Improving awareness for healthcare, changing doctors’ practice – towards prescribing based on evidence of diagnostic tests – coupled with improving technology in diagnosis led to the boom in private and standalone diagnostics laboratories. Gradually, supported by private-equity funding, organised pan-India diagnostics chains spread their network through the franchisee model. In the current situation, key participants in diagnostics are doctors and hospitals, laboratories, franchisee (collections centres), and vendors (re-agent suppliers).

Doctors (and hospitals) are the undisputed spearheads for diagnostics

Although ‘self-referred’ preventive or wellness tests have emerged as a new trend in diagnostics, doctors and hospitals are still the primary source of referrals for various healthcare tests. As doctors changed their treatment practice to ‘evidence based’ (from the traditional trial and error approach) in order to administer appropriate and timely treatment and to curtail the abuse of drugs, the growth outlook of the diagnostics industry started becoming rosy. Doctors remain undisputed leaders of the diagnostic business because they are the ones who initiate leads for diagnostics labs by referring patients, often to specific labs. Other participants’ bargaining power comes from volumes of tests or patients that they handle.

Laboratories are challenged by intense competition

After doctors, laboratories play an important role, but their bargaining power and profitability is greatly challenged because of intense competition – there is no regulatory entry barrier and the presence of unorganised players is wide-spread. Laboratories are collectively represented by pan-India chains and standalone labs. While pan-India chains are generally organized and accredited from domestic and international agencies (National Accreditation Board for Testing and Calibration Laboratories – NABL, The College of American Pathologists – CAP), standalone labs are largely unorganised and operate purely based on their local connections. As per sources at NABL, India has just about 1,200 accredited labs, i.e., only about 1% of over 100,000 diagnostic labs that function in India.

India has just about 1,200 accredited labs, i.e., only about 1% of over 100,000 diagnostic labs that function in India

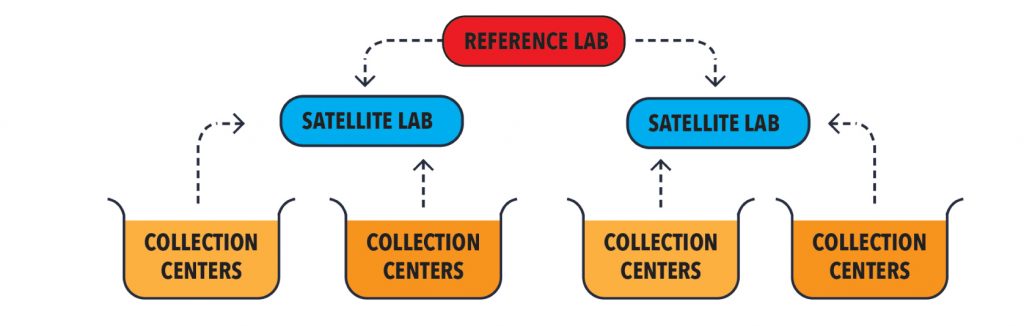

Diagnostic chains mainly operate under a hub-and-spoke model

Typically, there is a central processing lab, satellite labs (regional labs), and collection centres. Central labs are normally equipped to conduct both routine and specialised pathology and at times radiology tests. Satellite labs offer a limited range of services and mainly act as feeders for central labs. Satellite labs are mostly owned by the diagnostics chains. In order to enhance the volume of tests for the central lab and its earning efficiency, diagnostics chains widen their sample collection network by using modern logistics and information technology systems.

In fact, satellite labs have the potential to leverage capital expenditure in a better way by effective extension of their network into wider areas using limited capital. Additionally, such labs play an important role for grabbing time-sensitive tests in regional areas.

Collection centres can serve multiple labs simultaneously

Collection centres are are mainly involved in the collection and forwarding of patient samples to satellite or central labs. They collect samples from walk-in patients, hospitals, nursing homes, pathology labs, doctors’ clinics, etc. These centres are company-owned or franchised. Some centres are equipped with basic equipment to conduct routine tests and maintain minimal staff – such as a receptionist, a lab technician, attendants, and people for delivery.

If collection centres are not owned by chains, they generally operate on a fixed sample-collection charge. A franchisee usually pays a franchise fee of around Rs 50,000 to get a license to operate a collection centre for a diagnostic chain.

Although collection centres and franchisees operate as per their underlying contracts with diagnostic chains, they are not always bound by terms to forward samples to specific laboratories or chains. Based on many factors (specification of a doctor, demand of a patient, capabilities of associate laboratories, or the margin they earn on the test), they could forward samples to labs other than their `associate’ labs.

