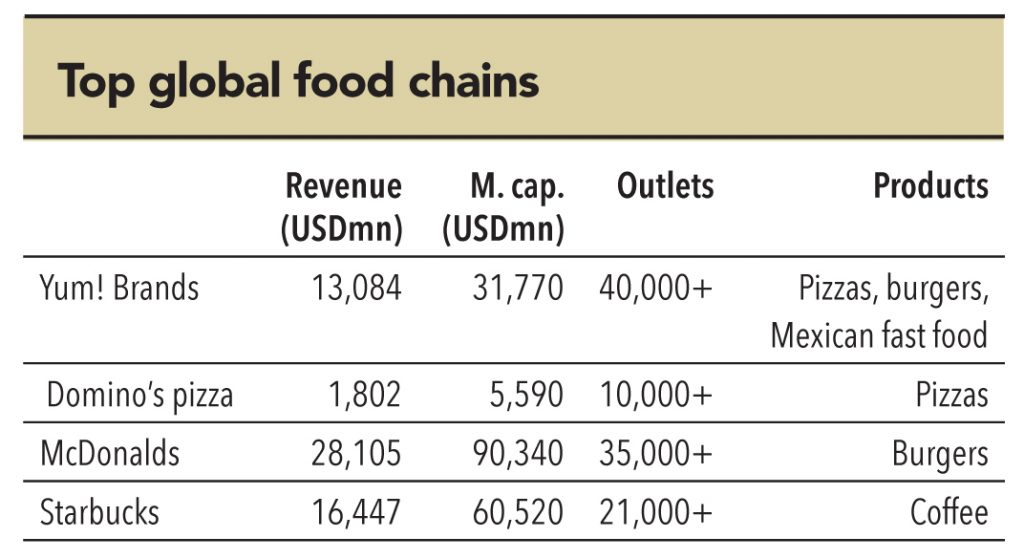

If gluttony is a sin then Indian gastronomes are probably among the biggest transgressors.Indian gastronomes have been partying non-stop over the past few years, celebrating either the launch of a brand, restaurant or category almost every week. The success of fast-food brands like Domino’s pizza, McDonald’s burgers and Yum! Brands’ fare has brought in a slew of players not just in the quick service restaurant (QSR) space but also in the fine dining category. Major global brands like Starbucks, Dunkin Donuts,Costa Coffee, Burger King and others have forayed in the QSR category and Michelin Star restaurants like Yauatcha have opened outlets in India, giving foodies a wide choice of culinary delights and experiences. The following table lists the global details of various fast-food companies that operate in India.

These global brands are compelling success stories and have proven business models. Besides, they are global majors, committing serious capital and are willing to tide over tough times. However, a brand’s success in one country need not necessarily spell its success elsewhere—each country is a different market, with different consumer preferences and unique habits. Consequently, the learning curve for brands is generally lengthy and crucial to achieve scalability. Despite the entry of several new players, the advantage lies with older players and their ability to build a scalable proposition.

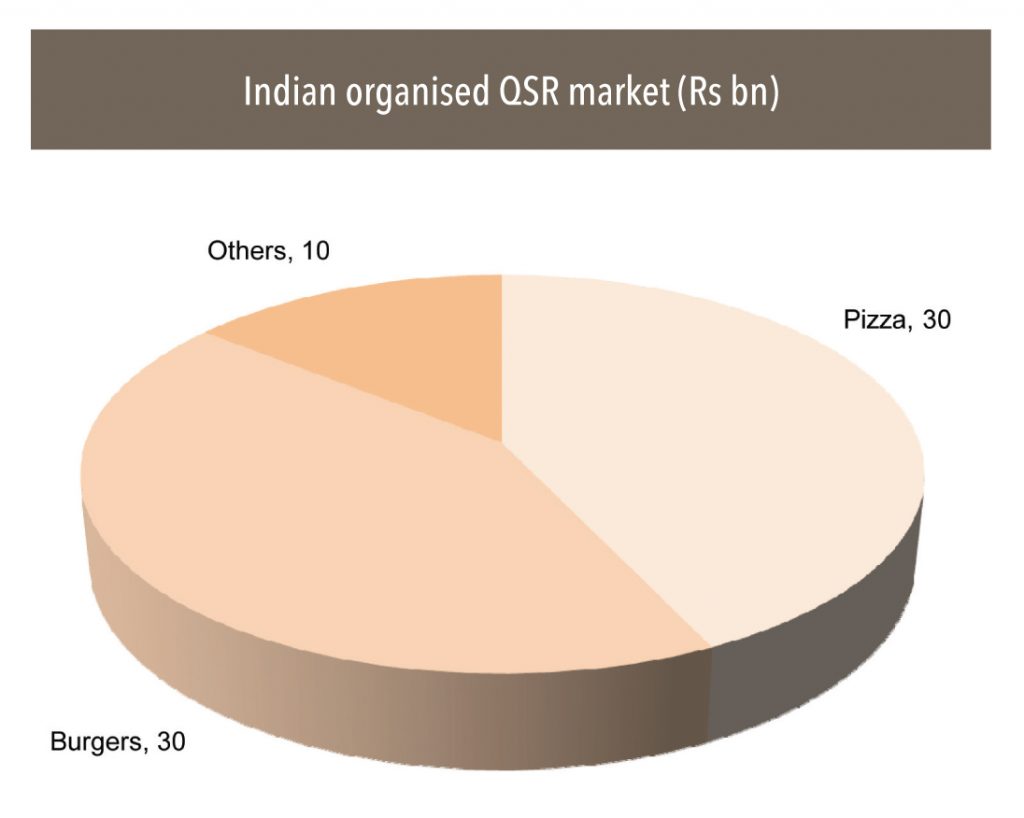

Western fast food (WFF) is the fastest growing category of the QSR segment in India. Two large segments of WFF industry are burgers and pizzas. In the US, the burger market is estimated to be twice the size of the pizza market, which is the next largest category. Given its role as the quintessential American meal, burgers have also proved to be the most portable concept globally, with an estimated global market size of over $135 bn. However in India, the markets for burgers and pizzas are roughly equal in size of Rs 30 bn each. This might well indicate an under-penetrated burger market with great potential—we may get a better idea as the market evolves. Still, the two categories have attracted many new players who continue to invest in them.

