After seeing the HUGE transformative capability of the Blockchain platforms, the next big questions that need to be answered are:

1) In what stage of its adoption cycle is Blockchain?

2) What is the kind of interest from potential clients?

3) What kind of pilot projects / POCs / live implementations have been carried out?

To answer the first question, GV took the help of a leading consultant in the technology space – Information Services

Group (ISG), who made an exclusive contribution to this report.

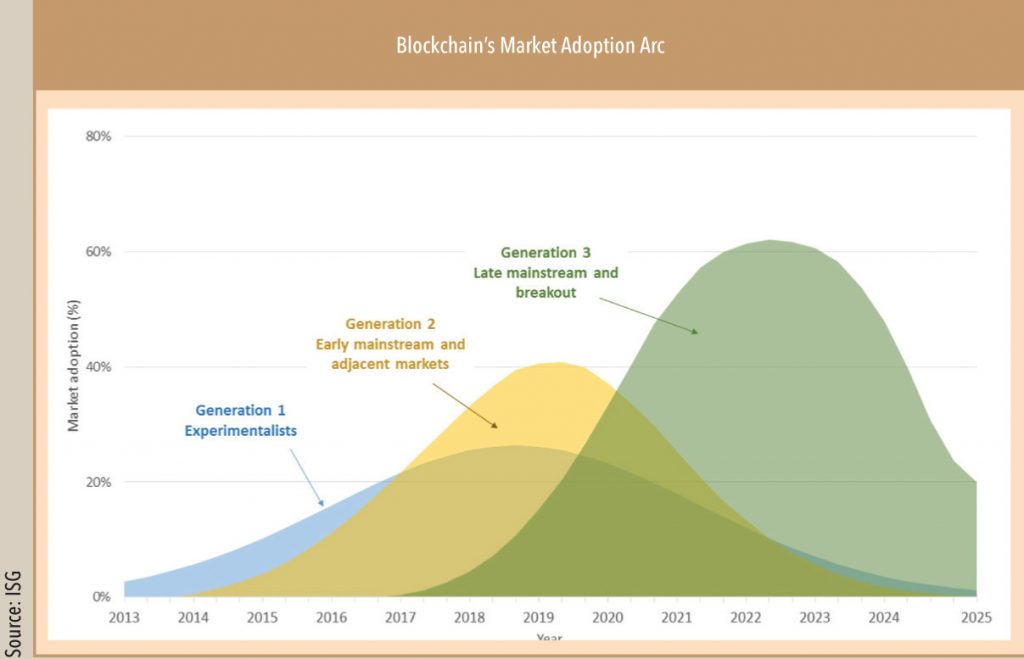

Blockchain is in the middle of its market discovery period involving experimental participants including researchers, programmers, business movers and shakers, venture capital investors, IT service and technology providers and buyers of software and services concentrated in the financial services industries. Not quite into early adoption, we expect 2017 will be another year of “hype” focused on Blockchain’s blue-sky possibilities and elusive practical realities.

We are forecasting the use and adoption of Blockchain applications in the enterprise will follow the traditional decade-long cycle typical of most new technologies where early-market experimentalists discover its possibilities, and practical applications follow. We anticipate the coming 12 to 24 months will see early experimentalists move from investigation projects into their first production trials, the stage where business processes meet technology proof of concept trials.

This will be followed by the first early mainstream production uses of second generation technology by early market movers in the financial and adjacent industries and markets closest to the experimentalists over a three- to five- year period.

Lastly, we expect Blockchain will see later mainstream adoption using a third generation of the technology as it breaks out of its seed industry and adjacent sectors from which it starts, and that this commences about half-way through the cycle and takes another five years to reach wider market use.

Overcoming Blockchain’s Use Case Chasms

Blockchain solves a unique issue, it prevents double-spending of Bitcoin. Once spent, it prevents the same Bitcoin from being spent again. It also creates consensus about the order of entries in its distributed ownership ledger. The capabilities that will find their way into future uses of Blockchain include:

• Different distributed ledgers that deliver value because the information in them is shared

• Different self-contained consensus processes that deliver value (i.e., smart contracts)

Outside of its Bitcoin beginnings – which solves preventing the double-spend of a coin or exchanged token of value – the potential use cases are even more interesting. However, to satisfy these interesting use cases, its current ownership ledger and consensus miner system must evolve if its market uses are to break into use cases beyond the ownership and double-spend problem Bitcoin Blockchain solves.

