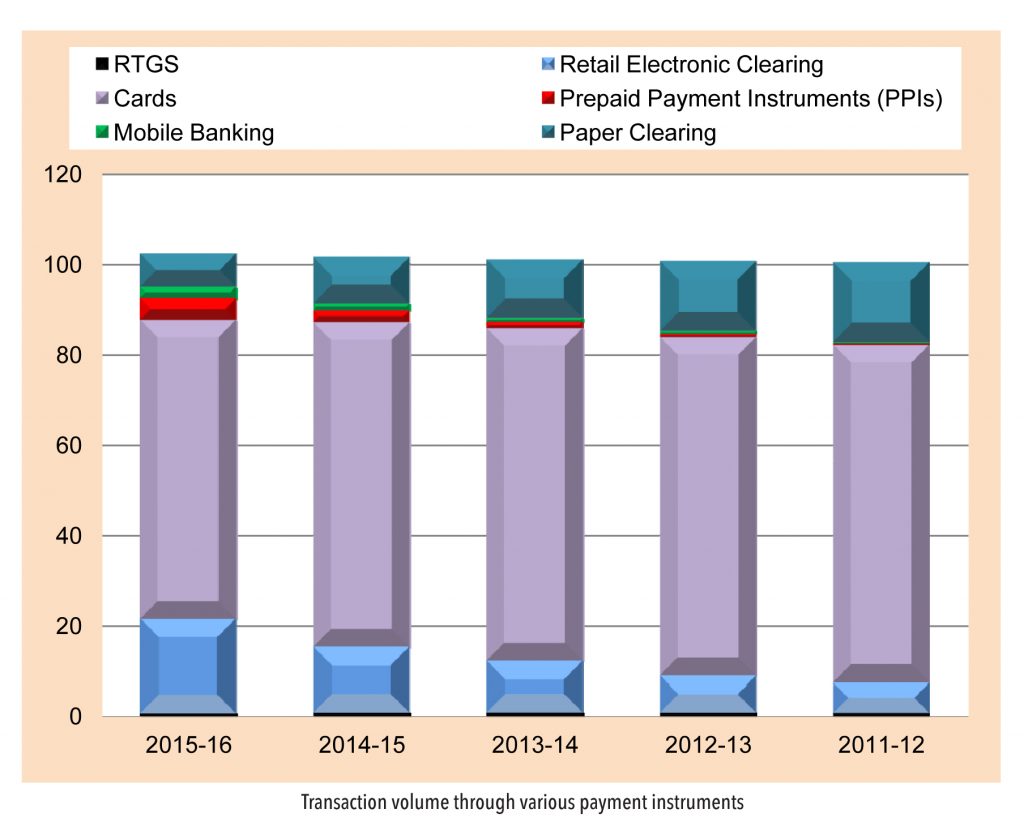

Safe, secure, sound, and efficient payment systems for the country have been the mission of every regulator. In order to expand the reach of the payment system and encourage product innovation, the Reserve Bank of India (RBI) established an umbrella organisation called National Payment Corporation of India (NPCI) in 2009 for all retail payment systems in India. There has been a shift in payment mode to clicks from cards – mainly due to new technology, improved IT infrastructure, and high smartphone penetration. Data indicates that the trend is towards paperless transactions.

The proportion of these (which includes retail electronic clearing, mobile banking, and prepaid payment instruments or PPIs)has increased rapidly to 28.1% in FY16 vs. just 7.4% in FY09. Paper-clearing and even the usage of cards are in a decline-mode. Within cards, the fall is mostly in debit card usage at ATMs largely because of increased acceptance of e-money by merchant establishment and efficient and secure payment systems. Emerging trends suggest that the proportion of mobile banking and PPI will increase significantly, largely substituting ATM transactions.

Payments are paramount

Payments dominate the average consumer’s banking relationship. Providing strong payment solutions (as a part of a larger strategy for digital banking) is imperative for banks. As per McKinsey’s report, the average customer interacts with his or her bank at least twice a day for payments-related matters, such as buying a financial product, checking on a payment, or paying a bill. These interactions represent more than 80% of customer interactions with the banks. Making an excellent payments platform is necessary for cross-selling other financial services.

Digital payments offer good solutions

Digital payments provide banks with a platform to boost fee and interest income, reach out to the underserved segment, and extend the value proposition.

• On the retail side: Mobile-payments solutions (mobile peer-to-peer (P2P) money transfers, international remittances, small-merchant mobile card readers) not only increase the frequency of consumer interactions but also boost the number of charged transactions and the cash flowing through the banking system (through prepaid, current accounts, and consumption-related lending).

• On the corporate side: Transaction banks that execute well on digital cross-selling can increase their market share of corporate deposits and lending. By tailoring payments solutions to the under-served segments (small and informal merchants, youth, international travellers, migrants, and low-income customers), banks can shift a bigger share of payments to bank-owned channels.

