Umesh Bhatka, a migrant worker in the textile mills in the industrial city of Surat sends money to its native village in Ganjam district in Orissa. The money takes a time consuming complicated route to reach his family. The money is dispatched through people from his community who travel to his village. Many a times some amount goes missing. Ramadhir kumar again a migrant worker at a construction site, keeps his wage with the contractor (for safe keeping), which he draws when he visits his native place. The contractor charges undue amount for just safe keeping. There are many such cases as migrant workers do not visit bank branch due to limited financial literacy; lack of proper documentation;complexity; and inaccessibility (due to limited banking hour).

In an endeavour to provide ubiquitous access of payment services and deposit products to small businesses and low-income households, the central bank initiated a vertical in the banking value chain called “payment bank”. This vertical aims to cover a large section of the population, especially low-income households, migrant labour and economically weaker sections under the net of basic banking services and financial products. Along with financial inclusion, the primary objective of payment banks will also be to facilitate high volume and low value transactions in deposit, remittance and payments, driven through cost-efficient technology.

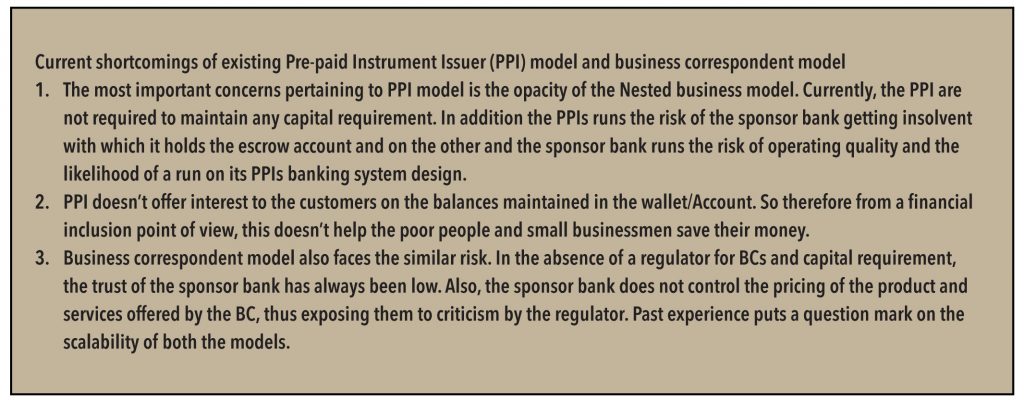

The concept of the payment bank in not new in India and some of its basic functions are similar to pre-paid payment instruments or the business-correspondent model. Due to difficulties faced by such entities and the risk associated with the model, the central bank promoted the concept of the payment bank. The goal of the central bank is to provide basic banking services to 450,000 unbanked villages. The payment bank will designate merchant establishments / corner shop as its access points on the pay- and-use model. This access point will address the issue of costly brick-and-mortar branches and offer low cost and easy access to the customer. From the merchant establishments’ point of view it is an additional source of revenue and increase in footfalls in his establishment.

1.Acceptance of demand deposits (current deposits, and savings bank deposits). Payments banks will initially be restricted to holding a maximum balance of Rs. 100,000 per customer. After the performance of the Payments bank is gauged by the RBI, the maximum balance can be raised. KYC norms are also simplified for small value transaction limited transaction.

2.Payments and remittance services through various channels including branches, BCs and mobile banking. The payments / remittance services would include acceptance of funds at one end through various channels including branches and BCs and payments of cash at the other end, through branches, BCs, and Automated Teller Machines (ATMs) and point of sale terminal.

