“Basmati rice is primarily produced in India and Pakistan, with India being the larger producer. The product is consumed a lot in the Middle East and West Asia. As that region is aspiring for food security, they will look at long-term and sustainable footholds, not only in basmati rice but also other staple grains and pulses,”

-Rakesh Mehrotra, CFO, KRBL.

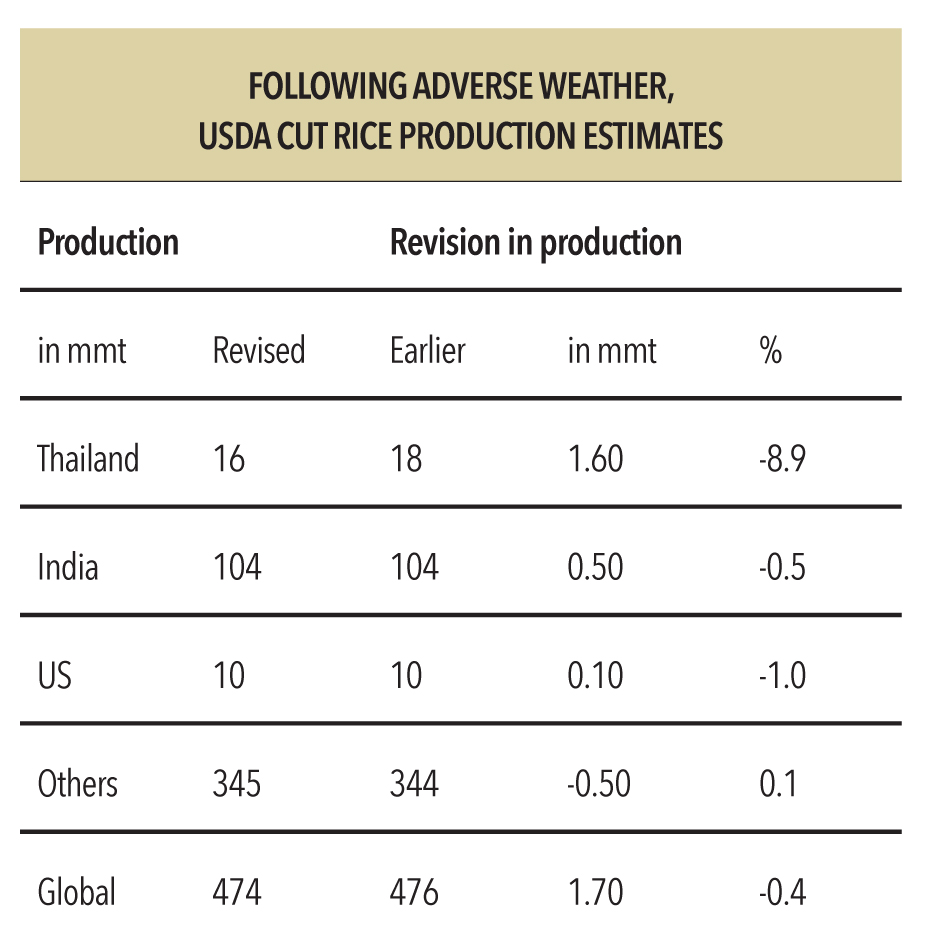

The nervousness led by excess supply and plunging prices is likely to be short lived, as globally, adverse weather has led to a cut in volume estimates for rice (by the USDA) for FY16 – this should push prices higher over the next few years . With softening commodity prices, basmati realisation has fallen (as with other commodities); rice exports grew 17% in April-August 2015 in quantity terms, underscoring that the demand has improved in response to falling prices.

