Although the Indian healthcare services industry, particularly hospitals, has come a long way (by building quality infrastructure, world-class services at affordable rates, and attracting global patients), its growth has always remained under check despite huge prevailing demand. The capital-intensive nature of the business, lower margins, and lesser flexibility to expand into small towns hinders the growth of the organised hospital industry.

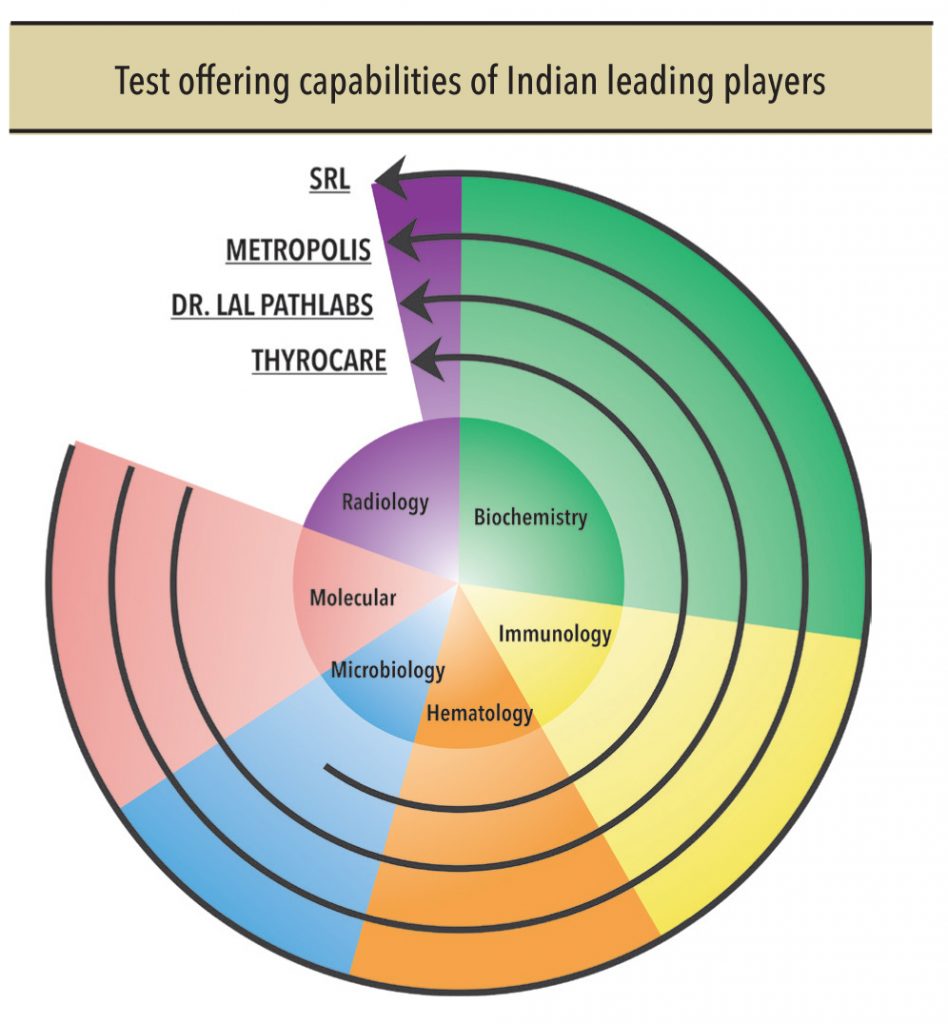

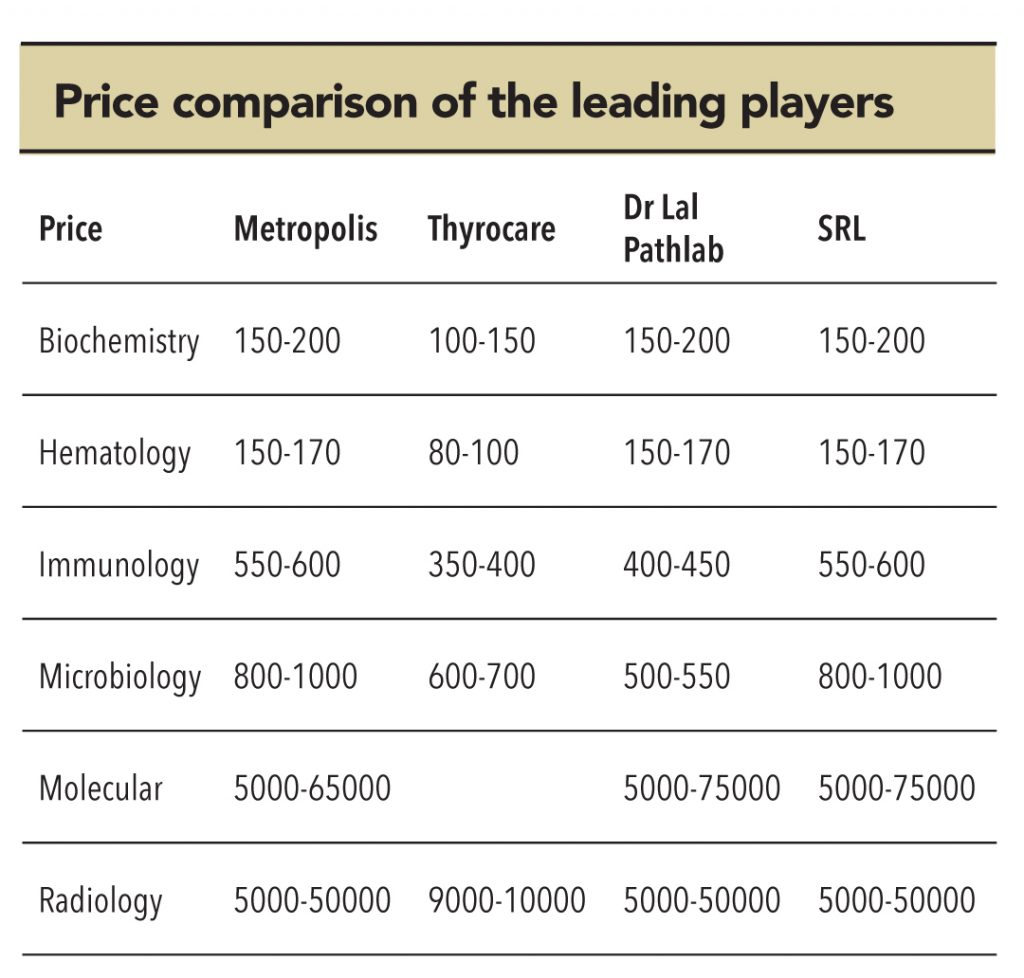

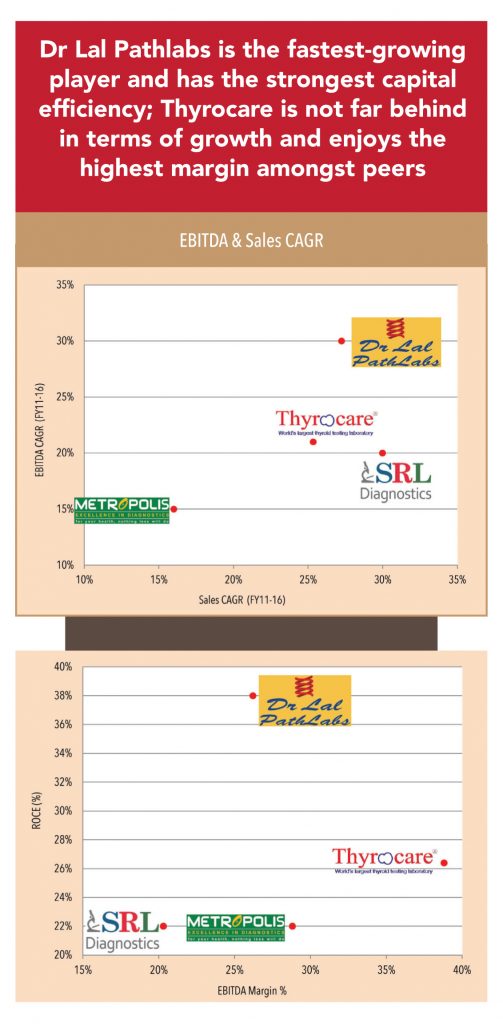

However, the diagnostic industry does not suffer from many of these constraints. It has emerged as the fastest-growing segment of the Indian healthcare industry, supported by strong capital efficiency (because of higher margins and healthy asset turnover) and its flexibility in expanding to the country’s interiors (sometimes even outside India) with a minimal capital spend. The conducive macro environment (under-penetration of diagnostics services with lower tests per patients, ageing population, changing disease profile to chronic lifestyle-related illness, and more importantly, the transition of the Indian industry towards becoming organised) provides enough visibility for long-term sustainable profitable growth. Its operational and financial soundness makes the Indian diagnostic industry a superior investment avenue. However, the limitations of the Indian diagnostics industry as an investment avenue is its relatively smaller base compared to hospitals.

