Traditionally, R&D has been perceived as intellectual property and a core activity. Outsourcing or partnering for R&D was considered a threat to the functioning of an organization. However, lately managements have been forced to consider outsourcing ERD due to global competition, reducing time-to-market for products, and cost pressures. This shift has led to a significant change in the ERD services portfolio, with greater emphasis on product engineering and innovation compared to staff augmentation.The focus is not on products alone, but also on the ecosystem of services around the product, including its geo-specific variants and associated platforms.

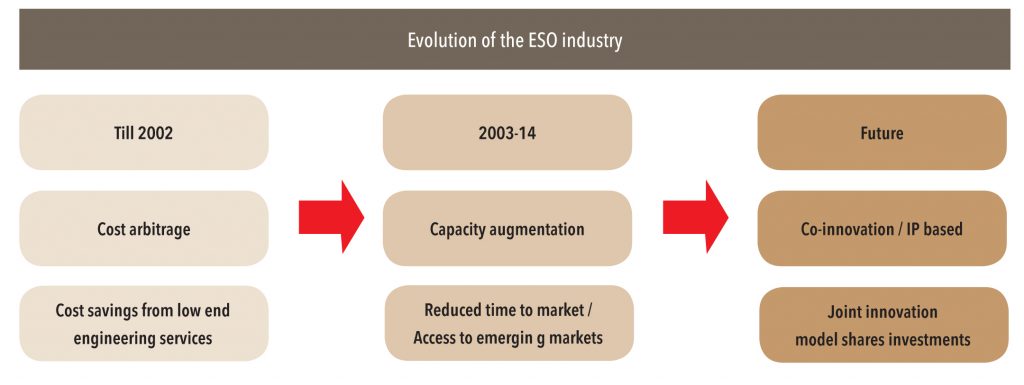

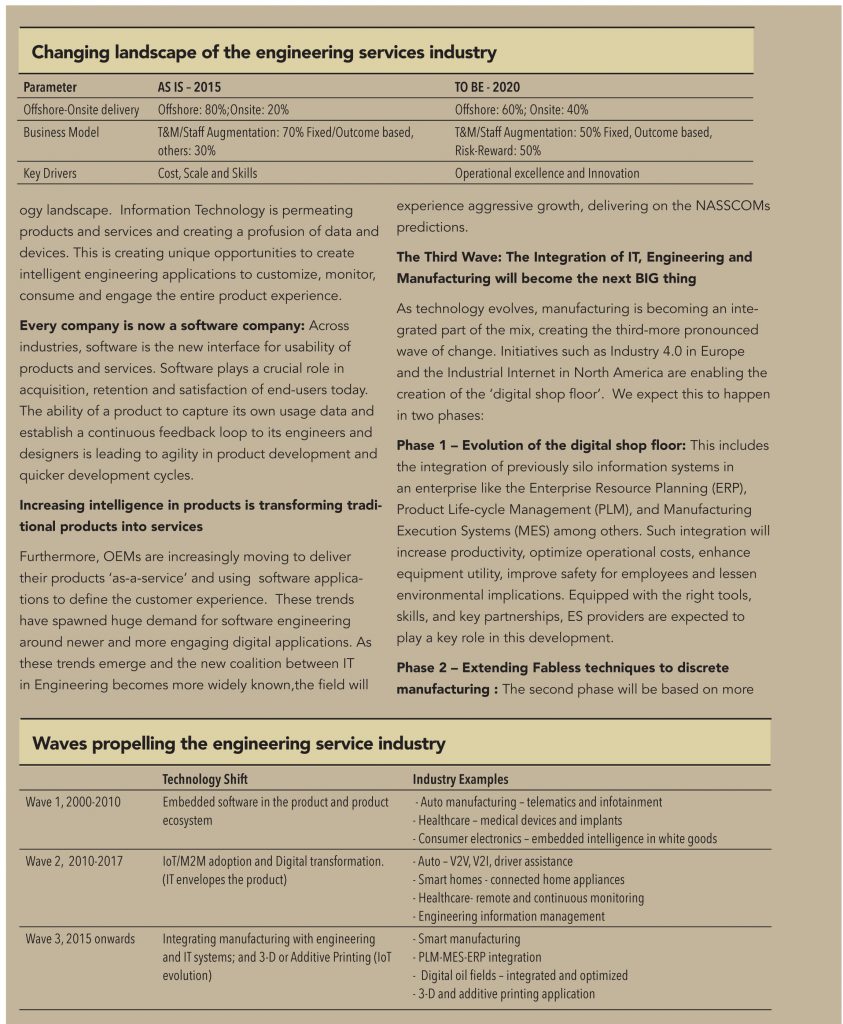

The evolution of the Indian ERD Outsourcing (ESO) industry can be broken down into three phases defined by the nature of work and the changing outsourcing business model.

