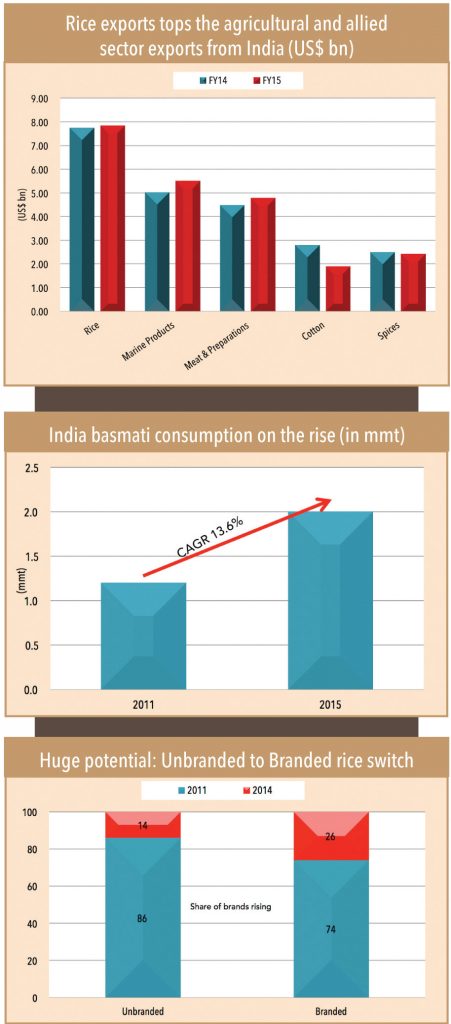

India accounts for 80% of the world’s trade in Basmati – the country exported Basmati worth US$ 4.5bn (or Rs. 300bn) in FY15, 12% of its overall agricultural-produce exports. Almost half of the country’s basmati production is exported to the Middle East, the United States, UK, and Australia. Ground View visited parts of Punjab and Haryana (that account for 82% of India’s basmati production) to get a reality check from the growers, artiyas (commission agents), millers, and companies. It has also tried to examine the prospects of India’s basmati rice industry, buyer behaviour, and price sensitivity. GV has also attempted to answer questions such as why the ‘eat out’ culture is leading to higher basmati offtake, why the Middle East will consume higher amounts of basmati, possible reasons why Pakistan’s basmati variety is losing market share to the Indian one, and why cropping patterns shifting away from basmati this year (and next) will lead to a price surge.

Currently, the industry is under stress with weak export demand and excess supply; however, the pressure is likely to alleviate as demand picks up and cropping patterns shift away from basmati next year, leading to a price surge. Domestic basmati demand (pegged at ~Rs. 120bn) has been growing at 15% in volume terms over the last five years as branded products are accepted more and with the growth of food retail. This trend should sustain, going by the changing lifestyles of Indians, higher propensity to spend, convenience, and rising brand awareness. A rebound in crude oil prices and Iran lifting the import ban on rice from India could drive export demand for Indian basmati. Basmati rice players have seen big deals and private equity investment over the last five years. However, these investments have flagged in the last two year. With India’s rice production almost static for last four years, its 12mmt rice exports could be lower leading to a spike in prices – this could result in resurgence in interest of the private equity players in the coming years. As a b2C category, integrated branded basmati rice companies are likely to make good secular investments.

