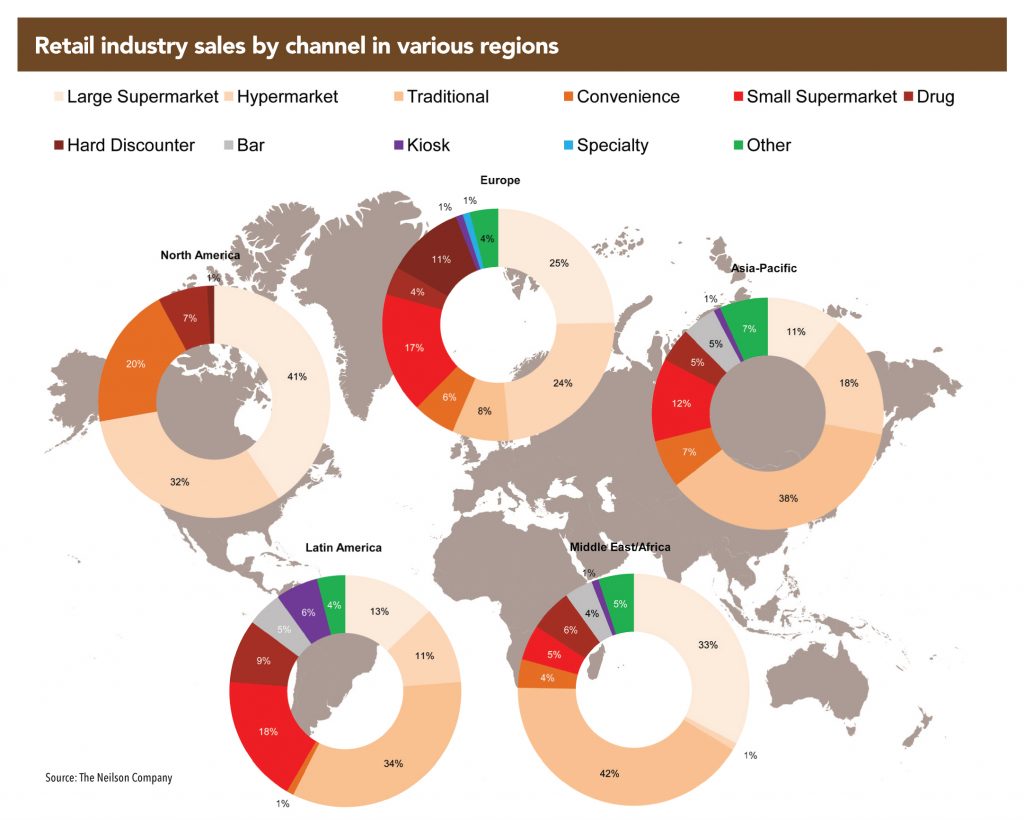

Global retail industry reported sales of US$ 22.6bn in 2015 and is expected to grow to US$ 28bn in 2019 (CAGR of 6%), as per market research firm ‘Research and Markets’. There is a huge variation in the structure of the retail industries in different geographies – modern retail dominates in North America and Europe, while traditional retail is more prevalent in Asia, Africa, and South America

Wal-Mart Stores, Inc

What differentiates Walmart?

EDLP (everyday low price): Wall-Mart pioneered EDLP since its first store in 1962, and captured millions of customers worldwide. EDLP is a pricing strategy that promises consumers that they will get better and lower prices on products than what competitors provide, without the need to wait for promotions or price discounts

Retail Link System (RLS): Wal-Mart revolutionised the way retail companies manage their supply chains in more ways than one. Walmart’s RLS is one of the largest B2B supply chain systems in the world and shares its vast trove of real-time sales data and forecasts with its largest suppliers that stock its shelves. This data helps the suppliers to plan their production and product delivery before stock-outs. The system gives the supplier 100 weeks of product sales history and tracks the product’s performance globally. For example, Procter & Gamble set up an inventory system with Wal-Mart that included an automatic re-ordering process linking the supplier and retailer. This system alerts P&G when a product is running low at a store, which in turn triggers an order for the nearest P&G factory to ship the item to a distribution center or directly to the store. For P&G, synchronising its product data with Wal-Mart’s sales saved the supplier millions annually. The goal is to master the art of knowing what it needed, how much is needed, and when it is needed.

Focus on smaller towns: Wal-Mart’s focus is on smaller towns instead of urban and suburban locations where its rivals Target, Costco, and K-Mart are less concentrated.