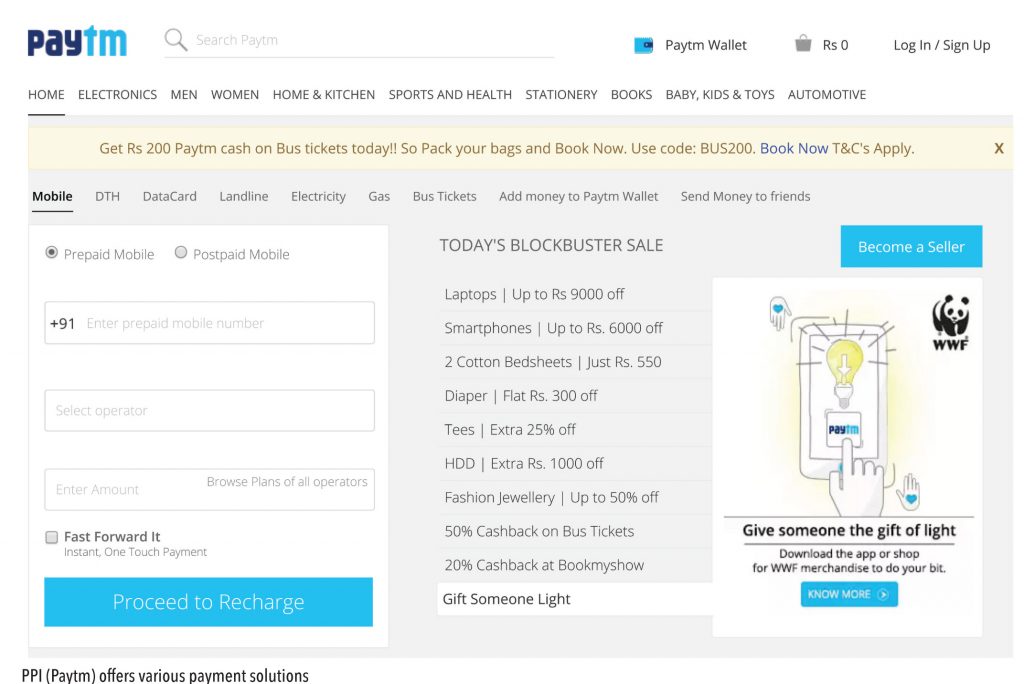

Issuance of PPIs as per instructions issued from time to time under the PSS Act.

4.Internet banking – The RBI is also open to applicants transacting primarily using the Internet.

5.Functioning as Business Correspondent (BC) of other banks – A Payments bank may choose to become a BC of another bank for credit and other services which it cannot offer.

6.The Payments bank cannot undertake lending

activities. Apart from amounts maintained as Cash Reserve Ratio (CRR) with RBI, it will be required to invest all its monies in Government securities/Treasury Bills with maturity up to one year that are recognized by RBI as eligible securities for maintenance of Statutory Liquidity Ratio (SLR).

Capital requirement. Since the payment banks will not be allowed to assume any credit risk, and if its investments are held to maturity, such investments need not be marked to market and there may not be need for capital for market risk. However, the payment banks will be exposed to operational risks. They will also be required to invest heavily in technological infrastructure for operations. The capital will be used to create such fixed assets. Therefore, the minimum paid-up voting equity capital of a payment bank shall be Rs1 bn. The payment bank shall be required to maintain a minimum capital adequacy ratio of 15% of its risk weighted assets (RWAs) on a continuous basis, subject to any higher percentage as may be prescribed by the RBI from time to time. However, as payment banks are not expected to deal with sophisticated products, the capital adequacy ratio will be computed under simplified Basel I standards.

