At the beginning of this century, Indian IT services companies catered primarily to US-based clients – trying to penetrate the European geography. They faced twin issues: (1) Reluctance from European companies to ‘offshore’ their IT operations, as it was perceived to be synonymous with ‘cheap’ and ‘poor quality’. (2) Stiff competition from local IT vendors, who had deep-rooted client relationships. However, Indian vendors kept pushing the door open, with their ‘cheaper, faster, and better’ alternative – all along supporting their business case by acquiring local companies or hiring local talent. The results have been sweeter than expected. Indian vendors have outgrown local EU vendors in the European region over the last decade – in turn, forcing many to merge or significantly downsize their operations. In this process, their growth rate in European markets far exceeded their growth rate in the US, though US still accounts for over 60% of their revenues. We see this ‘Great European Leapfrog’ by the Indian IT industry continuing over the next decade, in the wake of declining resistance to offshoring, lower competition, improvement in perception of their delivery quality, mammoth untapped potential, and above all, the significantly better ‘value for money’ experience offered by Indian IT companies.

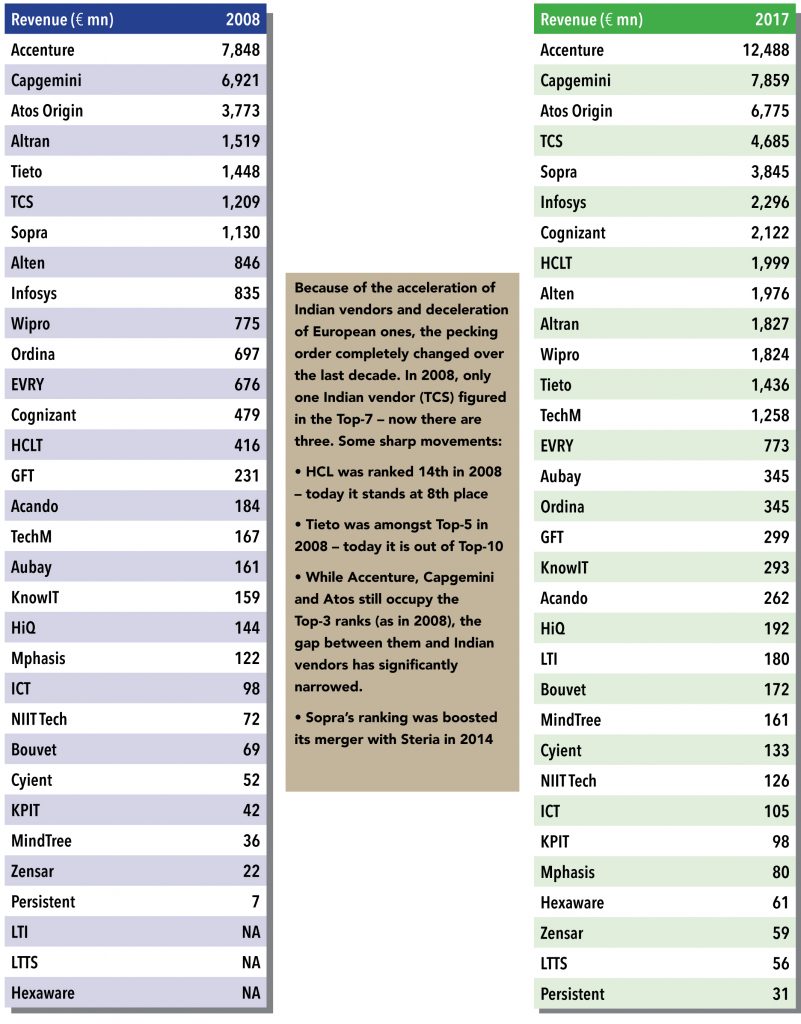

Over the last decade, the European IT services landscape has undergone a remarkable transformation. Ten years ago, the landscape was dominated by home-grown IT services companies, and global majors like Accenture and IBM. Indian IT ‘outsourcing’ vendors, who had already established themselves in the US market, and were capturin market share at a rapid pace, were finding it difficult to break through language and cultural barriers in European companies.

