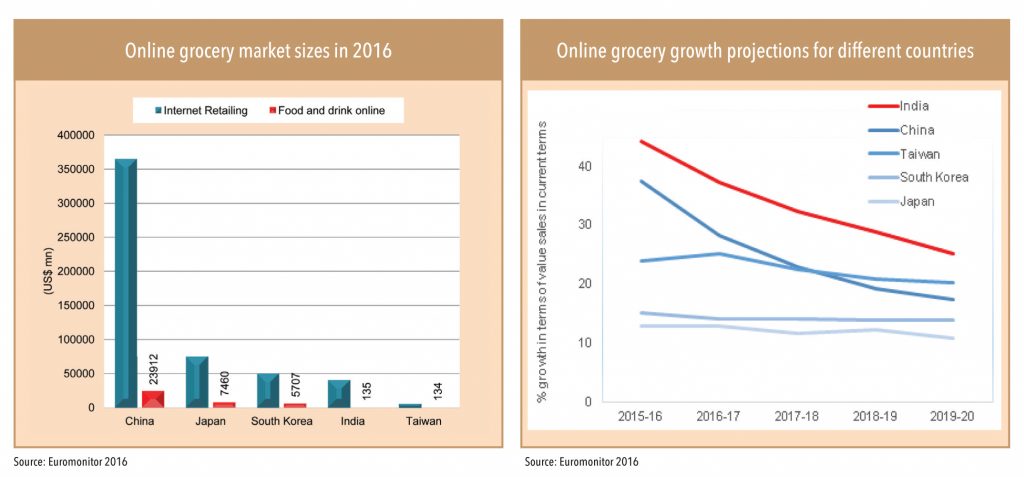

The ecommerce sector in India is expected to have touched about US$ 22bn in 2015 as per IBEF. E-tailing, which comprises of online retail and online marketplaces, has become the fastest-growing segment in the larger market with a 56% CAGR over 2009-14. PWC pegged the size of the e-tail market at US$ 6bn in 2015. While grocery retailing accounts for almost two-third of the total retail market in India, online grocery accounts for less than 10% of the total e-tailing market. Compared to China, Japan, and South Korea, the online grocery market in India is disproportionately small.

Compared to China, Japan, and South Korea, online grocery market in India is disproportionately small

History of ecommerce in grocery in India

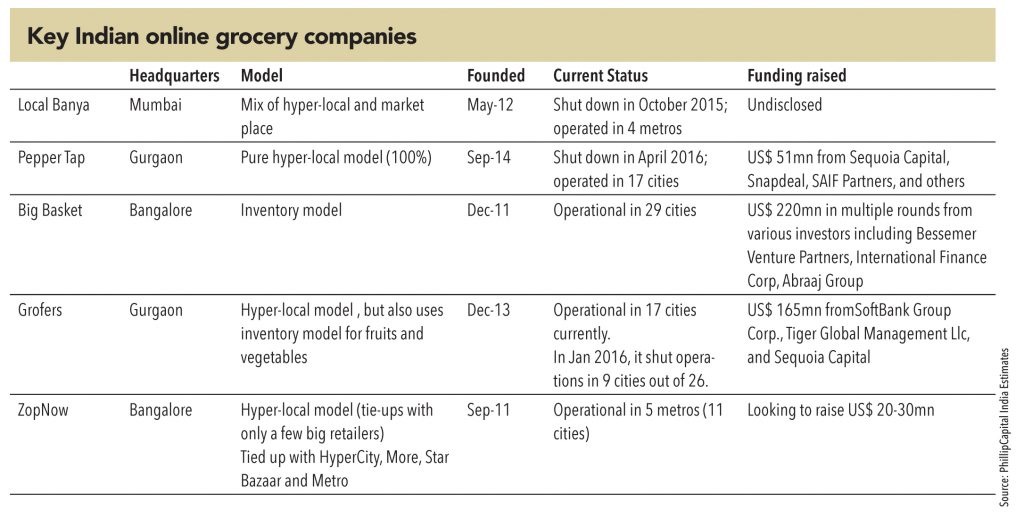

In India, the first e-commerce start-ups in grocery emerged in 2011-12 with the arrival of Zopnow, BigBasket, and LocalBanya. Since then, a multitude of online grocery start-ups have mushroomed across India in the last five years. According to Tracxn, there are at least 490 grocery delivery start-ups in India that have together raised at least US$ 486mn from investors. However, cracking the online grocery model is not easy. Out of the five largest online grocery start-ups in India, two have already gone bust.

