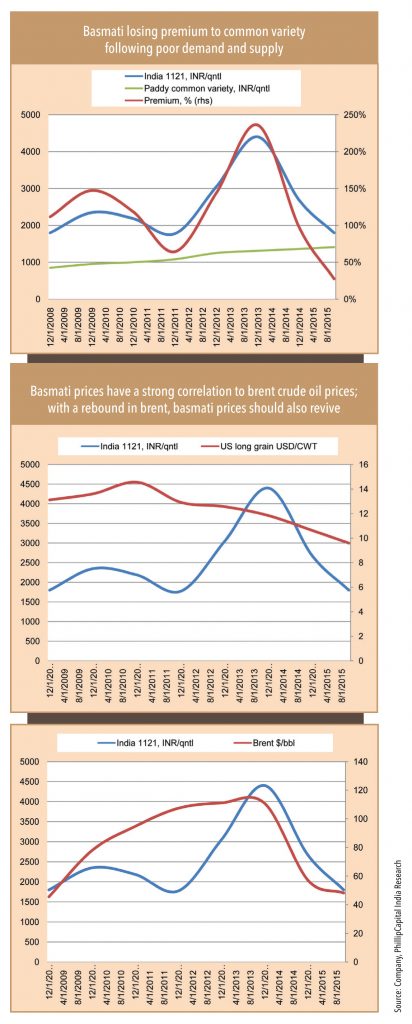

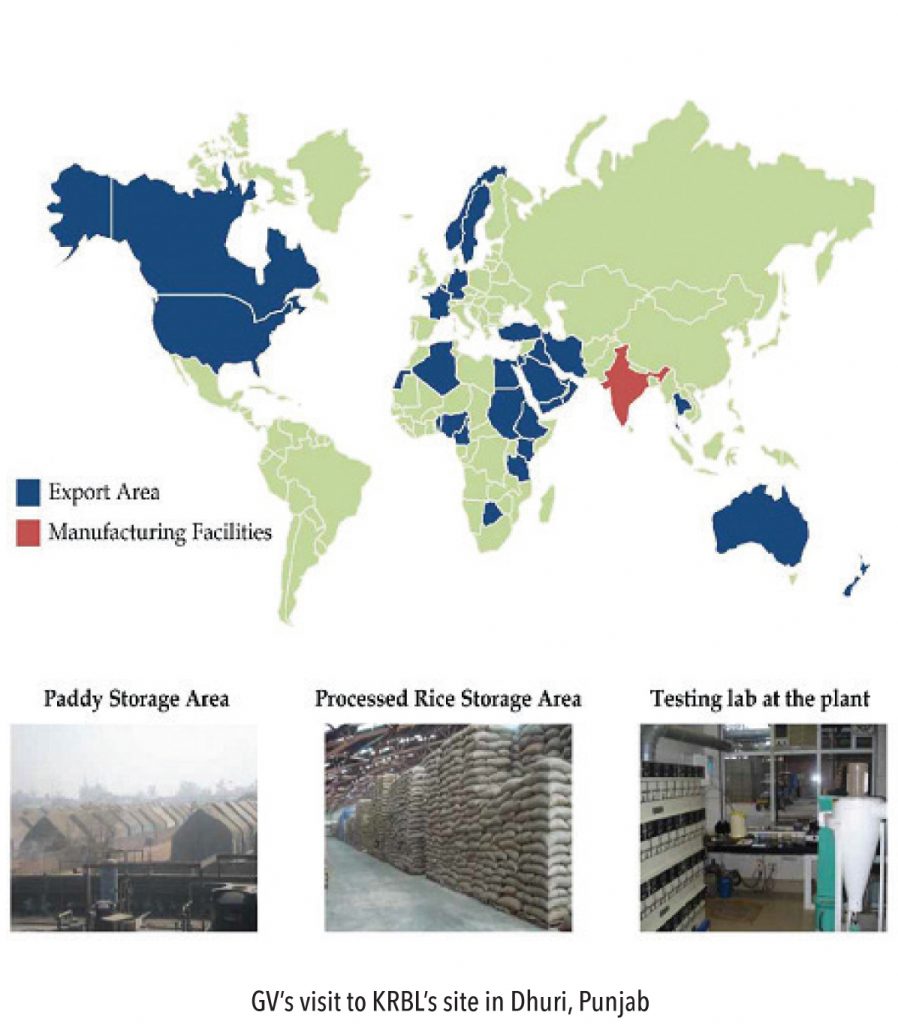

Surplus production for five consecutive years buoyed rice stocks in the open market. Because of this glut, premium rice varieties (such as basmati) saw their prices falling throughout this season. Some varieties of rice have seen prices almost halving. Growers and stockists believe that these varieties have led to huge losses. Despite the subdued outlook, area under basmati cultivation is still likely to have risen 5%, as it is more remunerative and traditionally has fetched higher returns (vs. common paddy) for farmers. A good crop and static exports have led to chaos in the basmati market lately. In CY11, basmati prices were suppressed due to higher production, but in CY12 production declined due to adverse weather conditions. As a result, CY13-14 prices were at around Rs. 40/kg up from Rs. 21/kg in the previous year. Firm prices over the last three years has led to higher acreage (CAGR of 17% in FY14-16 to 2.2mn hectares in FY16 from 1.6mn in FY14), leading to higher availability and pushing prices lower. This, along with Iran’s ban on imports from India and a fall in crude oil prices and other commodities has led to plunging prices of basmati.

