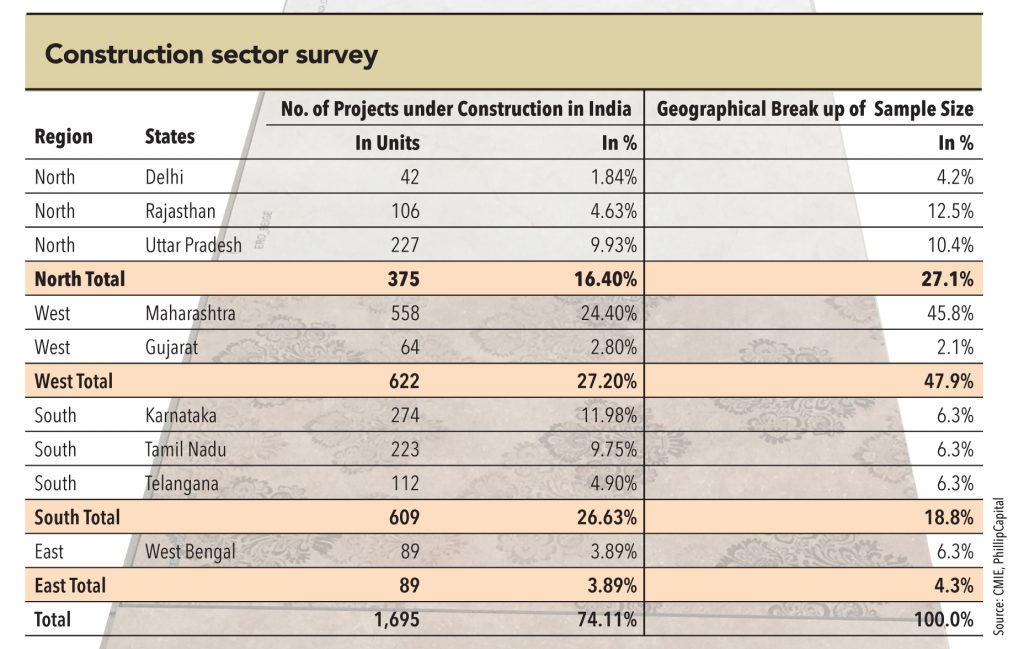

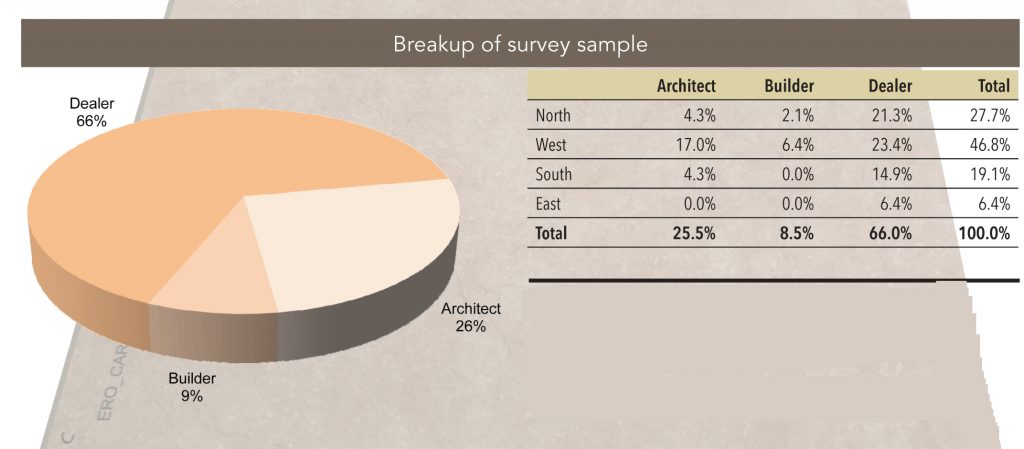

In light of the significant construction activity all over India and the number of stake-holders involved, it was imperative to seek a balanced opinion of the state-of-affairs by interacting with all parties. These included developers, channel partners, and architects, all of whom play a vital role in determining the fortunes of domestic tile companies.

