India’s key strengths (in the context of its chemicals industry) are its steadily growing domestic chemicals demand (India is the ‘fastest growing’ economy in the world) and its large population base. The recent spurt in investment interest has been because of a slowdown in the Chinese chemicals industry ever since the government announced stricter environmental pollution measures in January 2015.

Why is the China factor so influential?

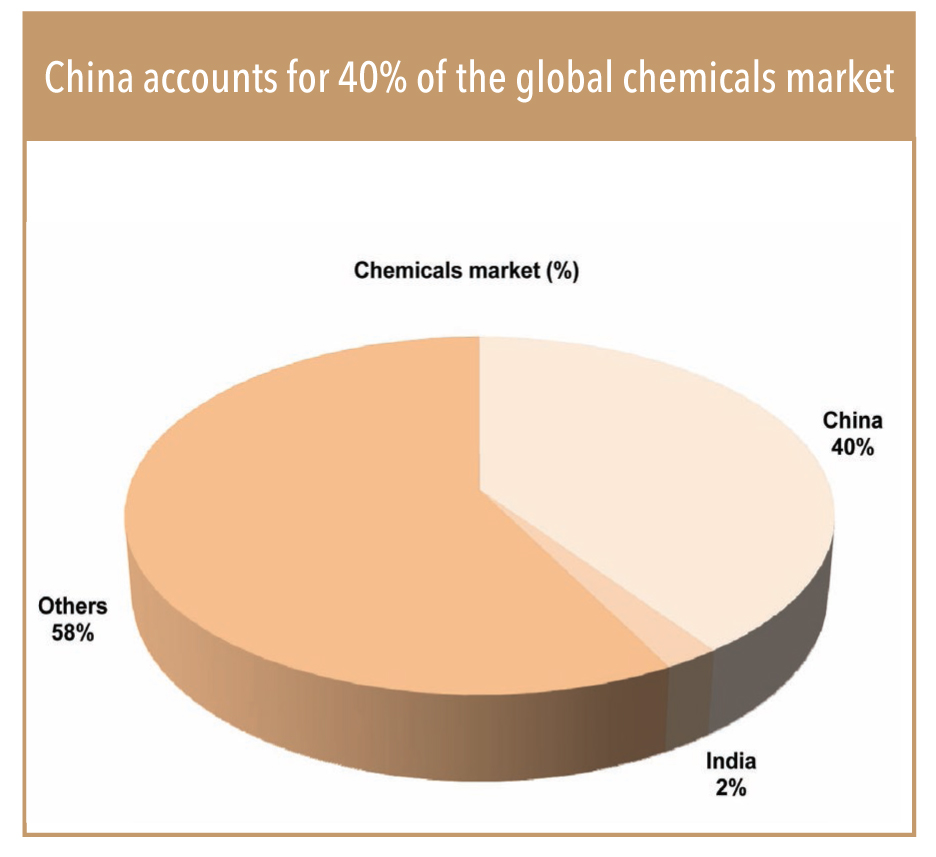

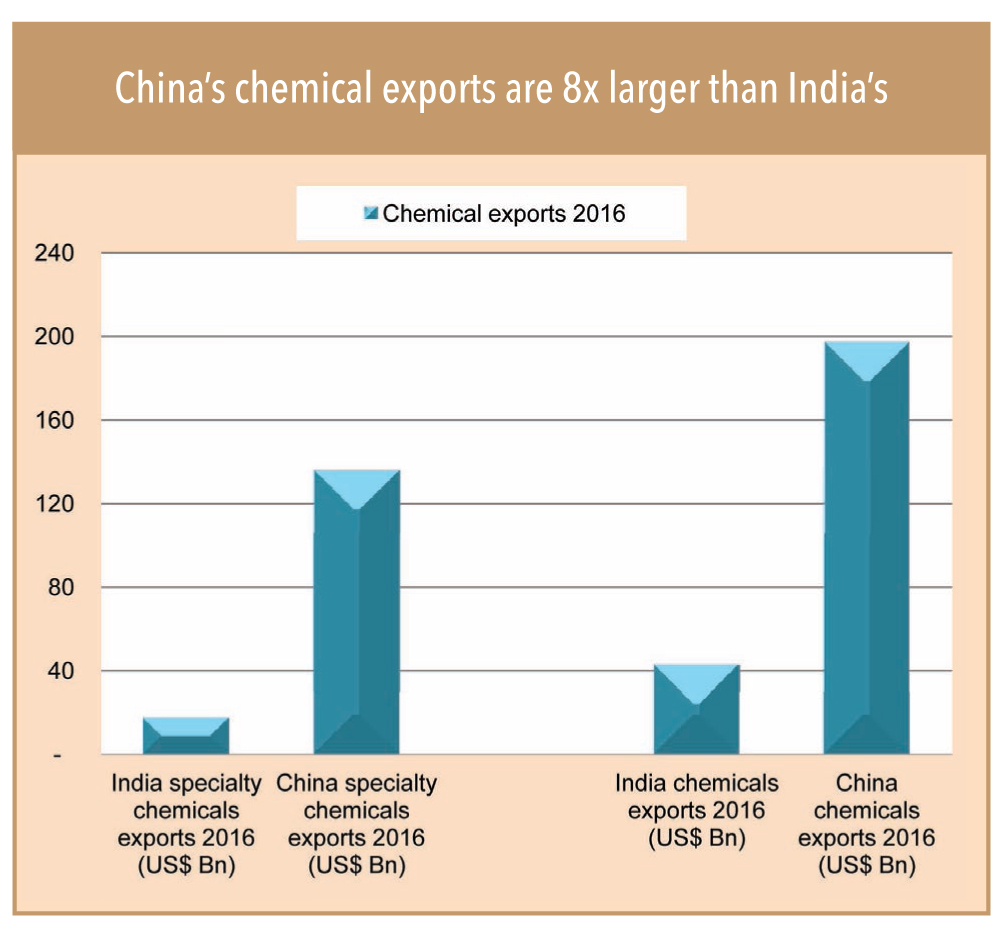

Well, simply because the Chinese market is humungous. The Chinese chemicals market size is about US$ 4.35tn (about 40% of the total global market). Its chemicals exports account for about US$ 200bn and specialty chemicals exports for US$ 136bn, which is eight times larger than Indian exports. This means that even a minor slowdown in Chinese exports could result in a robust exports opportunity for the Indian industry, as India is considered a alternate manufacturing hub of chemicals by the world now. Therefore, it is not surprising that the ‘China factor’ remains a leading driver of the India chemicals industry’s exports growth.

Specifically, India exported US$ 43bn worth of chemicals in 2016 compared to China’s US$ 200bn.India’s specialty chemicals exports (excluding bulk organic, inorganic chemicals, and pharmaceuticals)

were just US$ 17bn while China’s were eight times more at US$ 136bn.

Updates on Chinese environmental policy implementation

Effective 1st January 2015, the Chinese government implemented its stricter environmental protection policies that enforced strict penalties (with no upper

