Can we expect domestic heavy CV volume reach earlier growth trajectory given sharp run-up in stock prices of the listed CV players? Although demand drivers of volume uptick like aging fleet, 50% volume decline from the peak are in place, but slow economic execution cycle, system under-utilisation and structural changes in the industry may keep growth uptick gradual rather than sharp shoot-up over the next 12-months. Apart from external economic factors, internal issues too are restricting major volume uptick such as low truck owners’ profitability and shortage of drivers/cleaners. Both these internal issues are pointing towards change in fleet structure of the Indian trucking industry since proportion of higher tonnage vehicles are moving up sharply leading to tonnage capacity growth ahead of volume growth. In the current edition of the Ground Zero we have tried to peep into demand outlook with both external and internal factors impacting it.

Contrary to current expectation, a meaningful CV demand recovery is still 12 to 18 months away. Goods truck utilisations are still below the comfort levels that will drive fleet addition. While there is strong government intent for boosting infrastructure, on-ground checks suggest that not many are beyond the drawing board stage yet. This, along with overcapacity in the system, specially in mining, will push a meaningful recovery in commercial vehicles further.

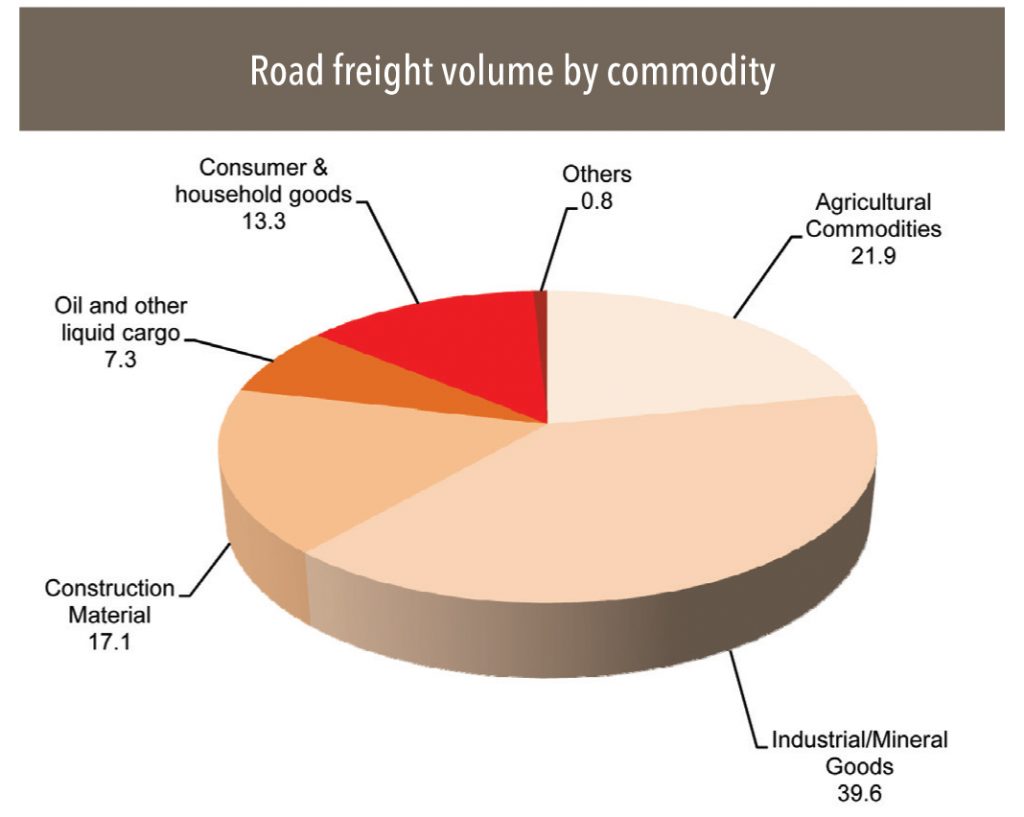

Commercial vehicle growth is dependent on freight demand from a number of sectors such as consumer, industrial goods, cement, textile, mining, construction, perishable agri products, liquid tankers, and external trade demand. Freight can be broadly classified into a few segments — a) goods transport (haulage and tractor-trailer), b) oil and other liquid cargo (tankers), c) mining (tippers and dumpers), and d) construction and infrastructure trucks (tippers, dumpers, and concrete mixers).