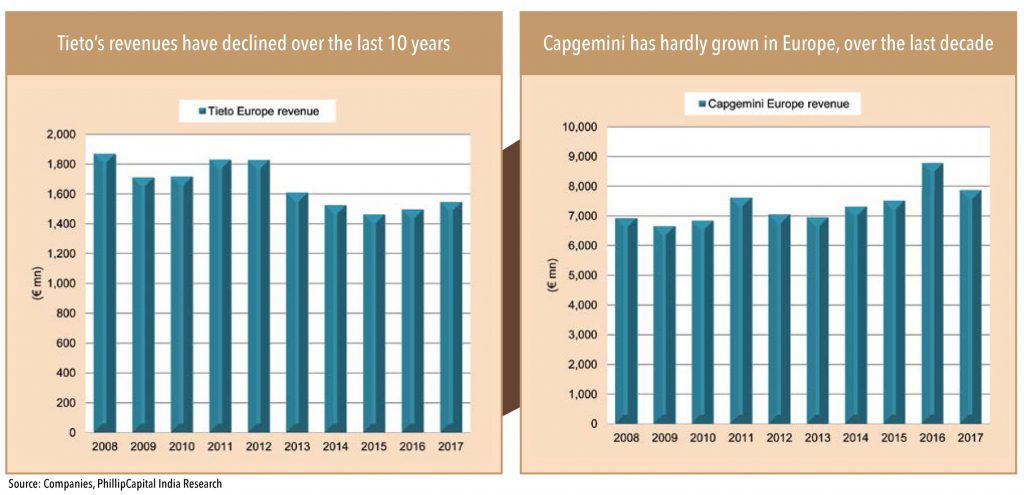

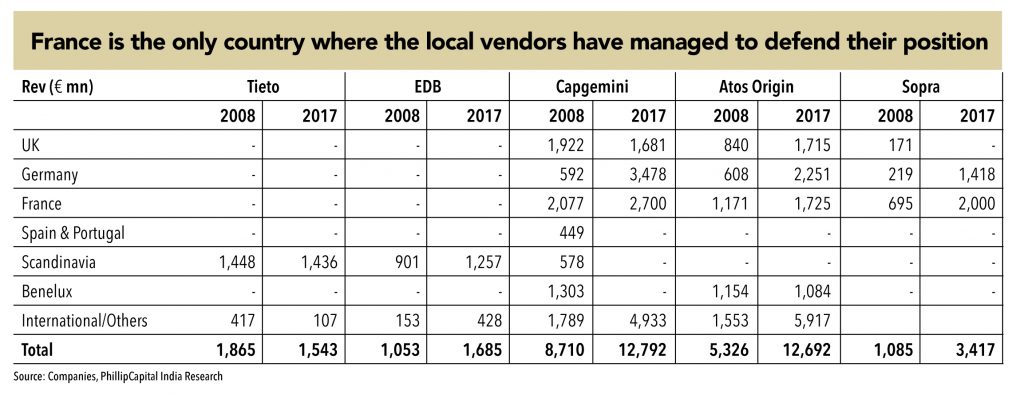

Fast-forward to 2018, and the landscape has completely changed. Over the last 10-15 years, European IT companies have struggled to remain afloat. Those that have managed to survive have lost significant market share. Tieto, with revenues of € 1.86bn in 2008, reported revenues of € 1.54bn in 2017 – a CAGR decline of 2.1%. Capgemini’s European revenues increased from € 6.9bn in 2008 to touch € 7.9bn in 2017, but helped by almost 20 acquisitions over this period. Organically, it reported a muted CAGR of 0.9% over the last decade.

“This offshore business will find its niche as

eBusiness did once the worst hype died down”

– Tieto, in its FY03 Annual Report.

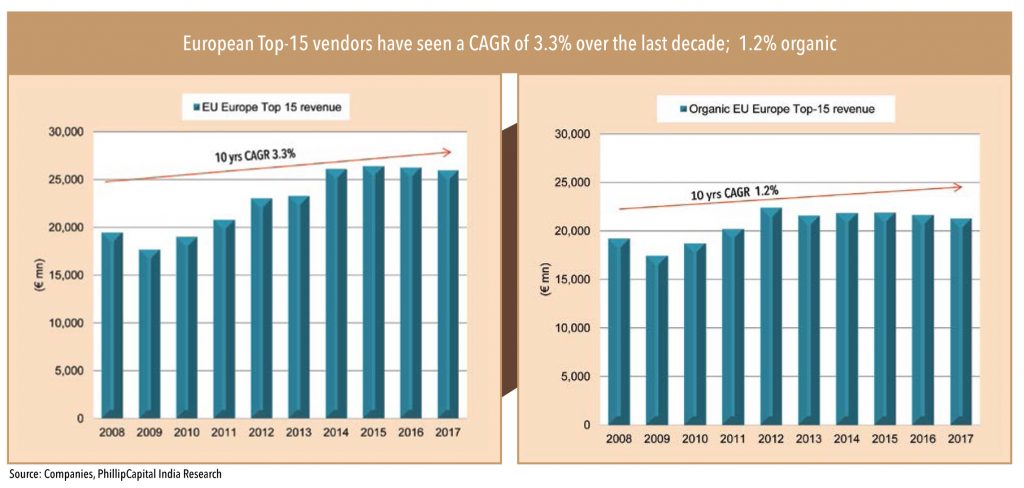

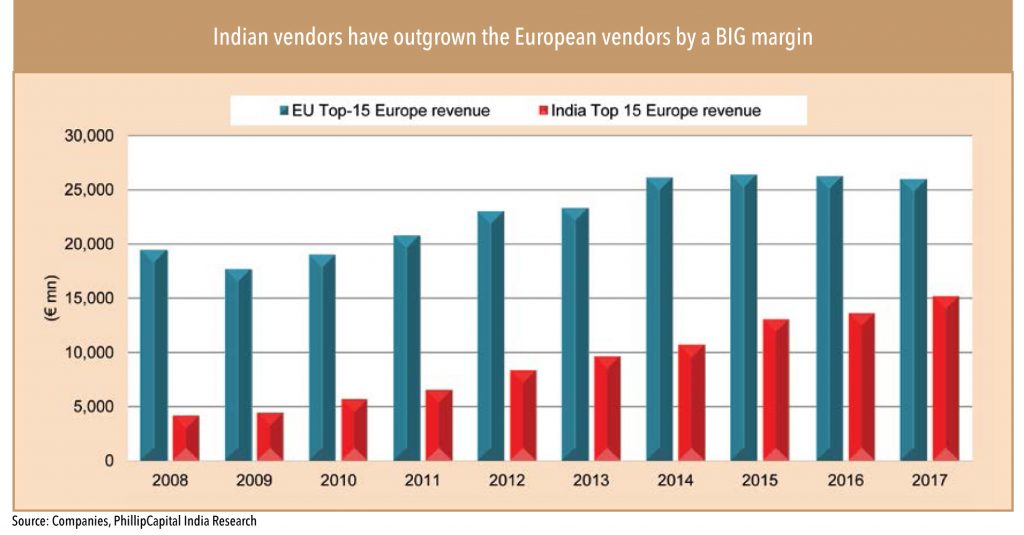

Cumulatively, top-15 European IT services providers had reported revenues of € 19.4bn in 2008 – that figure now stands at € 25.9bn – a measly CAGR of 3.3%. Remove some of the large acquisitions and the top-15 European vendors will report an even lower CAGR of 1.2%. During this period, some of the promising names had to merge with bigger players (Steria-Sopra), while many others had to downsize.

