The government strongly inclined to become an ‘enabler’ vs. being a provider earlier, but…

GV team’s discussion with various stakeholders (financiers, builders, policy makers) indicated a strong commitment by the government towards addressing India’s housing shortage. In order to incentivise borrowers and generate demand for housing, the government has taken on the role of an ‘enabler’, by providing various incentives and grants.

…will it put its money where its mouth is?

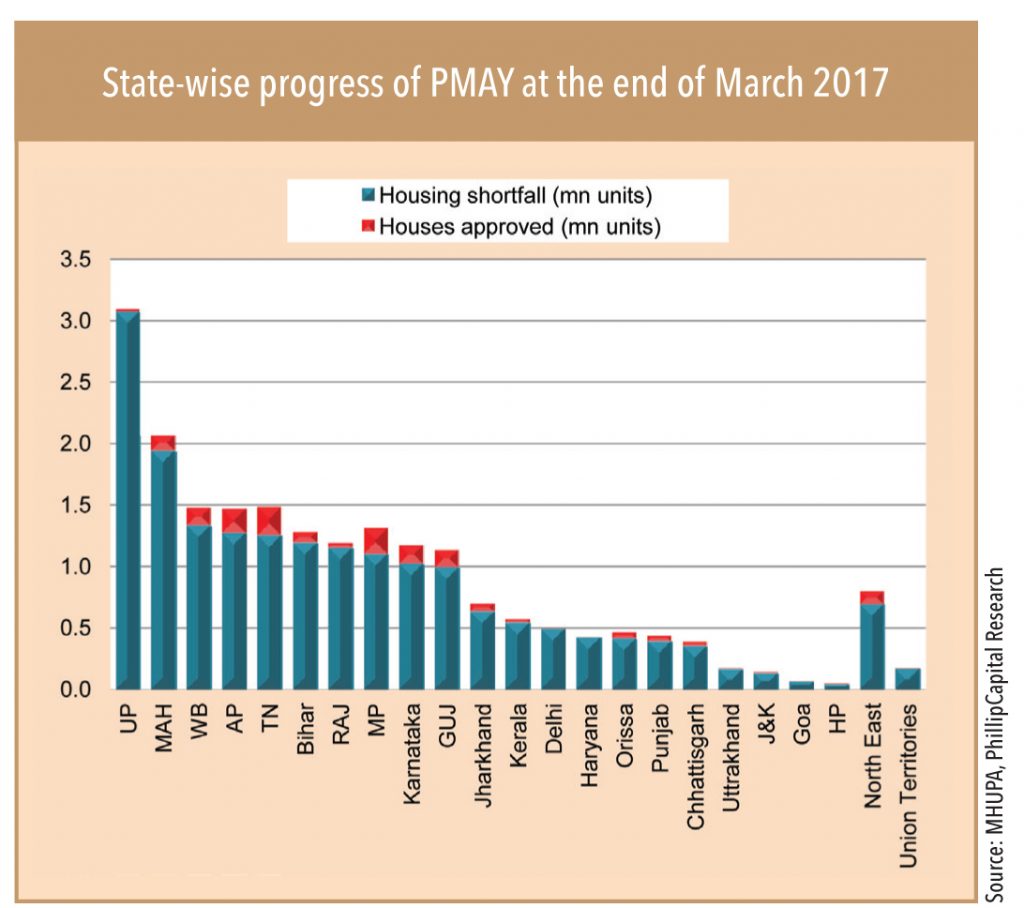

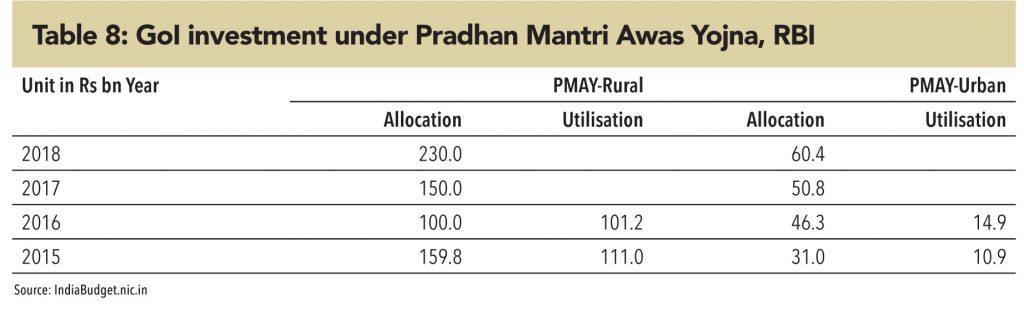

The housing shortfall of 10mn houses would require central government support (grant and subsidy) of Rs 1.8tn. However, the allocation in the previous four years has been low, and the worst part is that the utilisation of the allocated amount was even poorer. The GOI allocated only Rs 200bn in the FY15-18 union Budgets and utilisation was poor at 15% in the initial two years. Allocation towards urban housing in the FY17-18 Union Budget was only Rs 60bn.

The housing shortfall of 10mn houses would require central government support (grant and subsidy) of Rs 1.8tn

Looking at this meagre annual allocation number, is it likely that the government will have resources to fund affordable housing? Given the poor past track record, can utilisation of the allocated amount improve? From GV’s discussions with government officials it appears that resources are not constrained. For FY17-18, it seems that almost 80% of the money allocated towards urban housing schemes has already been used up (within three months) and the ministry is ‘contemplating’ additional fund allocation under supplementary demand for grants.

Stakeholders are enthusiastic about the government’s housing mission

Builders are delighted with the credit-linked subsidy scheme, as it has acted as a catalyst in boosting the demand for houses, especially in the small-ticket segments. Moreover, the income-tax benefit for affordable housing projects has pushed developers to take a plunge into this segment, given that mid-income or high-income house projects have been seeing a slowdown.

On affordable housing developers, HDFC’s annual report says, “While the demand for affordable housing remained robust, there was a slowdown in sales of high-end luxury apartments in certain pockets of the country. However, with the boost given to affordable housing, more developers are recognising the benefits of increasing supply in this segment – where the real demand lies. Affordable housing projects typically work on lower margins, but higher volumes; sales tend to be swift in this segment. With many developers not keen on holding large stocks of unsold inventories, the affordable housing space has become more attractive.”