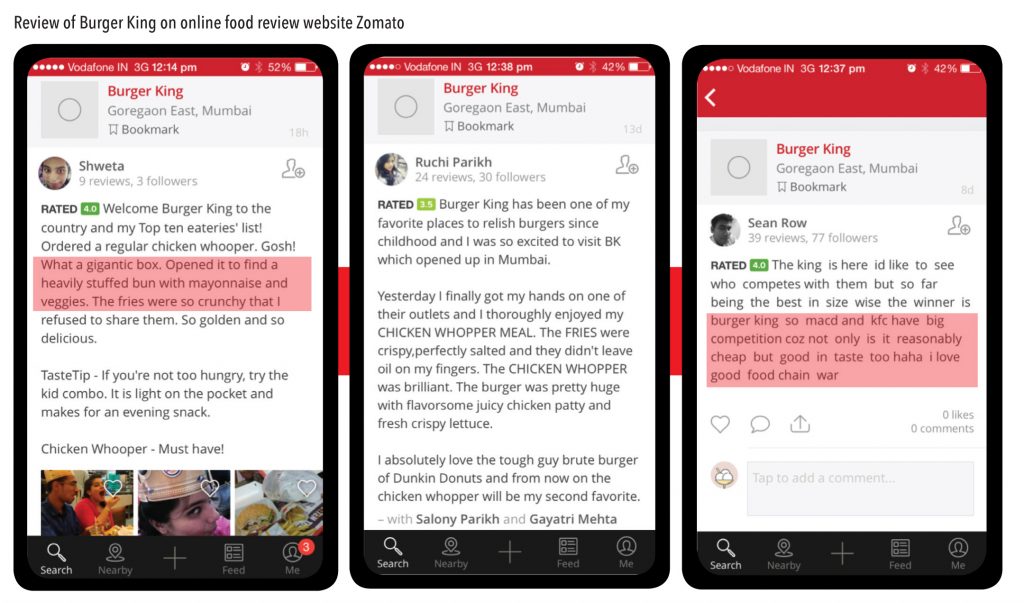

“We will have burgers that no one in India has ever had before,” says Rajeev Varman, CEO of Burger King’s India operations. Burger King is an iconic global brand and its association with burgers is as strong as that of McDonald. The initial reaction to Burger King seems to be enthusiastic. Delectable menus, a value-for-money proposition, colourful brand imagery and innovative marketing strategy have characterized Burger King’s entry in India. The first outlet opened in Saket, New Delhi on November 9, 2014, and according to the company 1,200 people pre-ordered its signature Whopper burger on e-bay

Burger King is a late entrant in the QSR space but it had been contemplating an Indian entry for quite some time. The delay is attributed to it not being able to find the right franchise partner in India. Partnering Sameer Sain’s Everstone Capital, which has significant experience in the QSR space, Burger King finally entered India. Scaling up a restaurant business requires a robust supply chain and back-end support but product acceptability comes first and it is the foremost ingredient for success. Reviews on Zomato are encouraging with particular emphasis on the size of its Whopper burger and value-for-money proposition.

The burger market is hungry for more and the addition of new player will only grow the market. Pre-ordering burgers on e-bay is indicative of the potential of the market. Burger King seems to have started off on the right note but scaling up of the business will require acumen and improvement in market conditions would be helpful