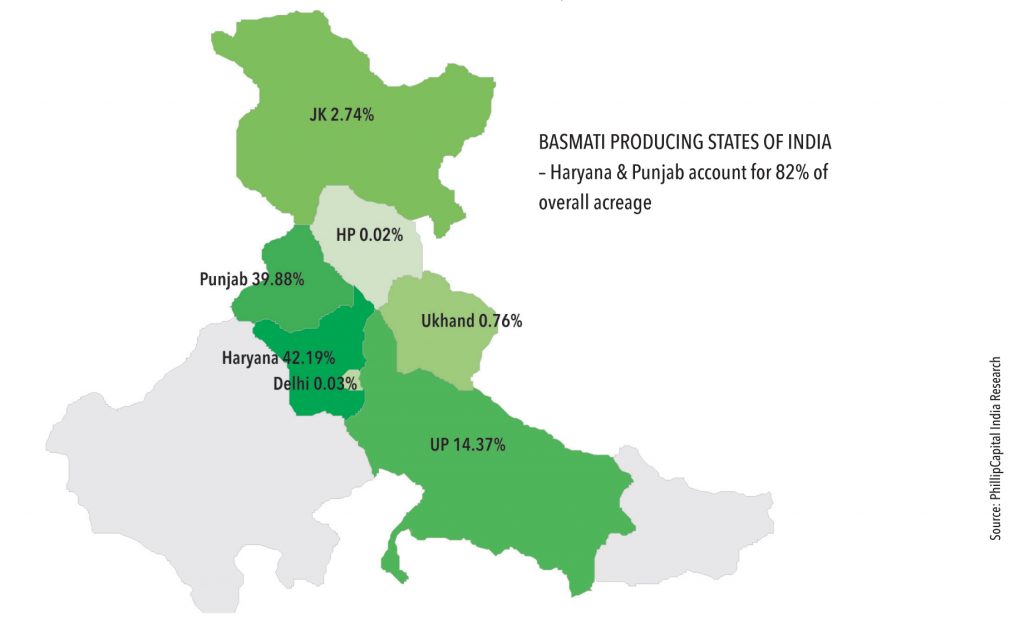

It is only possible to grow basmati rice in precise climatic conditions, soil quality, and temperature – and this is present exclusively in the Indo-Gangetic area of the Himalayas. Basmati is also a legally protected trade name – this prevents any rice grown outside of the Indo-Gangetic area from being called basmati.

Basmati rice has a typical pandan-like (pandanus amaryllifolius leaf) flavour (nutty) caused by the aroma compound 2-acetyl-1-pyrroline. Farmers in the northern parts of India, especially at the foot of the Himalayas have been growing this scented rice for centuries. The supremacy of Basmati over other varieties is mainly due to its unique and delicately balanced characteristics such as superfine (long and slender) kernels, exquisite aroma, sweet taste, soft texture, and delicate curvature, all of which makes it excellent for cooking.

The size of the global rice industry is approximately 477mmt, or US$ 285bn, of which basmati accounts for only 2.6% at 11.5mmt or US$ 7.3bn. India accounts for ~80% of basmati produced or 9mmt (US$ 5.7bn) and Pakistan for 20%. Although basmati represents a small part of India’s US$ 40bn agriculture and allied-products exports, it offers the country high product visibility in the world market. The basmati industry size is about Rs. 420bn —

