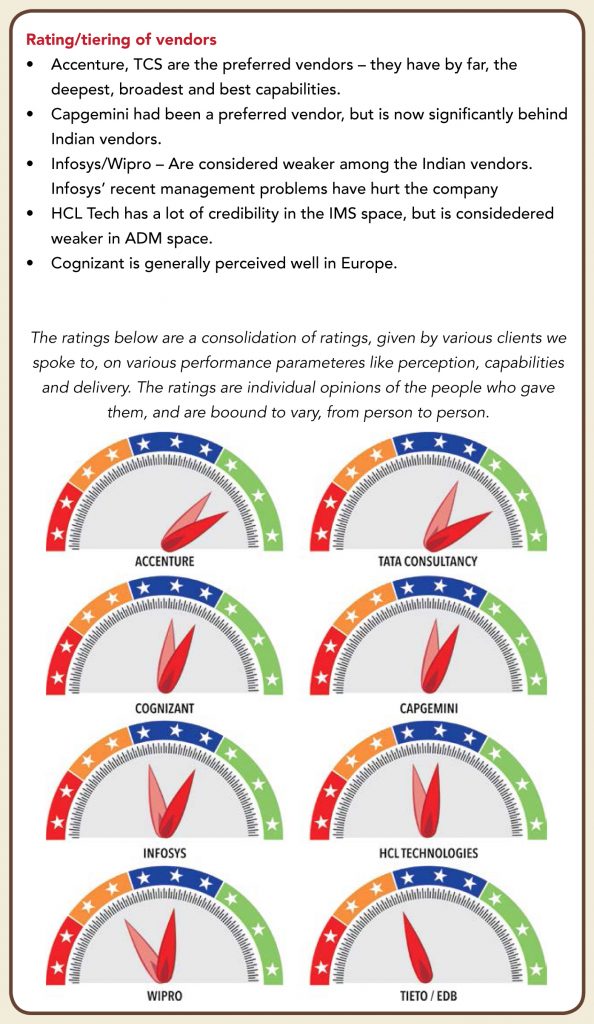

Key takeaways from the interactions:

• For EU vendors, offshoring, for a long time, remained more as a vendor, than any integral part of their business strategy.

• They continued to believe that EU companies will give them business, even at a premium, because they were ‘locals’. What they didn’t anticipate was that if the premium they were asking for was high, business would walk out.

• Even while the key pitch of Indian companies was always offshoring, in the early 2000s EU vendors such as EVRY and Tieto would not even mention the word. Surprisingly, even then, the top management layers of these EU vendors were keen on offshoring. However, the next two layers were biased against it, on fears of job losses, employee union protests, etc.

• Later, EU vendors started offshoring to Eastern Europe, thinking that perhaps clients might prefer Europeans over Indian techies. But even in this, since their implementation strategies weren’t great, they did not achieve desired results. EU vendors were using outdated models and were reluctant to change their processes/systems; in short, they were not up to speed with competitors.

• Misguidedly, and for a long time, these EU vendors tried to avoid the ‘negative connotation’ of working out of India or competing with Indians because they presumed that such actions would get them labelled ‘cheap’.

• Eventually, EU vendors had their ‘Nokia/Kodak’ moment. While they thought that their local EU business would continue no matter what, they ignored the fact that Indian vendors, hungry for growth and market share, were willing to go that extra mile to capture theirs.

• Many countries in Europe still have the ‘9 to 5’ mentality, and hence present no competition for Indian vendors, who offer 24×7 support.

• Capgemini is like a huge company with kingdoms, and has lot of politics inside – the exact opposite of Indian companies.

• European vendors have now been rendered good for only government contracts. They are not deemed good enough to work for top European companies and do not appear to have the ability to support global companies. They do not have any cutting edge technology, are neither digitally perfect, nor are they strategy consultants. What they do have is a footprint for EU/Nordic/CEE delivery – which is not a long-term sustainable advantage.

EU vendors tried to avoid the ‘negative connotation’ of working out of India or competing with Indians because they presumed that such actions would get them labelled ‘cheap’

• Just no substitute for the kind of hunger the Indian firms have. Europeans just don’t have it.

• Indian vendors are much faster in dealing with issues – their response time is significantly lower than European or even global vendors such as Accenture and IBM. Compared to the multi-layered delivery structure of EU vendors, Indian firms have a flexible flat structure, aimed at only one thing – ensuring high levels of customer satisfaction.

• TCS was specifically mentioned for its effort to provide 24×7 support and even bypassing SLAs (Service Level Agreement) to resolve any issue. One example that was cited – when a large BFSI client had a banking problem, TCS solved the problem, despite it not being the cause of it.

