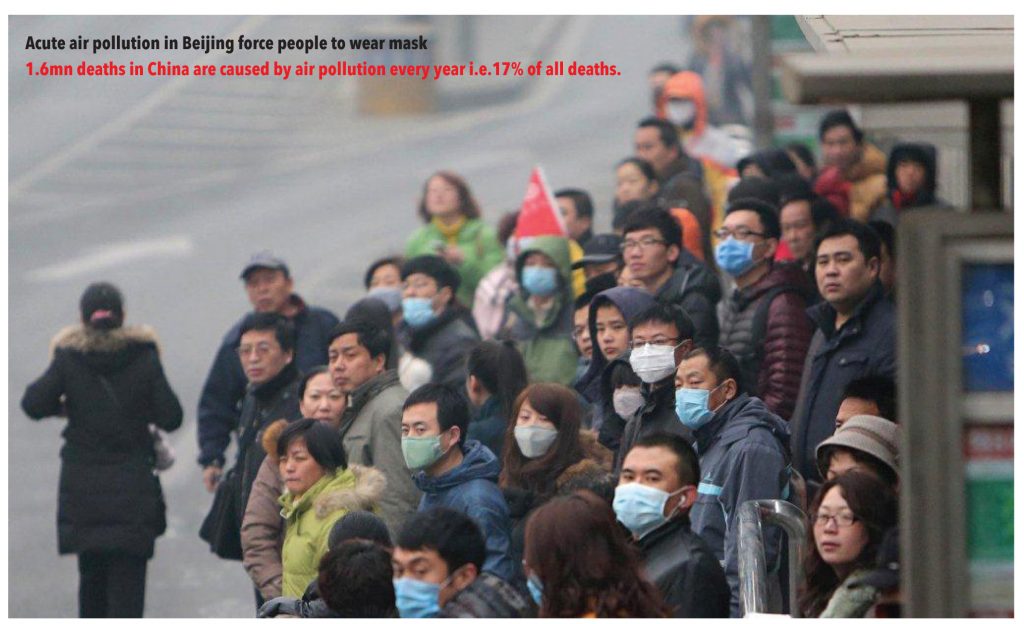

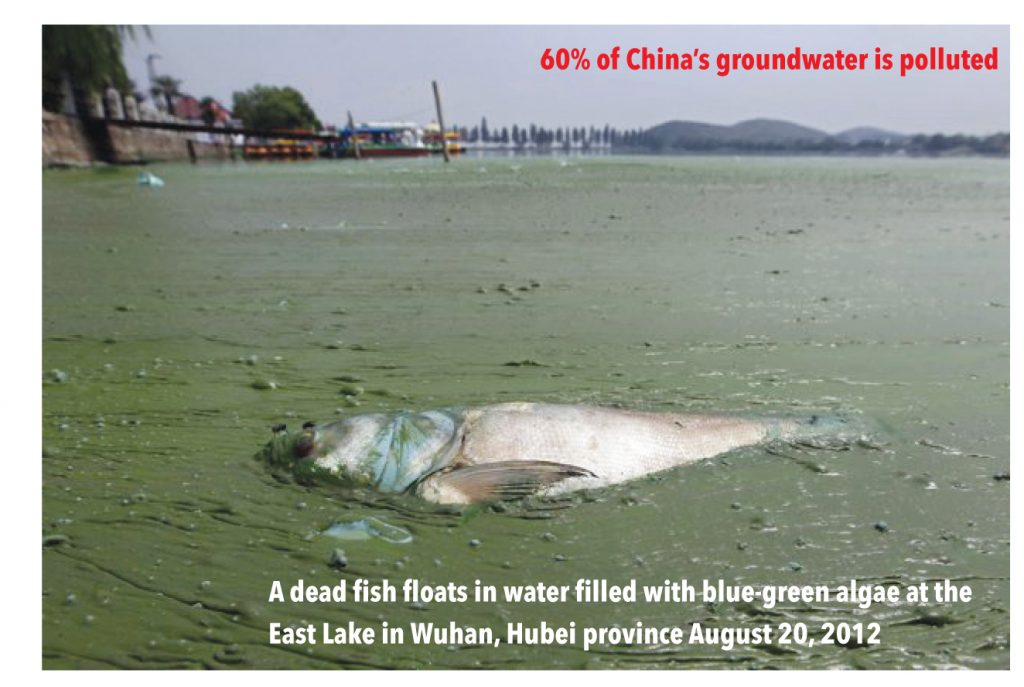

Rapid economic progress and simultaneous fast industrialization has certainly made China the global leader in terms of production, consumption, and exports of industrial output such as chemicals. On the other hand, blind economic/industrial expansion and lax regulations have contributed to serious environmental problems. Various studies indicate that 16 of the world’s 20 most polluted cities are found in China. Moreover, 20% of China’s farmland, 16% of its overall soil, and ~60% of its groundwater is polluted. A study by an NGO says that 1.6mn deaths in China are caused by air pollution every year (4,000+ each day) — 17% of all deaths.