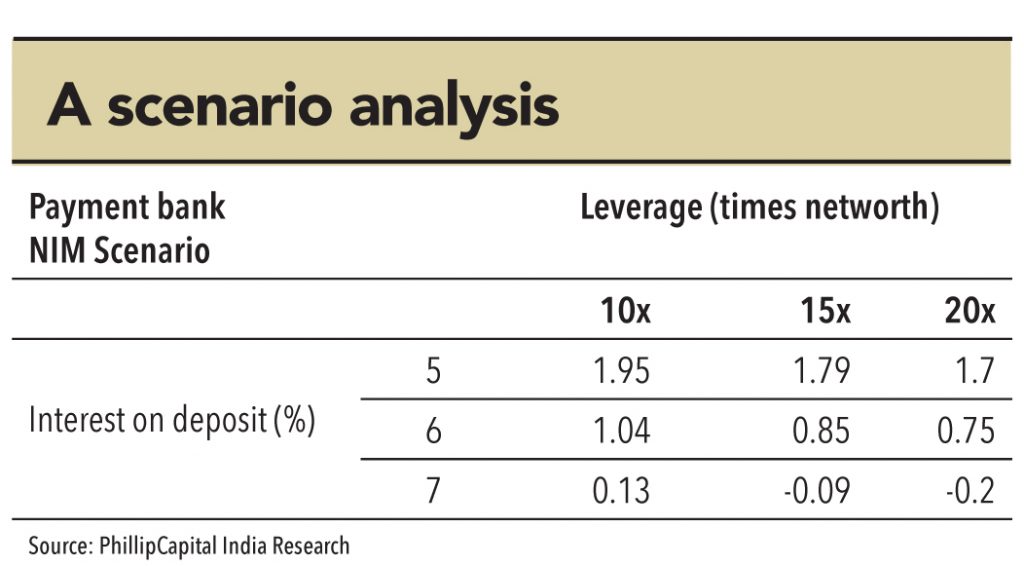

As payment banks will have almost zero or negligible RWAs, its compliance with a minimum capital adequacy ratio of 15% would not reflect the true risk. Therefore, the bank should have a leverage ratio of not less than 5%—its outside liabilities should not exceed 20 times its networth/paid-up capital and reserves.

Promoter’s contribution. The promoter’s minimum initial contribution to the paid-up voting equity capital of a payment bank shall be at least 40%, which shall be locked in for five years from the date of commencement of business of the bank. Shareholding by promoters in the bank in excess of 40% shall be brought down to 40% within three years of the date of commencement of business of the bank. Further, the promoter’s stake should be reduced to 30% of the paid-up voting equity capital of the bank within 10years, and to 26 % within 12 years from the date of commencement of business of the bank. Proposals with a diversified shareholding and time frame for listing are preferred.

Foreign shareholding. The foreign shareholding in the bank would be as per the extant FDI policy.

Voting rights and transfer/acquisition of shares. As per Section 12 (2) of the Banking Regulation Act, 1949, voting rights in private sector banks are capped at 10%, which can be raised to 26% in a phased manner by the RBI. Further, as per Section 12B of the Act, any acquisition of 5% or more of voting equity shares in a private sector bank will require prior approval of the RBI. This will also apply to payment banks.

Prudential norms. As payment banks will not have loans and advances in their portfolios, they will not be exposed to credit risks and the prudential norms and regulations of the RBI as applicable to loans and advances, will therefore not apply to them. However, the banks will be exposed to operational risks and should establish a robust operational risk-management system. They may face liquidity risks and therefore are required to follow the RBI’s guidelines on liquidity-risk management, to the extent applicable.

There is need for transactions and savings accounts for the under-served in the population. Also, remittances have both macro-economic benefits for the region receiving them as well as micro-economic benefits for the recipients. Higher transaction costs of making remittances diminish these benefits. Therefore, the primary objective of setting up of payment banks is to enhance financial inclusion by providing (i) small savings accounts and (ii) payments/remittance services to the migrant labour workforce, low-income households, small businesses, other unorganised-sector entities and other users, by enabling high volume and low value transactions in deposits and payment/remittance services in a secured technology-driven environment.

