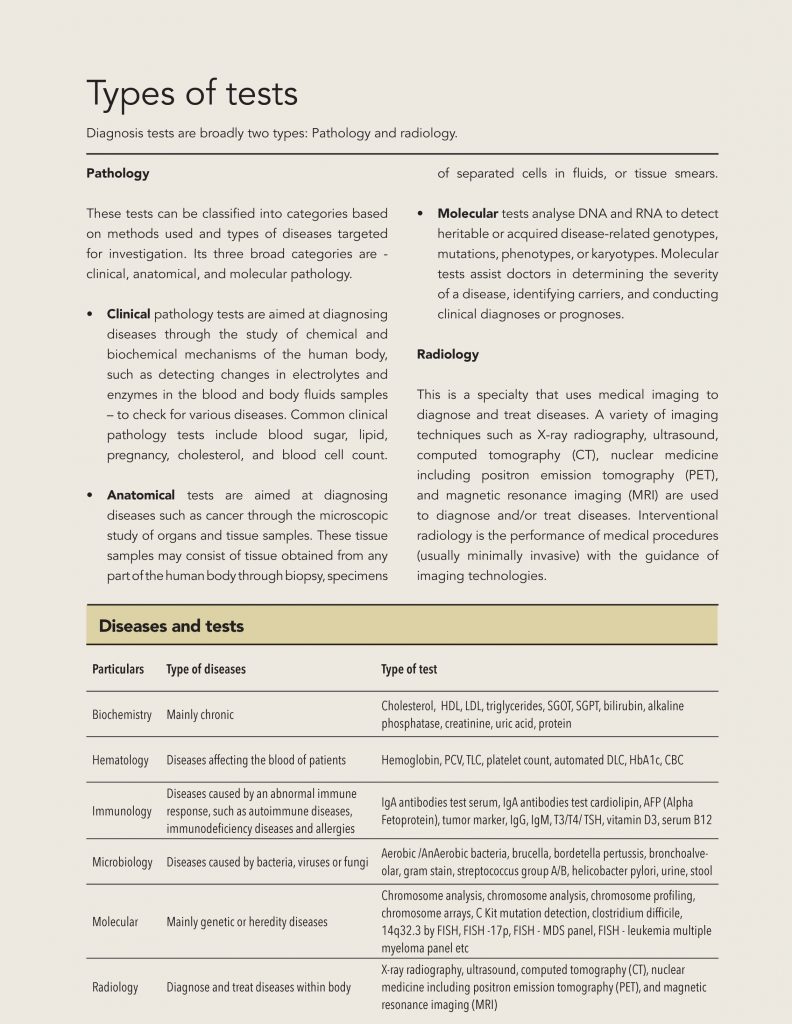

Even as there is limited awareness about overall healthcare or diagnostic tests in India, claims by various laboratories or diagnostic chains about the number and type of tests they offer is mind-boggling – sounds like a marketing gimmick. Among large organised chains, Dr Lal PathLabs offer the highest number of tests at about 4,600, followed by Metropolis, which offers 4,500, and SRL at 3,800; Thyrocare brings up the rear at a much lesser 135. While the huge number of tests offered can make things confusing, diagnostics tests can broadly be categorised under: Biochemistry, Hematology, Immunology, Microbiology, Molecular, Radiology