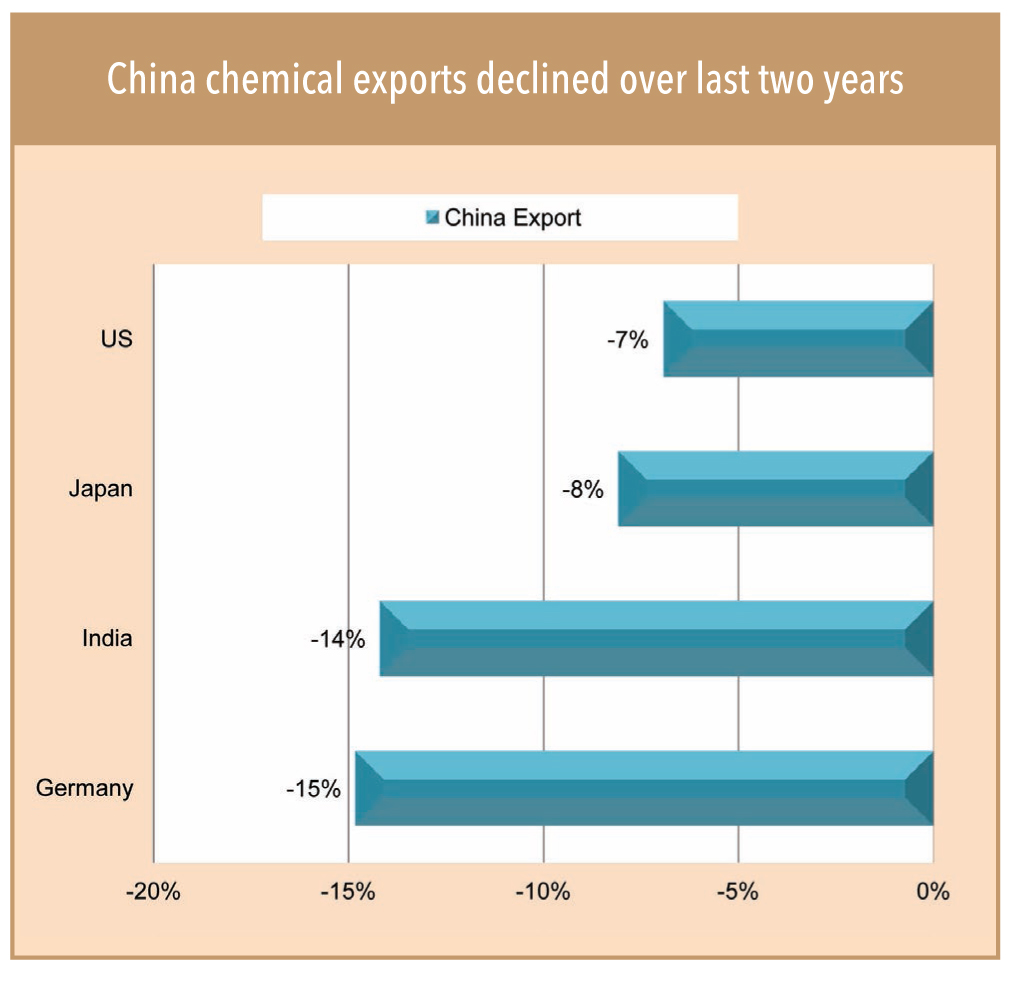

limit), seizures and shutdowns of plant and property of illegal environment polluters, and compulsory effluent treatment. This resulted in the plants of thousands of small and midsized chemicals players closing down, and incremental cost pressure because of effluent treatment requirements. As a result, China’s chemicals industry (the primary source of various chemicals to the world) suffered a 10% decline in exports.

