“Anytime your competitors know what to do, but find it difficult to copy, you know you have a moat here”

-Herb Kelleher, founder of South West Airlines

The government has taken measures to increase the formalisation of the jewellery sector. However, With the unorganised sector (70% of overall market) still occupying a lion’s share, it is worth investigating if organised players have the means to gain share in this highly competitive market, where personal rapport with traditional jewellers still holds sway over the contemporary designs of modern jewellers.

Mind-set altering campaigns and celebrity endorsements

Organised players (Tanishq) are either using path-breaking ad campaigns or they are hiring celebrity brand ambassadors (Kalyan Jewellers, Joyalukka’s, and Malabar) in order to attract customers. South India (40% of India’s gold demand), has the highest share of the organised market, since these jewellers have using celebrities since 1990’s to promote jewellery within masses.

Generally, celebrities endorse a brand only when they have full confidence in a jeweller’s policies and practices. South-based jewellers have adopted a strategy that FMCG companies usually follow – i.e., appointing a region-specific star for south markets, and a national celebrity for the rest of India.

North-based jewellers such as PC Jewellers, who aim to become pan-India players, are following in the footsteps of south-based jewellers. Explaining the Akshay and Twinkle Khanna deal, Balram Garg, promoter of PC Jewellers had said that – “Much of our marketing and advertising was concentrated on smaller cities during the last few years, but now the company has decided to go for national branding.”

