Specialty chemicals are relatively high-value, low-volume chemicals. They are normally produced at a smaller scale (compared to commodity chemicals) and are sold based on their performance or function, rather than for their composition. They can be single-chemical entities or combinations of several chemicals and they tend to sharply influence the performance and processing of customers’ products. Specialty chemicals’ products and services need intensive knowledge, process development, and innovation whereas commodity chemicals are sold strictly based on their chemical composition — they are single-chemical entities. The commodity chemical product of one supplier is generally readily interchangeable with another.

The Indian chemicals industry (highly fragmented; largely represented by over 40,000 SMEs) has a natural disadvantage in terms of feedstock vis-à-vis the disproportionate cost advantage that Chinese players enjoy in bulk/commodity chemicals (led by their scale, provincial capital funding, and fiscal benefits) — therefore, the Indian players maintained their focus on small-scale, customised, value-added segments (basically, specialty chemicals).

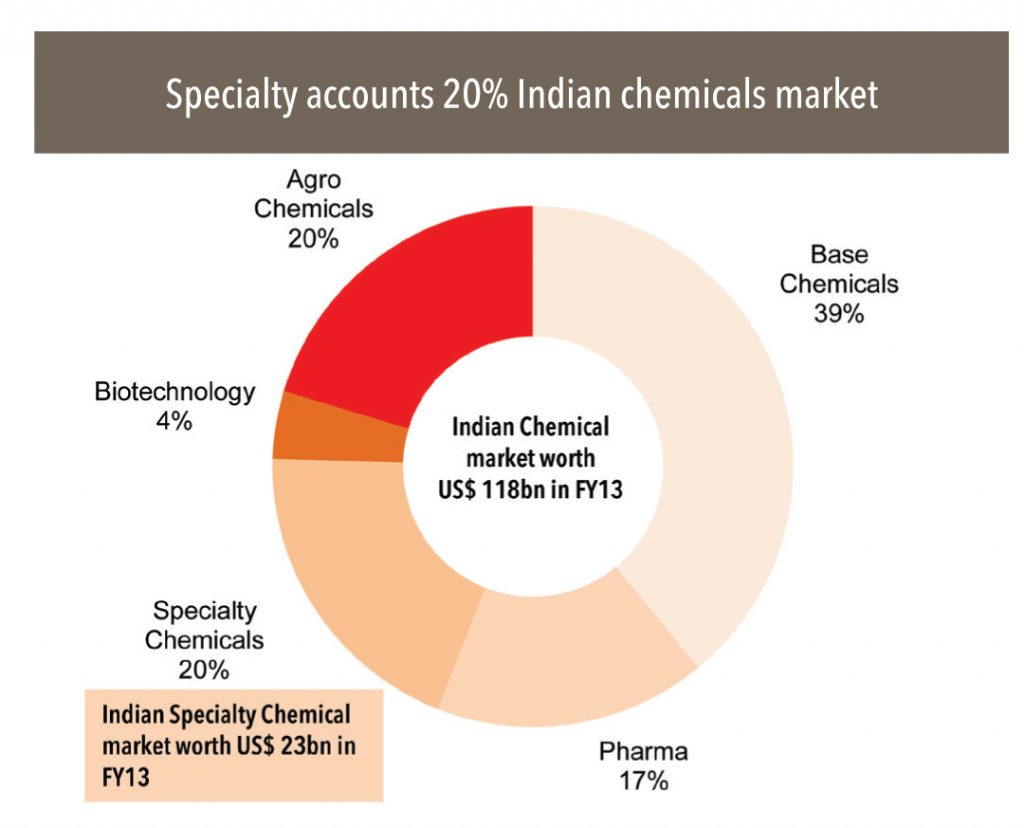

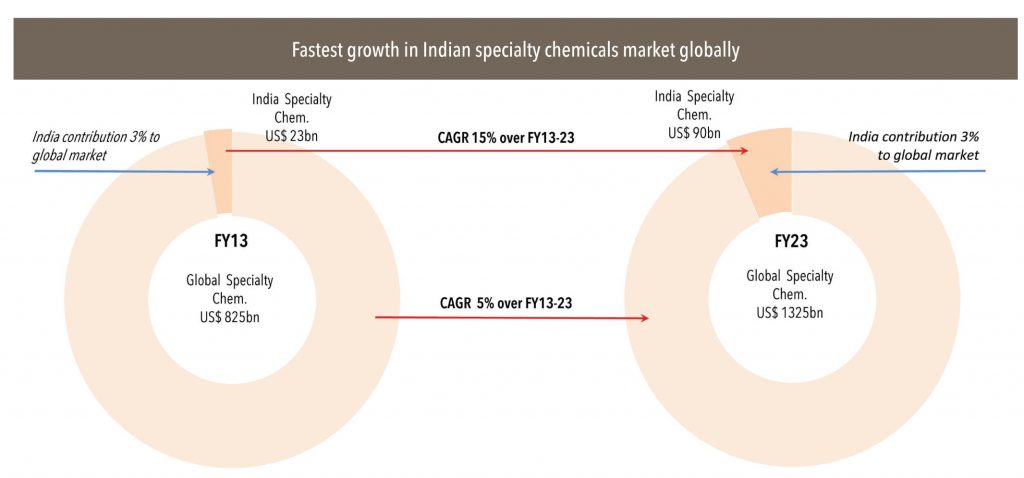

The Indian specialty chemicals industry (US$ 25bn) accounts for a marginal 3% of the global specialty chemicals market and about 20% of the overall Indian chemicals market. Unlike the domestic chemicals industry, which is dominated by a few large upstream players (Reliance industries, Indian Oil Corporation, Essar Oil), the domestic specialty chemical industry is highly fragmented (40,000 companies) and 60% of its volume is produced by SMEs. Most of the domestic specialty chemicals businesses were created to meet immediate local demand with relatively smaller investments. Nonetheless, there are a select few (Aarti Industries, Vinati Organics) for whom supply arrangements with global chemical majors has worked wonders.

