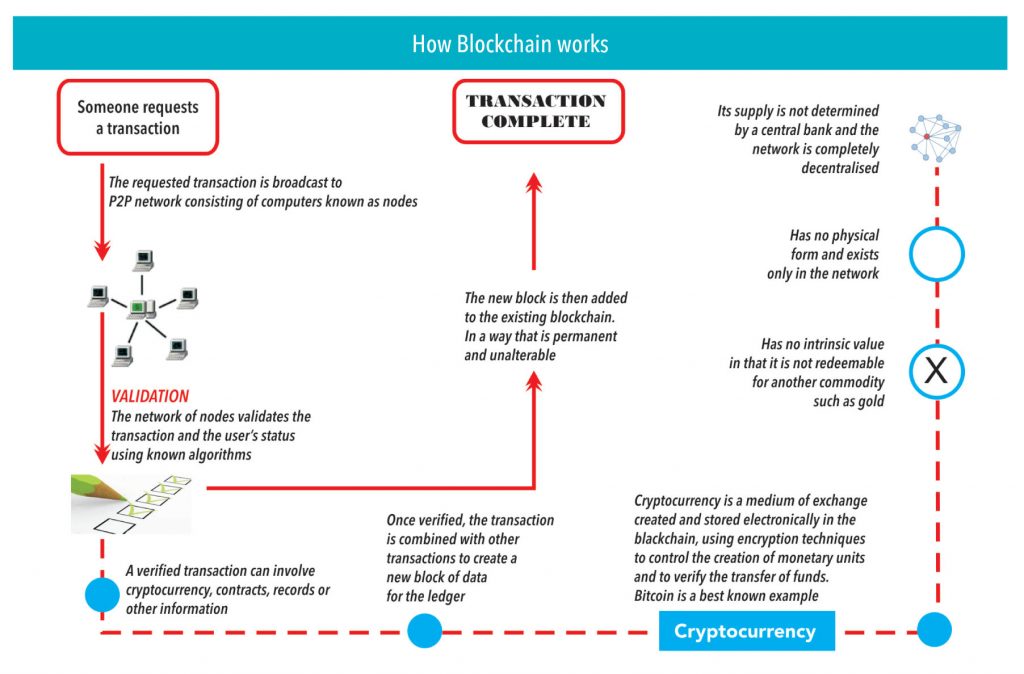

Blockchain is a manifestation of ‘distributed ledger’ (shared ledger) technology. It is a database system supported by cryptographic verification, which can be written only once. It is bound by a series of blocks that are subsequently verified into a chain sequence of linked batches over time.

To understand how a Blockchain works, it a good idea to explore how Bitcoin (an instance of Blockchain technology) works. It would be easy to ‘extend’ this understanding to other Blockchain platforms.

Bitcoin is a digital payment network, based on the concept of DLT, which uses Bitcoins as a currency. For people familiar with coding in C/C++, Bitcoin represents an ‘object’ of the ‘class’ Blockchain. As in the coding language, a ‘class’ is an abstract declaration, while ‘object’ is a real-life manifestation – similarly, Bitcoin is a real-life implementation of the Blockchain/DLT technology. Also, since an abstract declaration is much more difficult to comprehend, Bitcoin, is useful to grasp the Blockchain concept.

