Morbi, in the Saurashtra region of Gujarat, is a hallowed name in the annals of the Indian manufacturing sector. Synonymous with the concept of cluster manufacturing of tiles, it is not commonly known that earlier this town held the distinction of being the largest producer of wall clocks as well as CFLs in India.

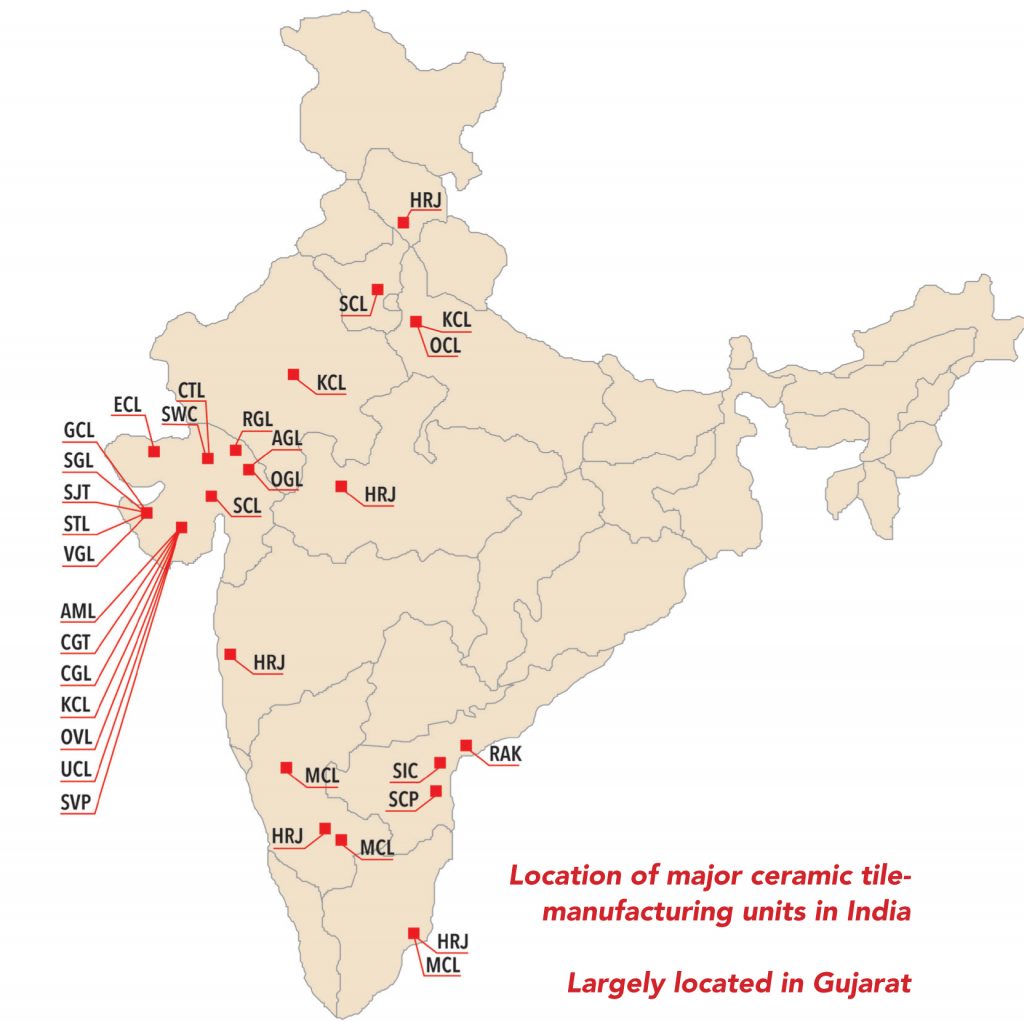

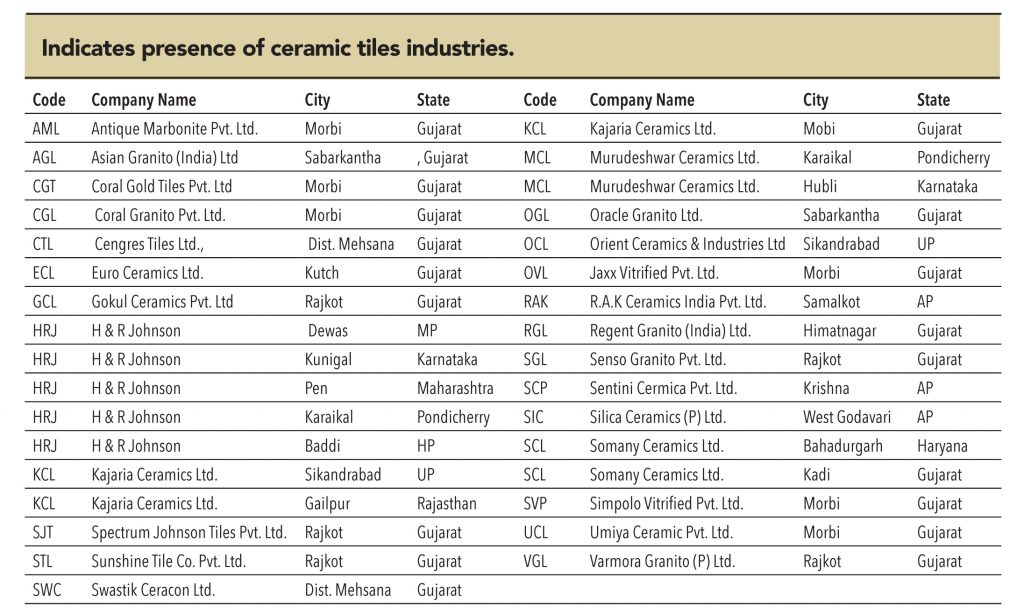

The sheer variety of housing materials manufactured here is breathtaking. Vitrified tiles for flooring and walls, quartz stone and mosaic tiles, tiles for roofing and sanitary ware – the town has manufacturing units for all these and more. Morbi accounts for 70% of all ceramic tiles manufactured in India and generates in excess of Rs 170bn in annual revenues.

1.Easy availability of raw materials: Key raw materials like clay, red and black soil, minerals (calcite and wallastonite), frits and glazes are abundantly available locally or from the neighbouring state, Rajasthan.

2.Reliable supply of power: Almost all the units in Morbi have access to dedicated supplies of gas for power. Stable supply of power ensures minuscule downtime and higher utilisation. This is a significant driver of operational profitability.