In the tile industry, dealers have become more stronger (top-100 dealers have a revenue of more than Rs1bn per annum)

by Mr. Tapan Jena (Industry Expert, CEO SunHeart)

Some interesting tit-bits from GV’s interactions across the country

“Thoda slow toh hai (business is indeed slow),” says a Mumbai based dealer matter of factly. “But it isn’t as if business has stopped”, he adds quickly. Metros across the country reflect this scenario. Smaller constructions, coupled with staggered purchases by builders (depending on individual liquidity) have seen tile dealers and distributors growing at a slower clip in the recent past. From the break-neck double-digit growth of 2-3 years ago, a more conservative 8-10% increase in revenues is what most channel partners are registering at the moment.

Hertz-Avis Redux?

“Chota hai toh kya hua, bhaav aur quality main toh yeh sab world class hai (so what if they’re smaller companies, their quality is world class),” said a dealer from Nashik.

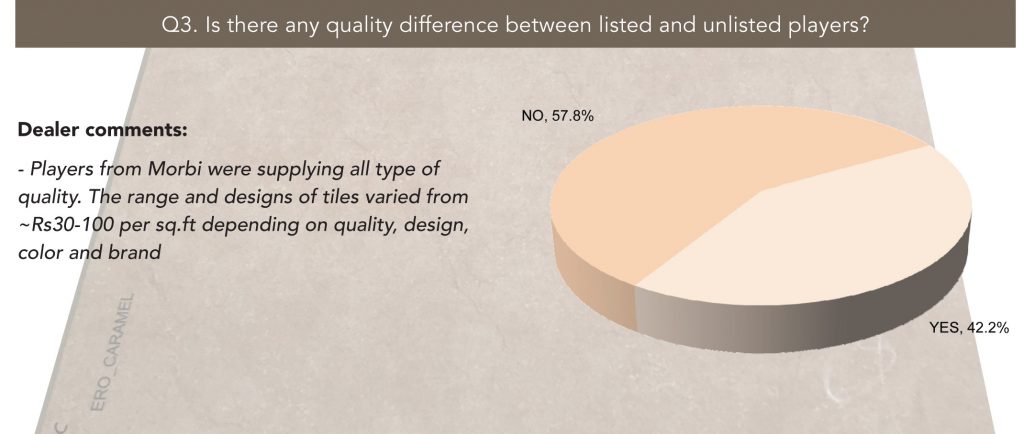

With prompt service and comparable quality, homegrown Gujarat brands like Varmora, Swastik, and Simpolo were trying harder to win market share through improved business practices like shorter turnaround time, prompt deliveries and equitable trade terms. While the quality of products offered were comparable to larger, listed peers, it was on servicing that they seem to be going the extra mile. Dealers and architects alike were unanimous in their feedback that Gujarat-based companies have stepped up follow-ups and servicing over the past few years and are faster in closing sales compared to larger, listed brands. This seems like a replay of the famous Hertz- Avis rivalry of yesteryears, wherein the smaller player opted to highlight the improved quality of its servicing instead of targeting the larger established competitor.