Cross-docking: To eliminate extra storage costs and maximise efficiency, Wal-Mart’s distribution centres use cross-docking. Once goods enter Wal-Mart’s distribution centres, they are crossed from one loading dock (inbound) to another (outbound) in 24 hours. This eliminates storage costs, allows drivers to continuously replenish stock at the retail stores, and helps bring unsold merchandise back to the distribution centre

What differentiates Costco?

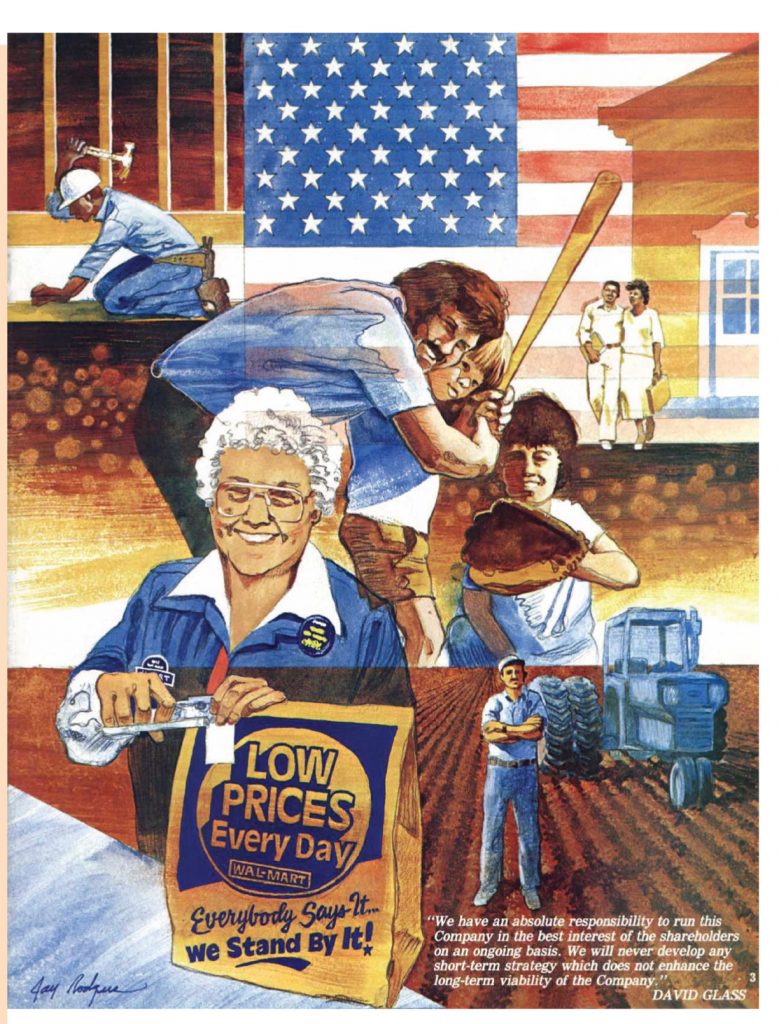

Costco relies on the following formula: (1) selling a limited number of items, (2) keeping costs down, (3) focusing on high volume, (4) paying workers well, (5) having customers buy memberships, and (6) aiming for upscale shoppers, especially small-business owners. In addition to this, it does not advertise, which results in cost savings of up to 2% of sales per year.

Low price-high volume: Goods at Costco are usually bulk-packaged and marketed primarily to large families and businesses. Costco keeps product prices low and never marks up any product more than 15% (less than the typical 25% at super-markets). It earns lesser margins compared to others, but those low margins are compensated by charging a US$ 55 annual membership fee to its 64mn members.

Fewer SKUs and products: Selling fewer items increase sale volumes and help drive discounts. Costco warehouse typically carries 3,700 products while a typical Wal-Mart super-centre carries approximately 140,000 products. Despite Costco’s large store volume, it sells only four toothpaste brands while Wal-Mart sells about 60.

Only members, warehouse shopping, no advertising: Costco’s high sales are achieved without any advertising (no newspapers, radio, TV, or billboards), except target-marketing when it opens a new warehouse. New members are added due to positive word-of-mouth from existing members. 91% of all members currently renew their membership in US/Canada (i.e., attrition rate is only 9%).

Lower operational costs: Costco drops its shipping pallets directly on the warehouse floor, no stocking up products on shelves. This saves millions in labour cost. Its floors are bare concrete slabs, which are more durable and easier to maintain

Aldi

What differentiates Aldi?

Subscribe to enjoy uninterrupted access