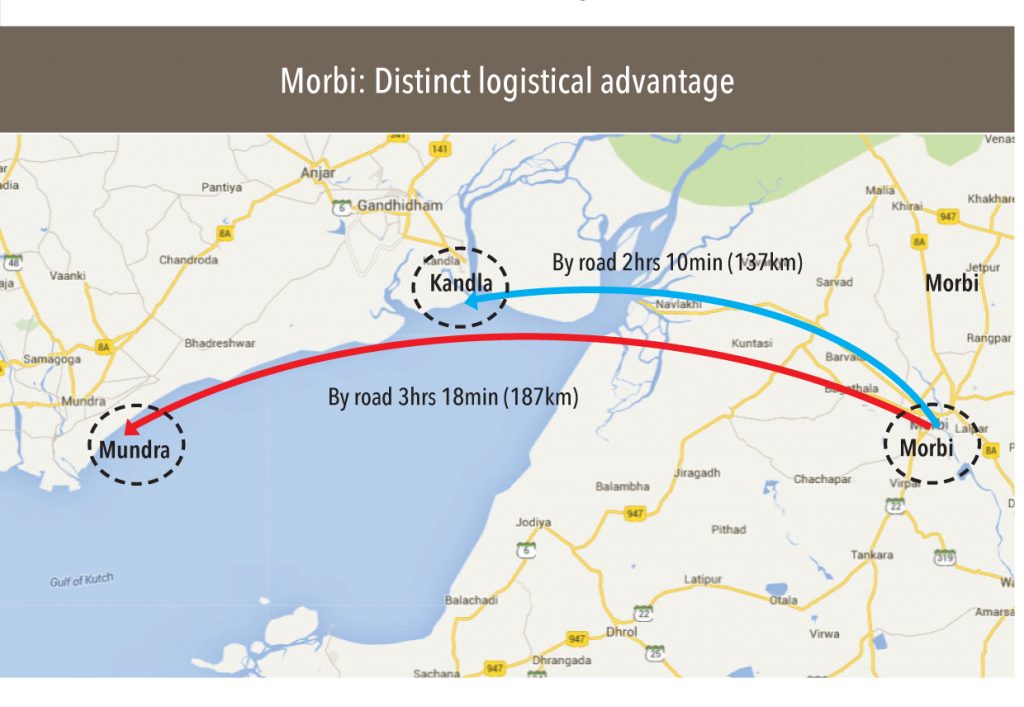

3.Logistics: Morbi enjoys excellent connectivity to national and state highways. This facilitates timely and cost-effective transportation of finished goods to most parts of the country (barring southern India). Proximity to large ports like Kandla and Mundra not only helps manufacturers access markets in southern India (through shipments to Chennai and Vishakapatnam) but also large, lucrative international markets in the SAARC region and the Middle East.

But there’s more to it than meets the eye. To borrow from Po (Kung Fu Panda), “There has to be a secret sauce!” Ground Zero’s two-day trip to Morbi to find out what makes the town tick was not just exhausting, but also most instructive and enthralling.

In a candid conversation with GV, Mr KG Kundalia, (President, Morbi Ceramic Manufacturers Association) explained’ “Yaha sab co-operation se chalta hai, sab ek dusre ki madad karte hai (everything here in Morbi operates on the principle of co-operation, everybody helps each other out)” – which pretty much sums up how the town has metamorphosed into the second-largest tile manufacturing cluster in the world in a short span of two decades.

Housing close to 600 units of various sizes, manufacturing in Morbi is dominated by the enterprising Gujarati Patel community. Said Mr Kundalia, “Akda-shastra hamare khoon me hai (numbers are in our blood)”. He alludes to the skill of cost management, born out of a centuries-old tradition of thrift. He went on to cite numerous instances of operational frugality – such as the fact that many companies outsourced specific functions like operational maintenance to specialists for a fraction of the cost to lower their opex, which would otherwise have been paid to in-house employees. Often, manufacturers borrowed spares from each other rather than block capital in expensive inventory. In some cases, manufacturers outsourced production of tiles to neighbouring factories due to saturation of their own capacities, thereby boosting utilisation levels at their peers’ facilities. The end result has been competitive operational costs and lower selling prices.

Mr. Jagdish Varmora of SUNHEART Tiles recalled the formative years of tile manufacturing in Morbi – “Twenty five years ago, there was an inordinately high proportion of manual intervention in the manufacturing process. We owners spent most of our time on the shop floor, managing labour and process rejection. It was very tough. There was no other way out, except for collaboration.”

Cooperation between various players in Morbi extends much beyond operational resources – to the extent of sharing precious capital. There have been several instances where Morbi-based promoters have funded equity stake in competitors for capex. This has bred a culture of knowledge and skill transfer – transforming the region into a global power house in tile manufacturing. Little wonder that the town today boasts of being able to manufacture one of the largest tile sizes in the world (2m x 1m) with relative ease, the highest density of digital printers globally, and the ability to match the operational cost of manufacturing in China (excluding logistics costs).