In response to these human hazards, the Chinese Ministry of Environmental Protection (tasked with protecting China’s air, water, and land from pollution and contamination) has implemented environmental protection provisions effective from January 2015 that enforce strict penalties and seize property of illegal environmental polluters. There will be no upper limit on fines and more than 300 different groups will be able to sue on the behalf of people harmed by pollution.

Under the new law, even local governments/provinces will be subject to discipline for failing to enforce environmental laws. Regions will no longer be judged solely on their economic progress, but instead must balance progress with environmental protection. Additionally, local governments will be required to disclose environmental information to the public.

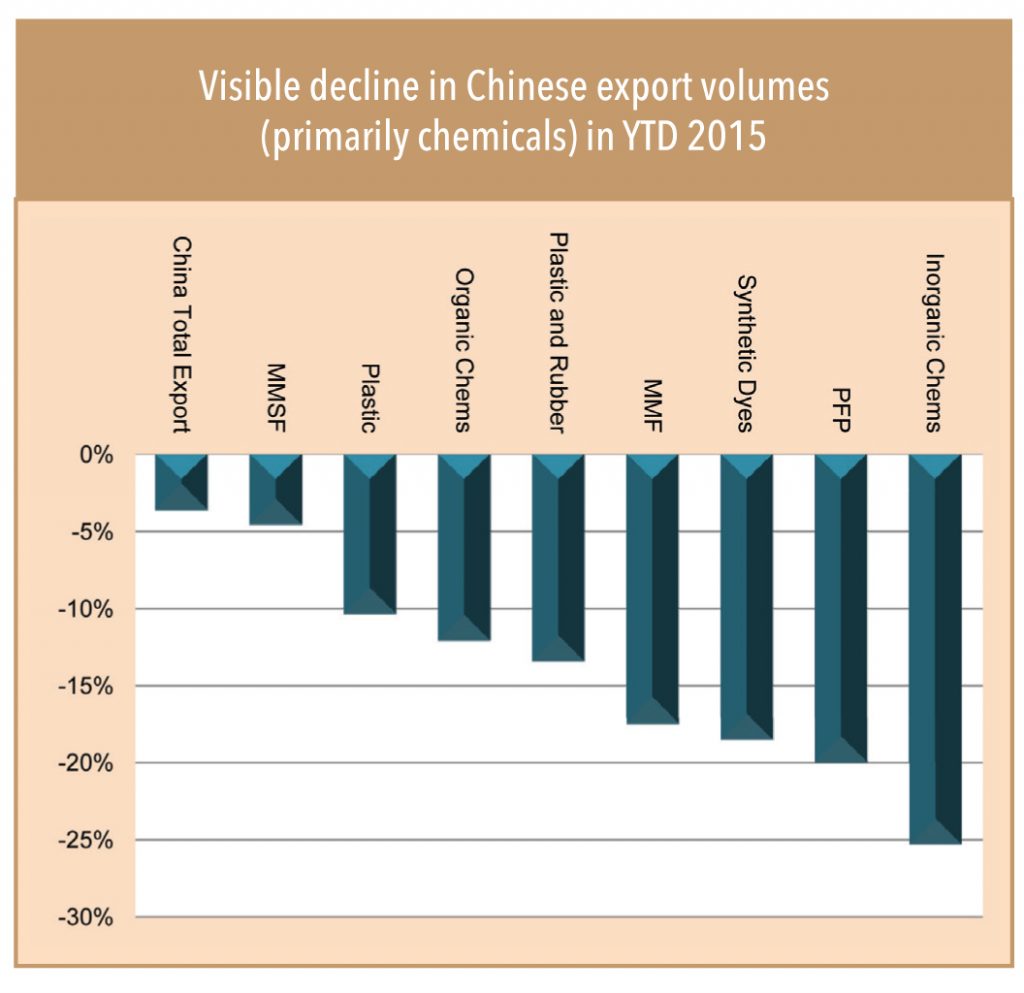

Such policy initiatives have already resulted in a shutdown of several major polluting industries such as papermaking, food processing, chemicals, and textiles — accounting for half the total water-pollutant emissions in China. As a result, Chinese exports have already softened starting January 2015.