Generation 1, until 2002—cost arbitrage: The first stage of ESO was largely based on cost arbitrage. Original Equipment Manufacturers (OEMs) and Independent Software Vendors (ISVs) leveraged Engineering Service Providers (ESPs) for engineering support by using staff-augmentation models. ESPs were able to provide scale, whenever and wherever required, with abundant talent pool across the globe. Project execution was limited to basic activities such as scanning and digitizing of engineering drawings to engineering change order management. Product engineering was considered to be a core and IP-centric activity and therefore beyond the realms of outsourcing.

2003-2014—capacity augmentation: The second stage was the movement to capacity augmentation from pure cost arbitrage. The second stage can be broken down into two phases: (1) 2003-2010 and (2) 2010-2014. In the first phase, growth in ESP was driven by customers’ need to reduce time-to-market, which the ESPs provided by use of relevant manpower and capacity augmentation. ESPs helped them to accelerate product development and provide scale on need basis. The second phase was largely to gain access to emerging markets,as these markets became important due to rising customer spends. However, project execution remained largely related to non-core product development and helping customize on-going designs for faster market launches. Partial product engineering was outsourced; but core R&D activity and IP-centric were still off limits for outsourcing.

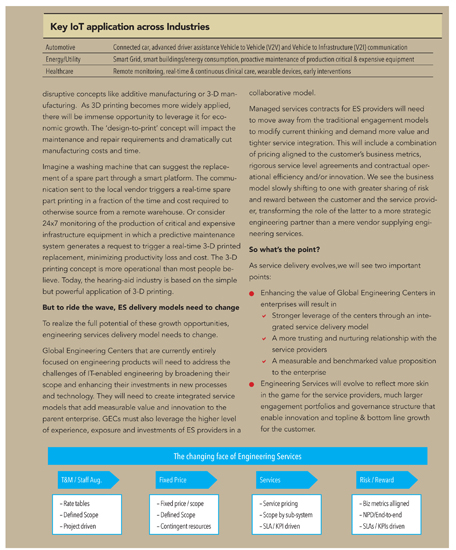

The future, 2014 onwards: The third stage is largely driven by globalization, reducing R&D spends, and product lifecycle pressures. Managements are focused on developing effective outsourcing strategies that drive significant improvement in global ERD operations. The ESO market has seen substantial growth and has evolved to encompass a broad range of new product development, value engineering, and product-support functions. Going ahead the growth of the ESO industry will be driven by product innovation capabilities and by how players collaborate with customers to share the risk-reward of R&D investments.

