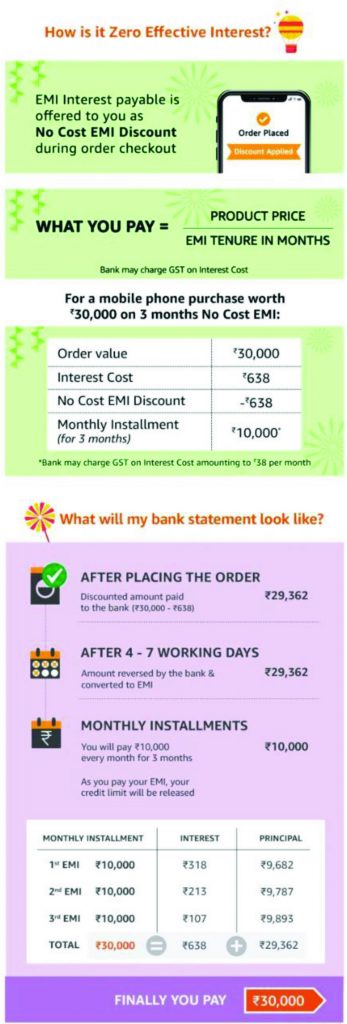

Banks and NBFCs offer zero-cost EMIs under which the total amount paid by a customer to banks or NBFCs will be the price of the product split equally across the EMI tenure. In these schemes, the interest payable to banks or NBFCs is offered as an upfront discount while buying the product, effectively making the EMIs ‘zero-cost’. That interest amount (or discount) is paid by the brand to the bank, which is also know as subvention.

There are four parties involved in any zero-cost finance product, financier, retailer, manufacturer, and customer. So how exactly does it become a zero-cost EMI for the customer? This illustration will throw some light on it.

• Lalita wants to buy a washing machine worth Rs 30,000.

• The seller, Bright Electronics, will provide an upfront no-cost EMI discount of Rs 638, which will be equal to the interest her bank will charge on a three-months EMI.

• The price of the product is reduced to Rs 29,362 and the bank (offering the EMI) charges Lalita interest on Rs 29,362, which is considered the actual loan amount, not the price of the product, which is Rs 30,000).

• For the bank, the credit is Rs 29,362 + interest of Rs 638 for 3 months = Rs 30,000.

• This Rs 30,000 will be converted to 3 EMIs of Rs 10,000.

• Lalita ends up paying Rs 30,000 in three EMIs of Rs 10,000 each, without any interest, down payment, and processing fee.

• Dealers receive the full transaction amount of Rs 30,000 adjusted for MDR fee (applicable in the range of 0.75-2.0%; charged by POS machine providers).

• The customer pays Rs 30,000 (including interest) and Rs 638 is paid by brands as subvention cost to the banks or NBFCs that gave the EMI option.

• Sometimes, dealers also tie up with a bank for cash-back schemes. In these instances, the cost of the cash-back is split between retailers and banks in a pre-agreed proportion.

Apart from the actual price of the product, Lalita has to pay 18% GST on the interest amount – an additional Rs 114 over the Rs 30,000. No-cost EMI is not exempt from tax on the interest part.

For most large brands such as Samsung, LG, and Voltas, the financed book accounts for 30-40% of sales. So at 20-27% IRR, which is normally charged by banks and NBFCs, subvention cost works out to 1.5-2.0% of these companies’ total turnover. They account for this cost as part of their marketing expense. The benefit for them is that it makes high-ticket goods more affordable for customers and drives demand as a result. It’s a win-win situation for both consumers as well as manufacturers.