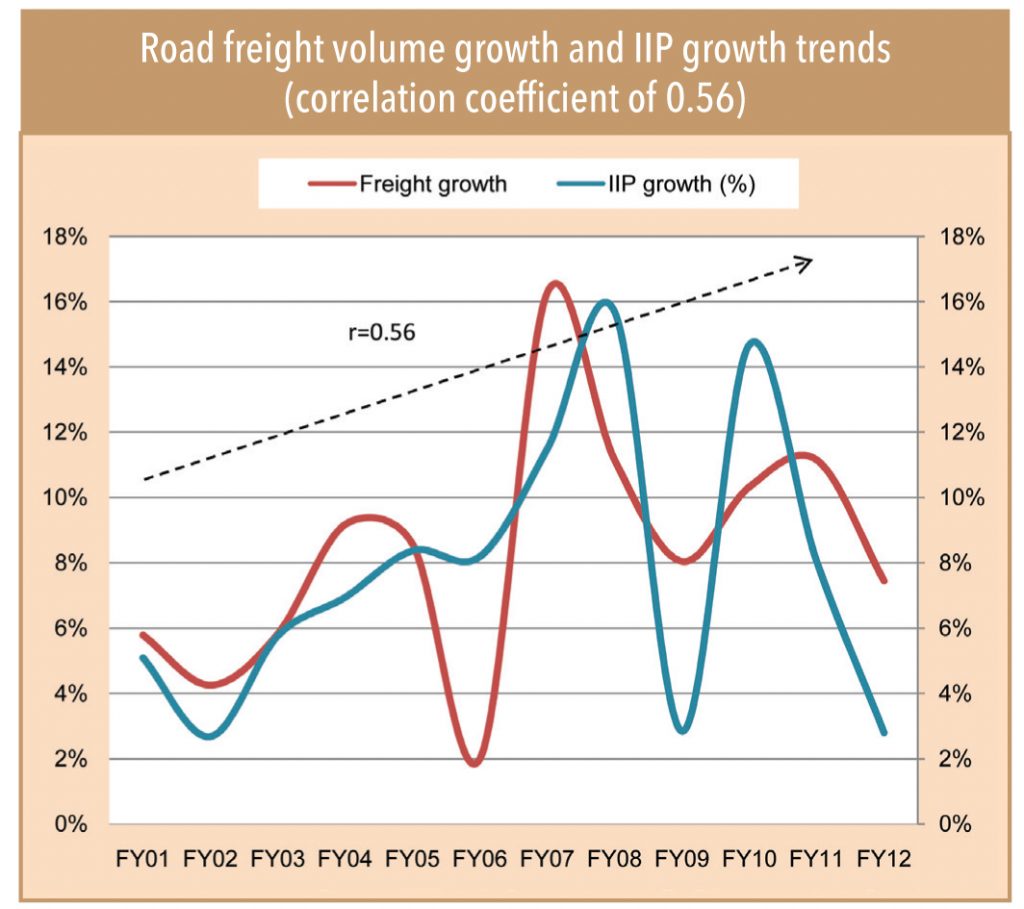

Road freight transport has a 0.56 correlation with the IIP growth rate in India. IIP growth is expected to pick up pace from H2FY16 —so a major uptick in freight demand is still about a year away.

Freight volumes showing marginal recovery – Still miles to traverse

Freight volume trends and transporters’ capacity utilisation are the lead indicators of CV demand since goods transporters (individual and fleet owners)

are the predominant users of the commercial vehicle industry. Since the last two years, freight operators are under severe pressure on several fronts — low vehicle utilisation, pricing, cost pressure, and driver availability — largely because of weak economic environment, fuel and labour inflation, cut throat competition and low demand.