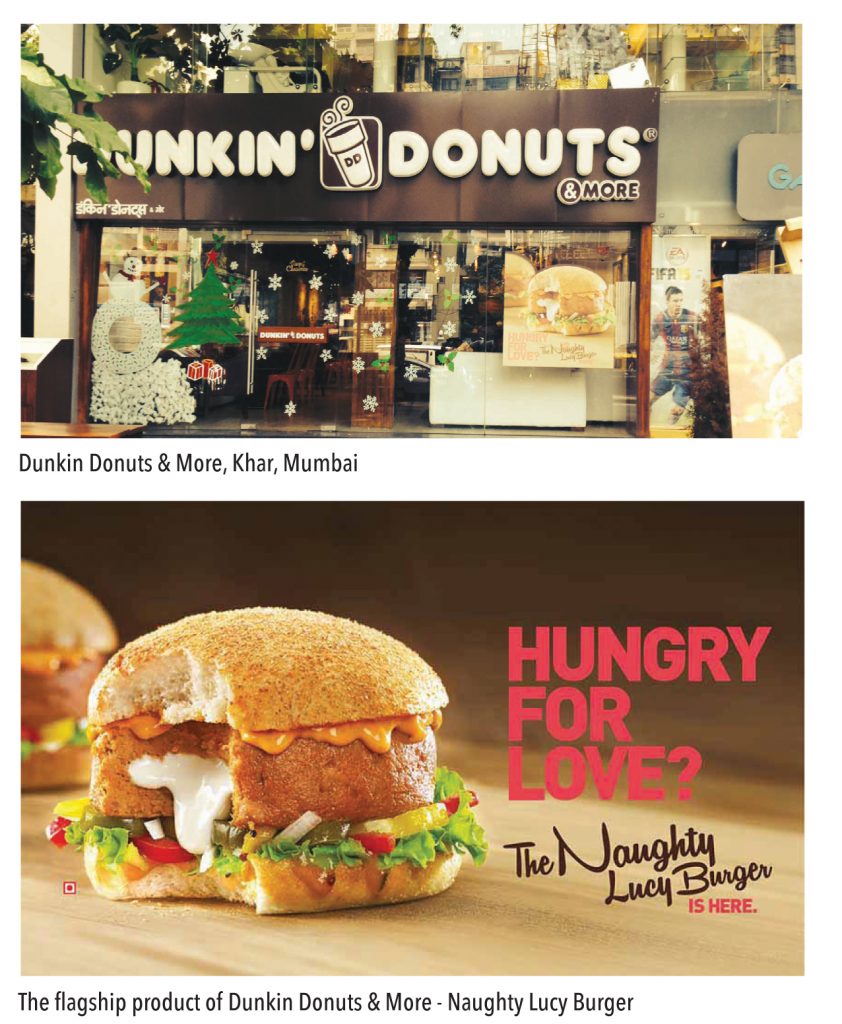

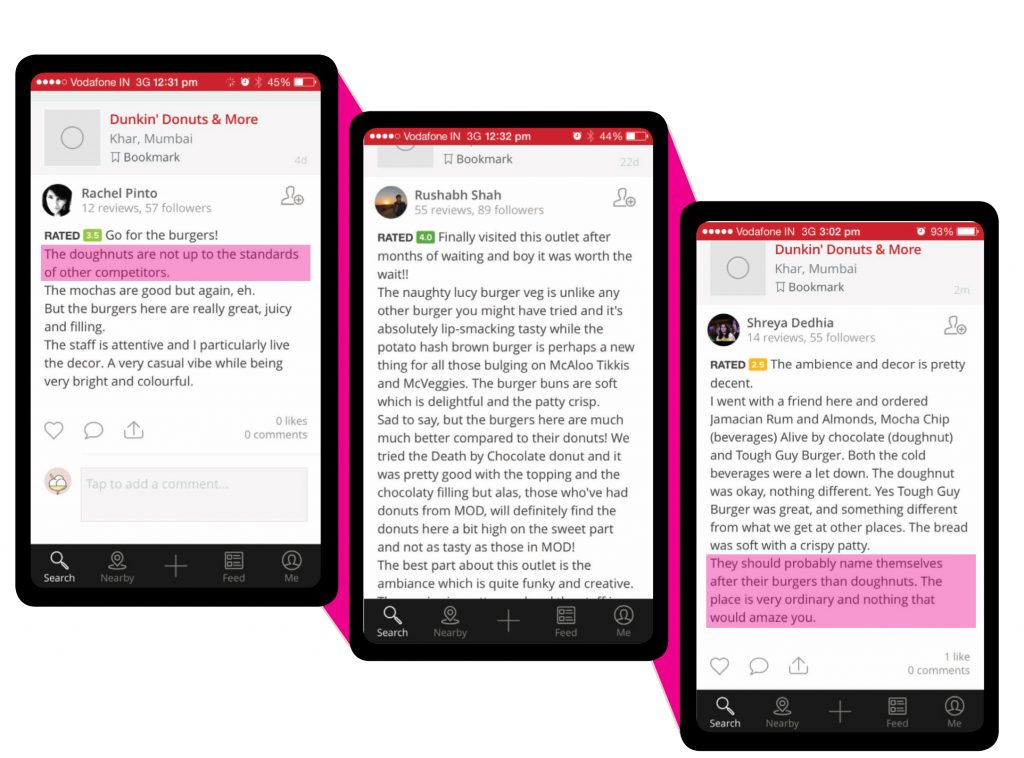

Dunkin Donuts is one of the most successful beverages and confectionary companies in the world. It competes with Starbucks and has 11,000+ outlets against Starbucks’ 21,000-plus outlets worldwide. However, the Indian story is turning out to be very different. “We want to be known for our burgers” says Mr Ravi Gupta. Dunkin entered India in 2012 with a master franchise agreement with Jubilant Foodworks. The donut-eating culture can, at best, be described as nascent and positioning on a wider product offering, which can ride on the elaborate supply chain of Dominos seems like a winning strategy for Jubilant Foodworks. However, Dunkin’s branding and product positioning is confusing as the mainstay offering over the long term will be burgers and not beverages and donuts.

Baked burgers a half-baked proposition

Dunkin’s burgers are baked and can be considered premium to those of KFC and McDonald because of their size and ingredients. Pricing is higher but the offering is not very clear. Indians have developed a habit of eating burgers with French fries and colas. Dunkin serves cola but does not have the numerous combination offers of McDonald or KFC and it does not serve French fries but offers hash browns. “We do not have a fryer in the kitchen and our burgers are much healthier than the KFCs of the world” says the restaurant manager of a leading Dunkin outlet. Baked products are healthier than fried products but few consumers know about the healthier offering because Dunkin has not advertised the proposition. “People generally do not sacrifice taste for health in India, it just doesn’t work” says Saugata Gupta, CEO of Marico. Indians love fried foods and will continue to throng to KFC and McDonald for their fried burgers.This value proposition, even though seemingly superior, is half baked. Consumer eating habits are difficult to change and adaptation is generally the right strategy. Interestingly, Dunkin’s donuts have not been widely appreciated and many prefer Mad Over Donuts. This further confounds the proposition as the perceived flagship products, donuts and coffee, have limited appeal but the ancillary offering (burgers) is great.

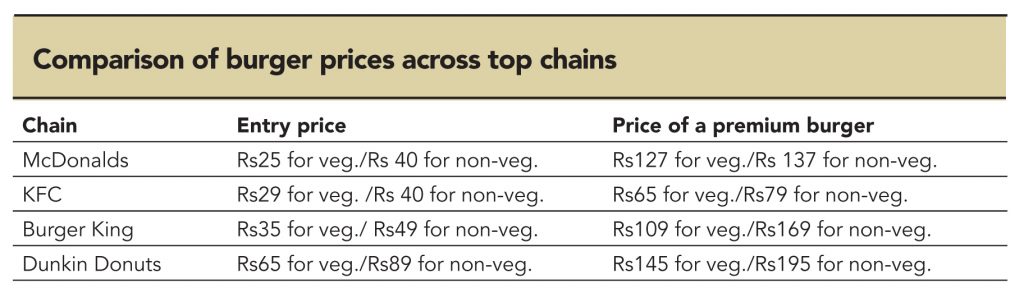

The following table shows the difference in pricing of various products from fast-food chains

No Duck soup

Jubilant Foodworks has ambitious plans for its Dunkin franchise. Jubilant will open 70 Dunkin outlets over the next three years, taking the total count to 120 outlets. Dunkin is not profitable as the business is in the nascent stage but achieving long-term profitability depends on driving the core values of the brand and evolving according to local consumer needs. The learning curve involved is still significant as Dunkin will have to move out of its comfort zone of beverages and confectionery to dining options. Competition in the category is very high and continues to intensify. However, Jubilant has developed a robust supply-chain model, owing to the success of Dominos, which will help the company to compete with the best.

