Government to probably look at housing shortfall only for the homeless (about 10mn units vs. TG-12’s estimate of 18.7mn)

In 2012, the technical group (TG-12) estimated that the need-based total housing shortfall in India in 2012 was 18.7mn dwelling units. The shortfall calculated by TG-12 captured a genuine demand for houses, but from the policy maker’s point of view, the priority is to address the housing shortfall for the homeless – whether it is a single person, a couple, or a family. The actual housing need for the homeless was never done before. Hence, under the Pradhan Mantri Awas Yojna – Housing for All by 2022 programme, the Government of India initiated the mammoth task of estimating the exact number of houses needed for the homeless. This would depend on demand survey for which all states/cities would undertake detailed demand assessment by integrating Aadhar number, Jan Dhan Yojana account numbers, or any such identification of the intended beneficiaries.

Though the survey is still ongoing in some states, GV’s discussions with various government official suggests that the advance estimate of the housing shortfall only for the homeless is around 10mn.

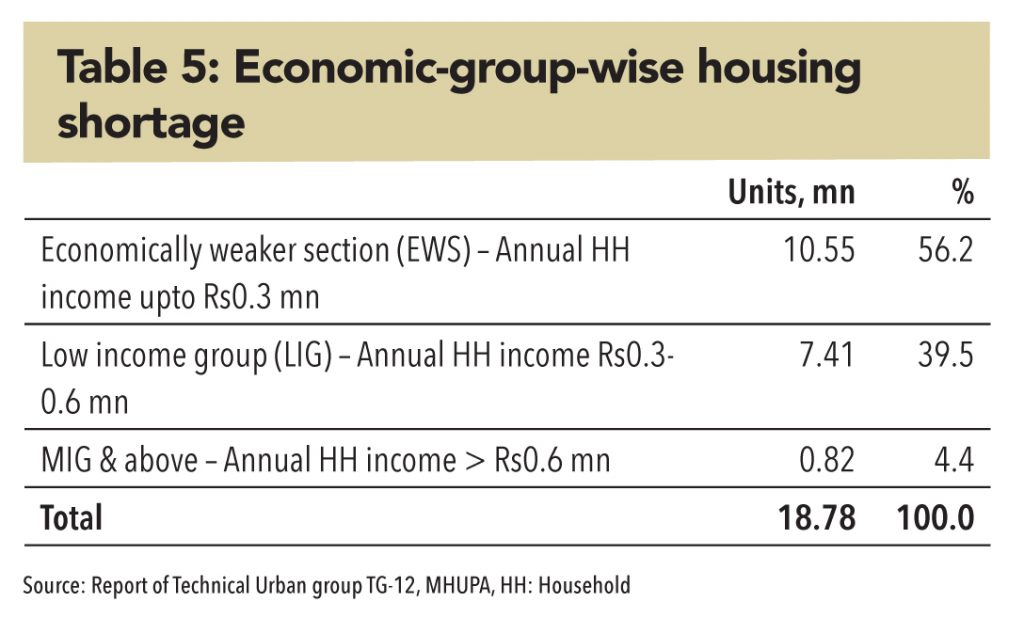

Therefore, it can be said that ‘the housing for all by 2022’ envisages building 10mn houses (not 18.7mn recommended by TG-12). Within these, 96% of the shortfall is in the economically weaker section and low-income group.

GV’s discussions with various government official suggests that the advance estimate of the housing shortfall for homeless is around 10mn (much less than the 18.7mn dwelling units that TG-12 estimated)

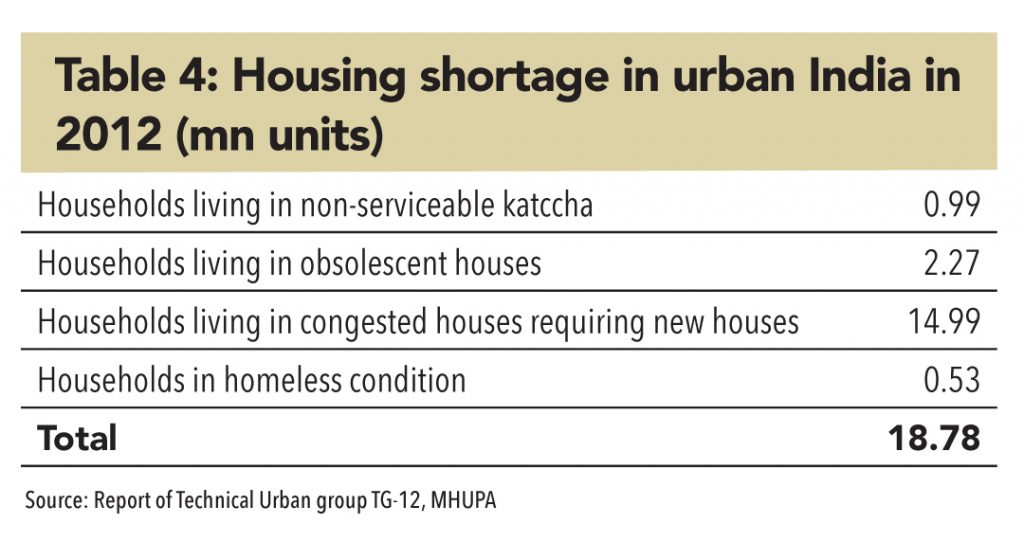

The technical group’s estimates

The methodology that TG-12 adopted considers: (1) identification of households residing in dilapidated and non-serviceable houses, (2) households living in congested conditions, and (3) homeless households. The TG-12 report found that 80% of the shortage emanated from congestion (need based). The manner in which it was calculated is – “couple or persons above 10 years of age who did not have their own room”.

