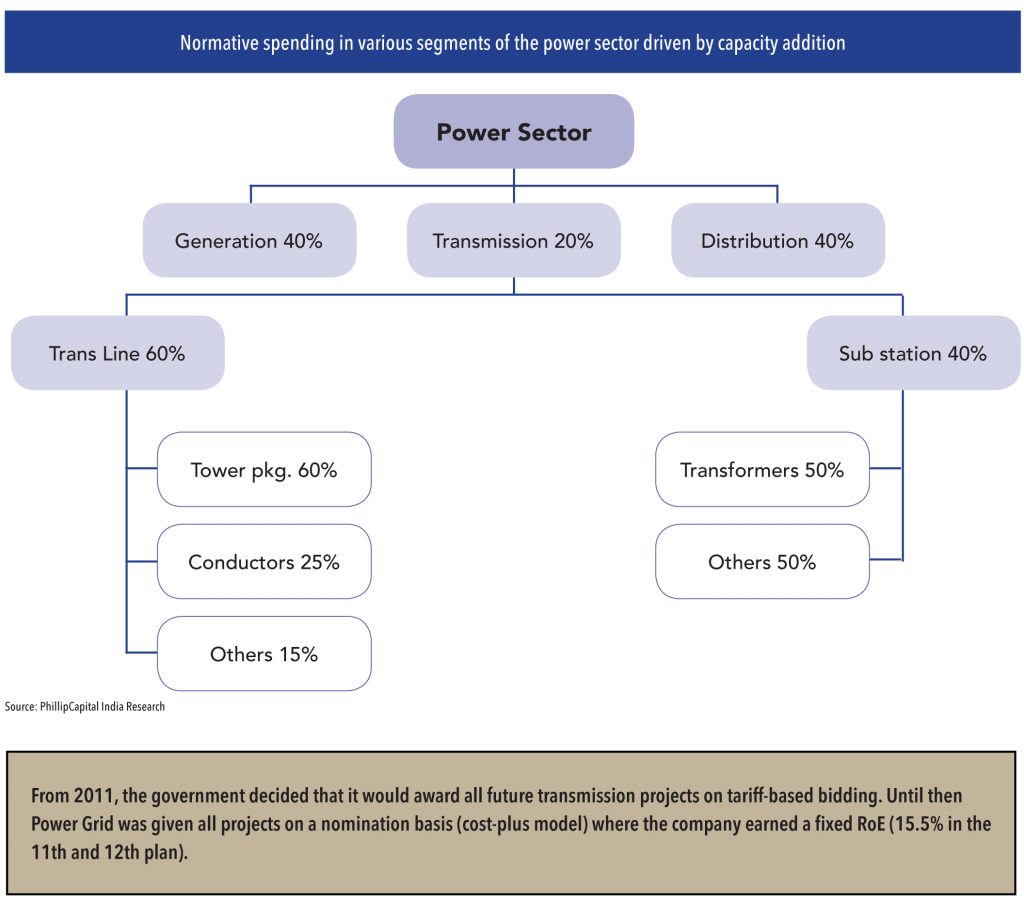

India’s power generation sector has seen strong capacity additions over the past few years with the entry of the private players. On the transmission side, Power Grid has done a commendable job in increasing the inter-state transmission network; the estimated capex over FY08-17 is ~Rs 1.8tn. Going into the 13th plan (2018-22), we expect spending on inter-state transmission to slow (+28% over the 12th plan), but see a sharp pick up in intra-state transmission (+82% ) as state spending in transmission picks up. This shift in growth translates into higher spending in the 220kv and HVDC space and lower growth in the 765/400kv segments. To augment capacities in the transmission space, the sector has been opened to competition from CY11 and we expect increasing private-sector participation in new transmission projects. This has serious ramifications for the incumbent, Power Grid, which was earlier getting projects on an assured-return basis. With tariff-based bidding, PGCIL would have to compete with private players and win projects with no assured returns.