“Collaboration between banks and fin-tech companies would enrich customer experience while healthy competition is also necessary to evolve technology.”

Banks should leverage data

Banks own rich reserves of raw behavioural data. Mobile channels enhance this data pool with location and search data, which can provide valuable insights into future customer choices. Banks could leverage their data strengths to create new services along the full span of the consumer decision journey, reaching beyond payments transactions to manage their customers’ entire digital wallet (for example, by optimising loyalty awards and special offers, payments terms, and instruments). If banks cling to their traditional, narrow view of the payments ecosystem, fin-tech firms will not only take the additional revenues from these channels, but will also enjoy prime access to a customers’ ‘digital trail’, including essential transaction information and direct traffic to preferred service providers within the digital sphere.

Payment solutions have seen a sea change

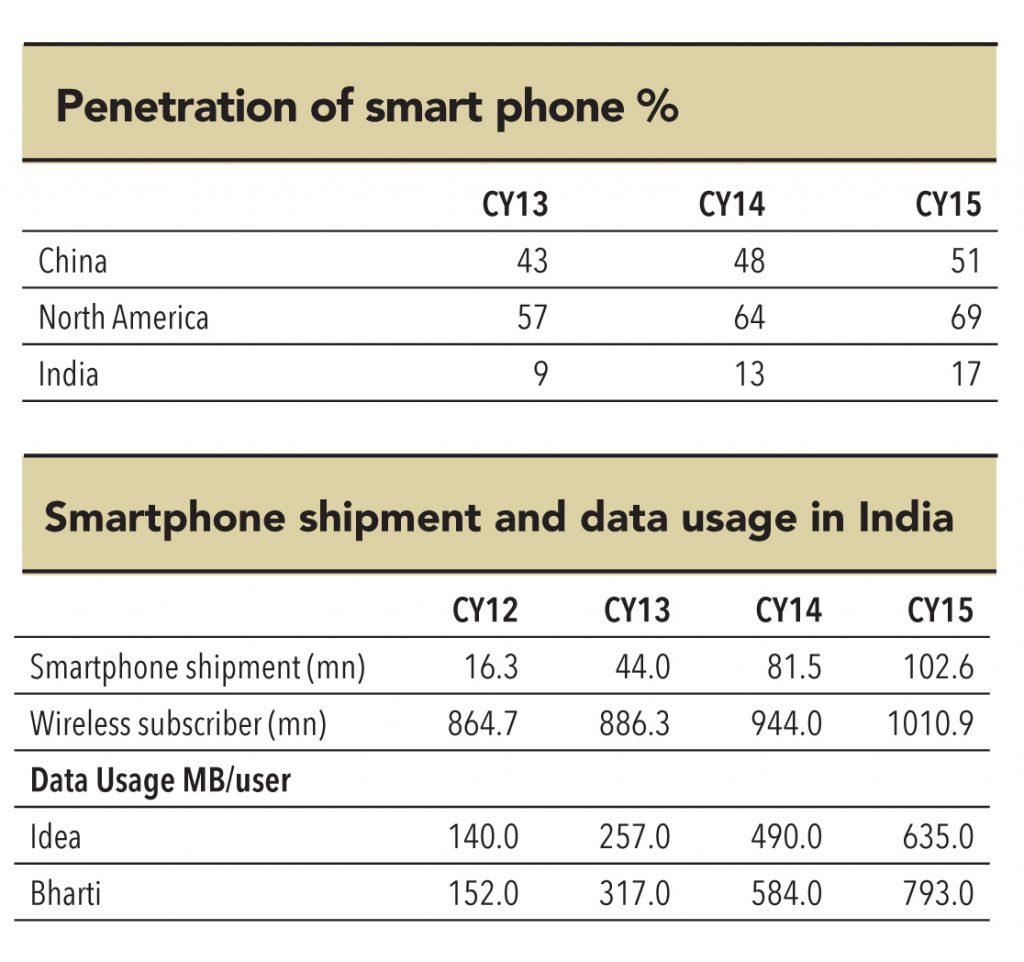

The Indian market has seen the advent of fin-tech companies – Paytm, Mobikwik, Oxigen, and Citrus Pay – and the market share of pre-paid payment instrument (PPIs) in total payment transactions in terms of volume has increased to 4.8% from virtually nothing five years ago. Increasing penetration of smartphones have increased customers’ expectations from their bankers – they demand efficient, safe, and cost-effective payment solutions. Realising the gravity of the situation, most banks now offer mobile and digital payments.