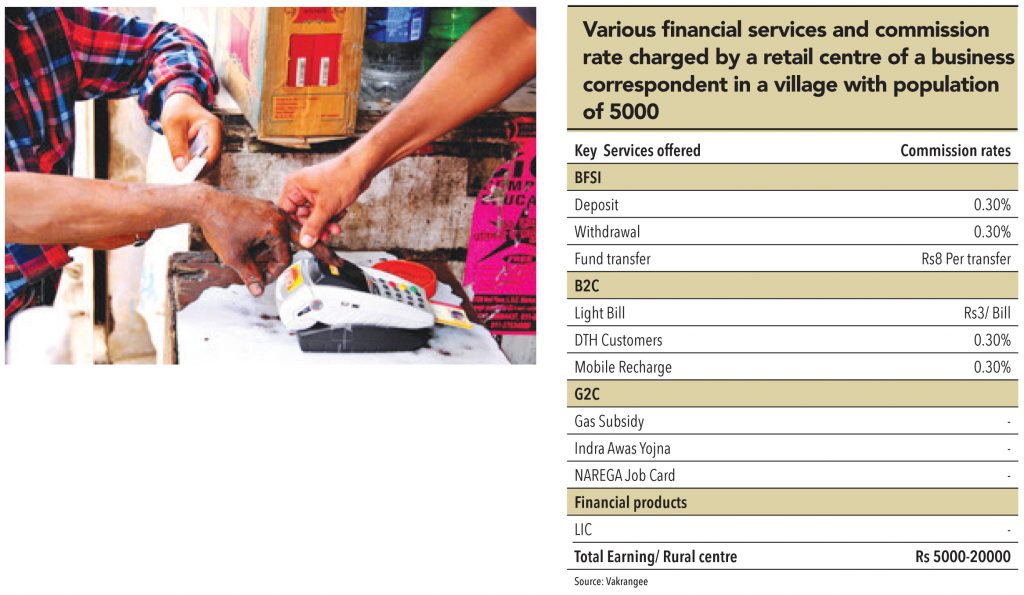

Apart from web-based and mobile app-based banking services, the payment bank would designate various merchant establishments / corner stores as its access points on the pay-and-use model. The merchant establishments / corner stores, unlike costly brick-and-mortar branches, will offer easy and low cost access to the customer. From the merchant establishments’ point of view, it is an additional source of revenue and increase in footfalls in his establishment.

Banking beyond branches is about shifting the bulk of low-value transactions to a much lower- cost and more ubiquitous retail channel, which makes for a significantly more compelling business case to serve the poor. The key is to leverage corner shops/merchant establishment that can be found in every village and in every neighbourhood. In much the same way as shops exchange their pre-purchased inventory of rice or cooking oil against cash, they can also exchange their own bank balance against cash (and vice versa). This can be done safely as long as the store takes in and pays back customers’ cash against an equal and simultaneous electronic transfer of value between the bank accounts of the customer and the store. The payment bank must put in place a technology platform (which can be based on cards, biometrics or mobile phones) through which it can authorize and record each transaction in real time, thereby ensuring that all client transactions are fully funded before the customer leaves the store.

A retail store’s business is to buy a stock of a good that people want –let’s call it rice—and to resell it in smaller amounts. Through this process, it steadily reduces its stock of rice and increases its stock of cash. When the cash inventory is depleted, the store needs to take some of its cash and exchange it for a fresh supply or rice.

Substituting “electronic money” or “bank balance” for rice, and the same mechanics apply for its bank reselling business. The store starts with a balance of electronic money in its bank account, and when a customer walks into the store to make a deposit, the store transfers electronic value to the customer in exchange for cash. When it runs out of bank balance, the store can no longer fund more customer deposits and it must go to the bank to re-stock on electronic money using the cash it has received from customers. A customer withdrawal is the same operation but in reverse. Thus, the only difference with the rice merchant is that the cash merchant can buy as well as sell electronic money for cash, i.e. it can conduct deposits as well as withdrawals.

Normal stores can thus act as cash merchants, aggregating the cash needs of customers so that only the shopkeeper, and not the entire community, has to travel to a branch in order to service their account. Cash merchants handle the logistics of local cash distribution, in effect bridging the distance between the bank branch (acting as a kind of wholesale cash aggregation point for cash merchants) and the places where poor people live and work. The store is paid a small commission per transaction served, making this a variable-cost transactional channel for the bank and at the same time a profitable new line of business for the shopkeeper / merchant establishment. The bank retains full control over the customer proposition, the marketing of the service, and in ensuring the safety and soundness of the IT platform and risk management policies.