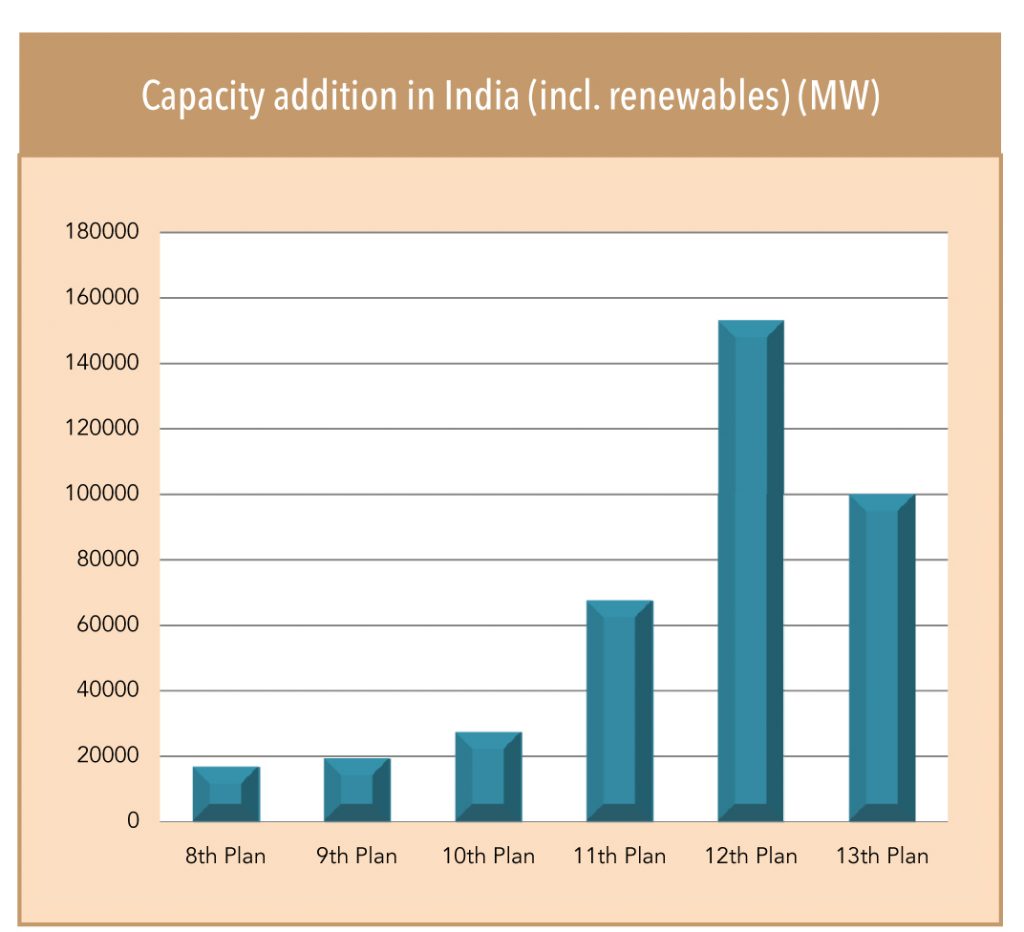

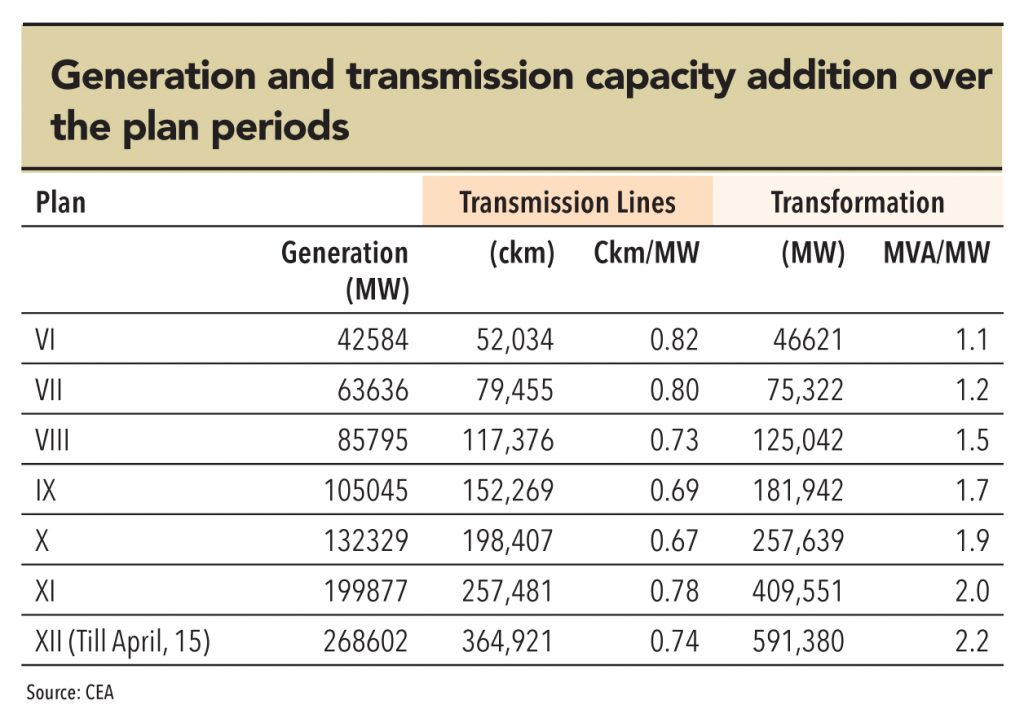

India has cumulatively added ~130GW in generation capacity in the last eight years and with a targeted addition of 120GW (CEA’s revised estimate at 150GW including renewables) in the 12th plan, India would add ~220GW over 10 years between FY08 and FY17. This compares very favourably to the previous plans — in the 8th, 9th, and 10th five-year plans, a much-lower 63GW was added cumulatively.