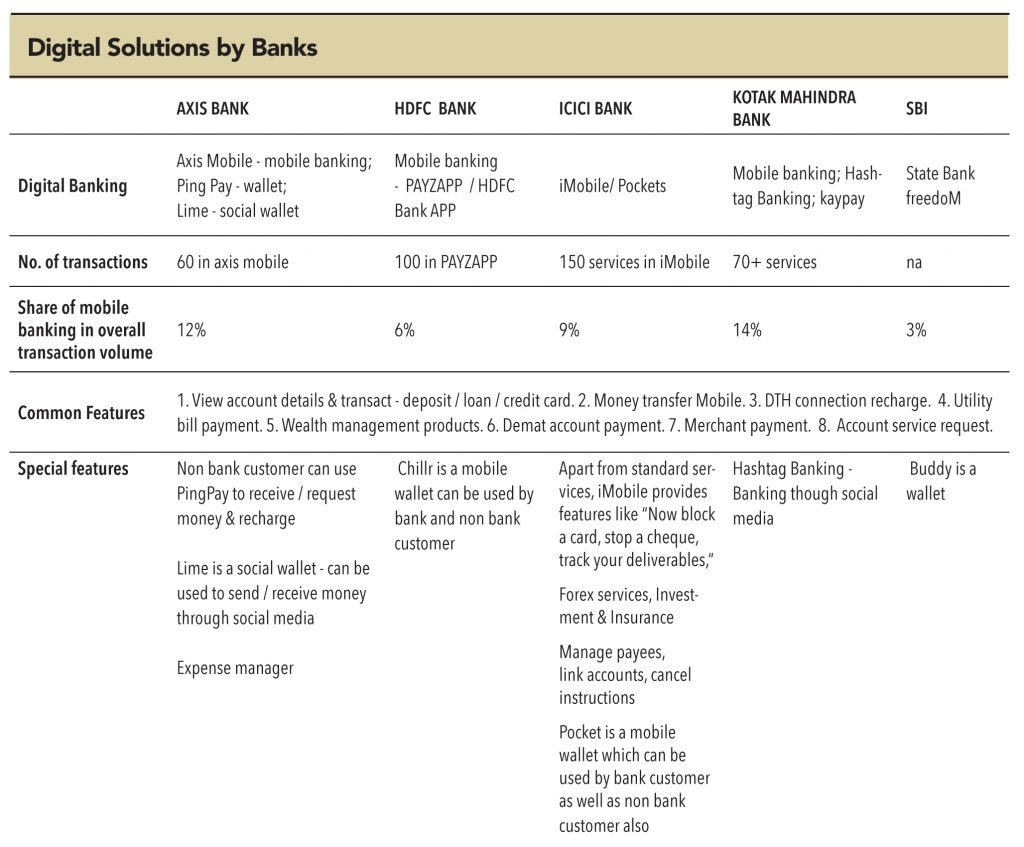

Private banks have initiated their digital banking transformation processes much ahead of their PSB peers. Today, the products and features offered by private banks are very much in line or even better than some of the products offered by fin-tech companies. Mobile banking commands close to double-digit share (10% of overall transactions) for private banks while for PSB giants such as SBI, it is just 3%. PSBs are definitely lagging behind in their digital initiatives – the share of mobile banking transactions is almost nil for PNB and BoI.

Not all is lost– cash is still king

At this point, not having a strong digital setup is not necessarily the worst thing in the world. Mr. PareshRajde (Chairman, Suvidha) pointed out in a GV conference that in India, only 8% of the population transacts electronically and the rest transacts in cash. Even for a developed country like the US, 50% of transactions still happen through cash. In India, around 90% of the population earns their livelihood in cash. Hence, self-service smartphone-based models cannot replace brick-and-mortar banking models entirely, at least not immediately.

To conclude, payment and remittance solutions provided by private banks in India – either through net, mobile, or phone banking platforms– are comparable to the best of fin-tech firms. These banks have either built technology or partnered with fin-tech firms. Moreover, NPCI’s unified payment interface (UPI) platform is all set to provide a payment solution based on a virtual address, thus overcoming the need for cumbersome bank account numbers or IFSC codes. Mr Rajesh Prashad (Head, Rupay – NPCI) believes that card transactions will continue in India for some more time,even though people are moving to mobile technology.

Multiple payment technologies will coexist, as India is a diverse market with different customer segments. Cash transactions have not been completely replaced by cards, even in the most advanced countries. There will be enough space and opportunity for different players – whether it is mobile wallets, payment banks, or a universal bank.

Unified payment interface can be a challenge to mobile wallets

National Payment Corporation of India (NCPI) is set to make transactions easier by introducing the Unified Payments Interface (UPI). This interface will allow a user to transfer money to another user in a single step. UPI users will not need to use their credit/debit cards or net-banking credentials to make/authenticate payments through UPIs. Instead, users will be able to transact on the UPI platform using a virtual address. A mobile-pin will then be needed to authenticate the transactions. There is NO separate or special app for UPI. It will be an update to existing net banking apps of banks that would provide UPI services. Initially, banks will be allowed to provide UPI services through its net banking apps, but based on that experience, PPIs may be included in the UPI ecosystem.