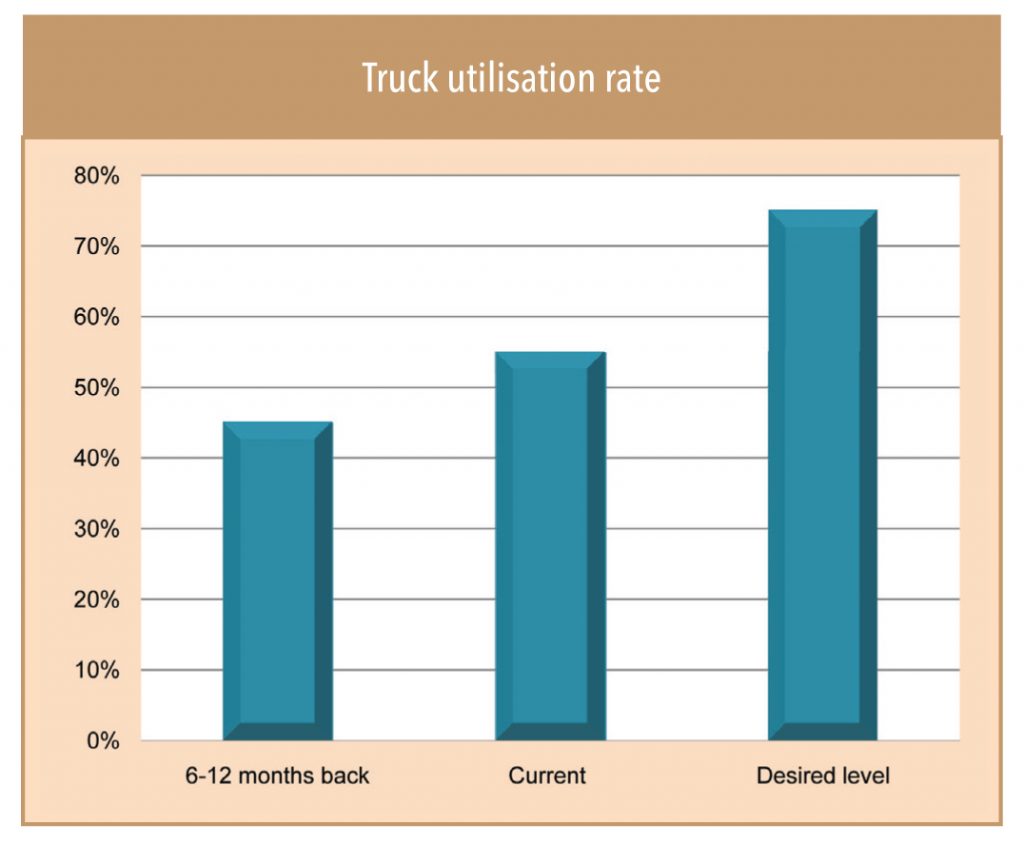

There are signs of a partial uptick in freight movement in pockets such as large port hubs dependent on export/import growth and in the consumer goods industry led by growth in e-retail. Although overall truck utilisation levels have started trending up in the last 6-12 months —to 50-60% currently from 40-50% earlier—they are still much below the comfort zone of >75%, which is a level that can spur incremental demand. The current utilisation levels will only keep replacement-led demand alive. Return freight availability is still a major issue for freight operators, thus retarding overall truck turnaround time and utilisation. “Return bhada milne mein time lag raha hai, truck ko thode din wait karna padta hai return bhade ke liye (return freight is an issue and the truck has to wait for a while before it gets a return journey),” said a fleet operator. All these factors say that a recovery is yet to fructify and is still at least 6-12 months away.

