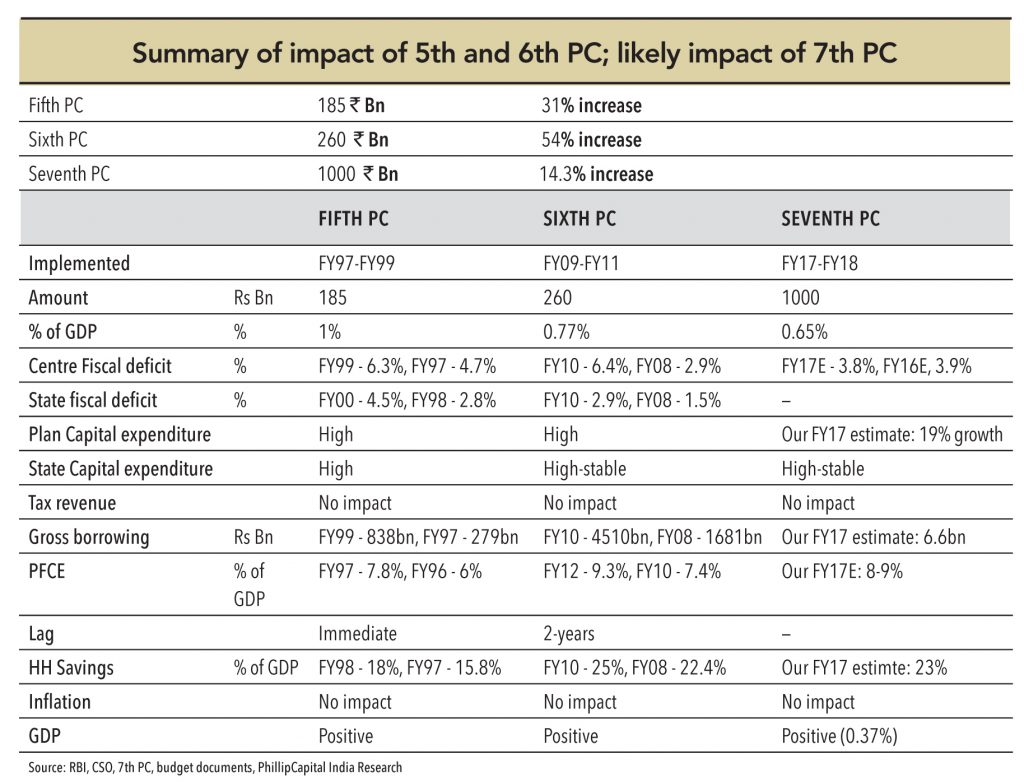

Higher private consumption, government spending, and private investment contribute positively to GDP (GDP =C+I+G) – to that extent, theoretically, the impact on GDP is positive. However, actual GDP growth rate at the time of previous pay commissions did not rise significantly, as other factors such as agriculture output and external sectors were not supportive.

7th PC impact on macro variables

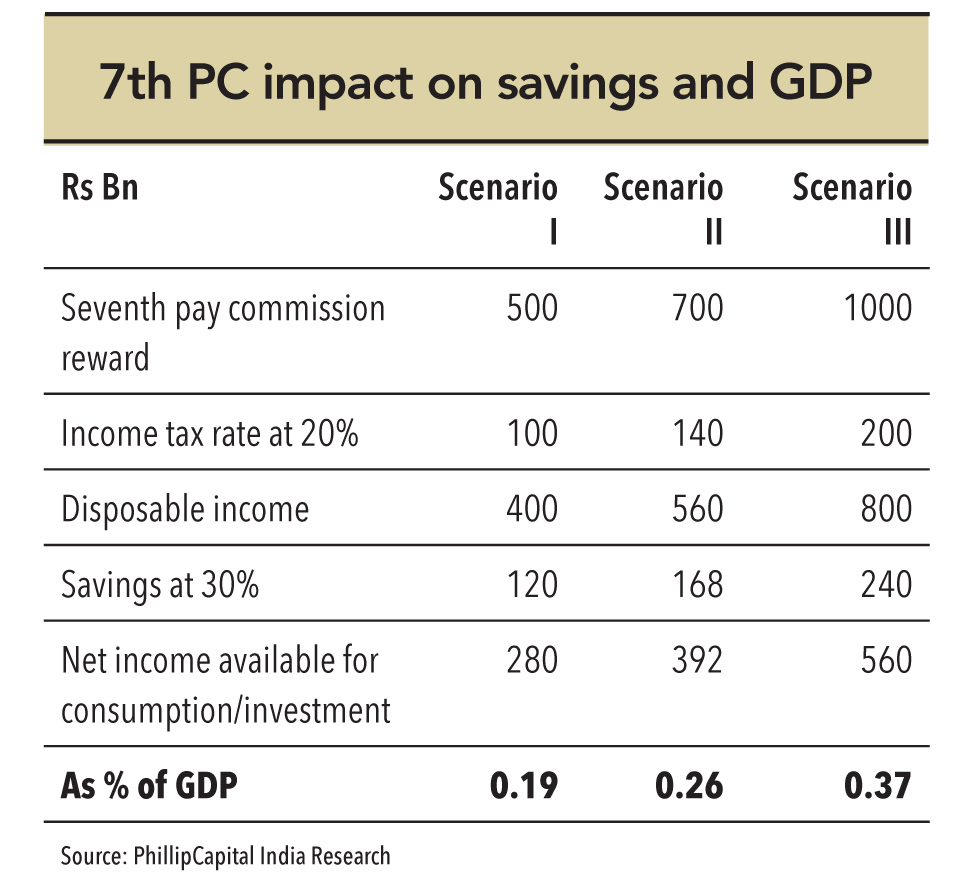

We expect private final consumption expenditure to rise with the 7th PC reward of Rs 700-1000 bn Assuming an income tax rate of 20%, disposable income in the hands of the government employees will be at Rs 560-800bn. A savings rate of 30% implies that Rs 400-560bn will be available for consumption/investment. This is about 0.26-0.37% of FY17 GDP – and is likely to be the extent of the 7th pay commission’s positive contribution to GDP.

“Government should inspire confidence in the minds of civil servants – that they will not be hounded by unnecessary harassment by investigation agencies. The recent trend of hounding civil servants like criminals for the failure of bona-fide decisions is not a happy one. This will discourage the bureaucracy from taking bold decisions for fear of being hounded if such a decision misfires. Any misadventure should not be looked upon with suspicion unless definite criminal intent (to benefit self or someone else) is present. If this trend is not checked, it will lead to disastrous consequences.”

– 7th PC

Subscribe to enjoy uninterrupted access