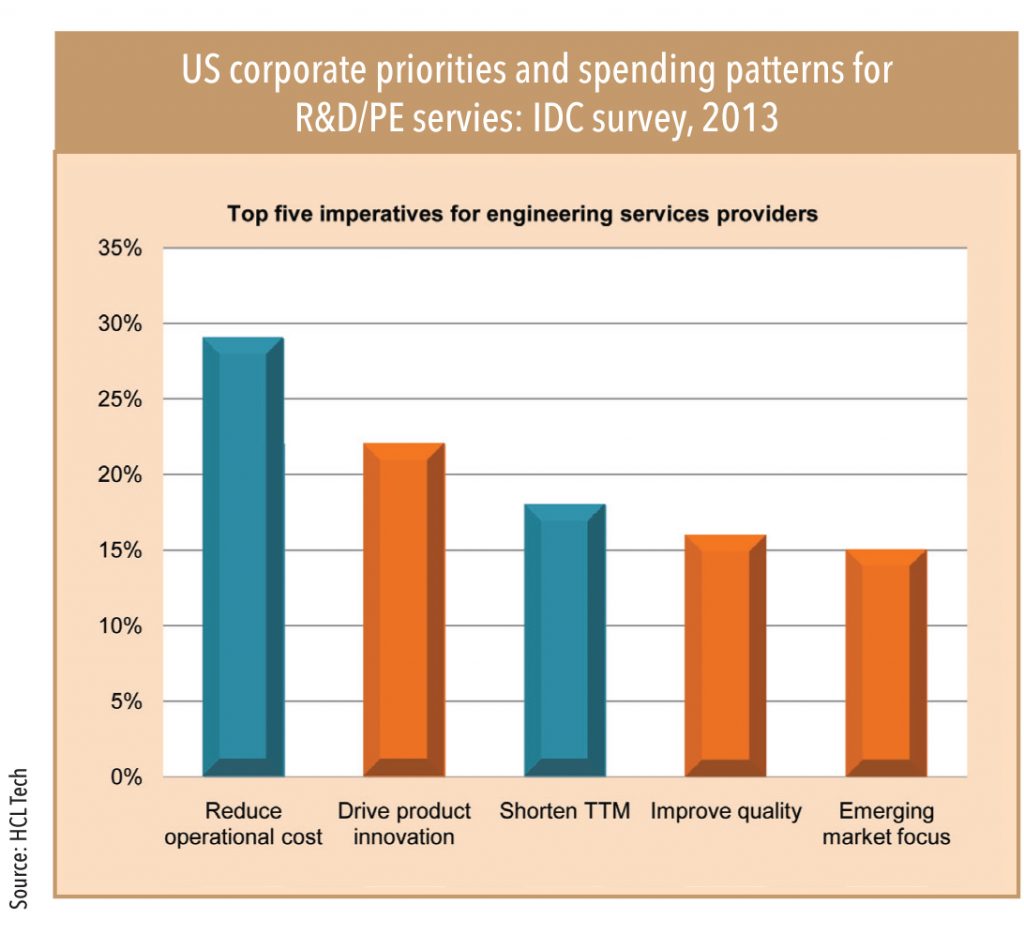

There are four major motivations for outsourcing: efficiency, market, resource, and technology.

Efficiency factors: Outsourcing largely to improve efficiency in terms of cost and increase the management bandwidth to focus on core activities. With reducing budgets and R&D spends, companies are looking to expand their footprint in low-cost countries to leverage the cost differential in the engineering effort.

Market factors: Increase in per-capita income in emerging markets has resulted in increasing consumer spends. Also, phased launches across the globe are no longer considered effective, as global/local competition can enter emerging markets quickly due to the shortening product lifecycles. Outsourcing has helped customers improve access to global markets with an ability to address emerging and adjacent markets simultaneously. It can also help companies meet temporary product development needs, without imposing a long-term commitment.

Resource factors: As the technological complexity of product engineering is increasing at a rapid pace, it is becoming increasingly difficult for ERD companies to get a flexible pool of engineers with the relevant capabilities and competencies.Outsourcing allows them to address technological and process innovations, when size and/or time constraints prevent them from establishing these capabilities in-house. Obtaining the necessary expertise and skills outside can help a company move ahead of its competitors.

Technology factors: The world is becoming more connected,with consumers expecting seamless experience across devices with advanced features and functionalities. OEMs and ISVs need to ensure that the product platform can integrate with an entire ecosystem of devices with different form factors and can be consumed in different manners (touch, voice, and video). All of this has increased the importance of embedded software as a means to merge the device with the application to provide a seamless experience.

