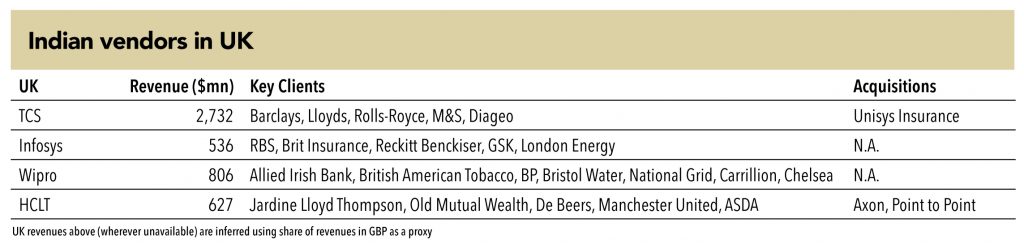

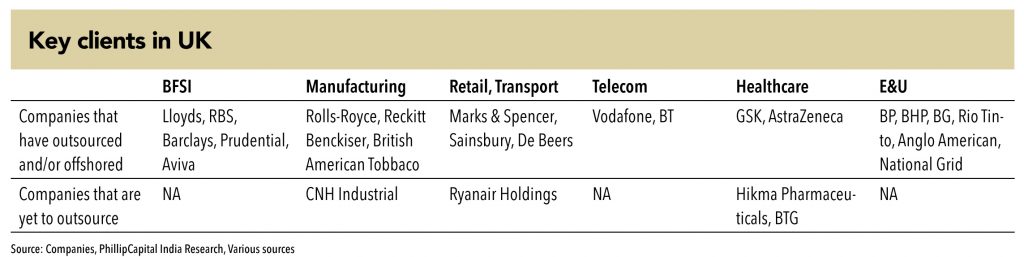

UK is the second largest economy in Europe (GDP of US$ 2.6tn) and has a fairly distributed market for all industries, from services to manufacturing. Top spenders in this region have opted for outsourcing, and over 50% of the companies have fully outsourced as well as offshored their mission-critical business processes. The top-5 such spenders are – Vodafone, BP, RBS, BT Group, and British Airways (ICA).

UK has been a stepping stone for most outsourcing vendors of Indian and other origins, primarily due to the country’s English speaking population and influence of US corporate practices. UK companies, including large government-owned enterprises such as National Rail, were the first companies in Europe to outsource their IT operations. Vendors such as TCS, Infosys, and Wipro started their EU operations from the UK, and gradually expanded them to Switzerland, Germany, France, and Scandinavia. TCS was the first to be selected for offshoring by UK’s government/public owned utilities and continues to build a strong brand value among UK’s PSUs.