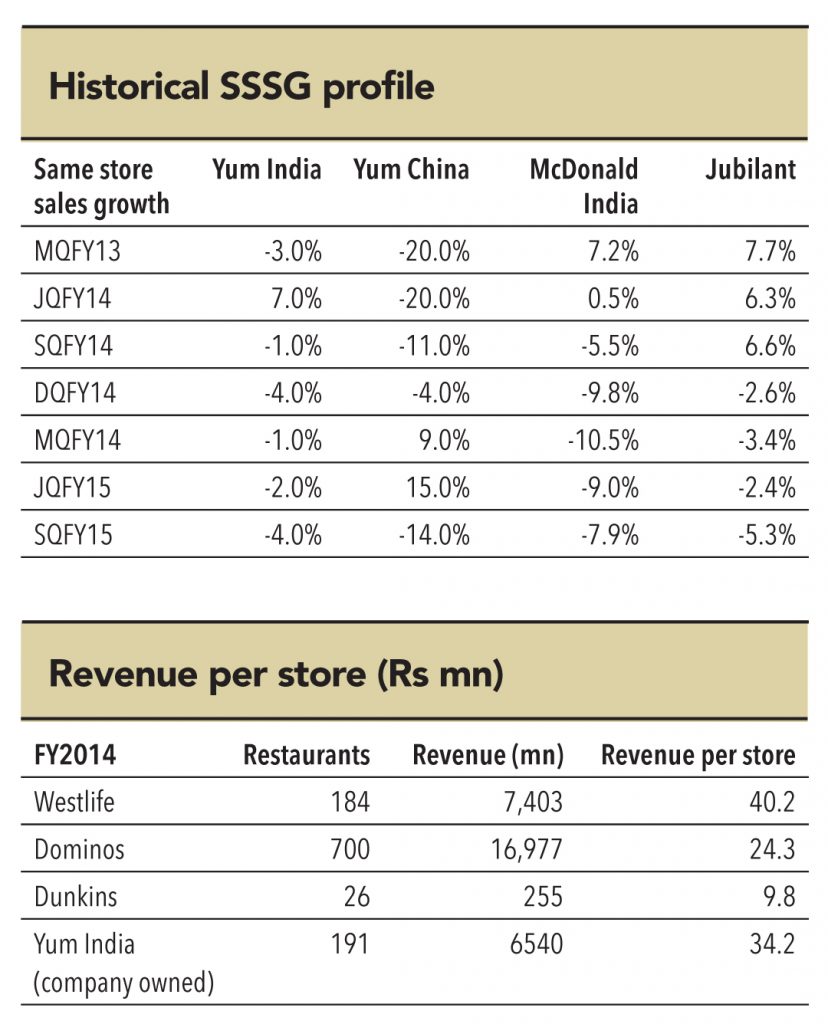

Mr. Ajay Kaul, CEO of Jubilant foodworks says, “Dunkin is at a different level of evolution compared to Dominos for us and it is not fair to compare the store sales growth of Dunkin and Dominos.” Dunkin’s loss for fiscal year ending March 2015 will be about Rs300 mn for its fifty outlets and the management guidance indicates a breakeven time frame of six years since inception—by 2018, with 120 stores. Profitability is likely to be protracted for the chain and will be margin dilutive for Jubilant Foodworks over the long term as Dunkin’s profitability is unlikely to match the store economics of Dominos.

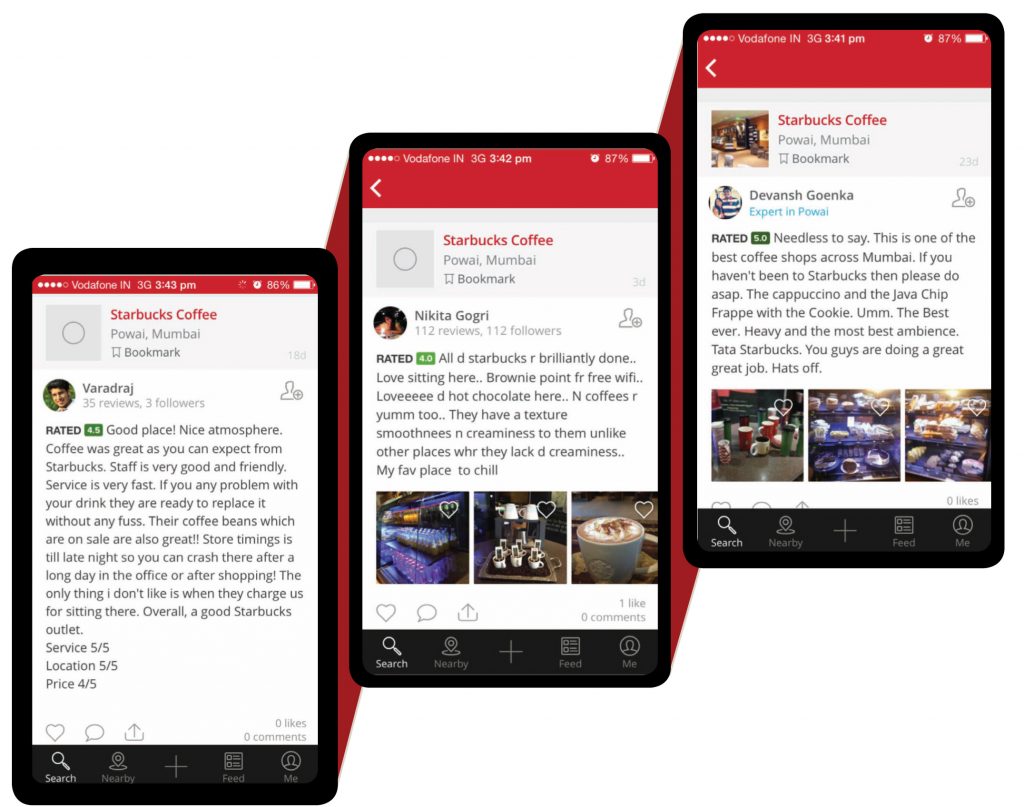

“We have a loyal customer base of people who have frequented Starbucks in other countries,” says the store manager of an outlet in a swanky south Mumbai mall. Starbucks is not just an iconic brand but it is also a cult brand. A darling of the investor community, Starbucks is the most successful QSR chain after McDonalds in terms of shareholder value creation and profitability. Its success is attributed to the genius of its founder Howard Shultz. Its track record of product innovation, creating new store formats and creating new market trends is unparalleled. Starbucks entered India in 2012 through a 50:50 joint venture agreement with Tata Global Beverages. Since the first outlet in Mumbai opened in October 2012, the venture has expanded rapidly, to 61 outlets, in just two years. Starbucks has captured the imagination of people in India and they rate the products and outlet ambience highly.

It operates in the premium range with pricing at about a 50% premium to the largest home-grown network, Café Coffee Day. However, premium comes at a price. Most of the stores are in premium locations and presently the store formats are rather large—2,500 square feet. The operating timings for the stores are longer than most QSRs. This means steep operating costs. The biggest challenge for Starbucks will be scaling up its premium proposition. Initial launch can be funded by equity but scaling up a restaurant business has to be achieved by ploughing back cash flows of profitable outlets.