Financiers are also optimistic about the demand for home loans in the affordable segment. As per Mr Sudhin Chokshey, Managing Director of GRUH Finance, “Many budgetary announcements aimed at the affordable housing sector, and particularly the infrastructure status for developers operating in this space, are likely to improve the supply. The credit-linked subsidy scheme is likely to push up demand.” According to Mr Chokshey, CLSS announced for MIG-segment families in the income segment of up to Rs 1.8mn for a one-year period up to December 2017 is debatable as this segment do not require interest subsidy. “What they require is better supply,” he concludes.

In its annual report, Dewan Housing Finance says, “For LIG, an affordable house would cost (on the higher side) Rs 2.5mn, approximately five-times the annual gross income of the LIG income group – making it, in fact, not very affordable. This would result in rising dependence on either subsidies or government construction as a means of bridging the ever-increasing affordable housing gap.”

As per the KPMG – NAREDCO report on affordable housing – “A thrust on encouraging private sector participation in affordable housing, traditionally the domain of the government, could provide the answer to India’s urban housing predicament. However, as things stand, affordable housing remains a challenging proposition for developers. Issues continue to persist in terms of land availability and pricing, the project approval processes, and other areas, which make low-cost housing projects uneconomical for private developers. Making affordable housing work in India necessitates the active involvement of all stakeholders concerned. Radical thinking on the part of the government can provide a much-needed fillip to affordable housing development in the country. Steps such as establishment of a single window clearance system, formulation of innovative micro mortgage lending models and tax subsidies would encourage private sector involvement. The developers, on their part, need to adopt innovative and low-cost technologies, which could enable them to deliver affordable houses quickly and cost-effectively.”

Subscribe to enjoy uninterrupted access