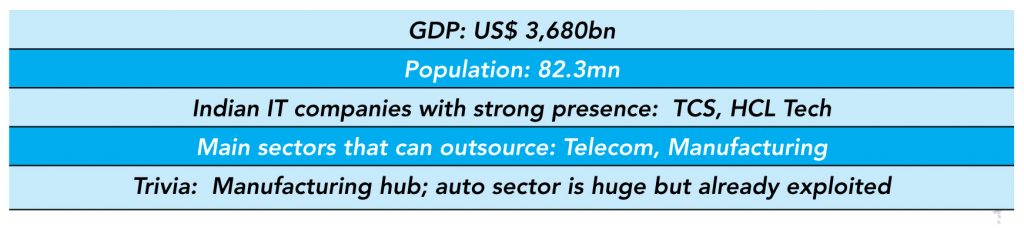

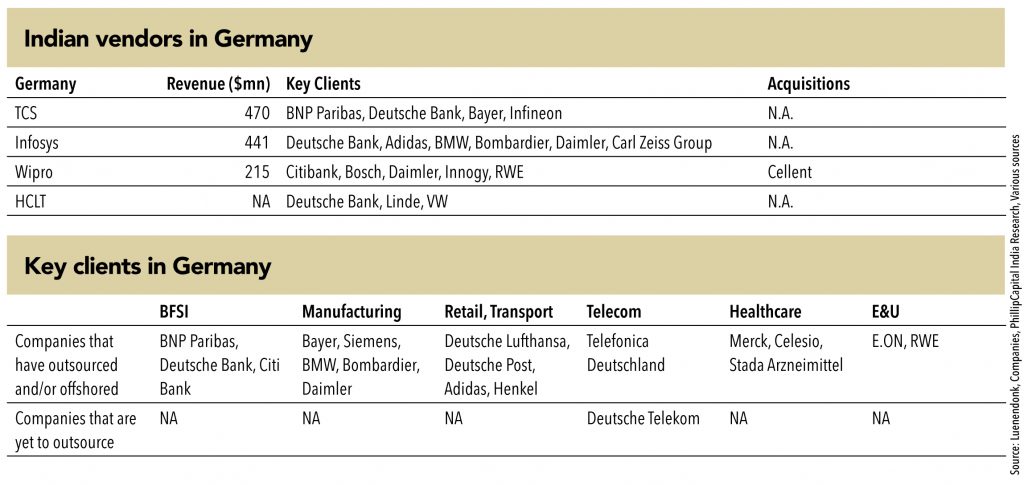

With a GDP of US$ 3.6tn, Germany is the largest economy in Europe and a hub for banking, manufacturing (mainly automobiles and aerospace), and capital goods engineering. While a fair portion of the top spenders in this region have outsourced their mission-critical business processes, there is an overall reluctance to offshore. Companies such as TCS, Wipro and Infosys remain strong in the region with large-sized deals and long-term relationships. The top spenders in Germany that are fully outsourced and offshored are – Volkswagen, Daimler, BMW and RWE – mostly automobile OEMs.

German industry is highly scattered across the country. There are over 1,400 companies in Germany with more than € 1bn in revenues spread across hundreds of villages, making it difficult for an offshore vendor to gain economies of scale. Additionally, most German companies have captive IT. Language and cultural hurdles have also been difficult for Indian vendors to overcome, as Germans prefer primary local vendors. However, gradually, with more exposure to the outside world and more Germans now speaking English, Indian vendors are slowly making their entry into this market.

In Germany, the manufacturing vertical – relating to engineering solutions and ADM – remains fairly outsourced and offshored. Also, healthcare companies are bidding for outsourcing a sizeable part of their critical patient-data related operations to large vendors. Verticals such as E&U, TTL, retail, and BFSI have preferred MNCs (not offshoring) or local vendors for managing their IT. Also, telecom companies own large IT subsidiaries, and remain reluctant to outsource/offshore their operations.

