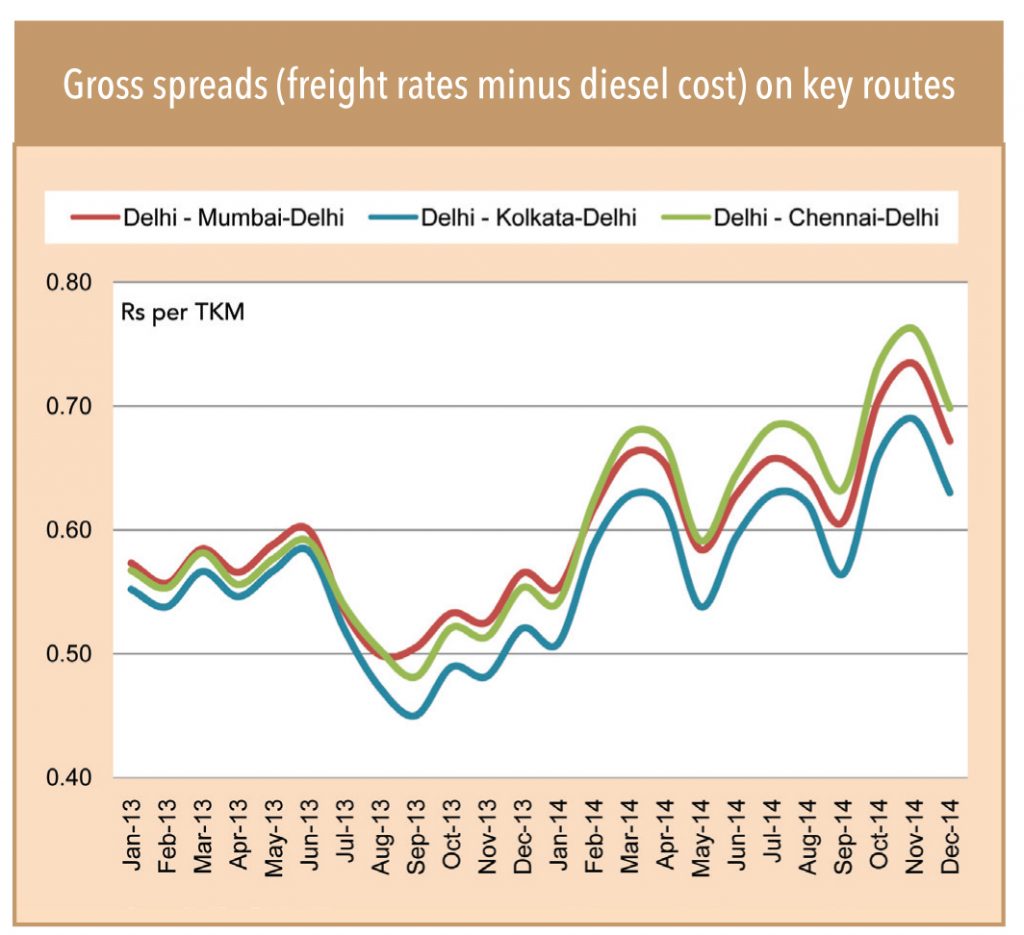

While recent diesel price cuts have given some relief, truck operators are already facing client pressure to reduce freight rates further; therefore, the recent rise in spreads may not sustain. Most operators have highly stressed profitability (barely able to service debts and meet costs), thereby affecting new vehicle demand.

Freight rate spreads are moving in a positive direction, but are they sustainable?