Economics of selling beverages

“Selling beverages is not very profitable,” says Mr. Ravi Gupta, as India, unlike the US and other developed markets, does not have a ‘morning market’. Mr Vishal Gupta, CFO of Costa Coffee, says it is common for people in the US and other developed markets to take their “daily fix of caffeine” as early as six in the morning. “We are very focused on site selection and our motto is the experience to customers,”he says. In the beverage business the value proposition is not just the beverage but the experience and ambience for customers, which make the catchment area critical.

Costa Coffee a leading UK-based beverage chain, with 2,800 outlets globally, entered India nine years ago and has 120 outlets in India. It will add 15-20 outlets every year for next few years. It has about 25 outlets at various airports, which are very profitable because airports have longer working hours with a significant morning market, as early as five in the morning. On an aggregate basis, Costa is profitable; and this has been achieved by focusing on careful site selection. It even bucked the trend of a decline in same-store sales growth in a slowing economic environment due to its consistent product quality and adept site selection. Costa’s stores usually measure 800-1,000 square feet; besides it has kiosks. As a rule of thumb, in the beverage business, which is split 70:30 between beverages and foods, large stores with revenue of Rs35,000 a day and kiosks with revenue of about Rs15,000 a day are profitable.

Customers hungry for more

Moshe’s, an up-market indigenous brand, competes with the likes of Costa and Starbucks. Its kiosks generate revenue of Rs15,000 a day but the larger stores generate on average about Rs50,000 a day in malls. Moshe’s operates in the fast casual dining space and prides itself on its quality of food and its wide range of beverages. Fast casual dining is an upcoming global category that has captured the imagination of people around the world for their innovative branding and quality of fresh food.

Starbucks’ store size and ambitious plans mean it will have to offer more and better dining options. It will consider opening smaller, 1,000 square foot stores in small cities; however, in small cities footfalls are lower than in metro cities. To manage profitability and scale up its offering Starbucks will have to introduce kiosks as well. Its menu, though sumptuous, will evolve to adapt to the Indian palate. Starbucks is an evolving model with initial focus on product off-take and establishing brand saliency. However, achieving profitability and scale are the two biggest challenges for Starbucks, which are not very easy to overcome in the short term. Nonetheless, it has started off on a promising note—profitability, even though protracted,will be achieved over the long term and a pick-up in the Indian economy will help.

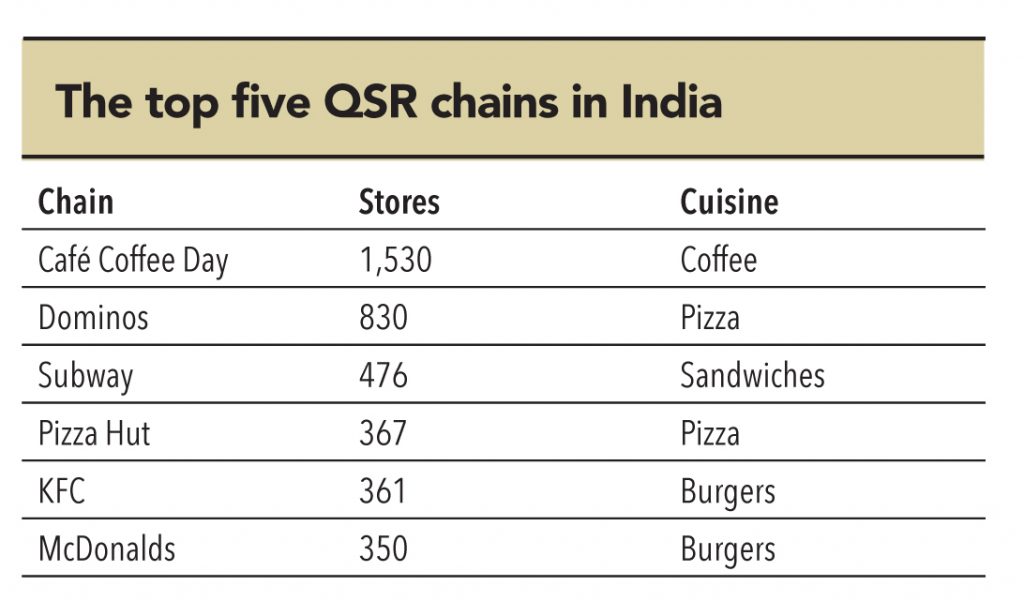

Players who entered the Indian market in the 1990s enjoy the advantage of consumer understanding across India. They have well established brands and their site selection and store openings are the smoothest. They have also developed significant online tools, which help them drive efficiency and scale. The big boys of the QSR business are Dominos Pizza, McDonalds, KFC and Pizza Hut. The smallest of the global brands, Dominos, is the beste stablished and most profitable QSR brand in India mainly due to its visionary franchise, Jubilant Foodworks.