There is lot of debate about survival of wallets with the advent of UPI services. Mr YadvendraTyagi (Director Business development, Citrus) says that the unified payment interface will actually help wallets, as customers across banking channels would be able to use them. However, their survival would depend on the product quality and customer experience. The survival of a ‘wallet’ company would be at risk if its business model is based around only money transfers. Fin-tech companies that are building their business model around payment solutions

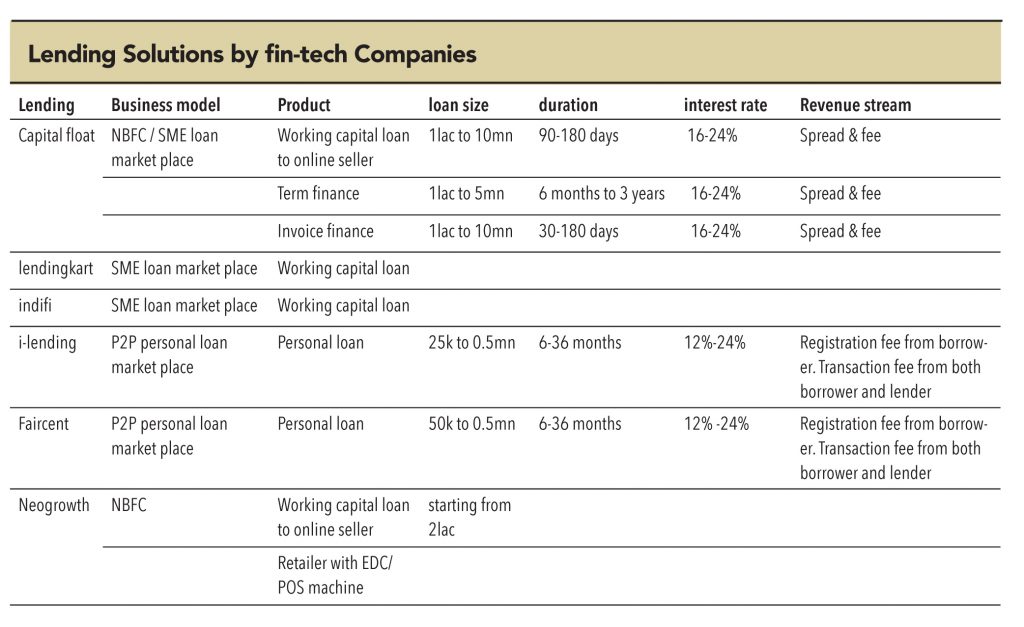

Customers have taken to digital channels like ducks to water, compelling financial institutions to provide the convenience of anywhere, anytime banking. While digitisation has transformed transactional banking, it has not made as big a mark in lending. This has led to the rise of many online lending companies and non-bank lenders (Lendingkart, Indifi, Iending, Faircent, and New growth) that capitalise on the inefficient lending process of banks.

The growth of these companies also demonstrates that customers are looking for more convenience, which digitisation can provide. The significant rise of non-bank lenders has led banks to invest more in digital technology, and form partnerships with them to retain their positions as leading operators in the lending market. Fin-techs are increasingly gaining legitimacy, even with regulators, and are expected to gradually gain customer trust.

The unique selling propositions of fin-tech companies include:

Lending game-changers

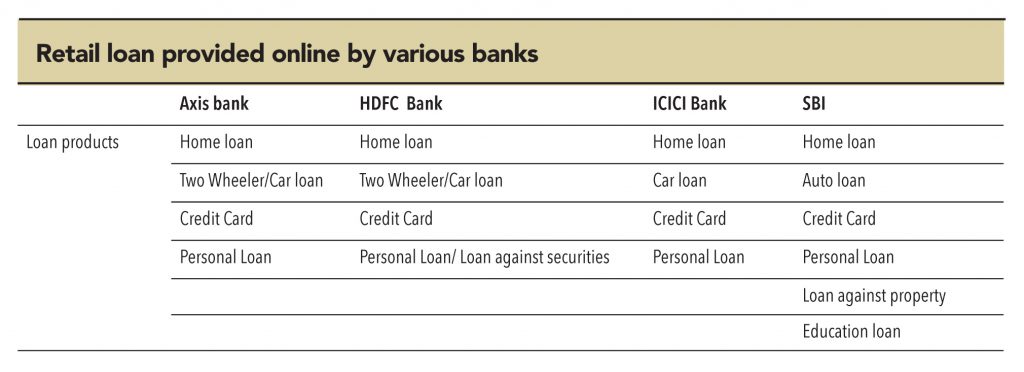

The size of fin-tech companies in the Indian lending market may be insignificant, but the offerings they have are noteworthy. Going forward, these offerings could be game changers. NBFCs have already adopted this changing face of lending into their operations. Even banks have started disbursing some of their retail products online, which offer twin benefits of convenience to customers and lower underwriting costs for the lender. Incrementally, more than 50% of personal loans and credit cards are disbursed online and the underwriting costs are 70-80% lower than branch banking. Even the turnaround time has dropped – to a few hours from a few days in the past.