Nevertheless, due to a lack of innovation in new products and applications, most Indian specialty players lack connectivity with ultimate consumers and operate as low-cost manufacturers of materials that the MNCs deem basic for their own specialty chemicals businesses. Hence, the Indian specialty chemical sector is largely an intermediate-manufacturing industry with its prime focus on cost containment.

Indian specialty chemicals, like commodity chemicals, is one of the fastest growing industry globally (only after China) and delivered 13% annual average growth over the last five years to US$ 25bn in 2014. More than exports, steadily rising local demand supported the momentum. The industry gained from faster GDP growth, domestic demand attaining critical mass, low-cost manufacturing, and enhanced focus on process R&D and engineering capabilities.

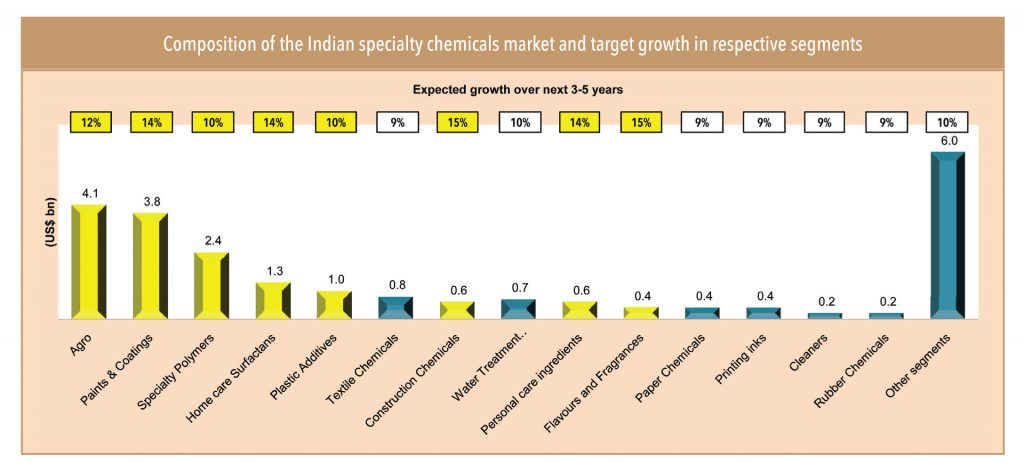

Since the domestic industry is focused on intermediate manufacturing, its growth is linked to the progress of end-use industries. While agrochemical ingredients represent the biggest single segment of the Indian specialty chemicals market, followed by paints, coatings and specialty polymers, the domestic industry is particularly strong in textiles and dyestuffs. Export of textile chemicals is an important contributor to this industry as this segment (represented by dyes, manmade filaments, and manmade staple fibres) is the only one that attained net exporter status.