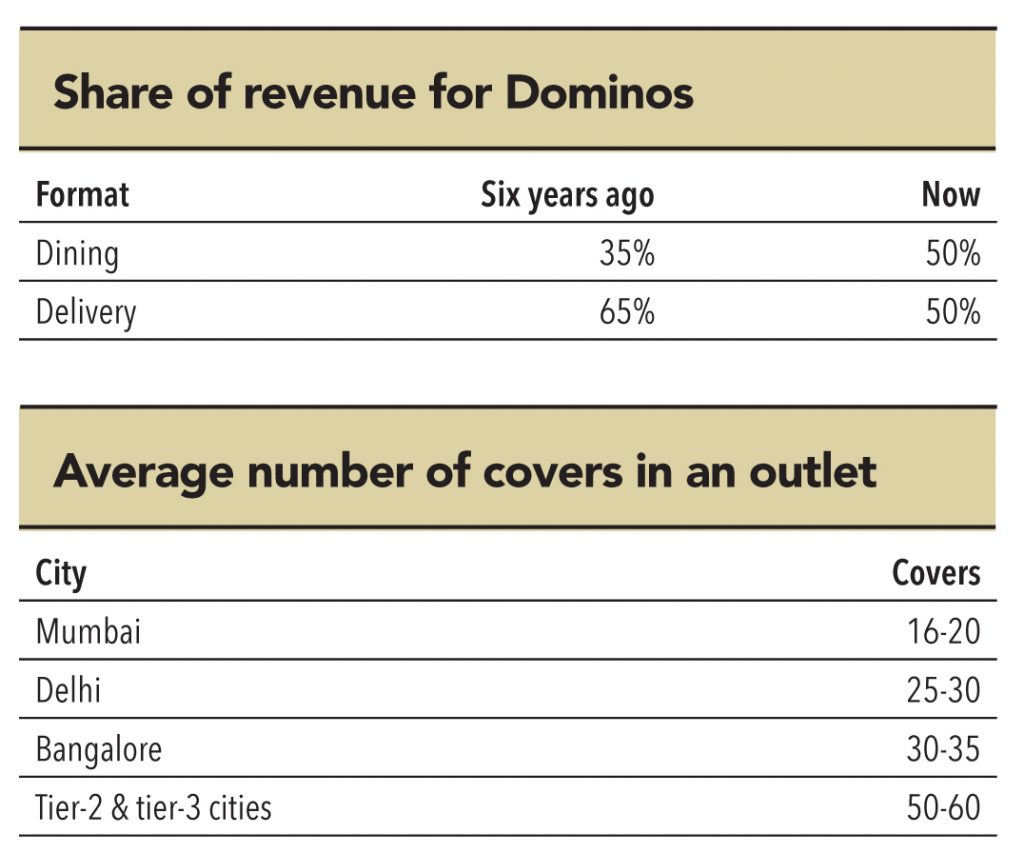

Dominos has 844 outlets and adds about 150 outlets each year. It has the most differentiated positioning in the market as it operates in the home-delivery segment as well as the restaurant category. Revenues are split 50:50 between home delivery (takeaway included) and dine-in. This ratio is slowly titling in favour of dine-in as Dominos penetrates tier-2 and tier-3 cities, which do not have a home-delivery market. Dominos is the most profitable QSR business model in India in terms of profit margins and payback period. The turnaround time for achieving store profitability is also the quickest and it has consistently innovated to keep consumers engaged.

Interestingly, even in an up-market mall like High Street Phoenix in Lower Parel, Mumbai, where customers have several options, Dominos clocks high footfalls, which is indicative of the strength of the brand. “Overall competitive activity has increased,” says Mr Ravi Gupta. “Pizza Hut has major expansion plans and wants to reach to 500 outlets by the end of CY2015. The opening of a competing store in the same catchment area is not good in the short term but in the long term it helps to expand the market—one brand alone cannot expand the market. When a customer sees more brands, he or she gets excited, trials increase, lifestyles change. This helps to make the customer go out more often, which leads to expansion of market”.

Although Dominos’ same-store sales growth has declined due to the economic slowdown, other mature formats have seen a sharper decline.

Dominos is still the best QSR business model in India and it can double the number of its outlets in India by 2020 without impacting its profitability. Dominos will be one of the biggest beneficiaries of economic revival and it will see a sharp growth in profitability and margins, driven by operating leverage.

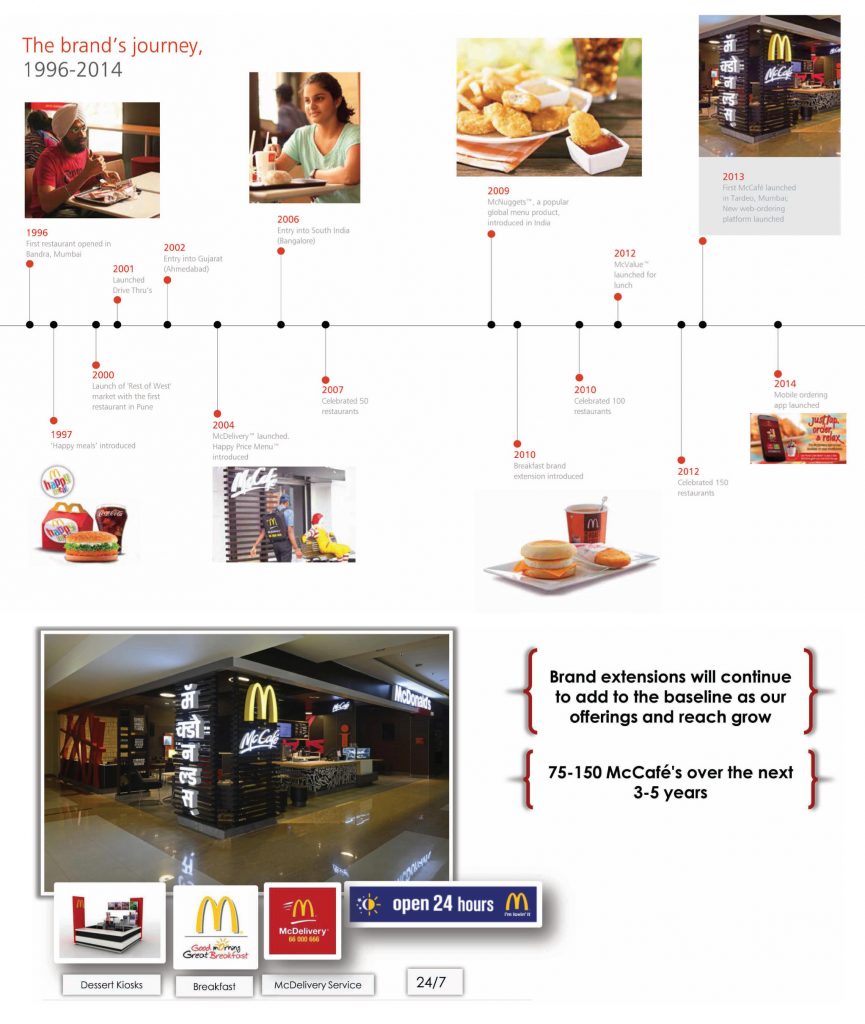

McDonald entered India in 1996 through two master franchise agreements, Hardcastle Restaurants, licensed to operate in West and South India and Connaught Plaza Restaurants for North and East India. It opened its first restaurant in Bandra, Mumbai and currently has 350 outlets and with annual system sales of about Rs14 bn. McDonald’s has most successfully adapted its menu to the Indian palate and delivers products and experience that straddle the consumer pyramid.

This has been the strength of the brand globally as it attracts people from all classes. McDonald’s revenue per store is Rs40 mn, the highest in India among established QSR chains. McDonald has consistently innovated in India with its menu and has added major brand extensions.

McDelivery. The company’s delivery model was launched in 2004 to cater to the home delivery market in metro cities. The model competes with Dominos for the consumer’s share of wallet in the home-delivery space. McDonald has consistently invested in online capabilities to aggressively build this model.

McCafe. McCafe is a brand extension launched in 2013 to capitalise on the fast growing trend of beverages and coffee consumption. The product pricing is competitive and similar to that of Café Coffee Day’s. This is a store-in-store format and it plans to open 300 McCafe stores over the next five years. A McCafe requires investment ofRs3 mn and it rides on the infrastructure of a McDonald’s outlet, which supposedly quickens the pay-back period.