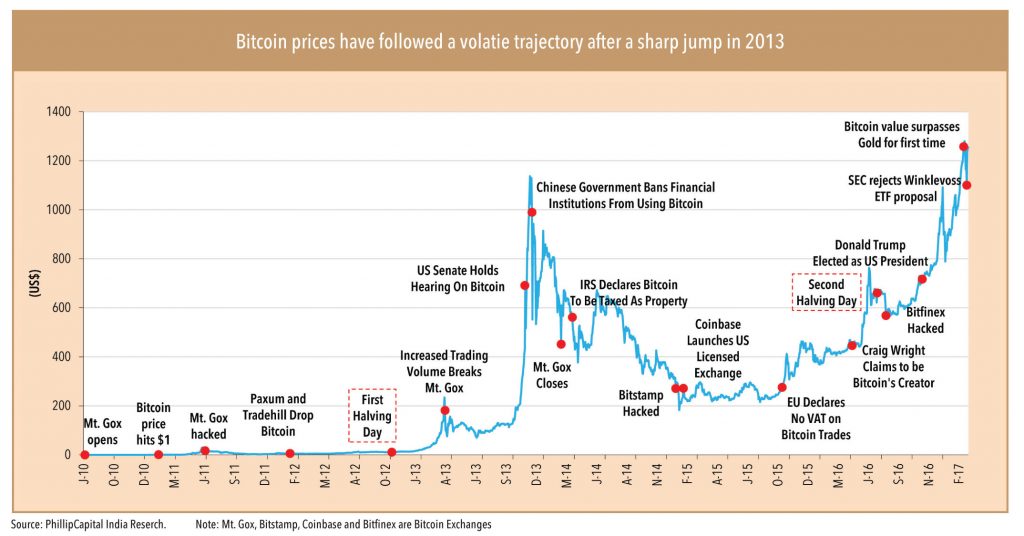

Bitcoin was created by group of independent programmers. The term was first coined by Satoshi Nakamoto in 2008. It was released as open-source software in 2009. It is a peer-to-peer system where transactions take place between users directly, without a third party. The first Bitcoin was ‘minted’ on 3rd January 2009, the first payment was made on 11th January 2009, and the software was released as open-source on 15th January 2009, enabling anyone with the required technical skills to get involved.

Bitcoin is not owned or issued by any central authority, government, or financial institution. It is an open-source distributed system without ownership. It is managed and operated by a worldwide community of developers and users.

“Real-time Bitcoin generation can be tracked here (https://blockchain.info/)”.

How Bitcoins work?

The Bitcoin platform maintains a public distributed ledger, which contains all the Bitcoin transactions that have ever taken place. It works without any central authority or regulator. Its maintenance is performed by a network of communicating nodes running Bitcoin software.

Generation of new Bitcoins depends on the transaction-clearing process, called mining, which is the process of adding and verifying new transaction

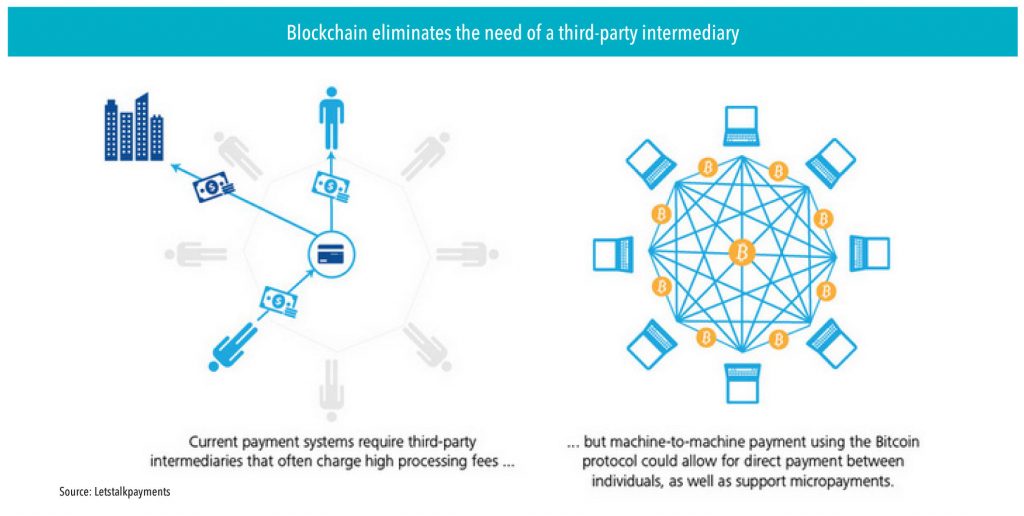

Blockchain eliminates the need of a third-party intermediaryrecords to Bitcoin’s public ledger. People who perform this task are called miners. Miners collect transactions on the network into large bundles known as blocks. A block is generated when a user transacts using the Bitcoin. The blocks are interrelated in a chronological order, with each block containing the hash (a large number written in hexadecimal format) of the previous block. Once the transaction completes, it goes into a continuous and authoritative record.

