Umesh Bhatka, a migrant worker in the textile mills in the industrial city of Surat sends money to its native village in Ganjam district in Orissa. The money takes a time consuming complicated route to reach his family. The money is dispatched through people from his community who travel to his village. Many a times some amount goes missing. Ramadhir kumar again a migrant worker at a construction site, keeps his wage with the contractor (for safe keeping), which he draws when he visits his native place. The contractor charges undue amount for just safe keeping. There are many such cases as migrant workers do not visit bank branch due to limited financial literacy; lack of proper documentation;complexity; and inaccessibility.

There is a need for commercial bank to shift the bulk of low-value transactions to a much lower-cost and more ubiquitous retail channel, which makes for a significantly more compelling business case to serve the poor. The key is to leverage corner shops/merchant establishment that can be found in every village and in every neighbourhood. The payment bank initiative by the central bank is an attempt to provide Ubiquitous Access to Payment Services and Deposit Products at Reasonable Charges. “Not enough credit in the wallet” is an indepth study of the potential opportunity for payment banks and its impact on other participants in financial value chain like commercial banks and NBFCs

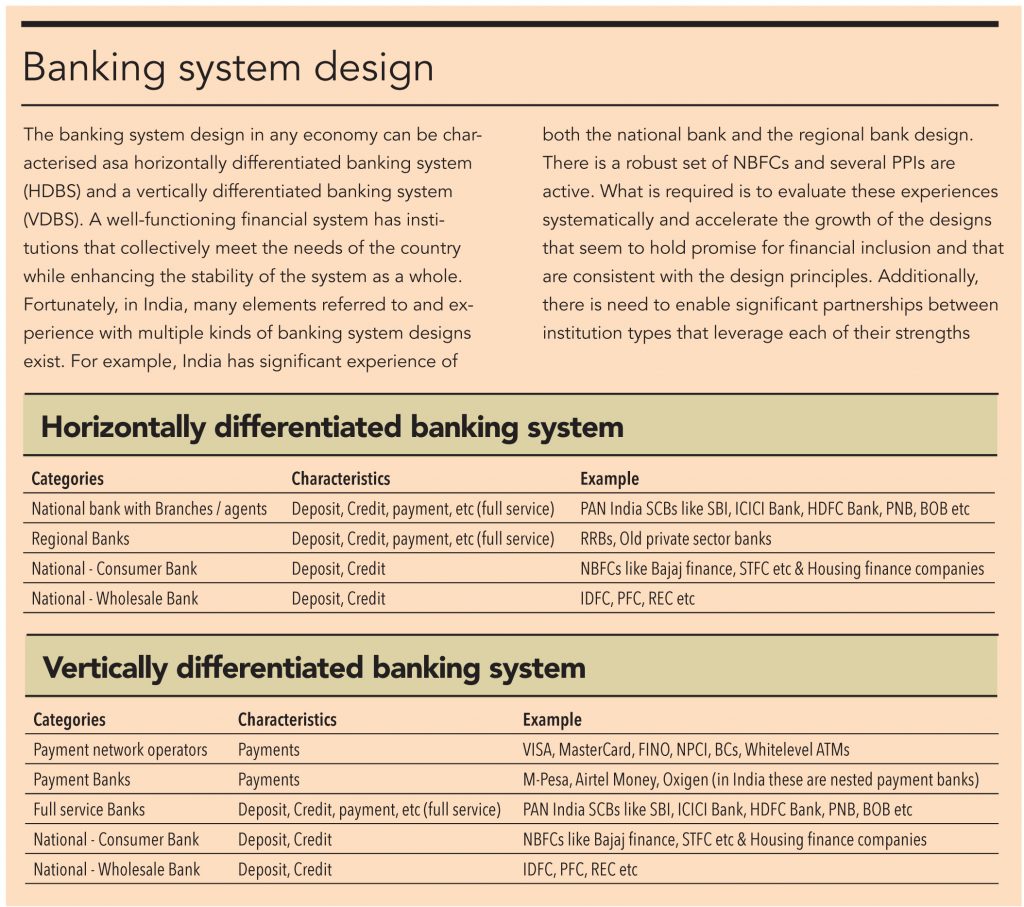

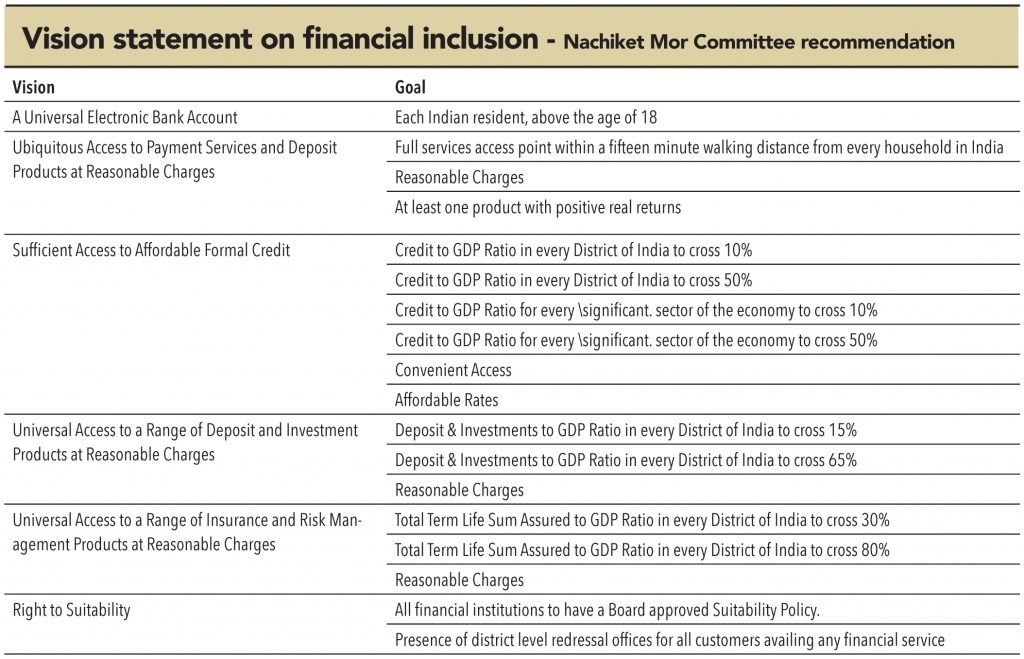

Providing low-income households and small businesses with access to financial services is not a new goal for India. Policy makers are well aware of its importance and have been very willing to learn from the successful experiences of other countries and to experiment with new ideas. However, progress on this front leaves much to be desired. When financial inclusion goals are specified and strategies articulated, there is little consideration of credit risk and cost to serve. Consequently, the Nachiket Mor Committee report aimed to address issues of credit risks and costs to serve for providing better access of financial services to small businesses and low-income households. The committee recommends six vision statements on financial inclusion.

The vision statement for Ubiquitous Access to Payment Services and Deposit Products at Reasonable Charges for small businesses and low-income households is as follows.

By January 1, 2016, the number and distribution of electronic payment access points would be such that every resident would be within a 15-minute walking distance from such a point anywhere in the country. Each such point would allow residents to deposit and withdraw cash to and from their bank accounts and transfer balances from one bank account to another, in a secure environment, for both very small and very large amounts, and pay reasonable charges for all of these services. At least one of the deposit products accessible to every resident through the payment access points would offer a positive real rate of return over the consumer price index.

Subscribe to enjoy uninterrupted access