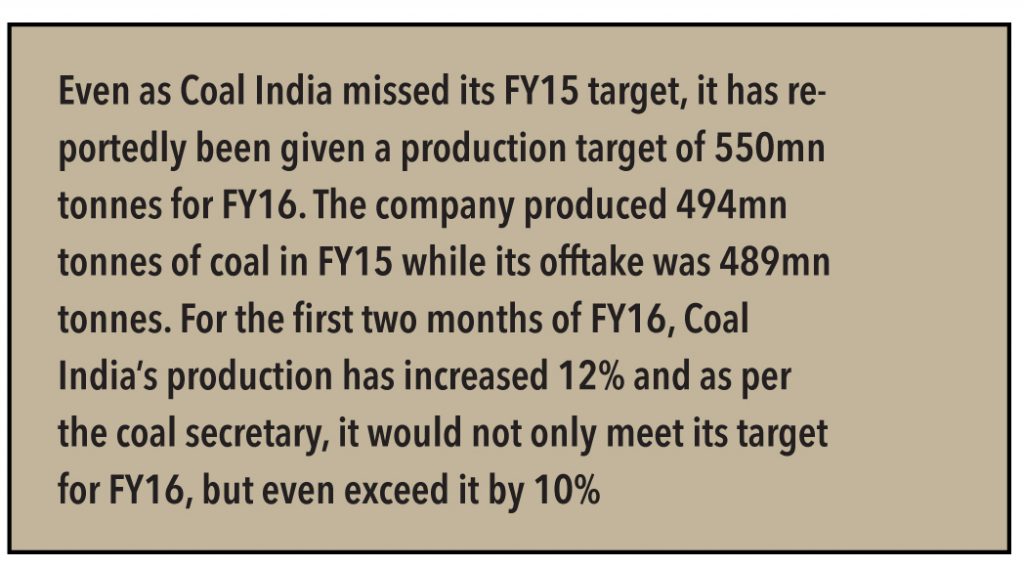

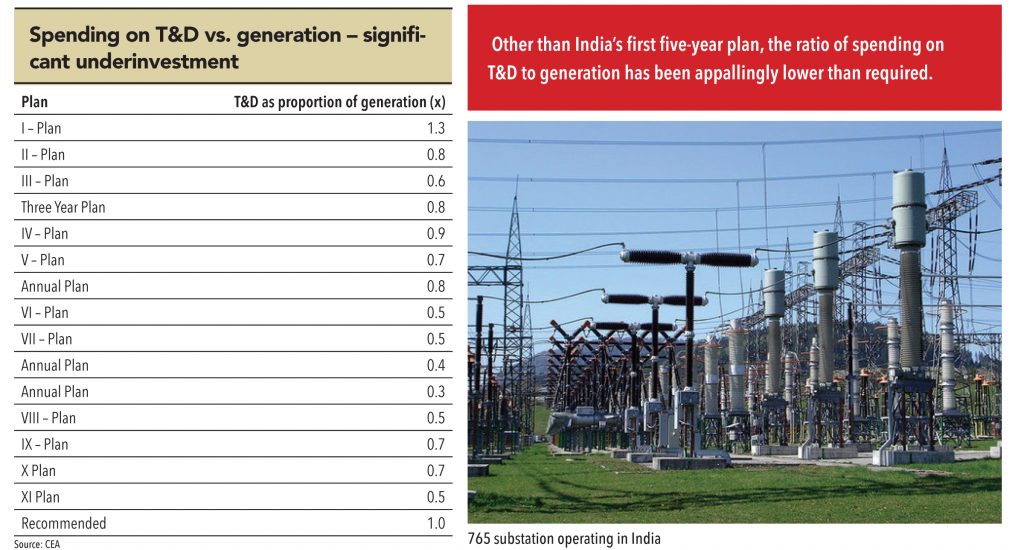

While India has managed to add decent power-generation capacity in the last 10 years, other inputs such as coal, transmission capacity, and distribution reforms have failed to keep up the pace. The current government is focusing on: (1) increasing coal production and (2) correcting transmission and distribution constraints to give back the power sector its mojo. The following pages detail the planned spending on inter-state and intra-state transmission networks and the consequent winners and losers.

