Today, cement is considered one of the vital industries in NER, by locals and the government. It is surprising that nearly 20 cement brands exist in this region. In terms of sheer number of distinct brands, it would probably be much higher than any other region in India with similar demographics. Interestingly, NER’s cement industry is not too old. While some smaller plants started coming up in 1999, Star Cement, which started in 2005, is believed to be the first large cement manufacturing plant in this region. Before this, all cement for this region was imported from other parts of India or from other countries. After Star Cement’s entry, multiple cement brands sprang up in NER, but almost all these cement ventures were started by local business houses. Dalmia Bharat is the only outsider to venture into this region and succeed — but Dalmia did so through an acquisition even though it had initially planned a greenfield plant.

Practically impossible for an outsider to set up a greenfield plant

Despite multiple incentives to setup Greenfield plants in NER, it is practically impossible for an outsider to do this. Many describe the effort as nightmarish. There are several instances of cement manufacturers trying to set up greenfield capacities here and failing miserably. Even big boys such as UltraTech and Holcim have attempted to venture into this region but have not yet tasted success. None of the mainstream cement manufacturers (barring Dalmia Bharat) have any manufacturing facilities in NER. Since these majors have not succeeded in greenfield plants, they are now determined to establish themselves in this region through acquisitions and alliance partners. A few are actively scouting deals or partnerships with existing cement manufacturers of NER. Dalmia Bharat initially planned a greenfield, but faced many hurdles. Changing tacks, it made two sizeable acquisitions – Calcom Cement and Adhunik Cement – and is now well established in NER.

Incumbents are in a golden space

• High social and geographic entry barrier: It is practically impossible for an outsider to enter this region without local support. Moreover, the terrain is difficult.

• Resource supply is committed, assuming no local issues: Most of the land in the hills is owned by the community, not the states. Plants located in states falling under the Schedule-6 (areas from Assam, Meghalaya, Tripura and Mizoram) do not fall under the purview of recent mining acts. Hence, there is no risk that cement players have to surrender limestone mines or reserves. Almost all cement plants in NER are based out of Meghalaya (barring few plants in Assam of which most are grinding units) and all the plants in this state enjoy Schedule-6 benefits. All fuel supplies are also through local sources only and the only threat to raw material sourcing is local agitation. Falling under Schedule 6, Star Cement management believes that the cement industry in Meghalaya is not liable to pay DMF, but it is liable to pay royalty on limestone (like any other region).

• A highly brand conscious market: Since NER is a brand-conscious market, it will generally mean higher price premium in realisations.

• Limited scalability means NER producers are in golden space: NER’s growth potential in the long term seems extremely strong. Given that NER’s landscape offers limited scalability for cement plants (scope largely only for existing players), the incumbents are probably in a golden space – they are likely to see sustainable earnings CAGR in the medium to long term