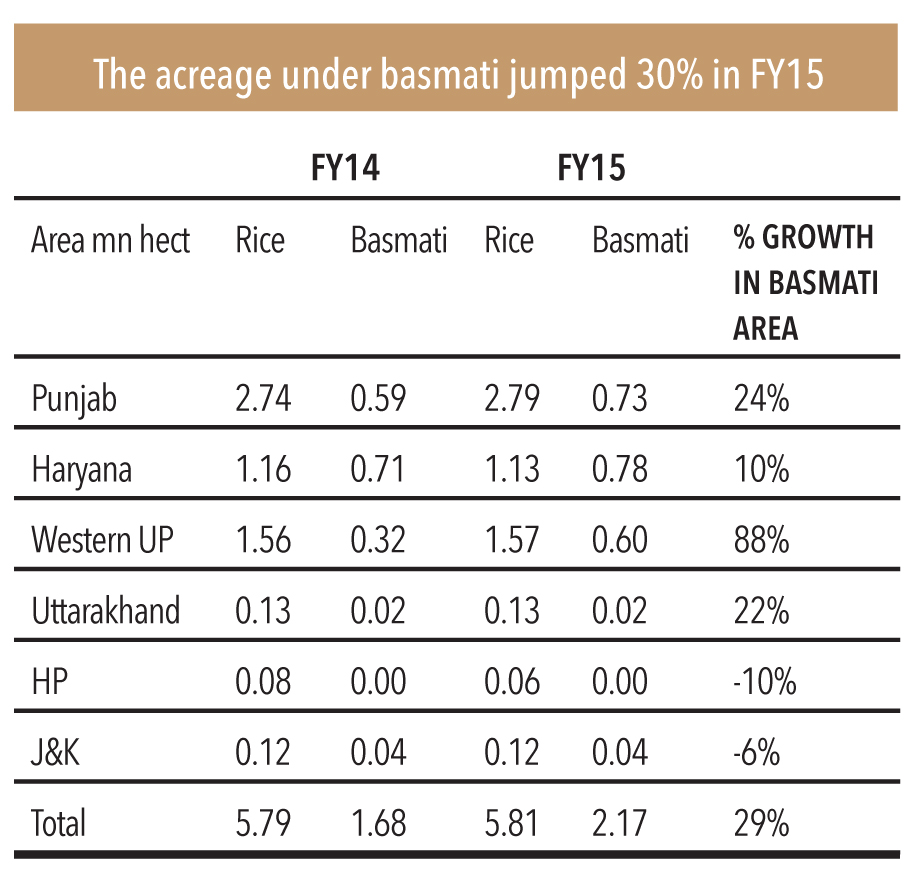

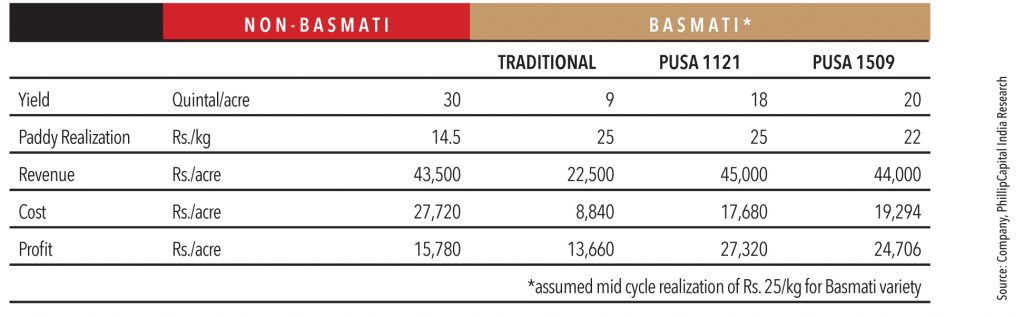

In India, basmati is grown in Haryana, Punjab, western Uttar Pradesh, Uttarakhand, and J&K. In Pakistan,basmati is grown in the Punjab province. This is generally a kharif (May to November) crop with sowing season starting from May-June and harvesting season ending in October-November. Earlier, farmers preferred to grow non-basmati paddy variety due to the minimum support price (MSP) and relatively higher yield. However after the introduction of PUSA 1121 (trade term: duplicate basmati) the economics favoured cultivation of basmati – as a result, the area under basmati cultivation nearly doubled in the past six years. The other approved Indian varieties include Dehradun, P3 Punjab, 386 Haryana, Kasturi (Baran, Rajasthan), Basmati 198, Basmati 217,

Basmati 370, Bihar, Kasturi, Mahi Suganda, Pusa 1121, and Pusa 1509.