With the healthy double-digit growth anticipation in user industries, the Indian specialty chemicals market is likely to deliver 12-15% average annual growth over FY15-20. Primarily led by ever-rising domestic consumption, increasing disposable per capita income, and changing life style in the country, Tata Strategic Management Group estimates Indian specialty chemicals to emerge as the fastest growing industry of the world and reach US$ 80-100bn by 2023.

Polymer additives: To see over 15% compounded annual growth

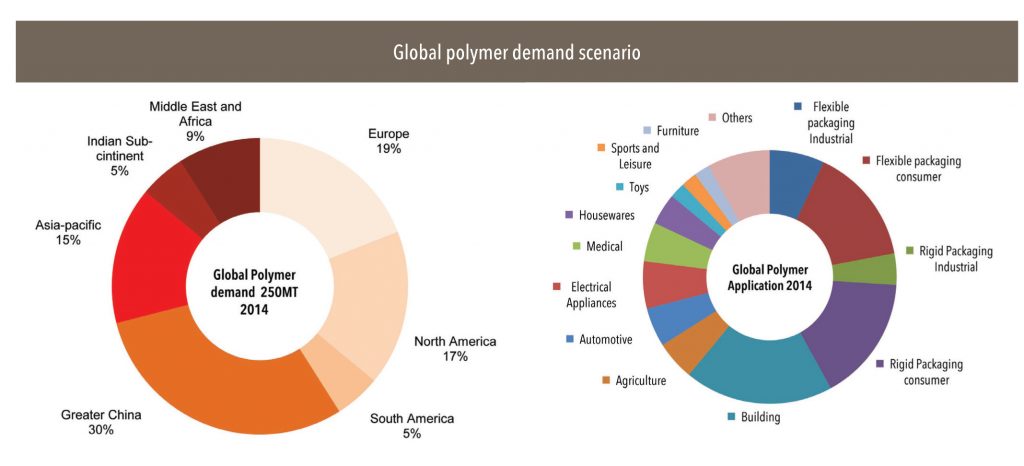

The Indian polymer additives market is estimated at ~US$ 450mn and is the third-largest consumer of polymers, only after China and the USA, with about 6% of total market share. Polymer additives are specialty chemicals added to base polymers to enhance certain properties or improve processing. The market is dominated by multinational companies such as Clariant Chemicals, BASF, Lanxess, Baerlocher, Akzo Nobel, and Dow Chemical. Major domestic players include KLJ Group, Fine Organics, and Vision Organics. KLJ Group and Baerlocher India are market leaders in plasticisers and heat stabilisers, respectively. BASF, after its acquisition of Ciba, is the market leader in flame-retardants, light stabilizers, and antioxidants.

The Indian polymer additive market saw 10% CAGR over the last few years and is expected to report >10% CAGR on a low per-capita consumption base (i.e., 5kg in India vs. 12kg in China, 65kg in EU, and 90kg in North America), increasing demand of plastic in end-use segments (packaging, construction, and automotive sectors) and rising applications (replacing wood, metals, and glass).

Dyes & pigments segment set for accelerated growth led by softening Chinese exports

Dyes & pigments is a leading segment of the Indian specialty chemicals industry, as India is a net exporter and accounts for ~15% of the global market, second only to China. The pigment market is largely represented by carbon black and titanium dioxide (TiO2) and their respective target end-users are rubber/tyre and paint industries. On the other hand, textiles consume 60% of dyestuff while the rest is shared by paper, leather, and other consumer industries.

As per industry sources, the global demand for dyes and organic pigments is forecast to increase 9% p.a. to reach 9mn tonnes with a market size of ~US$ 24.2bn in 2015. This growth will have a direct bearing on the domestic production of dyes and organic pigments since a large proportion of production is exported. On the other hand, softening Chinese exports (which account for about one-third of global demand) due to environmental concerns would drive accelerated growth for the Indian colorant segment.