The prices of PUSA-1121 basmati were at Rs. 25-30/kg in the past three years (Rs 60/kg at peak) had plunged to Rs. 14/kg before settling at Rs. 17.5-18.5/kg this year. The going rate for the less-preferred 1509 variety is anywhere between Rs. 11-13/kg against last year’s Rs. 25/kg. However, thanks to the Union government’s recent order to procure Pusa 1509 from Punjab at MSP rates announced for common paddy (i.e., Rs. 14.5/kg), some supply should get taken out of the market,which could stabilise prices.

“Basmati prices (that were firm for the past three years) have fallen even below the normal paddy variety. Sowing basmati has cost us heavy. After suffering losses between Rs. 10,000-15,000 per acre, we have decided not to repeat our mistake.”

– Gurnam Singh, a very old progressive farmer in Ambala, Punjab.

“Most farmers felt the only way out before the Punjab government was to either support basmati growers with a Minimum Support Price or come up with export and milling policies. The major problem is that basmati growers of Punjab solely depend on private players.”

– Pushpinder Singh, a farmer.

Ground View interviewed some basmati paddy farmers who are currently in distress as the prices have plunged even below the common paddy variety – an artiya (commission agent) from Ambala district blamed the export crunch and the excess supply of the famous PUSA 1121 variety of basmati, which is now fetching Rs. 12-17/kg vs. the common paddy variety at Rs. 14.5/kg. Basmati prices in the past three years were at Rs. 18-28/kg and had peaked at Rs. 55-60/kg. Plunging basmati prices and rising input costs have led to serious losses for farmers (Rs 10,000-15,000/acre) and some farmers that GV spoke to have even decided to shift to the normal paddy variety in the next season.

“Most of the farmers are indebted to ‘artiyas (commission agents)’; therefore, they are averse to risk. A switch to any other crop other than paddy is a risk. Creation of cold storage, forward linkages with agro-processing industries, and rural employment, would reduce dependence on agriculture and will help the farmers get out of the debt trap,”

-Jagraj Dandi, JS Statistics,

Dept. of Agriculture, Govt. of Haryana.

“Excess production has led to a huge pileup with exporters. We are advising farmers against cultivating basmati. They will fetch good prices only if annual basmati arrivals in the markets remain at around 2mmt in Punjab,”

-Ravinder Singh Cheema, President of the Punjab Arhtiya Association and Vice-Chairman of the Punjab Mandi Board.

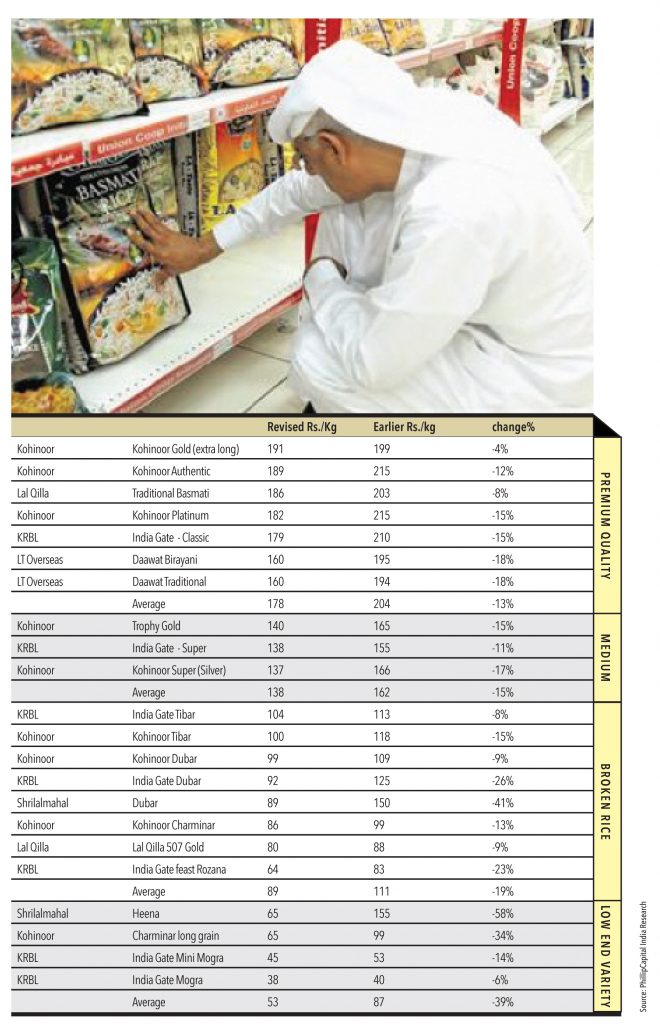

Falling prices of basmati have landed many UAE traders in a soup, with most defaulting on their credit obligations. India Pusa 1121 is now being sold at US$ 750/MT vs. US$ 1,200-1,300/MT at the beginning of the year, while Pakistan basmati prices have plunged by 40% to US$ 730-750/MT from US$ 1000/MT in FY15.

“Thai rice is not very famous in the Middle East, it has a larger market in the US, Senegal, Hong Kong, and China. Consumers here tell us that while it matches basmati in terms of fragrance, it becomes starchy after cooking.”

-A retailer in Dubai

“Famous Pakistan basmati brands in Dubai are Falak and Mehran. These brands used to be at a slight premium to Daawat or India Gate. While Falak prices in super markets have corrected to Dh 28 (from Dh 45) for a 5kg bag. Daawat and India Gate prices have sustained at Dh 45-60 for five kgs,”

-A trader in AI Ras market in Dubai.

Subscribe to enjoy uninterrupted access