• The systems and processes of Indian vendors are far superior to their EU counterparts; their delivery mechanisms are more efficient.

European IT services vendors have no momentum. We don’t see European firms becoming more competitive

Just no substitute for the kind of hunger the Indian firms have. Europeans just don’t have it

• Indian vendors are succeeding not just because of their cost advantage, but also their access to talent, which EU vendors are no match against.

• Indian vendors are big – hence scale benefits work in their favour. They also have deep industry experience, which is always a key to selecting vendor. Start-ups can make good presentations. However, only large vendors such as TCS can execute and deliver, integrating the old back-end IT.

• The top Indian players are very strong now and it will be almost impossible to dislodge them. European firms have become niche players.

• Indian vendors are also happy to start small (unlike EU companies). This is what most clients want – to test waters with relatively smaller low-risk project. Additionally, Indian vendors are very agile and fast – they get people on site as soon as clients need them.

• According to one CTO, the four primary reasons for the success of Indian vendors were: (1) language and time-zone compatibility, (2) decent cost arbitrage, (3) unavailability of good technology people in Europe, and (4) Silicon valley being oversold. On point 4 he believed there isn’t much difference in the quality of people in Bangalore and in the Silicon Valley.

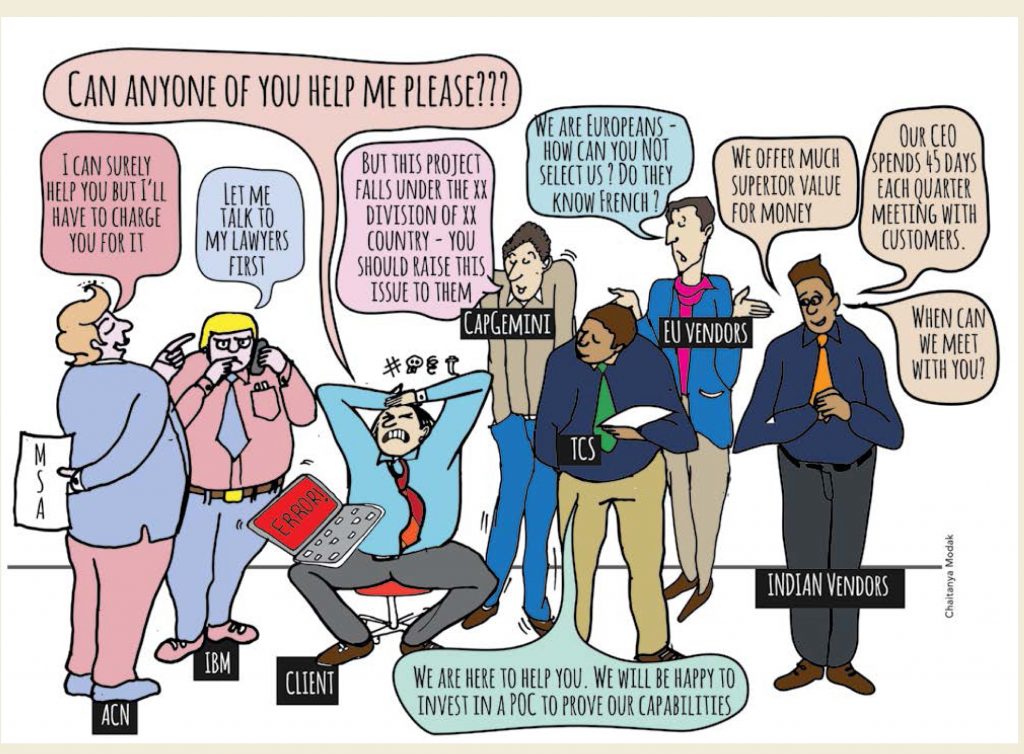

• While dealing with Accenture, clients need to have a very strong legal team by their side because Accenture winds contracts tightly and end up charging clients for anything that is not in the contract. On the other hand, Indian companies value integrity and do as much as possible for clients, even if they have not signed-up for it.

The top Indian players are very strong now and it will be almost impossible to dislodge them. European firms have become niche players

Where do the Indian vendors lack or lag behind?

• Indian vendors are constantly growing, but so are local vendors based out of Eastern Europe.

• Indian vendors lack in terms of innovation (despite their so-called innovation labs) even as they remain miles ahead in traditional services such as ADM and IMS. Issues that were cited include ‘serious lack of innovation related to how to change the business’ and ‘no out-of-the-box thinking’. Indian vendors tend to demonstrate only what they’ve learnt from other clients, and try to replicate (even force-fit) the same solutions for clients.