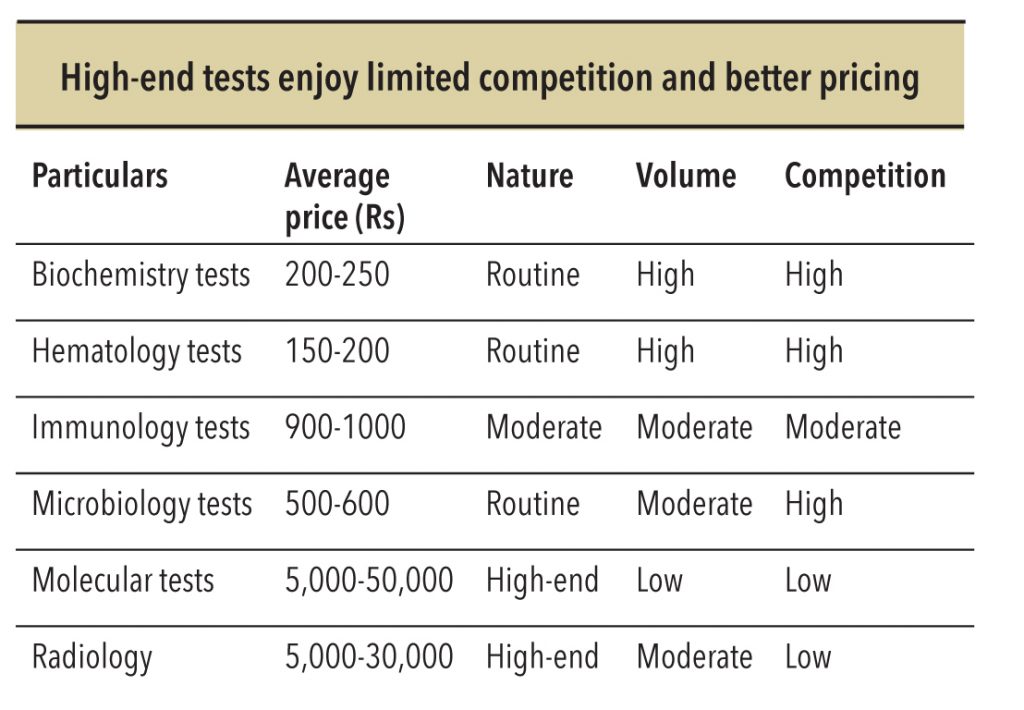

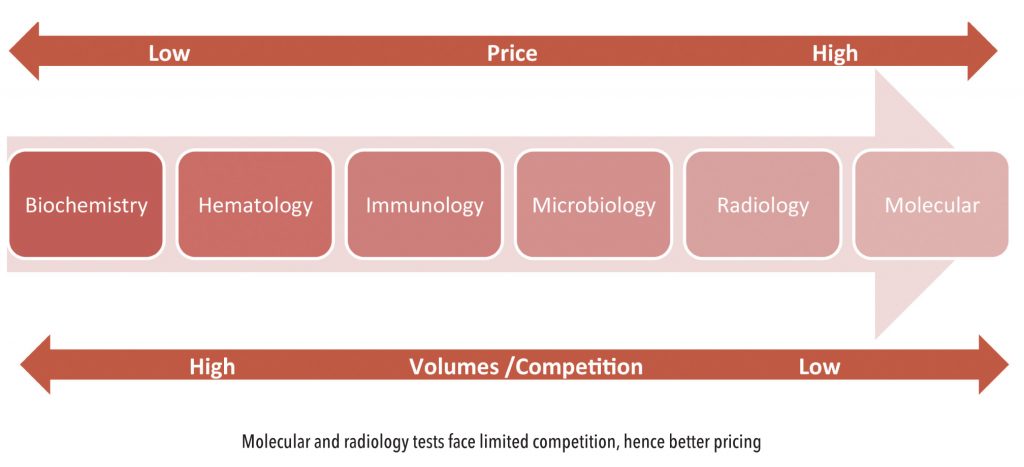

Routine, regular, and voluminous tests

Supported by high volumes, the basic costs (reagents, analyser) to laboratories are comparatively low; accordingly, their pricing is low. Generally, these tests are offered by all small and unorganised players, which results in intense competition and ultimately lower prices. These include:

• Biochemistry: Including liver and functioning, sugar levels, and cardiac tests

• Hematology: Including hemoglobin, platelet, blood count, blood coagulation

• Microbiology: Normally, tests of urine, stool, sputum, and pleural fluids.

• Immunology: Related to hormones, cancer markers, vitamin deficiency, etc.

