Although the Indian specialty chemicals industry has come a long way, it remains at a relatively early stage of development. However, the current outlook for Indian specialty chemicals is at its best for an accelerated and quality growth led by steady domestic demand, emergence of conducive export opportunity led by Chinese environment issues and enhanced facilitation by government initiatives.

While the healthy track record of double-digit growth in domestic demand for specialty chemicals has already attracted global MNCs into India, the entry of more such MNCs will intensify competition for small and inefficient local players, making their survival difficult. Hence, the industry should see gradual but definite consolidation, leading to qualitative growth.

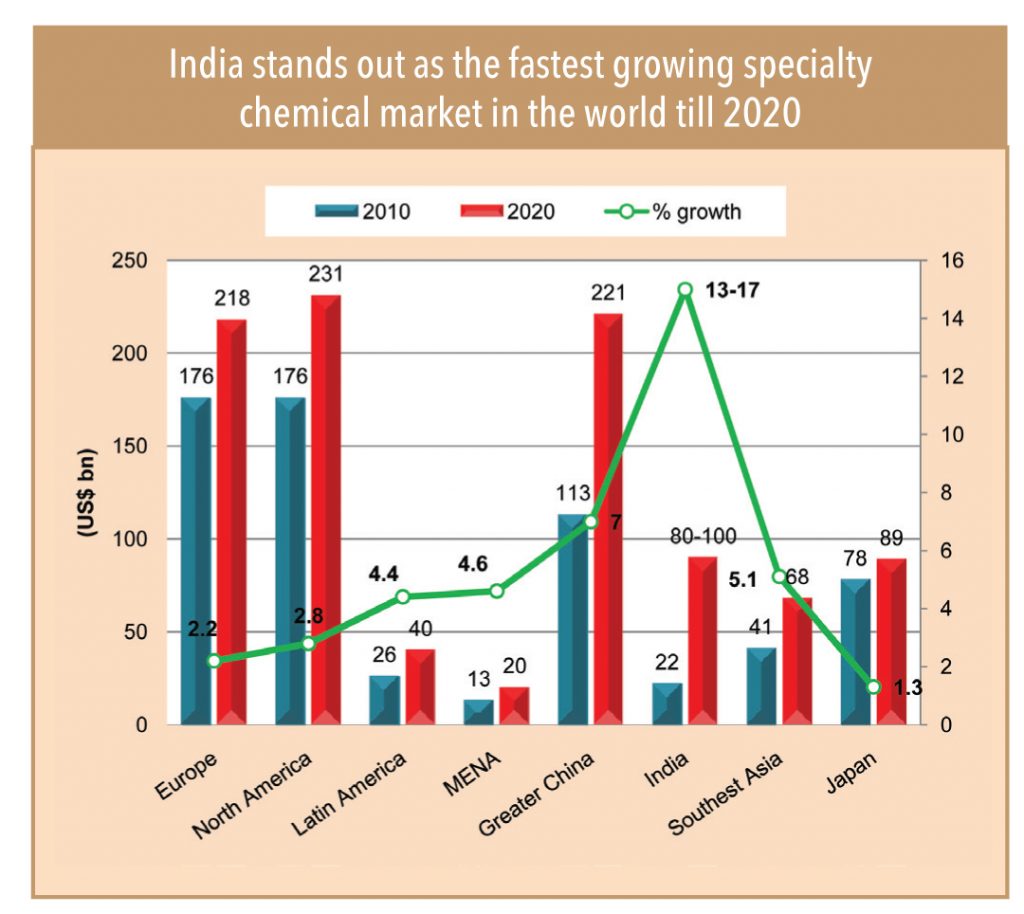

On the other hand, rising population with lowest per-capita consumption of chemicals in the country and India’s relatively strong GDP growth outlook (7-8% over the next few years) indicates strong potential for India’s chemicals demand. As per industry estimates, India’s specialty chemicals market should deliver strongest annual growth in the world (outpacing even China’s) over the next five years.

Additionally, favourable business initiatives by the Indian government — in chemicals infrastructure development, facilitating international investment, and the Make in India campaign — give visibility. With the government’s focus on creating a conducive business environment, capex into the Indian chemicals sector has already seen a 52% yoy jump to Rs 1.46tn in 2014 and FDI into the sector has jumped by 49% yoy in FY15 to US$ 4bn (DIPP). Such capacity creation, along with China’s exports softening and global peers looking at India as an alternate source of specialty chemicals, enhances the growth visibility this industry.