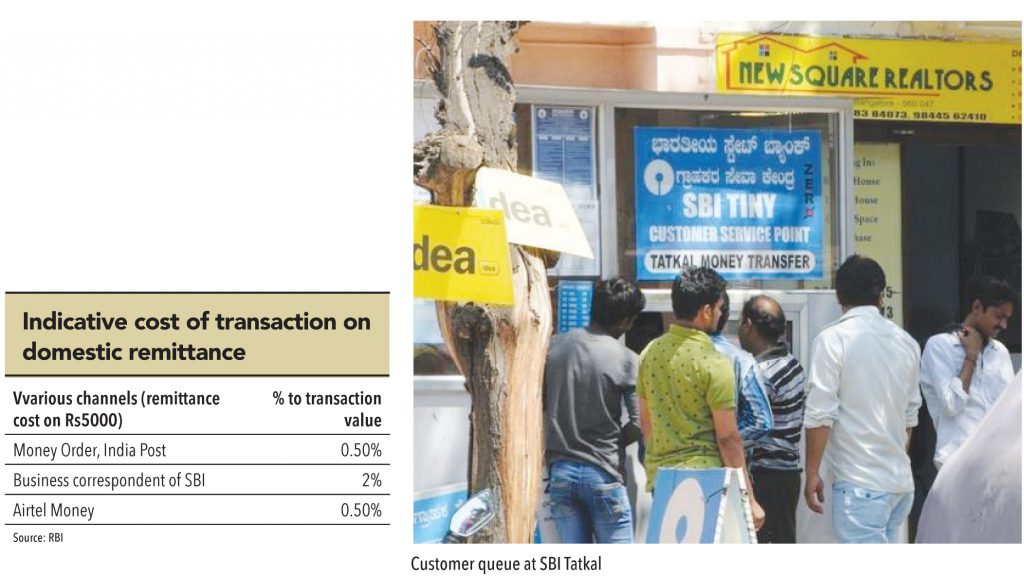

Currently PPI issuers and business correspondents use biometric scanners to allow their customers to make remittances. A customer who wants to remit funds to another individual (receiver), needs to walk into the centre and authenticate his identity by using the thumb impression in a biometric scanner. After verification, the customer deposits the money at the centre and in turn the centre manager will credit the receiver’s wallet from his own wallet and later deposit the money received in his account. Another way of making the remittance is that the customer directly transfers the money from his own wallet to the intended receiver’s wallet after the identity is authenticated. In this process, there is no handling of cash by the centre manager, only the customer’s wallet is debited and the intended receiver’s wallet is credited immediately.

Due to restriction in lending activity, the spread earned by payment banks is expected to be very thin and hence the entire business model would evolve around payment services. In order to enable a low cost easy access to the customer, the model would be similar to a banking correspondent model, wherein the payment bank would appoint merchant establishments / corner shops as its access point enabled by strong IT support. The advantage which payment banks would have compared to business correspondents or PPIs is that, under payment bank model cash out from merchant establishments / corner shops would be allowed, thus removing the major hindrance faced by BCs & PPIs.

Thin Intermediation margin

A competitive deposit product is a pre-requisite for customer acquisition, which is crucial to a stable remittance business. But the restriction on lending activity would put a cap on its ability to provide higher interest on its deposit product. However the deposit product offered by payment banks is expected to provide interest rates higher than the prevailing market rate in savings deposits. Large commercial banks provide 4.5% interest on saving deposits.

Theoretically, a payment banks margin should not be more than margin of SCB adjusted for credit risk, tenure premium and high operating cost. Long term credit risk adjusted margin of top six commercial banks is averaged at 230bps. The seven year average tenure premium between 1 year and 5 year corporate bond is 40bps. Operating cost of SCBs would average at 2% of asset. The transaction cost in alternate banking model is 30%-40% of cost incurred under branch banking model. Hence opex under agency / franchisee model can be around 80bps compared to 200bps opex (operating cost to asset ratio) under branch banking model. The upper limit of margin for payment bank is expected to around 100bps (i.e. 230bps credit risk adjusted margin – 40bps tenure premium – 100bps opex). However the actual margin would depend on the individual company’s business model and market dynamics (which again will depend on number of new licensees).

Strong reliance on payment solution

The payment bank model would revolve around low cost payment solution for small ticket transaction.Payment solution would include