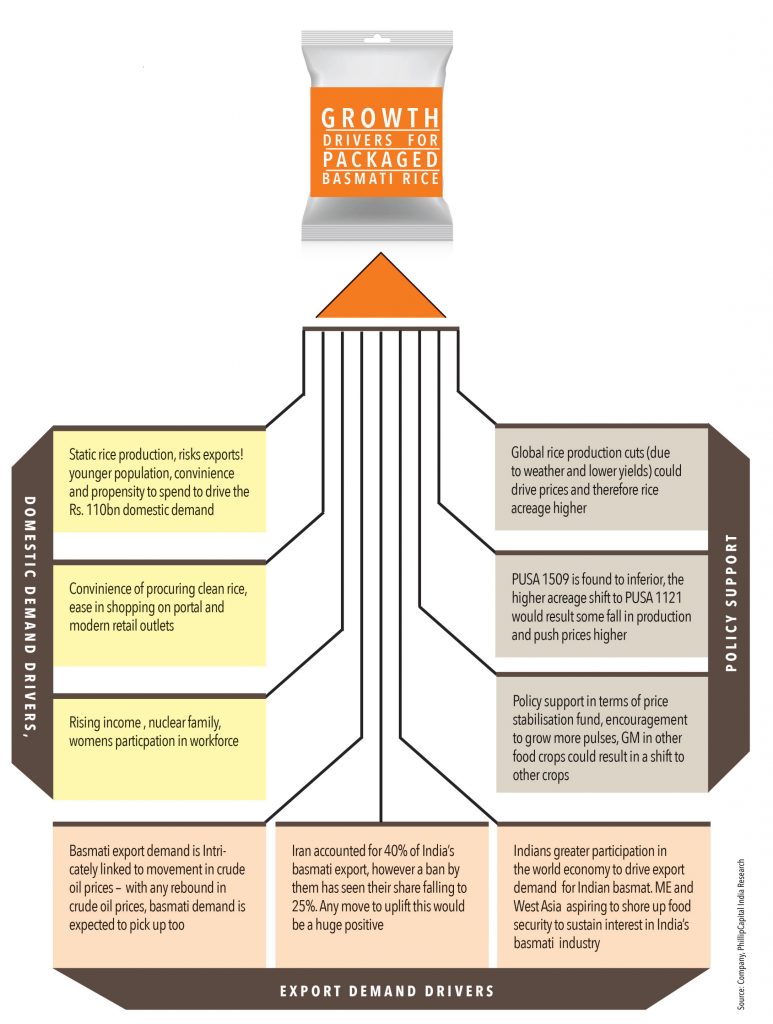

Industry estimates peg basmati demand (Rs. 120bn) to have seen a CAGR of 12% in 2001-14 (vs. 1.2% for rice), led by strong demand from both domestic and international markets. With a rise in income levels, shift in consumer preference (to branded rice from unbranded), rising ‘eat out’ culture, and expansion of organized retail in India, consumption of branded products has been rising. Domestic demand is likely to grow at 12-15% over the next two years vs. 15% in the last five years. Export demand looks healthy – a rebound in crude oil price and any decision by Iran to lift the import ban on rice from India will drive demand further.