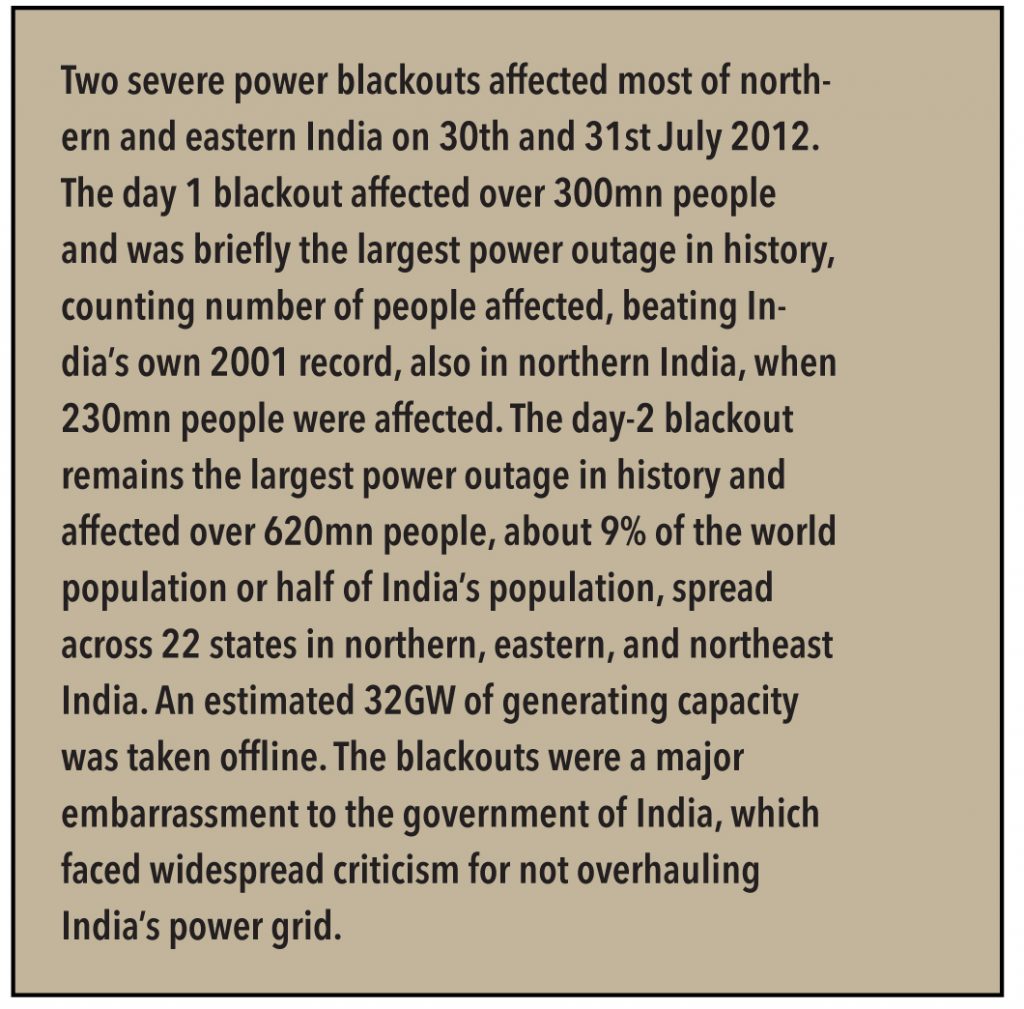

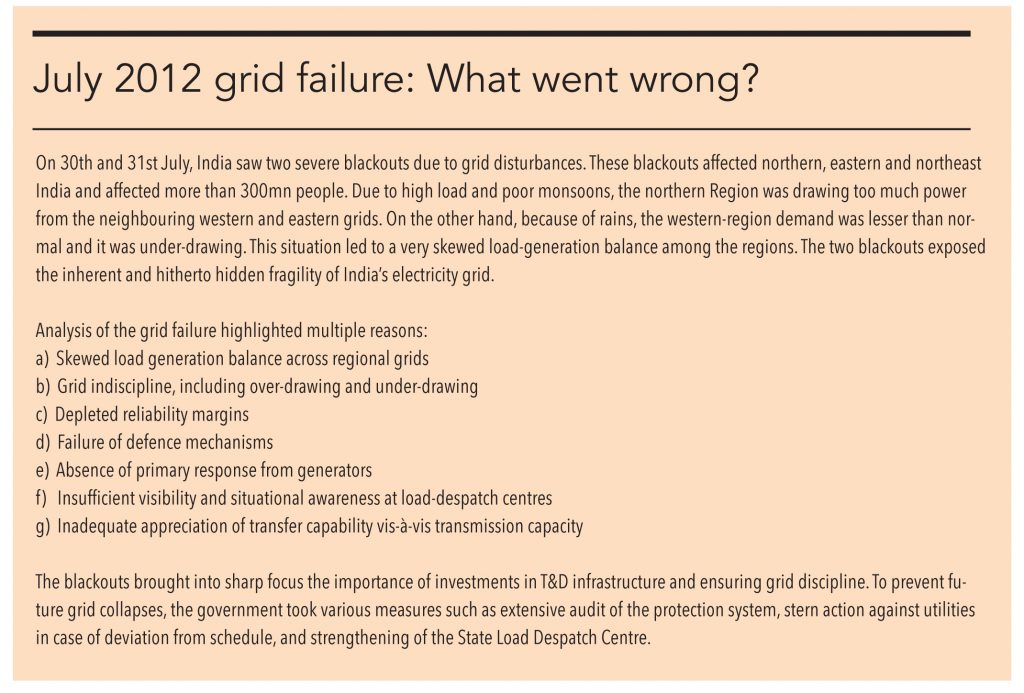

An important event that contributed to the renewed focus on establishing a robust and reliable transmission system that can withstand the different load profiles across the country was the northern region blackout in CY12 after a grid failure.

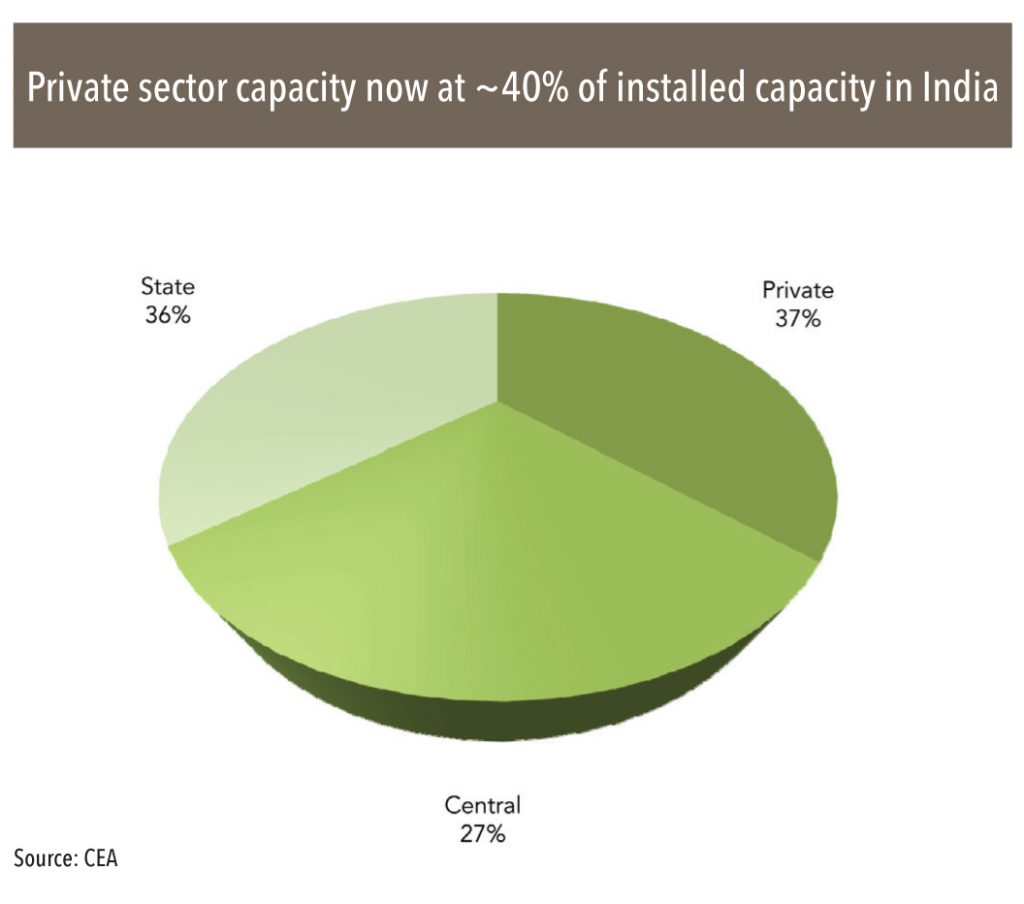

The reforms ushered in by the Electricity Act, 2003, led to the private sector strongly adding new generation capacity over 2010-15; the private sector now accounts for ~40% of the generation capacity in India. While large capacity was added in the last five years, a major portion of it is underutilized because of: (1) paucity of fuel and transmission botllenecks and (2) lack of offtake by SEBs. The government has already started working on increasing coal India’s production and is now focusing on removing transmission bottlenecks.