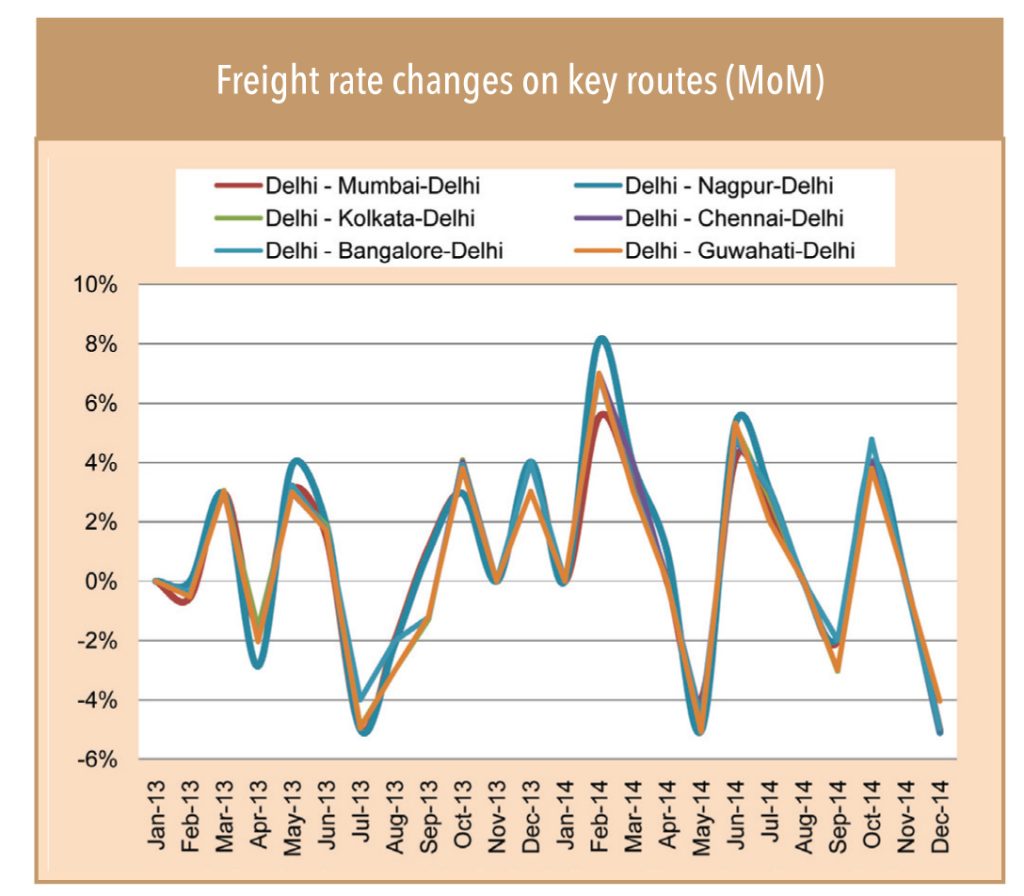

Due to overcapacity in the system and the resultant competition, freight rentals are facing severe pressure for the last two years. Operators have been unable to commensurately increase rentals despite repeated increase in diesel costs, higher operating expenditure (driver/cleaner costs), increasing toll check points/rates across national highways, and higher repair/maintenance costs. The recent drop in diesel prices (which operators passed on only in a small way) has improved the freight-rental-to-operating-costs ratio compared with what it was for the last 6-9 months. It remains to be seen if the current spread improvement is sustainable — fleet operators say that they are already facing client pressure to reduce rentals, based on perceived diesel-price-cut benefits. “Clients

ke mail aane shuru ho gaye hai. Bol rahe hai bhav ghatau (clients have started mailing asking for a rate cut)”, says a fleet operator. This is already visible in the 4.5% drop in truck rentals since the beginning of December.

Diesel prices cut – only a short-term respite and non-sustainable at current utilisation levels

Although the recent Rs 6.8 (11%) cut in diesel prices improved the gross margins of truck operators, a 4-5% cut in December freight rates partially shaved of the gains. With low industry utilisation levels and pressure from major clients, further freight rate cuts are quite likely. When diesel prices had run up 15%, operators could hike their freight rates by only 10%. “Profitability tabhi hi badhegi jab hum rate maintain kare aur diesel price cut ka fayda ho (profitability will improve only when we are able to maintain freight rates and enjoy the benefits of diesel price cuts),” says a fleet operator.

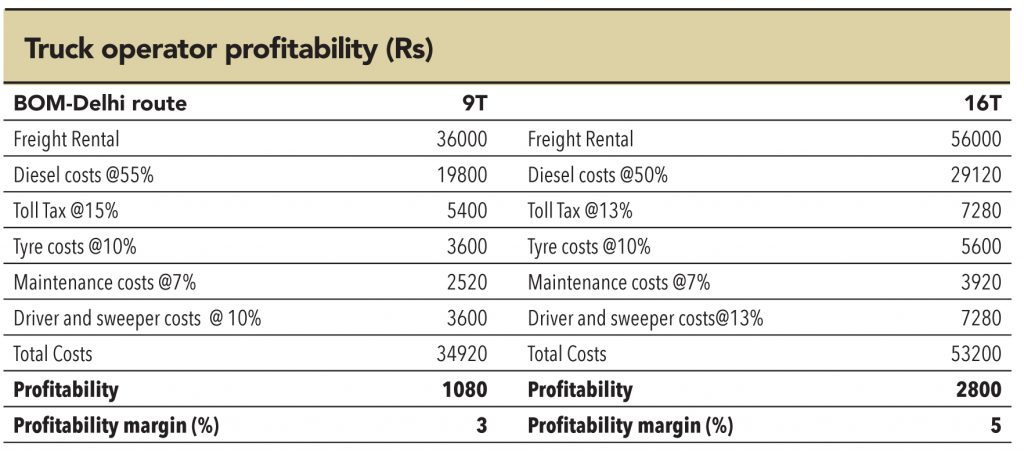

Truck owners’ profitability continues to be stressed

Truck owners’ profitability has been under stress primarily due to low utilisation, cost inflation, and competition-led low-pricing environment. Although the recent reduction in diesel prices has provided partial relief to truck owners in the form of an improvement in gross margin, their spreads are still much below desired levels.

Truck owners say that the trucks they purchased 3-4 years ago are yet to make cash profit. This scenario is unlikely to improve until utilisation, turnaround time, and pricing improves, given that the operators are already down to 3-4% margins. These kind of low margins leave little room for a truck owner with 3-4 year old trucks to service debt and interest costs. This in turn is leading to low appetite for new truck purchases and a slowdown in replacement vehicles. Another consequence of low profitability is that fleet operators have taken to hiring or leasing vehicles rather than owning or adding trucks to their fleets — >75% vehicles (prevalent norm) of large-fleet operators are now running on this hire-and-lease model rather than the previously favoured own-and-operate

model. Thus, truck owners’ capability to service debt becomes important for a meaningful recovery.

Cost structures: Beneficial to own higher-tonnage vehicles

Truck owners are operating at very thin margins of 3-4%. In this scenario, operators are finding higher-tonnage vehicle more attractive due to their better scale and operating metrics, which increases profitability.

Lender apprehensions on new truck financing due to low operator profitability

Since truck owners facing low profitability are unable to make regular loan paybacks, lenders are becoming increasingly reluctant to finance new vehicles, particularly to customers who lack an operating history. CIBIL’s rating of truck owners based on their existing loans also constrains financing by lenders such as scheduled banks. However, NBFCs are more lenient about loan disbursals compared with scheduled banks based on old relationship and higher interest rates. A Mumbai-based CV dealer says, “Recently we had to forgo a number of orders due to the bank’s reluctance to loan to small truck owners”. The reluctance of large financiers (such as banks) in financing CV purchases is further aggravating truck owners’ profitability — when banks and NBFCs refuse loans they tend to rely on local financiers, who charge exorbitant rates.

Subscribe to enjoy uninterrupted access