• Few clients said that they do not rely on Indian vendors for digital solutions and preferred small boutique vendors from Germany, Switzerland, and France for these services. An example cited here – a leading industrial company chose BCG Digital Ventures as its vendor for digital RFP, despite BCG being highly expensive (EUR 3,000/day for a junior consultant), because it offered a unique experience.

• The clients seem to select a boutique/niche vendor for ideation/change-the-business – for a small period 12 weeks or so. They then tend to use a traditional company for putting the ideas into production.

• The new challenge for Indian vendors is that the work is no longer labour intensive and the resources required are of very high calibre. For digital solutions, one needs people from good institutes. EU clients prefer people from Russia and Eastern Europe, who they perceive to be better in analytics and data mining.

• European companies’ employees tend to question things while Indians treat clients like kings (clients can dictate terms). Indian vendors need to change.

• When Indian companies acquire EU/French companies, they want to change them (culturally) into Indian companies – which does not work. Ideally, Indian companies should get locals to head these acquired companies, as these people would understand both cultures and facilitate a smooth integration.

The new challenge for Indian vendors is that the work is no longer labour intensive and the resources required are of very high calibre

Independent of pricing, TCS is better overall than IBM and we are more satisfied with TCS than with IBM

• Accenture is more realistic in its estimates – It charges higher rates, but its FTE is lower (vs. Indian vendors). Indian vendors build a buffer in FTEs and hence end up at similar levels.

Why has TCS emerged as a strong player in the European region?

• Management and team stability – people who started working 12 years ago on a project are still with the company.

• It never tries to bypass proper channels in order to revive/expand its business (few Indian vendors try to sidestep the CIO to get a contract).

• Two very important deliverables that you can expect from TCS are consistency and certainty.

• It is highly competitive cost-wise.

• It is highly flexible with contracts vs. Accenture/IBM who appear to be helping but always “keep the MSA in their back-pocket – ready to read it out to you, if you ask for anything incremental”.

• An example: An industrial firm said that it acquired a company in a completely new geography and wanted to integrate its IT. TCS did not have a presence in that region, but promptly set up a temporary delivery centre and helped integrate the systems quickly.

• It has best of both the worlds – formidable size + an energetic workforce. On the flip side, TCS will only do what you tell it to do; Accenture, on the other hand, will have some strategic view and is generally able to impress the management more.

• TCS focuses on delivery, while others on selling. Other vendors give up margins for marketing, while TCS does that for delivery.

• TCS offers a very compelling proposition – has platform-based approaches, is bold and aggressive, and willing to make significant investments for its clients.

• Its investment in Diligenta is playing out well – it appears ready to take the risk of migrating a large number of policies.

• A company said that it is a small client for TCS, and yet Mr Rajesh Gopinathan (TCS’ CEO) has met its CTO twice in the last six months – demonstrating personal commitment. The client was also impressed with the fact that TCS wasn’t too pushy about increasing business and was happy maintaining the relationship – assuring the client that it is there for them, whenever needed. This demonstrates the quality of the management team.

• TCS and Cognizant might not have the same vertical industry experience and the look-and-feel as Accenture, but they still get work done at much affordable prices. Accenture can be very unaffordable sometimes.

• TCS was the first Indian vendor to come to Germany in 1985; others came only after 2000. Gradually, TCS has built a base of 600-700 German resources. Still, almost 80% of TCS’ German revenues come from only 10 clients, which are large companies such as DB and Siemens.

• TCS is very stable, focused on efficiency and delivery – but lacks creativity and vitality.

• According to one client, TCS benefits from four factors in clinching deals: (1) It makes investments way before the cycle starts by nurturing relationships, (2) it has proactive thought leadership, (3) it runs a disciplined accounts team, and (4) it does not chase illusions, does not let itself get distracted, and maintains focus.

• TCS offers a depth of intellectual capital that I haven’t seen at any other company – except for Accenture

• Independent of pricing, TCS is better overall than IBM and we are more satisfied with TCS than with IBM.

TCS offers a depth of intellectual capital, not seen at any other company – except for Accenture

How does Infosys fare in terms of perception and capabilities?

• The Lodestone acquisition, while giving Infosys access to EU clients, was not properly integrated. After 2015, when the earn-out period for Lodestone ended, almost 500 Lodestone employees left Lodestone, including the founder. The promoter was reportedly frustrated with Infosys’ management’s excessive focus on costs and only costs.

• Infosys has repeatedly toyed with the idea of growing its consulting division, trying to rise up the strategic ladder. However, the company hasn’t been able to do this or even become successful with IP development (with a few exceptions). In its most recent management transition, the company has simplified its strategy and decided to reduce its IP/consulting ambitions.