a. Domestic remittance services

b. Cash ins and Cash outs services

c. Airtime top-up and related recharge services

d. Utility bill payments

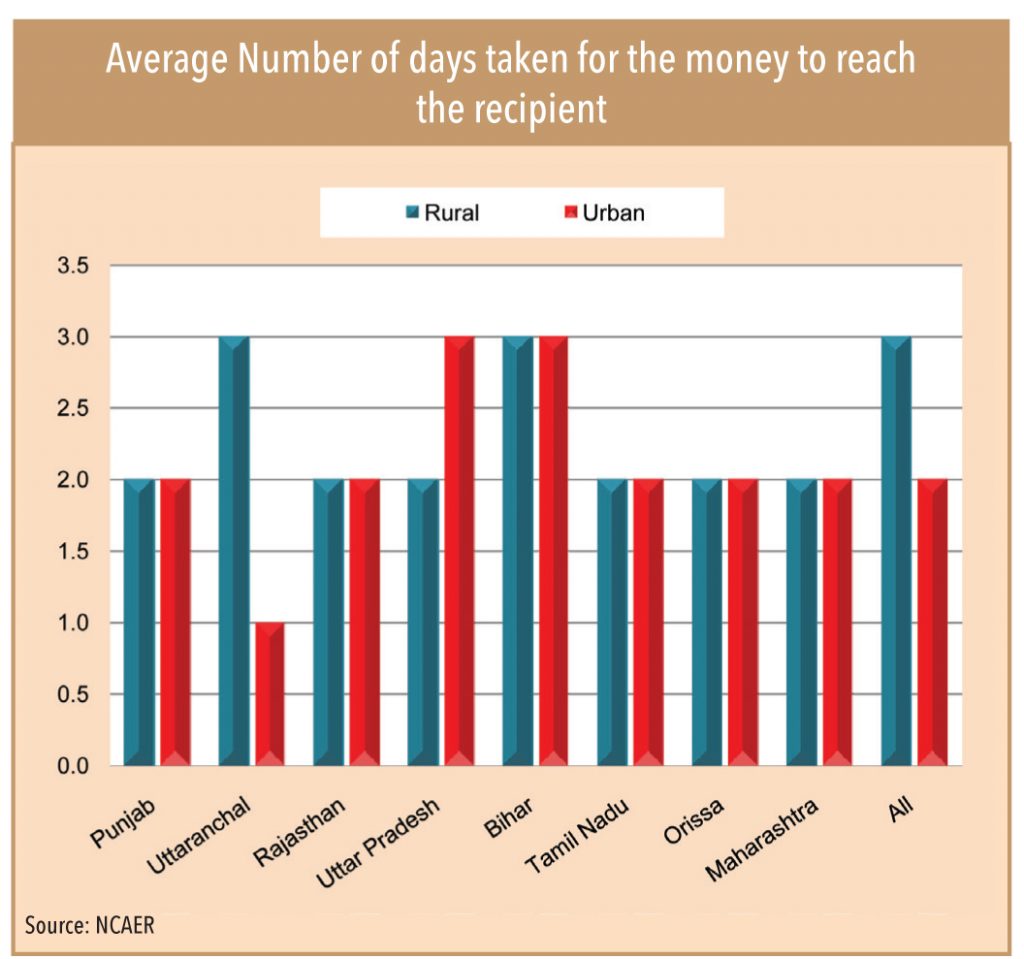

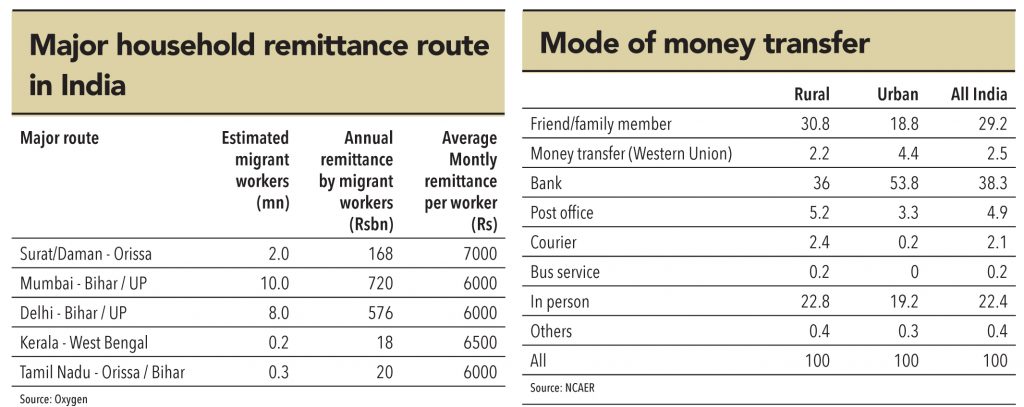

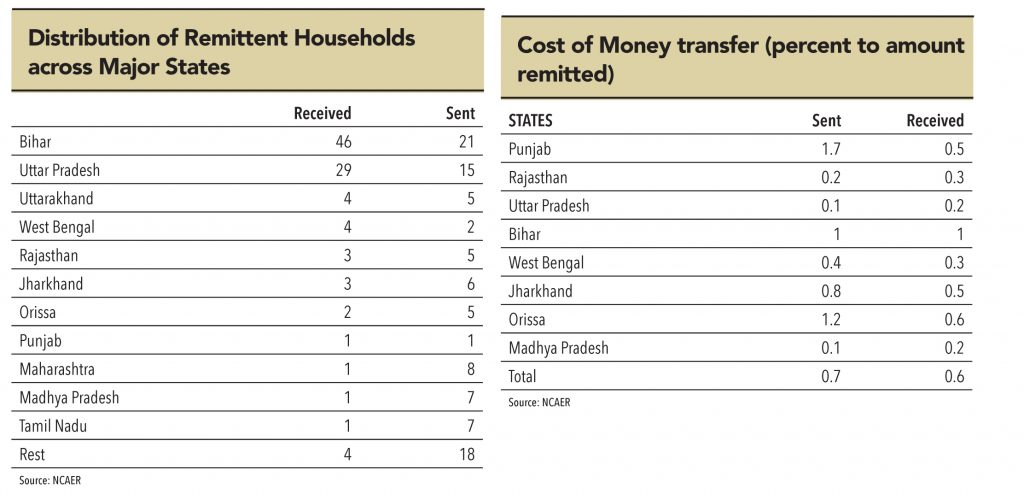

Domestic household remittance market is pegged at Rs2000bn per annum, growing at CAGR of ~12%. According to industry surveys, 40% of the domestic remittance business is channelized through formal sources like commercial banks; banking correspond (BC) and post office etc.

The informal system which operates primarily through friends and family, couriers, bus services, hawala channels and in-person transfers, is still widely preferred over the formal financial system. Migrants prefer informal channels for a variety of reasons which among others include costs incurred in making transfers, and opportunity costs. Even access to the formal financial system is not sufficient to ensure its usage. Migrants may simply refuse to use the channel due to low levels of financial literacy, lack of penetration in the home region, and time consuming process. Intuitively, the lower a person is placed in the income distribution ladder the more likely is he/she to be excluded from the financial system or be more dependent on the informal system.

Transferring money through informal sources is inconvenient and more time consuming and risky.For example, money is transferred free of charge through friends or relatives who are travelling back to a migrant’s home town. Similarly, cash couriers operating in specific migration corridors whose livelihood are to travel and physically deliver cash for migrants are another choice for making the transfers. Migrants may also prefer to transfer the amount themselves during trips to their own villages and towns for social occasions and between jobs. Although the formal financial system does offer security, speed, and cost effectiveness, attributes that are cherished by the migrants, the system has cumbersome documentation procedures, is often inconvenient and does not have deep enough penetration.

The domestic household remittance market offers a market opportunity of Rs20bn in terms of revenue, factoring a commission rate of 1% (0.5% on both side of the transaction sender & receiver). The Rs12bn( 60%) unorganised market remains the potential market for payment bank and other organised player in the financial value chain like PPIs, business correspondent, small banks etc.

The only other comparable country of India’s size with a large internal migrant population is China. A few studies estimate that the Chinese domestic remittances market is nearly three times the size of the Indian market. However, the crucial point that needs to be mentioned is that the formal sector in China accounts for 75% of the total remittances market transactions as opposed to less than 40% in India. Roughly 45% of the remittances are channelled through China Post, while 25% are handled by the commercial banks.