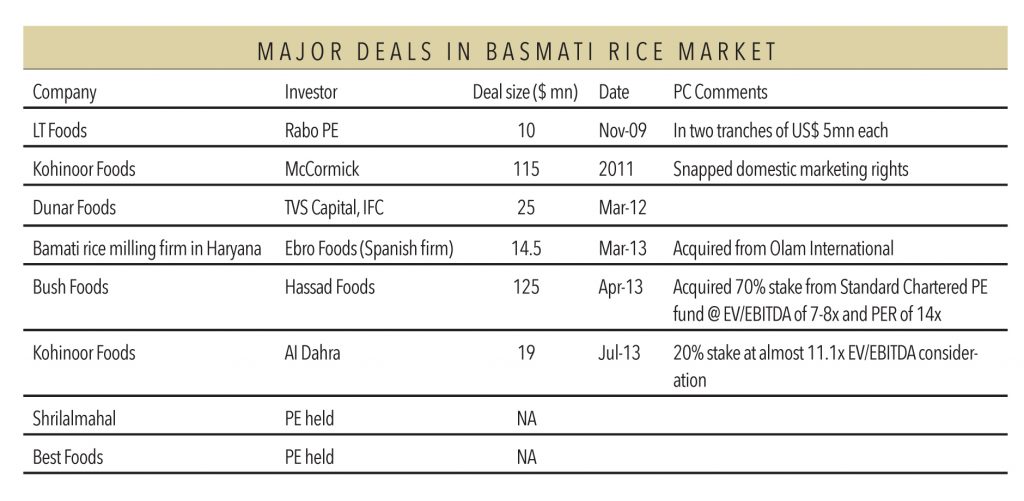

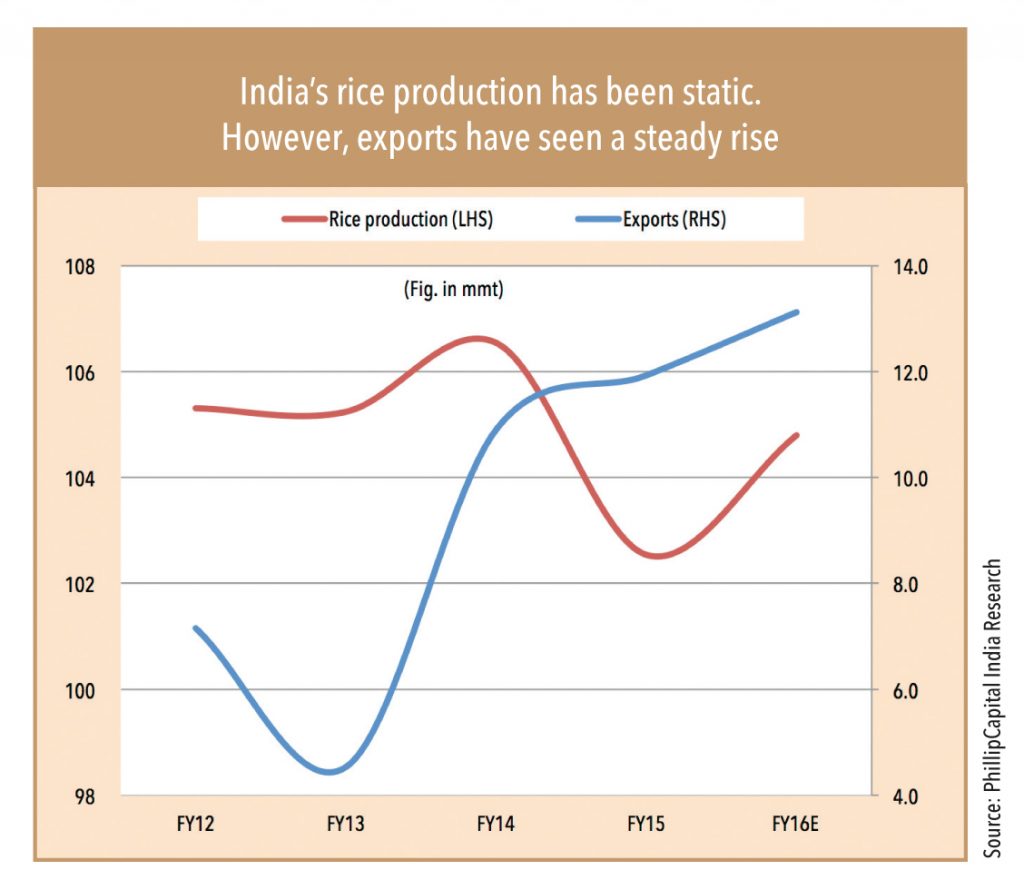

For many years, private equity funds and venture capitalists did not have agribusiness on their radar. This is changing. Agri-GDP growth has been volatile and middling (2-4%) – therefore, it is likely that rising investor interest in the packaged-rice market is not based on current statistics. It is mostly because packaged-rice players earn over 2/3rd of their revenues from branded products – the key driver for valuation besides their distribution network in India and overseas. With static rice production at ~105mmt, dwindling monsoons, and depleting water-table levels, India’s 10mmt rice exports could be affected, leading to sustained PE enquiries and interest in the branded-rice segments.

“What is working for agribusiness and food and retail is that it is driven by domestic factors, unlike many other sectors. It is a sure bet for investors in terms of sustained growth and return on investment.”

– Anil Jain, MD, Jain Irrigation.

For the third time now, the USDA (US Department of Agriculture) has lowered its forecast of global rice production for FY16 (by 1.7mmt to 474mmt, down 1% yoy; first decline since FY10). Thailand, India, and North America (large exporters to the global market) account for most of the expected global rice production decline in FY16. The smaller global crop is due to both reduced area and lower average yield, with adverse weather a main factor. At 159mn hectares in FY16, global rice area is almost 1mn hectares below FY15, with Thailand accounting for more than half of the decline. The rice area is also projected to be smaller than a year earlier in Africa and the United States. FY16’s season average farm price is projected to be at US$ 12.8-13.8 per cwt (up from US$ 11.9 in FY15, up 7.5-16.0% over last year).

Besides, India’s production has been static at ~105mmt in FY12-16 while its exports of rice (all varieties) has nearly doubled in the same period (exports rose to 13.2mmt in FY16 from 7.2mmt in FY12). With firming prices of pulses and other cereals and lower water availability, the acreage under rice is likely to fall. This, along with rising domestic demand could risk exports and push prices higher.

“Procurement cost is low; therefore, lower stock cost and increased exports will help in volume and income growth in H2FY16.”

– Satnam Arora, Managing Director, Kohinoor Foods.

