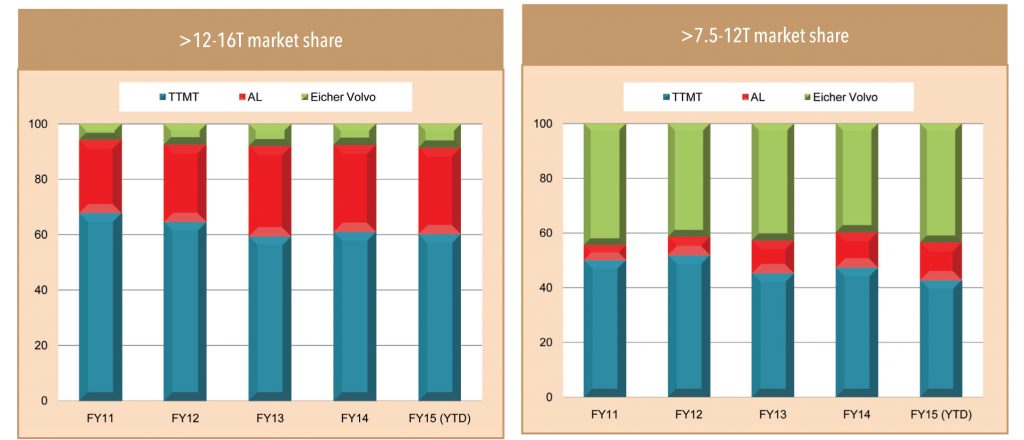

Indian heavy commercial vehicle industry has been a virtual duopoly since long and is likely to remain so over 4-5 years due to wider product portfolio straddling all the key segments. Although onslaught from Bharat Benz and Volvo-Eicher have increased in recent past, they still operate in niche segments with gradual approach to enter new segments. Also, customer decision to switch brands with lack of operating history in local conditions also becomes a deterrent.