Until the arrival of these alternatives, Blockchain’s progress into other ecosystems and markets (Strategic Market Decisions and Blockchain’s Uber-Ecosystems) could be delayed (as discussed in our Aug 2016 report).

Early Mainstream and Adjacent Markets

As with all forecasts, the closer to the action, the better the vision. As we look out toward the medium-term between 2018 and 2021, we see some notable business use cases close to the financial services industry that are likely to see trials and uses that include:

• Insurance claims processing systems

• Derivatives trading systems

• Trade authorisation systems

Additional uses during this period, beyond Bitcoin’s Blockchain methods, could include applications in investment banking, digital identity, smart authorisations, and at-arms-length transparent regulatory attestations / audits among others.

Late Mainstream and Breakout

Longer-term forecasts are as good as putting one’s finger in the air to determine which direction the wind is blowing today: although you do not know exactly what direction the wind will be tomorrow, it will be one of four and their variations. Instead of adding fuel to the “Blockchain disrupts the world” fire, the longer-term view for Blockchain is more about possibilities than likelihood. Most of these uses will include expansion into industry uses outside of the financial services industry.

Some of these uses might include: automotive servicing and sales, shared patient medical records in healthcare, virtual online retail and wholesale distribution markets, and event ticketing systems in the entertainment industry.

Other uses might include machine-to-machine applications servicing edge-of-network IoT sensor uses, legal services, life-science market testing, and new markets for asset rentals and trading, longer-term property records, law enforcement uses, and utility energy trading.

Decisions About Blockchain’s Future

Blockchain’s future is going to follow the traditional decade-plus adoption arc of most new technologies. Along the way, the path will be bumpy and smooth, depending on the path one is on, the addressable use cases of the underlying technologies, and the environmental conditions impacting the journey.

• IT leaders: The key decision for IT leaders will be determining where along the spectrum of Blockchains path the enterprise needs to be: experimentalist, early mainstream, later mainstream, and for which business purposes and why. These decisions will be followed by when to jump onto the path, and which path to take.

• IT providers: The key decision for IT vendors will be determining when to jump aboard the Blockchain train, for what destination, and which tracks and schedules to choose.

Exclusive contribution by Jim Hurley, ISG Research

Mr. Hurley provides clients with research based insight into the future of business IT for strategic and tactical growth and profit. His research focuses on practical uses of changing and emerging technology for business including the uses of data science, cognitive computing, cybersecurity and compliance, Blockchain, digital intelligence and digital labor enabled business processes.

Mr. Hurley is a graduate of Boston University with a BFA and has graduate training in computer science, engineering, physics and mathematics. He is a co-inventor of numerous software and business improvement process systems used in many different industries, as well as the co-inventor of MRI systems used in the healthcare industry and magnetic confinement systems used in the energy industry.