What constitutes a successful model for online grocery?

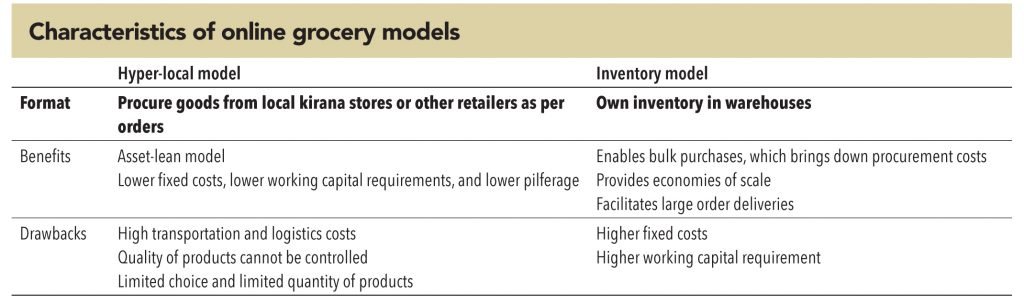

Like the traditional ecommerce space, there are two business models in grocery ecommerce – hyper-local model and inventory. Players using the inventory model (like BigBasket) use low-cost warehouses on the outskirts of cities and deliver products directly to customers. Hyper-local delivery players (like Grofers) procure goods from the local kirana stores and then deliver the goods to customers. While both models have their own benefits and drawbacks, most players use a combination of the two in different proportions.

Zip.in is a Hyderabad-based online grocer that follows the inventory model. In a guest post on website iamwire.com, Zip.in’s CEO, Mr Kishore Ganji, highlighted that the hyper-local delivery model is less promising because of its many inherent drawbacks, which continue to remain unresolved. In the post, he wrote that this model suffers from higher transportation and logistics costs, lower margins, lower ticket size, and lower control on quality. The result is that hyper-local start-ups operate on wafer-thin margins and end up losing money on every delivery. Comparatively, inventory-based models, in spite of their higher fixed costs, are more promising as they offer higher margins due to economies of scale and higher quality control, he had said.

Some players like ZopNow claim to have found a solution that includes the best of both models. ZopNow is a Bengaluru-based online grocer that has tied up with big retailers (such as HyperCity, More, Star Bazaar, and Metro) for procurement, instead of with multiple local kirana stores. In media reports, this company has said it believes that its unique model, which it calls ‘scale-local’, trumps both warehousing (inventory) and hyper-local models as scale-local model offers benefits of both without the drawbacks of either. In a recent interview to vccircle.com, Zop’s CEO, Raj Pandey had said, “We have opted for the ‘scale-local’ model, which gives us access to a wide range and optimises logistics costs as well. While we are not running a warehouse, we have scale and better unit economics. Plus, there is no pilferage, no rent, and no utilities.”

While the debate about which model is superior rages on, the success of both Grofers (hyper-local) and BigBasket (inventory) indicates that both models can work with the right strategy

So what is the right strategy for online grocery in India?

The key differentiating factors between traditional ecommerce and grocery ecommerce are – delivery times (faster delivery expected for grocery due to perishability of goods), gross margins, ticket size, and nature of products (includes perishable goods). Gross margins are lower in groceries (vs. say white goods), but swift deliveries, in fact, cost more – hence grocery companies need an adequate ticket size to generate sufficient gross profits and make each delivery profitable. Currently, even existing online grocery customers order only a portion of their groceries online, and purchase the rest from nearby kirana outlets or modern retail stores. To increase ticket size, companies will have to continually provide highest levels of service and ensure more business from each customer per order.

