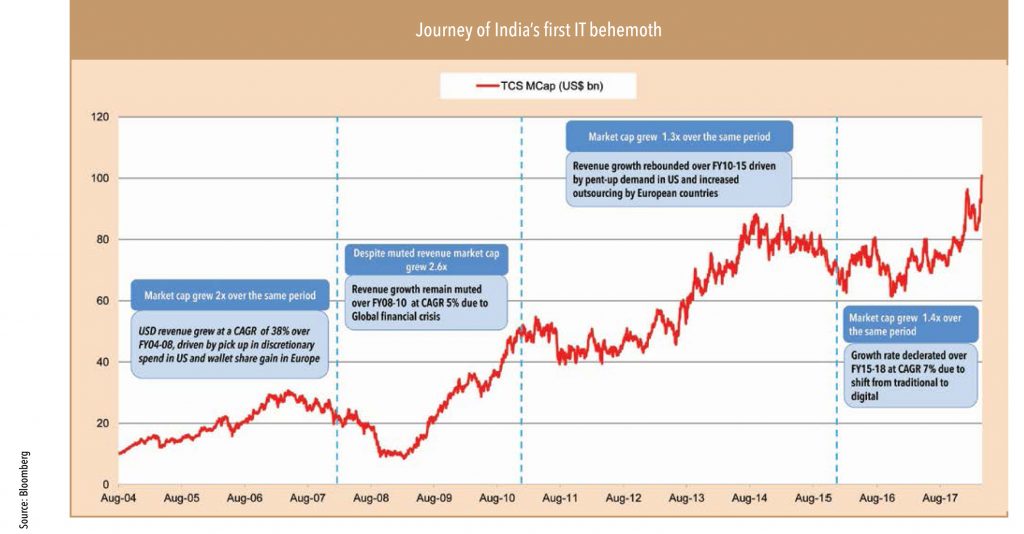

Can Titan dominate the industry as TCS has done in IT?

TCS became the first company from Tata’s stable and from India to join the elite +US$ 100bn league. Tanishq (Titan) and TCS are leaders in their respective fields, with TCS holding a pole position in Indian IT services and Tanishq having the highest market share in the domestic jewellery industry. Both companies have been leaders in their respective space as they have incorporated best-in-class systems and processes, adopting policies that gives equal importance to employees, customers and shareholders.

TCS has been able to take the lead in Indian IT services as it started the concept of onsite billing with work done at offshore offices. Recently it has differentiated its capabilities and heavily invested in its digital business, while other players are still struggling with their legacy businesses. Tanishq literally set the ‘gold standard’ in the jewellery industry by: (1) introducing ‘Karatmeter’, (2) launching its differentiated 19=22 gold exchange programme, and (3) focusing on lightweight and studded jewellery, while other players were focusing on plain gold jewellery.

What needs to happen for Titan to become the next TCS?

Reverse DCF (discounted cash flow) analysis suggests that for Titan to reach even half of TCS’ current stature in the next 12 years:

1.Its jewellery business will have to generate a CAGR of 18% over FY 19 – 30, gaining market share from unorganised players

2.Its EBIT margin shall have to rise to 15% by FY30 from around 11% in FY18, driven by increasing share of studded jewellery, operating leverage, and improved profitability from newly-incubated business

3.Its market share in jewellery will have to touch 20% in FY30 from 4% in FY18 If Titan can pursue this scorching path until FY35, it will near the US$ 100bn target

There are several strong tailwinds, and if these are used well, they can propel further growth. Titan has a good chance of taking up an unassailable lead over other organised players.

