The battle between ecommerce and offline retailers in India intensified after Flipkart’s big billion day sale, where the online retailers faced allegations of undercutting and selling below costs. Ecommerce has been branded as a discounting channel by most of its offline peers. The availability of FDI (foreign direct investment) in the form of private equity to ecommerce players through complicated corporate structures is another bone of contention for offline players. Mr Biyani of Future Retail says, “Online market places are funded by foreign money and Indian players don’t have access to it.”

But not everyone agrees with this. “Online is just another competition, but the way you react to it is different,” says Mr Bawankule of Google. “Everyone is saying price is the bogie, but if that were the only case then physical retail should close down as it would lose significant business to online. Ecommerce players also have to make a strategy to acquire customers, then retain them using loyalty, pricing, service, etc.”

A catchment area of an offline retailer can be easily disturbed even in physical retail when a competitors sets shop there or for that matter in many such catchments. The retailer (rather than reacting and complaining), then has to respond by changing his strategy (product mix, promotions etc.) to counter competition. Therefore, businesses have to evolve and respond to competition rather than react.

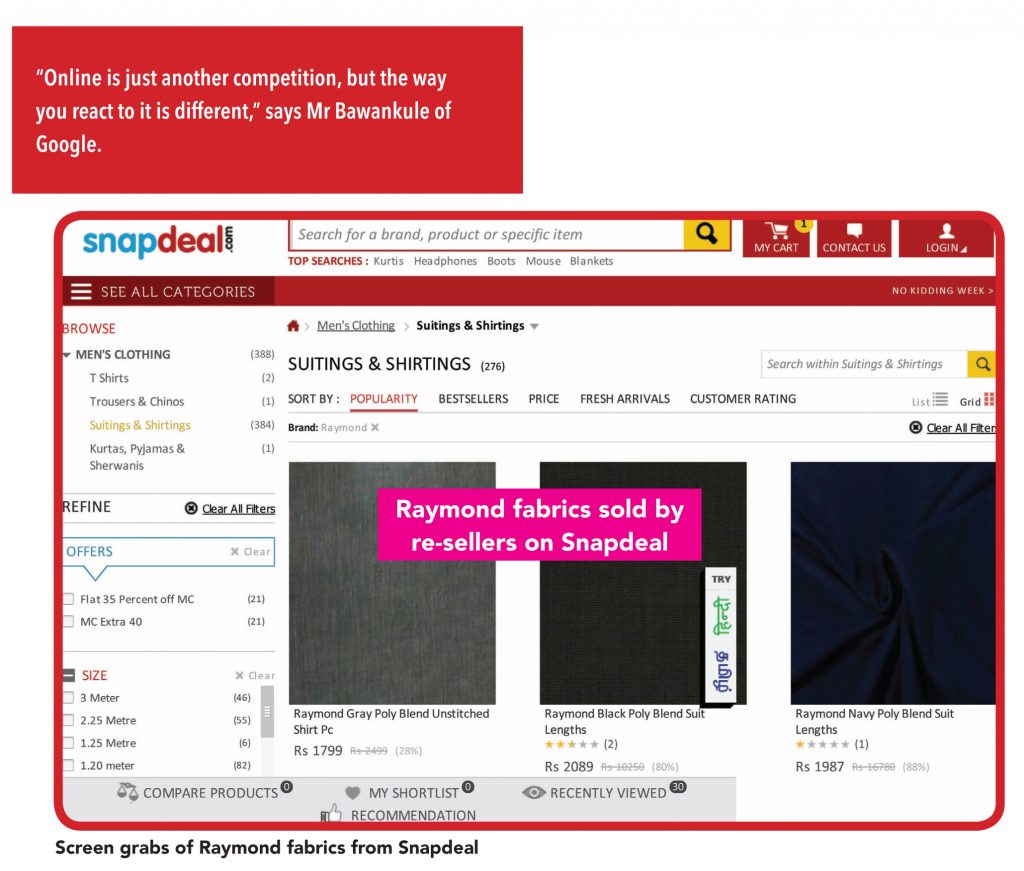

In many ways, the offline competition from unorganised players is spilling over into online. For example, any MBO (multi-brand outlet) can sell online.

The physical world will mirror itself on the online world. The difference is that the customer will come to the online store instead of the offline store.

