As banks revaluate their core value propositions and contemplate their digital strategies, they essentially have a choice between three strategic postures:

Most banks are comfortable adopting the ‘catalysts’ role…

Traditionally, most financial services incumbents have been comfortable partnering or playing the role of catalyst in their own industry – especially where there is an opportunity to share processes or services that are considered ‘non-core’, and which help all collaborators either reduce their costs or create new market opportunities. There are many examples of such partnerships in India – such as CIBIL, where various banks collaborated to create an entity that provides data about a borrower’s credit history. It helps loan providers manage their businesses or help consumers secure credit faster and at better terms. The use of CIBIL’s products has led to a massive change in the way the credit lifecycle is managed by both loan providers and consumers. ARCIL is another example – it helps banks by acquiring stressed assets, subsequently reaching a resolution or undertaking a recovery exercise.

“Most banks in India believe that tie ups or collaboration with fin-tech firms would be an appropriate strategy to embrace digitisation”

…but in the future, collaboration will need to go a step further

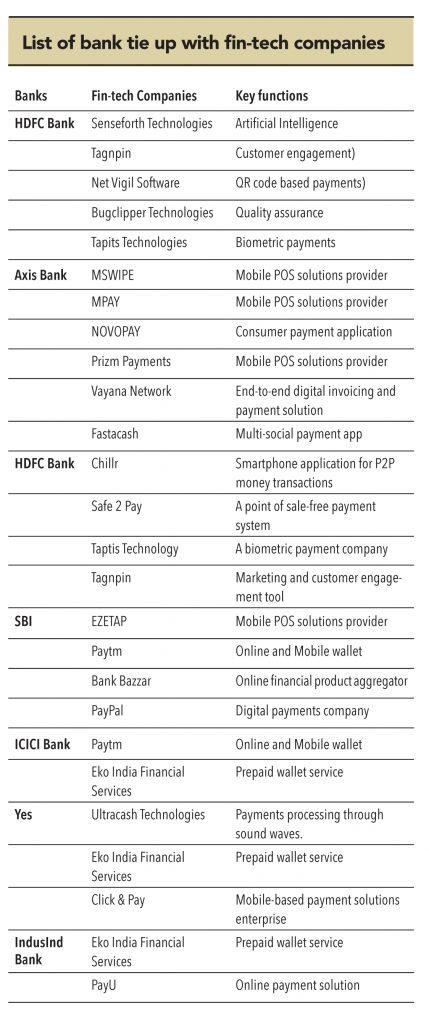

In order to maintain and grow value in these times of change, established players will have to keep looking at collaborating more closely with those in different industries and outlooks. Most banks in India believe that tie ups or collaboration with fin-tech firms would be an appropriate strategy to embrace digitisation. There are several examples: ICICI Bank has tied up with FinoPaytech, State Bank has tied up with Reliance JIO, Kotak Mahindra Bank has tied up with BhartiAirtel. The increasing number of traditional banks tying up with payment banks or fin-tech companies is a testament to the collaborative approach.

Coexistence of physical and virtual branches in India

Due to financial and social reasons, the concept

of branch banking in India cannot be done away with. While setting up and running a physical branch is undoubtedly expensive, the situation in India is not as bad as it is in the US or Europe. In the last few years, Bank of America has reduced its branch strength to 4,789 from 5,328 while JPMorgan Chase slashed its branch count by 2% to 5,504. For both organisations, the savings were substantial.While BofA’s workforce came down by roughly 15%, JPMorgan Chase pruned its staff strength by 6,000, leading to savings worth US$500mnin H1 2015.

“As per State Bank of India, “A mobile banking transaction costs about 2% of the bank branching cost, 10% of ATM-based transaction and 50% of the In ternet banking cost”

Banks in the US or in Europe are facing the heat of dwindling spreads in their intermediation businesses. Moreover, high penetration of smartphones and financially literate customers provide opportunities for fin-tech companies to disrupt the system. This is not the case in India. Another important differentiator is social – in India, people would not be inclined towards trusting a ‘faceless’ bank. They would want to know who their banker is. Therefore, the idea of not having branches and physical presence for assisting customers may not be a wise strategy for this country.

However, despite India’s peculiar predispositions, the fact is – the face of traditional branch banking is already seeing a change and will continue to evolve. There can be several innovative formats – from being ‘pure digital’ or ‘pure traditional’, branches could end up being mixed models– where they offer the best of both. For instance, a ‘single-employee’ branch model could work (especially for smaller coverage areas) where most services would be digital, but a person would always be available for support and assistance. Bank branches are not going to totally disappear – but they are going to transform. Multi-formats would most certainly be the way ahead.

Here are two examples of co-existence strategies:

• New-age private bank IndusInd believes in the co-existence of the physical and virtual. Physical branches are essential to ‘on-board’ a customer and cross-sell a product, while virtual branches take care of the transactional needs of a customer by providing them the option of anytime and anywhere banking.

• DCB Bank has initiated an aggressive branch expansion drive. It plans to add 150 branches in two years, thus doubling its network. This bank believes that a physical footprint is essential to on-board customers and cross-sell new products. From a customer’s perspective, DCB believes that the physical branch’s presence provides a sense of reliability and trust, which is a key factor in banking.

“Bank branches are not going to totally disappear – but they are going to transform. Multi-formats would most certainly be the way ahead”

Subscribe to enjoy uninterrupted access