There appears to be too much turbulence in Infosys and a perceptible change in fundamentals

• There appears to be too much turbulence in Infosys and a perceptible change in fundamentals. The new CEO is a good person, but perhaps not as charismatic and impactful as Mr Nandan Nilekani or Mr Vishal Sikka. The stability of the vendor plays a very important role. Infosys might just have lost the battle in that turbulence.

• On the other hand, TCS’ change of CEO – from Mr N. Chandrasekharan to Mr Rajesh Gopinathan – was absolutely seamless – same people, who were servicing earlier remained and continued to speak the same thing as before.

• Earlier, during NRN’s term, many people in Europe left Infosys. The departure of Mr. BG Srinivas, specifically, was a big blow to its business.

HCL is doing well in the EU, especially in the IMS domain. Axxon and Volvo acquisitions have performed well for HCL

Cognizant has also been very strong in Europe. It appears capable of balancing the India efficiency and local business forefront

What about other vendors like Cognizant, Wipro, and HCL?

• Cognizant has also been very strong in Europe. It appears capable of balancing the India efficiency and local business forefront, because it has acquired many local companies. It also has a strong digital footprint.

• HCL is doing well in the EU, especially in the IMS domain. Axxon and Volvo acquisitions have performed well for HCL. Even the recent IBM IP of Lotus notes – they appear to be making good money out of it.

• Mr Vineet Nayar has really handled HCL’s business well. Mr. C VijayaKumar (the current CEO) appears to be a good leader, though he lacks Mr Vineet’s charisma.

• Wipro has not been able to capitalize on the opportunity. It did well in few healthcare accounts in the region initially, but then seems to have lost its way.

• Wipro hasn’t been able to define its differentiator – what is Wipro really good at? Is it delivery, or client connect? BPO, application, IMS, or ERD? It has spread itself too thin across the spectrum.

• But Wipro has very high standards of integrity, leading to very high levels of trust with clients. It is known to have zero tolerance for integrity issues; the company will sack employees found in violation immediately.

• The recent acquisition of Appirio by Wipro was a good one. Appirio is in a leadership position, has a unique pricing model, and, for a change, its integration has been handled properly by Wipro’s management.

• However, overall, Wipro/HCL tend to oversell and under-deliver.

Wipro has very high standards of integrity, leading to very high levels of trust with clients. It is known to have zero tolerance for integrity issues

• KPIT is very strong in the auto domain, especially on the embedded electronics (software side). It boasts of engineers who are very strong technically and very well appreciated.

ERD domain

• Indian vendors started with digitisation of drawings and testing will gradually move up the value chain. They are now coding algos for embedded systems.

• Indian vendors are strong in IT, but weak in design – they can write an algo, but are weak in system engineering. For system issues, good design capabilities are required. This is why Altran/Alten have been able to maintain market share.

• The problem with Indian vendors is that they want to put Indian people in the front office. This does not work in the EU (especially in Germany/France and more so in ERD domain). It has to be a local who knows the language and who has the patience to explain.

• Overall, Indian companies are still making significant inroads in the domain with their pool of engineers. Schneider Electric, which even Accenture wasn’t able to crack, is working with Tata Elxsi.

Indian vendors were able to gain market share from Accenture (who was described as carrying the MSA in its back-pocket) and from IBM (who was said to bring a lawyer along to negotiation meetings).

Language barriers still loom large, especially with smaller companies – the Indian vendors have not been able to tap into them much

What are the challenges that Indian vendors still face that can prevent them from growing further?

• Language barriers still loom large, especially with smaller companies – the Indian vendors have not been able to tap into them much.

• In mid-size and large-size companies, where English is the language, Indian vendors have done remarkably well.

• Also, once the initial barrier is broken, Indian vendors start introducing Indian colleagues into the system, driving up efficiency and delivery.

• GDPR in the UK and Scandinavian countries can be a potential dampener – it limits the personal data that can be put outside the EU region. However, Indian vendors are trying to circumvent this by setting up near-shore centres (e.g., TCS in Budapest).

• Switzerland has a very similar geography as the US. Swiss companies have the same way of sourcing staff, a high share of English-speaking staff, and a similar way of looking at Indian companies (positive).

• At many companies, incumbent local EU vendors have long-standing (15-20-30 years) relationships; and it is difficult to displace them unless they falter substantially.

• There is still a certain hesitancy in the EU (especially in Germany) to work with Indian vendors.

• Some of the pan-European companies have a federated structure, with each country deciding on its own IT vendors. Managements of German/French/Italian units still prefer their own local vendors.