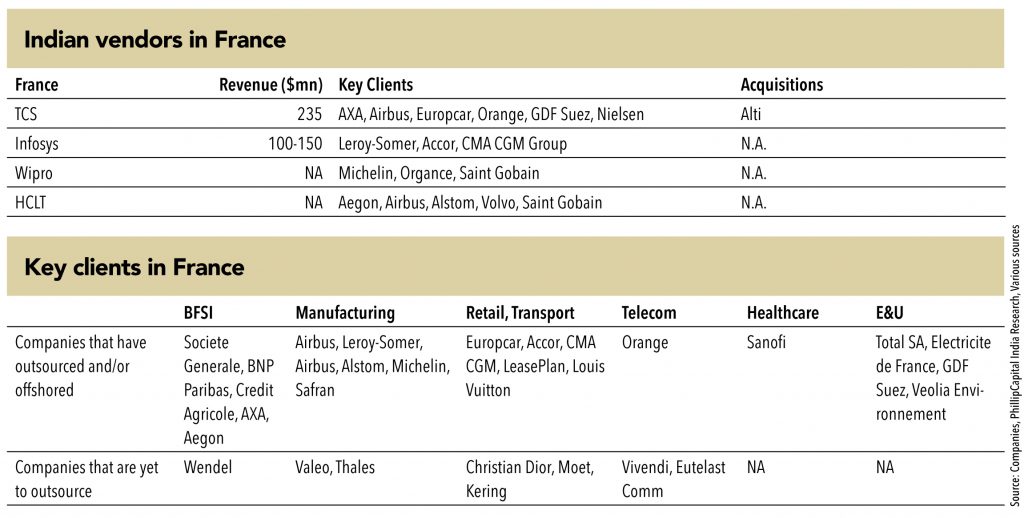

With a GDP of US$ 2.6tn, France remains a large market for banks, retail, manufacturing, and E&U in Europe. For the IT outsourcing industry, this market is the second largest in terms of potential IT spending (after Germany). Indian top-5 IT vendors have fairly established their presence in the region through partnerships or acquisitions, which helped them mitigate cultural as well as language barriers. The top-5 spenders in France that have fully outsourced and offshored their IT operations are – SocieteGenerale, BNP Paribas, EDF, and Alstom.

French people tend to be very nationalistic, and hence are reluctant to enter into any contract that entails a job migrating from France. Just like in Germany, Indian vendors have found it difficult to overcome language and cultural hurdles in France. However, gradually, with more exposure to the world and more French people now speaking English, Indian vendors are slowly making their entry into this market.

The French IT outsourcing market is of two types: (1) engineering/consulting companies, dominated by local vendors such as Altran, Alten, and other local ERD companies, and (2) IT-oriented companies like Capgemini, Atos, Sopra, ACN, CGI, and IBM. In both segments, Indian vendors are gradually gaining market share – overcoming language barriers through acquisitions or hiring local talent.

In France, manufacturing and telecom remain largely averse to outsourcing. Verticals such as retail, TTL, and healthcare are also generally reluctant to offshore, but are partnered with local vendors for outsourcing. BFSI and E&U giants have been fairly open towards outsourcing as well as offshoring.

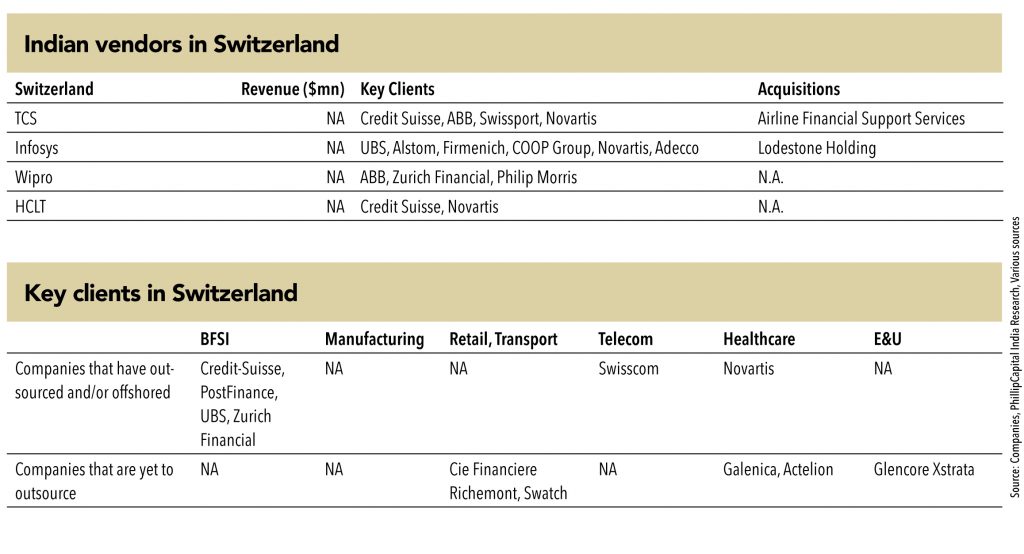

With a GDP of US$ 0.7tn, and being a consumer-driven economy, Switzerland is a major market for CPG, retail, banks, and healthcare companies. Its per capita GDP (at US$ 78.8bn) exceeds that of Germany, UK, and France. Among its top spenders, most companies have outsourced as well as offshored. This is a strong market for Indian IT vendors in terms of offshoring. Top-5 Swiss companies that have offshored their IT operations are – Credit Suisse, UBS, Novartis, and Roche.