Its operational and financial soundness makes the Indian diagnostics industry a superior investment avenue

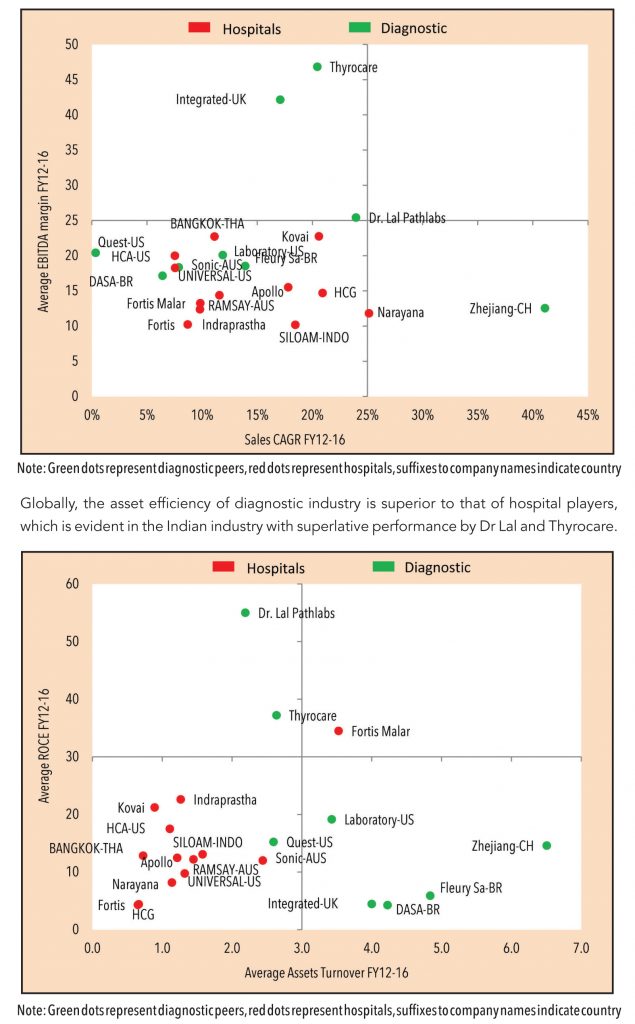

Globally the diagnostics industry proved to be superior compared to the hospitals both operationally as well as financially

Likewise in other geographies, Indian diagnostic peers outperform the hospital industry both in terms of sales growth and earning efficiency.

As far as secondary investments in Indian diagnostics are concerned, there are only limited options available including Dr Lal PathLabs, Thyrocare and Fortis Malar hospitals (SRL’s diagnostic business is proposed to be regrouped as per Fortis Healthcare’s business restructuring). Hence, led by visible long-term growth and limited investment options,these listed players will continue to enjoy premium valuations for long.

Because of the limited investment opportunity in the secondary market and fragmented nature of the Indian industry (larger share of unorganised players) the Indian diagnostic market will remain a hot investment destination

for private equity and venture capital.

In this context , Mr Abhishek P Singh, Ex-Director, PWC says, “Although the Indian diagnostic market looks very lucrative as an investment destination for private equity and venture capital, there are limited quality investment avenues available.In its early stage of progress, the domestic industry will test all possible ways to expand — either through PE/VC funding or M&As or partnerships or diversification into more complex tests.”