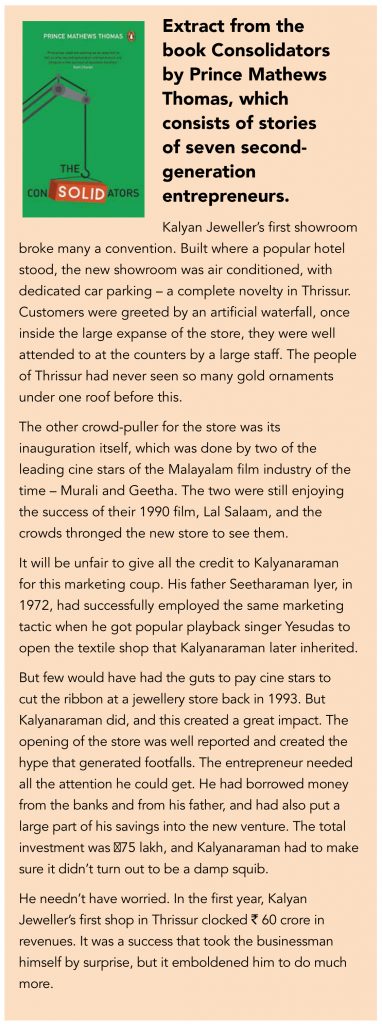

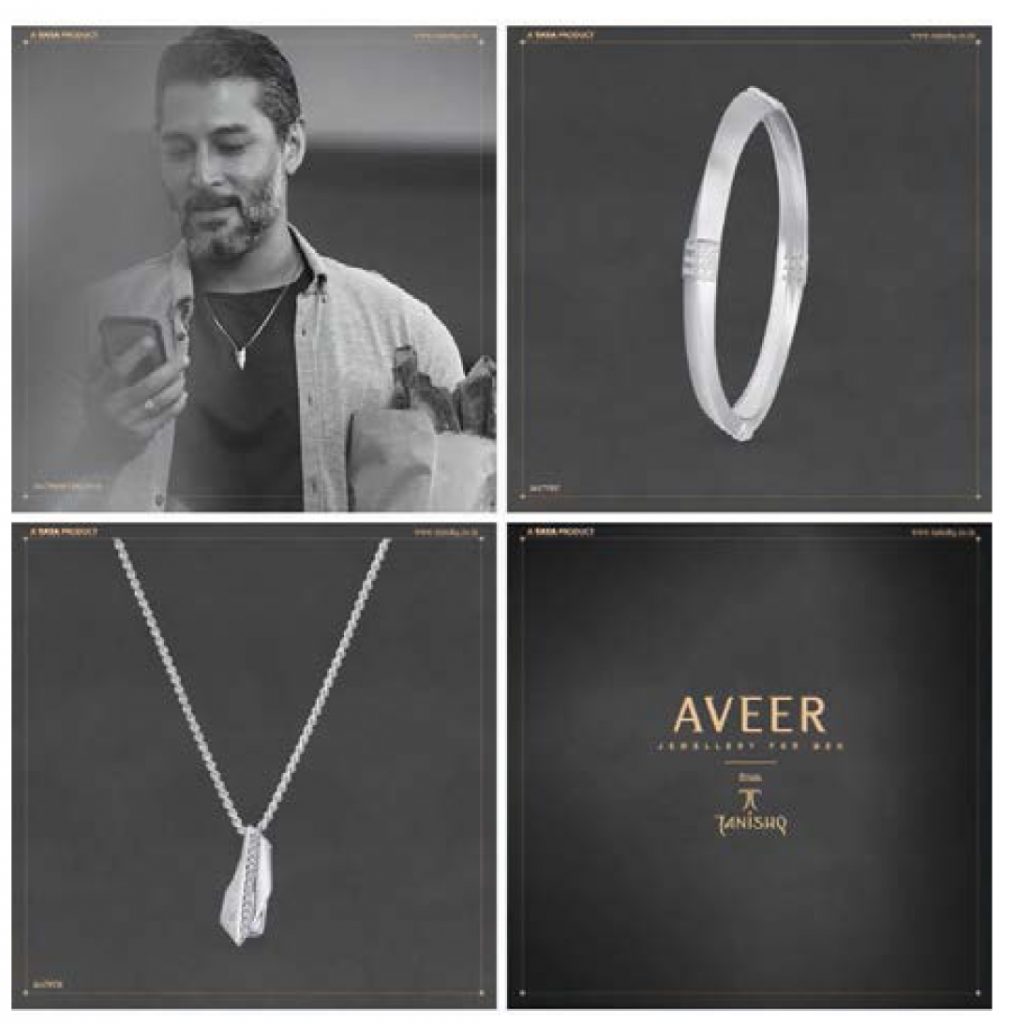

Tanishq, along with hiring brand ambassadors, has focused on creating out-of-the-box ad campaigns (featuring second marriage, inter-community marriages) which look at ending stereotypes and luring a progressive audience to its stores. It has backed these ad-campaigns with brands that cater to different audiences – Mia (for working women), Aveer (jewellery for men), and Rivaah (wedding collection).

Tanishq is setting the ‘gold standard’

Increasing urbanisation, the rise of nuclear families, and increasing financial independence of women is tilting the shift towards national and organised jewellers over traditional jewellers. National organised players have an edge as far as design is concerned, since jewellery is manufactured using in-house manufacturing facilities (Karigar park) and backed by CAD (design) team, whereas small jewellers procure it from the same vendors and artisans thereby lacking differentiation”.

Introduction of Karat meter changed the fortunes for Tanishq

In 1999, Tanishq introduced the ‘Karatmeter’. The company was struggling at the time, but this apparatus enabled it to garner enormous trust among customers and enhanced its brand equity. The Karatmeter created a sensation – thousands of women walked into Tanishq showrooms to check their jewellery and when 60% found their gold to be below caratage, it prompted their next purchase from Tanishq.

Keshav Duggar, 42, who runs a jewellery shop called ‘N K Jain’ in Coimbatore said, “I am a small jeweller, and I always face a trust deficit despite selling compliant jewellery. It is not possible for a small-time jeweller to buy Karatmeter, given that it costs a lot (1.2mn) and there is an annual recurring fee of 25,000.”

Gold exchange programmes offer higher caratage, lower deduction; draw customers

Organised jewellers have been running exchange schemes (Tanishq’s is called “19 = 22”) since many years. Customers can bring in their old gold jewellery to the stores and get it tested on the karat meter, and if the purity of the jewellery is lower than 22 carat but higher than 19 carat, then customers can exchange it for a 22-carat piece of jewellery (of their choice) by paying only the ‘making’ charges. Historically, Tanishq has been able to pull significant numbers of customers via this scheme. Currently, it is running a scheme where it offers a 4% deduction if the gold jewellery is below 22 carats and 0% deduction if the jewellery is above 22 karat.

“Gold is a highly penetrated category in India. But, the quality is obviously not the same everywhere. Whenever we go into any new town, we straight away get a lot of business. There are local jewellers, but the quality of their service and experience is not great. So when we go in, their customers move to us,” said Sandeep Kulhalli, VP – Retail and Marketing, Tanishq.

Doing more for employees

Organised players like Tanishq have standard operating procedures in order to ensure that employees receive the best training on customer-relationship management, which helps them remain highly motivated and to cross-sell. Tanishq provides subsidised lunches, late-night drop facility (in case of festive season), a proper incentives system, and a well-defined career path – all this enables an employee to upgrade from customer-executive to store-manager. However, such facilities are not provided to employees in franchisee stores (where the franchisor controls everything).