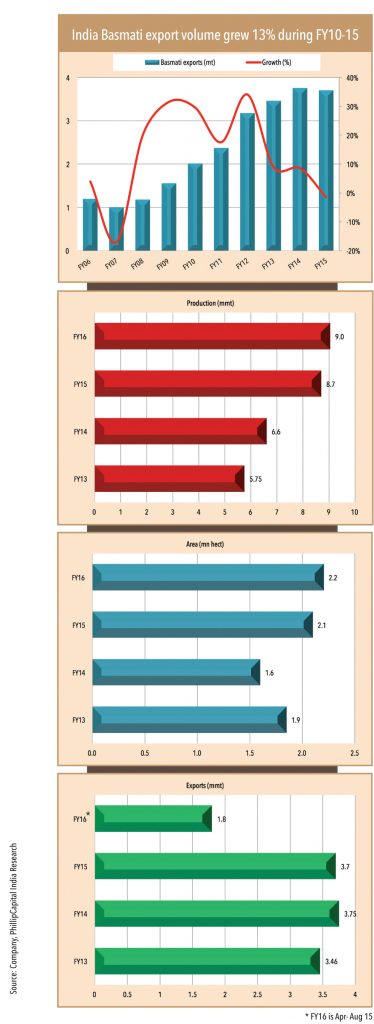

The government introduced the new variety, Pusa 1509, in FY14 – its yields are relatively higher and it is a short-duration crop (lowers crop cycle time by 30 days and saves 5-6 irrigations). Today, Pusa 1509 and Pusa 1121 occupy almost 85-90% of the gross sown area under basmati in the ratio of 25:75. However, Pusa 1509 has limited acceptance in the international market; therefore, it is priced at a discount to Pusa 1121.India produces about 9mmt of basmati rice annually, of which around 3.8mmt is exported. Demand for Indian basmati remains strong in the Middle East, Iran, and other traditional markets. Local traders (in the APMC wholesale market in Vashi) believe that with an improvement in India’s economy, local consumption of basmati is steadily rising. Basmati rice fetches a good price in the international market. With the opening up of new markets (Japan, Korea, and Indonesia under WTO regime) and also with the government of India removing minimum export price, the export of Indian rice increased tremendously. China has decided to import Indian Basmati rice – this is likely to increase the demand for Indian basmati. Of the total basmati rice production (9mmt) in FY15, head rice (full-grain) recovery is around 6.3mmt (75%) whereas the remaining is broken rice (2.7mmt). Generally, a major portion of head rice (6.3mmt) is sold in the export market and fetches better average price realisation per kilogram. In India, both head rice and broken rice are consumed – this lowers the average realisation in the domestic market. As the export market is a full-grain market, its realisations are better. Indian basmati exports have compounded at 13% in FY10-15. During the same period, the domestic basmati market has compounded at a higher rate of 15%.