Lack of well-developed cold-storage infrastructure in India is one of the major challenges for Indian online grocers. Unlike traditional e-commerce players, online grocers need strong cold-storage infrastructure for storing and transportation of perishable goods. As a result, online grocery companies which will invest in cold-storage infrastructures in their target markets will be able to deliver high-quality products to their consumers. This will help ensure repeat orders and also help to increase ticket sizes.

Like many traditional organised retailers who went bust while trying to expand too quickly, many major online grocery players have also gone bust for the same reason. This is because setting up the sourcing, warehousing and distribution of groceries for online sales requires building of infrastructure at the local level. Rapid expansion across the entire country without focus on supply chains will lead to a significant increase in procurement and distribution costs, and make businesses unsustainable. Grofers learnt it the hard way in January 2016 when it had to shut operations in 9 out of 26 cities due to sustainability issues after rapid expansion.

Building a localised supply chain is essential for a business like online grocery

Each market is different

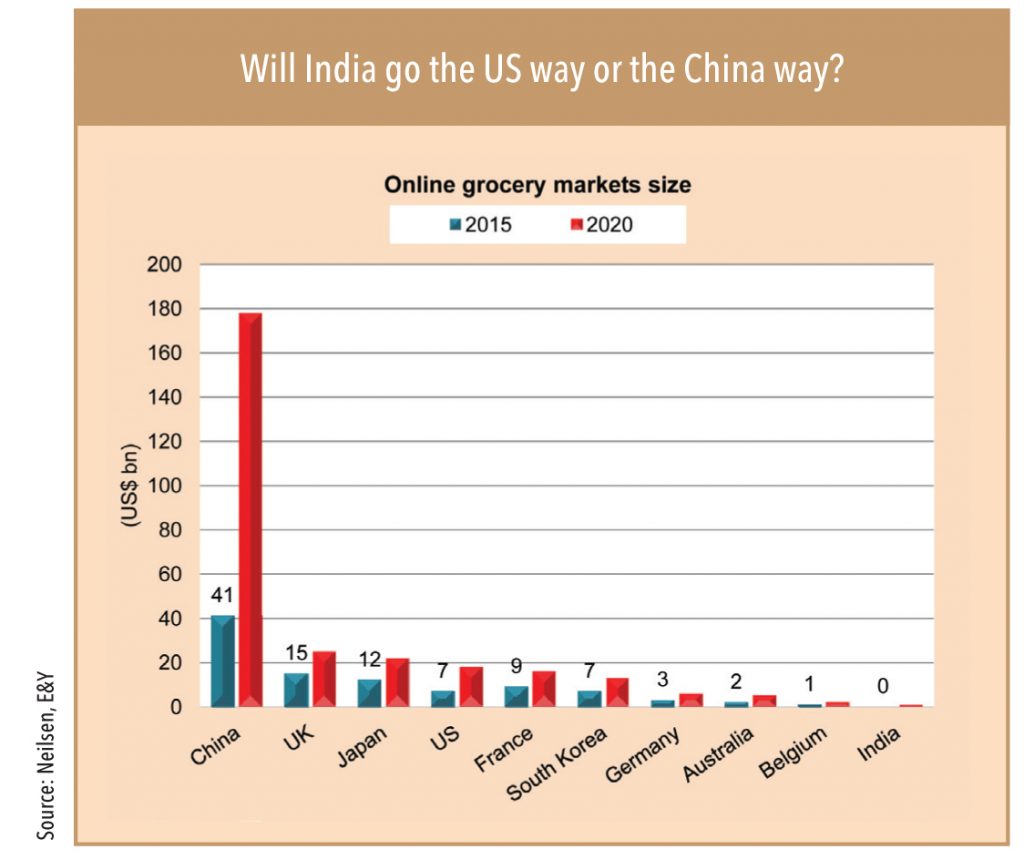

While China and many developed nations have seen a sharp growth in online grocery over the last decade, the US online grocery market stands out as being disproportionately smaller. This could be due to the following reasons: (1) Population density and concentration in the US is lower than in China and other developed nations, which makes grocery ecommerce less feasible due to high delivery and warehousing costs, and (2) the dominance of Walmart and Kroger (42% combined share) over the US grocery markets has reduced the innovation intensity in the industry.