Dr Rajan says, “BASF is convinced about the growth of the Indian specialty chemicals industry and that it can grow more and faster, which is evidenced from our commitment to the country. BASF is already setting up a huge plant in Dahej, Gujarat, with an investment of Rs 10bn. A new plant is coming up in Chennai for automotive catalyst business. We are setting up two other plants for the construction chemicals business. Additionally, BASF is setting up its global R&D/innovation campus in Mumbai. Such initiatives indicate the growth potential of Indian specialty chemicals”.

“We are set to establish highly advanced technologies leading to the creation of a robust system across platforms, for example, upgraded technical-service labs to modernise manufacturing practices, leading to tailor-made products and services. This will further reinforce our commitment towards the specialty chemicals business in India and bring us closer to offering innovative and customised solutions for our customers,”says Dr Deepak Parikh, Vice-Chairman & Managing Director, Clariant India.

The recent upgrading of India’s rank in terms of ‘ease of doing business in the world’ to 52nd from 76th, at a time when global MNCs are feeling the heat of excessive government intervention in Chinese chemicals industry, would further drive FDI flows into Indian chemicals. Indian specialty chemicals industry is all set for accelerated growth over the next decade compared with its historical growth of 11-14%.

Mr Manish Phanchal, Chemicals Head, Tata Strategic Management Group says, “The Make in India campaign is a key initiative of the current government, which aims to make India a global manufacturing hub. We expect the Indian specialty chemical market to grow at 15-18% per annum in FY14-20 and majority of it will be catered to by domestic production. Additionally, the entry of more and more MNCs into the country with an intention of tapping domestic demand and as an alternate source of intermediates to China would further scale up the domestic industry. That is how India would gain prominence in the global specialty chemicals industry like it earned in the pharmaceutical world.”

Scalability and efficiency to drive value growth of Indian chemicals peers

While the Indian specialty chemicals market is larger (US$ 25bn) than the domestic pharma market (US$ 15bn), it is relatively less preferred by investors,primarily due to lack of scale and/or lower operational efficiency. Domestic specialty chemicals are highly fragmented — there are about 40 listed specialty companies with consolidated sales about US$ 8bn, representing just about 30% of the total market.

Although the Indian specialty chemicals market is well represented by global MNCs (BASF, Clariant, Dow Chemical, Huntsman, Akzonobel, Mitsubishi Chemical Corp, Croda, Du Pont, Henkel, Wacker, Evonik, Syngenta, Solvay), barely a handful of companies are large. Among the listed names, BASF, SRF, Pidilite, Gujarat Flurochem, Aarti Industries, and Atul have sales in excess of Rs 250bn.

