Across sectors, R&D has always been treated with the utmost confidentiality and hence, there has never been scope for any form of collaboration in this field. However, shrinking R&D budgets, reducing time-to-market, and the rapidly evolving technological landscape has forced many companies to consider outsourcing as an option. Due to the changing mindset, the quality of the work being outsourced has evolved significantly. With the largest pool of engineers at their disposal, Indian IT companies (captives and third-party) have a mammoth opportunity before them. Let’s read further to find out how the sector has evolved and what challenges and opportunities lie in store…

Engineering research and development (ERD) has emerged as the next-gen domain for the Indian IT industry. In this domain, Indian IT companies have seen robust growth over the last five years (15% CAGR); more importantly, the quality of the work being outsourced to the Indian companies has evolved significantly—to innovation and development- driven high-end projects from cost-arbitrage driven low-end tasks. Having extensively tapped BFSI and manufacturing across US and Europe through the wide palette of service lines such as ADM, IMS, and BPO, Indian IT companies are now looking at the huge potential in the ERD domain.

Engineering Research & Development – as the name suggests, involves research and development in various engineering domains. The segment is primarily related to sectors that involve high-end engineering capabilities such as automotive,aerospace, telecom, electronics, and medical devices. Companies in these sectors spend huge amounts of resources to continuously develop new products or product enhancements.

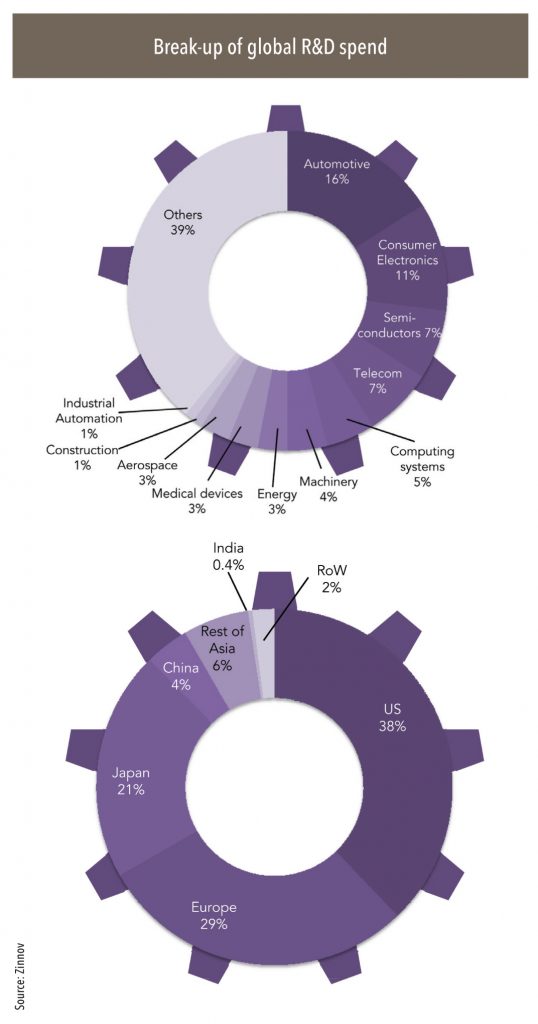

In FY14, global ERD spend grew by ~3% to US$ 1.44tn. Automotive and consumer electronics sectors accounted for over 25% of this spend—automotive driven by safety and emission-efficiency requirements and consumer electronics driven by increasing demand for new products and interfaces.US and Europe continued to account for over 2/3rd of this spend with Asia (excluding Japan) constituting 10% and growing fast.

Sectors

Among sectors, automotive, aerospace, electronics,and medical devices are expected to see continued high levels of investment in engineering R&D. Key drivers of higher ERD spends in these sectors are:

Automotive: Regulatory compliance, green energy, enhanced customer experience, energy efficiency, higher electronics content.

Aerospace: Innovation in product design, green energy.

Medical devices: Regulatory compliance, innovation in product design, enhanced customer experience.

Consumer electronics: Innovation in product design,enhanced customer experience, digitization.

Regions

Amongst geographies, US continues to spearhead the global investment in ERD, accounting for over 35% of the global spend, followed by Europe, Japan, and China.

