National-level organised players such as Titan follow best-in-class practices (priority – employees first, customers second, and shareholders third). Some of the instances of Titan’s best practices:

• Procuring gold from most trusted sources/legal channels. Usage of Indium (which is 160x) costlier vs. cadmium for soldering jewellery pieces

• Providing best equipment, which enables its workers to make world-class jewellery

• Setting up Karigar Parks, providing these skilled workers with subsidised land for housing needs and taking care of their children’s education

Some of the organised players, who aspire to tap the capital markets for their expansion needs, will have to clean their books and adopt best practices that are at par with the market leader Tanishq. Only then would they be able to command the desired valuation in the jewellery sector, which is already tainted by multiple scams and fraud.

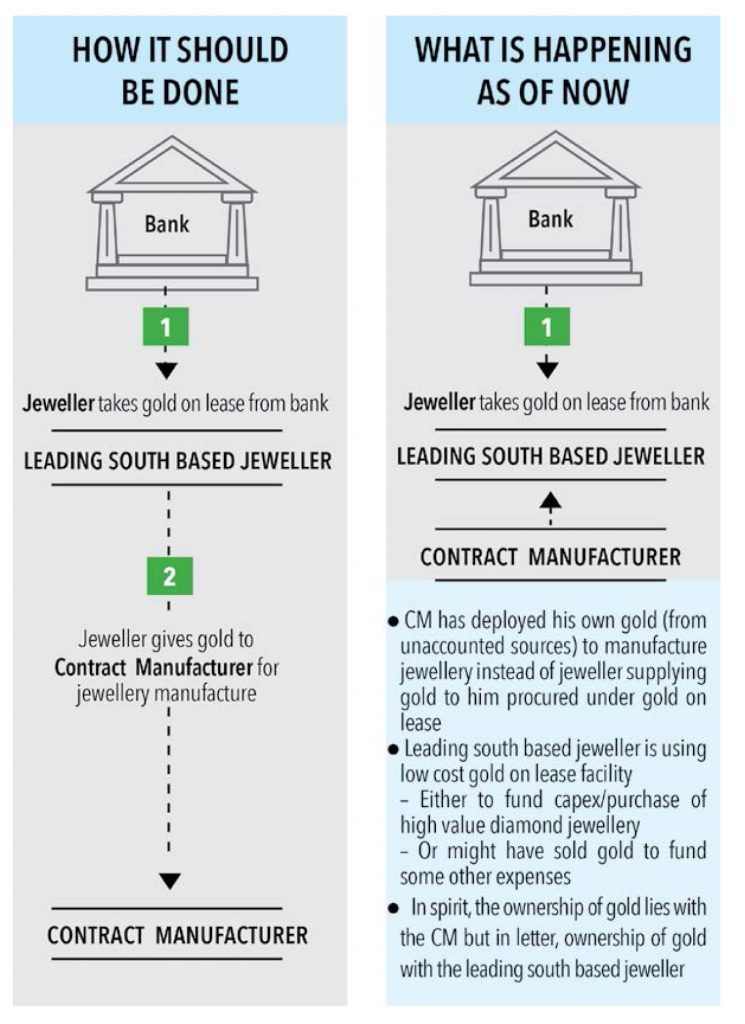

As per the law and books of accounts, the jeweller is the owner and custodian of raw gold, but actual ownership (in spirit) of this gold lies with the CM – or contract manufacturer. However, there is a high probability that instead of giving gold to the CM, a south-based jeweller has sold the original gold (procured from the bank on lease) to fund capex or purchase high-value diamonds. This enables the jeweller to expand its retail network faster by misusing the low- cost gold-on-lease facility. If it were to borrow money for expansion from banks, it would have to do so at market rates – the gold-on-lease rates are much lower. However, according to sources, in the medium term, this jeweller might start facing a liquidity squeeze if the contract manufacturer starts demanding the original gold.

There is no smoke without fire

• No sales returns: This particular south-based jeweller has not returned a single piece of jewellery to its CM in the past three years. Generally, 3-4% of goods are returned to the CM due to various reasons including defects.

• CM was stumbled that even if leading south based jeweller decided to melt jewellery on its own instead of returning he will have to bear significant amount of losses since jewellery involves good component of stones.

• The CM receives payment from this leading south-based jeweller in 1.5-2.0 months , which is relatively longer than the market norm of making payments within 15 days. Footfalls at most of the retail outlets of this jeweller are low since it charges higher making charges in the value-conscious southern market.

Why then is this contract manufacturer scoring a self-goal?

The CM, despite being aware of these malpractices, is continuing to associate with this jeweller because the deal is lucrative and there are no real alternatives. “25% of my business comes from this jeweller and I earn higher margin vs. supplying other jewellers, so it is difficult to find a replacement,” the CM claimed.

Keyur Savla, a jewellery contract manufacturer supplies jewellery to a leading jewellery retailer (who has recently set up the biggest standalone showroom in South India). This jeweller makes payments for making charges in gold terms (bars/coins) to Keyur Savla, instead of money and making these payments off the record. The jeweller has strong political connection and is probably liquidating all its black money accumulated in the form of gold before money laundering norms become more stringent.

Subscribe to enjoy uninterrupted access