Structure of NER’s cement industry

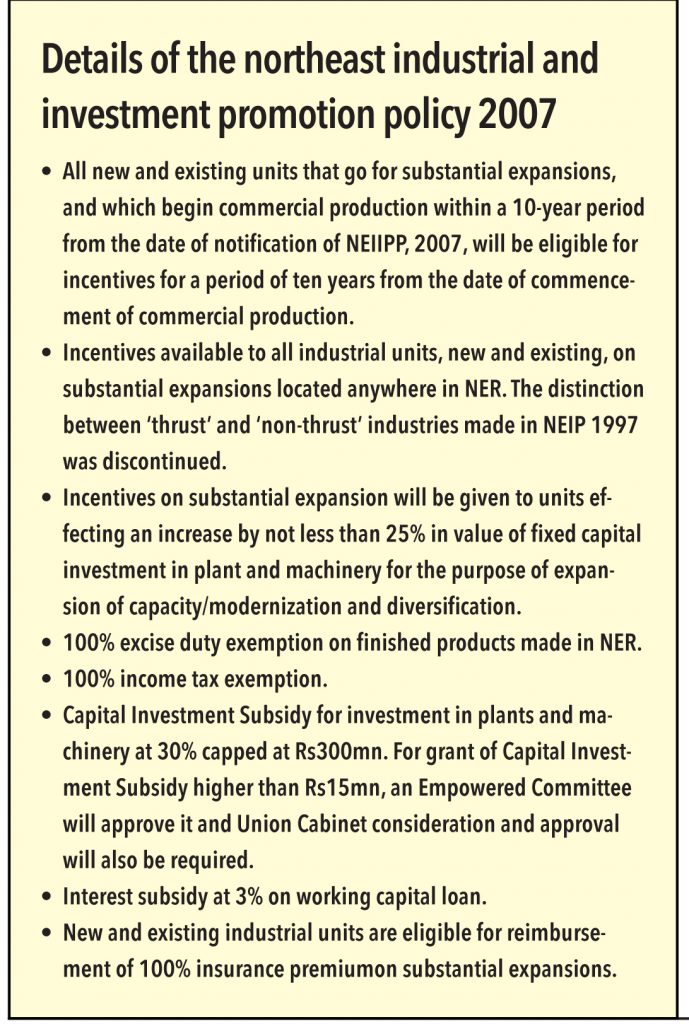

Almost all integrated cement manufacturers in NER are based in Meghalaya. More interestingly, all these plants are on a single stretch of road – Jaintia Hills (spread across 40-50km) barring a couple of plants that are a bit ahead (another 40-50km). Meghalaya is the heart of the cement industry and on the Jainitia Hills road, there is nothing other than cement plants. The only notable plant that is not located in this belt is the vintage plant of Mawluh Chera – it was a government-owned plant in Cherrapunji that is now shut for over two years. Set up in the early 1960s, Mawluh Chera is the oldest Public Sector Undertaking (PSU) in Meghalaya and its only state-owned cement plant.

Motivations of local entrepreneurs setting up cement plants

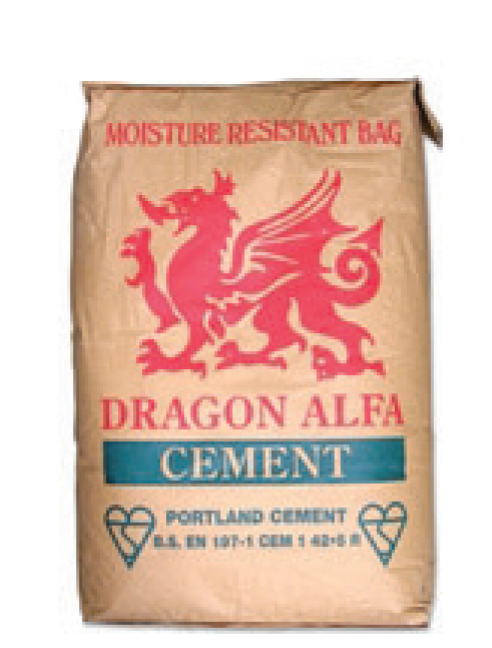

Given the various disadvantages that NER faces (geographical isolation, transportation bottlenecks, small market size, low investments and virtual absence of private sector),the central and state governments announced various incentive and subsidy schemes to attract investments and capital into the region. The first such instance was the Transport Subsidy Scheme in 1971. This scheme was introduced to develop industrialisation in the remote, hilly, and inaccessible areas by providing subsidy in the transportation cost incurred by industrial units so that they could compete with other similar industries that were better off geographically. Subsequently, other incentive plans such as NEIP 1997 and North East Industrial and Investment Promotion Policy (NEIIPP) in 2007 (which itself was an extension of NEIP, 1997) were also announced to attract investments from industries in NER.

Given these benefits, many local business entrepreneurs who owned mining lands contemplated venturing into cement manufacturing. Star Cement was among the first to take initiative and others followed. More interestingly, almost all of these plants were initially setup only to cash in on incentives with a plan of seeking a lucrative exit later. Today, Star Cement, Dalmia Bharat, and TopCem (three largest) are the only players that appear committed to remain in the business of cement manufacturing for the long term. Although others may yet continue, it is too premature to assume that they will make their mark in the region. It does appear that all other brands / cement manufacturers are available for sale.

If plants are available, then why aren’t deals happening?

Despite multiple plants being available for sale, barring Dalmia’s acquisition of Calcom Cement and Adhunik Cement, no other deal has gone through. There are multiple reasons for this:

• Like in many failed consolidation discussions, the sellers’ expectations are too high.

• Logistical connection between NER and other regions of India is not very strong. Many manufacturers do not want to venture into this region, as they find virtually no synergies with their operations in other regions.

• For many mainstream manufacturers, it has proven tough to monitor developments in NER and seek an entry, given the unique nature of this region. Existing ways in which raw material is available, and the nature of fuel-supply agreements with locals, did not provide comfort to most these cement manufacturers.