Companies

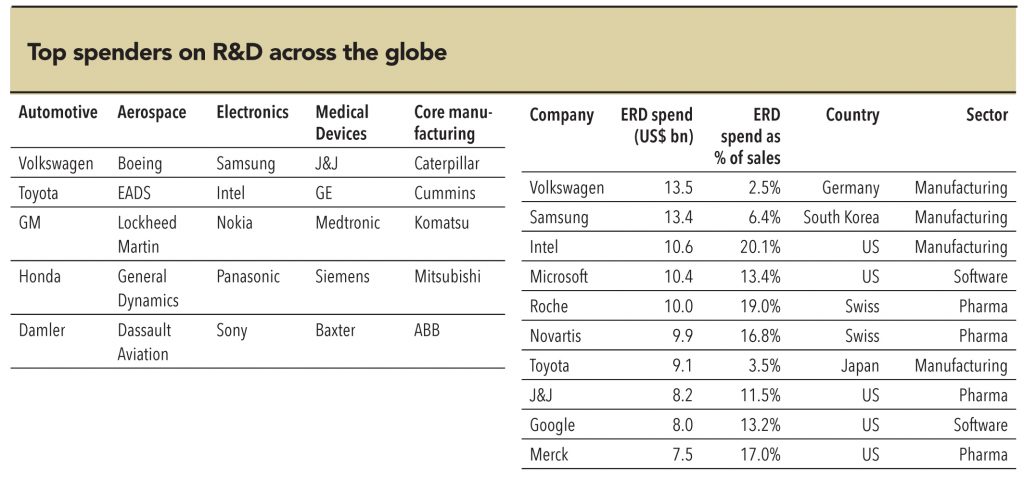

In FY14, Volkswagen stood out as the highest spender on R&D at US$ 13.5bn. Samsung, Intel, Microsoft, and Roche fill up the remaining spots in the top-5. Among the top-20 R&D spenders across the globe, 10 belonged to the manufacturing sector (primarily automotive and electronics), seven were from healthcare, and three were from software. Geographically, the US and Europe accounted for 15 of the top-20 R&D spenders (eight and seven respectively) while four companies from Japan figured on the list.

Focusing on ERD expenditure, the following companies claim the top-5 spots in their respective segments:

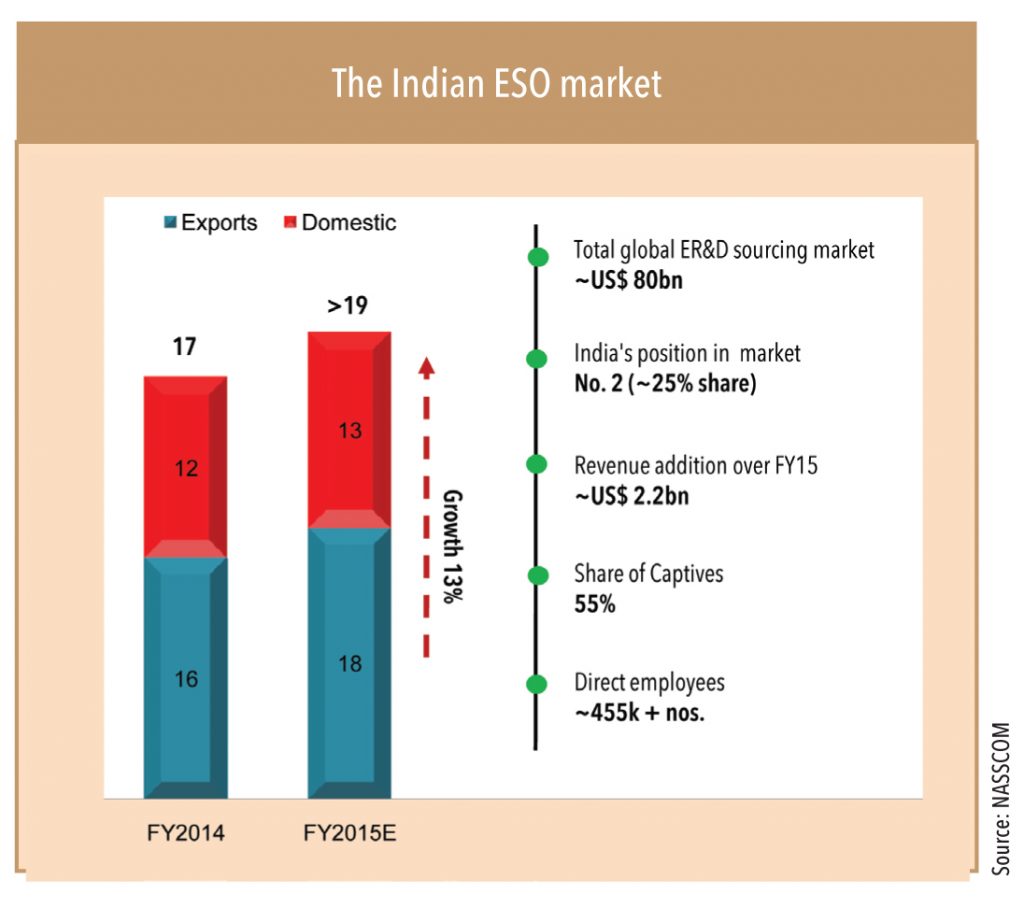

As per NASSCOM’s estimates, the Indian ESO market stood at US$ 19bn in FY15, an addition of US$ 2.2bn over FY14’s market size. The country holds the second position in the ERD global sourcing market (US$ 80bn) with 25% market share trailing China.

Subscribe to enjoy uninterrupted access