Non-traditional data gathering

Consumer behaviour and marketing analytics are driving a sustainable competitive advantage in an era of eroding product differentiation, waning customer loyalty, and exploding volume and variety of data. Apart from pulling data from traditional sources such as civil data, bank statements, and verification, fin-tech companies are also gathering data in non-traditional ways – such as shopping patterns, academic records, and online footprints. Such data is going to make credit decisions more mainstream; banks will embrace this approach soon.

Fin-tech companies believe in symbiosis

Most fin-tech companies and banks in India do not believe the disruption theory. They believe that banks and fin-tech companies need each other’s support to encourage product innovation and provide commercially viable solutions to customers.

• Banks need fin-tech companies to improve product delivery and customer experience, and enable them to not only manage increasing compliance costs, but also the risk of non-compliance.

• Fin-tech companies need banks for better customer understanding, to manage regulatory risks, and to support continuous innovation.

Mr K A Babu (Head Digital Banking, Federal Bank) calls his bank’s digital strategy 3As – Anywhere-Anytime-Any Device. He views digitisation as not just a cost-saving strategy, but also as a new revenue stream. He believes that in order to innovate, banks will collaborate with fin-tech companies and even invest in some of them in a quest to innovate.

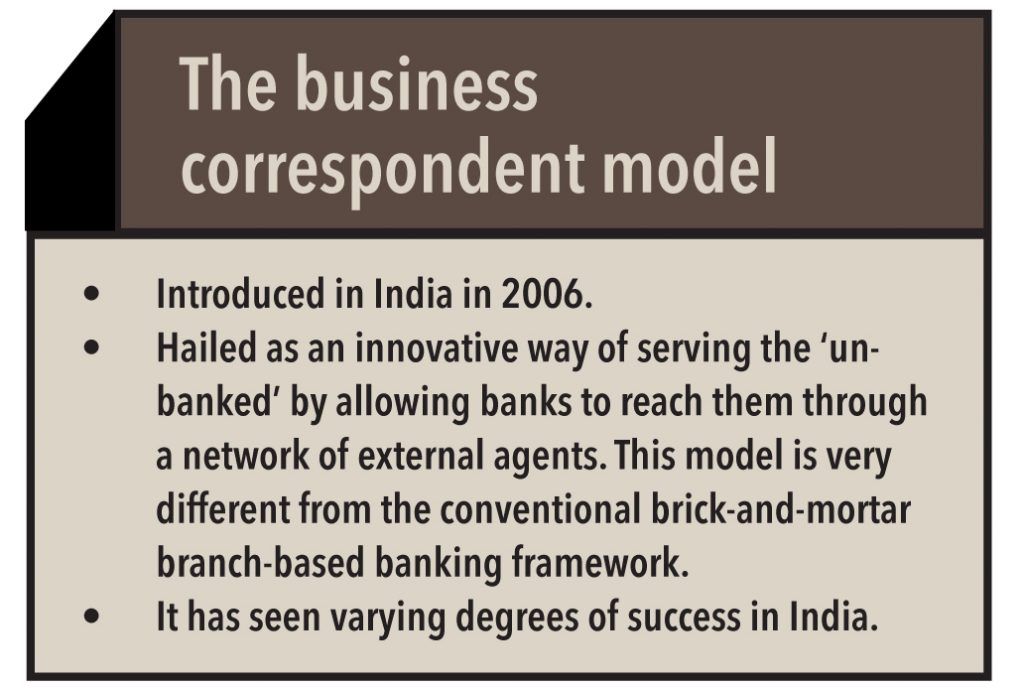

The growing influence of technology provides a secure, efficient, and cost-effective solution to the financial world. The much talked-about ‘underserved’ segment at the bottom of the pyramid is still excluded from formal banking channels as costs do not justify returns – the mathematics of high product-delivery costs and low volumes makes the risk-reward unfavourable. This model can provide strong competition to micro-finance businesses, where lending rates are very high. In fact, banks are exploring this opportunity in a big way, as the yields in traditional banking products are continuously under pressure. The business-correspondent-assisted unsecured loan distribution may not steal a large chunk of the micro-finance market, but will result in margin compression, which can be negative for micro finance businesses. Data analytics and customer’s financial transaction behaviour provides insights into business opportunities for loan products. Technology assistance can improve banks’ outreach to hinterlands and create disruption in some of the established models such as micro finance.