Employing the right staff: Not all organised players are on target

Organised players such as Tanishq and TBZ are known for their excellent sales service, hospitality, and consistency in service across regions/stores. Conversely, some leading south-based jewellers such as Kalyan Jewellers tend to keep more south-Indian staff in stores in the west and north India, instead of hiring local people – this is in order to keep costs and attrition lower, and these companies tend to trust their native staff more. Also, there are very few sales women (most of the sales staff is men). In a business where the customer and decision maker is a lady, female staff and communication in the local language is an important factor for a store’s long-term success.

Ability to converse in the local language and knowledge about local ‘taste’ helps to understand regional customer needs better. Moreover, it also helps overcome community bias — north Indians may be apprehensive about entering a store with a south-Indian ambience. Already, many national jewellery players face intense competition from strong regional players such as Punjab Jewellers in Indore and Waman Hari Pethe in Mumbai. If national players want to take on these regional players, then they will have to go to another level of localisation/customisation and focus on their core management and marketing capabilities.

“Family jewellers, including regional chains, are traditional in mind-set and management. This does not include certain management and marketing capabilities that an outside player, a corporate marketer like us brings.”

– Mr Kulhalli, Senior VP – Retail & Marketing, Jewellery Division, Titan

Large-format stores are doing very well, even in small towns

Large-format stores (10,000+ sq. ft.) can handle higher footfalls and keep varied inventory for different occasions such as weddings, fashion, and daily wear. The mantra of ‘more design, higher business’ works for these stores. Organised players such as Tanishq can offer a better customer experience in LFS, which will be difficult to match for all smaller players. For example, Lalithaa Jewellery opened an LFS (130,000 sq. ft.) in Hyderabad in 2017 with an investment of ` 7.5bn for a single store.

CK Venkataraman, CEO Jewellery Division of Titan Industries said that in Gujarat, women now prefer to buy diamond jewellery rather than gold jewellery. “However, in southern states like Tamil Nadu, gold jewellery is still in fashion. Another major demand is for everyday jewellery, which can be worn to the work place by women. Our latest business initiative is to open such large format stores across the country to cater to a large number of customers.”

M Kiran Kumar, Chairman and Managing Director of Lalithaa Jewellery said, “We have items starting from 1,000 and going up to even 3 crore. We do not have any exciting offers to attract customers. We observe the best practices in crafting pieces and ensure that making and wastage charges are under 7%. This directly reflects in the price.”

Checks revealed that small stores are seeing intense competition from large players in tier 2/3 cities as the latter provide customers with a variety of choices. Well-trained employees are also an advantage. Opening LFS in tier 2/3 cities is more affordable than opening a store in metro cities because of the difference in rental costs and space availability.

Difficult to get franchisee partners, if brand is not well known

Franchise representatives suggest that it does not makes much financial sense to take franchisee rights of a jewellery brand if: (1) the brand is not well known (otherwise competition from strong regional players makes success difficult for franchise partners), (2) the amount of investment required is high, and (3) gold prices are volatile. Most organised players expect franchise owners to have an inventory turnover of 2.0-2.5x and investment of ` 120-150mn (assuming store is set up in tier 1/2 cities where competition is lower).

Terms and conditions favour the franchisor

Most organised players do not provide favourable margins to their franchisees and they do not accept any sales returns either. Moreover, franchisees do not receive any help for availing bank credit or low-cost gold on lease facilities – making their businesses quite vulnerable. Therefore, in a volatile gold price environment, their profitability can get hurt. A senior banker from a private bank said that it is not possible to provide low-cost gold on lease facility to franchisee partners “since they are traders”.

It will be difficult for organised players (excluding Tanishq since it is a brand from Tata’s stable with a nation-wide appeal) to expand beyond their home turfs and attract franchisee partners, given the risks involved. In our view, because of the huge investment required and long payback period, it is difficult for even big players to enter into tier 2-3 cities, where regional/ small stores continue to hold sway.

“Thangamayil does not plan to add any store via franchisee route, since current terms and conditions that organised players are offering to franchisee partners are not attractive enough.”