• Mainstream cement manufacturers who do not want to deploy substantial capital into the region sought entry by becoming marketing partners or alliance partners of local cement manufacturers in NER – these manufacturers have largely rejected this approach.

• Its current market size – around 7mn tonnes per annum – does not appeal to most mainstream cement companies.

Star Cement – Star Cement is among the oldest and largest cement manufacturer in NER. Its current capacity is about 3mn tonnes. It has a state of art integrated setup in Lumshnong, Meghalaya, (1.4mn TPA) and a split-grinding unit in Sonapur, Assam (1.6mn TPA). It is also considered to be the most cost efficient producer of cement in NER.

Amrit Cement Industries – Its current capacity is ~1mn TPA and it has long-term ambitions to increase its size to 3mn tonnes in NER and set up split grinding units in Bihar. This company also wants to set up an integrated cement unit in neighbouring country Nepal. It sells cement under the brand name Amrit Cement.

Magic Cement – This is the flagship product of RNB Group (Meghalaya).

Dalmia Cement – Dalmia Bharat ventured into NER by acquiring Calcom Cement and Adhunik Cement. It is currently the largest cement capacity in NER (3.6mn TPA). While Adhunik’s setup is in Meghalaya, Calcom has recently commissioned an integrated setup in Assam. Dalmia Bharat sells its produce under its national brand Dalmia Cement. It also owns one of the premium product lines Dalmia HALC Cement in this region.

Taj Cement – This is a product of Hill Cement Company, which has and integrated site at Meghalaya. It started in 2007 and has plans to scale up its capacity to 1mn TPA.

Barak Valley Cement Ltd – This is a small listed cement manufacturer (400,000TPA capacity) based in NER. Its sells its products under the brand Valley Strong Cement. This is the farthest cement site in Meghalaya – about 70km ahead of Star Cement’s Meghalaya site.

TopCem Cement – This is a product of Meghalaya Cements. It is an integrated cement plant in Meghalaya with clinkerisation capacity of 2,600TPD and 3600TPD of cement. It has a grinding unit in Amingaon, Guwahati, Assam. This is the third largest brand in NER.

Best Cement – A product of JUD Cements, which has an integrated setup in Meghalaya with a capacity of 500,000TPA. It has ambitions to scale this up to 2mn TPA

Surya Gold Cement – Surya Gold is a grinding setup in Assam and is the first to introduce the concept of bulk cement to NER. It sells products under Surya Gold Cement and Surya Concretec.

Max Cement – Promoted by Green Valley Industries, it is a local brand with an integrated capacity of 1mn TPA in Meghalaya.

Raksha Cements – This is a small integrated unit – just 60,000 TPA capacity – based in Assam. Barring Calcom (Dalmia Bharat’s Assam unit), Raksha Cement is one of the few NER cement manufacturers with an integrated setup in Assam. It sells under the brand Raksha Cement.

Virgo Cement – This is another cement brand in NER that is now virtually absent. It is a 600 TPD cement-manufacturing unit located in Damas, East Garo Hills District, Meghalaya. In June 2015, five suspected AMEF militants lobbed two IED bombs inside this factory and fled into darkness under the cover of open fire. There were no casualties, but the plant was partially damaged. The belief is that the attack was because of rejected extortion demands.

Prithvi Cement – This unit is located in Lanka, Assam (near Dalmia Bharat’s Assam unit). It is a small cement manufacturer.

Cherra Cement: – This is the oldest cement brand in NER and a product of Mawluh Cherra Cement. This plant is now shut down, and barring a few hoardings advertisements around the plant area in Cherrapunji, its presence is virtually absent.

Goldstone Cement – Goldstone cement is an upcoming plant in Meghalaya with an integrated setup. The plant is likely to be operational in next 12-18 months. Scalability of this plant (as per sources) is likely to be upto 2.5mn TPA.

Purvanchal Infra & Industries: Yet another brand present in NER.

While there are nearly 20 cement brands in NER, it is still a fairly consolidated market. Out of the installed capacity of ~11mn TPA, the top-3 cement manufacturers – Dalmia Bharat, Star Cement and TopCem – have almost 70% share. Small cement manufacturers are hardly left with any choice but to follow the larger cement manufacturers. Star Cement, Dalmia Bharat and TopCem remain the tier-1 brands in this

UltraTech Cement – It brings cement to NER from its Bangladesh facility (it has a small grinding setup in Bangladesh of 500,000 TPA).