“Average cost of each transaction at a branch is around Rs 60 while with self-service it is as low as Rs 10”

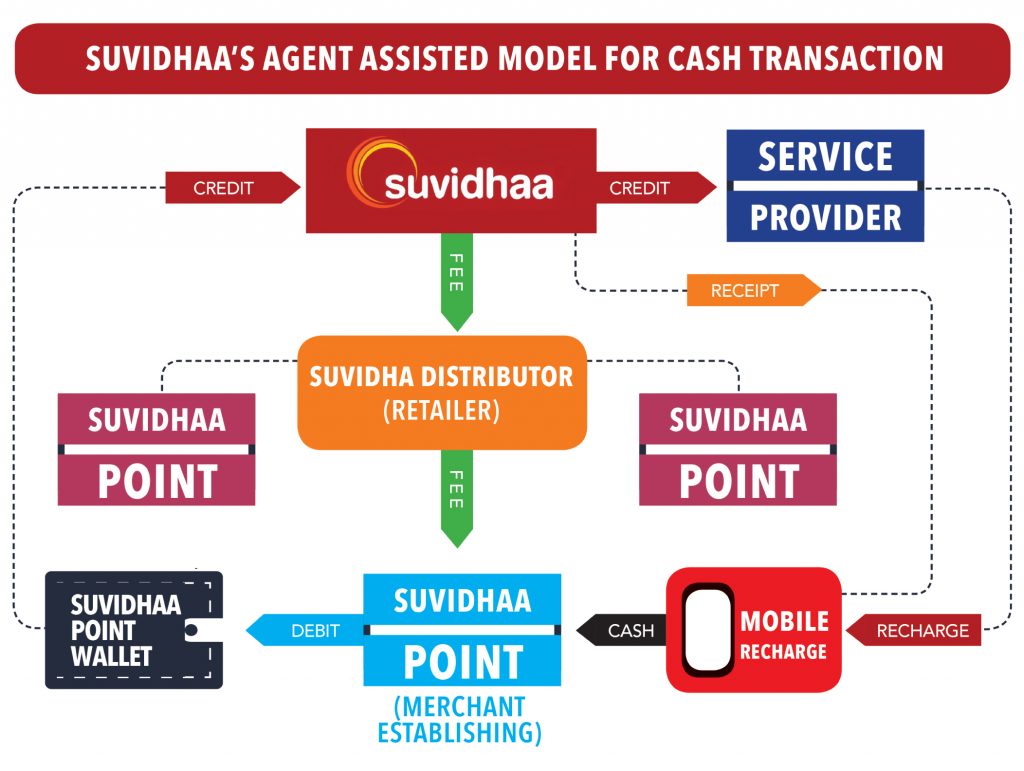

Suvidhaa

Suvidhaa, a PPI, acts as a business correspondent for loan products for some large banks such as Axis Bank. Its Chairman, Mr Paresh Rajde, strongly advocates a collaborative approach with banks, which can revolutionise loan products for the underserved. This model provides last-mile connectivity through the agent-assisted model. Strong customer database and state-of-the-art technology helps to underwrite unsecured loan products much faster.

Sahaj

Just like Suvidhaa, Sahaj (an associate company of Srei Infrastructure) provides digital services to rural India through its 6,344 IT-backed common service centres (CSC) across West Bengal, Bihar, Odisha, Assam, Uttar Pradesh and Tamil Nadu.Sahaj’s aim is financial inclusion; about 696 of its CSCs act as business correspondents for banks.

Deposits and borrowings are any banks’ raw material and a strong franchise in these determines its ability to withstand competition. Providing a strong payments plan, as part of a comprehensive strategy for digital banking, is therefore an imperative for any efficient and cost-effective deposit franchisee.

Three factors have driven CASA growth of late – electronic payments, internet banking, and cards. The next wave of growth will be driven by mobile banking. Banks have embraced digitisation in their deposit products very well. Opening a savings account, to transactions in deposit accounts anytime, anywhere is a reality. Demand from customers for anytime anywhere banking has necessitated the inclusion of self-service features in a deposit account, which has tremendously increased branch productivity and reduced costs. As per Federal bank, the average cost of each transaction at a branch is around Rs 60 while with self-service (internet,mobile,or phone banking), it is as low as Rs10. As per State Bank of India, “A mobile banking transaction costs about 2% of the bank branching cost, 10% of ATM-based transaction and 50% of the Internet banking cost”

Important question –do banks require so many branches?

Branches are vital touch points for customers. It acts as a point to on-board the customer, cross-sell new products, and provides a sense of reliability to the customer. Globally too, there are contrasting examples – banks follow varied strategies when it comes to building customer touch-points. On one end of the spectrum we have banks like Atom and Fidor, whose strategy is branchless banking; on the other, we have examples of Wells Fargo in the USA, which believes in the coexistence of both formats, even in a country where financial literacy is much higher. In the Indian context, banking penetration is still underdeveloped, customer ignorance about financial product is high, and physical presence provides a great sense of reliability. In such a scenario, coexistence of branch and digitisation seems to be an ideal strategy, especially for mid- to small-sized banks.