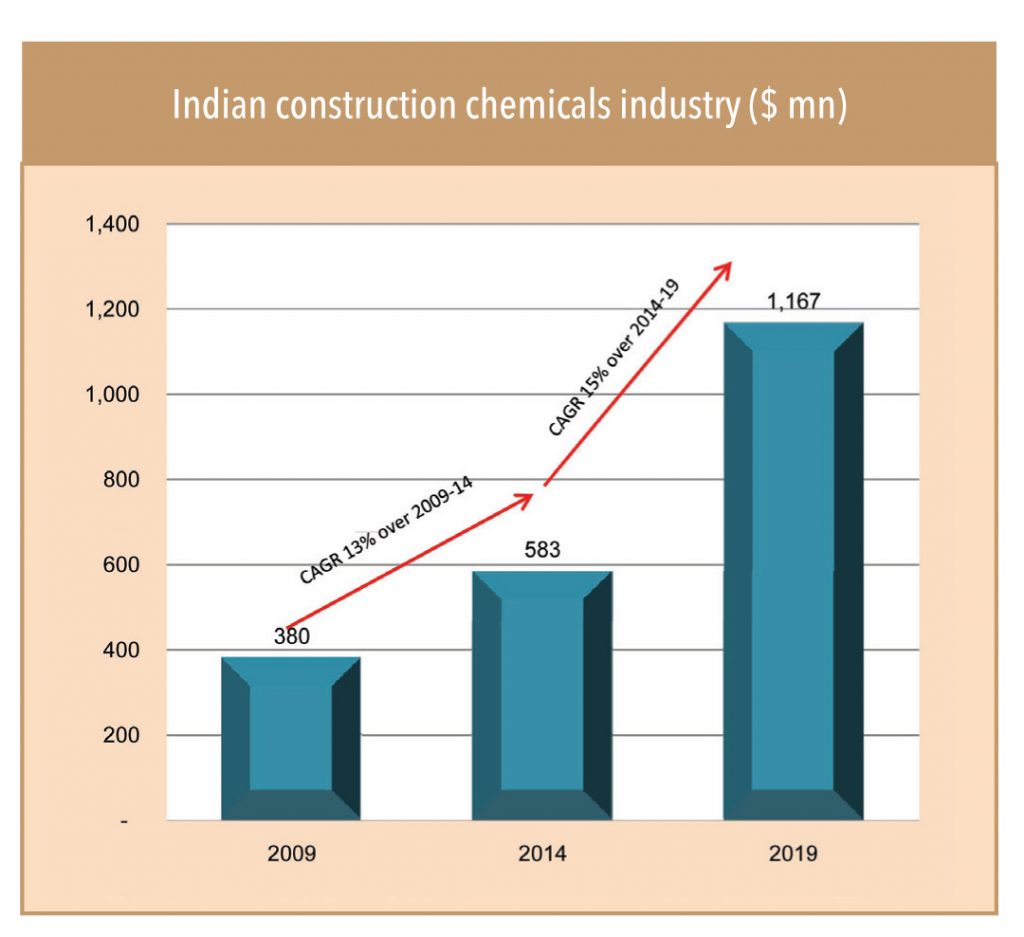

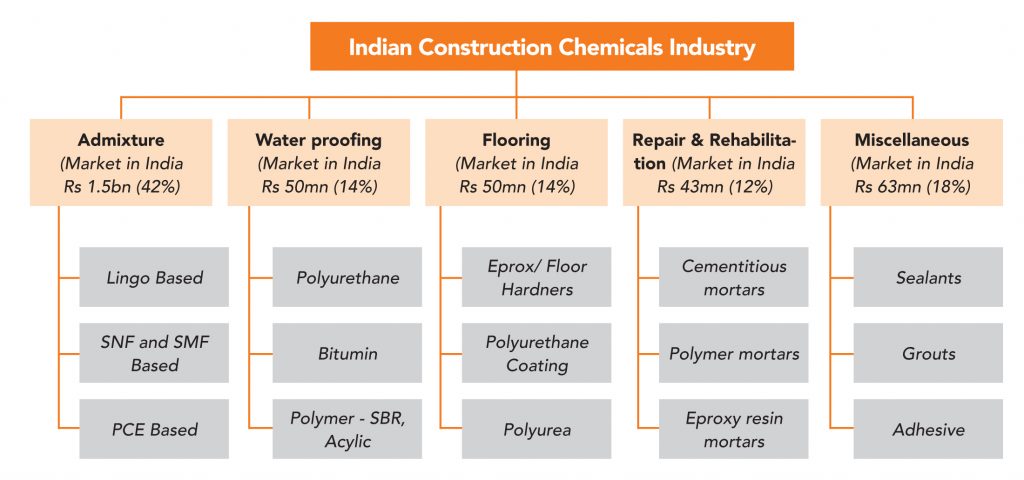

Construction chemicals to see >15% annual growth

The construction chemicals market in India has seen 13% CAGR to Rs 3.5bn in 2014 from Rs 1.9bn in 2009, supported by improving awareness of their usefulness and growing preference for ready-mix concrete. The domestic industry is relatively consolidated with leading players (Pidilite, BASF, SIKA, FOSROC, SWC) holding dominant positions. However, approximately 300 companies are estimated to be operating in this segment. Going ahead, the construction chemicals industry – largely domestic oriented – is expected to see accelerated growth of >15% led by adoption of international construction standards and increase in high-rise buildings in tier-1 cities. Additionally, government initiatives such as ‘Housing for all by 2022’ and ‘100 smart cities’ would drive the domestic construction chemical markets by >15%.