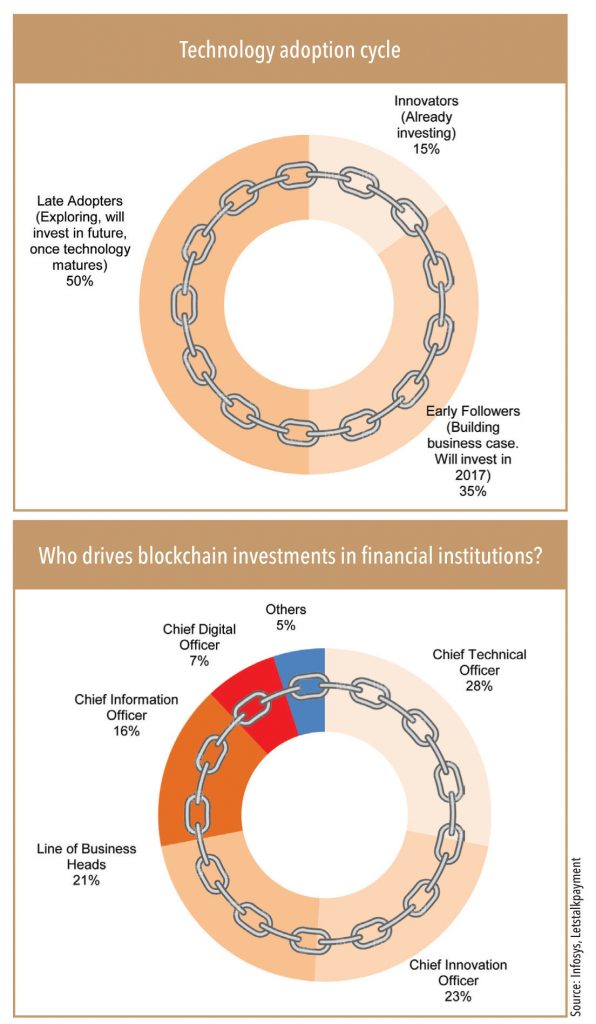

A recent paper published by Infosys (a leading Indian IT services company) helped GV find the answer to the second question, which is – ‘What is the kind of interest from potential clients?’.

Infosys has been making significant inroads in the Blockchain space, having implemented pilot projects for India’s largest private sector bank, ICICI Bank, and the leading banking group in the Middle East, Emirates NBD. With an aim to gauge the interest level in this new technology, Infosys Finacle and Let’s Talk Payments (LTP) partnered to explore the next phase in the adoption of this technology through a survey among key decision makers in financial institutions. The survey respondents included more than 100 business and technology leaders from over 75 financial institutions, ranging from small regional banks to multinational banks.

Key findings of the survey were:

• 50% of banks surveyed have already invested in Blockchain or will do so in 2017

• Average investment in Blockchain projects in 2017 is expected to be about US$ 1mn per institution

• 33% of respondents expect to see commercial Blockchain adoption by 2018, while 50% expect to see it by 2020