“Banks run the risk of becoming redundant if they do not adopt new technology”

As the banking industry goes through a digital evolution, there is a great shift in the way services are rendered to the customers. From only branch banking at brick-and-mortar locations, banks are now transforming to a digital platform in order to save on personnel and infrastructure costs and to reduce reliance on service staff.

In the US, large banks were, up until recently, consciously reducing the number and size of their branches, as they were adapting to the changing behaviour of their customers, who started increasingly using digital channels for banking. Despite large banks such as Bank of America, Merrill Lynch, JP Morgan Chase, and HSBC rationalising and reducing their branches, recent Federal Deposit Insurance corporation (FDIC) data reveals that per-capita number of branches in the US have actually been growing, given that these large banks are setting up branches in unrepresented metropolitan cities. This is in contrast to the generic view that digitisation in the financial services industry would make branch-banking services redundant.

Wells Fargo’s balanced strategy, based on data

This San Francisco-based giant believes that banks need to leverage on branch-banking services along with digital channels in order to effectively reach out to customers and increase the effectiveness of financial inclusion. Wells Fargo is trying to achieve this by integrating technology between branches, mobiles, online banking apps, ATMs, and call centres.

Wells Fargo holds the view that branch banking continues to be an integral part of the services value-chain. In order to make rational decisions about branch expansion, it has been continuously monitoring data related to traffic/footfalls and branch performance. This data suggests that in any given six months, 75% of its customers visit a branch; this shows that branches continue to add value to the overall banking experience. Another interesting aspect of these footfalls is that a large chunk of them are from ‘millennials’, who are usually perceived to be tech savvy; but apparently, they still visit branches to initiate their financial relationship with the bank. Most of its competitors have been encouraging their customers to open an account through mobile applications, but Wells Fargo has a neutral approach as 85% of its new account sales have been through branches.

Wells Fargo builds and refines its digital channels and uses them in conjunction with branch banking. It does not treat this as an ‘alternate’ platform. For example, the bank provides its branch employees with tablets, which communicate with nearby ATMs – the purpose of this is to serve customers in case they run into any problem while transacting at the ATM. Although customers have been using the digital channel for banking, branches continue to play a pivotal role in rendering the entire range of services.

Neo-banking surges ahead

The banking space is now seeing a remarkable transformation in terms of neo-banking, in which banks are just a click away, as there are no brick-and-mortar locations. One of the key driving forces for neo banking would be tech-savvy customers who prefer not to visit branches, a higher number of millennials in the customer composition, and greater penetration of smart devices. Neo-banking aims to simplify online transactions, while reducing overhead costs and passing on these benefits to customers in the form of lower interest rates or lower fee charges. On the flip side, neo-banking poses few challenges in terms of large complex transactions, which may require to be carried out through a branch, which neo banks do not have.

Atom Bank is an example of a revolution in the banking industry and it is challenging the conventional set up of existing banks. The bank received its license in June 2015 and became UK’s first bank to operate completely through mobiles. The bank has already introduced residential mortgages and by the end of 2016, it will roll out more products such as fixed savings, current accounts, overdrafts, and debit and credit cards in a phased manner, which will all be serviced through the app.

Another example of newbanks is Fidor Bank in Germany, which redefines traditional banking from the ground up. Started from scratch, it aims to provide a truly innovative and differentiating customer experience that offers a comprehensive suite of financial products and services by owning the entire infrastructure. The bank adheres to two main principles of financial innovation: openness and community. Openness is the flexibility and agility that enables banks to create an extensive ecosystem of partners and capabilities, while also leveraging APIs to develop differentiating applications. Community is about bringing users together and solidifying a bond between the bank and its customers, as well as between customers themselves.

The bank is the primary entity in the Fidor Group, which holds two additional entities: FidorTecS and Fidor Payment Services. FidorTecS is the development branch of Fidor Group, developing, implementing, and maintaining the fidorOS platform and its library of APIs. It employs around 30 developers and has been a standalone organisation under Fidor Bank since 2013. Fidor Payment Services, as a strategic business unit within Fidor Bank, provides payment services for more than 40 payment methods worldwide. It is the exclusive enabler of Fidor payment products and transaction business. FidorPays leverages the network to allow users to make payments between accounts, transact with ‘crypto-currency’, and make real-time payments across the globe.