Vendors (equipment and reagent suppliers) are normally at the receiving end

Vendors supply diagnostic equipment or analysers as well as chemical reagents to laboratories – these are the key to any diagnostic test. The diagnostic devices and reagents market is largely dominated by leading multinational companies such as Siemens, Abbott Diagnostics, and Roche Diagnostics. There are few Indians companies who compete with these MNCs including Transasia Bio-Medicals and Agappe Diagnostics. Apart from these, there are over 50 diagnostics companies, who focus on either importing from various international markets (including China) and distributing in India, or on manufacturing and supplying rapid diagnostic test kits.

While the MNC biggies are suppliers of devices as well as reagents to all leading diagnostics chains and a few large standalone laboratories in India, local manufactures or distributors of imported devices/reagents depend on unorganised diagnostic players

While the MNC biggies are suppliers of devices as well as reagents to all leading diagnostics chains and a few large standalone laboratories in India, local manufactures or distributors of imported devices/reagents depend on unorganised diagnostic players.

Normally, diagnostic machines or analysers come with specific reagents. While the analysers are a one-time capital cost, reagents are key variable costs for diagnostics laboratories. Hence, vendors are more lenient in terms of prices while selling machines, but try to make money from regular reagent supplies. Wherever vendors see scope for high volume of reagent sales at a lab (based on high tests volume), they tend to supply machines on a marginal rent, and take a certain volume commitment for reagents from these labs. Such an arrangement is a commonly followed practice among laboratories and vendors and is called ‘reagent rentals’.

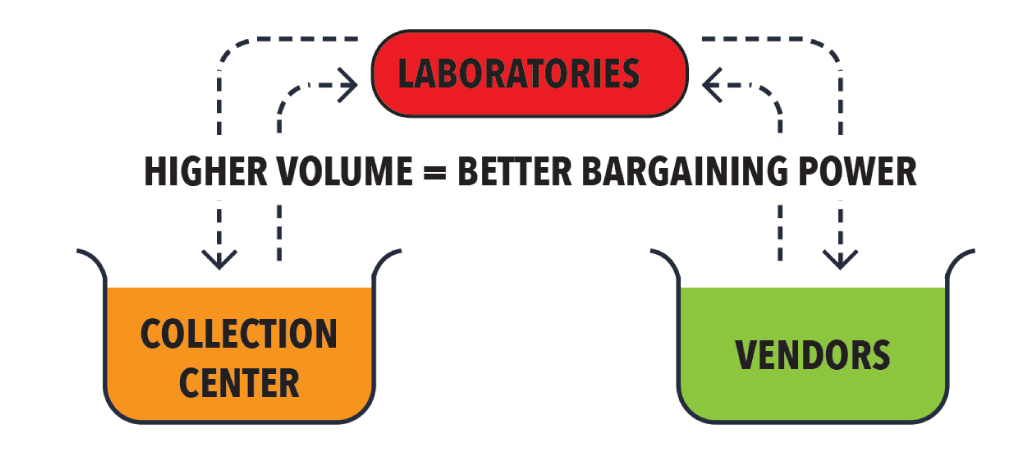

Business of scale – volumes play a key role in lab-franchisee payment terms

Doctors reign supreme in diagnostics since (more often than not) they generate leads for laboratories through referrals, often to specific laboratories. The bargaining power of other participants of the diagnostic business (laboratories, franchisees, and vendors) depends on the volume of tests/patients they handle. While the diagnostic chains are trying their best to expand their networks of collection centres through franchisees and leveraging modern logistics of flights and technology, franchisees enhance their patient base through strong local connect with doctors, hospitals, and clinics. The main reason for generating volume is that it ultimately provides the required bargaining power. Volume decides the terms of payment between laboratories and franchisee; therefore, different labs-franchisees have different terms. However, in few cases, brand positioning of the laboratories overpowers the volume generated by the franchisee.

In the case of commercial supply arrangements between the vendor and laboratories, ONLY volume plays a pivotal role. While large diagnostic chains get a better bargain on reagents and analyser machines largely on ‘reagent rental’ basis, standalone/smaller laboratory chains try to negotiate hard on machines and do not receive great deals for reagents.

Ms Ameera Shah, MD, Metropolis says, “Volume plays an important role in the profitability of a centre, but in our experience, quality directly contributes to volumes. Metropolis enjoys a good reputation for specialised and super-specialised tests and doctors and patients choose us for the quality and the accuracy we deliver. Vendors operate in a competitive market and laboratories enjoy bargaining power as vendors cater to only about 10% of the market.”

Volume decides the terms of payment between laboratories and franchisee; therefore, different labs-franchisees have different terms

Subscribe to enjoy uninterrupted access