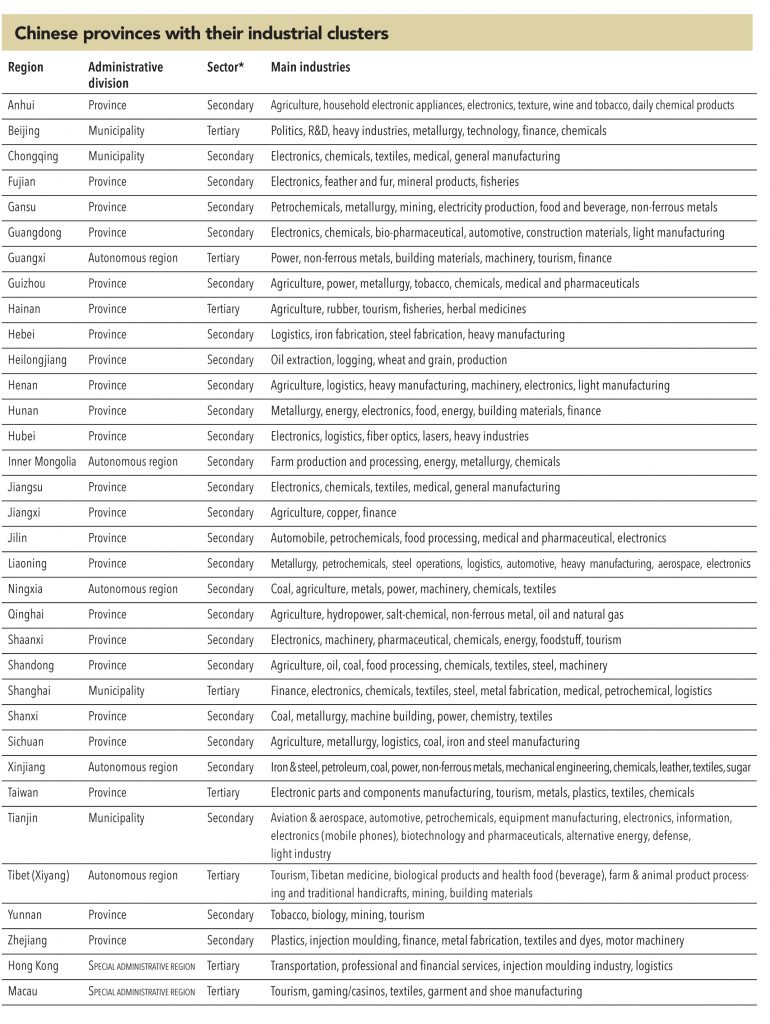

Belying the skepticism of the entire world about whether China would actually continue such a strict environment-polic implementation, China’s Ministry of Environmental Protection moved one step ahead. It made it mandatory for all polluting industries to operate from industrial clusters situated away from human habitats. This made the survival of many chemical manufacturers in China difficult, and caused either permanent shutdowns or relocation of manufacturing units into the industrial belt.

Such policy initiatives have already dented China’s exports performance significantly, as well as its economic progress. During last two years, China’s chemical exports to its leading export destinations (covering US, EU5, India, Japan and Korea, which put together account for about 35% of its total exports) has seen a healthy correction. Specifically, Chinese chemicals exports to Germany declined by 15% followed by India (-14%), Japan (-8%) and US (-7%).

Regulatory updates on China

Recently, Chinese authorities, with an intention of ‘stocktaking’ their environmental policy implementations conducted inspections of thousands of chemicals manufacturers over a period of five months. They found more than 54% of some 41,928 enterprises across the country in violation of environment protection laws, according to the Ministry of Environmental Protection. The prime reason for noncompliance was the relaxed approach by state/province authorities in order to maintain strong economic growth in their province.

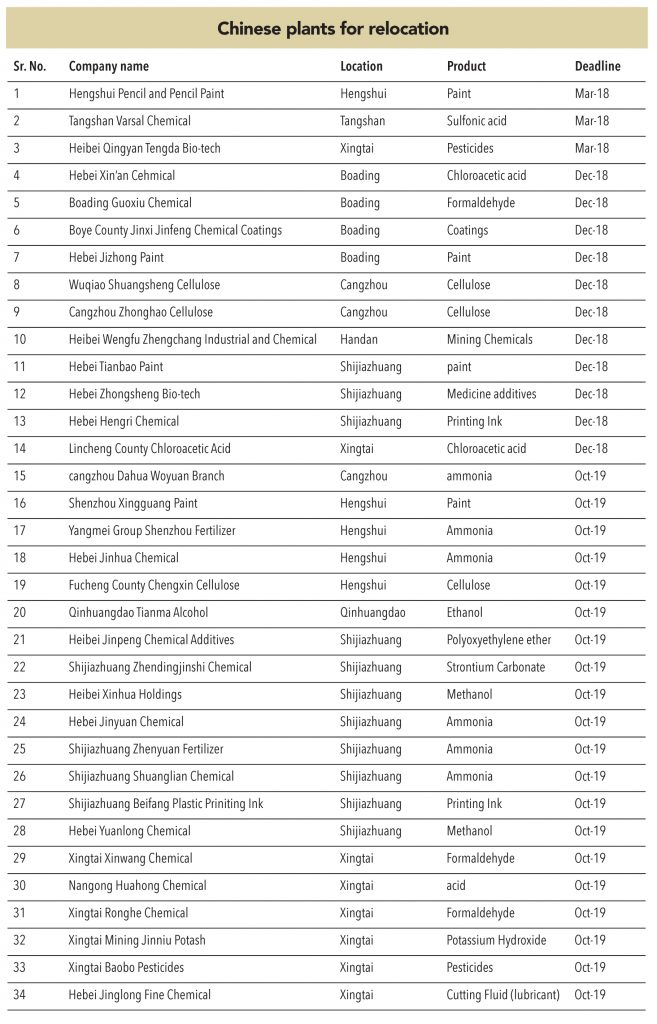

Hence, the Chinese central government (overpowering province authorities) issued a new directive making it mandatory for all small/mid-sized chemicals plants that fall into the toxic category to start relocating their plants in 2018 and complete this process by the end of 2020. All larger plants need to relocate by the end of 2025, and must start the process by no later than 2020. As an alternative, existing plants can also be re-engineered to produce non-toxic products, or must be permanently closed if re-engineering or relocation is impossible.

