As banks are making an all-out effort to correct past mistakes, NBFCs could suffer

During 2001-2010, there were many banks and NBFCs who started consumer-durables financing, but most quit after only a few years when they realized that due to the very small ticket size, opex in the segment was pretty high at 10-18%. Additionally, credit costs were also higher at 3-8%. As none of them were able to generate profits in this product category, most either stopped CD financing or continued it selectively. The only NBFC that was able to crack this business was Bajaj Finance.

Bajaj Finance ramped up its presence quite fast across dealership points, even in smaller cities, and eventually was able to reduce opex cost, substantially aided by higher volumes. Moreover, with the help of analytics and robust risk-management systems, it was able to manage credit costs at very low levels. As a result, it was able to generate profitability in the product segment where banks or other NBFCs failed. So it wouldn’t be wrong to say that it was Bajaj Finance that actually created the market for consumer-durable finance.

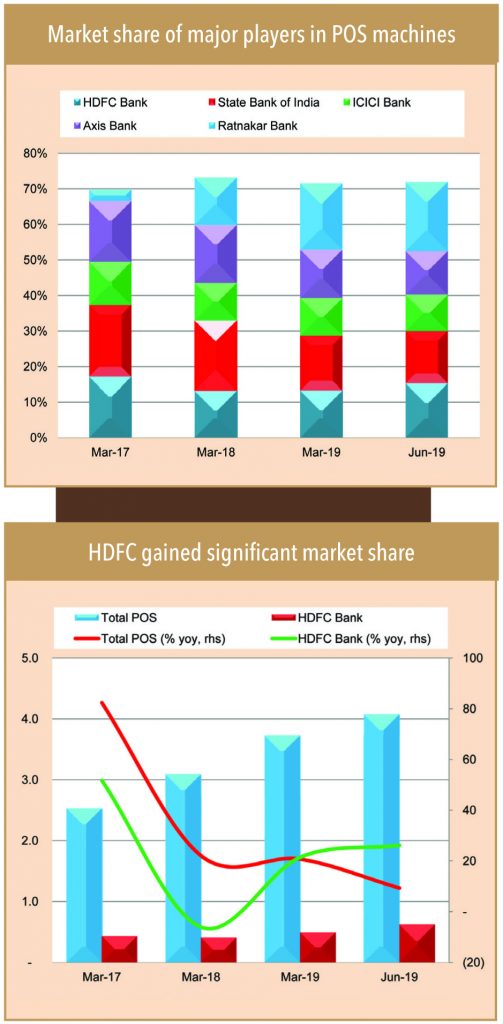

Interactions with various large retail chains, exclusive outlets, small shops, and OEMs suggest that banks (particularly HDFC Bank) have become very aggressive in zero-cost financing since the last six months. They have increased their dealership presence significantly and are also offering lucrative schemes. While paper finance require a physical presence (of the bank or NBFC’s executive), card finance does not. Card-finance schemes can be activated (on the HDFC POS machines provided by Pine Labs) by the merchant. As of March 2019, HDFC had 4.9 lakhs POS machines, which is 13% of the entire banking system. However, in just the first quarter of FY20, it increased this number by a whopping 26% to 6.2 lakhs, taking its market share to +15%. Channel checks suggest that HDFC Bank has wrested significant market share from Bajaj Finance in the last six months – the bank’s market share improved to 15-20% in H1FY20 vs. less than 5-10% in FY19 while Bajaj Finance’s share has come down to 55-60% from 70-75% last year.

Bajaj Finance didn’t stop at just consumer durables finance, it used the analytics to cross-sell other products such as home loans, personal loans, business loans and two-wheeler loans. No other NBFC or bank saw this coming! Bajaj Finance used the ‘pull strategy’ by offering easy finance on a product, which no other bank or NBFC was offering, and then once the customer was in, it was easy to cross-sell other loans. And, in the process, it continued to grab a larger wallet share – not only from the new/potential customers of banks, but also from their existing ones. This started making private banks worried. The recent aggression is a fallout of this worry – banks are making an all-out effort to correct past mistakes.