While electricity reforms brought in strong additions in generation capacity, a similar increase has not yet happened in transmission, despite the sector being opened up to the private sector from CY11 (inter-state transmission).

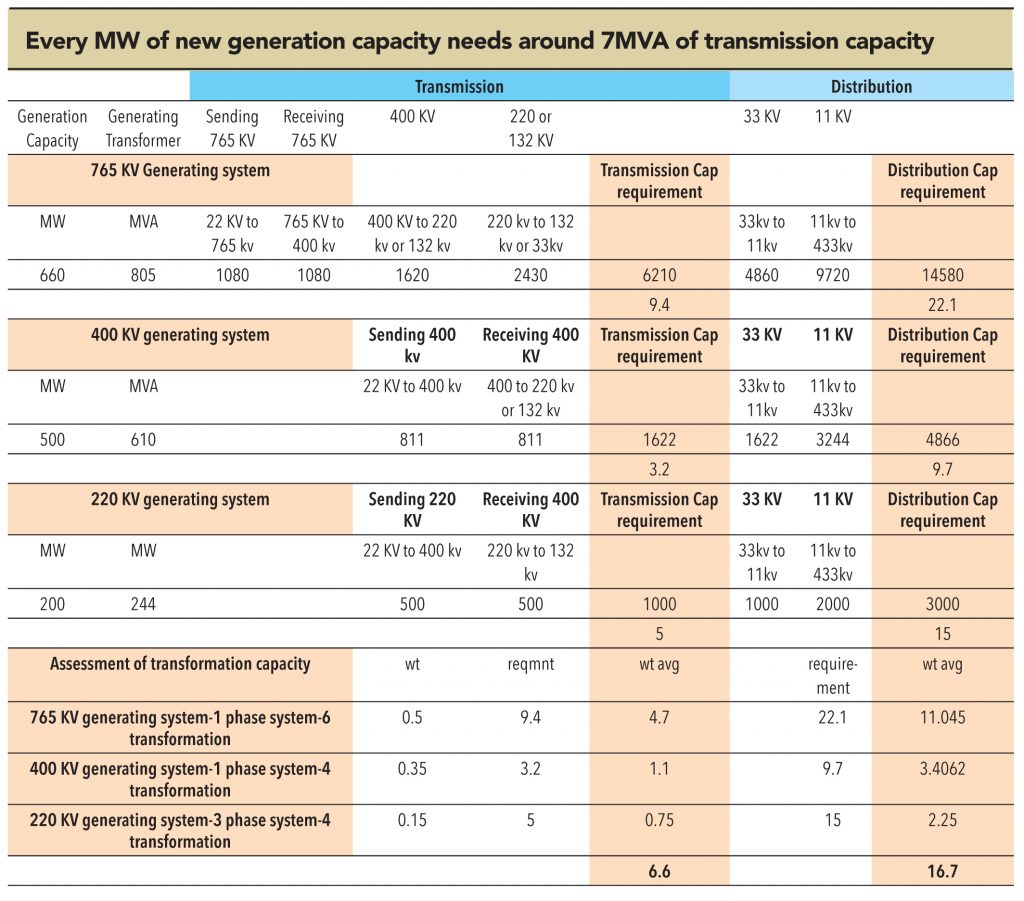

However, today India has only 2.2MVA of transmission capacity per megawatt of generation capacity — this is far below the required 7MVA and largely explains the congestion that is visible in the interstate transmission of power across the country. While Power Grid has done a good job in terms of adding transmission capacity, it has clearly not been sufficient. Understanding this need, the government opted to open the sector to the private sector, but this has had mixed results.

Subscribe to enjoy uninterrupted access