Will the intense margin-killing competition of yore return?

Despite a late entry into matics, the Ghadi brand has garnered significant market share due to superior quality offering at a reasonable price, expansion in distribution network, and lean operating structure

Superior formulated products, higher capital investments, and to some extent, technological advantages of national branded players in matic detergents and liquids will keep away small and local unorganised players, since their technical and product knowledge is limited to popular and mid-end detergents. However, mid-sized organised players are already trying to make a dent in the biggies’ market share. Rohit Surfactants (Ghadi brand), a dominant player in popular detergents, has made inroads into matics with aggressive pricing and strong marketing support (Amitabh Bachhan as the brand ambassador). It has priced Ghadi Matics at 1/3rd HUL and P&G matic products. Ajit Kumar, a distributor in Satna in Madhya Pradesh puts it succinctly – “The strong consumer acceptance for the Ghadi brand has been because it gives Surf Excel (superior product ) quality at Wheel (reasonable) prices”.However, for the most part, even smaller organised players stay out of high-end detergents – whether matics or liquids – as the process is highly technical, time consuming, and costly. As an HUL detergent contract manufacturer based out of north-east India puts it – “We contract manufacture HUL’s key popular and mid-end brands and if we stretch ourselves we might able to manufacture matics, but manufacturing liquid detergents is not our cup of tea.”