Mr Chen Jining, China’s Minister of Environmental Protection, warned (in the media) about taking further serious action against polluting industries that fail to meet national requirements by the end of 2016. This would lead to numerous plant shutdowns and shifting of plants, resulting in supply-demand imbalance in the global chemical industry — creating an export opportunity for Indian peers.

Mr Miao Wei, China’s industry minister, was quoted

by the Communist-party newspaper, People’s Daily, as saying, “Many provinces are planning to relocate more than 1,000 chemical plants away from populated regions, a move which may cost around 400bn yuan.”

“China’s chemical industry has ignored environmental

issues in the past. In order to have US$ 1 benefit they have destroyed environment worth US$ 10. Now china has become more sensitive and has to spend almost US$ 1tn per year to clean up its environment,” says Mr Satyen Daga.

Mr Rajendra Gogri, MD, Aarti Industries says, “Stricter environmental pollution practices in China and consequent clampdown on inefficient chemical plants have certainly led to import substitution from China by many global chemicals players. Such a scenario enhances Aarti industries’ export scope and similarly other Indian companies should also benefit.”

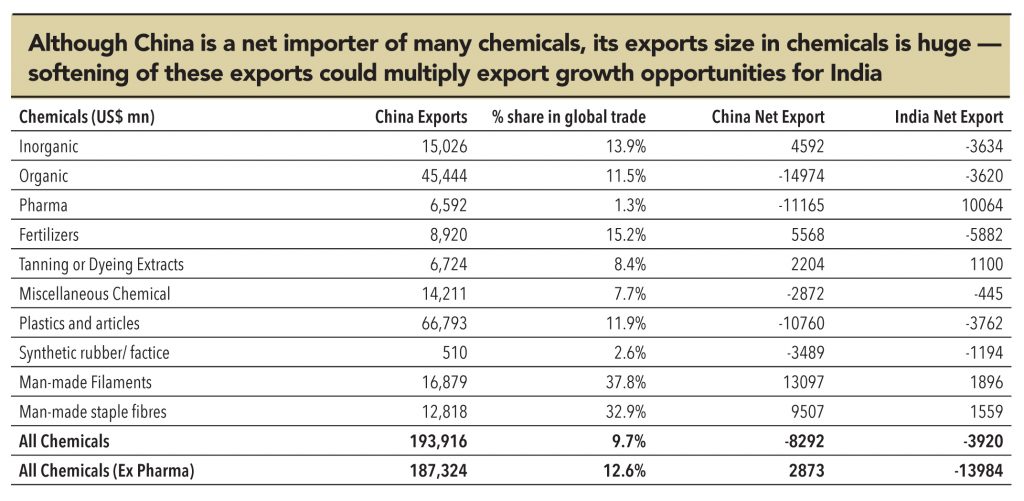

Though China has been a net importer of all chemicals put together, it is a large exporter of various chemicals such as manmade filaments (worth US$ 13.1bn), manmade staple fibres (US$ 9.5bn), fertilisers (US$ 5.57bn), inorganic chemicals (US$ 4.6bn), and tanning/dyeing extracts (US$ 2.2bn). Implementation of new environmental laws in China has already caused a decline in its chemicals exports and the trend is likely to sustain in FY16-17, led by the enforcement of stricter environmental laws. Incidentally, India’s net chemical trade with international markets is almost similar to China (although much smaller than China’s). Hence, the emerging trade gap due to softening Chinese exports offers huge export opportunity for Indian chemical players.

