In spite of visibly higher demand for healthcare services (including diagnostics), India’s healthcare sector falls well below international benchmarks (in terms of physical infrastructure and manpower), and is below the standards of even comparable developing countries. In order to meet the growing demand for healthcare services, which require huge investment, contributions from private sector (foreign and domestic) were envisaged by private equity (PE) investors. In fact, private equity (PE) investments have always been perceived as a magic wand for the transformation of any under-developed industry into an advanced one with modern infrastructure. While growth and profitability remain primary goals of the PE industry, its contribution to economic development is undeniable.

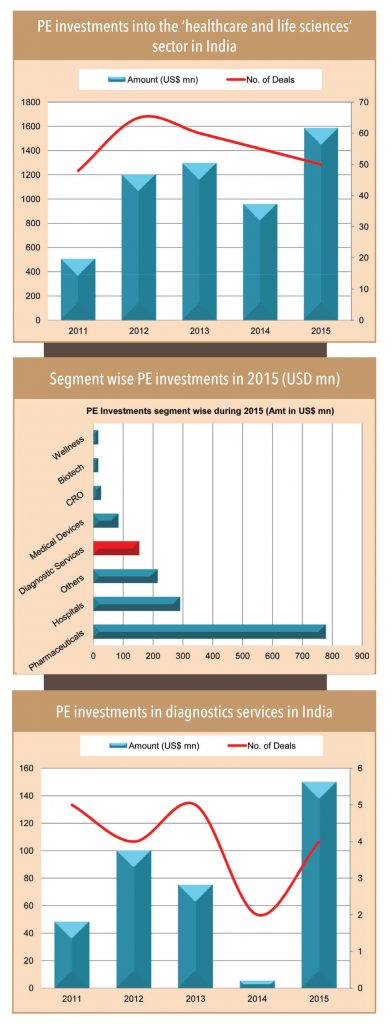

As per Venture Intelligence, PE investments into the `healthcare and life sciences’ sector in India touched a record high of US$ 1.59bn in 2015 (across 50 deals), 22% higher than the previous high of US$ 1.29bn (across 60 deals) recorded in 2013, and a whopping 66% higher than the US$ 957mn (across 55 deals) in 2014. Over last five years, PE investment in India has seen 33% CAGR. India PE investments into diagnostics were ~10% of total investments in healthcare and life sciences. Given the highly fragmented nature of the Indian diagnostics market (organised players hold only 15% market share), PE funding could play an instrumental role in overall growth of the domestic industry.

Over the last five years, PE investments in India have seen 33% CAGR; such investments into diagnostics were ~10% of total investments in healthcare and life sciences

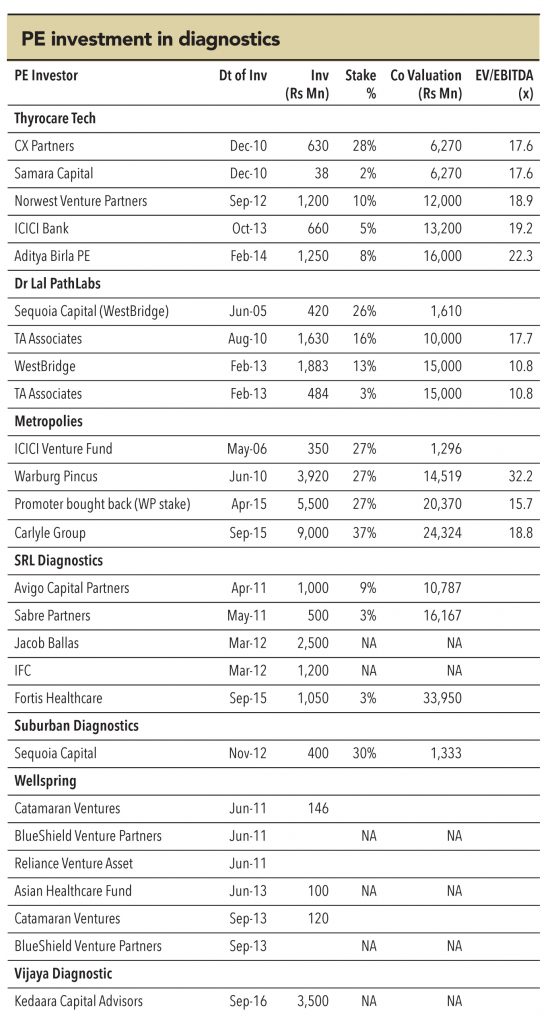

Over last few years, organised players such as Metropolis, Dr Lal PathLabs, SRL, Thyrocare, Wellspring, and Vijay Diagnostics have received PE funding to the tune of Rs 28bn in multiple rounds. Supplemented by such funding, these chains really emerged from nowhere into prominence in just a few years, and their valuations multiplied. Few industry experts perceive this as a `valuation game’ – which has been the case in e-commerce up until now.

