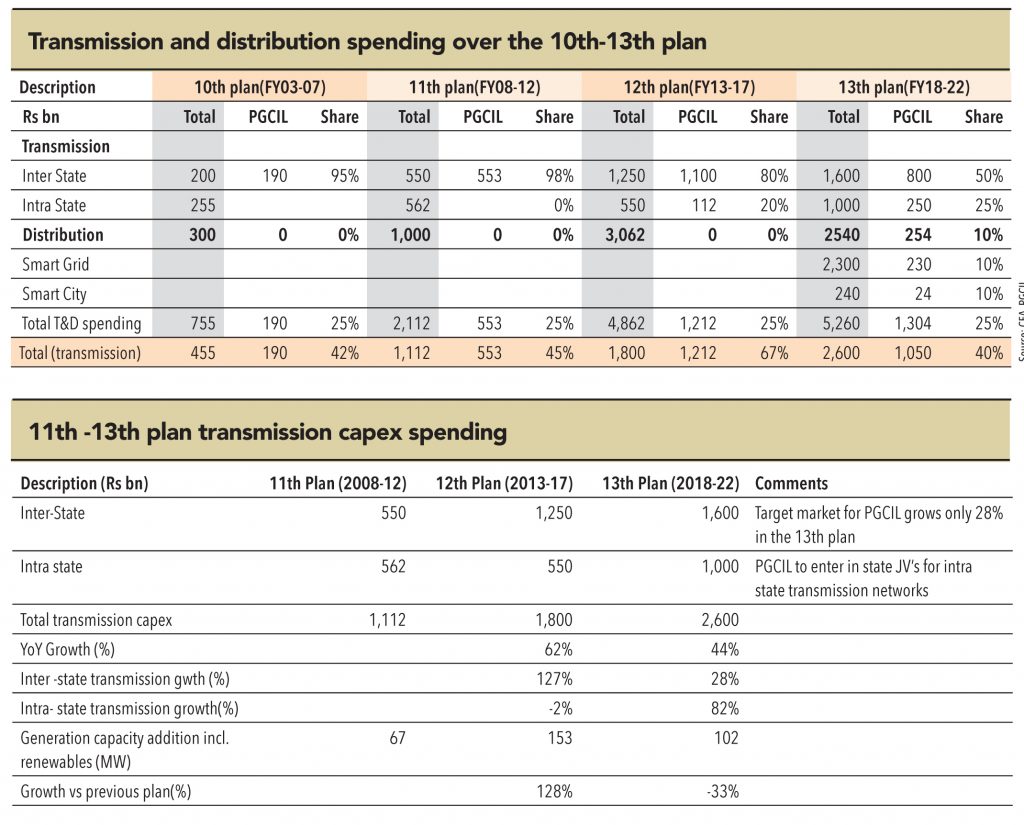

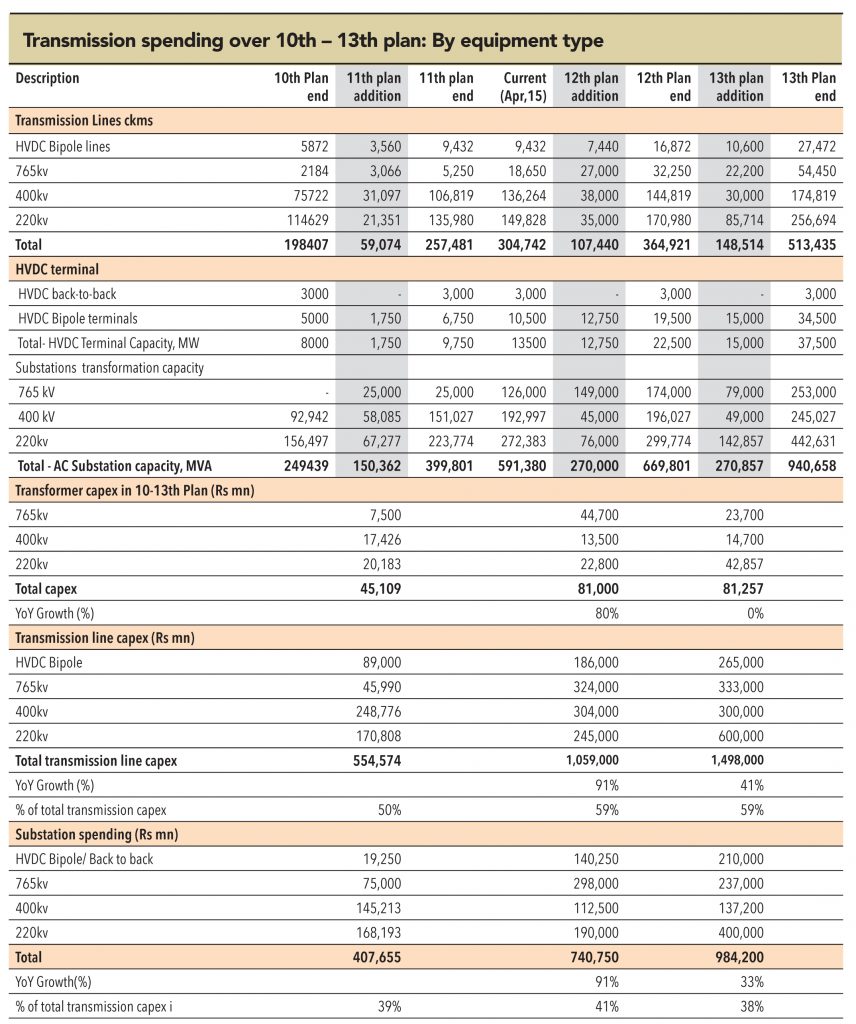

Based on the capacity addition required for the inter-state and intra-state transmission system, a capex of Rs 2.6tn would be required over the 13th plan. Out of this, Rs 1.6tn would be spent on the ISTS while Rs 1tn would be spent by the states on the intra-state transmission network (220kv and below).

PGCIL was the dominant player in ISTS in the 11th Based on the capacity addition required for the inter-state and intra-state transmission system, a capex of Rs 2.6tn would be required over the 13th plan. Out of this, Rs 1.6tn would be spent on the ISTS while Rs 1tn would be spent by the states on the intra-state transmission network (220kv and below).

