Realizing the need for gathering additional funds for the power sector, the government promulgated the Electricity Act, 2003, to promote private participation in the transmission sector. The act provided for transmission licenses by the CERC and SERC and for determination of tariffs under section 61/62 through competitive tariff-based bidding. Thereafter, a model transmission agreement was notified in May 2012.

There are two routes for the private sector to participate in transmission — either via the JV route or through a 100% owned Independent Private Transmission Company (IPTC). It has been proposed that all new transmission lines shall be ‘bid out’ from January 2011 and only lines that are of national interest shall be given to Power Grid on a nomination basis. All intra-state transmission networks would move towards TBCB (tariff-based competitive-bidding) from 1st January 2013.

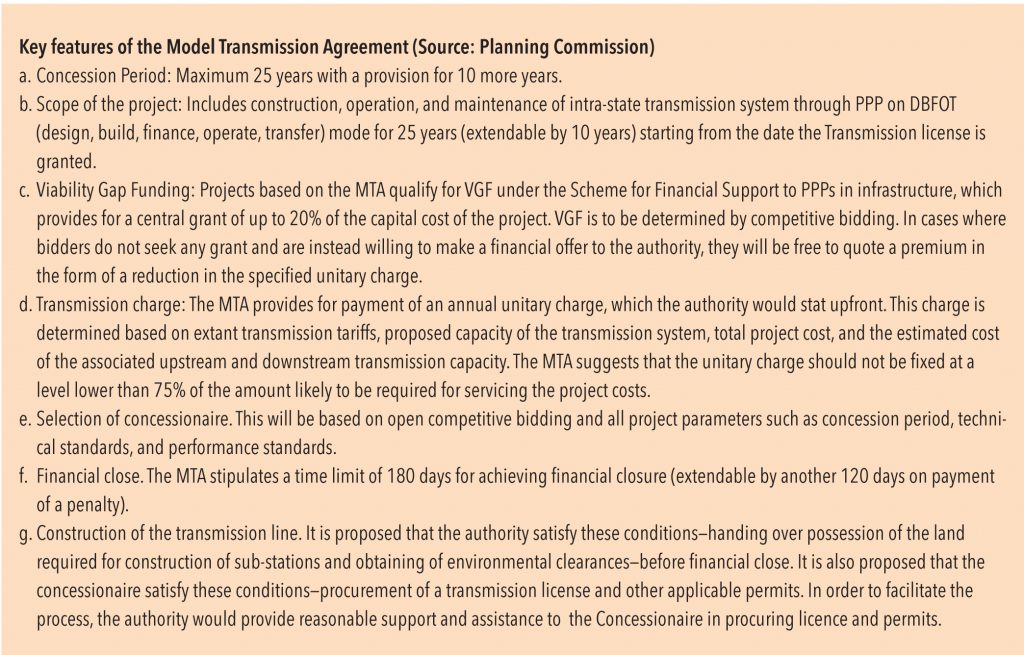

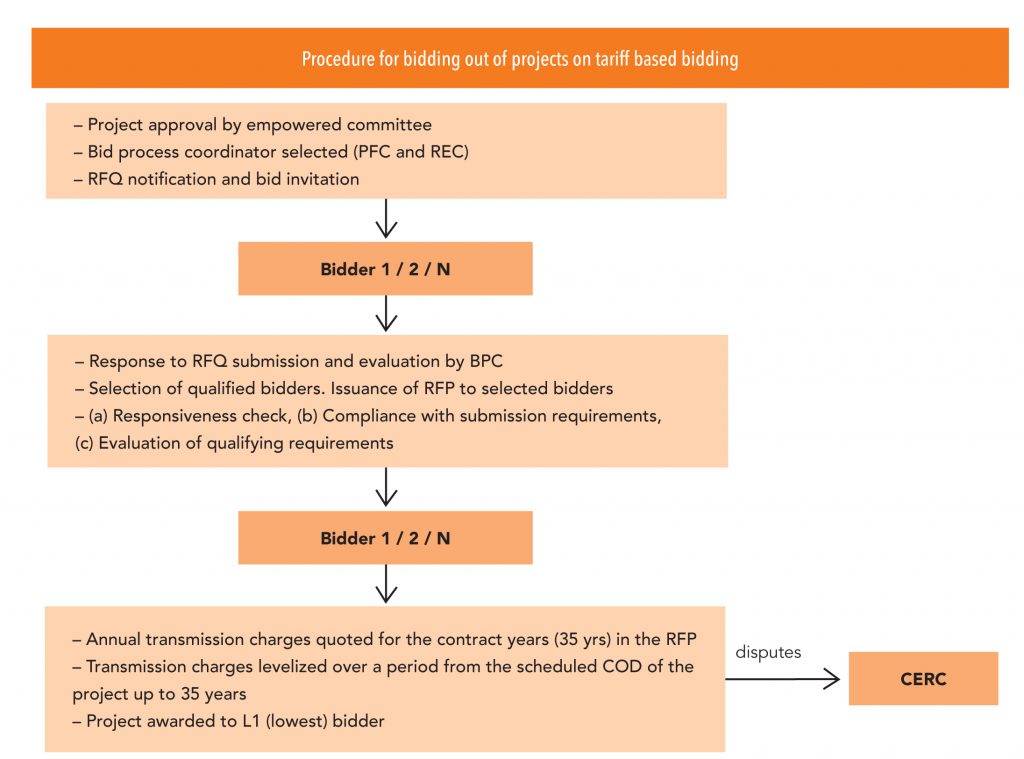

There are two ways for ‘bidding out’ the transmission networks: (1) model transmission agreement using the lowest VGF as notified by the Planning Commission or (2) the Standard Bidding Documents as notified by the Ministry of Power. For most of the inter-state transmission projects that PFC/REC bid, they use the SBD method while some states have used the VGF model as stated by the Planning Commission.

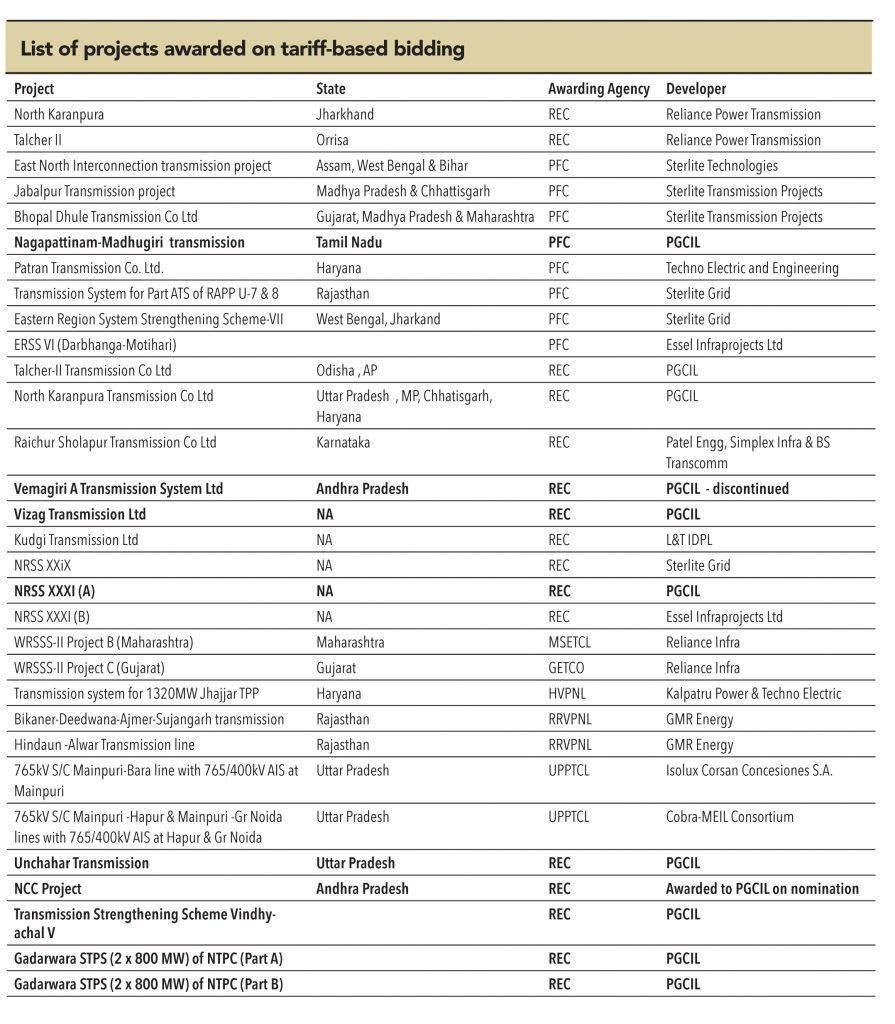

A list of projects that have been awarded on tariff-based bidding over the last 2-3 years follows. PGCIL has won nine projects out of the 18 that it had originally bid for, which implies a 50% market share in such projects. Recently, PGCIL was given projects worth Rs 300bn on a nomination basis by the government; of these, the Rs 200bn Raichur-Pugular HVDC lines was done on Tamil Nadu’s insistence, as the state wanted this line to come up on time. Currently, Rs 280bn of projects are out on TBCB (to be awarded over the next few quarters).

Competitive intensity was quite high in the initial tariff-based projects, as more than twenty players participated in such projects. Reliance Power Transmission won the two initial projects based on very aggressive bids. Construction work on these two projects is yet to take off, as the company has petitioned the CERC for an increase in transmission charges.

Heightened competition continued until 2013; however, in recent bids, the number of players declined to 5-7; it seems like most players have realised that executing these projects is not easy because of issues (severe Right of Way and clearance-related)that developers face. For example, for the Kudgi transmission project, L&T expects to make IRRs in the range of 18-20% while PGCIL has also mentioned that IRRs for recent projects are rising.

Subscribe to enjoy uninterrupted access