From their humble beginnings in the 1970s, as a viable alternative for customers whose financial needs were not sufficiently met by the existing banking system, NBFCs in India have come a long way in the last 20 years. So much so that they have gained prominence and added depth to the financial sector. In fact, with continued product innovation and with the help of analytics and technological advancements, they no long serve only the ‘unbankable’, but have been giving tough competition to banks. However, at the moment, learning lessons from past mistakes, banks are preparing themselves to fight back, regain lost ground, and re-establish their dominance. Will they succeed? Time will tell, but this issue tries to shed as much light as possible on the various factors in play.

Banks are changing. Product profitability is giving way to customer profitability. The new mantra seems to be – give it all, even if it is small

While looking at the details and nitty-gritties of zero-cost financing schemes prevalent in the current consumer durables segment, there was something very interesting that stood out. Something that could have huge negative ramifications for few NBFCs. Something that could dramatically change the business dynamics for banks and NBFCs ahead.

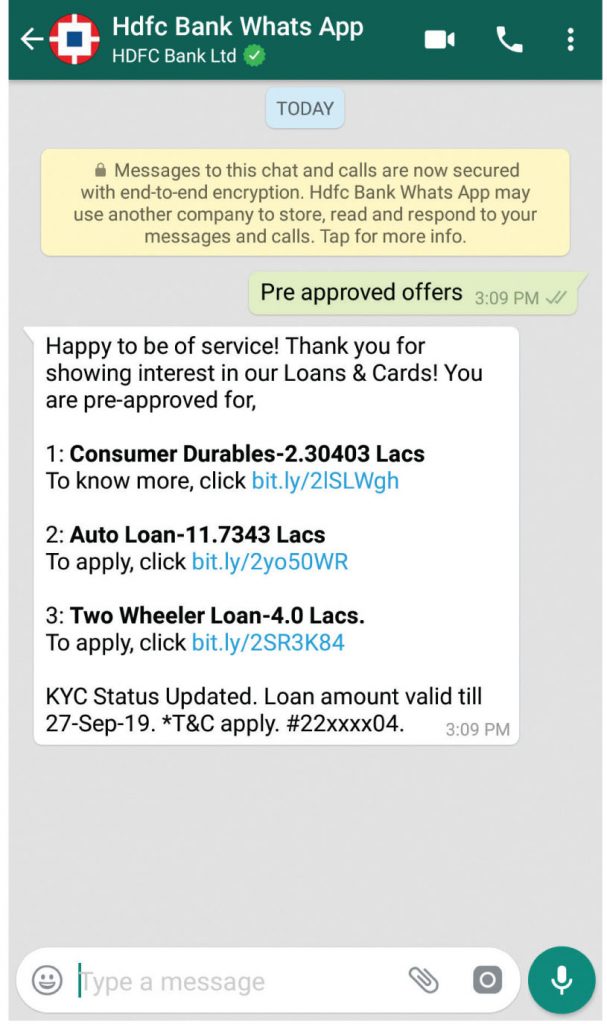

For decades, banks have been money centric, and have had a product-specific approach for pricing – which is essentially based on cost plus risk premium. However, of late, few banks, especially HDFC Bank, have turned very aggressive in zero-cost consumer durable financing, a product segment that we believe will not only be loss making in the near term, but even from a long-term perspective, will deliver a less-than-required rate of return for banks, due to very small ticket size and high opex costs.

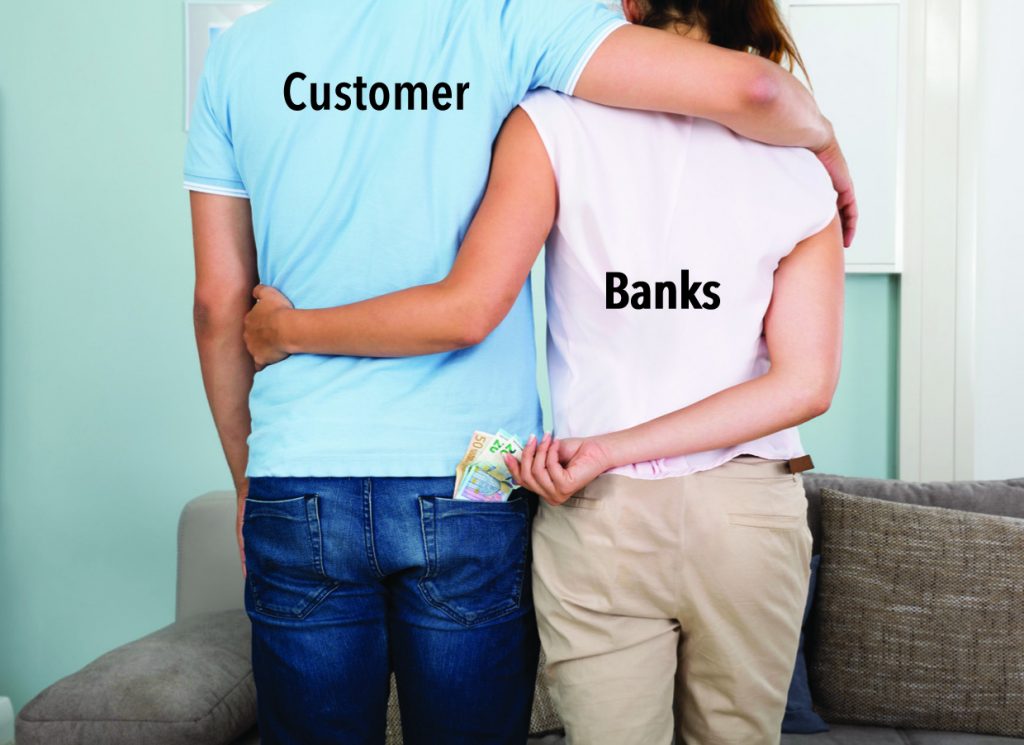

In that case, why are banks seemingly committing hara-kiri? Interactions with various banks, OEMs, and retail chains revealed that banks have been losing customers to NBFCs and fintech companies because of the latter’s product innovation and pull strategies. Here, pull strategies means roping in customers and then using analytical capabilities to cross-sell other products, including products that are offered by banks to customers.