As per the TG-12 report, urban housing shortage is prominent across the economically weaker sections (EWS) and low-income groups (LIG), which together constitute over 95% of the total housing shortage. It estimated the housing shortage among the middle-income groups (MIG) and above at 4.38%.

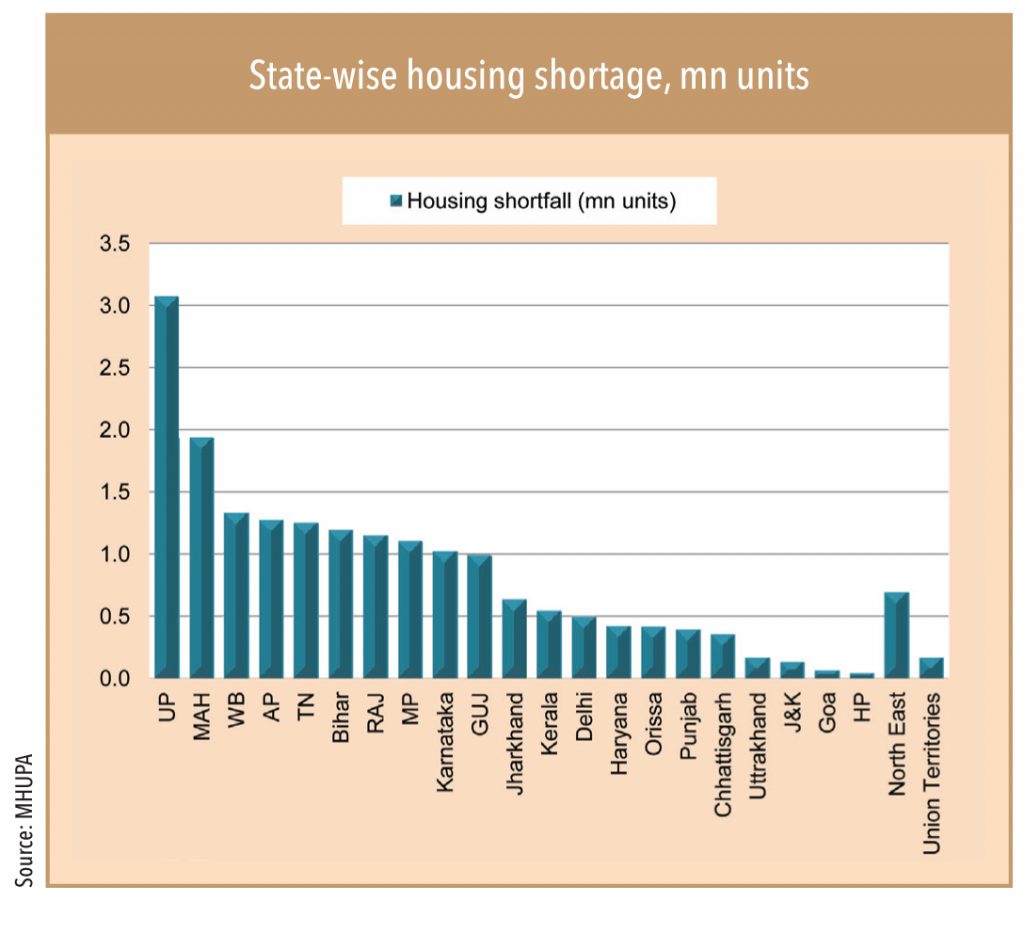

State-wise housing shortage

State-wise distribution indicated that top-10 states (in terms of population) contribute to 76% of India’s total housing shortage, with Uttar Pradesh’s contribution among the highest at 16.5%. Various state governments such as Maharashtra and West Bengal have launched their own housing schemes to tackle the need in the EWS segment. Though they have made some progress, the gap is still too wide.