Ms Radhi Mehta, Vice-President, MDI Laboratories (one of the advanced diagnostic chains that have a collaboration with German Laboratories MDI) believes that the increasing price completion and simultaneous spike in equity valuations after rounds of PE funding is purely a valuation game.

However, a closer look at the details of PE funding into large diagnostic chains suggests that their valuation increased because of the expansion in their businesses after the funding. For example, Thyrocare’s implied valuation increased 2.5x over FY11-14 after it received funding from CX Partners (valued at Rs 6.27bn) in December 2010 and from Aditya Birla PE in February 2014 (at a valuation of Rs 16bn). During the same period, Thyrocare’s revenue and profit multiplied 2x. Similarly, Dr Lal’s implied valuation increased 1.5x between two tranches of PE funding (TA Associates in FY11 and FY13) while its revenue and profits saw 1.9x expansion in the same period.

An increase in the number of comparable diagnostic healthcare facilities may exert additional pricing pressure on some or all diagnostics service providers

PEs to supplement rapid progress of the organised market

PE funding has provided financial flexibility to organised diagnostics chains for expanding their franchisee network into tier-2 and tier-3 cities, strengthening of processing capabilities (particularly in automating sample processing), and for brand creation. These together strengthened their scale and earnings efficiency vs. the unorganised market.

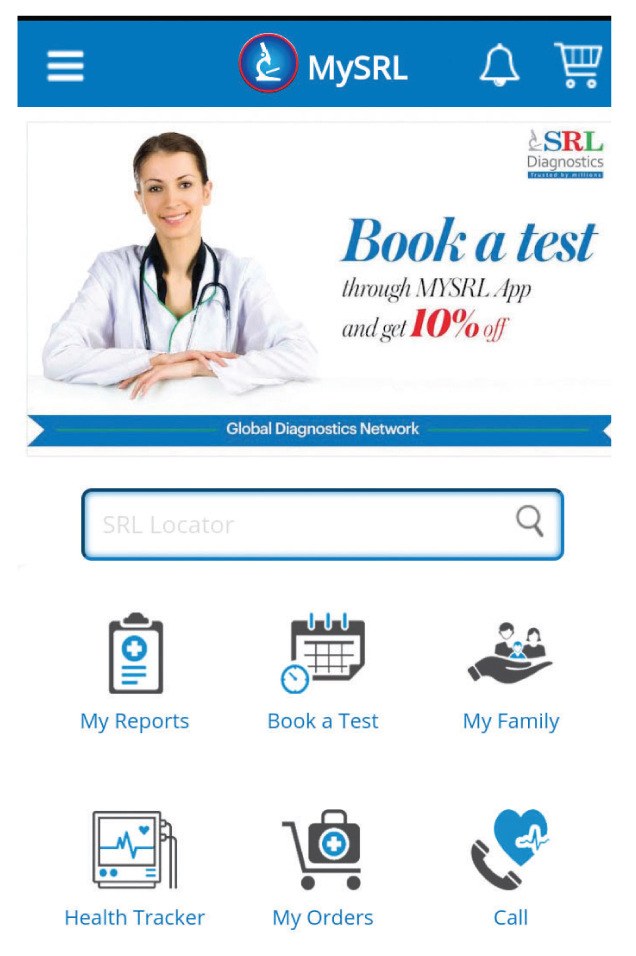

While the steady flow of investments into the Indian diagnostics industry strengthened its capability (in terms of technological advancement and automation), it also intensified competition in the industry meaningfully. The level of competition among organised chains is visible from their initiatives towards brand creation and in their promotional offers.

Thyrocare, whose business strategy is attaining scale benefits through extended geographical reach, has used print and digital media (both TV, Radio, and 3000 theatre screens across India) for creating awareness about its brand across the country through its advertising slogan – “Think Thyroid, Think Thyrocare”. Similarly, in order to boost its key focus area of “preventive healthcare” (which so far was largely targeted at the educated urban mass), Thyrocare appropriately uses online advertising. This is evident from the fact that if one searches for Thyocare on Google, the results reflects its diagnostic package offerings first, its main website, and three of its nearest franchisees. This shows its branding focus. On the other hand, Metropolis and Dr Lal are relatively slow to advertise, and try to create brand equity among doctors through high-end test offerings (such as molecular tests).

Many diagnostic chains use promotional offers for brand creation. An increase in the number of comparable diagnostic healthcare facilities may exert additional pricing pressure on some or all diagnostics service providers. However, such developments are more likely to supplement the transition of the Indian diagnostics industry to a systemic organized play more from an unorganized play. Thus, PE funding helps the Indian diagnostics industry to achieve its self-actualisation with quality services in a more organised manner.

About brand creation led by promotional offers, Ms Radhi Mehta, Vice-President, MDI Laboratories says, “Rather than discounts and promotional offers, it is the accuracy and authenticity of test reports as well as the ability of the lab to resolve the queries of referring doctors on test reports in a timely manner that play a important roles in brand building.“

Subscribe to enjoy uninterrupted access