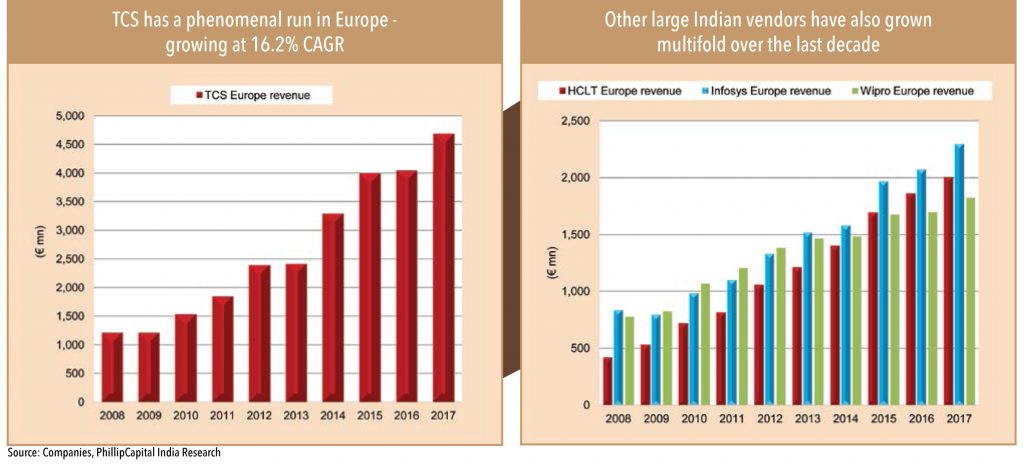

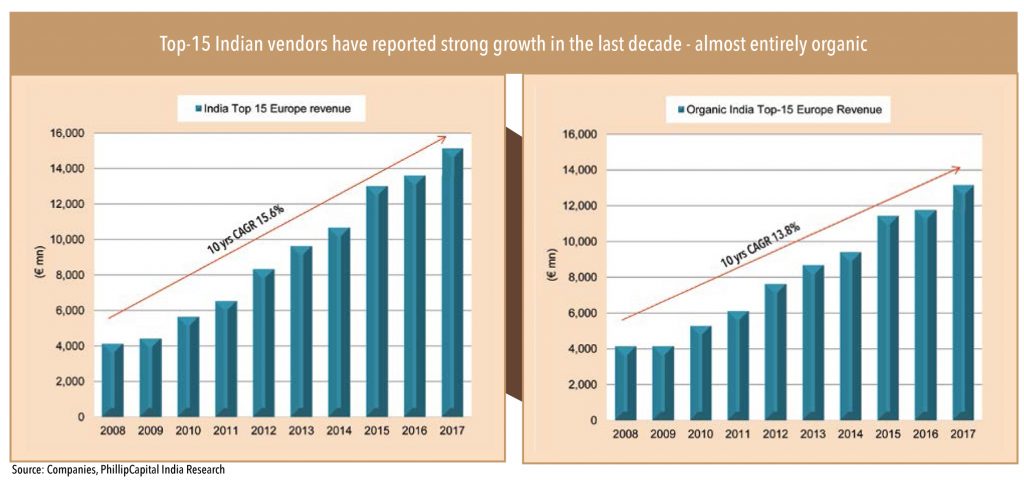

Over the same period, Indian IT services companies, with their so-called ‘flash in the pan’ outsourcing strategies, captured market share across geographies, verticals, and service lines.In 2008 (FY09), TCS’ Europe revenues were €1.2bn, which swelled to € 4.7bn in 2017 (FY18)– a whopping 16% CAGR, all organic. Similarly, Infosys and Wipro doubled their revenues from Europe over this decade, while HCL Tech, more

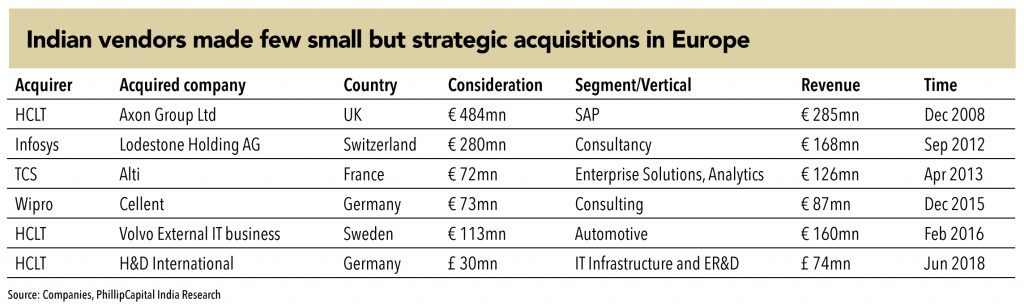

than quadrupled from € 416mn to touch € 2bn in 2017 .Cumulatively, the European revenue of top-15 Indian IT companies almost tripled from € 4bn in 2008 to touch € 15bn in 2017 – a strong CAGR of 15.6%. More importantly, very little of this growth came from acquisitions – Alti, Lodestone, DesignIT, Celent and Axon were the only notable acquisitions in Europe by these companies.

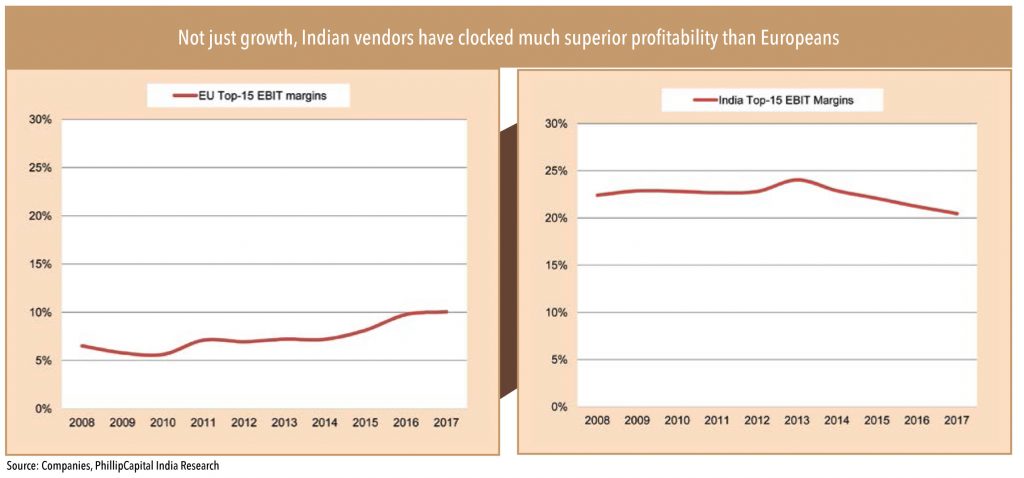

Simultaneously, profitability was also dented While European vendors struggled to grow and tried to cling onto their fast-diminishing market share, their profitability remained significantly below the Indian vendors. Over 2008-17,consolidated EBIT margins of the top-15 EU vendors remained between 5-10% – expandng slightly due to acquisition of higher margin offshore vendors like iGate. Indian vendors do not provide separate margins for their European business. Assuming that the margins in Europe will not be too different from US/overall margins, top-15 Indian vendors’ margins were at much superior levels of 20-25%.

