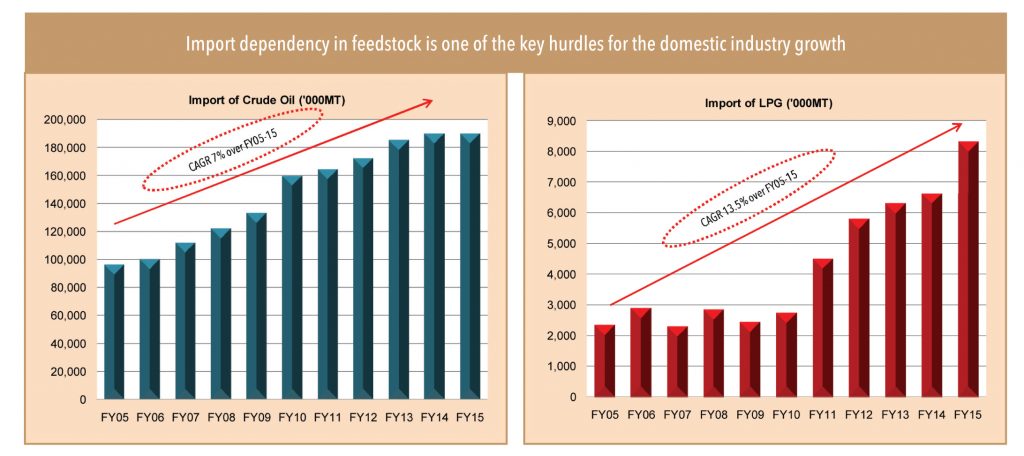

The Indian specialty chemicals sector has come a long way in the last seven decades or so — it has grown from a small-scale sector to a multi-dimensional one, which is taking on the challenges of globalization. The sector now holds a recognised position in the global map; however, India’s disadvantage in feedstock position and lack of adequate infrastructure hinders its progress into the big league.

“The Indian chemicals industry either uses natural gas or crude oil as feedstock for manufacturing and these constitute a major portion of cost of production (30-60%). India imports nearly 76% of its crude oil requirements. Fluctuations in oil prices affects the growth projections of chemicals manufacturers — at times they are unable to pass-on the cost escalation (due to sudden increase in oil prices) to end consumers,” says Mr Prabhsharan Singh, Head, Chemicals & Petrochemicals Division, FICCI.

The other big deterrent in the growth of the Indian chemicals industry is inadequate infrastructure or lack of common infrastructure. Due to its very nature, the chemicals/petrochemicals industry requires certain basic infrastructure facilities such as common-effluent treatment plants, an effective green belt segregating the chemical units from the human habitat, a good port with a chemical storage terminal, and adequate berthing facilities. At present, each unit has to create specialised facilities on its own, which leads to duplication of efforts and investment that impacts the earning efficiency of the Indian chemicals industry that is largely represented by small and medium enterprises.

More often, the scale of the Indian chemicals industry is believed to be one of the key restricting factors in domestic market growth. The industry is highly fragmented — with over 40,000 units in small-scale sectors and spread over various parts of the country. Installed capacities in most of these units are much smaller than global scales, which puts them in a disadvantageous position while tapping export opportunities where large volumes and operating efficiency is almost always a must.

Mr Sanjay Chaturvedi, Ex-Strategy Director, Rohm and Haas, has a different take on the challenges that the industry faces. He believes that the root cause of weakness in India’s specialty chemicals industry is lack of technical talent. Specialty chemicals is an application-driven industry and it requires an integrated team of material scientists, chemical engineers, and chemists — which India lacks. He also believes that another key concern is that the Indian entrepreneur lacks a ‘global’ mind-set.

Mr Chaturvedi feels that chemicals is a knowledge-based industry and the areas for R&D include improvements in the manufacturing process for reduction in cost of production, application development to diversify demand, and new-product development. The level of R&D investments in the Indian chemical sector is low at around 0.3% of total sales and this is mainly concentrated on process development by local players. Thus, India does not have even a single application-testing centre.

However, the government’s “Make-in-India” initiatives such as (1) setting up of reverse SEZs in feedstock-rich countries of the Middle-East, (2) formation of industrial clusters with common infrastructure,(3) facilitation for innovation in chemicals, and (4) establishing specialized vocational- training centres coupled with a continuous focus on green technology in chemicals are likely to address the age-old hurdles that Indian specialty chemicals industry has faced.

Subscribe to enjoy uninterrupted access