Horses for courses

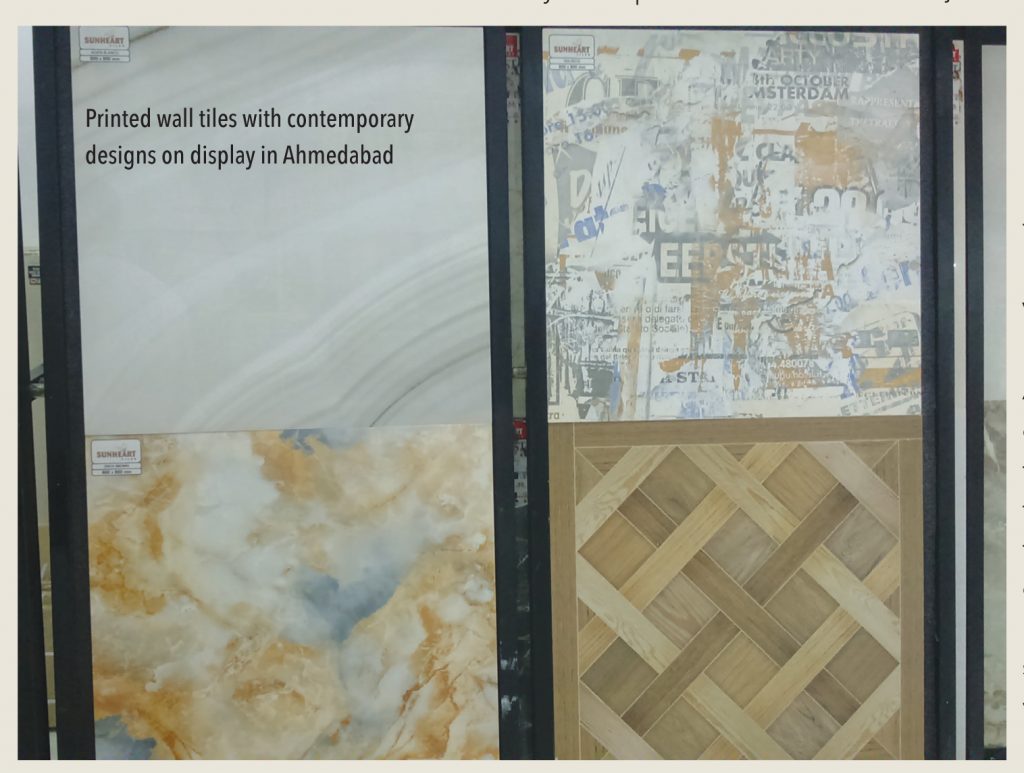

While larger listed players have a vast repertoire of tiling products, smaller, unlisted manufacturers are not far behind. With the flexibility to customise the size of the tiles and monthly introduction of new designs, they have carved out a reputation for tailoring their products to match specifications of architects and builders. “Quality and delivery were as per specifications. The finish was superb”, replied a mid-sized builder from Maharashtra. About the quality of the product from a smaller brand he said that, “While the product costing was very competitive, their speed and efficiency was amazing”..Apparently, the adoption of digital printing technology has enabled manufacturers today to close out supplies of even smaller batch sizes, making them more amenable to customizing for relatively sized orders.

Show me the money!

“Cash is always King”, says Mr Aghara of Simpolo Ceramics, from Gujarat. Sales were being made against advances in many cases, something which an overwhelming majority of dealers confirmed. With the appetite for counter-party risk down dramatically, credit offered by tile manufacturers has shrunk to 15-30 days, from 30-45 days previously. This practice has also been adopted by most tile dealers on a pan-India basis, since they are becoming averse to lending their liquidity to contractors/builders.

Chinese dragon being contained

Anti-dumping duty (levied a couple of weeks ago in Mar’16) is forcing stockists of imported tiles to liquidate inventory. With US$ 1.37/sqm of punitive duties on glazed, unglazed, and porcelain tiles, imports are expected to subside – especially in the southern parts of India.

“Demand for Chinese tiles in the luxury/super-premium categories is relatively price insensitive – these will remain. It is in the premium and economy ranges that the difference will be felt”, says Ronak, a dealer of imported tiles into India. “It is only in the economy range of tiles in southern India that the impact will be really noticeable”, he adds.

This view was endorsed by all kinds of domestic tile manufacturers – they are upbeat about the revival of sales, especially since southern India is a sizeable and stable market.

What’s in a name? Apparently, quite a bit!

With all manufacturers usually carrying out ‘point-of-sale’ promotional activities, smaller brands are stepping up their game. Branding and advertising is now a top priority, as managements of several smaller unlisted companies are keen to increase brand awareness and visibility at the pan-India level.

Traditional media aside, focused efforts are being made through advertisements in business and trade magazines. Participation in trade shows and organising specific events also seem to be picking up. The use of social media is also rising, with few Gujarat-based brands encouraging interactions through platforms like Twitter, Facebook, and Instagram.