The primary reason for this huge difference is that the European vendors were fighting their battle with wrong weapons. Indian vendors had a lowcost surplus pool of engineers in India at their disposal. This helped them quote much lower costs than European vendors, which were mainly onsite companies deploying high-cost European talent.While the price differential led to rapid growth and market share gains by Indian companies, it also helped them maintain their margins at much

higher levels– leveraging economies of scale. And of course, gradual depreciation of the INR (in which offshore employees had to be paid) also helped Indian vendors.

Why did this happen ?

The primary reason for this remarkable transformation in the European IT services sector (the shift to the Global Delivery Model) was that most European firms underestimated the strategic challenge that offshore firms posed. They responded inadequately, long after it had become clear to customers that Indian firms not only offered a more attractive price point, but also fundamentally better service.

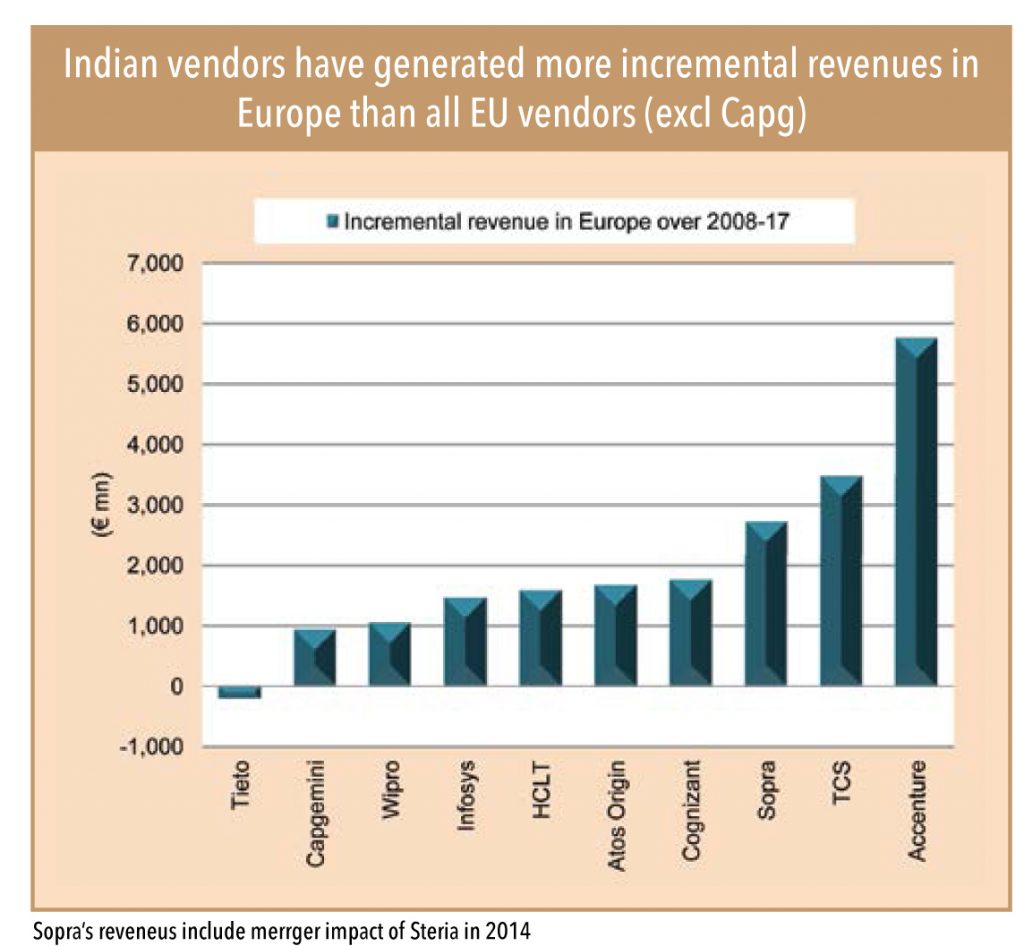

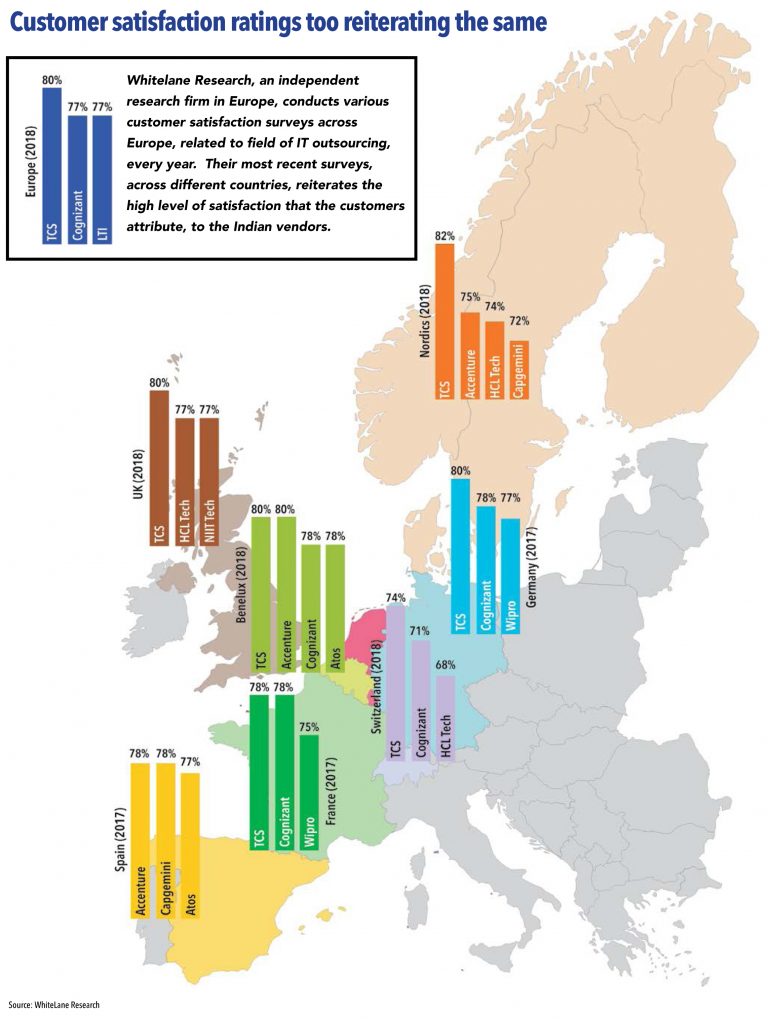

This is proven by the incremental revenues added by Indian vendors in Europe over the last decade. TCS alone added €3.5bn of revenues over FY08-17 – only second to Accenture. Even Cognizant, Infosys, and HCL added more revenues than ALL European vendors, adjusted for their acquisitions.

