In November 2013, a hitherto unknown word caught the fancy of the world – Bitcoin. While the first Bitcoin was ‘minted’ in 2009, its knowledge had remained confined to a select set of programmers. But in November 2013, the price of ‘Bitcoin’ quintupled in a month – catching the fancy of the who’s who of the technology and financial industries. Over the next three years, Bitcoin, and its parent concept, Blockchain, became a household name among technology companies.

In the last two years, there is probably not a single financial or technology company that would not have explored Blockchain. As a concept, Blockchain promises to transform the way we trade by eliminating the two biggest inefficiencies in a transaction – time and cost. It promises to approve / execute transactions ‘real-time’, while reducing the role of ‘third-party intermediaries’.

It promises to be one of the (if not THE) most disruptive technologies that the world have ever seen. If implemented with caution, taking all stakeholders along, it can truly transform the way the world transacts today – rendering scores of technologies and hundreds of business, obsolete.

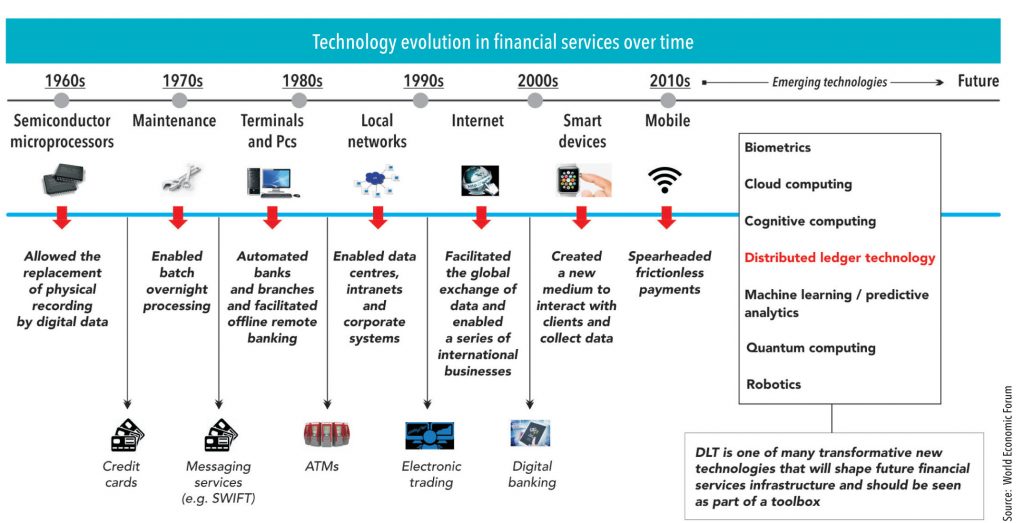

The medieval and pre-medieval periods used the barter system for trade – where people exchanged goods and services for other goods and services in return, without the need for a common denomination called ‘money’. Though in use for many decades, the system had its own disadvantages. First, the person who wanted to exchange any goods or services had to find another person trade with. This exercise proved highly inefficient – consuming significant time and energy. Second, there was no common measure of value for trade. To overcome this problem, the first coins were minted by king of Liyda in 600 BC, followed by paper money by China. Since then, technology evolution has brought many changes to the financial systems. The first credit card was issued in 1960s to ease the burden of carrying cash. The introduction of ATMs in 1980s, replacing tellers and branches, changed the way the financial systems operated. The emergence of internet-enabled transactions across borders and in different currencies and the invention of smart devices in early 2000s enabled ‘any-place any-time’ transactions.

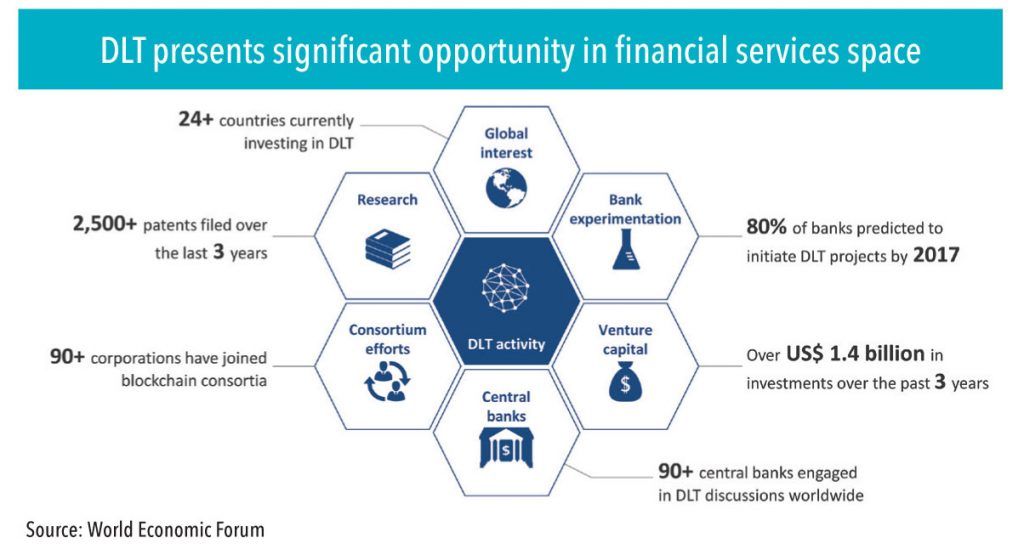

Since all these methods are controlled by regulatory authorities and are often completed with the help of third-party intermediaries, their time and costs were high. Hence, there has always been a latent need for a technology/platform that can facilitate transactions in real-time with minimal cost. This led to the emergence of distributed ledger technology (DLT) – an enabling mechanism, which can be collaborated with the existing systems, to make transactions/processes happen in real-time and at much lower cost.

Subscribe to enjoy uninterrupted access