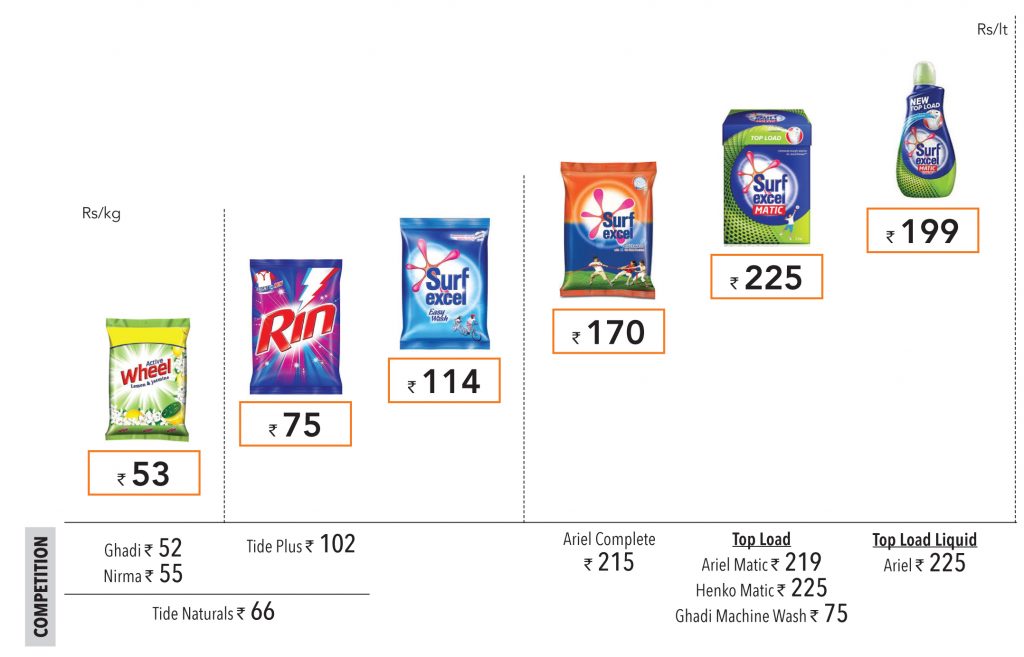

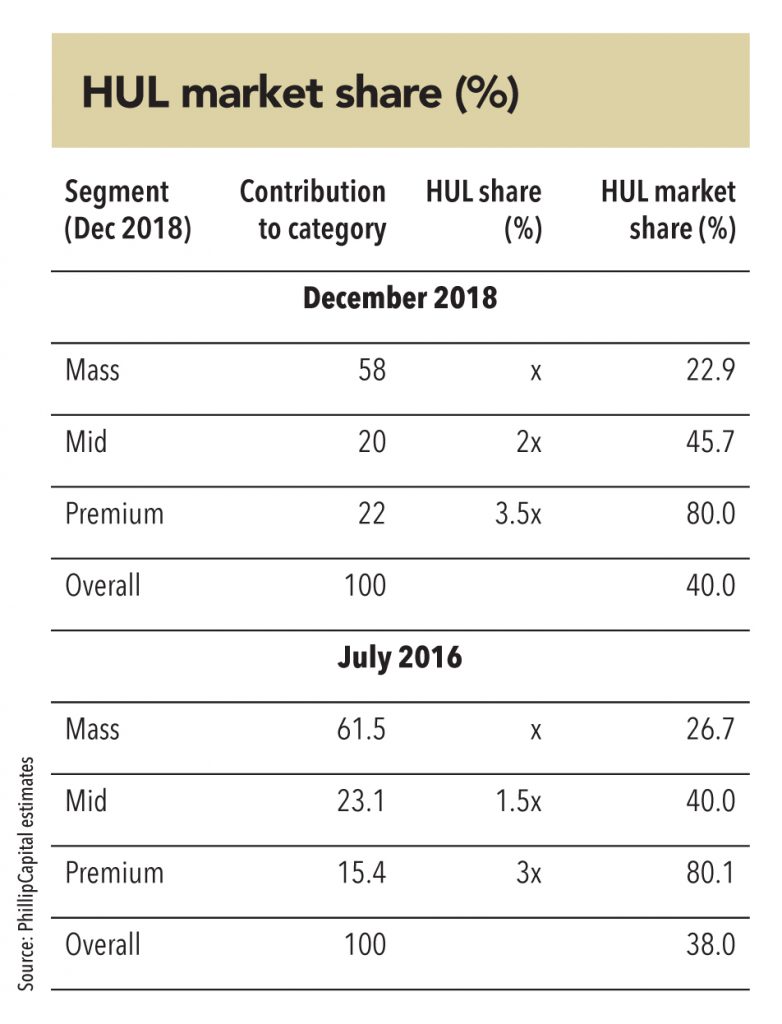

HUL, with c.40% market share, continues to dominate India’s Rs 200bn laundry-detergent market because of its ability to straddle price points with different products, its solid distribution network, and its strong focus on premiumisation. HUL’s market share in premium segment is high (+80%) while in the popular segment it is low (25-30%) due to strong local competition. As tailwinds for detergent premiumisation play out, HUL will be key beneficiary. It launched the Rs 10 LUP for Surf Excel brand some years ago and has been able to upgrade mass and mid-detergent customers to the premium segment because of improved affordability. Sanjiv Mehta, MD and CEO of HUL said, “Surf at the Rs 10 price point has led to exponential growth because we are now offering an aspirational brand at an affordable price point.”