Our discussions with CIOs and other senior executives at leading companies across Europe (read special section) have revealed that European firms have not been able to overcome the strategic and structural challenges that have impeded their performance for the better part of the last 20 years. Customers believe the performance gap between European and offshore-based firms has grown and they see European services firms as ill prepared for the increasingly strong competitive pressures that they will face in the years to come from offshore-based services firms.

Meanwhile, India as a location for IT capabilities has gained significantly in terms of strategic importance, for many of Europe’s largest corporations. Many European companies have now moved significant parts of their business to offshore-based IT services firms and their own captive centres. When it comes to IT services, European businesses are either working with Indian firms or interested in engaging them.

Moreover, the ‘India focus’ is shifting from gaining a cost advantage to leveraging India as a base for innovation. As the CIO of one of Europe’s largest industrial corporations explained: “We are doing increasingly higher-end work in Bangalore where we are hiring architects and people with experience in data lakes and the digital space. Offshoring for us has undergone a paradigm shift. The quality of talent has improved greatly and we are going into all the areas where the future is”.

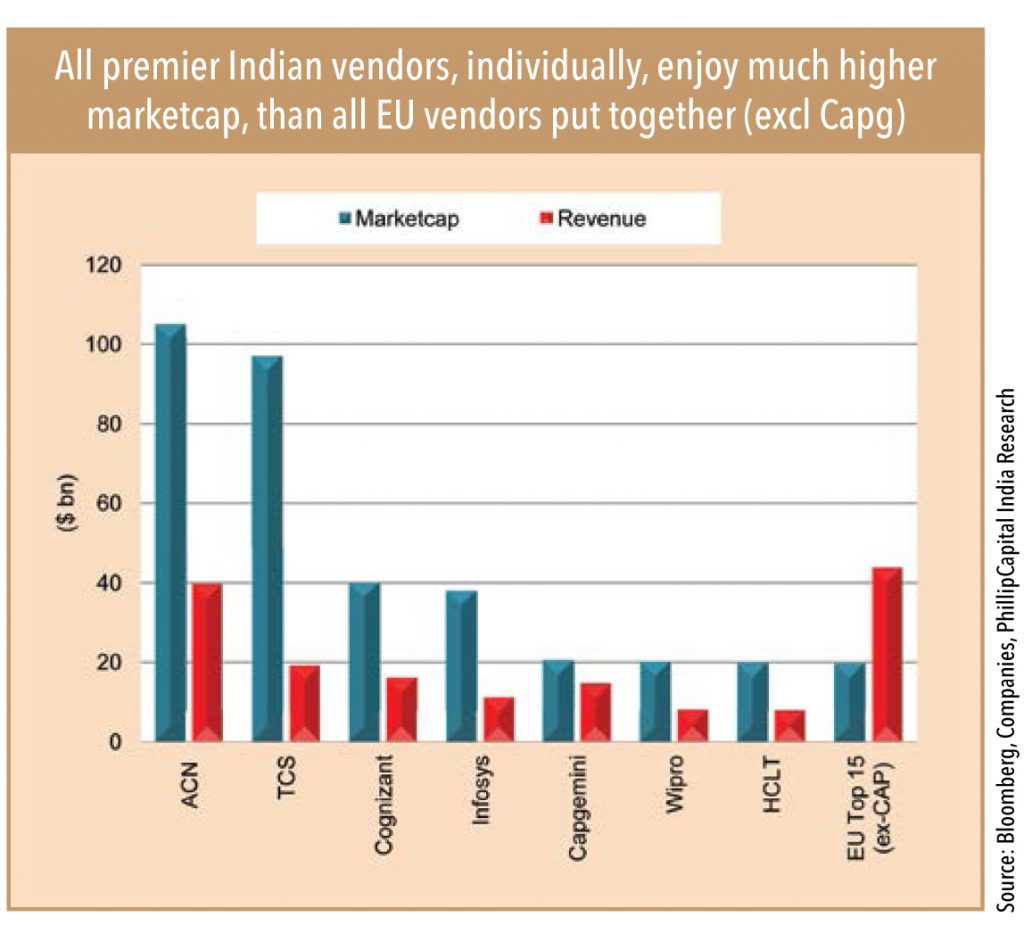

This has been appropriately recognized by the stock markets.Over the last 10 years, TCS’s market cap has grown by 7x (in US$ terms), and is now within touching distance of Accenture – which is almost twice its size in terms of revenues. In fact, all five large Indian vendors (TCS, Cognizant, Infosys, HCL, and Wipro) today have a marketcap higher than the COMBINED marketcap of top-15 European vendors (excluding Capgemini).

Over the last few years, many European IT services firms have undertaken enormous efforts to transform their operating models – but these have yielded only mediocre results. With few exceptions, these firms have experienced significant market share losses in their home markets, failed to meet their financial goals, and seen their strategic market position erode.

European IT services firms were caught off guard

European firms badly underestimated the competitive threat they faced, believing that offshoring would never grow beyond a niche in Europe. They focused on risk rather than opportunity, which the European press reinforced with an endless number of stories about failed offshore projects.

Lulled by a false sense of superiority, these firms failed to see that the very nature of IT services competition was changing.For example, a 2006 study of German IT services firms found that 92% saw no competitive threat from offshore services firms.

TietoEnator’s 2003 annual report expressed an opinion typical of many European IT services firms at the time. Ari Vanhanen, Senior Vice President, Telecom & Media,compared the current interest in moving production to low-cost countries with the eBusiness boom in 1998-99.

“Companies believe uncritically that everyone should operate in the same way. I forecast that this offshore business will find its niche as eBusiness did once the worst hype died down. Certainly not all production will be moved to China or India. We have made careful analyses of operating conditions in various countries and right now we are able to offer the same advantages as low cost countries but with TietoEnator’s core strengths – closeness to customers, industry expertise and reliability.”