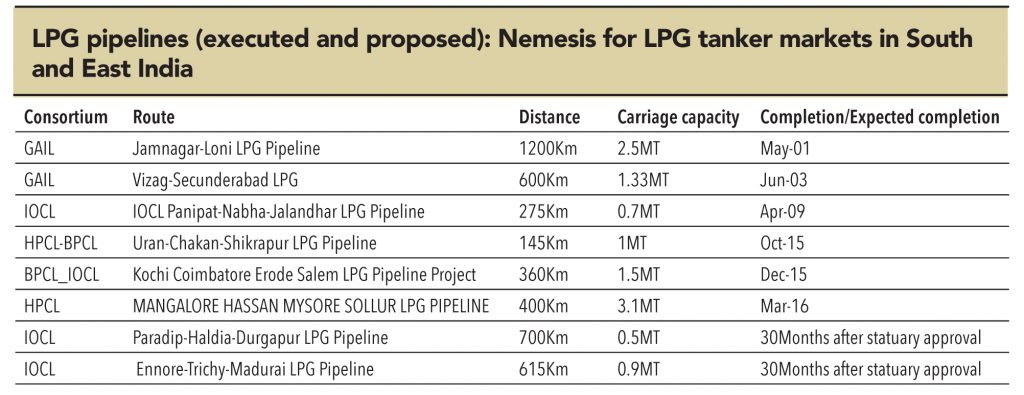

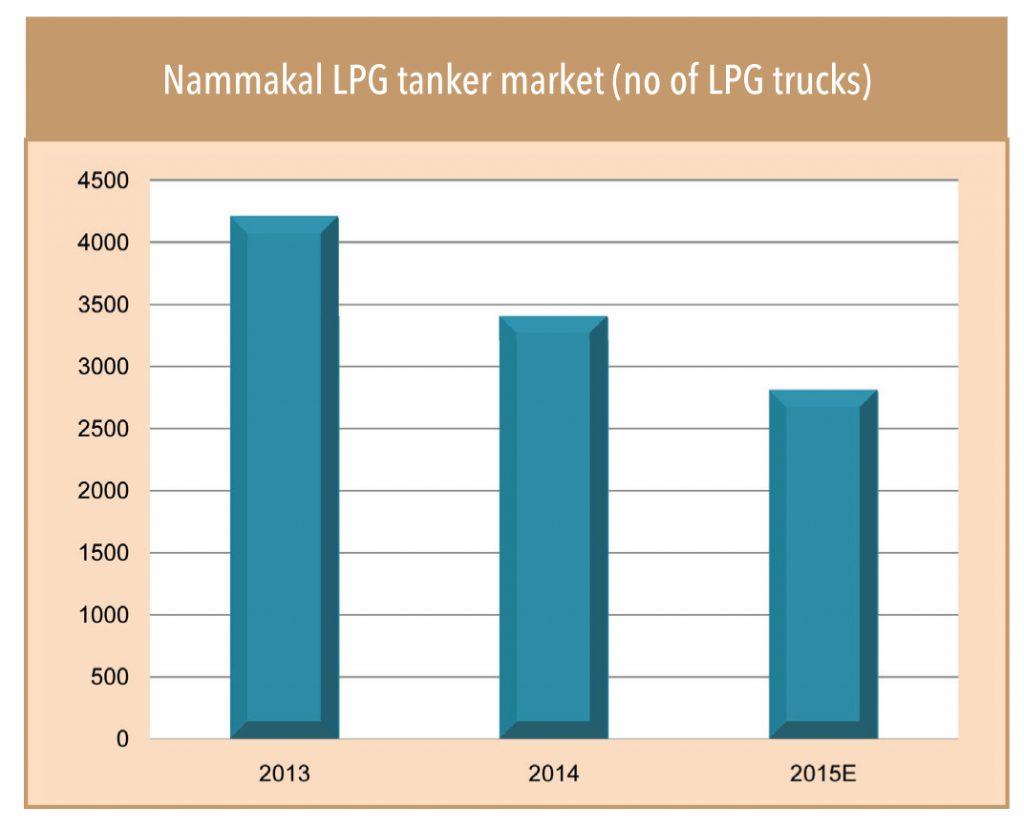

LPG-tanker fleet size to keep shrinking: Liquid tankers constitute roughly 7% of total freight load in India with LPG tankers making up for a significant chunk of liquid tankers. However, the LPG tanker market is shrinking fast because of low utilisation and a gradual rampup of pipeline infrastructure.As gas pipelines improve, demand for LPG transportation through the road network will dry up. Other products (milk, water, and non-LPG petroleum) will drive the demand for liquid tankers, albeit with a lower share in the overall freight pie.

K. Ammaiappan said, “Gradually all LPG transportation will shift to pipelines and the tankers market will cease to exist in 5-10 years. Converting LPG tankers for a different use is also not feasible and scrapping a hazardous-materials tanker is a costly affair”.

– Nammakal LPG Tanker Operator Association Treasurer: Mr K. Ammaiappan

Nammakal survey reveals that a gradual extinction of LPG tankers is a distinct possibility

Nammakal is one of the largest LPG-fleet-tanker markets in India, with about 4,500 vehicles. The Nammakal LPG tanker Operator Association believes that over the next 10 years, the LPG tanker market will almost vanish from the region. The operators here plan to reduce their fleet by 20% over the next two years because of low utilisations (running 2,500km/month) — to achieve its goals of increasing this utilisation to 4,000km/month (to remain viable), it will have to reduce its fleet.

Significant LPG pipeline addition in the southern and eastern regions of India will shrink the LPG tanker market considerably over the next few years. Likewise, the Uran-Shikarpura LPG pipeline will also decrease the LPG tanker market in the Western region. A greater emphasis on city gas distribution in western states such as Maharashtra and Gujarat will have a domino effect. Thus, the LPG tanker truck market will gradually become extinct across India starting with the Southern and Western markets.

Tippers market: Return of buoyancy in mining to be slow and gradual

The tipper segment was a key driver in the earlier growth cycle of 2004-2013 due to an increase in mining. For the tipper segment to revive, a meaningful resumption in mining is a basic prerequisite as mining bans/restrictions in various states have led to overcapacity. Operators, dealers, and companies point out that sales have almost halved from 60,000-65,000 annual tipper sales in 2010-11.