PGCIL was the dominant player in ISTS in the 11th

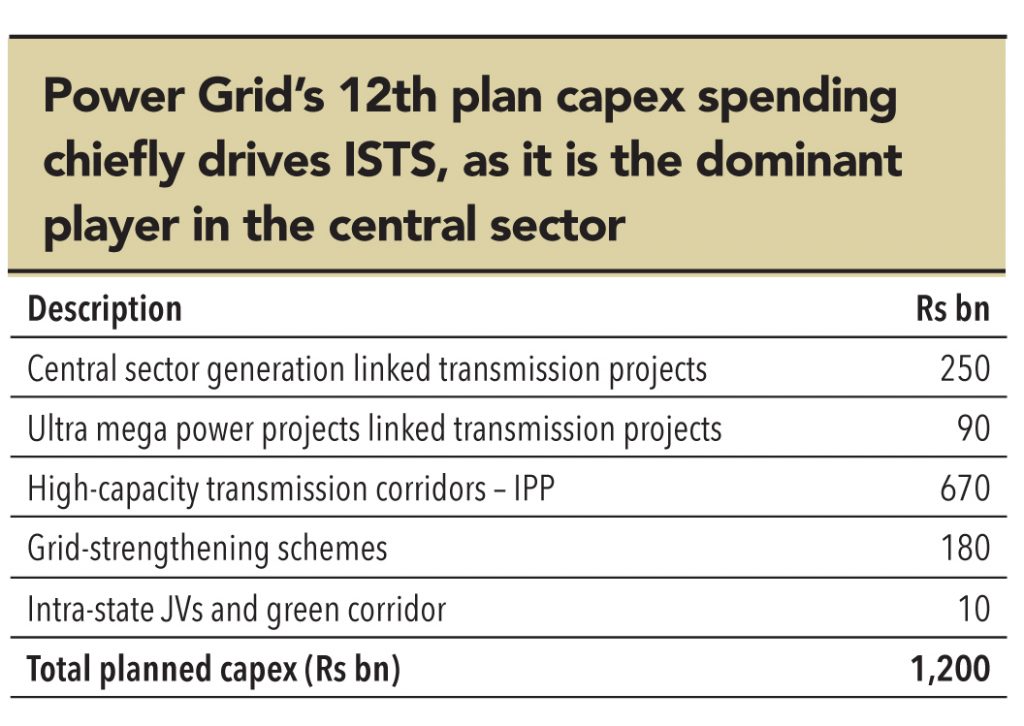

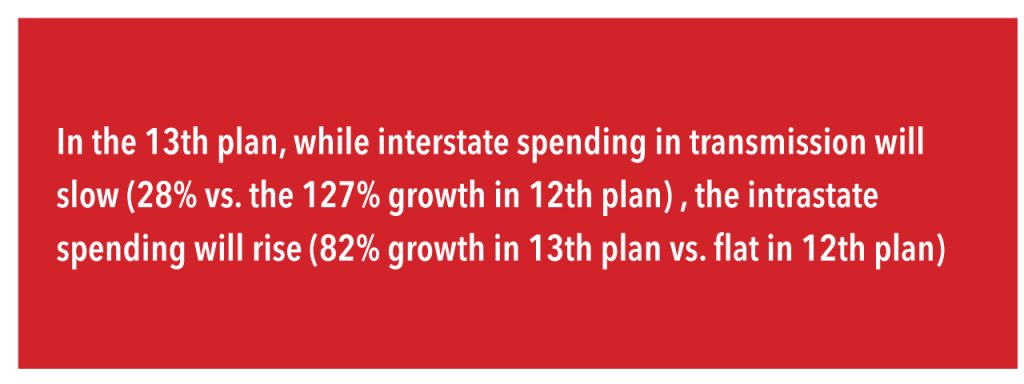

ISTS spending would slow down to 28% in the 13th plan from the 127% growth seen in the 12th plan while the intra-state spending would jump 82% over the 12th plan as states step-up spending to upgrade their networks to align with the inter-state transmission corridors. Large growth in ISTS during the 12th plan was driven by the Rs 670bn spending on setting up the nine High-Capacity Transmission Corridors (HCTCs), which have been set up to link the generation plants.

A slowdown in the ISTS spending along with higher state spending has two repercussions for the sector and therefore on PGCIL:

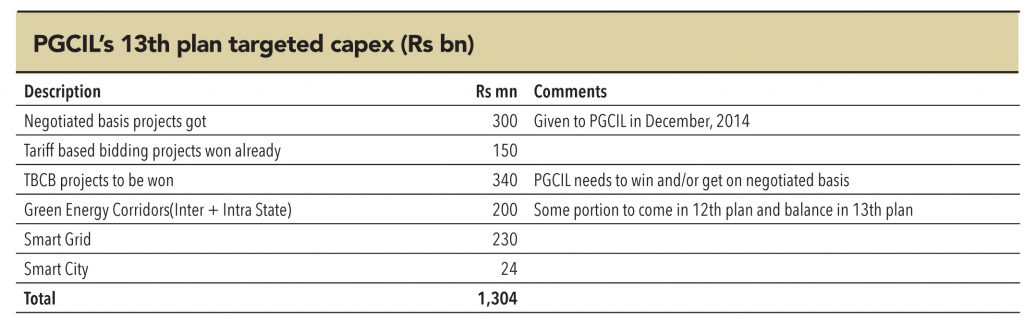

a. Not only is PGCIL required to win ISTS projects on tariff-based bidding going into the 13th plan, the growth in spending on such projects is also seen slowing down (28% in 13th plan vs. 127% in 12th plan). This implies that PGCIL will need to diversify its growth areas (in distribution and smart grid) to keep up its momentum.

b. With intra-state spending rising 82% to Rs 1tn, states will need to step up their spending requirements

in building transmission capacity. PGCIL has already started working with states to help them upgrade their existing infrastructure (JVs formed with Bihar and Orissa).

Based on the inter-state and intra-state transmission capacity that is expected to be built in the 12th -13th plan, it seems like there will be a big jump in spending from the states on intra-state transmission and HVDC lines while capex in the 765kv segment (transformers, lines, substations) will decline. Here are some details on how spending is likely to flow to various equipment providers and contractors:

a. Transformers: Based on transformation capacity additions of 271,000MVA, total spending on transformers in the 13th plan would be flat vs.the 12th plan and +80% versus the 11th plan. More importantly, transformer capex is likely to decline in the 765kv segment (Rs 24bn, -47%) and increase in the 400kv (Rs 49bn, +9%) in the 13th plan. Currently, there are five serious players in 400/765kv transformers—Alstom T&D, TBEA Shenyang, Crompton Greaves, ABB, Siemens, and Toshiba who would see reduced demand going into the 13th plan. Orders for 1200kv transformers are likely to start flowing in only in the end of 13th plan/early 14th plan. Total spending in the 220kv segment in the 13th plan is likely to see a sharp jump of 88% to Rs 43bn (+10% in the 12th plan) as states upgrade their transmission network. Most of the players that are strong in the 400/765kv transformers have not been very aggressive in the 220kv segment, which has historically seen more competition and is a very commoditized market.