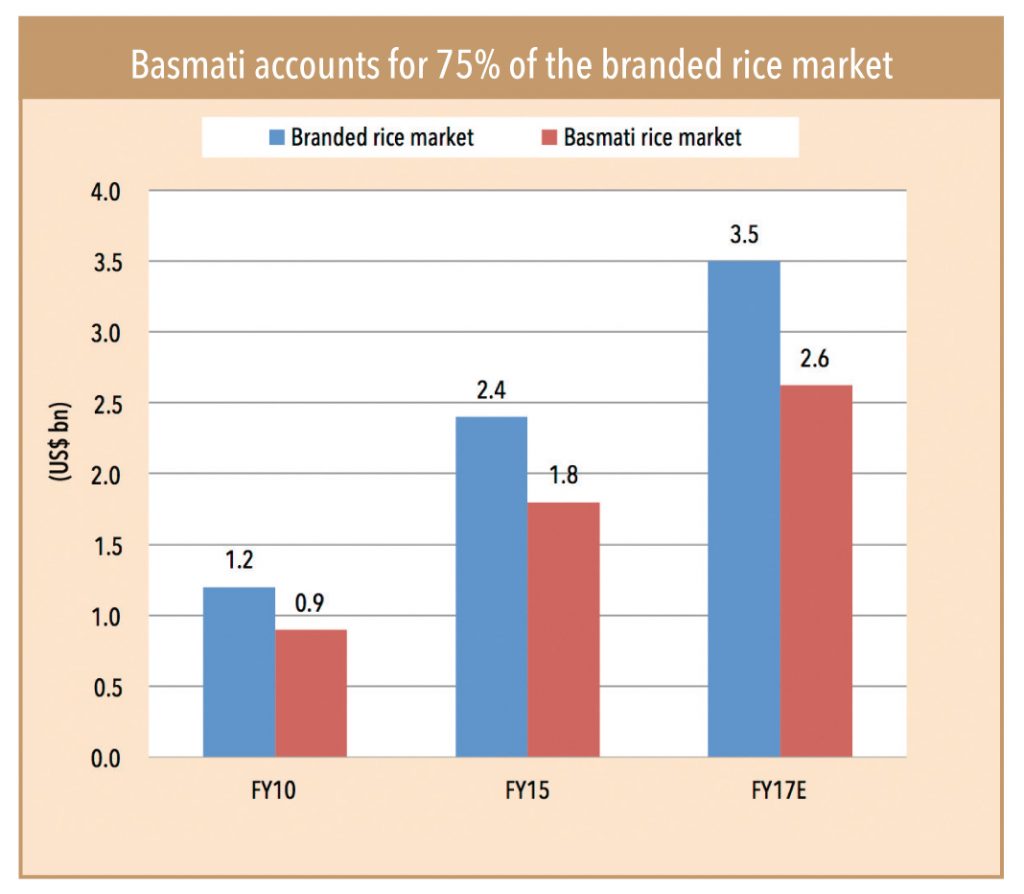

The size of the domestic industry is pegged at US$ 2.4bn or Rs. 120bn. Basmati accounts for 75% of the branded rice market. The size of the basmati industry could touch US$ 3.5bn by FY17 (industry estimates). The main growth drivers of branded rice are convenience of procuring clean rice packs from stores, rising income levels, urbanisation, rise in food retail, and brand awareness. Consumption of branded rice is growing in both southern and northern India.However, grains sold in the south are generally smaller and are mainly non-basmati.

Growth in the modern retail segment boosted the branded rice market. As per industry estimates, the retail segment has been growing at 15-20% annually, and the growth rate is likely to jump to 25% by 2017. Last few years have seen many traders and millers launching their own rice brands – the latest entrant is Adani with the Fortune brand – this underscores the potential of the branded rice market in India. According to a report in ET, branded rice can command about 33% premium over loose rice at the retail level and a modern retailer can earn a 20% margin vs. 12% for loose rice.

Unbranded basmati (loose basmati) accounts for 74% of total basmati sales in the domestic market, lower than 86% in FY11 due to growing awareness – the potential to tap the conversion (consumer uptrading) is still huge.

Branded basmati players are becoming consumer focused by improving their offerings (value to premium range with attractive packaging and trade promotions) and leveraging existing brands by hiring brand ambassadors such as Amitabh Bacchan and Sanjeev Kapoor. Incumbents are also expanding their sales and distribution network and are making their products available to all conventional and modern-trade formats. To capitalise on rising distribution platform and as an economic rationale for expanding distribution network, they are broadening their product offerings (to wheat, wheat flour, pulses, sweets, and savouries).

“Income growth, rising number of nuclear families, growing ‘eat out’ culture, and greater participation of women in the workforce are fundamental factors driving demand for packaged rice

– Rakesh Mehrotra, CFO, KRBL

“Brand awareness has increased more at the wholesale level than at the retail level. About 20 years ago, we used to get rice from different states in gunny bags, with just the weight mentioned on it without any brand name. Now all the rice in bulk comes branded.”

– Sunil, a basmati rice trader at Vashi (Navi Mumbai) AMPC market

“I prefer buying packaged rice because of the convenience and ease of procuring clean rice as opposed to the laborious task of cleaning (checking for stones and impurities) when purchased from wholesalers or local kirana’s (corner stores).”

-Mrs Shubhashree, homemaker, Chennai.

“Although traditionally we consume a lot of ponni and kolam variety, occasionally we cook basmati for its aroma, long grains, and fluffy non-sticky texture. We have tried many varieties but we prefer Kohinoor Gold basmati.

– Ms Sadhna, student, Chennai.

“Kohinoor and India Gate basmati rice are famous brands in Qatar. Some varieties from Pakistan are also available in the market. Approximately 30% of Qatar’s population comprises of Indians and Pakistani’s and the locals also use it (basmati) regularly.”

– Parameshwaran, NRI, Qatar.

“I have cooked Pakistani basmati rice – the length of the rice is short but it’s very tasty and high in aroma, also it usually takes less time to cook.”

– Mrs Revathi, a homemaker from Coimbatore.