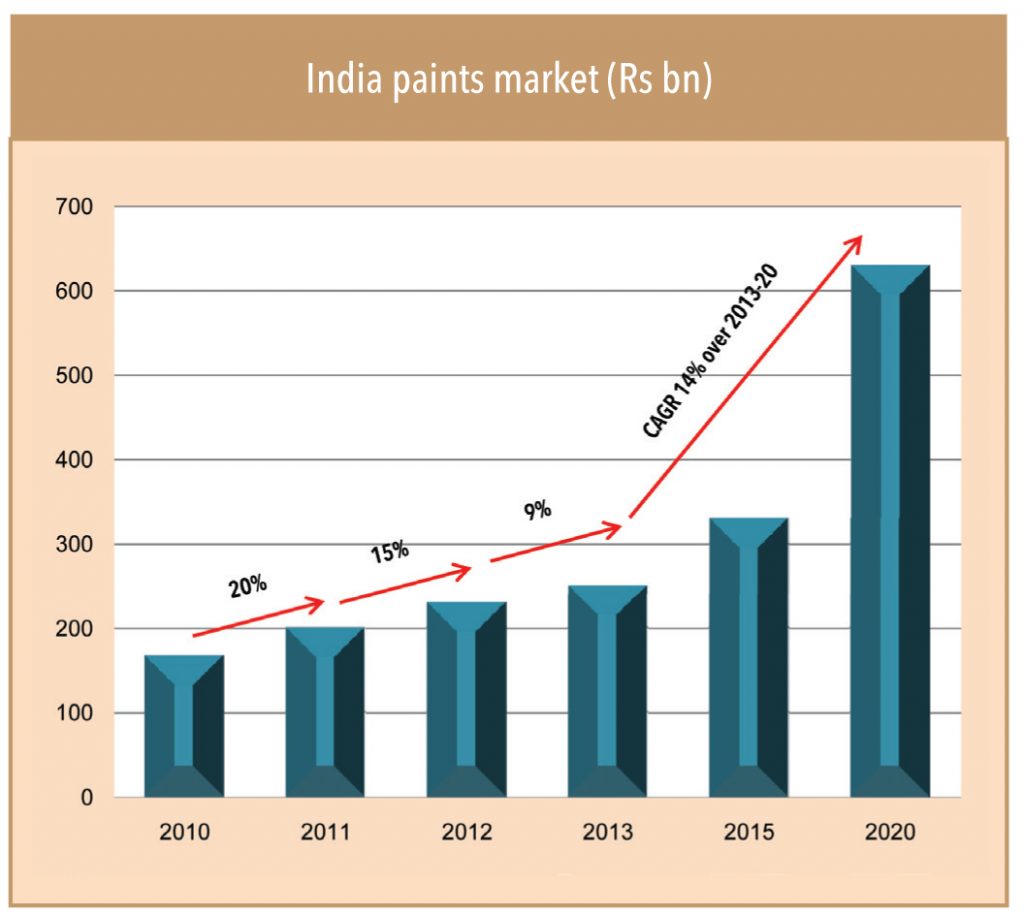

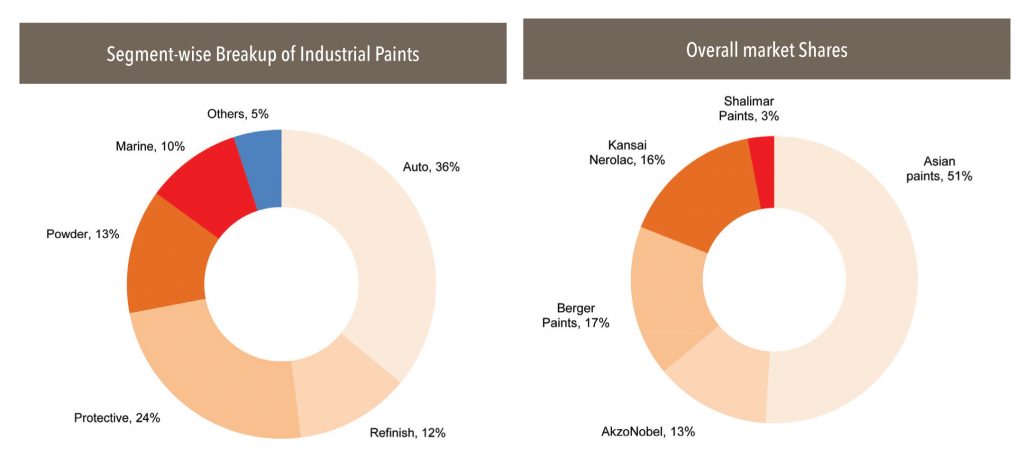

Paints segment CAGR at 14% to touch US$ 9.3bn in FY20

The Indian paint industry is pegged at about US$ 4bn (4% of global paint market) and split between decorative (70%) and industrial paints (30%). The segment is crowded with the presence of both organized and unorganized players. While the industrial paints segment is dominated by organized players (due to the need for specialized technology, higher capital investments, and good relationships with institutional/industrial buyers), the decorative segment sees competition from unorganized players. Global paint leaders are also well entrenched in the Indian industry, led by their alliances with Indian peers and better technology.

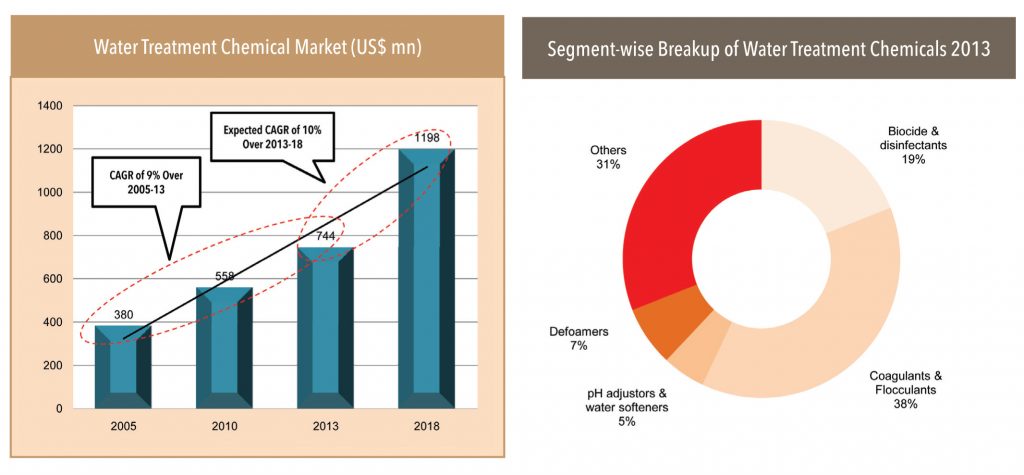

Water treatment chemicals: Market to grow with stricter government regulations

The Indian water treatment chemicals market was at ~US$ 744mn in FY13. It experienced a 10% CAGR from 2010 to 2013. Based on applications, the market is classified into chemical processing, food and beverage, metal and mining, pulp and paper, power generation, oil and gas, and refinery.

Coagulants and flocculants, which are used to purify water by coagulating the dissolved impurities, form the largest segment with ~37-40% market share, followed by biocides and disinfectants with 17-19% market share. Apart from use in potable water, the customer base is widespread across diverse industries ranging from large power plants, refineries, and fertilizer factories, to pharmaceuticals, food and beverages, electronics, and automobile companies. The market is highly competitive and participants include private companies, MNCs, and JVs. The market for water-treatment chemicals has seen a shift from traditional products to technically more advanced products. Manufacturers are increasingly producing patented formulations with exclusive rights that offer customized solutions in a particular market.

