First, can THE VERY SURVIVAL of jewellery industry be under threat?

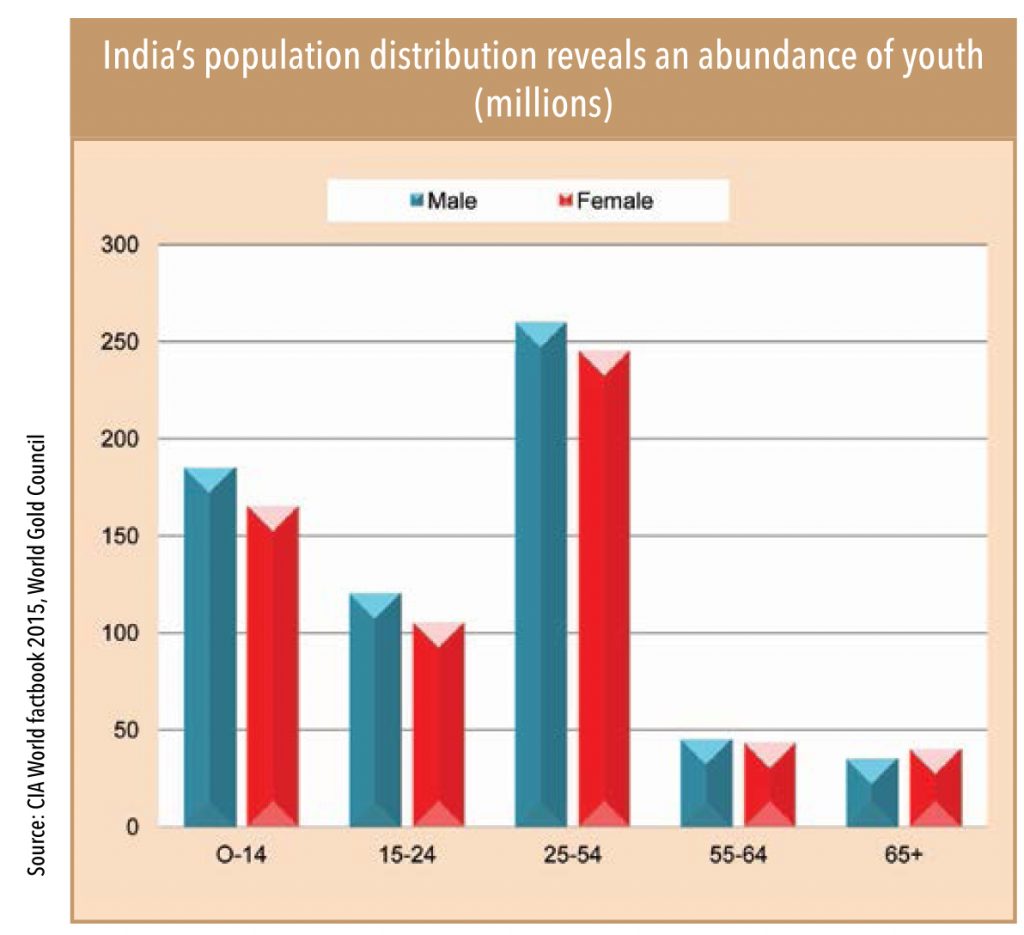

India is one of the youngest countries in the world with about half of the population being under the age of 25. With changing times, younger Indians prefer to ‘collect experiences’ such as travel or to buy gadgets rather than accumulate assets (such as gold or property). “The younger generation of urban shoppers is tempted by other products. As a result, gold is competing with designer and luxury fashion (designer clothes, handbags and shoes, silk sarees), and the ubiquitous Smartphone when it comes to high-ticket purchases.” – WGC report.

India’s youth – boon or bane for jewellers?

Jewellery retailers are aware of the potential threat and many are trying to lure young customers by positioning light-weight jewellery products as ‘aspirational’ ones, especially in urban areas. For instance, Titan has launched Mia and Malabar Gold launched Starlet to entice young working women who typically prefer light, simple, and stylish jewellery, which they do not want to stick inside a locker.

Uberisation of jewellery: Not yet a threat

Ahmedabad-based Shreya Jani said, “I take jewellery on rent from my local jeweller since I prefer to wear different jewellery on each occasion and try to save money to spend on leisure activities”. In India, jewellery-renting has existed for many decades, but it used to be restricted to known and loyal customers. This is changing, albeit slowly. Well-funded jewellery players such as Eves24.com and rentjewels.com are trying to take this business pan-India. A visit to Eves24.com’s Bandra showroom (in Mumbai) showed that renting jewellery was simple, but very expensive. Anyone can rent jewellery for a minimum period of three days at a fee that equal 3% of the value of the piece that is selected; in addition, the customer has to pay a ‘deposit’ that is equal to the value of the jewellery – which is daunting.

Because of this high upfront payment in the form of a deposit, it is difficult to find takers for high-value jewellery. Besides, in India, there is quite a bit of emotional or sentimental value attached to jewellery, at least for wedding jewellery (which is 50-60% of the overall market). For now, until attitudes towards jewellery changes, rent-seekers will find difficult to thrive in this market.

“Higher gold prices have led to customers exchanging their old jewellery for making wedding-related jewellery; large fresh purchases of gold jewellery happen when gold prices are either declining or stable.”