Over the last 5-10 years, banks have lost credit-worthy customers to NBFCs and they are finally fighting back and trying to recover the ones they have lost. The customer drain that banks faced has brought about some hard changes in their DNA – they are now adopting a holistic approach towards their customers, rather than a transaction or product-based approach. Perhaps the most important shift is a never-before mantra – give it all even if it is small. If the customer is worthy, banks will lend, even if the ticket size is small, and even if it means a loss or negligible profit in that particular product or transaction. The objective now seems to be to not let customers take their business to other entities and eventually move away for good. Instead, banks are gearing up to offer them what they need.

Banks today are not only becoming sensitive towards customer needs and product requirements, they are working towards building strong long-term relationships with customers. In this process, they are even prepared to take losses. The mantra propping this new approach is to have maximum customer wallet share and look at an aggregate return over customers’ life times, rather than one-time return on a single transaction. Banks are willing to take this approach even if it means no profit, or even losses in few products or services. They have realized that if their existing customers move to NBFCs or fintech companies because the banks have not been able to fulfil their requirement, there are high chances that these competitors will cross-sell other profitable products (which the banks offer too) to these poached customers . Banks have realized that they must focus on existing customers and reduce customer attrition to better tap into the lifetime value of their relationships.

This changed behaviour of banks reminds me of an incident from my past. My father is a first generation entrepreneur. He started a jewellery shop in 1980 with a stock of just 10 silver nose pins, and now owns two showrooms. In the last 40 years, he has not only outgrown other established people, but has also earned the respect of his customers. I can confidently say that his strategies and way of running the business has been successful. On many occasions that I accompanied him to the shop, I remember customers telling him to give them a discount or let go of his margins because they were buying from him for the first time (“Pehle baar le rahain hain aapki dukan se, is baar mat kamao, agli baar kama lena”). And to my consternation, my father used to oblige, giving customers an extra discount, even if it meant negligible margins for him in that particular transaction. Finally, I asked him why he does this. His reply has stayed with me – “This is not a discount beta (son) – it is an investment that I am making to build a long-term relationship with customers. This investment will give me many opportunities in the future to earn from those very customers. A business is all about building relationships, profitability follows automatically”.

Consumer-durables financing used to be a product segment that banks weren’t very keen on, and because of this, NBFCs such as Bajaj Finance took it up 10 years ago – and thrived. However, in the last six months, it is becoming quite clear that this segment is no longer pariah for banks – case in point, market leader HDFC Bank’s aggression in this space. This new approach of banks – of looking at a customer from the perspective and prospective of their lifetime rather than per transaction – will lengthen the product offerings lists of banks and simultaneously increase the “not to do list” of products for NBFCs.

Despite the country’s large and robust banking system, NBFCs in India have been thriving for four key reasons:

With banks entering the fray, NBFCs will have a tough time, especially in geographies or product segments that bank are competitive in, and also in customer profiles that banks are willing to lend to. This is because banks have a natural advantage in terms of lower cost of funds and no NBFC would be able to match them in terms of pricing.

Banks have a natural advantage in terms of lower cost of funds and no NBFC would be able to match them in terms of pricing

Consumer durables zero-cost finance schemes that have changed the way banks look at customers

A chain is only as strong as its weakest link – one weak part will render the whole chain weak. Consumer-durables financing was that weakest link for banks, which Bajaj Finance made the most of. So how has a small segment like consumer-durables financing changed the way banks look at its customers. What did NBFCs such as Bajaj Finance foresee in this segment 10 years ago, and why did banks take so long to understand this game?

The answer perhaps is that it is not about the product, it is about the nature of the customer that is associated with consumer goods. It would be a reasonably fair assumption that people buying consumer goods would have an aspirational nature. Such customers are assets for any financial institution, as they take more loans throughout their life spans – certainly more than non-aspirational customers would. For quite a while now, customers, especially aspirational ones, no longer save to purchase goods such as ACs, refrigerators, TVs, or washing machines – they simply purchase these goods on finance. As they mature, these customers are likely to take big-ticket loans such as home loans. So, if a bank or an NBFC get a hold of such a customer early on, there is a high probability that they can cull more business out of them through their life span.

The BFSI research team at PhillipCapital conducted a small survey (50 people) to find out the first thing that they bought on finance after they started working – home, car, two wheeler, or consumer durables and 90% said either a consumer durable good or a two wheeler. This says a lot about the changing mind-set of customers and so also banks’ changing attitudes towards customers. For banks, a customer is no longer just a ‘transaction’ or a ‘swipe’; they have started looking at customers from a lifelong relationship point of view.

Subscribe to enjoy uninterrupted access