Dessert kiosks. Another extension to compete with an upcoming trend of ice-cream parlours. The per capita consumption of ice cream in India is significantly lower than similar developing economies like Indonesia, which leaves scope for penetration.

24 X 7. McDonald’s also started 24 X 7 outlets in key locations like airports and railway stations to cater to the burgeoning market.

McDonald’s strategy has been to compete in as many categories as possible like breakfast, beverage, dining and confectionery—all with a value- for-money proposition. Globally the company operates on a franchise model, earning royalty income, but increasing product lines helps revenue growth. Consequently, the company has one of the highest revenues per store. However, a franchisee must buy new equipment, increase inventory, train staff and make other such investments, which increases the payback period and shrinks return ratios. Even though McDonald’s has made significant additions to its product line through brand extensions and product introductions, including premium burgers, the decline in same-store sales growth has been alarming—higher than both Yum! Brands and Dominos.The base effect and the economic slowdown are main reasons, but a cursory look at McDonald’s global business outlook is not very encouraging. Whether the impact of a changing global strategy will dent the India business is debatable but there is little doubt that McDonald’s faces an arduous task of revamping its global strategy.

A lot on one’s plate

Recently McDonald’s made significant changes in its top management with CEO Don Thomson announcing his retirement from March 1, to be succeeded by Steve Easterbrook, senior executive vice president and chief brand officer. McDonald’s has been losing market share to fast casual dining outlets like Chipotle, Shake Shack, Nandos and even to Burger King. Even though McDonald’s per store revenue is almost twice that of Burger King in the US, the consistent decline in SSSG is alarming. In the recently announced results for 2014 on January 23, the behemoth reported a decline in comparable sales (SSS) of 2% in constant currency terms, reflecting negative guest traffic in all major segments. Burger King reported a SSSG of 3.6% in America in Q3 2014 against McDonald’s decline of 3.3% by focusing on a simpler menu and effective market communication.Some experts say McDonald’s should stop replicating its competitors and stick to the basics but McDonald’s is experimenting with enhanced customization to compete more effectively with fresh competition. McDonald’s is rolling “Create Your Taste” burgers, where customers can choose their buns with a choice of 20 premium ingredients in up to 2,000 outlets in the US. It is also experimenting with a simple menu in some parts of the US. Mr. Thompson admits that reviving the company will take time. Forging the right strategy for such large scale business for growth in the wake of slowing global economic growth and fast changing consumer trends is a time staking proposition and may not have quick-fix solutions in the near term.

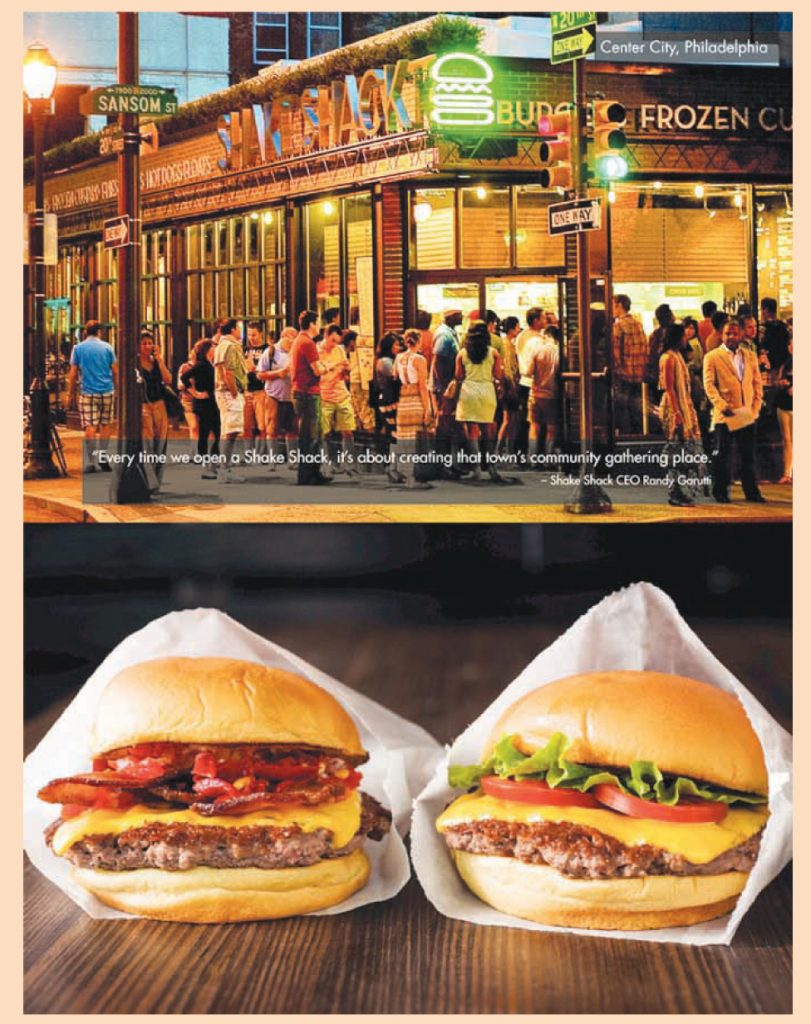

Shake Shack, a fast casual dining restaurant chain, is the new darling of investors. Shake Shack listed on NYSE on January 30 and the share price more than doubled from the initial offer price of US$21 per share to a high of US$52. The current market capitalization of Shake Shack, US$1.65 bn with 63 restaurants, is equivalent to India’s Jubilant Foodworks with 888 outlets. Shake Shack is a play on the fast emerging category of fast casual dining, which has captured the imagination of consumers and investors.

In developed economies the penetration of top fast food chains has reached saturation level—there is a definite shift of consumer inclinations away from fast food chains to fast casual chains. Fast casual restaurants offer limited table service compared to fine dining restaurants but provide higher quality food with fewer processed or frozen ingredients than fast-food restaurants.As fast casual restaurants occupy the sweet spot between the two saturated categories of fast food and fine dining, they attract customers trading up from fast food for healthier offerings and also customers trading down from fine dining for quicker and cheaper but equally healthy food offerings. According to market-research firm Mintel, the American fast-casual chain outlets grew by 10.5% in 2014 against fast-food chains, which grew by a mere 6.1%. Some of the emerging players in the fast chain industry include Shake Shack, Nando’s Chicken Restaurants and Chipotle Mexican Grill.