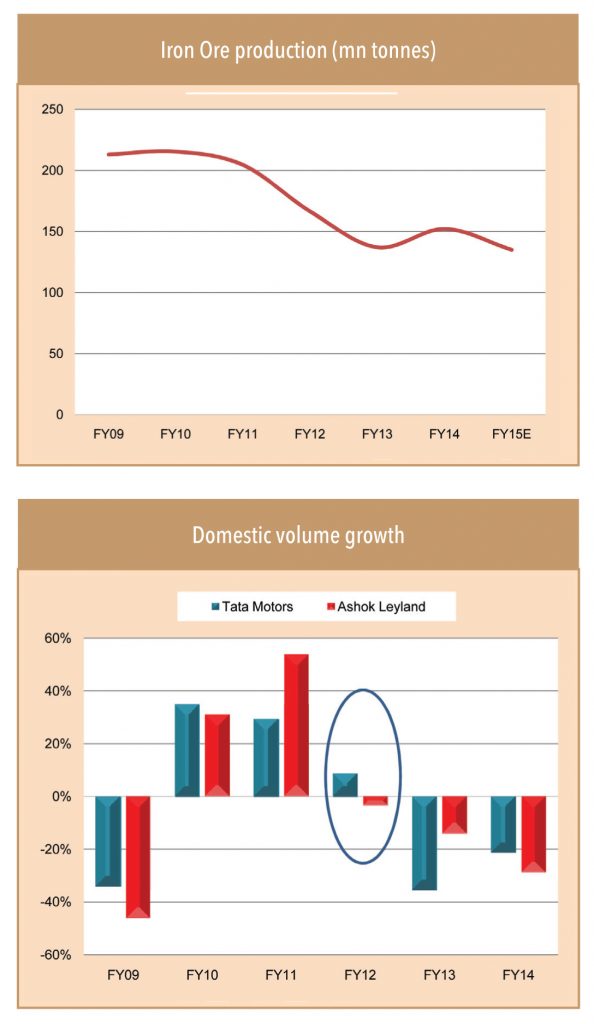

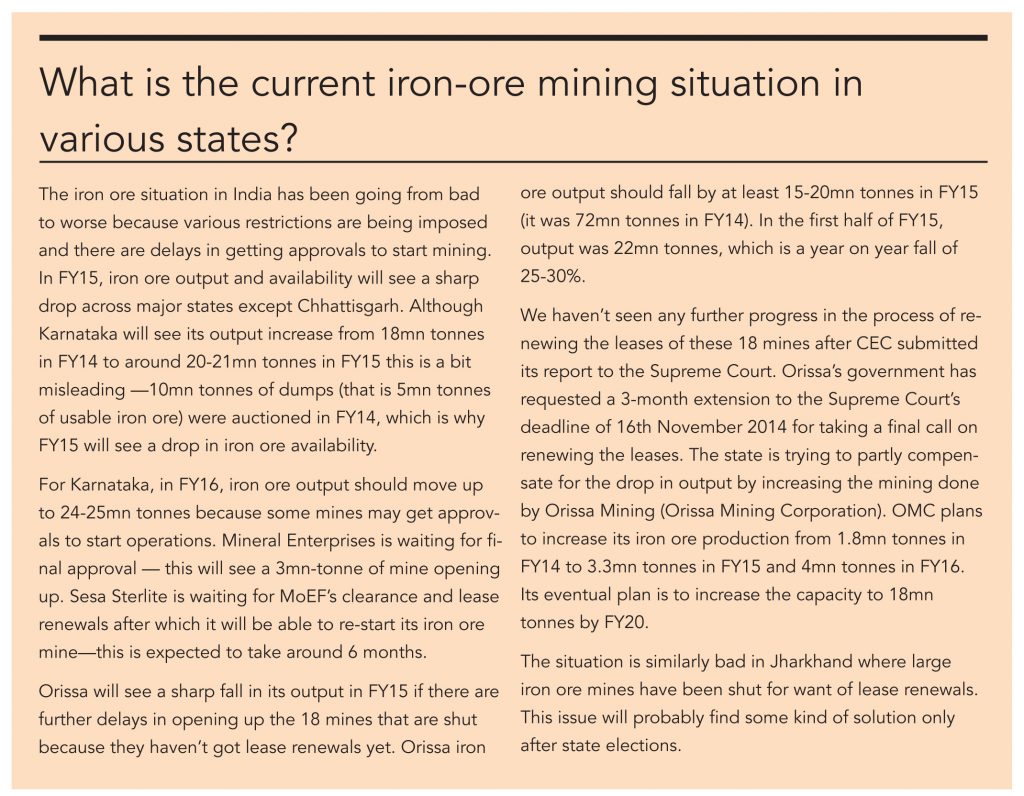

India’s current iron ore production has come down by about 40% from its peak, led by mining bans in Karnataka and Goa and various restrictions imposed in Orissa and Jharkhand. This has had a significant impact on the revenues of various OEMs. The mining ban in Karnataka impacted Ashok Leyland’s domestic volumes during FY12 vs. Tata Motors,’ given the former’s strong presence in these regions. Ashok Leyland’s domestic volumes fell by 3.5% while Tata Motors’ grew 8.7%.

An improvement in output largely depends on various regulatory approvals from the government, including mining approvals. This is further explained in the following excerpts from Mr Dhruv Goel’s interview (MD SteelMint) published in the November Ground Zero issue (Click here to view) where he talks about the iron mining situation in various states.

A resumption in mining may not lead to an immediate pick up in demand for tippers

Even if the mining activity were to pick up from FY16, surplus tipper capacities in most mining areas will curb demand initially, says a small truck operator in Barbil, Orissa (hub for iron ore trading). He said, “Hamne toh saari truck bech di aur bhaade ki truck se kaam chala rahe hai (I have sold my entire fleet and currently operate only a hired fleet). Agar mining shuru ho gayi, toh din ke 5000-tonne iron ore transport karne ki existing capacity hai (overcapacity in Barbil is about 5,000 tonnes per day).”This implies that about 2mn tonnes of incremental iron ore per annum can be transported without any fresh demand for trucks. While this is the situation in Barbil, other regions will also have a similar situation and hence demand from the mining segment is a while away (except for a material ramp up in iron ore production,which is subject to regulatory approvals).