Demand for basmati rice has seen a CAGR of 20% in the past five years driven by growth in domestic and exports markets. With the rise in incomes and shift in consumer preference to branded rice, domestic demand is likely to remain strong. In basmati exports, India has taken away a substantial share from Pakistan – its only competitor – due to superior quality and higher production. Industry sources say production of basmati rice has increased in the current kharif season due to higher acreage (+5%) and sowing of high-yield Pusa 1509 variety (which consumes less time and water; however, it is less preferred). Higher supply and a fall in export demand (especially by crude exporting economies such as Middle East) have pressured basmati prices lately, so much so that the basmati paddy variety, which used to command a significant premium non-basmati paddy, actually traded at a discount for a brief period. However, with firm prices of pulses, cotton, and ample stock of basmati, we see the crop acreage switching from basmati to other competing crops. Lower acreage coupled with rising demand is likely to lead to an increase in realisations over the next 1-2 years.

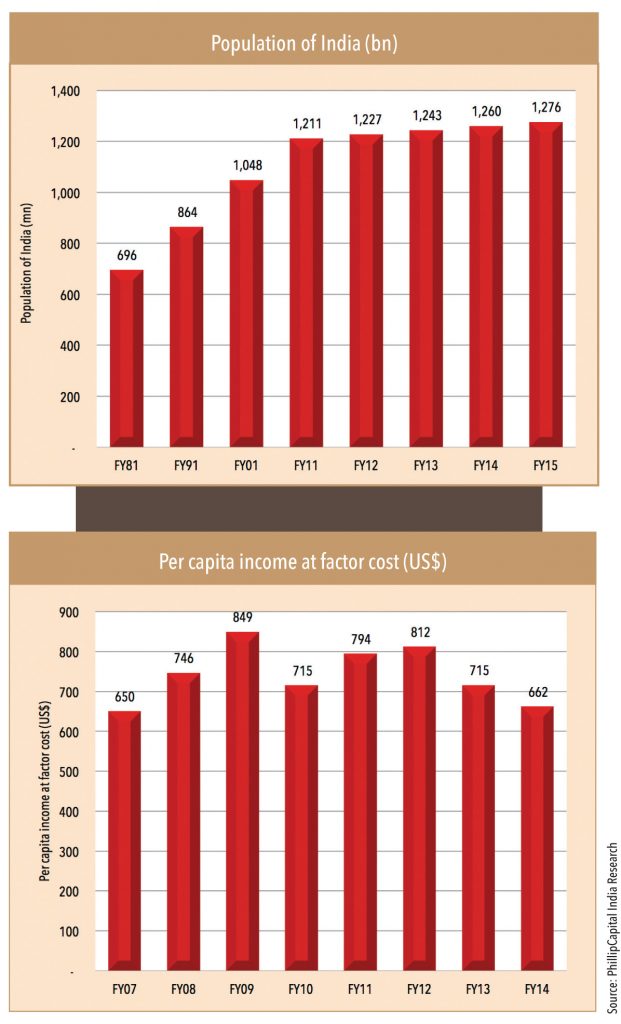

Population (1.27bn) is a key demand driver of agricultural growth in India, whose consumption expenditure is likely to touch US$ 3.6tn by 2020 up from an estimated US$ 0.2tn in 2015. A large population ensures high demand for agricultural produce.

Domestic demand for packaged food has been on the rise mainly due to rising income and propensity to spend, changing lifestyles, women participating in the workforce, and most important, convenience of shopping (portals and modern retail outlets). Indian basmati demand is also likely to benefit from rising external demand going by India’s wider participation in the global economy. India exported agricultural products worth US$ 40bn in FY15, of which rice formed a major part (US$ 8bn or 20% of total). Of the total rice exports, basmati rice accounted for almost 60% or US$ 4.5bn. There is a general surge in demand for agricultural produce from India. Growth in the export of basmati rice is likely to follow a rebound in crude oil price.

• The Middle East is the biggest export market for Indian basmati rice and accounted for over 83% of its exports in FY15. Hence, any political turmoil in this region may adversely impact India’s exports

• While most incumbents hedge their forex exposure, a high volatility in foreign currency could adversely impact revenues, margins, and earnings

• Any high volatility in procurement costs could impact margins. Incumbents are engaged in purchasing both semi-processed rice and paddy depending upon the demand and price expectations. This exposes them to fluctuations in raw-material prices. While a longer inventory-holding period may result in higher realisations (because of ageing), it results in higher carrying and interest costs

• The Indian government had banned exports of non-basmati rice in April 2008 to curb inflation and subsequently lifted this ban in September 2011. Although there has been no ban on basmati rice exports, any such policy change could significantly impact the industry.

Subscribe to enjoy uninterrupted access