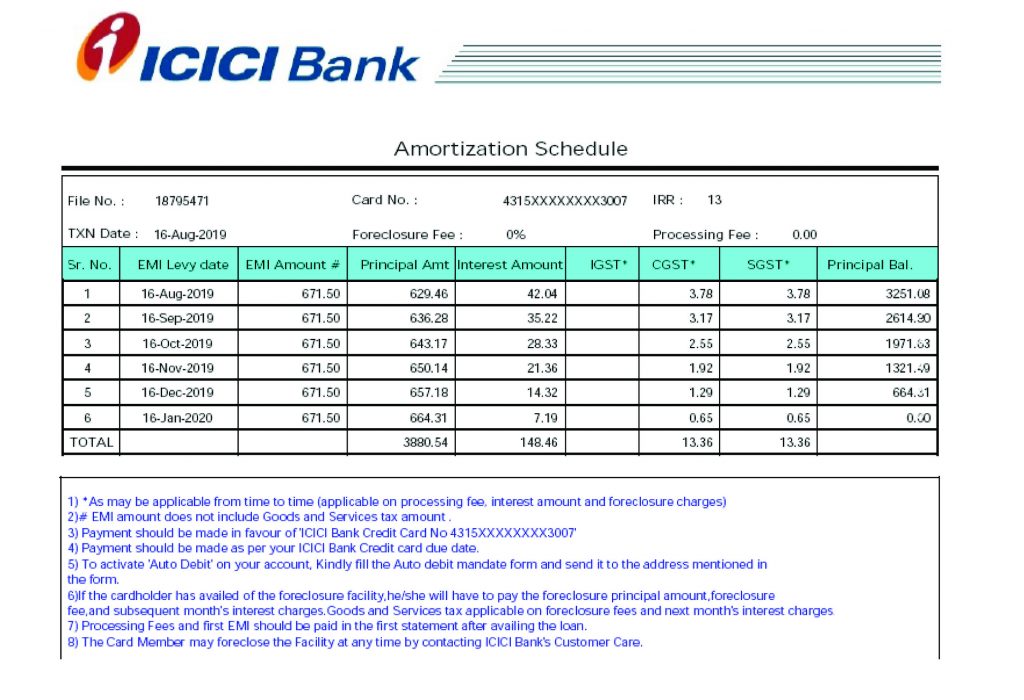

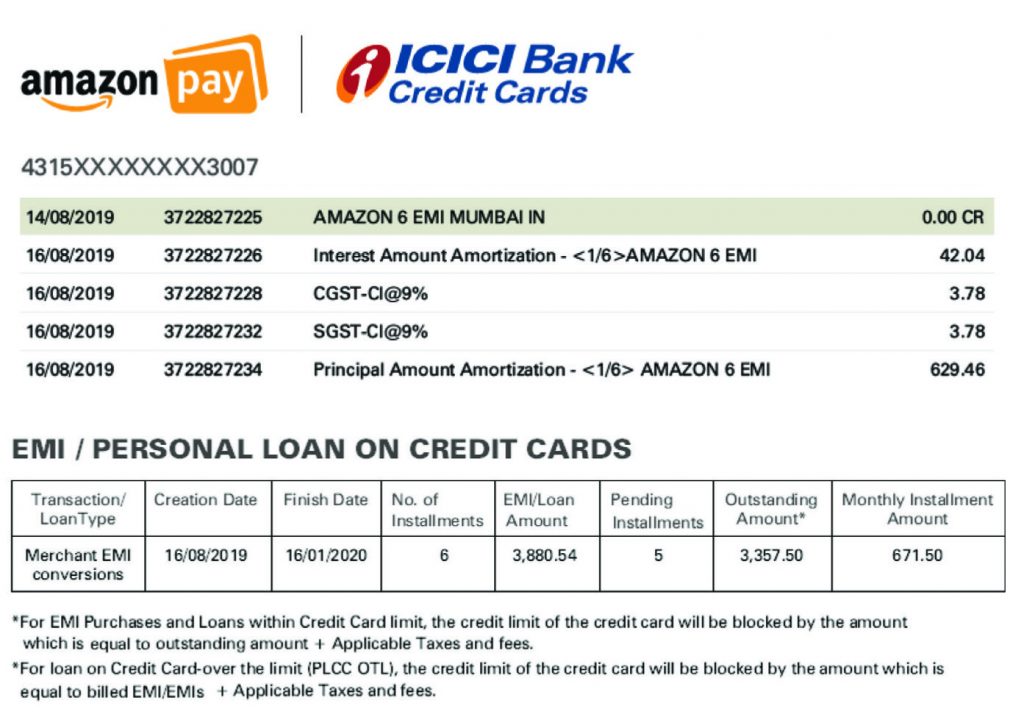

Amit is a working with a FMCG company and he recently bought a product on Amazon at zero-cost EMI with his ICICI Bank Credit Card. The cost of the product was Rs 4,029. He had three payment options – cash on delivery, upfront payment through credit or debit card, or zero-cost EMI option with tenures of 3, 6, and 9 months. He choose the 6-month EMI of Rs 671.5, at the end of which he would pay Rs 4,029. He did not have to pay any processing or foreclosure charges, but he had to pay an additional charge of Rs 26.72 as GST on the interest amount – which is 0.7% of the total price of the product.

Subscribe to enjoy uninterrupted access