Around 70% of the market is dominated by the organized sector, largely water management multinationals and large-scale domestic companies such as Nalco Chemicals India, Thermax, and Ion Exchange (India). These companies have a diverse product portfolio and a strong distribution network to cater to the Indian market. The water treatment chemicals market is likely to see a CAGR of 10% to reach ~US$ 1.4bn in 2020. In its 12th five-year plan, the planning commission has earmarked an investment of US$ 26.5bn, to ensure safe drinking water for rural and urban areas. The plan aims to increase focus on desalination and on ensuring environment protection through wastewater, and solid and sewage treatment. Over the next five years, the oil and gas sector is likely to be buoyant with major government and private sector companies expanding their plant capacities — this will boost water consumption and the need for wastewater treatment chemicals. Another critical success factor could be the ‘Clean Ganga’ initiative.

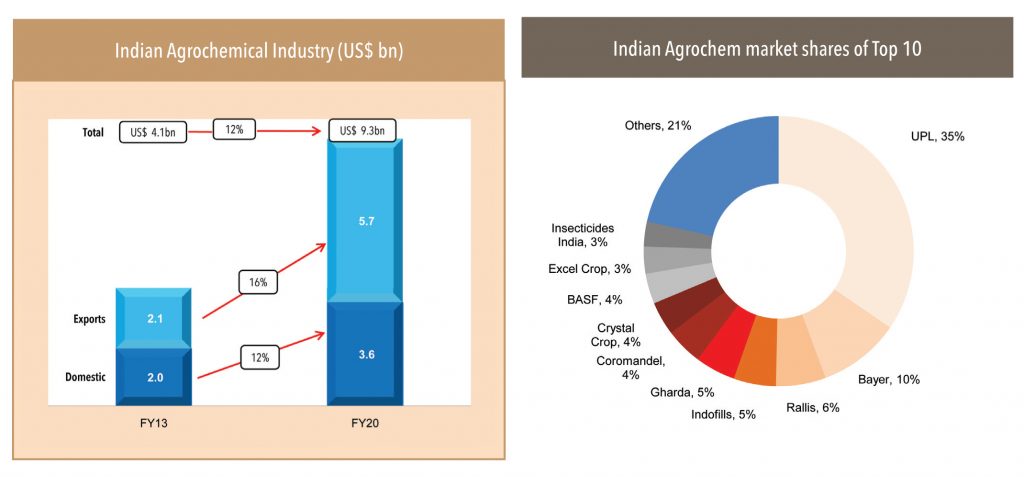

Agro-chemicals are expected to see 12% CAGR until FY20 to reach US$ 9.3bn

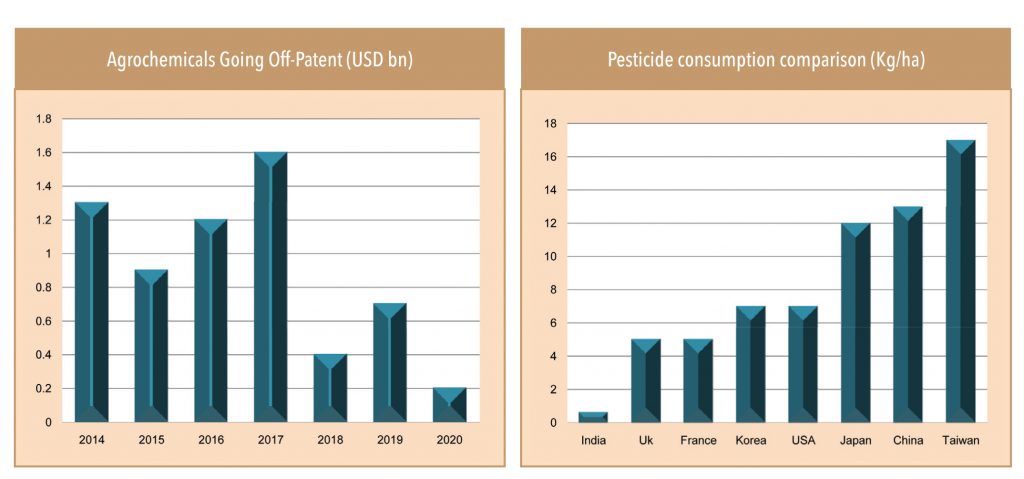

The Indian crop-protection industry is estimated to be US$ 4.25bn in FY14 and grow at a CAGR of 12% to reach US$ 9.3bn by FY20. Exports currently constitute almost 50% of this industry and are seen growing at a 16% CAGR to reach US$ 5.7bn by FY20, thereby touching 60% share. Domestic market is seen growing at 8% CAGR to US$ 3.6bn by