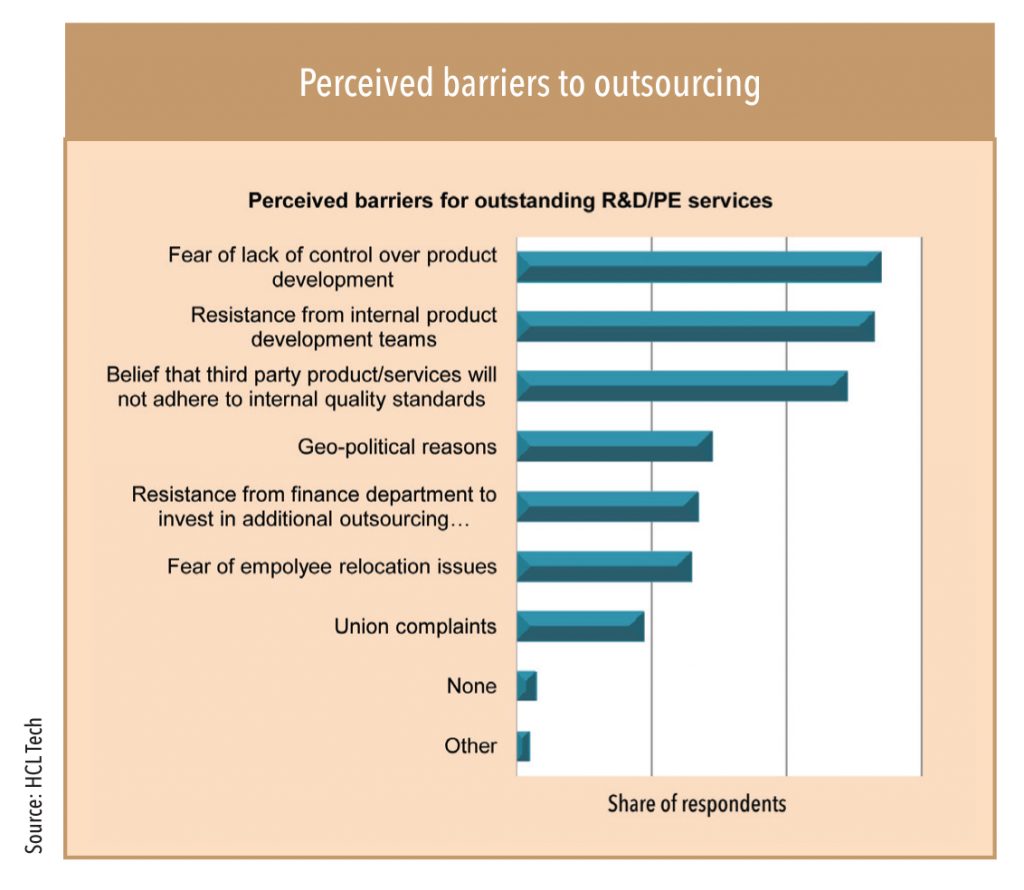

While the levers for outsourcing are fairly obvious, the customer’s mind set towards outsourcing, especially R&D, remains fraught with barriers. The perceived barriers to R&D vary according to the clients’ industry, size, and R&D spends. The perception of barriers increases as R&D activities increase. The companies’ need to guarantee proximity to clients is one of the main barriers for ERD sourcing. Overall, if the costs of the sourcing operation exceed benefits it is generally considered an important barrier.

Barrier 1: Fear of lack of control over product development

Most companies consider their product-development roadmap to be an important differentiator and do not show willingness to disclose details of their next-generation products and solutions for fear of leakage to competitors. This leads to fear of outsourcing work related to product development.

Barrier 2: Quality of outsourced work

Companies believe that outsourced work created by third-party vendors will not adhere to their quality standards. The belief comes from loss of complete control over labour and processes. There is a widespread perception that vendor employees are less loyal and have much lower incentive to produce good work at a reasonable pace.

Barrier 3: Geo-political reasons

Geo-political barriers arise out of diversity across countries and include cultural barriers, physical distance, time difference,and political instability.

Besides these, other major barriers are

• Legal or administrative barriers

• Taxation issues

• Trade tariffs

• Concerns about employees (including trade unions)

• Concerns surrounding violation of patents and/or Intellectual Property Rights

• Conflicting social values of companies

• Linguistic or cultural barriers

• Difficulties in identifying potential/suitable providers abroad and once identified, educating them (vendor development).