At the same time, the Indian firms understood that the global IT services industry was going through a much more profound transition. Nandan M Nilekani, co-chairman, Infosys board, said, “The global IT services industry is going through a major change — the world is ‘flattening’ itself. Traditional models are no longer valid and are fundamentally delivering lower quality, with higher costs, delays, overruns, etc. Clients are increasingly dissatisfied with that, he added. In the end,Nilekani said that “This is a battle of business models. We believe that at the end of the day we have a disruptive business model that is a threat to the existing business model and older companies will have to reconfigure themselves to look more like us if they’re going to be globally competitive.”

The European IT services sector faced a vicious series of interrelated problems

The European IT services sector has faced a vicious series of interrelated problems, many of them self-inflicted. In addition to the more fiercely competitive environment brought on by the shift to the global services model, for which most firms were unprepared, European firms also had to contend with challenges brought about by the European debt crisis and the steep declines in demand driven by the austerity programs that many countries embarked on in response.

Most European IT services firms experienced plummeting volumes and prices, had to digest high impairment and restructuring costs (primarily severance pay), and simultaneously needed to pay retention bonuses and absorb significant salary increases to retain staff, which in turn negated much of the savings from the restructuring. On top of these challenges, some European IT services firms such as Tieto in the Nordics spent many years fixing self-inflicted problems resulting from overly ambitious acquisition-led expansion strategies in the past.

These developments led to enormous top- and bottomline problems and forced firms to reposition themselves strategically, including delisting and geographic retrenchment. However, they took an incremental restructuring approach, largely because of an ill-timed decision to maintain high dividend payout ratios.

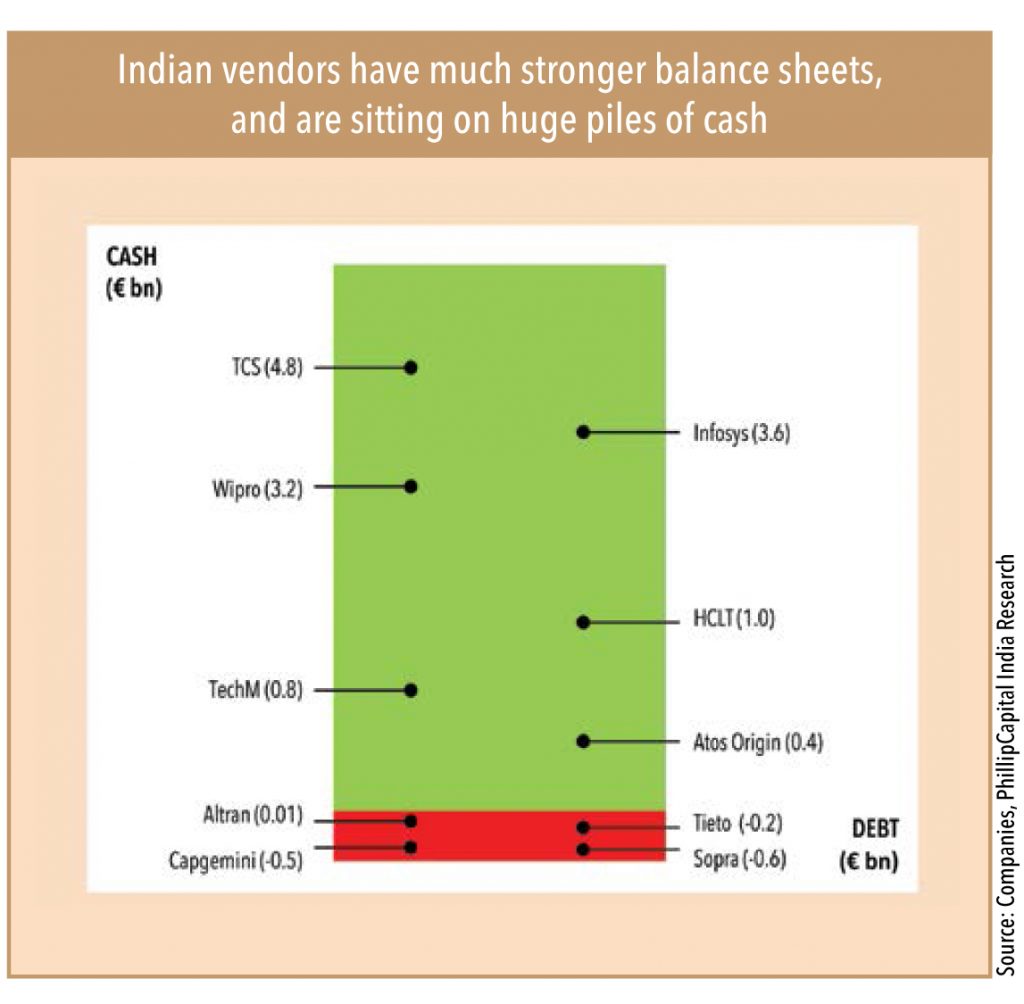

The higher growth and profitability of Indian vendors meant that they were generating significantly more cash, and were sitting on much healthier balance sheets. European vendors,while generating lower cash, invested a lot in acquiring companies across Europe (and the US) to mitigate their declining/decelerating sales. Indian vendors faced no such crunch – they made very few acquisitions in Europe – the top-5 Indian companies made very few acquisitions, of significant size, over the last decade.

The evolution of Tieto, the Nordics’ largest independent IT services firm, has followed a unique downward path.In 2005, the CEO had forecasted that by 2015,TietoEnator will be a leading global provider of high-added-value IT services and a larger, more international and more profitable company.However, after reaching a peak of € 1.8bn in revenue in 2008, Tieto’s revenue began to fall — and kept on falling.In the six years between 2008 and 2014 Tieto spent € 285.8mn on restructuring, averaging 2.4% of

revenue – most of which it spent on severance pay.Nor is it over yet, although restructuring costs since 2015 have dipped to less than 2% of revenue on average.In addition, the company incurred significant impairment losses related to scaling back its international ambitions, as management divested most of its operating companies outside the Nordics. While its foreign subsidiaries were all relatively small, their sale was a long-term distraction for the company. In all, the divestitures took five years to complete and most entities were sold at a loss.

Today the geographic scope of Tieto’s ambition has been cut back to the Nordic markets. Its modest goal now is “to become customers’ first choice for business renewal as the leading Nordic software and services company.”