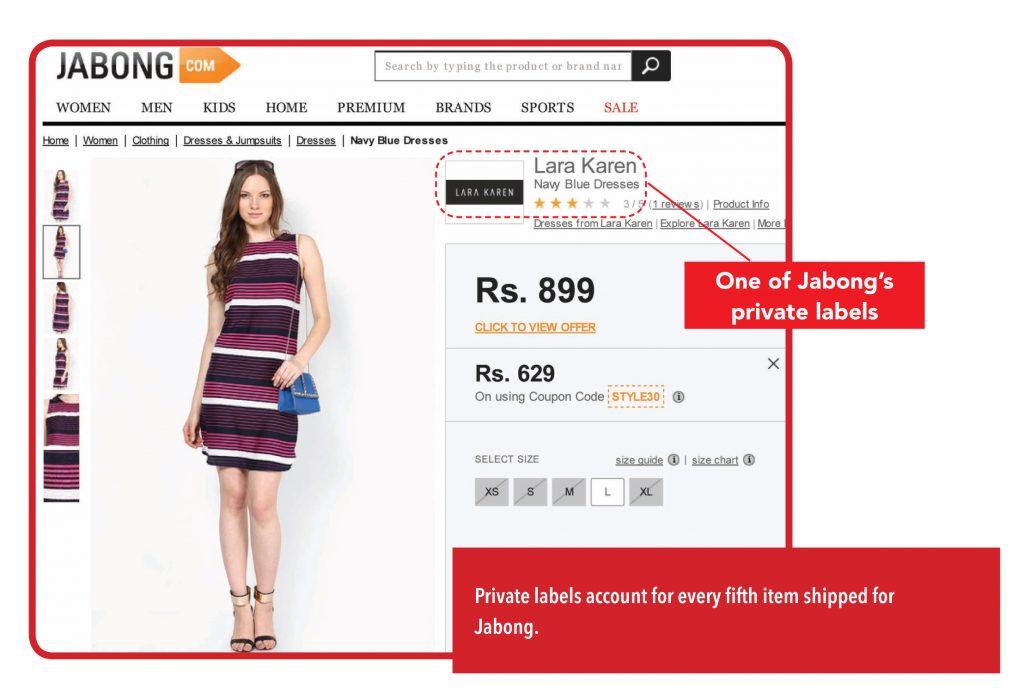

The share of national apparel brands online is not significant and it is the same in the offline world, even though these brands have existed for years. Mr Basrur from Raymond says, “It is just that the unorganised segment has got a bit more authenticity selling online.” A significant portion of the turnover of online players such as Myntra and Jabong will be from smaller brands (which in the offline world would pass off as unorganized) and private labels, says an industry observer.

Mr Basrur adds, “Doing business online has its own set of costs — warehousing, logistics. The advantage is that it has the ability to showcase the entire inventory to the customer”. But customer acquisition online is the most challenging part. Just as for physical stores, a brand or retailer tries to draw the customer from another brand or store by advertising or through new stores and offers, online players have to draw customers. They also incur costs for marketing (website), advertisement, and search engine optimisation.In fact, customers have high expectations from online players such as discounts, free deliveries, and returns. Thus cost of doing business online is mirroring offline. Online is more efficient only if there is vast product range.

Inventory challenges exist both offline and online. Aggressive expansion by offline players to expand their retail footprint resulted in high inventory and debt levels. Some large ecommerce players face these issues too.