Shift to higher tonnage vehicles – Unlikely to alter market share dramatically

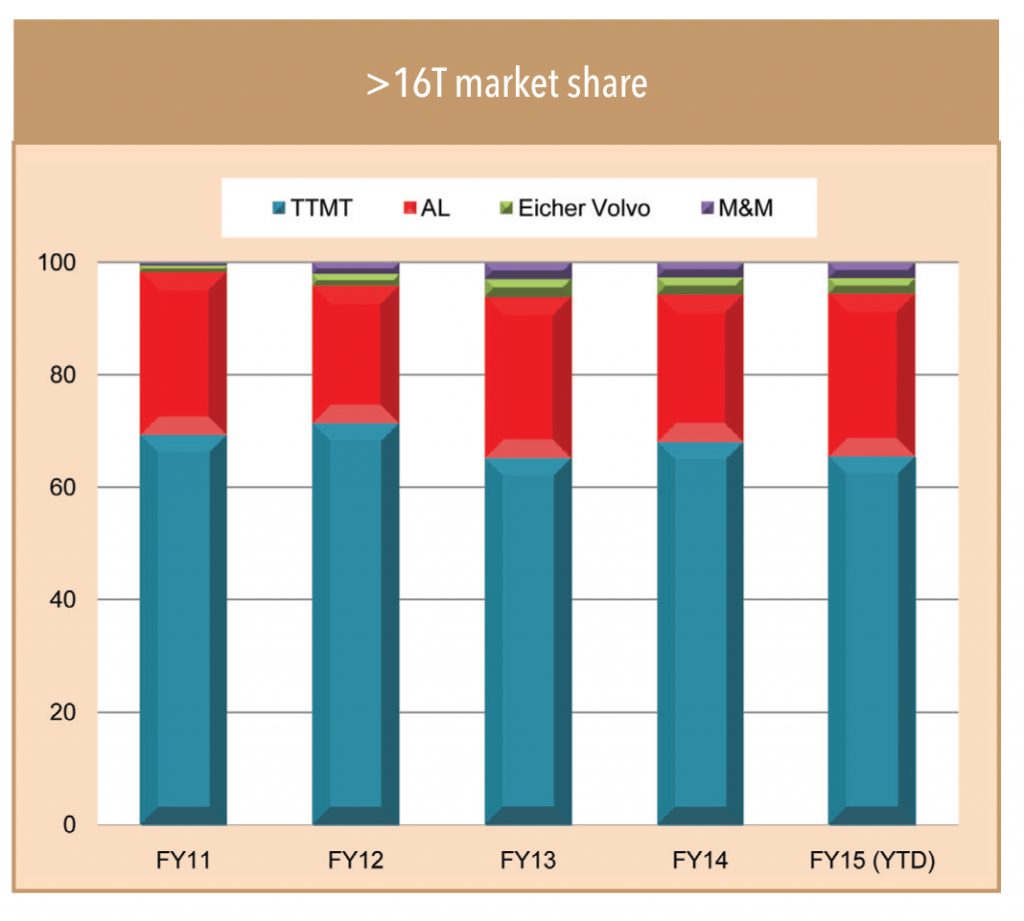

A shift towards higher-tonnage tractor-trailer and multi-axle vehicles is a given. The superior operating economics of these larger vehicles, acute driver shortage and increasing driver demands, and improving highways networks will drive this growth. Tata Motors and Ashok Leyland are well-entrenched across all segments with a higher volume share in the >16T haulage and rigid segment. A shift towards higher-tonnage vehicle may negatively affect Eicher Volvo, given its higher share in the <16T segment and miniscule presence in higher-tonnage rigid and haulage vehicles.

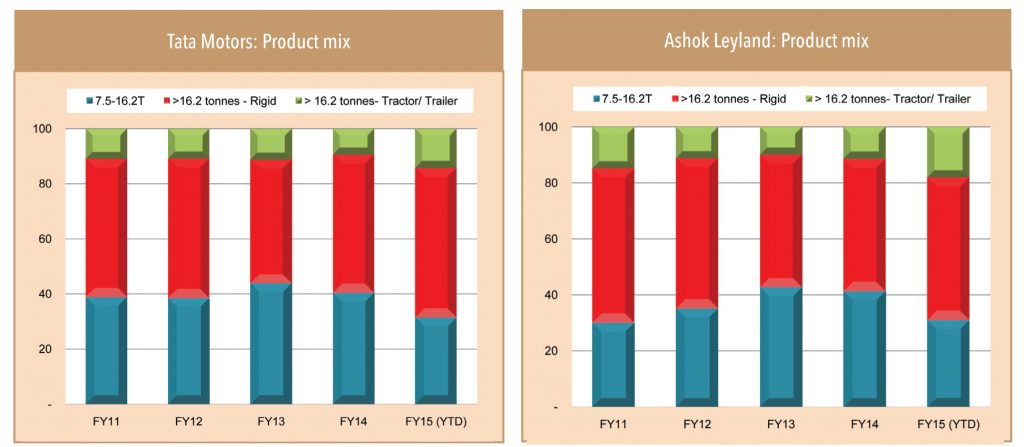

In terms of product mix, AL and TAMO have an almost similar mix with marginal shift across different periods depending on the growth in their key regional strongholds. Decline in mining in southern states impacted Ashok Leyland’s volume share in the rigid segment in FY12-13. Similarly, superior growth in southern haulage markets tends to improve Ashok Leyland’smarket share in high-tonnage tractors/trailers— as seen so far in FY15 (YTDFY15 18% share in M&HCV volume vs. 11.5% in FY14).