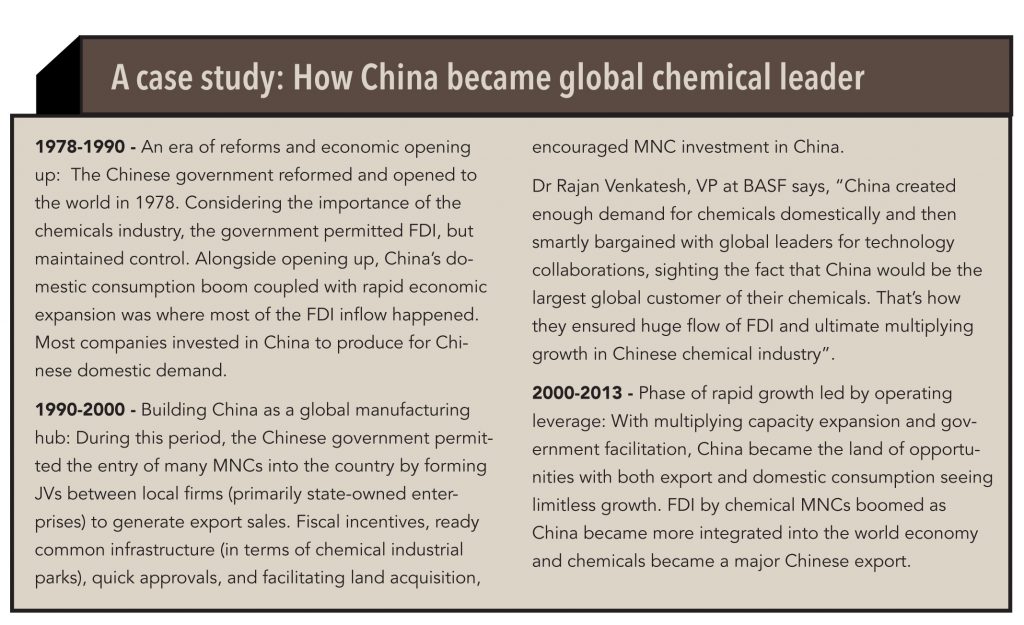

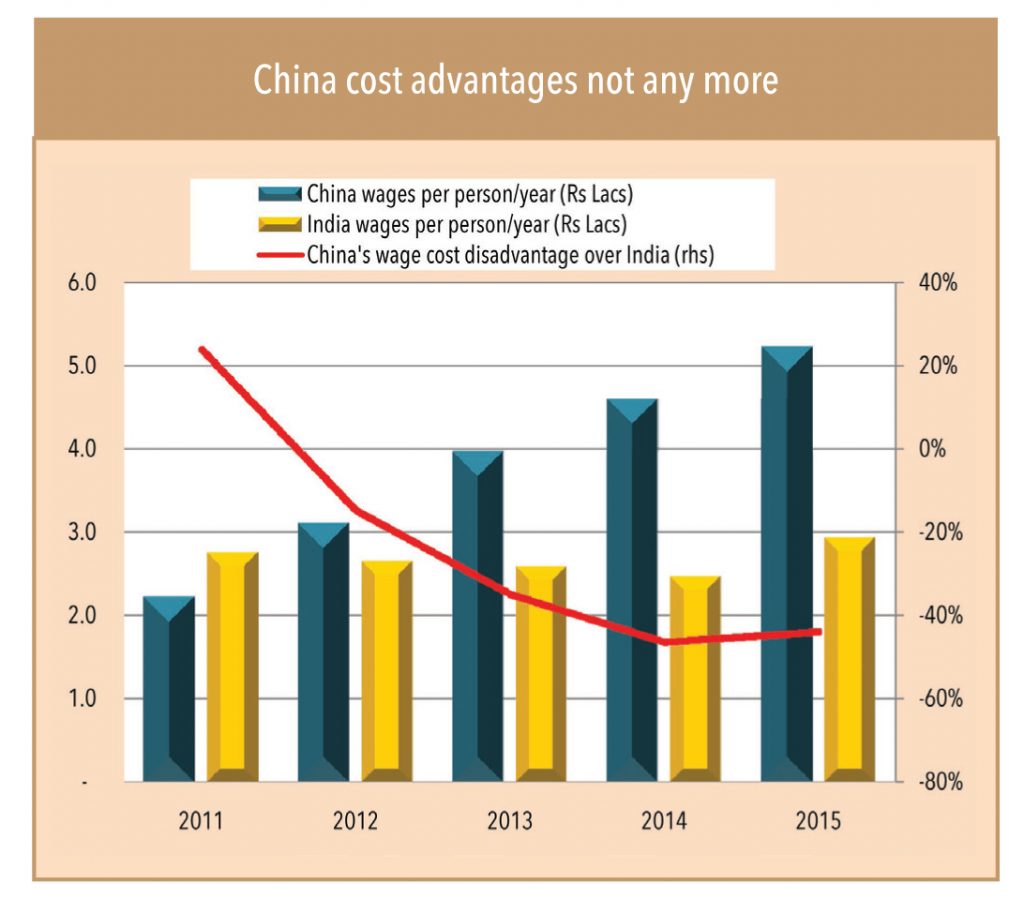

While rising chemicals demand led by rapid economic expansion propelled China towards becoming a choice destination for MNCs, government facilitation and cost advantages made the country a global manufacturing hub for chemicals for these MNCs in the last couple of decades. The very reasons for China’s booming chemical industry are turning sour — rampant growth has started hitting its environment in a big way and labour cost advantages are no longer a reality.