P&G – The sleeping giant

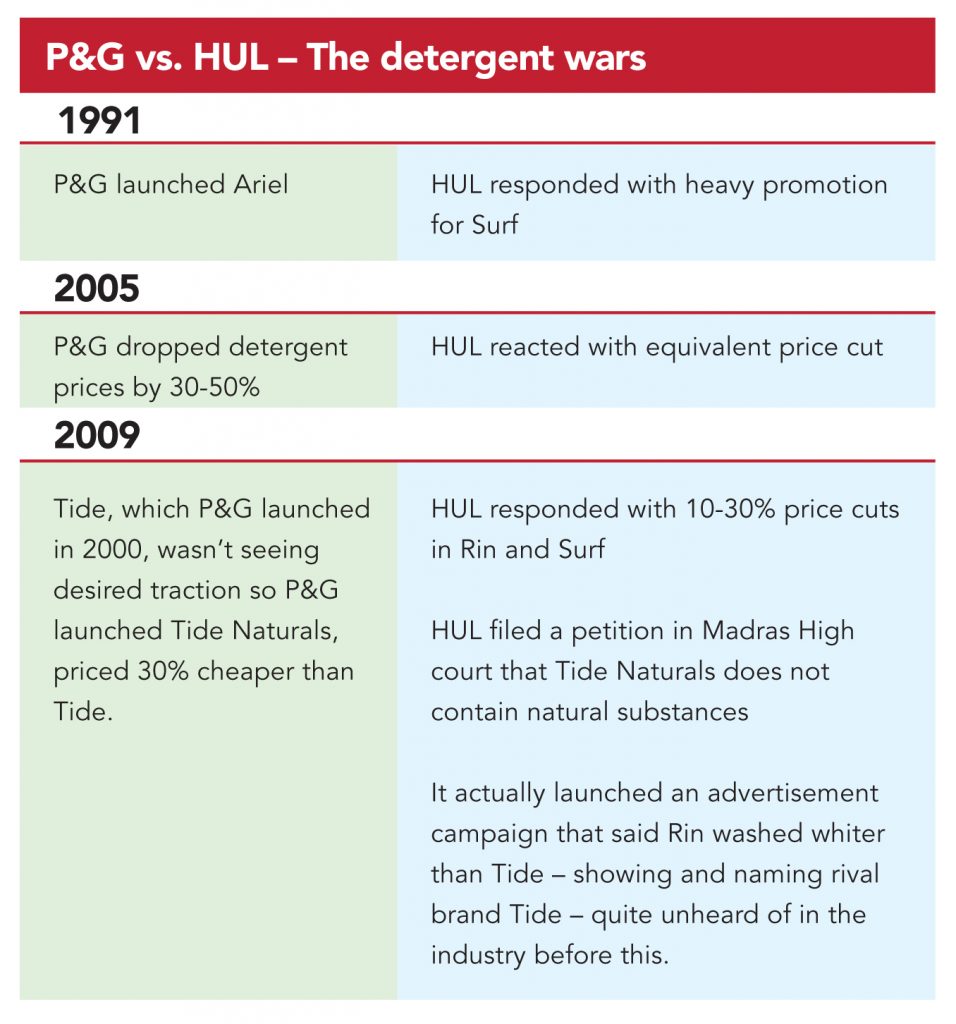

P&G was very aggressive during 2005-2014 as its mandate was to drive volume-led top-line growth. This led to price wars in the laundry segment. However, from 2014 to 2018, P&G’s profitability has been under pressure at a global level – which has led its subsidiaries across the world (including P&G India) to focus on profitability. This led to relatively lower pricing action and new product launches. The limited-period price-offs and extra grammage promotions that P&G has been running for the past few months may not be enough to challenge HUL on the premiumisation front.

P&G India’s CEO Madhusudan Gopalan (who recently completed one year as CEO) said in a recent media interview that the company will focus on driving respective category growth through improved affordability (via low-price packs), increasing distribution reach, and eventually upgrading customers to larger SKUs. However, it will try to maintain a balanced approach between topline and bottomline in ensuring this objective.

What happens to HUL if P&G decides to start competing aggressively?

HUL could see some impact on margins in the short term if P&G decides to play detergent premiumisation story in a meaningful manner via using price-discounting strategy in order to grab customers. In the longer term, when customer start consuming premium products, the preference will be for branded products since this will keep washers in good condition and in turn the size of the premium detergent market will rise.

Private labels of e-commerce and MT companies can become a threat

Since MT stores and e-commerce chains have a complete hold over their customers, they are in a position to customise and price products as per their customers’ tastes and preferences. Private labels allow MT and e-commerce companies to create price points that are not available in the market, and still manage to widen or maintain their margins. Recently, Grofers, one of the leading e-commerce players, conducted its own research, which showed that many of its customers used bucket-wash powders for washing machines since machine-wash detergents were expensive. Seeing an opportunity, Grofers launched a far cheaper machine-wash detergent (c.40% lower than market leader HUL’s Surf Excel) under its brand Happy Home. It claims that many customers have shifted to its new detergent.

Subscribe to enjoy uninterrupted access