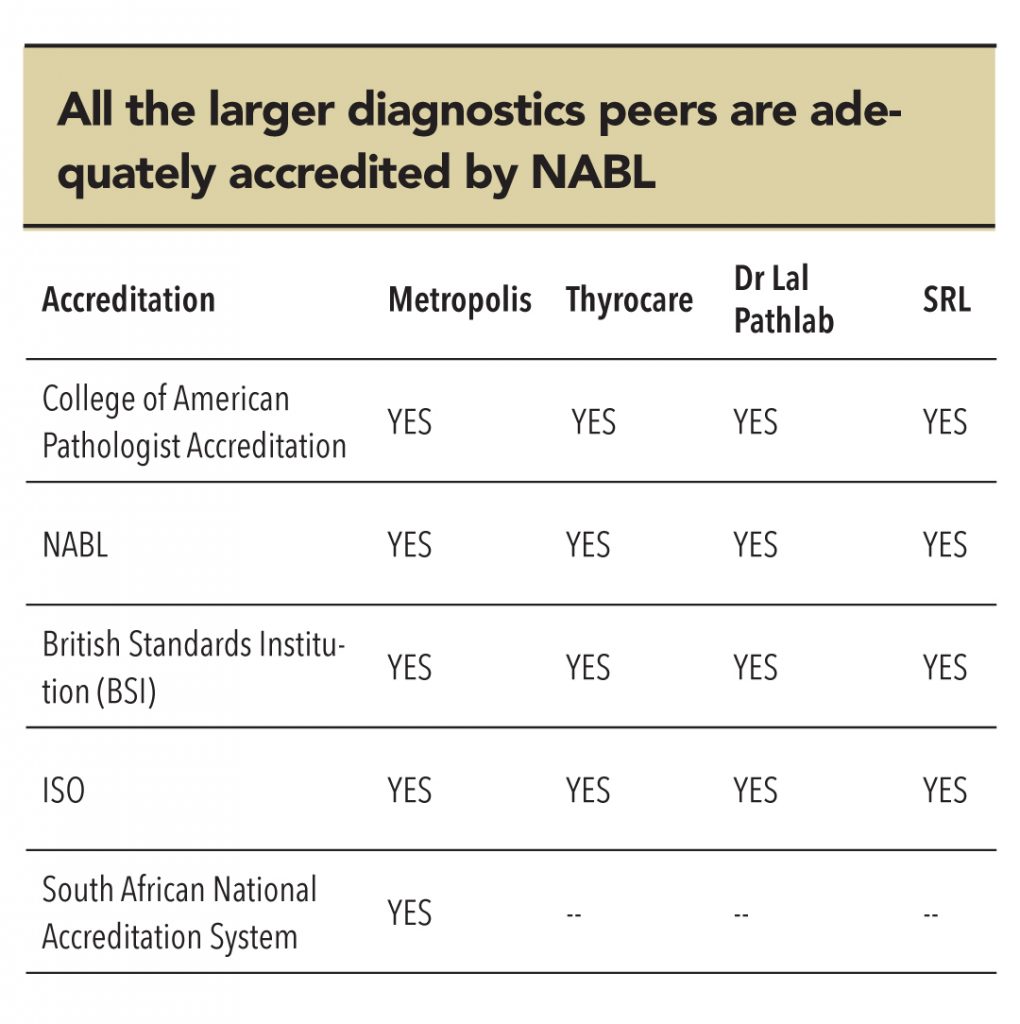

Leveraging NABL’s mutual recognition arrangements

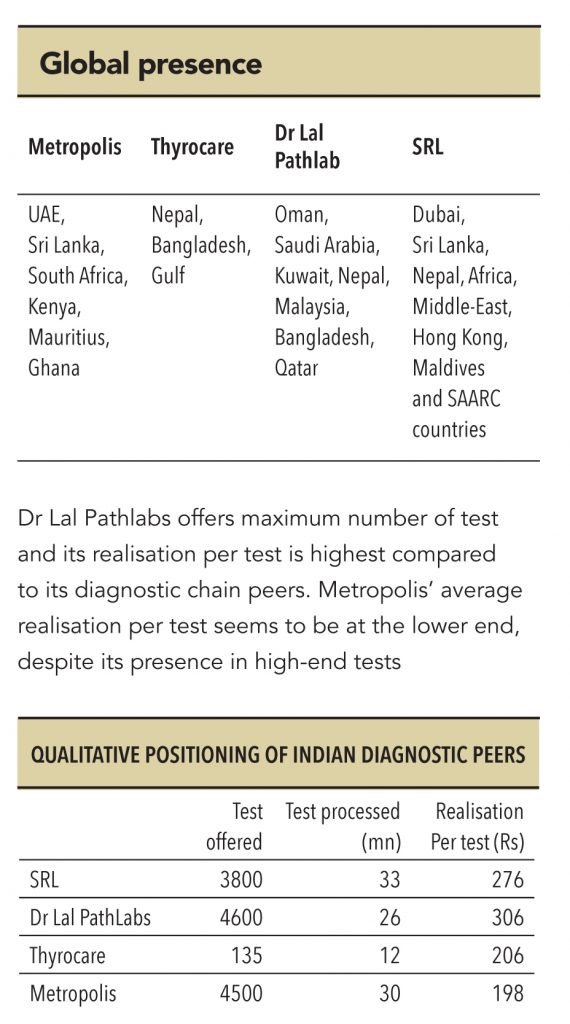

(MRA) with the international bodies like International

Laboratory Accreditation Co-operation (ILAC) and Asia Pacific Laboratory Accreditation Co-operation (APLAC), Indian diagnostic peers expanded their geographical reach in various emerging markets. In fact, NABL’s MRA facilitate acceptance of test/ calibration results between partner countries.

Subscribe to enjoy uninterrupted access