To be able to generate non-conflicting transactions on this platform, the miners have to compute a cryptographic hash of the block that needs certain pre-defined criteria. This process is known as hashing.

How new Bitcoins are generated?

Unlike the fiat currencies that are issued by central banks of respective countries, Bitcoin does not have any central regulator that creates Bitcoins. Pending Bitcoin transactions are collected by mining computers every ten minutes and are then turned into a mathematical puzzle. The first miner to find the solution announces it to others on the network, to check whether the solution to the puzzle is correct. If majority of the miners give approval, the block is cryptographically added to the ledger. The miners then move on to the next set of pending transactions. The miner who found the solution gets predefined number of Bitcoins (BTC) as a reward (after another 99 blocks have been added to the ledger), out of the unmined pool of Bitcoins. All this gives miners an incentive to participate in the system and validate transactions.

The reward halves every four years. From 2009 till 2012, miners got 50BTC for every successful transaction which declined to 25BTC for 2013 to 2016. Currently, miners get 12.5BTC for every successful transaction.

Total number of Bitcoins that can be mined:

Bitcoin platform was started on 3rd January 2009 by Satoshi Nakamoto and the first transaction was recorded by paying a reward of 50 Bitcoins to its creator. Bitcoin mining process was designed in a way that for each block mined, the miner would get 50 Bitcoins, and each new block would be mined at an interval of 10 minutes from the previous block mined. So in the first four years, the total number of Bitcoins mined was ~10.5mn. The new Bitcoins mined have to be halved every four years. Hence, the total number of Bitcoins mined generated – governed by “the sum of a geometrical progression with common ratio < 1” – would be ~21mn. As on 26th December 2016, the total number of Bitcoins mined stood at 16.1mn, leaving 5mn unmined Bitcoins.

Bitcoins can be obtained:

• From Bitcoin exchanges

• From Bitcoin ATMs

• By accepting Bitcoins as payment for goods or services

• By mining Bitcoins

• By exchanging Bitcoins for cash

Blockchain market size:

In February 2015, the number of merchants accepting Bitcoin for products and services surpassed 100,000. Instead of the 2-3% that credit-card processors typically impose, merchants accepting Bitcoins often pay fees of 0% to less than 2%. Though Bitcoin usage at the merchant level has grown significantly recently, it has not yet gained as much traction in retail transactions. Many of the regulatory bodies (like The European Banking Authority) have warned that Bitcoin users are not protected by refund rights or charge backs.

Most Blockchain platforms would operate just as the Bitcoin platform works. Digital contracts will be initiated by the transacting parties, vetted by third parties, and added to the chain of transaction via a cryptographic code.

ISG, a leading global technology research and advisory firm, has defined Blockchain as “a general purpose distributed and decentralised transaction ledger that is being investigated for all sorts of industry business processes and application uses beyond digital currency”. It operates through digitally signed contracts, verified by third parties (independent/private). These third parties would encrypt the transaction using a cryptographic code and add the transaction to the ledger (yes, third parties are involved, but more on this later).

Market need for Blockchain

Blockchain eliminates fraudulent transaction in the network. Say a transaction is taking place between two users, A and B. Now what happens if B tries to change the transaction details? It may happen that he sends two different versions of the same transaction, at the same time, to half of his nodes each. These nodes, in turn, update their ledgers and send the transactions to a following node. In this case, half of the nodes receive one version of the transaction, which is correct, while the rest of the nodes receive other version of the transaction that is invalid. Blockchain, in effect, removes this double-spending (when two different transactions try to spend same Bitcoins) problem.