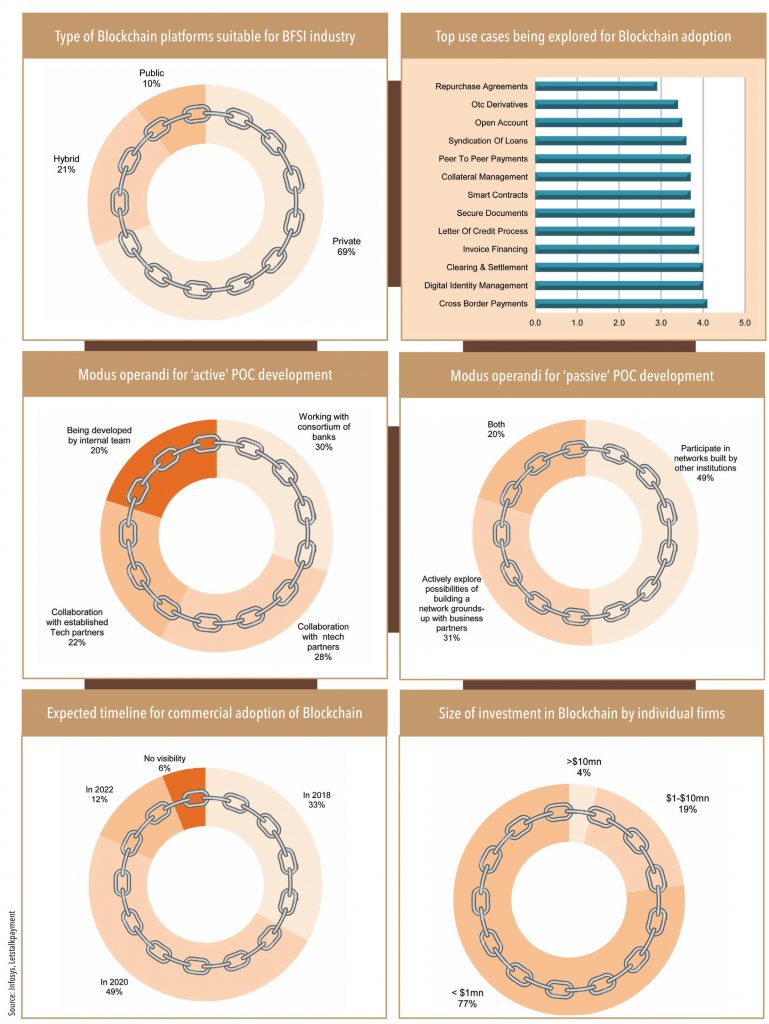

• Majority of banks surveyed, about 69%, are experimenting with permissioned Blockchains, while 21% plan to use hybrid variants

• Cross-border payments, digital identity management, clearing and settlement, letter of credit process, and syndication of loans, are the top-5 use cases chosen by the respondents as the most likely for commercial adoption

• About half of the banks surveyed were working with a FinTech start-up or a technology company to augment their Blockchain capabilities; another 30% had opted for the consortium model

• 74% of banks surveyed stated that executives driving Blockchain initiatives in their organisations were either Chief Technology Officers, Chief Innovation Officers, or Line of Business Heads