Strategic facilitation by government agencies in China has resulted in massive FDI flow into the chemicals industry, but perils of subsequent excessive capacity creation (i.e., rising dependency on imported feedstock, scarcity of resources such as energy and water), and more importantly, frequent government intervention favouring state-owned enterprises has become a concern for MNCs’ business strategies from 2014.

Since China’s key advantage – low labour costs – is no longer a reality, MNCs have already wheeled their facilities from their homeland to emerging markets and find India (with cheap work force, quality standards, rapid growing economy, and good demand) a decent alternate source for manufacturing chemicals.

The Indian chemicals market, which has so far largely been driven by internal consumption, would benefit from steady growing domestic consumption on one hand, and the emerging export opportunity due to moderating of export from China.

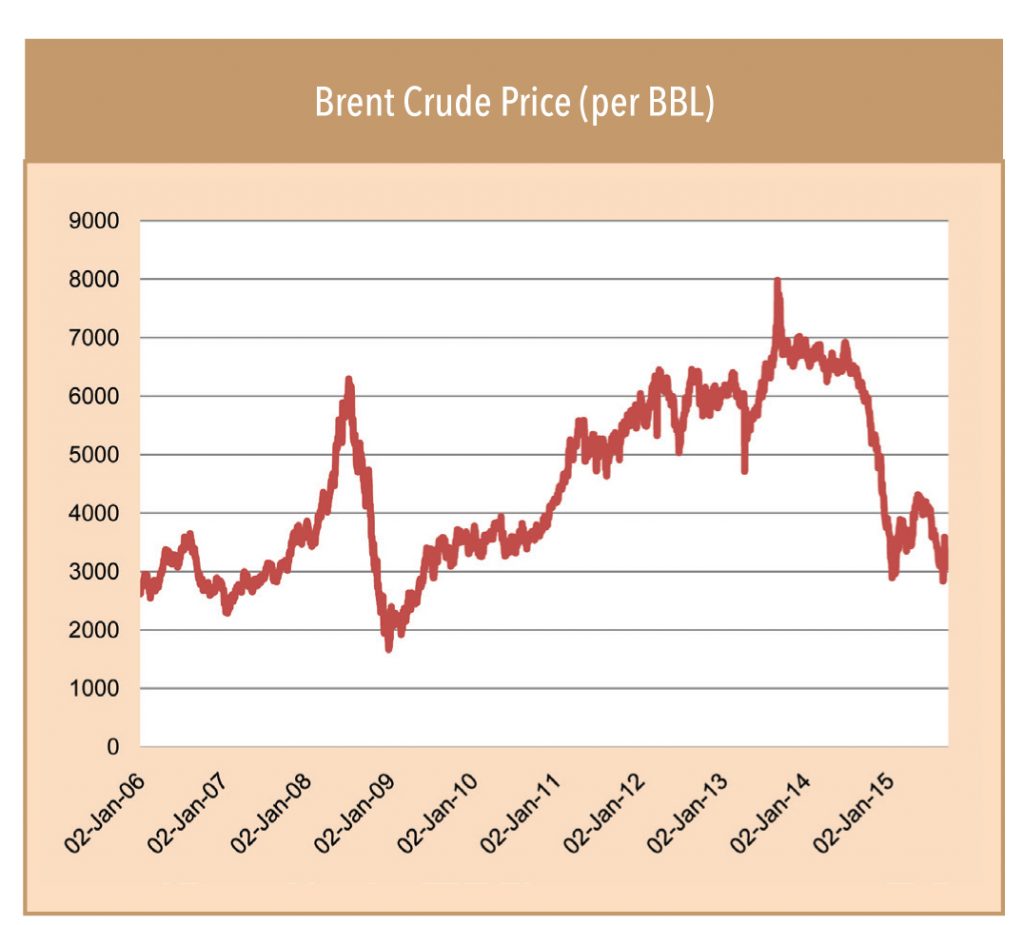

Oil prices saw a sharp correction since mid-2014 with the price per barrel sinking to its lowest point since 2009. From its peak in June 2014 (average US$ 112) to this year’s low in October 2015 (average US$ 46) the oil price fell by 57%. The price of naphtha, another key feedstock for the Indian petrochemicals industry, has similarly declined from a high of nearly US$ 953/tonne in June 2014 to US$ 433/tonne in October 2015.