“China plant shutdowns and relocation in the Chemical Park are going on for the last one or two years. But from this year, they (China’s government) have started a round of inspections, under which they go to specific provinces. My feeling is that this is not the end of it. This, in fact, is to get much more serious and stricter. Progress with relocation of chemical plant into chemical parks is relatively very slow; I feel the pressure on chemical companies could get intense in the near term.”

-Dr. Kai Pflug, Management Consulting (China)

Maintaining its drive to protect the environment, the Chinese government has introduced a new type of green tax from 1st January 2018. With this, firms that cause pollution will be taxed under a uniform set of national rules instead of the discretionary fees collection practice of local governments. Companies will pay taxes ranging from CNY 350 (US$ 55) to CNY 11,200 (US$ 1,175) per month for noise, according to decibel levels. The tax has set rates of CNY 1.2 on stipulated quantities of air pollutants, CNY 1.4 on water pollutants, and a fairly wide range of CNY 5 to CNY 1,000 for each metric tonne of solid waste. Such a policy further discourages the manufacturing of polluting industries such as chemicals, steel.

How has China lost its age-old cost advantages?

Low-cost manufacturing played a huge role in making China the second-largest economy in the world by 2010 from being the ninth largest in 1980. However, this is no longer a strength for China. Led by various policy initiatives in the recent years, manufacturing costs in China have seen a meaningful rise. In order to protect its environment and ensure safety, China has already made effluent treatment a must and put in enough restrictions on various types of discharge from manufacturing plants, resulting in rising operating expenditure for manufacturers in China.