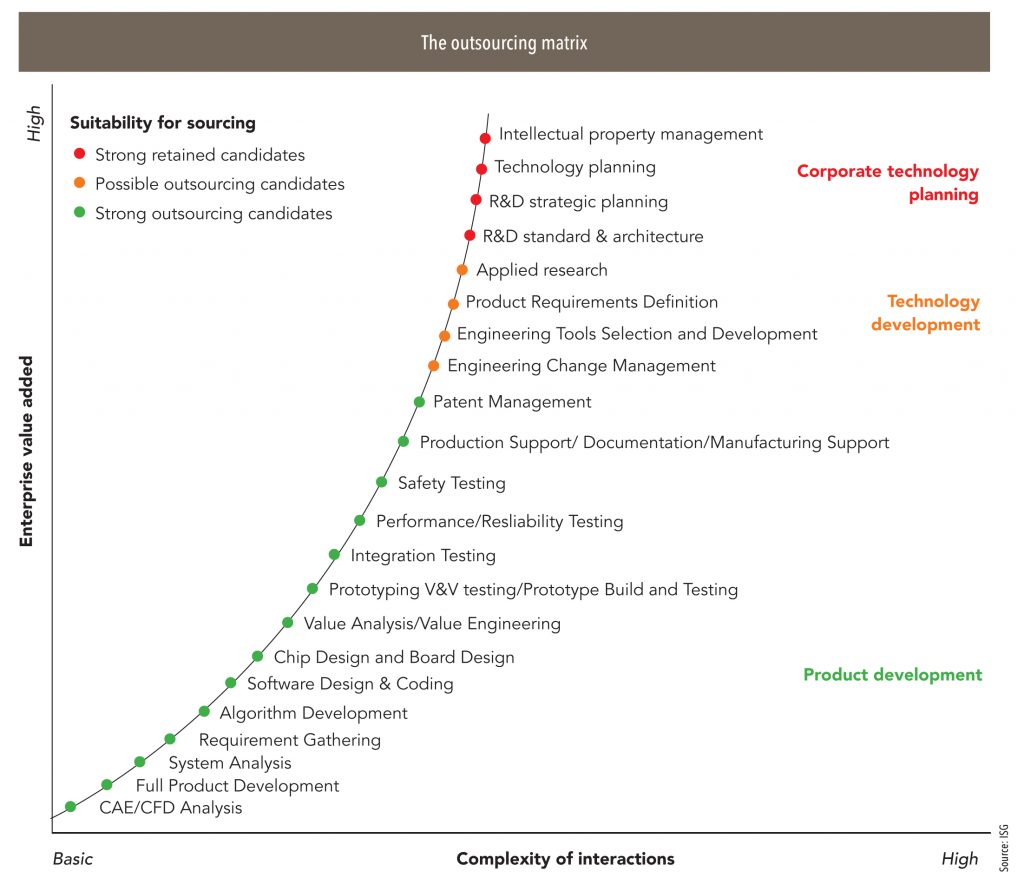

ERD is currently in its early days of outsourcing (relatively) where customers are facing the same kind of questions that haunted those who chose to outsource functions such as CRM and ERP a while back. The key question is which function to outsource and which to retain in-house. It represents a classic dilemma for any industry, where the company tries to determine what its ‘core’ business functions are (critical to success, important to clients) and what are relatively ‘non-core’. Once the company is able to resolve this dilemma,it just needs to map the delivery capability of the vendor—which is a function of the vendor’s vertical expertise, global footprint, scale, and value proposition—and take the decision accordingly.

While the product development and lifecycles of various ERD verticals (aerospace, automotive, consumer electronics) differ significantly, functions that they can/cannot, or rather would/would not outsource are fairly similar.

Over the last two decades, ESO vendors have established strong credentials in product lifecycle management (production support, integration testing, and software design) by building/investing in vertical domain knowledge and technical competencies. Because of these enhanced capabilities, the range of functions that are strong candidates for outsourcing in the product development stage has expanded significantly.

Building on the domain knowledge and technical expertise of the last two decades of work in the ERD space, these ESO vendors have expanded their value analysis/value engineering (VA/VE) proposition across all verticals, especially in the last five years. They now offer full services for computer- aided engineering/computational fluid dynamics (CAE/CFD) analysis, full product development, prototype build and testing, and manufacturing support across nearly half the industry verticals. Customers are increasingly outsourcing domains such as applied research, system analysis, and algorithm-development.

However, the outsourcing vendors still have a long way to go, before they can hit upon the most lucrative target of getting their customers to outsource corporate technology planning. The domain would include R&D architecture and planning, IP management, and technology strategy.

It is interesting that outsourcing growth in mechanical and hardware product development has been half of the outsourcing growth in electronics, software, and embedded software product development. The main reason is that manufacturing (broadly) requires far more specific expertise in industry, domain, and products than electronics/software. Because of this, growth trajectory for outsourcing in the manufacturing vertical will always lag behind electronics and software.

Subscribe to enjoy uninterrupted access