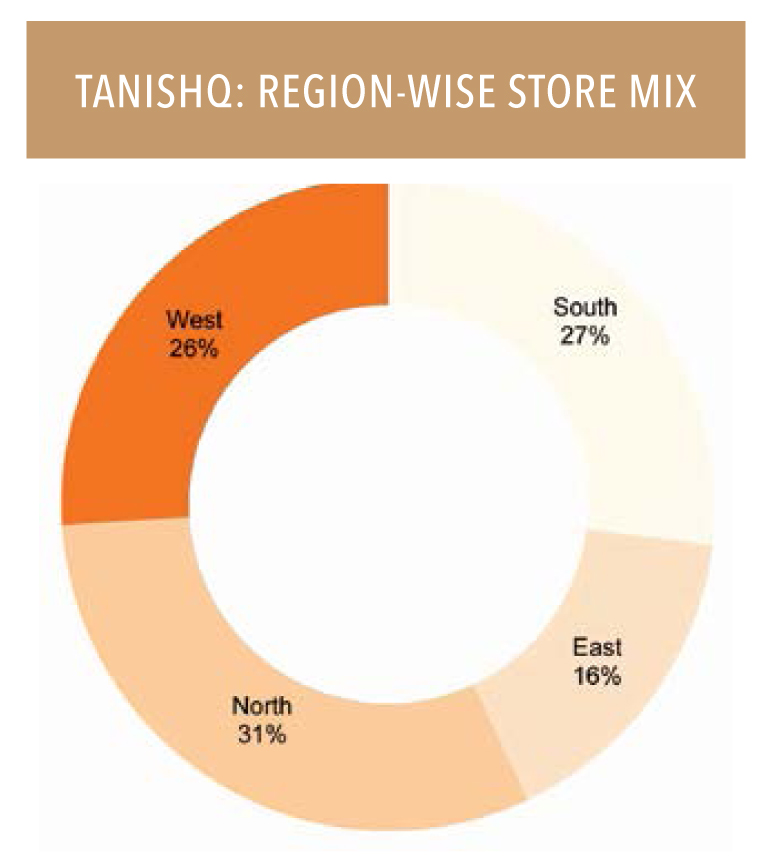

These include: Network expansion: Tanishq has around 253 stores across 157 cities, with limited presence in south India due to the presence of well-entrenched organised jewellers and customers’ limited appetite for studded jewellery, which is Tanishq’s forte. Tanishq is in strong position to add stores via the franchise route, which other organised players may find difficult: (1) if the brand is not well known, (2) high investment is needed, and (3) terms and conditions are tilted in favour of the franchisor.

Titan’s management has said that it sees potential in at least 400 towns (already present in 157 cities in India), where it believes it can set up at least one Tanishq store. It has launched multiple initiatives to gain market share in cities where it is not in the top-3 despite being present for more than a decade. Although urban India may lose its love for gold/studded jewellery in the medium to longer term, in rural India, with a more entrenched traditional outlook, the growth of the jewellery industry will continue. The government’s plan of doubling farmer income by 2022 can support the jewellery industry’s growth in rural areas, but in this case, Tanishq will be at a disadvantage, given its focus on studded jewellery.

Aggressive foray into wedding jewellery: A shot-in-the-arm for Tanishq

Tanishq had a laidback approach towards wedding jewellery (+50% of total jewellery demand in India) because of lower RoIC and high-ticket value leading to customers becoming reluctance to pay thorough the banking channel. Being a national player, Tanishq also found it difficult to serve regional tastes and preferences. With more than 50% of India’s population under the age of 25, India’s wedding jewellery segment is likely to only keep rising.

Recognising this, Tanishq has corrected its strategy with the launch of a separate brand Rivaah, for wedding jewellery. Within this, it has launched exclusively focused designs (community wise) within India and create special wedding zones within its retail stores. and increasingly customers have become vary of buying gold from un organised jewellers

“Tanishq (jewellery business) will grow 2.5 times on the back of more stores and increasing our market share in wedding jewellery. The sub-brand ‘Rivaah’ for wedding jewellery currently contributes around a fourth of our jewellery business.” – Mr Bhaskar Bhat, MD, Titan Industries.

Exports – massive opportunity that is yet untapped.

India exports gems and jewellery worth US$ 40bn every year (15% of total exports), marginally lower than its domestic jewellery industry (US$ 50 bn). With a large Indian diaspora residing in key economically developed countries, Tanishq can make significant inroads into these markets.

Compliance with laws will slowly turn into an advantage in India

The government has taken measures such as hallmarking (to be implemented soon), GST (which ensures an audit trail making tax evasion difficult), PAN card requirements (to avoid money laundering and reduce the flow of black money) to increase formalisation within the jewellery sector. With the unorganised sector occupying a lion’s share (70%), the government’s moves present enormous opportunities for organised jewellers such as Tanishq who are already compliant with laws.

Focus on lightweight jewellery

With the deployment of in-house karigars, a design team, and integrated manufacturing facilities, Tanishq has the advantage of making exclusive design (with economies of scale) – this is difficult for other players to replicate. It has also taken initiatives to increase its market share in the high-value diamond jewellery segment (2/3rd of the overall diamond jewellery market), where its current market share is miniscule. It has been backing these initiatives by path-breaking ad campaigns.

Subscribe to enjoy uninterrupted access