• HR teams of European companies remain the biggest impediment to offshoring; it is hard to convince them (strong business case needed) to fire existing employees.

• Company from a non-first-language English country – servicing a client in another non-first-language English country – is always a big hurdle to cross.

• Most Europeans find India a difficult place to live – this translates into a reluctance to outsource to the country too.

• An interesting admission from a key client – the challenges with Indian vendors are actually of our own making. Earlier, we used to tell them to just implement the task and NOT ask any questions. Now we want them to ask questions and they are struggling.

• Indian companies’ culture of listening to one’s boss or client is becoming a problem for them. Now that cost arbitrage is no longer that relevant, inputs matter. Indian vendors need to find another source of value creation (other than reducing body counts or lowering the rate).

Company from a non-first-language English country – servicing a client in another non-first-language English country – is always a big hurdle to cross

Germany and France

• Germany and France are very difficult geographies to conduct business in. They have strict data restrictions and their cultural and language challenges are very different from those in the UK or in Switzerland.

• Managements in Germany/France do not TRUST the results from India-based vendors. They believe that Indian vendors will deliver on time, but the solution delivered won’t work. This is why most managements want to work with local vendors.

• German industry is especially scattered across the country; one out of almost every 3/4 villages has a company with more than € 1bn in revenues. There are over 1,400 companies in Germany with more than € 1bn in revenues, making it a very scattered market. Therefore, it is difficult for an offshore vendor to gain economies of scale. Additionally, most German companies have captive IT.

French people tend to have high nationalistic sentiments, and hence are reluctant to enter any contract that sees any job migrating from France to any other country

• This is why only some large German conglomerates such as DB and Deutsche Telecom are the only companies that have outsourced. Even Volkswagen joined the bandwagon only five years ago.

• Germany is also a difficult geography as it has mainly manufacturing companies (which tend to spend only 1-2% of their revenues on IT) as compared to BFSI companies in UK/Switzerland (that spend ~40% of revenues on IT). There is very little investment banking in Germany – most of it is run from London

• But gradually, other smaller German companies are giving offshoring contracts and considering Indian vendors.

• In the 2006 FIFA World Cup, Germans interacted with different people across the world, which perhaps enhanced their desire to open up. Even so, senior managements of most German organisations do not know how to speak English yet.

• Things are changing though – the new generation is learning English and is more open to globalisation. Vendors are also trying to front local people and training themselves in German.

• Overall, Germans don’t like outsourcing – they want to keep everything in-house.

• French people tend to have high nationalistic sentiments, and hence are reluctant to enter any contract that sees any job migrating from France to any other country.

• The French IT outsourcing market has two types of companies:

o Engineering/consulting companies that typically grow by 4-5% annually and employ ~120,000 employees. Almost 50% of the market is captured by Altran, Alten, and other local ERD companies.

o IT-oriented companies such as Capgemini, Atos, Sopra, ACN, CGI, IBM. This would be € 25-26bn, growing at annual rate of ~3%, employing more than 200k FTEs. It is a highly fragmented market, difficult to penetrate.

The perception about India and Indian vendors needs to change. People still believe Indian vendors have engineers working out of mud huts. More people should visit Bangalore and Hyderabad, and see the grand scale and competence level of Indians

Pricing – Accenture is 10-20% more expensive than TCS (significant for a large contract)

Future for Indian vendors in Europe?

• There is still significant room for Indian vendors to grow. No saturation yet, especially in Nordic countries, Germany, and France.

• Offshoring penetration in the whole of Europe currently is not be more than 10% and can easily rise to 30%, which represents a 3x opportunity.

• Many EU clients are already sold on the idea of offshoring and employing Indian vendors and don’t need any further persuasion. For other clients, especially those yet to test waters, Indian vendors just need to put a better value proposition on the table.

• Indian vendors are ahead of the game when it comes to technologies such as analytics, integration of mathematics, coding, and use-cases. Indian people are perceived to be better at maths and data analysis, but a bit weak in use-cases and domain expertise.

• They are beyond the cost proposition (that is considered a given). They now compete (and need to compete) on strategic inputs and partnership-based models.

• They would do well to utilise some cash on their balance sheets to make acquisitions in Europe in order to break cultural and language barriers. The most important aspect, however, remains integration – where their track record isn’t very impressive.

• Indian vendors have moved up the value curve; they are now competitive in digital, strategic, and automation fields.

Offshoring penetration in the whole of Europe currently is not be more than 10% and can easily rise to 30%, which represents a 3x opportunity.

The Indians are beyond the cost proposition (that is considered a given). They now compete (and need to compete) on strategic inputs and partnership-based models.

Subscribe to enjoy uninterrupted access