Since India depends on imported crude/naphtha for over 75% of its feedstock requirement, the correction in input cost prices and simultaneous reduction in energy costs certainly benefits the domestic industry. More importantly, the specialty chemicals players are set to enjoy better profitability due to lower input costs as they hardly pass-on the benefit of lower input cost to user industries. Since specialty chemicals account for only <5% input cost of user industries, these players retain the cost advantage, but rarely pass it on. On the other hand, commodity chemicals find it difficult to retain the benefit of lower crude costs, as competition forces them to pass it on. Hence, Indian specialty chemical players would be the larger and sustained beneficiaries (vs. commodity players) of lower crude prices in the near future.

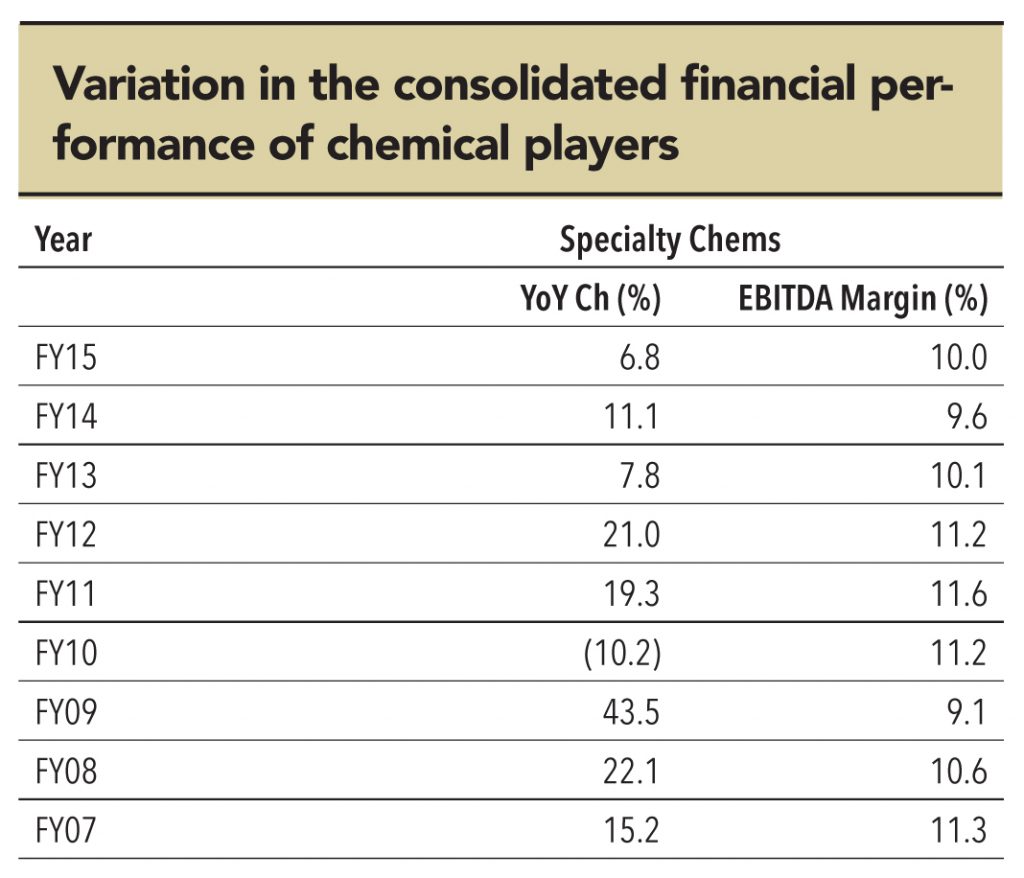

The consolidated financials of the Indian specialty chemicals players indicate that sales of specialty chemical players grew sharply with the spike in crude prices in early FY09, but declined with the correction in FY10. On the other hand, margins were higher in FY10 vs. FY09 — this is because the per-unit margin remained unchanged while the falling crude prices dragged overall sales of specialty chemical industry. . Similarly, the industry witnessed the margin expansion in 2015with falling crude dragging the overall sales. Going ahead, with the bleak outlook over crude prices in the foreseeable future, the domestic specialty chemical industry is expected to deliver healthy operating efficiency in the near future.

Subscribe to enjoy uninterrupted access