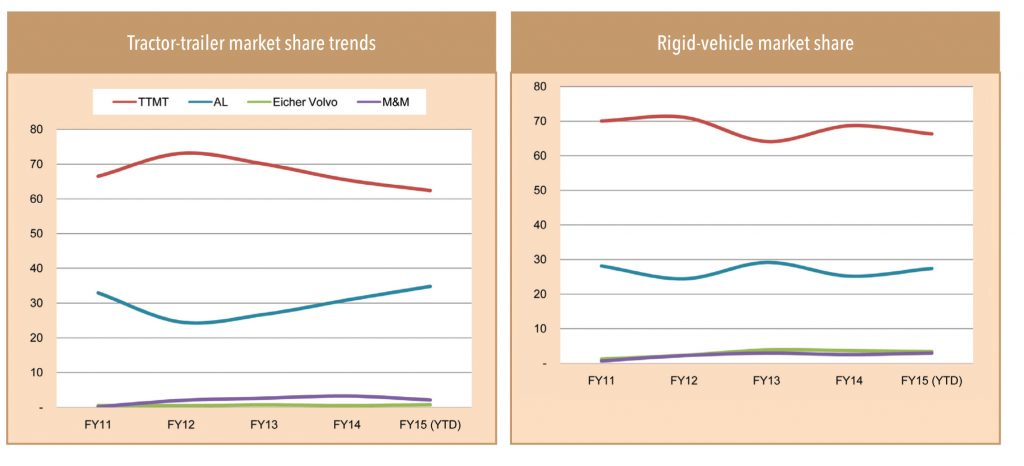

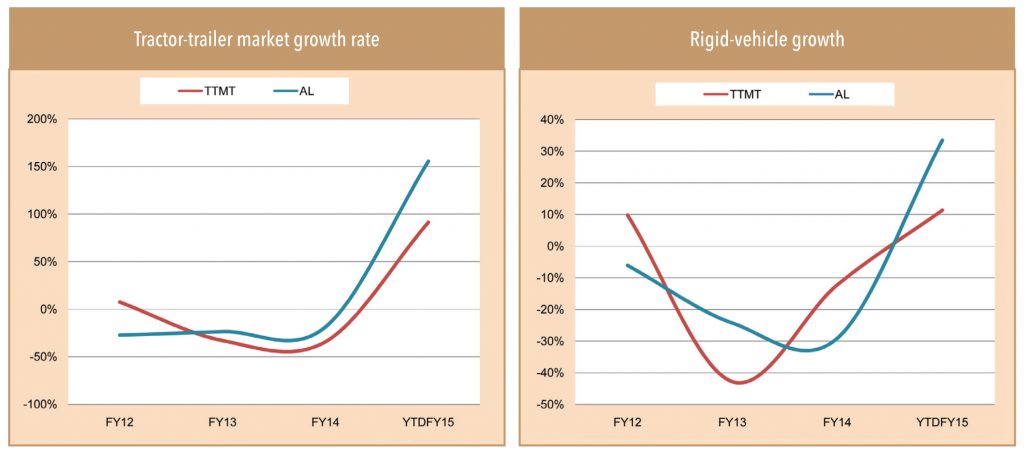

Long-haulage tractor/trailer market: Tractor/trailer is the fastest-growing market in M&HCVs, with YTDFY15 yoy growth of 110%. While Tata Motors is the market leader in the >16T segment with 63% market share, Ashok Leyland follows with 35% share. Other players such as M&M and Eicher Volvo are still very marginal players, with little prospect of any major near-term improvement due to their lack of portfolio and because their existing customer base is in the smaller M&HCVs segment.

Although Tata Motors’ has partially lost market share (from a peak of 70%) in the last couple of years due to soft Northern and Western markets, their share is unlikely to change meaningfully further. Very high growth in the segment provides opportunities for all the players and will not impact incumbents meaningfully despite marginal decline in market share. Thus, both incumbents tend to benefit from the market shift to tractors/trailers from 16T haulage

Construction and mining segment: The high-tonnage rigid vehicle segment will be a key beneficiary of construction and mining sector revival. Even in this segment, Tata Motors’ has dominant market share of around 66% and Ashok Leyland is #2 with 27%. Ashok Leyland’s share could rise if iron ore mining resumes substantially, given its strong presence in the Southern markets.