Switzerland is becoming one of the major markets for Indian IT vendors – both IT and BPO services. The presence of MNCs and a wider acceptance of the English language (as compared to France penetratedhave helped them capture market share in Switzerland at rapid rate. Leading companies in almost all segments (UBS, Credit Suisse, LafargeHolcim, Nestle, Novartis, Swisscom) were early adopters of the outsourcing model, and have deployed local/MNC/Indian vendors. E&U and healthcare verticals are the only ones that are relatively underpenetrated through offshoring.

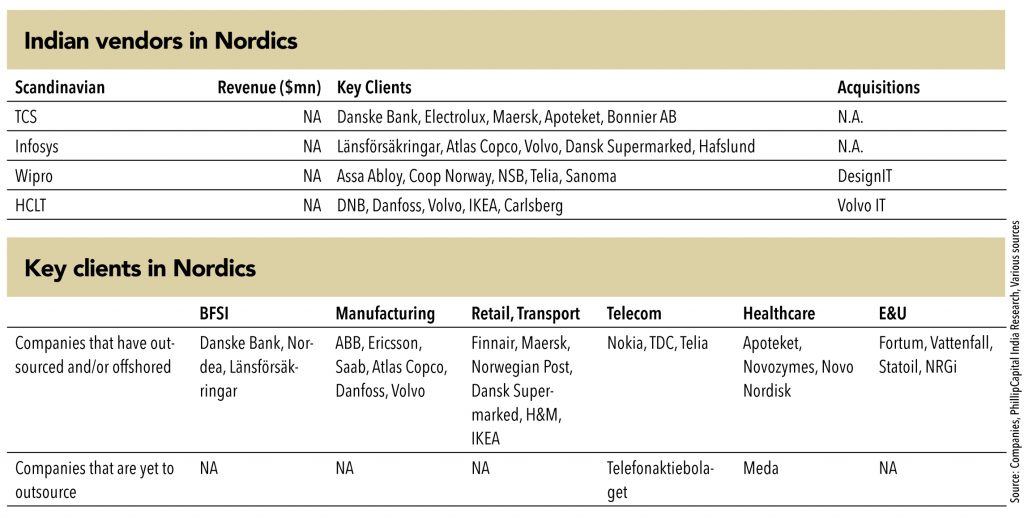

Scandinavia has a more diversified landscape in terms of verticals, with the major ones being telecom, manufacturing, and E&U. Significant number of the large companies in the region have already outsourced their IT operations. Many have opted for offshoring, too, along with the SMEs in the region. Most of them have opted for a digital transformation of their existing IT infrastructure. The top-5 spenders from this region who have fully outsourced as well as offshored their IT operations are – Ericsson, Telenor, Statoil, DNB, and Volvo.

Scandinavian companies regularly invest on improving/migrating their technology to achieve cost efficiency and business competencies. As a result, a large proportion of these companies have outsourced as well as initiated RFPs for offshoring contracts. Top spenders in IT outsourcing are telecom, banks, manufacturing and E&U companies. Contracts from this region tend to be long-term partnerships with large TCVs.

Most companies in this region started offshoring using IMS to test waters, which meant that Indian vendors like HCL, TCS and Wipro gained an early advantage. They have capitalized this to gain market share in other domains such as application development, BPO, and CRM/ERP.