Says Mr Bhavesh Varmora (MD, Varmora Granito), who has one of the largest units in Morbi – “Our core strength has always been cost control. That’s the reason why even established brands in the country tie up with us or source a sizeable portion of their products from here. It is merely a perception that we are only cost warriors. If it weren’t for our quality, we would have perished long ago.” He adds almost as an afterthought, “It is this perception of not manufacturing world class quality that we are trying to change.”

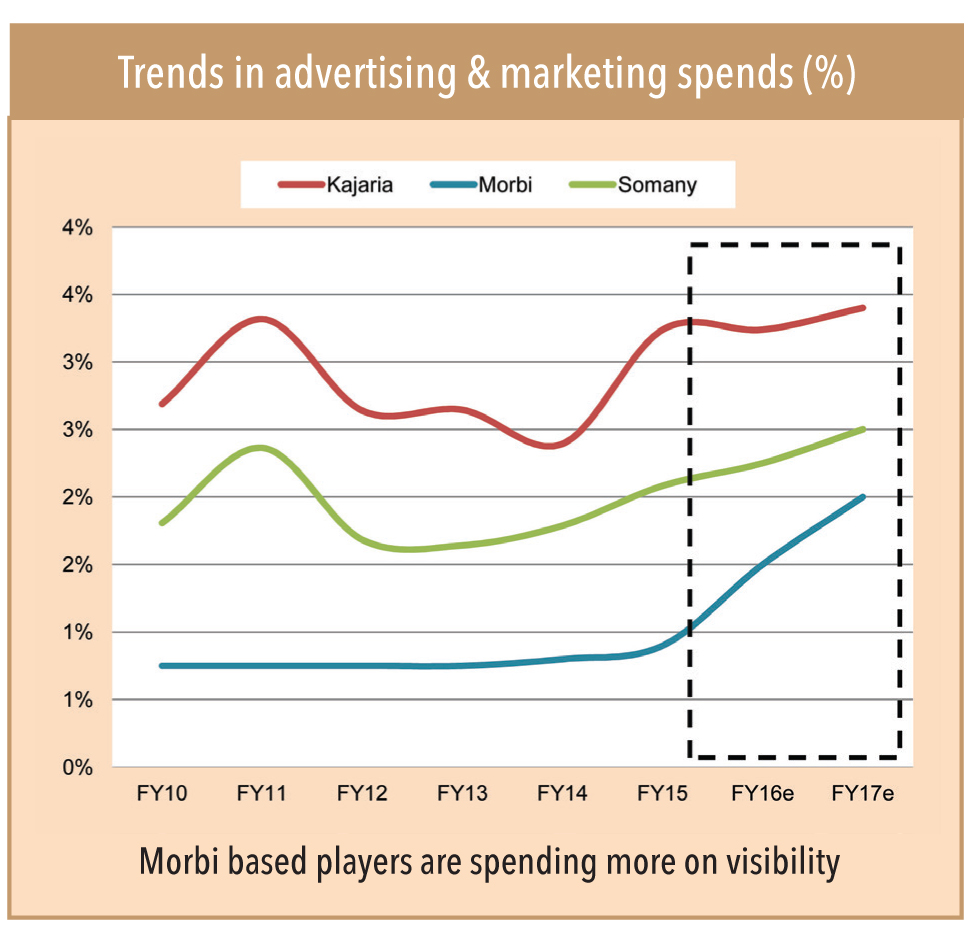

His competitor, Mr Jagdish Varmoa of SUNHEART Tiles agrees. Drawing from his vast experiences, he says, “We have nearly halved our manufacturing costs to Rs 12-13/sq. ft. over the past decade. Rejection today is less than 2% across any product manufactured in Morbi. None of the larger brands can match our costs, hence they buy from us.” He adds, “We aren’t very active on the marketing front, that’s where we lag behind. Unless we market ourselves to consumers in a big way, they won’t know about our products and consciously ask for our brands. And unless they don’t consciously use our products, they won’t realise our quality”, he shrugs.