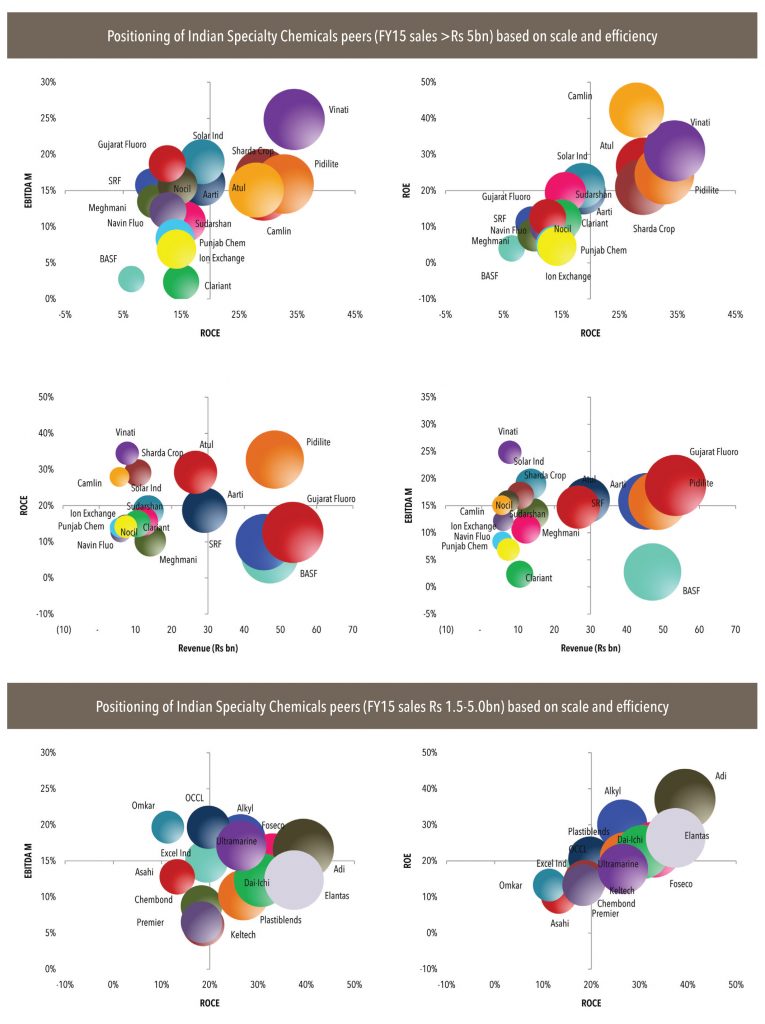

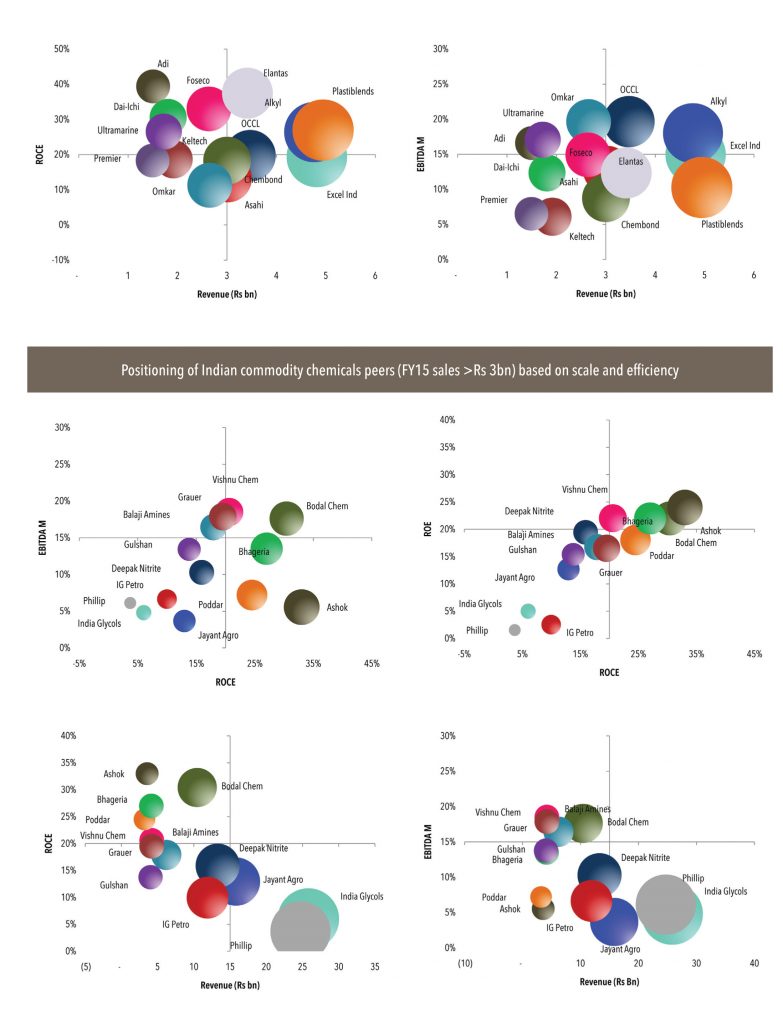

While Indian specialty chemicals should see accelerated growth, it is scalability and efficiency (led by R&D process/product/application) that would drive progress, as increasing competition from MNCs will pose a challenge for Indian companies.Considering the highly fragmented nature and smaller scale of Indian specialty chemicals players, it is best to segregate them in terms of peers with sales of >Rs 5bn and with sales Rs 1.5-5.0bn with efficiency defined in terms of EBITDA margin of >15% and ROCE/ROE of > 20%.

Efficient names among listed specialty players with revenues of over Rs 5bn are Vinati Organics, Aarti Industries, Atul, Sharda Crop, Pidilite,Solar Industries, and Camlin. In this block, peers such as SRF and Gujarat FluoroChemicals, whose ROCEs dropped below 20% due to large capex, would mainly benefit from on-going emergence for special fluoro-chemistry capability, thereby enhancing their earning efficiency. On the other hand, listed MNC majors such as BASF and Clariant fall in the bracket of inefficiency due to major capex and high overheads.

Efficient names among listed specialty players with revenues between Rs 1.5-5bn are – Alkylamane, OCCL, Dai-Ichi Karkaria, Foseco, Ultramarine, and Adi Fine Chem. Efficient listed commodity chemicals players with revenues over Rs 3bn are – Bodal Chemical, Vishnu Chemical, Bhageria, Elantas Beck, Poddar Pigment, Transpek, and Indo Borax.

Subscribe to enjoy uninterrupted access