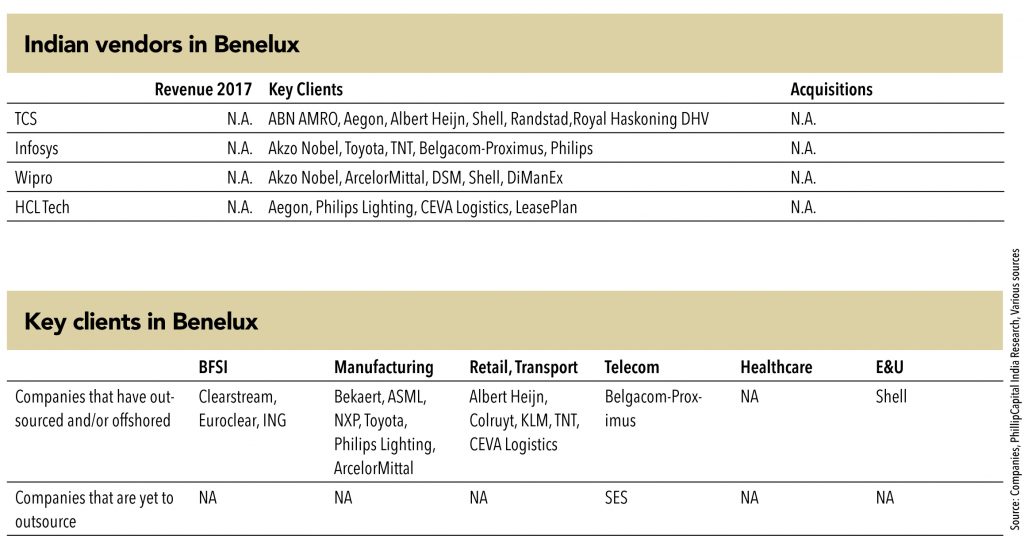

Benelux regions include the richest countries (on per capita GDP) in the Eurozone, with E&U, CPG and technology being the major industries. Large number of the top-spending companies have outsourced their IT operations, while many remain reluctant to offshore. The top-5 spenders from this region who have fully outsourced as well as offshored their IT operations are – Shell, KPN, ArcelorMittal, Belgacom, and ING group.

The region has very few large companies – and most of them are already using offshore services. Among top spenders, majority of telecom and E&U companies have fully outsourced as well as offshored their IT operations. Manufacturing, retail, and CPG have opted for outsourcing, but haven’t offshored yet.

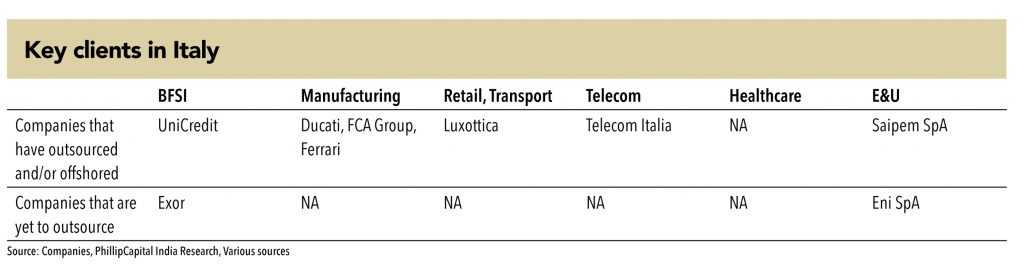

Italy has the largest accumulation of utilities and retail in Europe, including public-owned utilities relating to water and other resources. A fair portion of the top spenders in this region have outsourced their mission-critical business processes, but they remain reluctant to offshore. A large portion of the companies are yet to opt for outsourcing. Among the top-12 spenders, none have fully offshored. Indian top-4 vendors have a small presence in manufacturing, retail, and TTL verticals in Italy.

In Italy, a large proportion of SMEs are from the retail vertical – fashion apparels and products. According to industry experts, companies from these verticals are also opting for digital transformation due to a change in their business model from open retail to online retail. This has uncovered a completely new opportunity for Indian vendors, even though the segment is currently dominated by local start-ups.