Given that both incumbents have a broadly similar product mix in terms of vehicle tonnage, with marginal variation due to regional mix, both Tata Motors and Ashok Leyland will benefit equally over a period. The impact of Bharat Benz in the higher tonnage segment is yet to be felt because it has only entered recently and without a wide product portfolio. Therefore, a new winner is unlikely to emerge in high-tonnage vehicles, at least in the next 2-3 years.

Discounts here to stay. Bharat Benz could emerge as a threat in the long term

The competitive landscape of the Indian truck manufacturing industry is undergoing a shift with Bharat Benz (Daimler) (BB) and Volvo Eicher (VECV) emerging as challengers of the virtual duopoly that Tata Motors and Ashok Leyland have over the market. Although truckers and freight operators were cautious on Volvo Eicher’s outlook, most stakeholders’ identified Bharat Benz as a potential game changer for the industry due to its superior trucks with better operating economics and higher driver comfort. Bharat Benz’s impactis clear from discount trends — it is able to sell its vehicles without major discounts/benefits, even as the two large players continue offering deep discounts. However, given BB’s limited production (about 1000 units/month), limited product range (early focus on successful 9-12T segment), and its gradual go-to-market approach, industry market share is unlikely to alter in a big way in the short run.

Why is Bharat Benz a real threat to the incumbents?

CV industry participants across the value chain are almost unanimously positive about Bharat Benz trucks in India. So far, Benz has been more successful in Southern states like Kerala and is eating into the share of incumbents such as Ashok Leyland. Three key factors going in favour of Bharat Benz in the Southern market are — a) better education levels of truck owners, thus, more focused on operating economics rather than upfront discounts, b) better service networks, and c) focus on driver comfort due to higher shortage in southern states. BB offers significantly better dealer remuneration vs. incumbents and its products consistently receive positive feedback from customers — this has led to few dealers shifting to Bharat Benz.

So far, Bharat Benz has restricted its production to align itself with current market demand and to sort out its supply-chain issues. However, it is planning to double its volume with more product launches from January 2015, which can dent the share of incumbents. Benz is unlikely to alter markets in the nearterm; however, in the longer term (3-4 years) it will dent larger players’ market share as it ramps up its product offerings and production and with the positive vibes its productsare generating .

Discounts – a new norm but marginally off from peaks

”Discount ke bina gadi nahin bikti (if you take away discounts, nobody is going to buy the trucks),” says a CV dealer. Due to emergence of a new strong player (Bharat Benz) and the aggressive discounting strategy adopted by Volvo Eicher and M&M, discounts may not reduce meaningfully from the current levels of Rs250,000-300,000. Discounts on Volvo Eicher and M&M products are 20-25% more than the ones on Tata Motors and Ashok Leyland trucks. OEMs face the dilemma of defending market share while selling vehicles in a tough economic environment — this is further compounding discount levels for both the large incumbents, despite their efforts to curb them. Few dealers pointed out that OEMs increase discounts at the end of the month to achieve volume targets. “Mahine ke shuru mein discount kam karte hain par mahine ke aant me discount fir wohin pahoonch jata hai (OEMs reduce discounts at the beginning of the month but by the end the month, it is back to the original levels)”, says a dealer. A 50% drop from peak volumes has improved customers’ bargaining power in an environment where leaders are trying to defend their market share.

Marginal and gradual price hikes to mitigate discounts impact

To reduce the impact of discounts, OEMs are adopting a strategy of small price hikes while keeping discounts even. Although this may not be the most prudent strategy, companies will continue to do this until demand recovers substantially. This is because if the leading players reduce discounts directly, marginal players such as M&M and Volvo Eicher may take advantage to gain share in the short term.

Subscribe to enjoy uninterrupted access