Agri-crop– seasonal uptick, but nothing much to cheer about

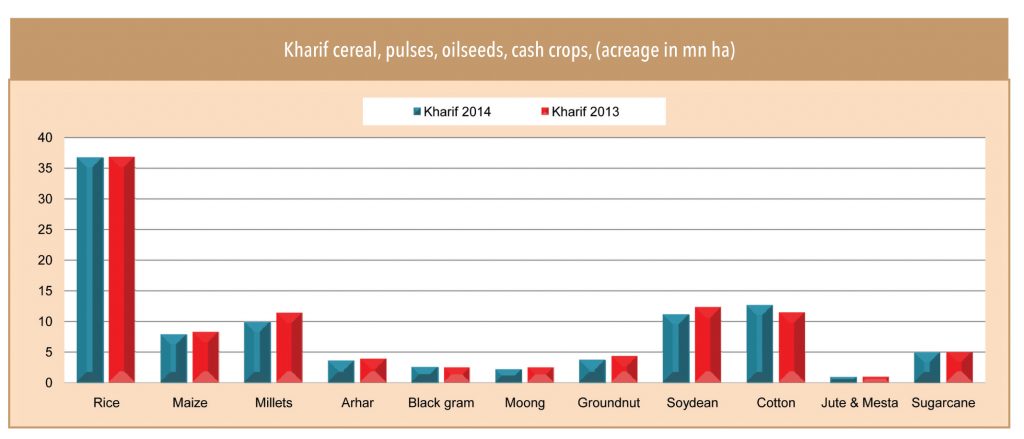

As northern India is the food bowl of the country, agri-crop production trends are a key driver for truck demand in the region. Agriculture produce, particularly food grains and perishables, are a key backbone of truck demand in the 9-to-16-tonne segment. There will not be a major pickup in agriculture-led demand in the near-term due to a marginal shortfall in the current kharif crop acreage (4% lower than FY14) and moderate monsoon.

Indian agriculture is still highly dependent on monsoons;major rain-deficient years have seen a significant drop in food grain production and in the current year, government agencies are estimating a 4% drop in total production for 2014-15. This will have a negative impact on agriculture-led freight demand over the next 6 months.

Few freight operators say that there are some signs of good volume uptick in agriculture products in the Northern region. However, this could be more seasonal/operator specific and may not be sustainable because of a fall in crop-production volume. Thus, a meaningful pick up in agriculture (grains)-led transportation demand is unlikely to happen because of the lower production outlook of current kharif crops.

Horticulture products transport to emerge as a big driver for refrigerated trucks

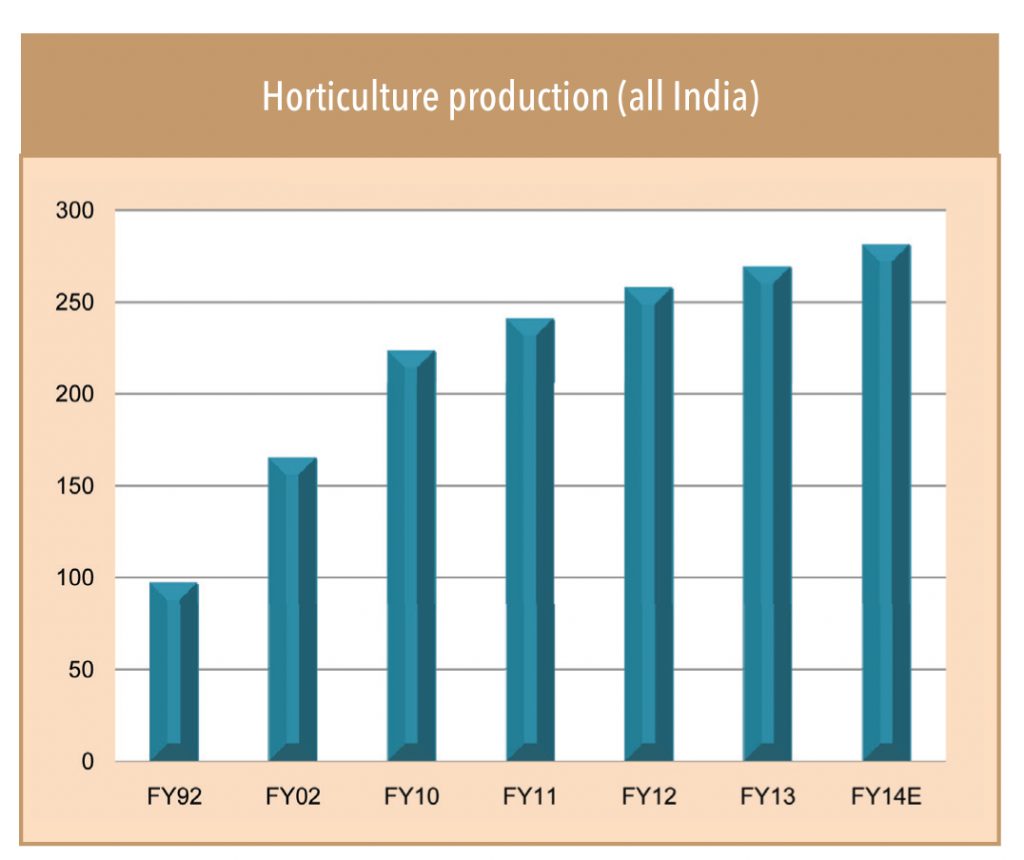

Demand for refrigerated trucks is likely to improve significantly in the medium term due to the government’s focus on horticulture products wastage minimisation, which varies between 15-30% across various crops — this will enable it to overcome seasonal inflation. A move towards less-water-consuming horticulture crops to adjust to the vagaries of rainfall bodes well for the agriculture produce market.