“Things are changing, these are all various phases of growth”, muses Mr. Girish Patel of Swastik Tiles, when questioned about branding and pricing power. “The first phase, from the early nineties till 2000, was the toughest. Everyone was equally inexperienced, focus was on cash flows and survival. Manufacturing scale and quality were a far cry. The next phase was from the start of the millennium to 2007-08 where everyone had stabilised operationally and turned their focus on growth and balance-sheet improvement, along with quality control on the manufacturing side. I believe the last phase which has been in play since 2007-08 has been very interesting, as all of us have expanded nationally in terms of distribution reach.” He adds, “With everything now in place, the focus for mid-sized players like us is towards improving visibility. Branding will now be a play an important role for Swastik as well as other companies from Gujarat.”

So is this the start of cut-throat competition, a classic ‘David versus Goliath’ saga in the making? “Not at all – there’s enough room in the market for everyone, whether branded or unbranded”, concludes Mr. Parth Shah, CFO of Swastik Tiles. He adds that only brands that have control on costs and offer contemporary products at the right price will have good market share. Today the customer is spoilt for choice, so a brand will succeed only if delivers on its promise of price and quality simultaneously.” It comes as no surprise then that all four unlisted manufacturers that GV interviewed are already ramping up branding and advertising budgets. One cannot help but get the feeling that competitive intensity in the Indian tiles market is set to move up a couple of notches.

This precipitates another question – who will be casualties? Will larger, listed brands languish or will challengers fare badly and shut down? Some interesting food for thought on this – 15-20 enterprises shut shop every year in Morbi due to various reasons, but rarely insolvency. “Bankruptcy toh yaha 1% se kam hai. Kabhi kabhi kuch karan se unit band karna padta hai(instances of bankruptcy are less than 1% in Morbi, there are several other reasons for closure”, says a promoter of a large manufacturing unit. For every shutdown, new factories spring up to make up for the void – a testament to the grit of the Patel promoters. While a definitive answer to this would only lie with those equipped with tarot cards and crystal balls, Mr Patel of Swastik Tiles summed it perfectly – “The marketplace is the best teacher, and nothing is certain. The only way to succeed is to be ready to unlearn and re-learn.”

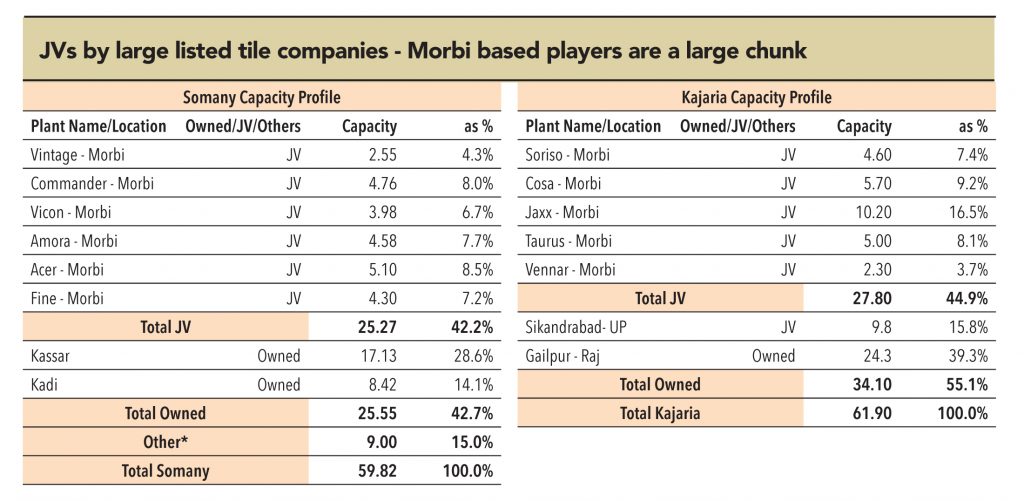

Kajaria and Somany ~45% manufacturing is through JV model..

Subscribe to enjoy uninterrupted access