THE CASE OF TIETO VS. COGNIZANT

Unfortunately, even now, it is still being somewhat unrealistic, as it faces competitors that give customers higher quality offering at a lower cost.

The experience of Tieto might suggest that IT services are just one more European sunset industry. In fact, these are boom times for IT services. Compare their performance against the performance of the Indian vendors, and the true extent of the disaster becomes clear.

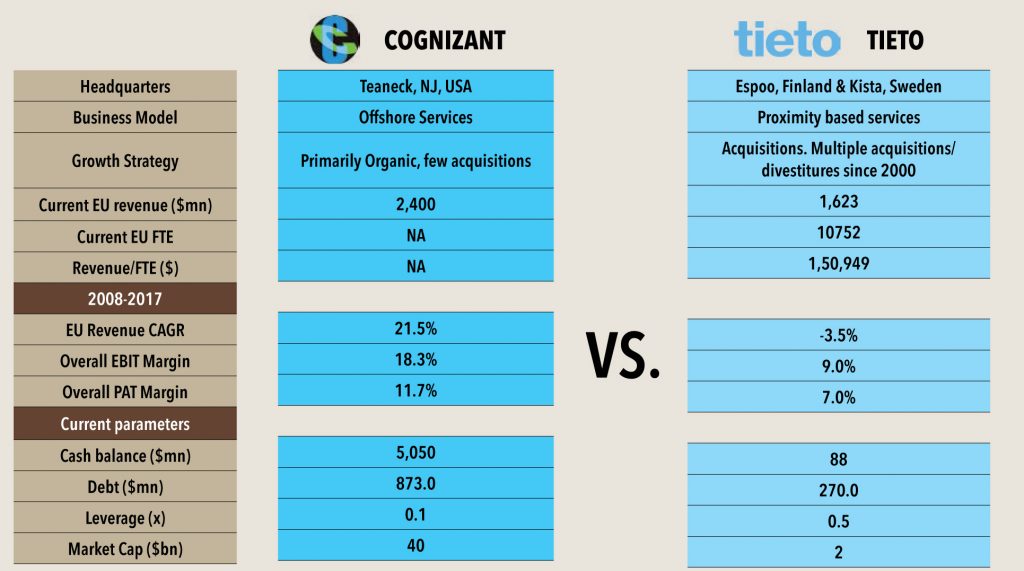

From the perspective of a traditional European IT services firm, Cognizant still looked like an underdog. However, a detailed comparison powerfully displays that these companies were operating based on fundamentally different operating models, with Cognizant significantly outperforming Tieto in all relevant criteria (see tables).

Over the next ten years, while Tieto was busy restructuring and retrenching, Cognizant expanded globally and on Tieto’s home turf.

In a short time frame of just ten years (2007-2017), Cognizant grew its European revenue by US$ 2.1bn. As of Q3 2018, just Cognizant’s European business is now more than 50% larger than Tieto in terms of revenue and twice as profitable.

These facts have not gone unnoticed by investors: Cognizant is now valued at US$ 40bn– a whopping 20x more than Tieto.

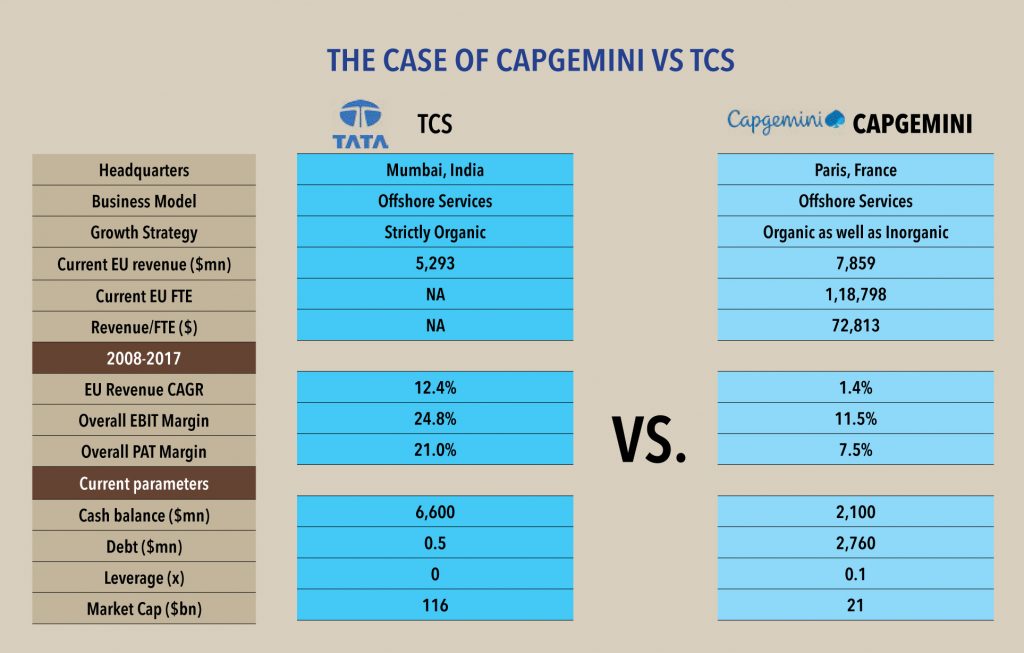

Over the last decade, the firm rankings in the IT services sector have changed dramatically.Looking at global revenue, TCS has now surpassed the largest European firms, Atos and Capgemini.

This is particularly remarkable considering that TCS’ revenue growth was all organic, while Atos and Capgemini grew predominantly through acquisitions – and unlike TCS, not in Europe.