b. Transmission lines: Transmission-line capex is likely to rise 41% to Rs 1.5tn in the 13th plan (+91% in the 12th plan) driven primarily by a surge in capex in 220kv and HVDC lines. Spending in 765kv and 400kv should be largely flat at a cumulative Rs 633bn. Spending for intra-state transmission in the 220kv lines is likely to be Rs 600bn (+145%) while HVDC lines witness spending of Rs265bn (+42%). Clearly, state spending on transmission line is seen picking up in a substantial manner.

c. Substation: Overall substation capex should be Rs 984bn in the 13th plan (+33% over the 12th plan) largely driven by spending on HVDC and 220kv substations.Spending on 220kv substations is likely to be Rs 400bn (+111% over the 12th plan) while HVDC substation spending is seen at Rs210bn in the 13th plan (+50% over the 12th plan). Cumulative spend on 765/400kv substations is seen declining 10% over the 12th plan to Rs374bn.

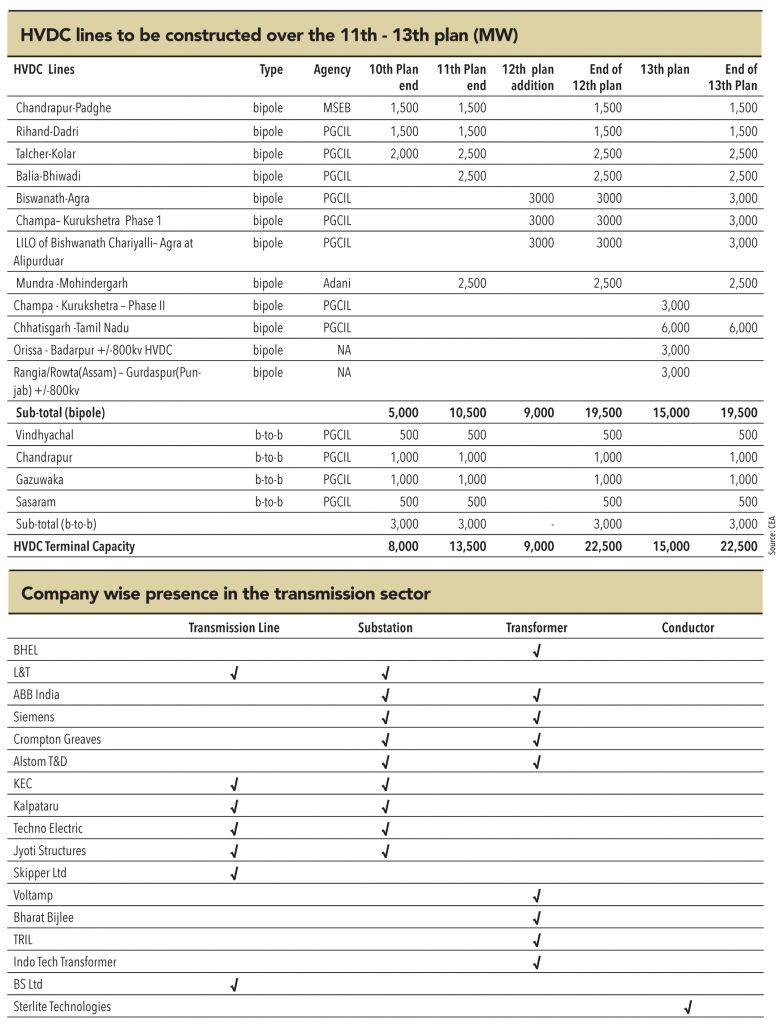

d. HVDC Substations: Four large HVDC terminals are envisaged during the 13th plan with a total 15GW capacity and estimated spending of Rs 210bn (+50% over the 12th plan). These are:

i. Champa Kurukshetra Phase 2 (3GW) – Work to start from 2HFY16 and likely to commission by FY19. This order has been awarded to Alstom SA for Rs 33bn and Alstom T&D’s share in this order is Rs 14bn.

ii. Chattisgarh (Raigarh) to Tamil Nadu (6GW) – Tenders already issued and likely to be ordered by Q4FY16. This project has been given to PGCIL on a nomination basis and the cost is Rs 200bn. We estimate that the HVDC portion of this order would be ~Rs 80-90bn. Four bidders are likely to participate in this order – ABB, Siemens, Alstom SA, and Toshiba. This line could be extended to Kerala for evacuating another 3GW of power.

iii. Orissa to Badarpur (3GW) – Still in the planning stage.

iv. Assam (Rangia/Rowta) to Punjab (3GW) – Still in the planning stage.

Subscribe to enjoy uninterrupted access