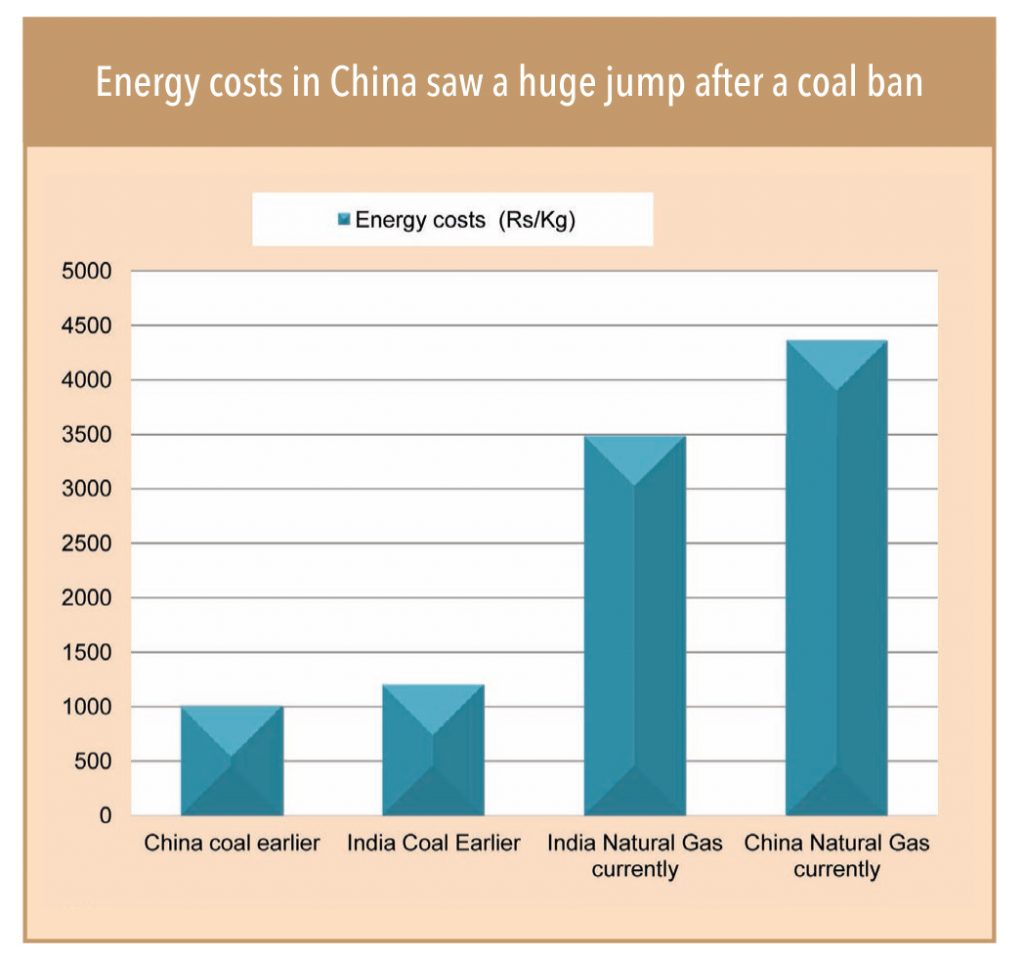

The Red Dragon is the world’s biggest coal consumer, but in line with its Clean Coal Action Plan 2015-2020, it has banned the usage of coal for firing industrial boilers and shifted to burning natural gas. In fact, it started promoting centralised heating and power supply that worked on natural gas and renewables, replacing scattered-heat-and-power engines fuelled by significantly lower cost low-quality coal. Such initiatives resulted in a multi-fold rise in energy costs in chemical manufacturing in China. Just to put this all in perspective, in China, coal with annual consumption of about 3.7bn tonnes, used to accounts for roughly 66% of its energy demand.

Similarly, on the energy cost front, Dr Hu highlighted that the ban on coal usage and a mandatory shift to natural gas resulted in a multi-fold jump in energy costs for all chemicals manufacturers. He said, “About 5mn tonnes of steam used to be generated with a one tonnes of coal burning at the cost of about CNY 100 per kg. Now, the cost to generate the same amount of steam using natural gas is about CNY 400 per kg,implying a 4x jump in energy costs. Not only that,the supply of natural gas is limited and does not satisfy the demand, which leads to an appreciation of gas prices.”