Esoteric tests are low in volumes, but high in value

Molecular tests (mainly tests related to DNA for genetic or heredity diseases) and radiology tests (particularly CT scan, MRI, and PET-CT) are high-end tests and command higher price. These tests do not fall under the concept of preventive healthcare. Their complexity is directly related to high-cost reagents and more advanced equipment. Volumes for such tests are normally an area of concern for laboratories, as these are very selective and done only on the referral of limited number of specialist doctors. Hence, laboratories offering such esoteric test build capabilities in their central labs and are required to build a rapport with specialist doctors (whose referral fees are also relatively high). However, these ‘higher-end’ tests often enjoy better revenue realisation per patient and superior margins.

Affordability of these esoteric molecular diagnostics tests is a subject in its own right. In India, only a small percentage of the population can afford expensive diagnostics tests. Organised players have taken this up as a challenge and come up with cheaper assays and associated instruments that will pave the way for offering complex genomic tests at affordable prices. In fact, diagnostic chains such as Metropolis, Dr Lal PathLabs, and SRL (apart from government-sponsored centre for DNA fingerprinting and diagnostics) offer molecular tests, and have well-trained manpower for providing counselling on genetic tests.

Dr Lal PathLabs offer the highest number of tests at about 4,600, followed by Metropolis, which offers 4,500, and SRL at 3,800; Thyrocare brings up the rear at a much lesser 135

Thyrocare, a well-known disrupter of prices in thyroid tests in India, has already shown its initial move of price disruption in PET-CT tests by offering these at 9,999 per test against competitors’ average pricing of around 25,000

Radiology tests are becoming more affordable and advanced at diagnostic centres

Radiology is a technique to let doctors see what’s going on inside a human body. Normally, these tests (including CT scan, MRI, and PET-CT scan) are generally known as ‘esoteric’ tests and are used for detection of cancer in its early stages, locating tumours, and sometimes even help to predict whether a tumour is cancerous or not. Conducting these tests requires specialist doctors and expensive imported equipment. The PET-CT radiology centres need to adhere to the Bhabha Atomic Research Center’s guidelines, as these tests require radioactive isotopes. Up until recently, only hospitals used to conduct these tests and they were very expensive due to low patient volumes. However, of late, diagnostic chains and large standalone labs have captured this as a pre-hospitalisation opportunity and have established fully equipped labs to conduct all radiology tests. This is likely to lead to optimal utilisation of expensive machines and to lower the test rates.

There are other basic radiology tests, including X-ray, ultrasound/sonography, colour doppler, and mammography, which are relatively low-priced and are offered by many labs – both organized and unorganized.

On the pricing of diagnostic tests, Dr Vivek Jain – Director, P.H.Medicals Centre says, “Volume of tests and competition certainly plays an important role in the pricing of pathology tests, but at times, the brand positioning of a laboratory in the region that it has a stronghold on, could allow it to take a price hike. On the contrary, the pricing of high-end radiology tests (primarily – CT scan, MRI and PET-CT) is completely inelastic to volume. Despite steady volume growth in patients for CT scan and MRI tests at P.H.Medicals, our test prices have remained static over the last five years. Within radiology, PET-CT enjoys least competition due to strict regulation and compliance requirements, yet price hike there is impossible.”

Devices used in diagnostics

Automated machines used for PATHOLOGY tests by organised players

Devices used in RADIOLOGY testing

Indifferent pricing structure by both organised and unorganised players, despite intense competition