The 10 most populated states contribute to 76% of India’s total housing shortage; Uttar Pradesh is the highest

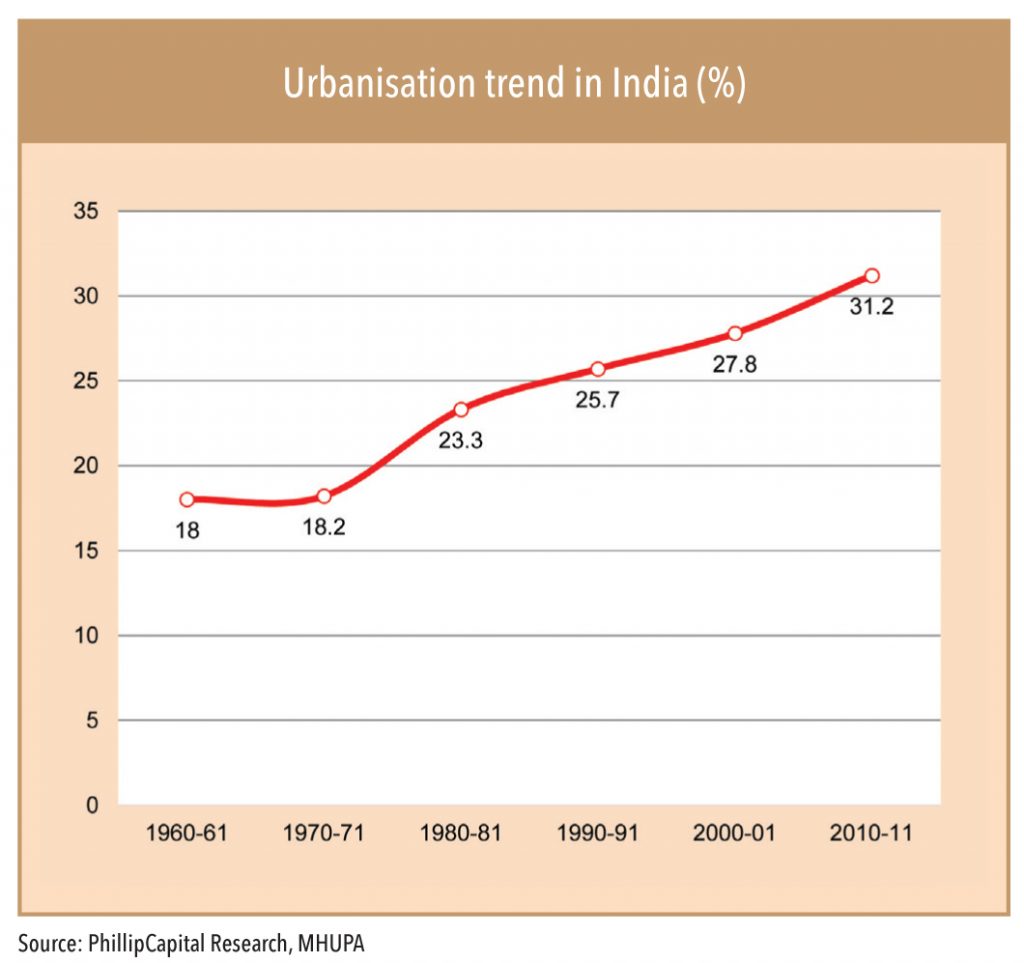

Increasing urbanisation to drive demand for housing

India’s urban population is set to outpace its overall population growth. Over 2001-11, India’s urban population CAGR was almost 3%, resulting in an increase in the urbanisation rate to 31.2% from 27.8%. Out of the 1.21bn people who live in India, 377mn are urban dwellers. Federation of Indian Chambers of Commerce (FICCI) estimates that by 2050, the country’s cities will see a net increase of 900mn people! Over 2012-50, the urbanisation CAGR is likely to be 2.1%.

India’s agriculture sector has a limited absorption capacity, so most of the growth in urbanisation is likely to be a consequence of a rural-to-urban migration. After India’s economic liberalisation, its manufacturing and services sectors have seen an influx from rural youth (in terms of employment). With the country likely to witness rapid industrialisation, this migration trend (rural to urban) is likely to continue.

As per commercial property and investment management firm JLL, “The main reasons for rise in shortage in affordable housing on the supply side is lack of availability of urban land, rising construction costs and regulatory issues while lack of access to home finance for low-income groups are constraints on the demand side. Construction costs form nearly 50% to 60% of the total selling price in affordable housing projects while for luxury projects this figure is 18% to 20%. Moreover, majority of the loans disbursed by banks and housing finance companies are above Rs 1mn”

Meanwhile, in urban India, the looming housing shortage and growing concentration of people has resulted in an increase in the number of people living in slums and squatter settlements. Skyrocketing prices of land and real estate in urban areas have induced the poor and the economically weaker sections of the society to occupy the marginal lands typified by poor housing stock, congestion, and obsolescence. According to a report submitted by a technical committee to the Ministry of Housing and Urban Poverty Alleviation (MHUPA), India’s urban housing

Source: PhillipCapital Research, MHUPAshortage is estimated at nearly 18.78 million households in 2012.

It is apparent that a substantial housing shortage looms in urban India and a wide gap exists between the demand and supply of housing, both in terms of quantity and quality in India (Bridging the Urban Housing Shortage – KPMG NAREDCO report).

Subscribe to enjoy uninterrupted access