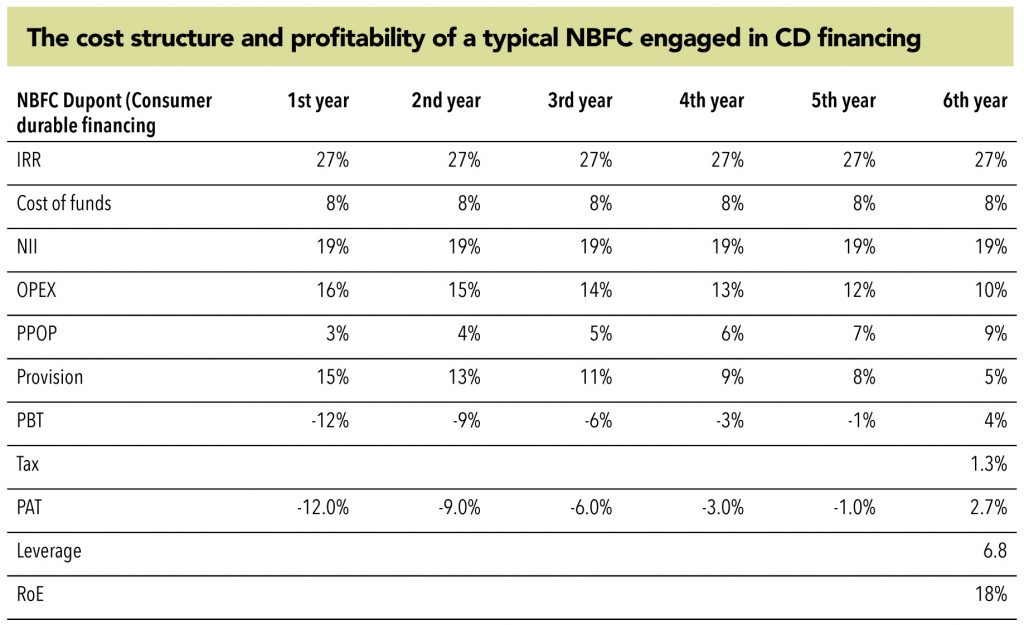

CD loans for NBFCs have a high IRR of 25-27% due to the subvention income received from manufacturers and the processing fee. However, operating costs are also high at around 10-15% as they incur significant costs – they need to have a physical presence at dealership points for documentation. In the initial years of operations, opex remains high at c.15% and as reach and dealership presence increases, and with introduction of EMI and loyalty cards, the ratio stabilizes at 9-10%.

Credit costs are relatively high at around 3-8%, given the unsecured nature of these loans. In the first few years, credit cost can be higher at 5-8%, which gradually stabilize at 3-5% in 4-5 years. Overall, NBFC players should make 2-3% RoA and 15-20% RoE once the business achieves scale. One NBFC said it achieved break even in 4-5 years.

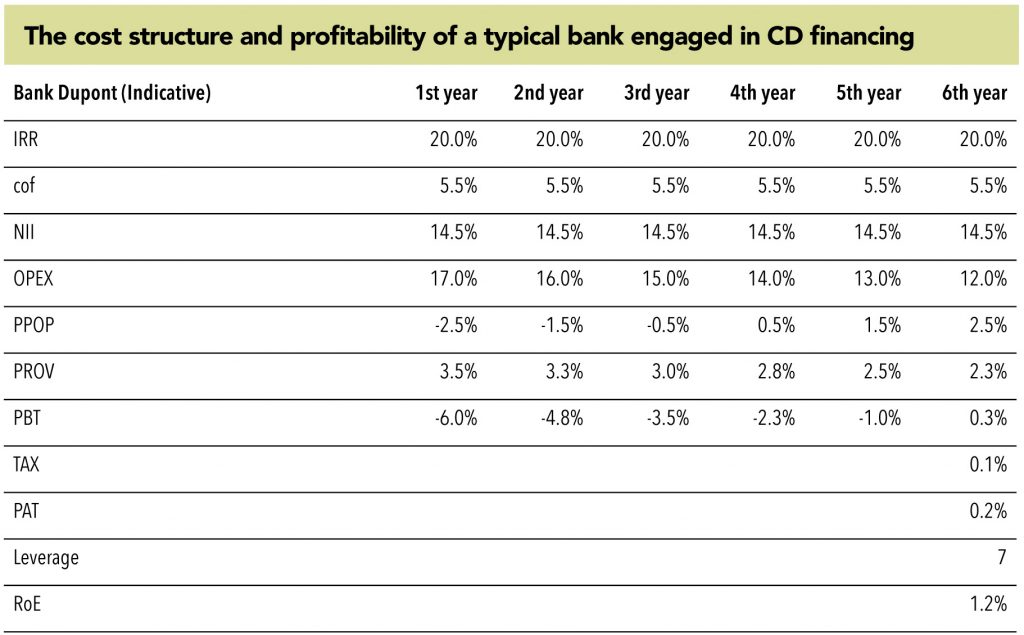

Banks generate an IRR of just c.20% on consumer-durables loans, which is significantly lower than what NBFCs make. While banks’ opex ratios are generally higher than NBFCs due to their higher regulatory costs, their credit costs are lower than NBFCs. This means that even after achieving scale in say 5-6 years, a bank wouldn’t be able to make much profit from this enterprise. Profit is not the motive for banks entering this business with new gusto, having the maximum wallet share of its customers is, even if it comes at a slight cost.

Therefore, even if banks won’t generate much return from consumer-durables finance, this enterprise provides a big enough opportunity to cross-sell other products. Besides, banks do not want to lose its customers to other banks or NBFCs because they did not offer a product. Banking is a relationship business, and if customers move out to any other bank or NBFC for any product needs, there is a high chance that they will be lured away for other product requirements, even if their home banks offer these products.

Subscribe to enjoy uninterrupted access