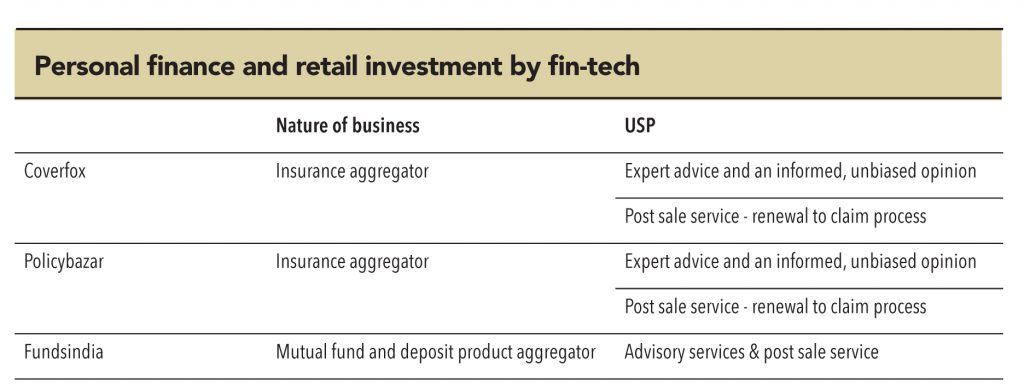

Higher customer expectations, unsatisfactory wealth management services from banks, poor after-sale services, and lack of expertise has warranted the need for a specialised wealth manager. Globally, financial services saw de-bundling due to a need for specialisation. This led to grooming of wealth management fin-tech companies in India such as Policy Bazar, Coverfox, FundsIndia and Scripbox.

Wealth and asset managers have, so far, enjoyed a level of insulation from fin-tech disruption due to two key factors – first, wealth and asset managers operate in a highly regulated, formal market. As regulators apply continued pressure on increasing fee transparency across the industry, organisations with higher operating costs will become less attractive to consumers. Winners will be wealth managers who are adaptable, agile, and have low-cost models. Wealth management products are ‘push products’ where customer interaction is quite essential. A mere digital platform may not suffice in a market like India. Moreover, the penetration level of life insurance is just 3.9% and share of mutual funds / equity funds is just 2.7% of household savings.

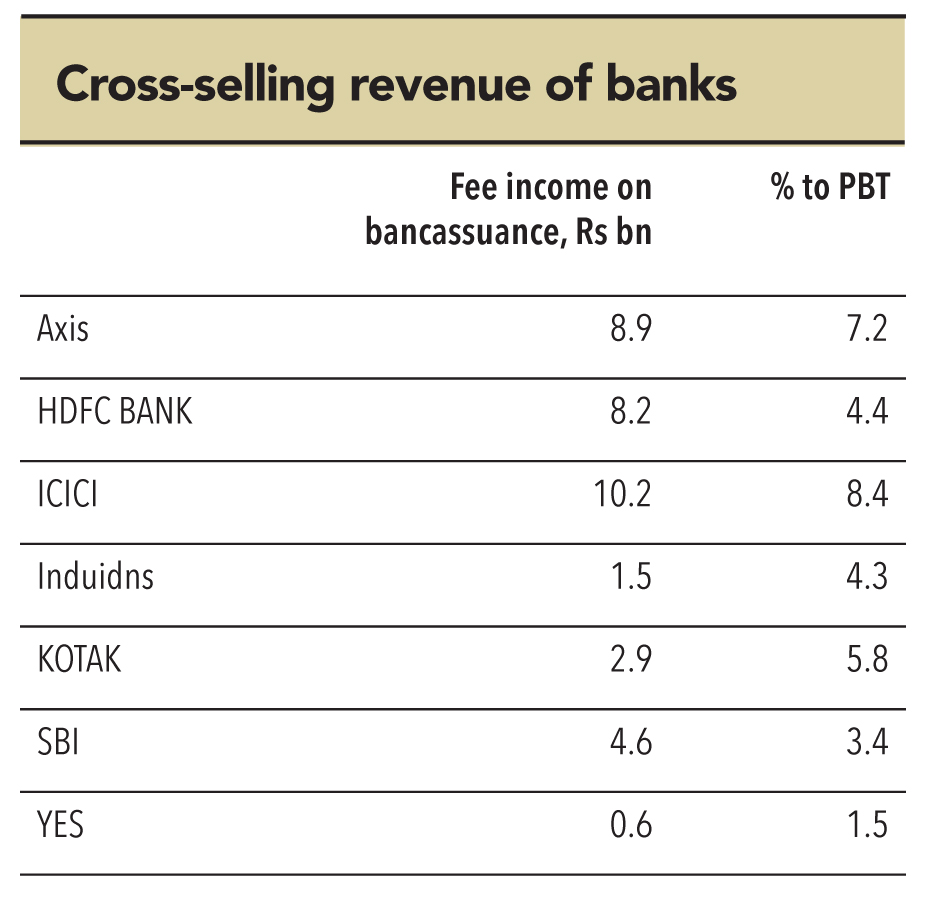

It is too early for fin-tech companies to disrupt banks’ wealth management businesses. The greatest likelihood in the near-term is the southward movement in fees and commissions on these products. Wealth management and cross-selling account for 5% of profit before tax for private banks. Falling rates may force banks to look out for more cost-effective alternate models to remain relevant. Banks that rely heavily on cross-selling as part of their overall fee, could have a tough time.

Subscribe to enjoy uninterrupted access