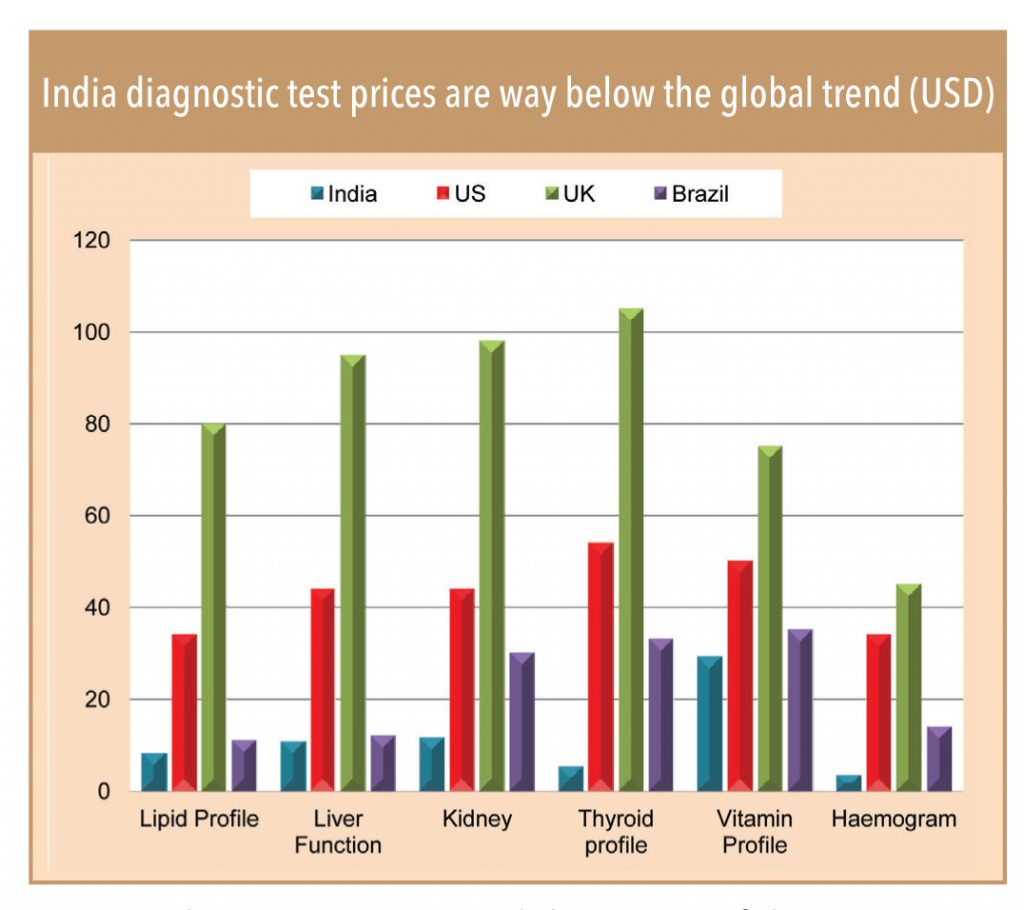

With over 85% of its population falling under the low-income class, India remains a very cost- and price-sensitive market in every business, including healthcare and diagnostics. Within diagnostics, reagents and kits are key cost components for every laboratory. The prices of tests in India are a function of economies of scale – in terms of the ability to spread overhead costs related to reagents, kits, reference labs, administrative, and marketing. Thus, led by (1) huge mass of patients, (2) large underserved healthcare market and (3) huge scope of growth, pricing of diagnostic tests in India has always remained 1/4th of advanced market rates, and at a 50% discount to comparable markets such as Brazil.

Pricing of tests offered by diagnostic players plays an important role in gaining volumes for the company. Diagnostics industry follows three-tier pricing of tests including: (1) price per individual test, (2) price per profile of tests, and (3) price for packages. Since the reagent cost (~30% of overall sales) is a major variable cost component for any diagnostic test, pricing of various tests depends on the reagents cost and the nature of the equipment-supply arrangement the labs hold with the vendors.