Benefits of Blockchain:

• Faster 247 transactions: Interbank/interparty transactions generally take few days for clearing and final settlement. Using Blockchain, these can be processed 247, real-time, and in minutes.

• Lower transaction costs: As there is no third party involved in managing transactions (dependent on the Blockchain platform), the cost of maintaining/verifying assets is eliminated, which reduces transaction fees.

• Trust-less exchange: Parties can make their own or transact on public exchange without the need of an intermediary.

• High-quality data: Blockchain data is complete, consistent, timely, accurate, and widely available.

• Durability and reliability: As the Blockchain network is decentralised, it does not have a central point of failure and hence it is better equipped to withstand malicious attacks.

• Trail of transactions: All transactions are recorded on the Blockchain, which cannot be altered or deleted. Hence, a user can get the trail of any transaction anytime.

• Transparency and immutability: Changes to public Blockchains are publicly viewable by all parties, creating transparency, and none of the transactions, once recorded, can be altered or deleted.

Mining / Vetting – the immediate challenge

The primary benefit of DLT, as listed above (and will be demonstrated with use-cases later), is real-time processing of transactions and eliminating the need for a central regulatory body. While DLT in its current form theoretically achieves the first (real-time processing), it only substitutes the second with a decentralised vetting authority – miners.

Most existing DLT platforms require miners or independent third parties to write a cryptographic code that contains the detail of the transaction, parties, and the address of the previous transaction. Given that DLT platforms haven’t gained much popularity or adoption yet, it is easy to find enough ‘miners’ who can write this cryptographic code to ensure real-time execution of the transaction. But as this platforms gain popularity, and more people/enterprises start adopting it, the existence and availability of enough qualified ‘miners’ could become a serious bottleneck for the adoption of this technology. Though it is early days in the adoption lifecycle of DLT, the availability of miners is a critical issue that needs to be addressed. Else, DLT will lose both its advantages – absence of central regulator (as the regulator will be substituted by third-party ‘vettors’) and real-time processing (as low availability of third-party vettors will delay transaction execution).

Public Blockchain

In a public Blockchain, anyone in the world can read, send transactions and expect to see them included if they are valid, and participate in the consensus process – the process for determining what blocks get added to the chain and what the current state is. Public Blockchains are secured by “crypto economics” – the combination of economic incentives and cryptographic verification using mechanisms such as proof of work or proof of stake. These Blockchains are generally considered ‘fully decentralised’. Well known public Blockchain platforms include: Bitcoins, Ripple, and Ethereum.