• Top Challenges

• Top Opportunities

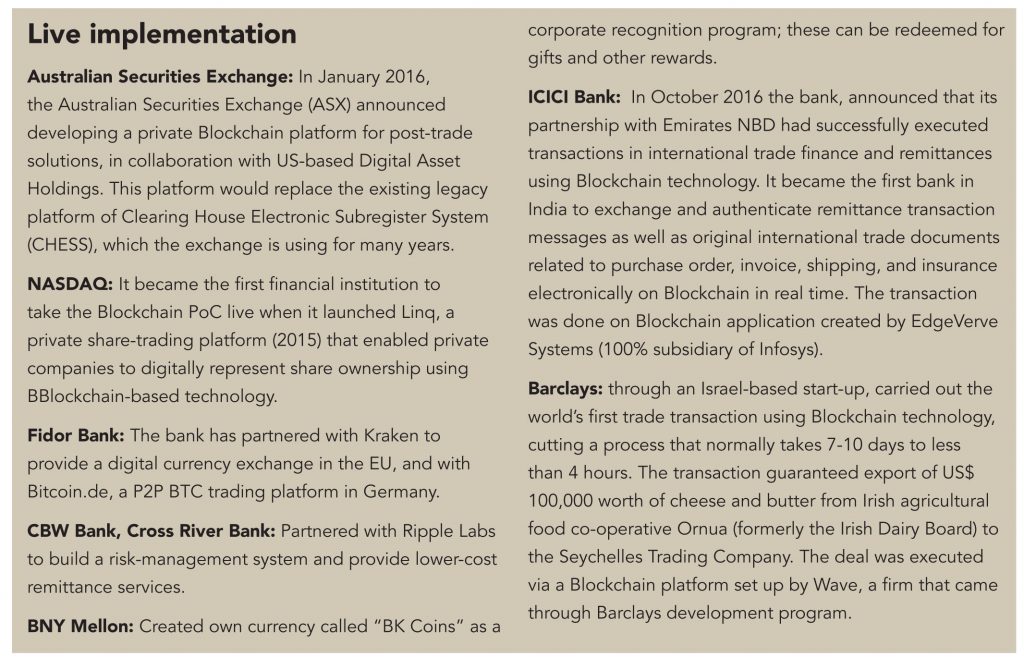

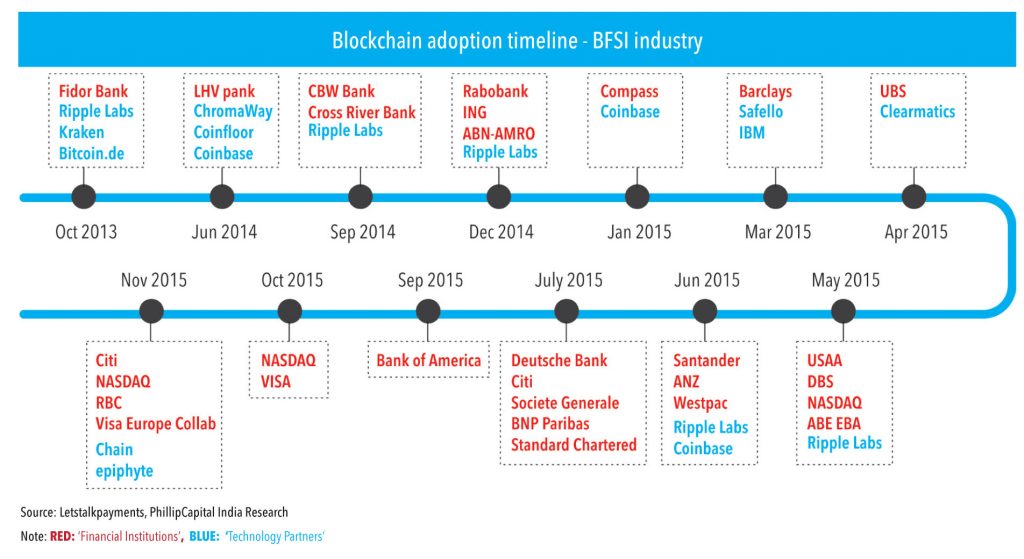

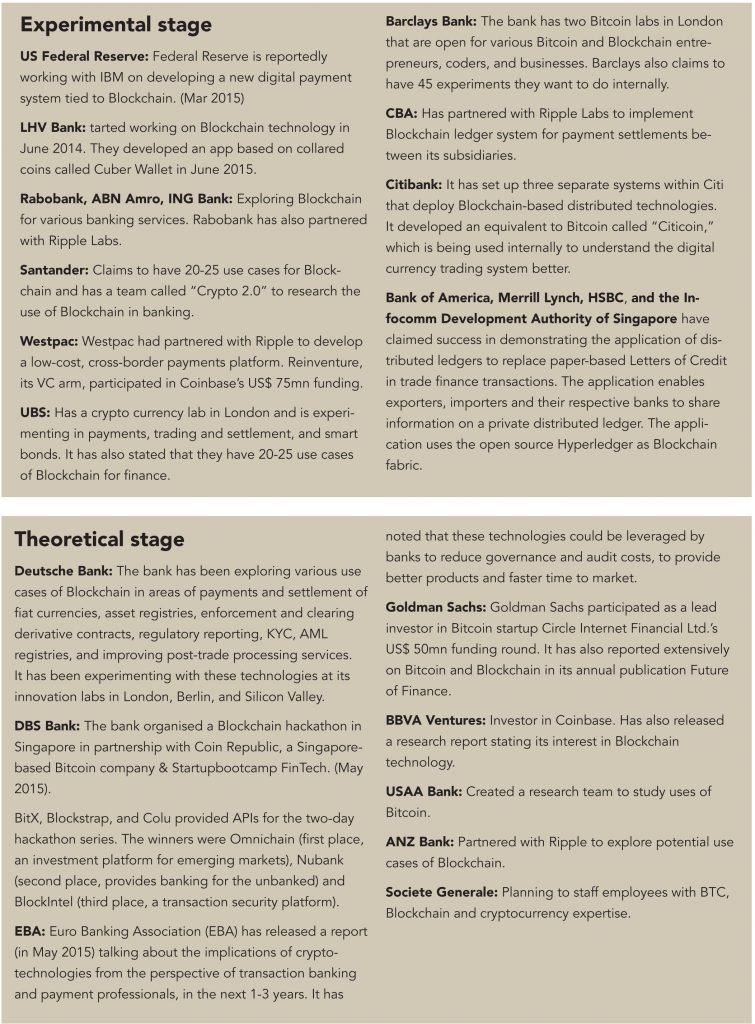

To answer the third question – ‘ What kind of pilot projects / POCs / live implementations have been carried out?’, GV engaged with various stakeholders – enterprises, vendors, and consultants, especially in the BFSI industry. Research and interactions led to the following details about the stages of Blockchain adoption by large global enterprises:

Subscribe to enjoy uninterrupted access