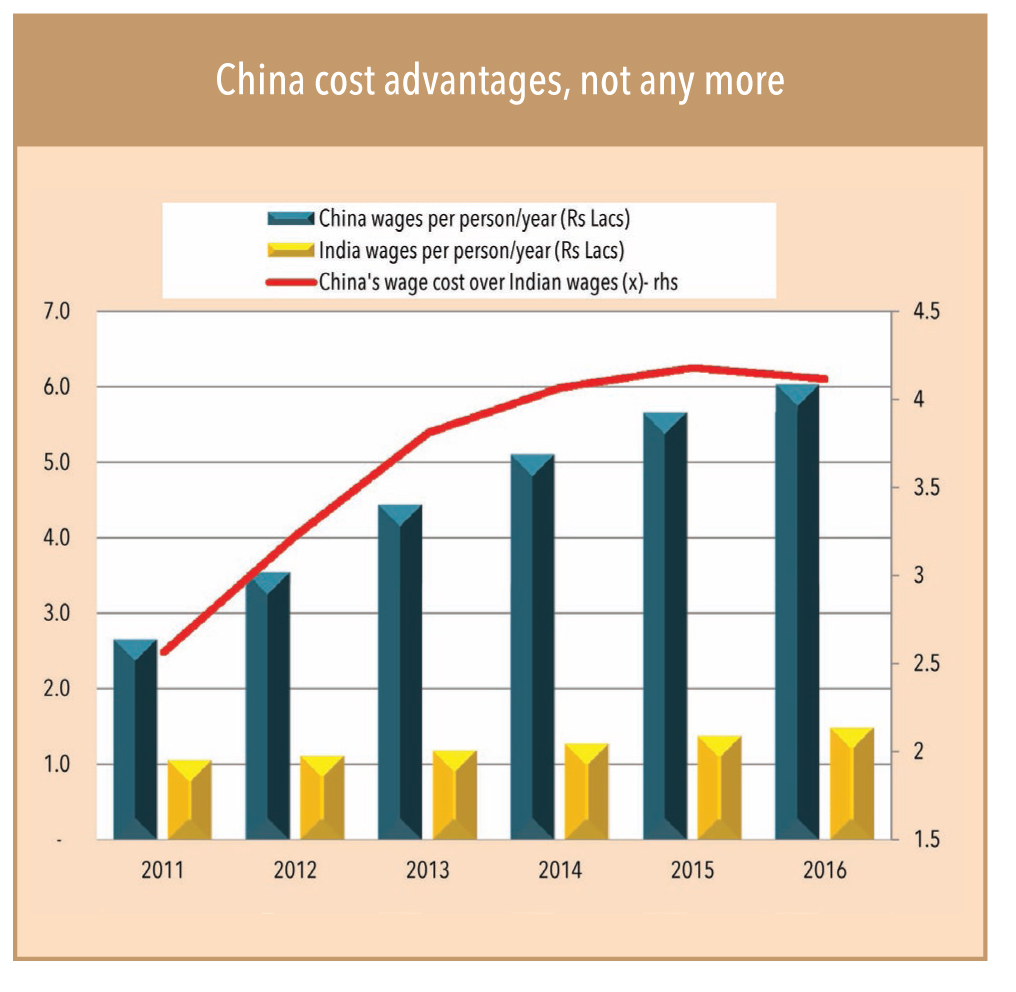

“China is facing the issue of labour shortage and that too a large part of its labour force is old. Specifically, normal industrial labour cost saw a rapid swing from RMB 2,000 per month in 2012 to RMB 4,000-5,000 per month in 2017 (implying cost escalation at 18% CAGR over the last five years).

-Dr. Richard Z.L. HU, ex-professor of chemicals, Zhejiang University, and current founder of Zheda Panaco Chemical company

Just like energy costs, other cost elements such as raw-material prices are appreciating continuously in China. Thousands of plant shutdowns across China due to environmental policy restrictions over the last couple of years, particularly for low-value-added products has already created a shortage in input materials in China, which was felt worldwide too. This shortage, coupled with rising energy costs, higher labour costs and incremental effluent treatment and compliance charges have boosted input material prices meaningfully vs. China’s historical strength of low-cost raw material prices.