Variety is the spice of life

Design additions in the tile portfolio have now become a regular feature every month, with 3-4 new designs being introduced by companies on an average, every quarter. “Indian taste is now sophisticated. Being contemporary is the name of the game”, says Mr. Muthuraman of Lakshmi Ceramics, Coimbatore.“If we’re not spoiling the customer for choice today, we’re doing something seriously wrong”, he adds, emphasising the importance of breadth in product offering. This was a common refrain across most channel partners in the tile industry.While international companies usually introduce new patterns and designs every six months, companies operating out of Gujarat usually introduce these every quarter and at numerous SKUs. Larger domestic brands usually follow suit in a couple of months.

Discipline, discipline, discipline!

The mantra is loud and clear for companies like Simpolo Ceramics, Swastik Tiles, and Varmora Ceramics who are currently just below the Rs 10bn threshold for annual sales. A strict control on the rejection rate, focus on value-added products and lean manufacturing set up are some ingredients that these companies are focusing on to make the leap into the big league. “If we don’t continuously streamline operations, we risk losing out on opportunities in the future”, says Mr. Girish Patel (M.D.), Swastik Tiles, very succinctly.

Imports into India: Imports into the country paint an interesting picture. While the upper-end of the premium range consists of Chinese tiles, Italian and Spanish tiles make up for a vast majority of imports at the luxury end. Accounting for about 8% of the overall Indian market in CY15 (by volume), Chinese tiles were being shipped in large quantities to southern India until recently, given the freight disadvantage encountered by local companies in inland transportation. However, the recent imposition of anti-dumping duty (ADD) on Chinese imports could see these imports reducing gradually.

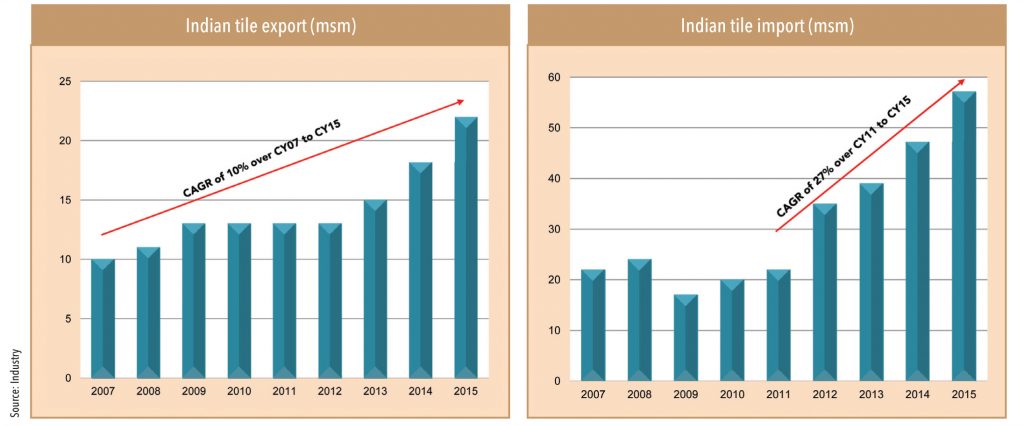

Increasing export focus: With domestic production outpacing demand by a few percentage points, Indian tile manufacturers have been increasingly focusing on exports. While the Middle East is one of the largest export markets, countries such as Bangladesh, Sri Lanka, Brazil, and Africa are also sizeable export destinations.

Overseas sales account for ~5% of revenues of the Indian tile industry at present, but this metric is expected to rise significantly over the coming decade on several factors such as capex by Indian manufacturers,increasing customisation for international markets, and a globally competitive manufacturing- cost profile. Global imposition of ADD on Chinese tiles should result in an abatement of supplies, serving as a kicker for Indian manufacturers to ramp up exports.