– Manoj Kumar, 31, a manager at Thangamayil Madurai Store

Exchange-gold segment: Still glittering for unorganised players

Under the GST Act, sale of old jewellery by an individual to a jeweller will not attract provisions of Section 9 (4) and the jeweller will not be liable to pay tax under the reverse-charge mechanism on such purchases. However, sale of new jewellery to individuals in consideration for exchange of old jewellery will attract GST.

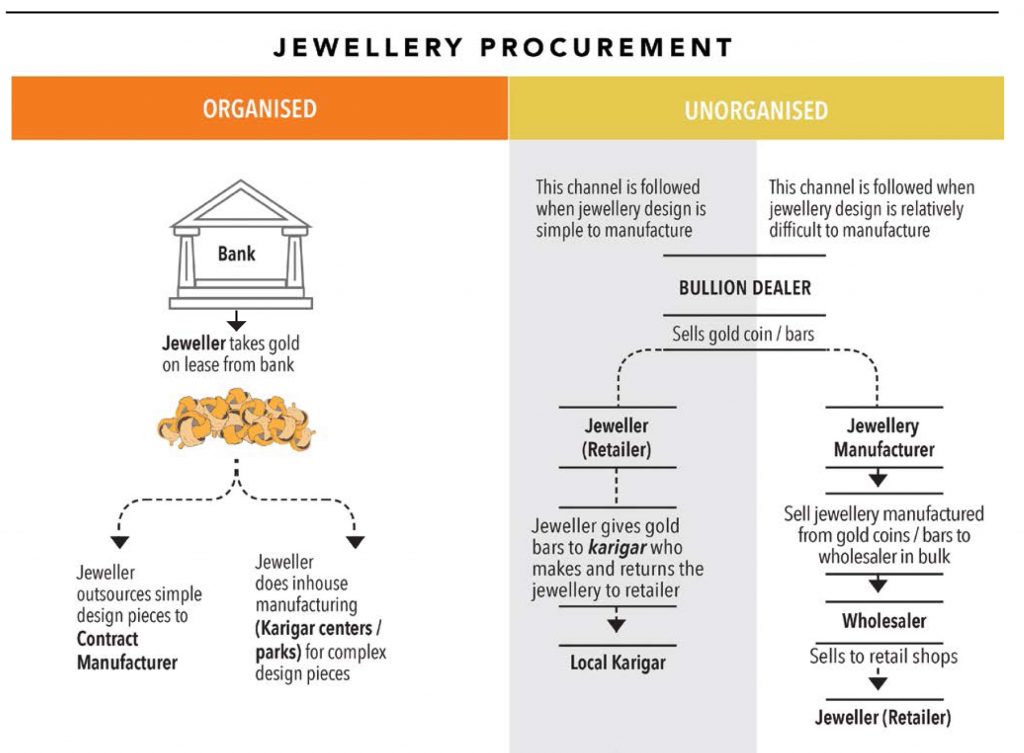

Some customers do not want to pay tax (3% GST on new gold jewellery) when they exchange old jewellery; some small jewellers are still in a position to oblige, because they haven’t paid GST on some of their stock – so they can provide this (GST-free) to such customers. However, this competitive edge is transient. It is likely to last only until small jewellers have such GST-free inventory. Small jewellers can also avoid GST in instances where their jewellery is manufactured directly from artisans / karigar (i.e., bypassing manufacturers – who are mostly fully tax-compliant), for example in cases where the jeweller’s source of gold is exchanged gold (melted and reused).

However, once the entire inventory of small jewellers becomes tax-paid (every piece is accounted in the system), it will become difficult for them to make sales that bypass GST (except for jewellery directly made by karigars).

Cat among pigeons: Risk of lower PMLA thresholds ever present

PAN Card disclosure (limited to ` 200,000) has not had a major impact on both types of players since employees of organised chains also manage to split bills among relatives and friends. So far, the impact of PAN Card disclosure has been limited to rural and small towns where customers: (1) do not have PAN card, and (2) purchase a single piece of jewellery (for example a kamar-bund – waist belt), which may be above 125-150 grams (valued upwards of ` 200,000).

Sabarinath, President of Coimbatore Jewellers Association, said that PAN Card, to some extent, has impacted business in Tamil Nadu since: (1) agricultural income is the main source of income for farmers in Tamil Nadu and most farmers do not have a PAN card, and (2) most of the shoppers are women who do not have a PAN card.

Jewellery demand was severely hit in August 2017, when the government decided to amend PMLA (Prevention of Money Laundering Act) which required disclosing an identity card for any purchase above ` 50,000. Demand returned to normal levels in October 2017 after the PMLA Act provisions were revoked. Any government moves to reduce the current disclosure threshold of ` 200,000 may dampen demand for organised jewellers.

How small jewellers brilliantly managed to reduce income tax outgo

There was a perception, that small jewellers’ direct-tax (income tax outgo) will increase after GST implementation, affecting their margins and leaving less money for them to invest in their businesses. This was because of the number of ‘white’ (accounted) transactions rising substantially.

However, small jewellers had an ace up their sleeves. Since most of these jewellery shops are managed by joint families, these firms have presented “loans from family members” as source of funds for buying incremental inventory . Therefore, although, the number of their legal transactions rose to 80% from 30% earlier, their PBT has increased only marginally (because now interest cost is being accounted in their books, which was not the case earlier).

Subscribe to enjoy uninterrupted access