– B A Ramesh, Joint MD, ,Thangamayil Jewellery

Karigars (artisans) should be treated as partners, not as bonded labour

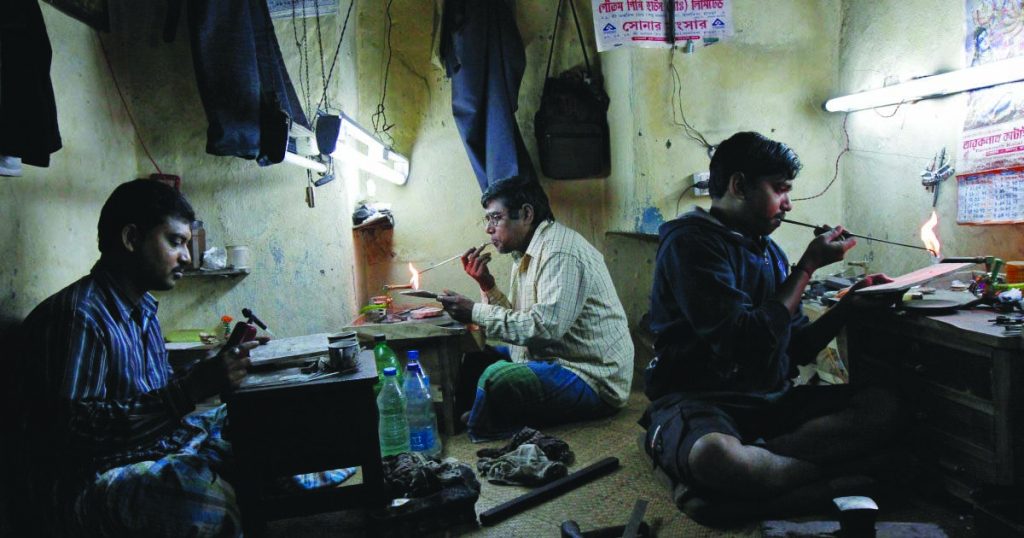

Small sized jewellery manufacturers have a short-term cost advantage – most of their karigars stay in hazardous workplaces and use outdated tools and equipment to manufacture jewellery thereby keeping cost of manufacturing low. In Zaveri Bazaar, the ‘mecca’ of jewellery manufacturing, the plight of the workers is shocking. The living condition of the karigars seemed pathetic – they made jewellery in the same tiny place in which they ate and slept.

Organised players such as Tanishq use indium for soldering jewellery pieces while others use the much cheaper cadmium, which poses long-term health hazards to the karigars and goldsmiths. Indium (44 000/kg) costs 160x more than cadmium ( 270/kg).

DS Rawat, Secretary General of Assocham, said that excessive and prolonged exposure to lethal chemical and gases can lead to ailments like lung tissue damage, kidney damage and lung cancer, thereby making the industry less attractive and not an employer of choice for the younger generations. He recommends that the manual methods of cutting, polishing, manufacturing and designing of gems and jewellery be substituted with high-end machines and software “by imparting practical training to the youth in use of laser machines and other modern techniques prevalent globally.”

Kalidas Sinha Roy, Secretary of Bengali Swarna Shilpi Kalyan Sangh (karigars association) said – “None of the stakeholders (jewellers/government) are interested in improving living conditions of workers and most of the workers live a life that is undignified and short. They die much earlier than the average Indian because of the toxic chemical and gases that they inhale. On an average, karigars earn only ` 50-60 per gram, while retailers charge hefty making charges.”

He said that most karigars do not want to come to Mumbai due to lower jewellery volumes in the last two years and are joining big jewellery chains – which give them the status of employees. “The government is planning to set up a mega jewellery park in Navi Mumbai (in order to improve karigars’ working conditions – but it does not make sense if traders and retailers do not shift from Mumbai. It is risky to transport high-value gold jewellery over a long distance,” he concluded.

Nevertheless, organised players such as Titan, with economies of scale, are likely to beat unorganised players in terms of cost by setting karigar parks and centres providing: (1) best food and accommodation, (2) latest tools and machinery, and (3) subsidised land for housing and educational facilities for children. “Tanishq ensures that none of us are working or living in poor conditions. Starting from safety precautions taken in workshops and ending with healthcare facilities, they ensure great living and working conditions!” reads a comment from a karigar on Tanishq’s website.

Organised / regional players (except Tanishq) are still very far away from adopting best systems and processes and will have to bring in best governance practices before they approach equity markets for growth capital

Some of the smaller jewellery manufacturers are also moving away from the traditional mind-set and are taking an active interest in the welfare of their karigars. Piyush Vinaykhia, 29, has a manufacturing unit named Parasvanath Jewellers near his house in R S Puram in Coimbatore. He provides food and accommodation to his workers, which in turn helps to improve their productivity. Since these workers stay away from families, he conducts a mini sports festival every Sunday (cricket) for them and even plays with them. He believes it is time for small jewellers to change their mind-set about karigars and treat them as equal partners. “This will help improve their art and creativity”.

Subscribe to enjoy uninterrupted access