Among the top spenders from the region, retail, telecom, manufacturing, and healthcare have outsourced their IT operations. On the other hand, many E&U companies (the largest industry) are yet to opt for outsourcing.

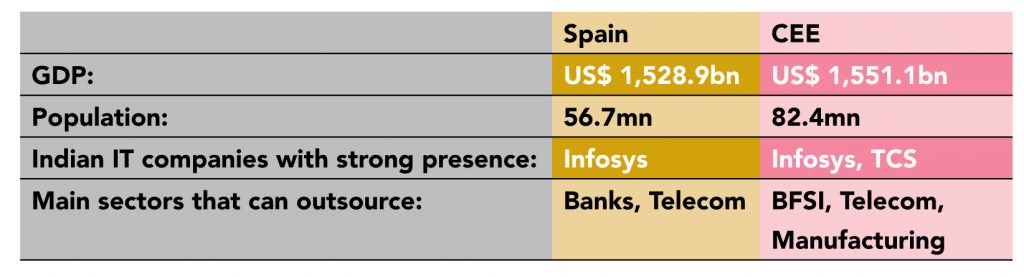

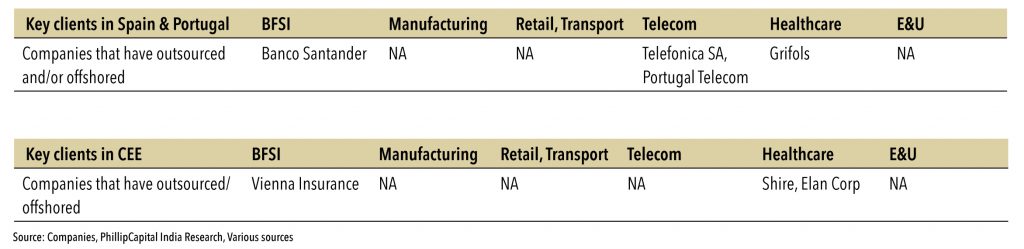

Spain & Portugal: With a combined GDP of US$ 1.6tn, Spain and Portugal is a large market for banks and SMEs in Europe. However, the potential IT spend remains very low in the region. Other than banks, very few companies are strategically set for technological changes. Large banks in the region might prefer a change in their legacy systems and would want to shift to a more lucrative IT model – preferably outcome-based contracts. Being pioneers in digital technology services and cloud implementation, there is a greater chance for the Indian vendors to win rebids from these banks. Among the large spenders, only one bank – Banco Santander – has outsourced as well as offshored its IT operations.

Overall, a large proportion of Spanish/Portuguese companies appear reluctant to offshore. Most of the industries (apart from E&U) have either consolidated their IT operations with a large MNC vendor or are in partnership with local vendors. Telecom giants like Telefonica and Portugal Telecom are yet to outsource their networking and IT infrastructure; however, both have outsourced their BPO operations.

CEE: Central and Eastern Europe presents a new opportunity for Indian IT vendors. Within CEE, Austria, Czech Republic, and Hungary form the largest chunk of the GDP. Majority of the companies in these regions have never outsourced, while almost none have offshored their IT operations. The diverse culture as well as language remains a strong impediment for IT outsourcing penetration in these regions. These economically small regions would be the biggest challenge for Indian IT companies.

In fact, the CEE region is also emerging as a competitor for Indian vendors, along with being a potential opportunity. Multiple EU IT vendors (Capgemini, Luxoft, Atos, Sopra) and MNCs (Accenture, ePAM) use CEE as an offshoring destination – competition to Indian cities of Bengaluru and Hyderabad. Employing Eastern European people, available at lower cost than those available in Western Europe, local vendors are able to extract an economic advantage from offshoring. However, availability of talent remains a bottleneck in these regions for it to replace India as an offshoring hub.

Subscribe to enjoy uninterrupted access