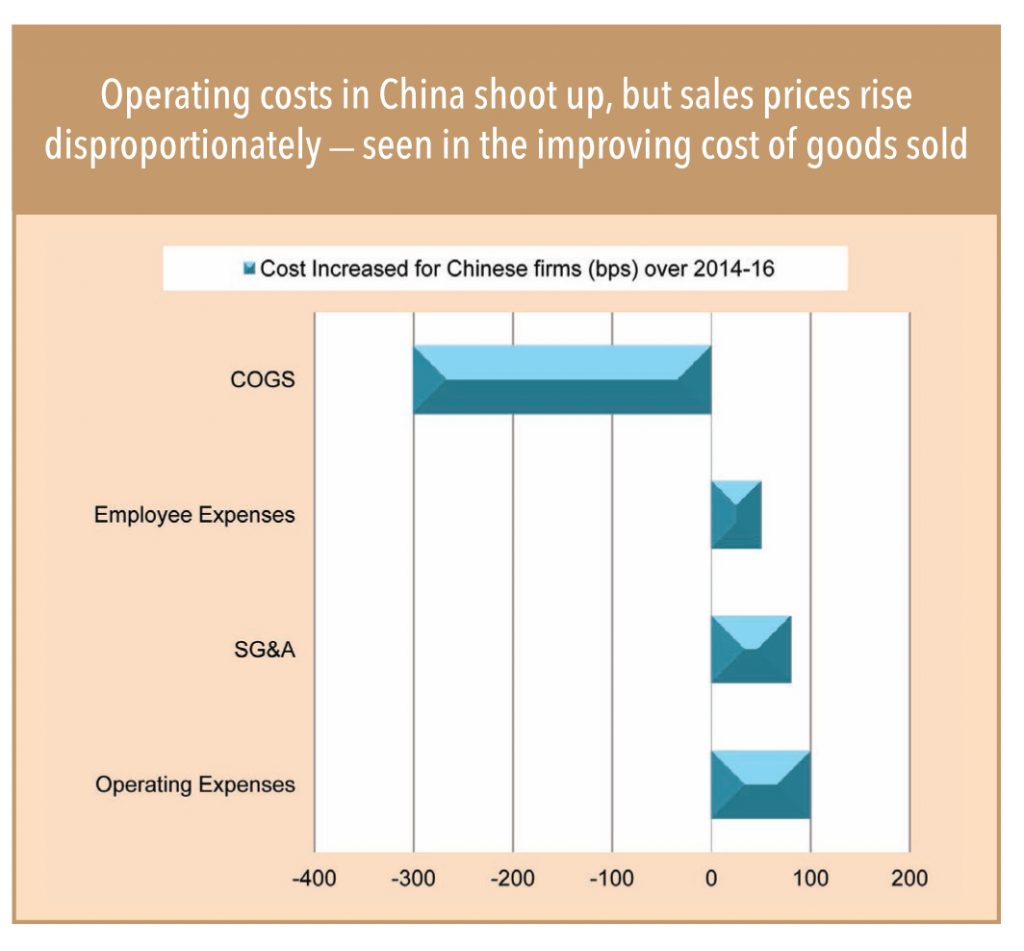

A cost structure analysis of listed 297 companies reveals that every cost item over the last couple of years has risen. However, as per available industry statistics (Bloomberg), overall costs (% of sales) have remained almost the same despite a spike in material, labour, incremental effluent treatment, and energy costs, as most of the spike in costs saw a ‘smart pass through’ (China consumes a lion’s share of its indigenous production). The disproportionate rise in chemicals product prices in China is visible in improving gross margins. However, such a price rise is not noticeable in international prices, specifically because of lower exports by Chinese manufacturers – and that is one of the key reasons that MNCs have begun to get uncomfortable about operating in China or sourcing from China.

“The Chinese road-freight cost for non-hazardous chemicals is about 40% higher than India, and should be even higher for hazardous chemicals. The key reason for these steeper costs are higher employee costs and infrastructure load (toll charges)”

-Mr Nirmal Momaya, Strategy Director, Camlin Fine Science

Given stricter directives by the Chinese central government about mandatory plant relocations or shut downs, it is very clear that many chemicals manufacturers will go through shutdowns or relocations into industrial clusters over the next few years. This indicates that the Chinese chemical industry will continue to face raw material shortage in the visible future, along with on-going concerns of higher operating cost due to higher effluent treatment costs, higher labour costs, and fuel costs. China’s weaker cost competitiveness in international trade and produc disruption due to wheeling of large manufacturing plants indicates continued slowdown in the Chinese chemicals industry and its exports.

India – a known alternative hub for chemicals – could bag a multi-year exports opportunity. China’s prolonged self-imposed slowdown offers a much longer window (of at least a few years) for Indian chemicals peers to establish themselves in the international market by building global clients and ultimately tapping the export opportunity emerging out of the Red Dragon’s slow down. This is also true for other competing Asian nations (Indonesia, Vietnam, Taiwan, Korea).

While other countries see opportunity in China’s slowdown, China itself does not seem too worried about its weakening export competitiveness, probably because of its shifting focus ‘to quality from quantity’, and putting more emphasis on structural improvements rather than quantity expansion. Practically, this means that China’s national priorities are changing – from its historical focus on GDP growth to its current focus on environmental safety, risk prevention, and anti-corruption. And while this does offer a multiyear chemicals exports growth opportunity for countries such as India, it may not be true for all chemicals product categories. As per its 13th five-year plan, China has prioritised innovation in new material (fine/specialty chemicals) and electronics chemicals, where India and other countries might face tough competition from China.

Mr Liu He (member of the Political Bureau of the Communist Party of China Central Committee, and Director of the General Office of the Central Leading Group for Financial and Economic Affairs) in his speech during the Annual Meeting 2018 of the World Economic Forum in Davos, Switzerland, on 24th January 2018, stressed the necessity to transit the Chinese economy from a phase of rapid growth to one of high-quality development. “Our focus needs to change from ‘Is there enough?’ to ‘Is it good enough?’,” he said. He underscored China’s fight against environmental pollution and said, “Green and low-carbon development is what the Chinese people want the most – in a break with the traditional growt model”.

Subscribe to enjoy uninterrupted access