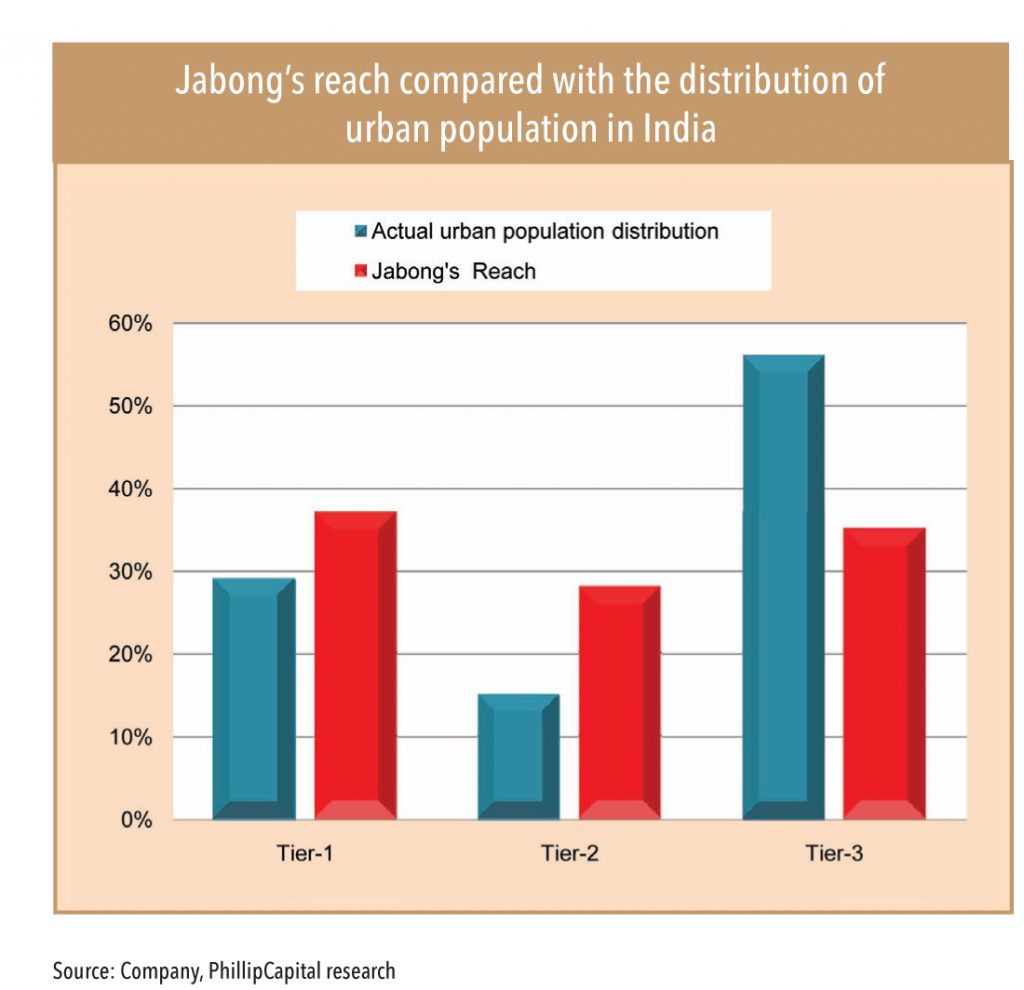

However, all said and done, brands need online channels as much as online players need them. A brand cannot survive only on own exclusive brand outlets — most already depend on departmental stores. Similarly, a brand cannot grow only using its own website — they will need to use major ecommerce players as they offer reach into 2/3-tier cities, which will help brands penetrate deeper without investing in stores.

The offline marketplace is getting replicated online

An industry expert explains the disruptive aspects of ecommerce in the context of physical retail — he says ecommerce is disruptive on two counts — technology to reach the consumer anywhere and disintermediation. Explaining further, he says, ecommerce has disruptive power as it can reach any customer, anywhere, and anytime. Therefore it can threaten the fundamentals of the offline businesses— for example, books chains across the world have been wiped out because of online sales. The same thing is happening to mobiles. The degree of invasion will vary and brands have to be careful how they engage online.

There was a time when Target and Macy’s were part of Amazon but they didn’t benefit and went their separate ways, after which they had to build online platforms from scratch and play catch up. The second aspect is disintermediation – if there are three channel partners sharing total 30% margin, then by reducing the chain, the customer benefits. But it kills the physical stores. Departmental stores and small multi-brand outlets are offline marketplaces in their own right as they sell multiple brands and products under one roof. But online marketplaces have no space constraints and hence can offer many times more stock than even a conventional departmental store. Jabong offers over 139,000 SKUs whereas Shoppers Stop can offer about 2,500 SKUs.

So are Indian retailers behind the curve and is going omni the best way ahead?

“Brick-and-mortar retailers are vulnerable due to internal issues, inefficiencies, and complacency,” says Mr Bawankule . He is of the view that discounting is here to stay not just because of PE funding but because of the very nature of the business. He says, “Discounting will continue for life and discounting is not customer acquisition. Even brick-and-mortar does it. US’ Black Friday is the largest sale day because of discounts. Consumers are deal seekers. If you don’t discount, then sales velocity may not be high and cash flows will be lower.” He is of the view that retailers must extend their reach and launch exclusive collections like Myntra has done. The success of going omni hinges on many things such as having reach, integrating reach with technology, offering convenience, and exclusive assortment. A retailer like Shoppers Stop with over 20 years of experience, merchandising relations with brands, and long-running customer loyalty program must go omni, says an industry observer.

However, omni-channel retailing, in its current form, may not be the best way ahead for most Indian players. An executive with a large Indian conglomerate explains, “Retailers outside are of critical size, therefore they can roll out their own omni-channel strategy. Most retailers in India are not of critical size.”

The positioning of the brand also matters. Brands such as Zara, which have high fashion quotient, fresh designs every fortnight, and emphasis on latest fits, have continued to do well from physical stores model. It is estimated that Zara’s draws only 5% of its global turnover from its online channel.

Organised retail is just 8% of India’s US$ 500bn retail market and online retail is already US$ 3bn, almost 10% of the organised retail. Therefore, brands as well as retailers face challenges of different kinds. Third-party retailers face price competition from ecommerce players while brands face the conundrum of dilution of brand value due to discounts with benefits of reach. To face these challenges, there is no formula. The third-party retailers have to go omni to face up to the challenge. However, for brands, omni might turn out to be expensive. An expert explains,” The cost of doing good omni-channel platform and associated logistics entails an investment of Rs 800 mn. The brand has to also incur Rs 1bn over 3 years on marketing initiatives to make this channel grow.”

An executive with a leading national brand says, “It will be ideal for brands if departmental stores go online. Departmental stores will feel the heat from ecommerce. Even though physical retail is still major for all the players, ecommerce could be big and hence brands have to gear up. If these players (departmental stores) don’t gear up then we have to be prepared. As this market evolves, it makes sense for brands to go online as there are better margins from disintermediation.”

Brands continue to engage with ecommerce players because of the reach they offer and also because they are a channel for liquidation of old inventory. If third-party retailers such as departmental stores can offer them the reach, brands would be happy to support them as they have more rational pricing norms and don’t discount recklessly on the back of PE funding.

Subscribe to enjoy uninterrupted access