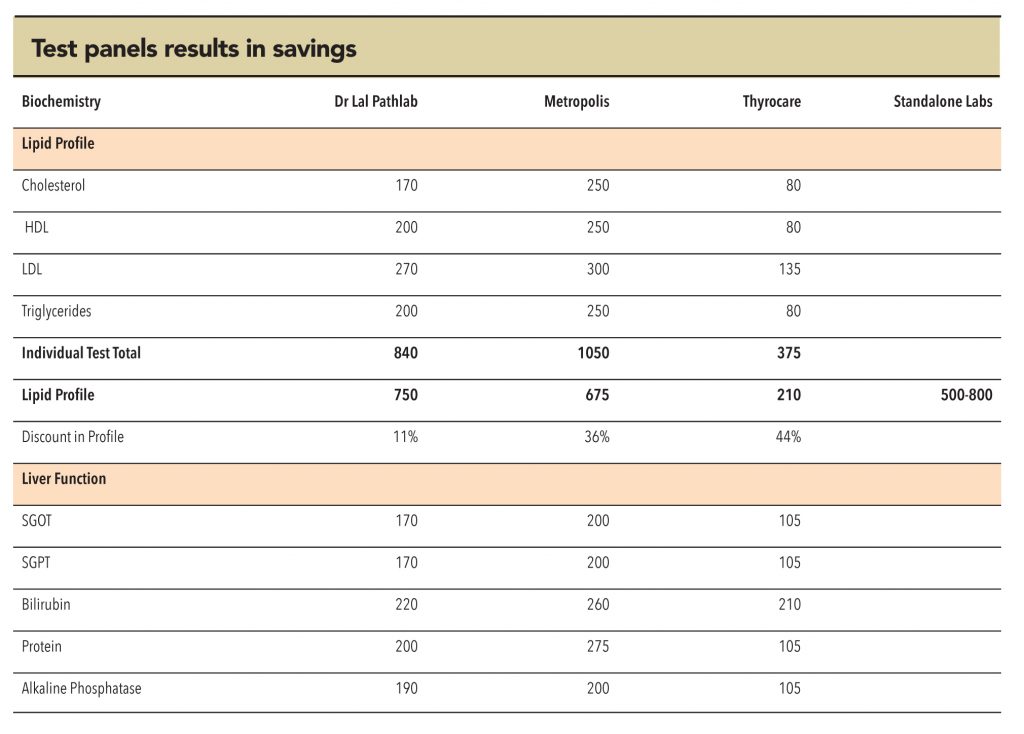

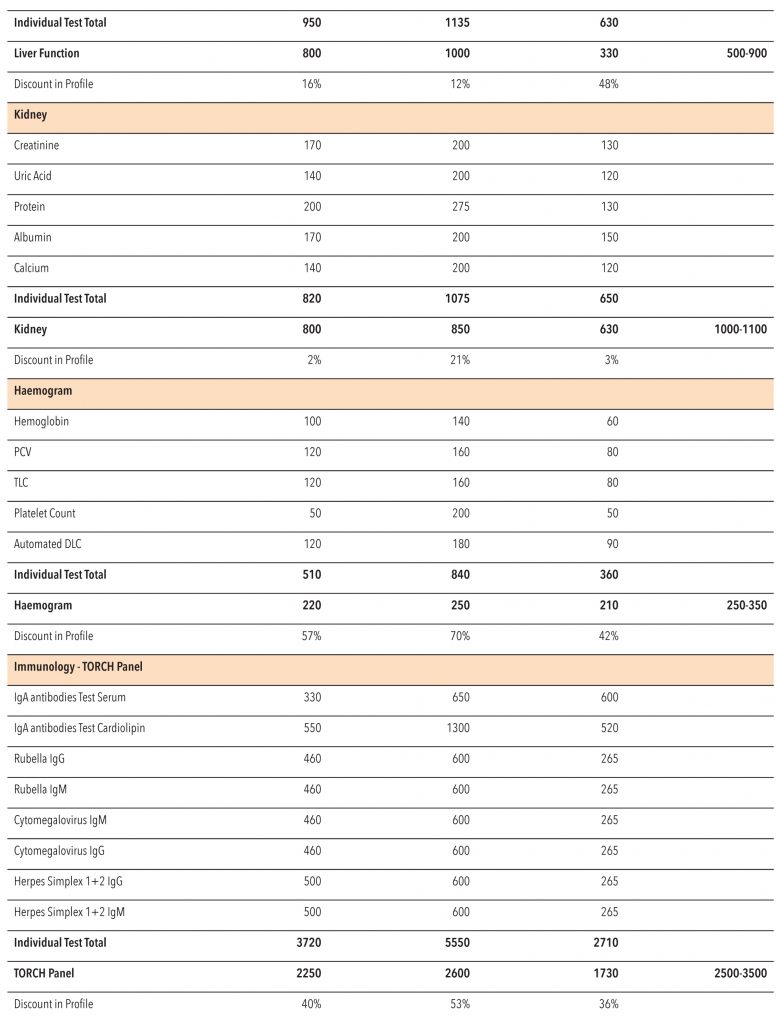

Test profiles provides additional cost savings compared to individual tests

In order to generate greater volume and improve the number of test per patients, diagnostic labs strategically price the profiles (all test related to a specific disease) of tests and various packages (comprising tests related to multiple diseases or organs) at discounts to individual test prices. This is a win-win situation for both – companies and patients. Through this, laboratories are able to utilise machines/reagents optimally, while the patients get lower prices.