Shake Shack is an upcoming global fast casual chain, headquartered in New York, which serves premium quality hamburgers, salads, hot dogs and other American meals. The USP of the chain is its product offering, which comprises 100% all-natural, hormone-free and antibiotic-free beef, chicken and dairy products and potato fries free of artificial trans fat. Apart from a very healthy food offering, Shake Shack offers a localised menu and distinctive interiors for each outlet, which makes a customer feel a distinctive personal touch compared to the standardized services of fast-food chains. Its average store performance of US$4 mn is more than twice that of McDonald’s average store performance in the US. Its popularity is such that in the summer at its original location, the wait in line for service can stretch to over an hour, especially on weekends, when the weather is pleasant. A webcam on the restaurant’s web page shows the current line in real time.

During the three fiscal years ended December 25, 2013, Shake Shack grew from seven Shacks in two states to 40 Shacks in six states, Washington, D.C. and eight countries,representing a 79% CAGR. Total revenue grew from $19.5 mn to $82.5 mn, a 62% CAGR and net income grew from $0.2 mn to $5.4 mn.

With most of the burger-restaurant segment comprising quick-service restaurants, fast casual chains like Shake Shack are well placed to take market share, as there is a high probability that consumers will continue to trade up to higher quality offerings given an increasing consumer focus on responsible sourcing, ingredients and preparation.Additionally, consumers will continue to move away from the added-time commitment and cost of traditional casual dining.

The restaurant was founded in 1987 in the Johannesburg mining suburb of Rosettenville when Portugal-born audio engineer Fernando Duarte took his entrepreneur friend Robert Brozin to a Portuguese takeaway outlet, Chickenland, for a meal. After trying the chicken—cooked in peri peri, a chilli sauce that originated in Mozambique—they bought the restaurant for about 80,000 South African Rand (equivalent to about £25,000 at the time). They renamed the restaurant Nando’s, after Duarte. Two years later, the restaurant had four outlets—three in Johannesburg and one in Portugal. By 2013, Nando’s had about 1,000 branches in 35 countries. It has three outlets in India and is highly rated on food-review websites.

The USP of the chain, besides the special spices it uses, is health. The chain considers not just flavour and taste as important but also the health aspect of the supply chain. It sources chickens locally and makes sure they are delivered fresh, never frozen. The chicken is then marinated for 24 hours, in a marinade that contains no preservatives, colourants or artificial flavours. Before cooking them, the chickens are trimmed of excess fat and then flame-grilled, which further reduces the fat content.

The strategic shift of preference from fast food to healthier fast casual food is not restricted to developed markets. Even in the under-penetrated market of India, fast casual chains like Nando’s Chicken, California Pizza Kitchen and Moshe’s have set up a niche for themselves and their market continues to expand.

Moshes was started was started by Chef Moshe Shek, an entrepreneur and visionary. It received seed funding from venture capital fund New Silk Route and has expanded to 14 outlets in Mumbai and Pune. The chain prides itself on its quality of food based on freshness and natural ingredients. Moshe’s positioning seems similar to Shake Shack’s and it is among the fast growing chains in India in the fast casual dining category.

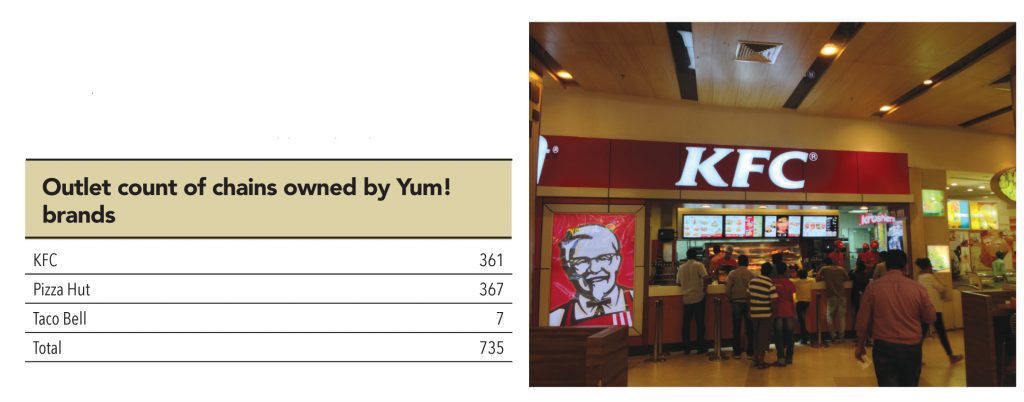

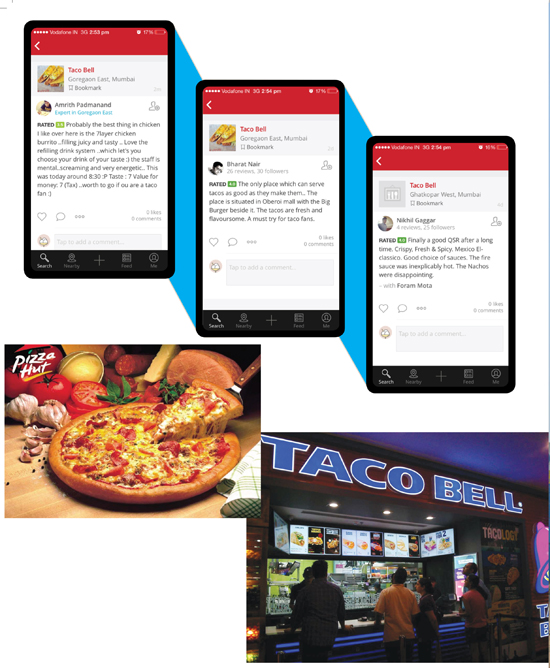

Yum is the most aggressive western fast-food chain in India. It has ambitious plans for its restaurants in India—it has scaled up its two major brands, Pizza Hut and KFC. It also launched Taco Bell recently and the initial response was encouraging. Its brands have been successful in China and it has been seeking to replicate the success story in India.

Yum’s store expansion has accelerated over the past few years and it has stepped up expansion of Pizza Hut and KFC. Pizza Hut competes with Dominos in the home delivery and fast casual dining space. The high store expansion strategy of KFC and Pizza Hut seems to be successful—KFC is considered a substitute for McDonald’s and its unique products have found wide acceptance in India. Similarly, Pizza Hut has found success as a pizza dine-in and delivery option. The new venture, Taco Bell, looks promising and may offer fresh legs for growth.

Subscribe to enjoy uninterrupted access