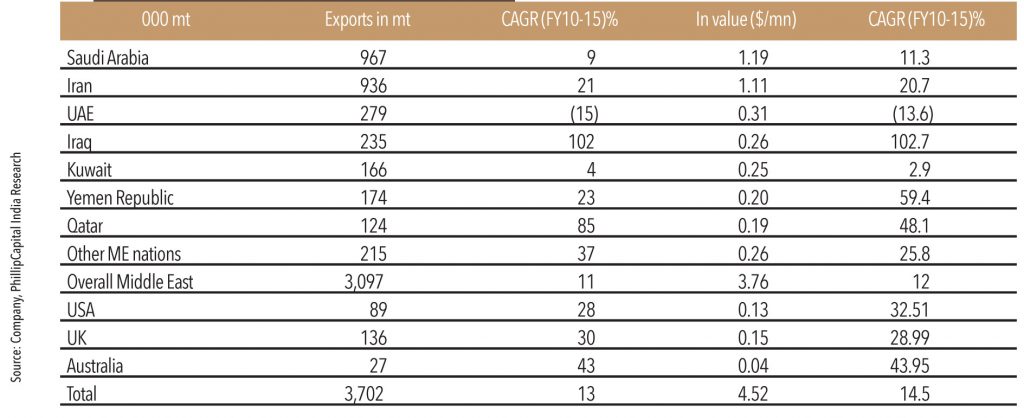

Among the food grains exported from India, basmati is an important commodity. In the 1980s, most Indian basmati went to the USSR and very little was exported to other countries. However, by the end of 1980s, the export share of the USSR decreased slightly while the share of other countries, particularly to Saudi Arabia, increased substantially. Indian basmati was exported to Saudi Arabia in considerable quantities by the end of 1997-98 and USSR’s share had gone down considerably by then. During the past few years, basmati export has been growing steadily – it touched 3.7mmt in FY15 from 0.8mmt in 2003 – on robust demand from traditional markets in west Asia. Middle East accounts for 83% of overall basmati exports followed by UK, US, and Australia, which account for the next 8%. Iran alone has been importing >40% of the total basmati exported from India in 2014; however, Iran’s ban in November 2014 on rice imports from India (allegedly to protect its rice producers) has seen its share fall to 26% and pushed Indian basmati prices lower. However, a part of this excess supply has been readily consumed by the Saudi Arabian market.

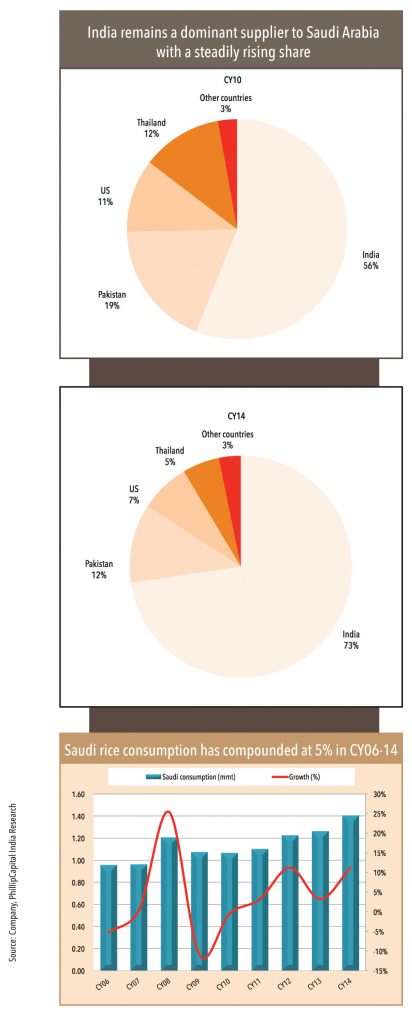

Saudi Arabia has no domestic rice production – the country depends fully on imports. Most Saudi nationals include rice as a major part of their daily diet. Most of the 10mn expatriates (from the Indian subcontinent and other Far East countries) living in Saudi Arabia (population 30.8mn, growing at 3% annually) are large consumers of rice. Basmati is the most popular rice variety in this country – Saudi Arabia imported about 1.4mmt of rice in FY15 and India remained the dominant rice supplier with its share steadily rising to 73% in FY15 from 56% in FY10; Pakistan’s share is 12%, US 7%, and Thailand 5%. Rice imports from Saudi Arabia are expected to grow by 7% in FY16 to 1.5mmt, mostly from increased supplies of Indian rice. Traditionally, Iran imported a third of Indian basmati. However, its ban on rice imports has made Indian rice cheaper and readily available for the Saudi market. The Iranian ban has also caused rice stocks in Pakistan to rise and pushed down export prices as well. The Saudi rice market is very price-sensitive. Reports indicate that Saudi Arabia’s demand for US rice is likely to decline significantly this year due to more price-competitive export offers from India, Pakistan, and Thailand (which also has excess rice stocks).

Subscribe to enjoy uninterrupted access