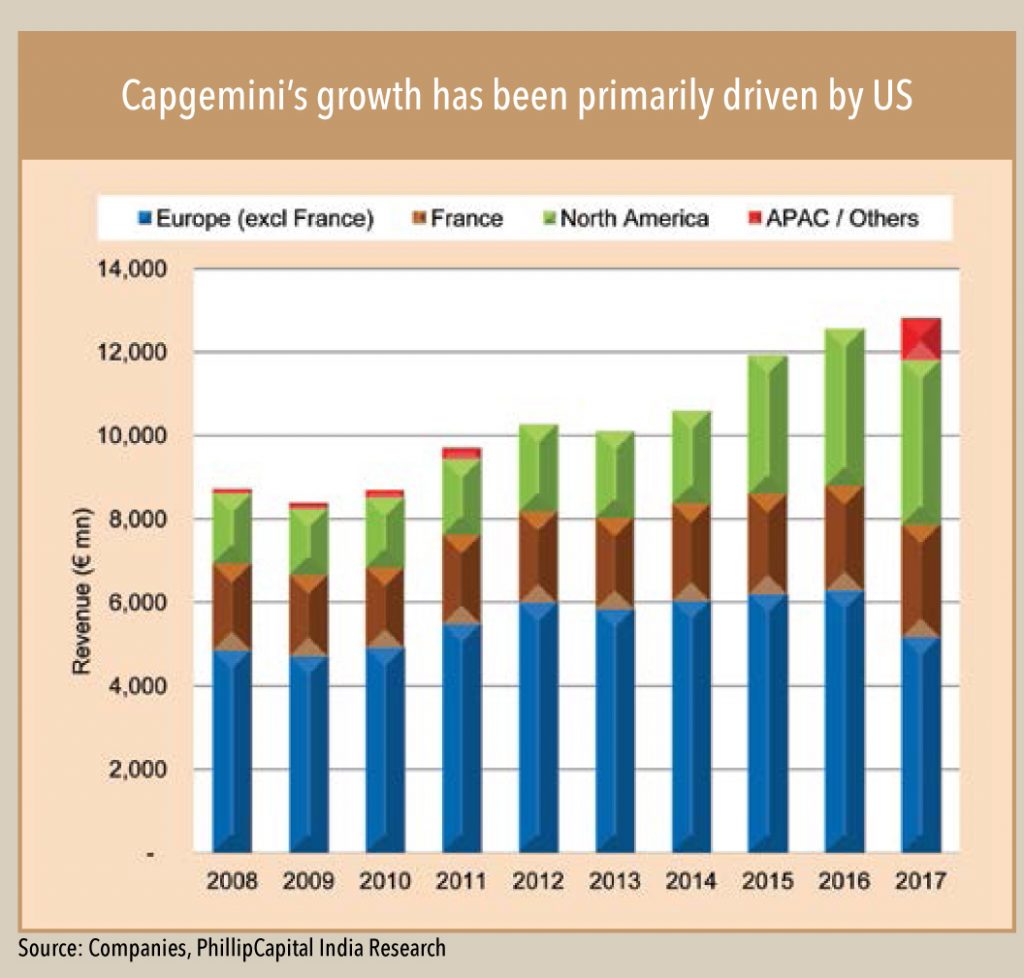

Over the last five years, both Atos and Capgemini have made a strategic push to expand their businesses in North America,largely through acquisitions. Capgemini acquired Kanbay (2006) and iGate in 2015. Atos acquired Xerox ITO in 2015 and Syntel in 2018. Expanding their business in the USA was seen by Atos and Capgemini as a strategic opportunity to achieve group-level operating margins in excess of 10%, and additionally participate to a greater extent in a fast growing market.

At Capgemini, North American revenue rose to 31% in 2017 up from 21% in 2013, following the acquisition of iGate. Similarly at Atos, North America represented 17.6% of revenue in 2017 versus just 11% five years earlier in 2013.

With the reorientation of Capgemini’s revenue toward North America, 70% of the company’s revenue growth – in the five years between 2013 and 2017 – was generated in North America,where revenue grew 90%. In Europe, by contrast, the firm’s revenue grew 9.6% for the entire fiveyear period. Despite being a European company,its organic growth in Europe was essentially flat when demand for IT services has been extremely strong.

Even in Europe, Capgemini has fared well, only on its home turf – France. Excluding France, its revenues from other European countries have only declined over the last decade.

In striking comparison, TCS achieved organic European revenue growth of 37% during roughly the same five-year period (FY14-18). TCS added € 1.4bn in new revenue, compared to just €516mn at Capgemini. While the growth TCS created was almost entirely organic, Capgemini’s numbers include the benefit of various acquisitions. Much of TCS’s growth was achieved in Capgemini’s home turf in markets all over continental Europe.

In CY18 too, the performance gap in favour of TCS has continued to grow. It showed 22.8% CC yoy growth in UK in Q2FY19 and 17.4% in continental Europe. By contrast, Capgemini achieved just 1.6% growth yoy (Q3CY 18).

In the case of Capgemini, it seems that the firm’s strategic push into North America has apparently led them to take their hands off the wheel in Europe. Atos, too, pursued a similar strategy and has had similar results.

As Indian vendors grabbed market share from European counterparts; they did well in some pockets, but were not able to penetrate others. Geographies such as UK, Scandinavia, and Switzerland were ‘conquered’ comprehensively, with Indian vendors grabbing large market share from incumbents. Even in regions such as Germany, France, and Benelux, Indian vendors saw decent growth, though language and cultural barriers still inhibited supernormal growth in these regions. Meanwhile, Italy, Spain,and Central Eastern Europe remained highly guarded by local companies and contributed little to the Indian vendors’growth in the European region.

While a deeper look at these regions (individually) follows

later, major drivers of growth in these regions for Indian

IT firms are as follows:

• The UK market is well entrenched now, and has a sizeable presence of almost ALL Indian IT firms with TCS being the largest with a practice of close to US$ 2.7bn. In the UK, Indian firms have captured significant market share in public-sector contracts (National Rail – TCS, Birmingham City Council – HCL), BFSI (RBS – Infosys, Lloyd – TCS),retail (Marks & Spencer – TCS, De Beers – HCL) and manufacturing (Rolls Royce – TCS, Reckitt Benckiser – Wipro). Use of English as the language of communication and a work culture similar to the US, where Indian firms already have significant presence, helped them expand their presence rapidly.

• On the other hand, growth in Switzerland was largely driven by capturing market share in BFSI (UBS – almost all, Credit Suisse – TCS) and manufacturing (Holcim – TCS, ABB – Wipro) segments. Again, TCS and Infosys have the largest presence in this region amongst Indian vendors.

• Interestingly, Scandinavian countries have seen the rise in penetration of Indian vendors, due to the latter’s ability in IMS. Scandinavian companies preferred to test waters by first outsourcing low-risk IMS contracts – later deciding to outsource other critical functions (like CRM, ERP and application development). With its strong capability in the IMS domain, HCL Tech has led the growth in this region for the Indian vendors, followed by TCS and Wipro.

Subscribe to enjoy uninterrupted access