Bitcoins: as explained in the earlier section

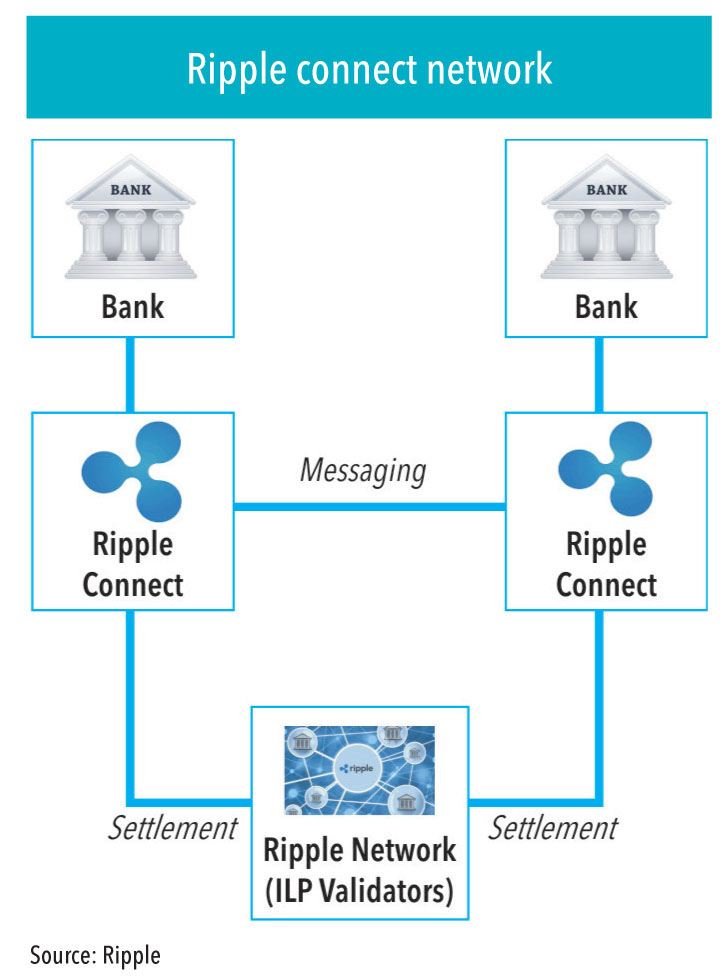

Ripple: Developed by Ripple Labs (earlier OpenCoin), it is a digital currency as well as an open-source payment network. Ripple is actually older than Bitcoin. It was first implemented in 2004 as a payment network and distributed exchange. The currency was not launched until February 2013 by OpenCoin. An alternative to RTGS, Ripple helps banks and financial institutions across the globe to send and/or receive payments in real-time across the network. Its currency is called XRP (ripples).

Ripple is similar to Bitcoins in a way that both are digital currencies, generated based on mathematical formulas, with a limited number of units that can be mined. Both are a peer-to-peer network, without needing any regulatory authority. However, the key difference between them is that Bitcoin requires mining to complete the transaction while Ripple does not. The creators of Ripple created 100bn ripples (XRP) at the start. Out of these 100bn XRP, 20bn were retained by the creators, seeders, venture capital companies, and other founders. The remaining 80bn were gifted to Ripple Labs, who will distribute 55bn of the 80bn to charitable organisations, users, and strategic partners. Ripple Labs will retain the remaining 25bn XRP.

Though Ripple is designed to operate without a central authority or regulatory, currently, most of its validating servers are either operated or managed by Ripple Labs. So it’s not a fully distributed ledger yet.

Through two of its licensing solutions – Cross-Currency Settlement and FX Market Making – it helps banks and financial institutions with real-time settlement for international payments. Munich-based Fidor Bank AG was the first bank to integrate the Ripple protocol to provide faster and affordable money transfer services to its customers. Other banks using the Ripple protocol are Cross River Bank, CBW Bank etc.

Ethereum: Unlike Bitcoins, where operations are pre-defined, Ethereum lets users create their own operations of any complexities. It was launched in 2015. It is an open-source decentralised software platform enabling smart contracts and Distributed Applications, which are built and run without third-party interference.

Ethereum is developed as a platform to facilitate peer-to-peer contracts and applications via its own currency.

Private Blockchain

In a fully private Blockchain, ‘write’ permissions are kept centralised – to one organisation. ‘Read’ permissions may be public or restricted. Likely applications include database management and auditing (internal) for a single company.

Hyperledger: It is an open-source collaborative platform developed by Linux systems in December 2015. Unlike Bitcoins and Ripple, which are working on a public decentralised platform, Hyperledger is a private distributed ledger. This platform supports functions like financial transactions, supply chain, IoT, and manufacturing.

Corda: Corda is a distributed ledger platform developed by financial firm R3. Though inspired by Bitcoin’s open-source platform, it shares its data only with certain entities on a ‘need-to-know’ basis. In a Bitcoin network, all transactions are visible to the entire community while in Corda, transactions are validated by specific parties to that transaction. Corda can also coordinate the workflow between firms without the need for a central controller

Subscribe to enjoy uninterrupted access