Cash ins and Cash outs services

Transaction fee from cash ins and cash outs can be source of revenue for the payment bank. A rough estimate suggests that India has 100mn migrant workers. As per NCAER survey, average household food expenditure of remittent households is Rs34057 per annum. This translates into annual cash out of Rs3406bn for these households. The cash ins and cash outs are chargeable due to infrastructure and working capital cost. The transaction charge varies between 2% to 3% depending on the volume. Thus the domestic migrant worker cash ins – cash outs market size can be pegged at Rs3trn, offering a revenue potential of Rs85bn

Airtime top ups, related recharge services and utility bill payments

The overall mobile recharge market is about Rs1,000 bn a year. Around 95% of the recharge is done at retailer outlets on a cash basis. These offer opportunities for payment banks by offering recharge solutions at their access points (mobile, Internet, or franchise outlet) by aggregating the recharge facility for multiple telecom service providers. Similarly, the DTH recharge market is pegged at Rs74 bn annually. Utility bill payment facility can also be sources of revenue.

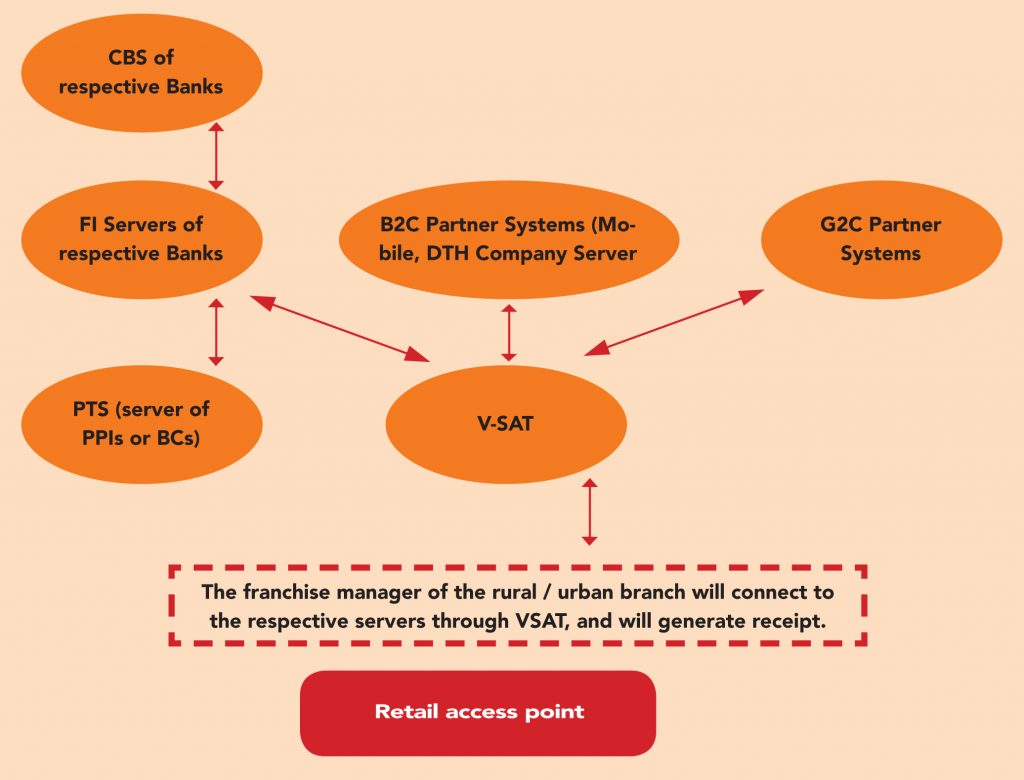

Once a customer comes to a retail access point (merchant establishment / corner shop), the merchant manager initiates the transaction on a laptop, which is connected to the bank and its partner servers through VSAT/data card. For example, if a customer came to deposit money in its account, he/she first needs to authenticate his/her identity through the thumb impression scanner at the centre. Once the person is verified, the centre manger will connect

its system to the branch server through VSAT/data card device. He will then transfer the amount from his settlement

account (rural manager’s current account) which he maintains with the bank, to the depositors account. Once the amount is credited in the customer’s account, a slip is generated with transaction details. If the transaction fails, the slip will not be generated. Similarly, if it is a withdrawal,

the centre manager debits the customer account and credits his settlement account and pays cash to the customer. The merchant establishment will have to keep cash to pay for withdrawals. While for banking transaction it needs to maintain a current account with the bank, for utility bill payments he maintains an online wallet. All the utility bill payments are done through this wallet.

Subscribe to enjoy uninterrupted access