The Indian market seems to have more in common to China than the US – high population density and heavily fragmented retail markets. However, unlike China, the cold storage infrastructure is still in nascent stages in India and there are many other supply-chain bottlenecks in the country, which will only ease with time. As a result, the growth in online grocery market in India is likely to be more gradual than that in China.

The Indian market has high population density and is heavily fragmented (like China) but does not have a developed transport and cold storage infrastructure (unlike China)

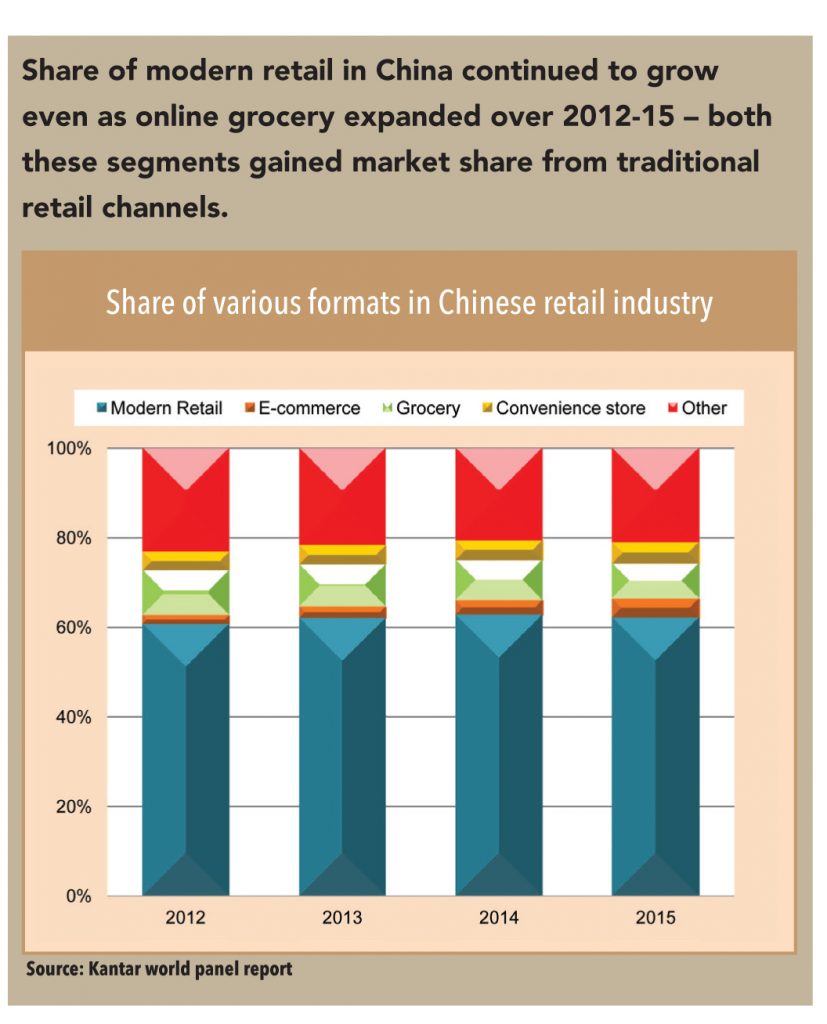

Modern retail and online grocery will both grow faster than the overall grocery market

Online grocery and modern retail have both grown faster than the respective retail markets in China and other countries, by gaining market share from unorganised retailers. Both online grocery and modern retail offer customers a one-stop solution and variety, which is not available in unorganised retail outlets. Also, unorganised retail does not offer huge savings offered by modern retail or home delivery offered by online grocery. Since both online grocery and modern retail offer unique benefits to customers compared to unorganised retailers and target different sets of customers, even in India, both modern retail and online grocery will grow faster than the overall grocery market.

Since both online grocery and modern retail offer unique benefits to customers compared to unorganised retailers, and target different sets of customers, in India, both these formats will grow faster than the overall grocery retail market

Subscribe to enjoy uninterrupted access