Rhino Cement – This is a new brand and believed to be introduced in NER by a local cement manufacturer – some large hoardings of this brand were seen at a couple of places in Guwahati. Interestingly, Rhino Cement is also a brand owned by an African Major – Arm Cement. Branding of both these brands appear similar and hence a possible tie-up of this local manufacturer with African giant cannot be ruled out.

Ambuja Cement – Ambuja supplies cement to NER through its Farrakka plant in West Bengal, but in minuscule quantities.

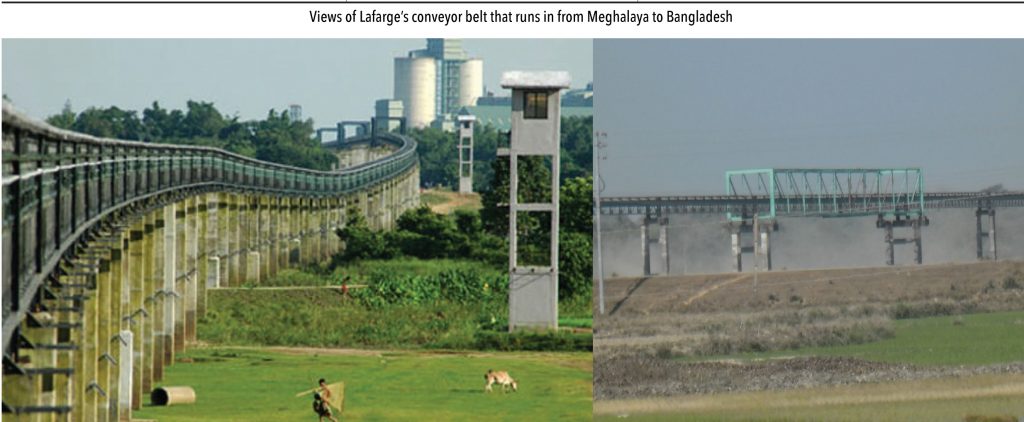

Lafarge – Lafarge is also present in this region to a small extent, but interestingly, it is the only cement capacity to have a fully integrated facility in Bangladesh. Given the scarcity of limestone in Bangladesh, Lafarge Bangladesh has laid a 17km-long conveyor belt that runs from Meghalaya to Lafarge’s cement plant in Bangladesh to supply crushed limestone to its integrated facility.

Crown Cement – This is a product of M.I. Cement Factory, Bangladesh. It exports marginal quantities of its produce into NER. Its capacity in Bangladesh is ~1.7mn TPA.

Dragon Cement – This is a product of Dungsam Cement Corporation, Bhutan. It is an integrated cement plant located 150km northwest of Guwahati with an installed capacity of ~1.3mn TPA and exports minor quantities to NER.

Though there are only three top brands, amusingly, all cement manufacturers tend to indulge in heavy advertising and branding – literally every second hoarding is a cement manufacturer’s. NER manufacturers have practically explored all kinds of local platforms to advertise their brands, especially the top three manufacturers. The branding campaigns are heavy on the local thrust with some unique attempts to connect with customers. Some such attempts include:

Surrogate branding

Star Cement initiated the concept of surrogate branding in NER – its aim was to increase visibility in places that its direct/indirect customers frequent (such as pan shops, dhabas, restaurants, plumbing shops, paint shops).

Radio advertising

Radio advertisements seems to be an excellent initiative to reach consumers,especially in underdeveloped and uncomfortable terrains such as NER – here, the reach of radio advertisements is much higher than other visual modes. This is a unique to this region – it is rare to hear cement advertisements on radios in other regions of India.

Campaigns for dealers / user segments and the general public

Large cement companies in NER indulge in advertising and branding practices that involve a lot of participation from its end users – especially by regional leaders such as Star Cement. For example, during the Durga Pooja Mahotsav the company organised campaigns in which it offered an all-expenses-paid trip to Kolkata (to participate in festivities there) for the world’s largest and biggest durga idol. It also offered additional prizes such as tablets, smartphones, silver coins, and cash prizes. These kind of advertisements and branding exercises are very well appreciated by the audience in NER, where even a small token of appreciation acts as a big morale booster.

Across roads, advertisements of cement brands almost overpower all others. Even in the remotest roads, for example the road from Shillong to Cherrapunji, the only advertisements those were visible were cement brands.

Subscribe to enjoy uninterrupted access