Exports to increase with more value-added products introduced by the India and with anti-dumping duty on Chinese tiles in other countries

Imports to decrease from 7% to 4% (of the total Indian Tile Industry) with imposition of anti-dumping duty

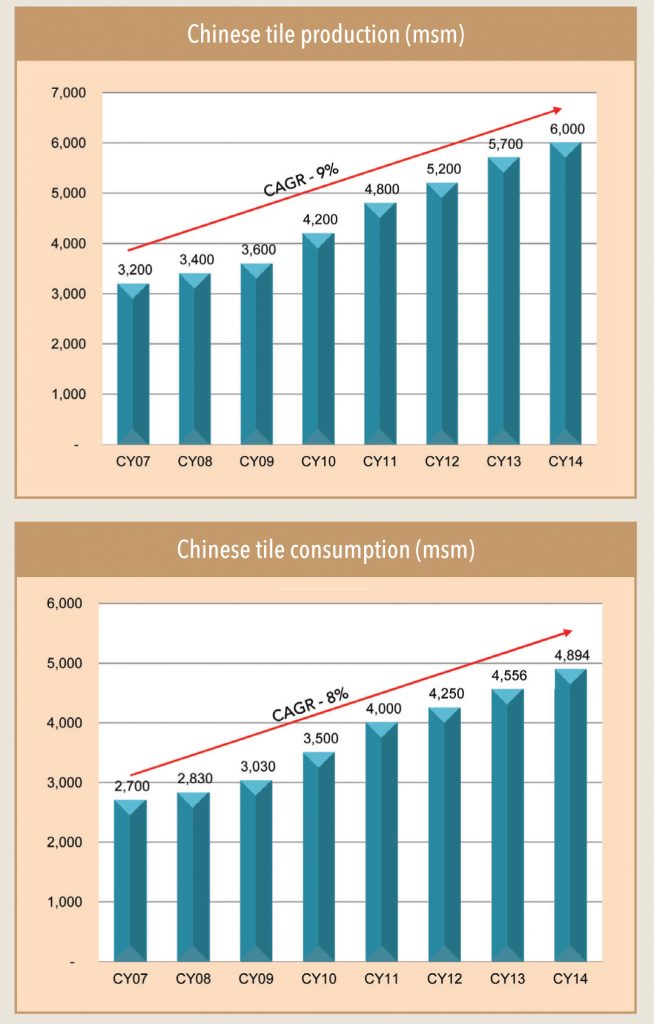

As is with most other industries, China’s manufacturing might has swayed the dynamics in the global tile market. With production of ceramic tiles far outstripping consumption, China’s exports have had a disruptive impact on production in various parts of the world. To put things in perspective, China produced about 6,000msm of ceramic tiles in 2014, but consumed only 4,894msm.

What has made matters difficult for local manufacturers in India is the proximity of south India to China. With shipping costs from south China to southern India lower than the cost of transporting from Gujarat, local manufacturers have faced stiff competition in this large and lucrative geography. In several instances, Chinese tiles have been 15-20% cheaper than Indian tiles. Moreover, volumes imported into India (largely into south India) have also dented sales, which by some estimates stood at ~38msm. Indian exports to SAARC countries have also encountered stiff price competition from Chinese tiles due to the price differential arising from the latter’s much larger scale.

However, the past few years have seen remedial action globally, to counter the threat posed by cheaper Chinese imports. The imposition of antidumping/countervailing duties (ADD/CVD) by several European countries, Taiwan, Brazil, etc, on imports of Chinese tiles has opened the export markets for Indian tile companies.

India, too, has recently levied ADD to the tune of US$ 1.37/ sqm, which is likely to be raised to US$ 2/sqm over the next few quarters. This is likely to restore price parity between domestic prices of tile and Chinese imports, thereby boosting competitiveness of Indian manufacturers. Channel checks indicate a reduction in the competitive intensity of these imports, especially at lower price points – where demand is likely to shift in favour of Indian manufacturers. However, in the premium and luxury segments, competition is likely to persist, in light of limited offerings by Indian players. Indian players expect imports from China to nearly halve from 7% of total industry size to 4% in the coming years.

Subscribe to enjoy uninterrupted access