India is significantly short of its required cold-storage capacity. In the interim, the refrigerated trucks market needs to be scaled up significantly from current levels to bridge the shortfall in cold chains and to curtail wastage. As horticulture production is rising at a much faster pace than cereal production,the refrigerated truck market has huge potential (current total fleet size is less than 10,000 trucks). However, the growth in these trucks depends on government incentives/push and is subject to APMC Act amendments (designed to widen the horticulture produce market). Thus, an immediate surge in the volume from this segment is highly unlikely.

In the near term, overall demand from agriculture freight should be only moderate. It will continue to be characterised by more dependence on the rabi crop rather than kharif (which is likely to be below last year’s levels).

Infra sector demand pickup – states like AP, Telangana, UP,and Bihar to be the key focus areas

A pick up in infrastructure-related construction can lead to a massive demand surge in M&HCV sales. Demand from infrastructure is one of the key drivers for dumpers and tippers as they are used to supply construction material and remove debris. Infrastructure contributes to about 17% of the gross road freight carried in India. Given the scope for large construction-material demand due to India’s relatively underdeveloped infrastructure, this segment is the backbone of demand growth for the M&HCV industry.

Financiers and stakeholders suggest that states such as AP, Telangana, Bihar, and UP are likely to be the key drivers of the infra push in the next few years. “Our focus will be on financing trucks in AP and Telangana, which will see a strong pick up in infrastructure activities. Similarly, Bihar and UP will also be in focus because of development potential in those regions,” says a large CV financer.

The new state capital for Andhra Pradesh will be Vijayawada, which will lead to many construction and infrastructure development activities in the region. AP has announced projects worth Rs4.5tn over the next 7-8 years. Likewise, Telangana has also identified Rs350bn worth of projects in its state water grid and roads (to be executed over the next 3-4 years).

Similarly, in UP and Bihar, many road and highways projects are currently under execution or inadvance stages of finalisation —this is likely to provide a significant infra push in these states.

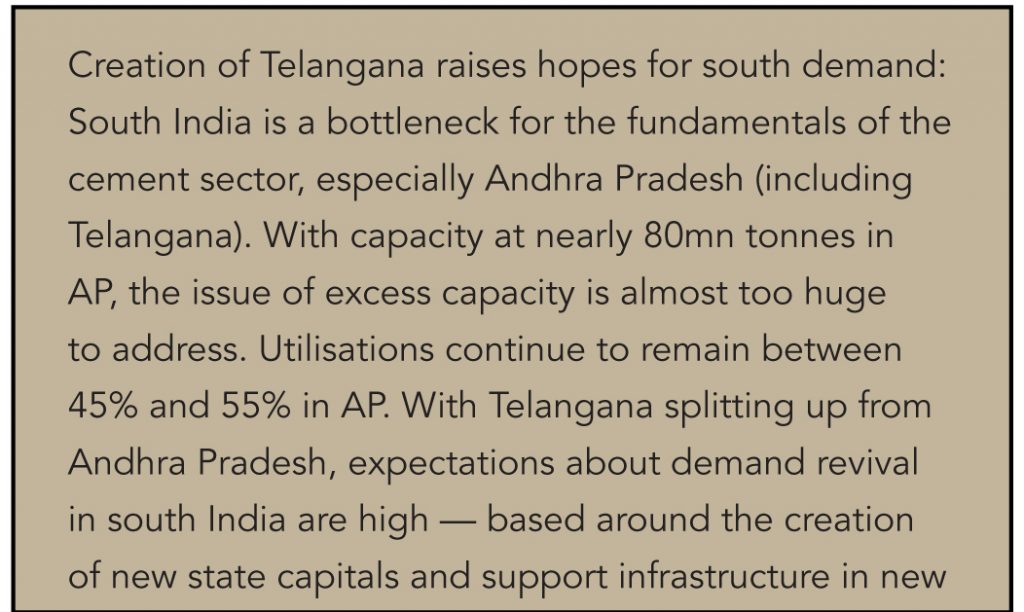

However, it will be a while before the demand from these states takes off, mainly due to delays from the government’s administrative machinery. This was highlighted in the Ground Zero issue in October 2014, which featured the outlook on cement demand (Click here to view the document). Excerpts from the note:

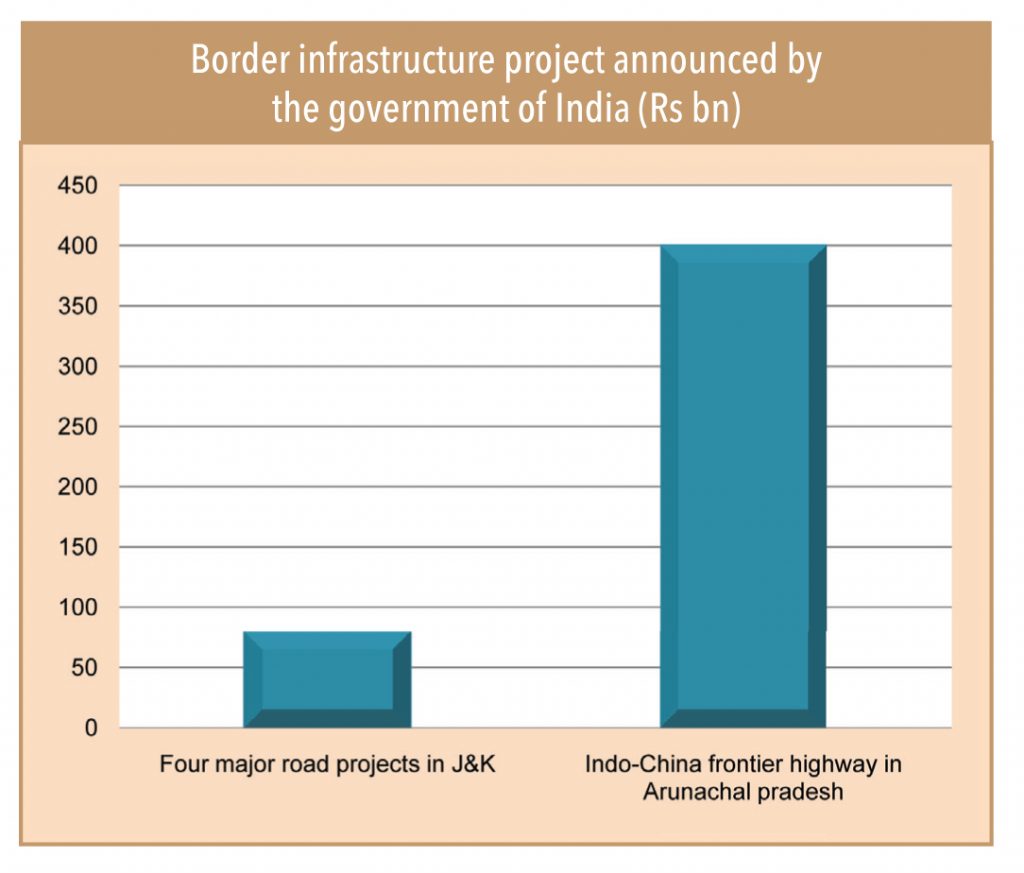

One more area from where demand can come in is through the central government’s major push for infrastructure in the border states of North East and J&K. The tough terrain in these locations will need high-powered and high-capacity trucks. So far, the government has announced road projects worth Rs500bn in both J&K and along the China border. However, work on these projects will be slow due to the rough terrain, many construction bottlenecks, and weather restrictionsfor most part of the year.

Based on the state and border infrastructure projects,significant truck demand should emerge from the infrastructure space in the next few years (unlike in the past few years). Anecdotal evidence suggests that trucks used in the construction segment have a lower shelf life of 4-5 years due to the tougher usage in the segment. The velocity of demand from these states and projects depends on the execution speed — it is likely to be gradual rather than sharp (as anticipated by the market) because execution challenges remain high.

Early signs of freight turnaround, but leap to high-tonnage vehicles will restrict volume growth

While it is not very farfetched to expect a major uptick in freight movement based on economic buoyancy,ground checks reveal that there is no major shift in the situation yet despite early signs of green shoots in a few sector and freight routes. Freight operators and truck owners are still wary of adding vehicles (due to system overcapacities and because they are approaching upcoming growth with caution rather than over optimism), but they are positive about the new government’s intent. Most hope for a recovery in 12 months.

Another impediment to high-volume growth will be a shift towards higher tonnage vehicles (highly visible now) due to better operating economics, driver shortage, and improving highway infrastructure. The Secretary of the Namakkal Trailer Association says, “Drivers, too, are forcing truck owner to shift to higher tonnage or multi-axle vehicles as they don’t want to drive 6-tyre trucks and want to drive trucks with better earnings and superior cabins etc.” This opens the possibility of movement towards higher tonnage vehicle since tonnage growth will be high with moderate volume pick up .

Conclusion: Contrary to current expectation, a meaningful truck-demand recovery is still 12 to 18 months away.

Subscribe to enjoy uninterrupted access