Intense competition in the industry will keep prices of tests or profile or package offered by the company under check

The table below shows the savings that profiles provide over individual tests. Patients can save 25-30% in a basic profile, which falls under the regular category of biochemistry and hematology. In the high-end tests (selective, referral-based), cost savings (profiles vs. individuals) is much higher at 40-50%. A diagnostics service provider can afford greater discounts on high-end profiles and panels as these have comparatively low volumes and almost nil walk-in patients.

With improving awareness about healthcare among the educated and because of increasing urbanisation, preventive and wellness packages have emerged as the fastest-growing segment in Indian diagnostics

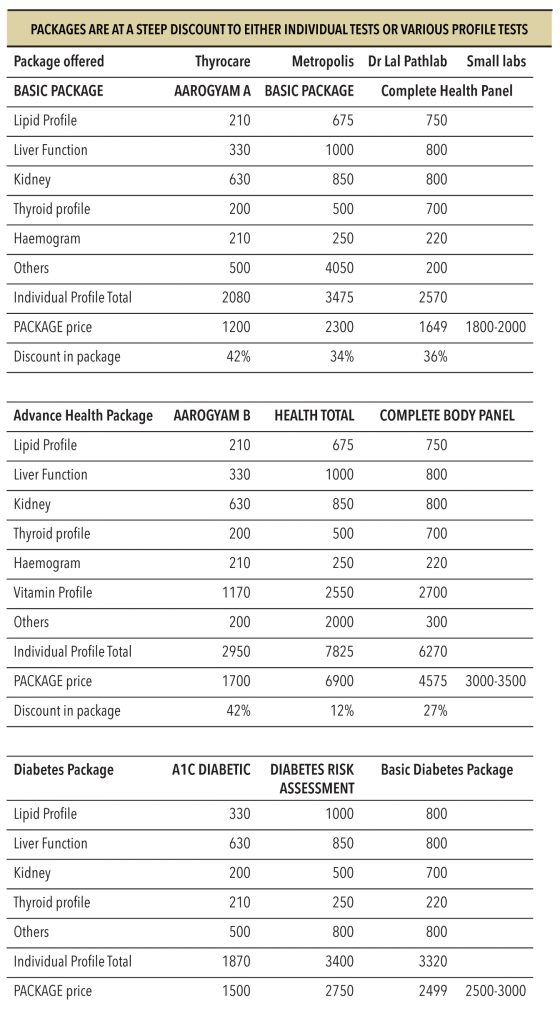

Wellness packages offer better operating leverage

Mid- to large-sized diagnostic chains and hospital-based diagnostic centres are increasingly packaging and marketing their available test menu in the form of preventive and wellness test packages. With improving awareness about healthcare among the educated and because of increasing urbanisation, preventive and wellness packages have emerged as the fastest-growing segment in Indian diagnostics. Due to the multiple tests per patients under the packages, they optimize the reagent cost per patient and improve the realization per patient. As these tests offer better operating leverage, their pricing (packages) is at a steep discount to either individual tests or various profile tests.

While it is established that volume of tests handled by the labs are critical for pricing, surprisingly, there is no major difference in prices of organised players (who try to optimise costs through scale benefits, and tend to accordingly price low) and unorganised players (who largely offer comparable prices to large players by lowering their reagent cost by procuring from local vendors). At times, unorganized players charge more than larger chains, but retain their business mainly because of their strong hold in the area and particularly because of local doctors remaining loyal to them.

Subscribe to enjoy uninterrupted access