FY20, as it is predominantly monsoon dependent.Globally, India is the third-largest producer of crop-protection chemicals, after the United States, and Japan. While the exports of agrochemicals will see accelerated growth led by upcoming patent cliff (expanding the generic opportunity) and cost advantage, the domestic market would see better growth led by rising agrochemical consumption and increasing demand of food grains from declining farmlands.

Personal care ingredients: Rising income and shift towards quality products to lead to 14% annual growth

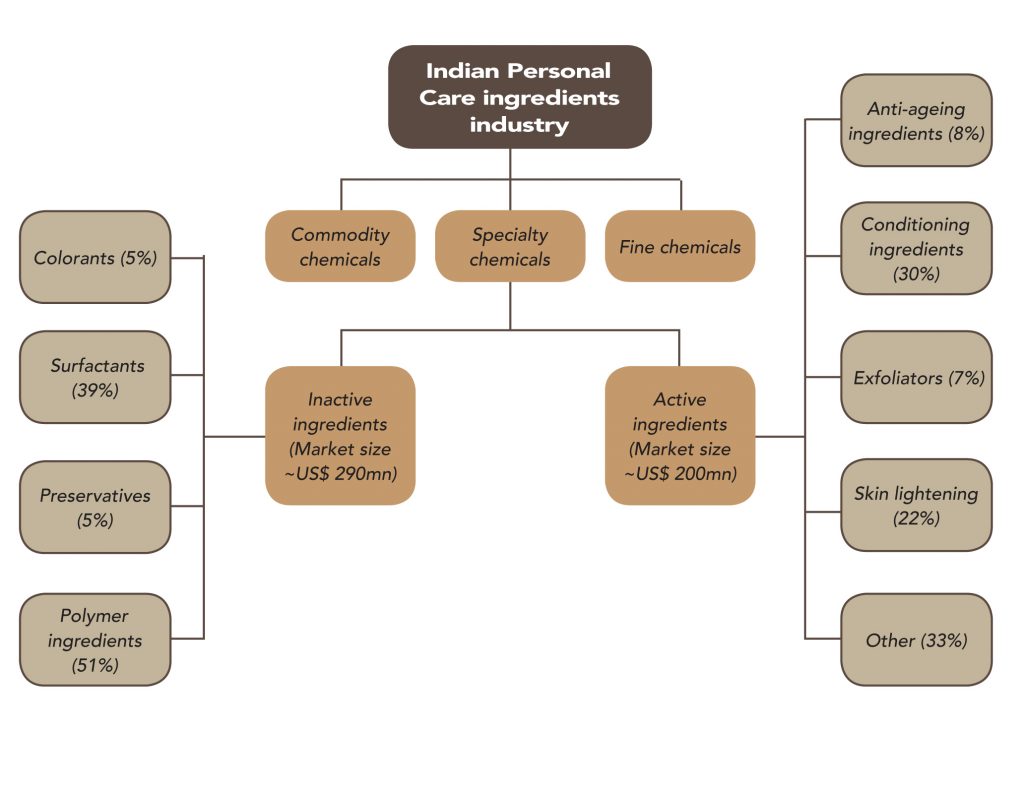

While the Indian personal-care industry (targeting bath and shower products, hair care, skin care, oral care, and fragrances) is estimated to be ~US$ 7bn, the personal-care ingredients market is about US$ 485mn. This market is characterized by strong presence of MNCs such as Cognis, Dow Corning, BASF, ISP, DSM, and Merck. Key domestic players include Vivimed Laboratories, SAMI Labs, and India Glycols. The market delivered 13% CAGR over the last few years. Rising income, increased availability, and wider product portfolio of companies has led to growth in personal-care products and thereby personal-care ingredients. Premium segments will show good growth potential with increasing awareness and evolving consumers who are ready to spend more on quality products. Industry estimates peg the personal care ingredients market growth at 14-15% to reach ~US$ 1.5bn by 2020.

Subscribe to enjoy uninterrupted access